2022/41

31 October 2022 - 06 November 2022 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Apollo is now offering Bitcoin custody for institutional clients

Mercado Libre has launched Bitcoin trading in Mexico

Simplify Asset Management launches Bitcoin ETF

UnionBank of the Philippines launches Bitcoin trading

Fidelity launching commission-free Bitcoin Trading for Retail Investors

Santander U.K. has placed £1,000 limit on deposits to Bitcoin exchanges

Apollo is now offering Bitcoin custody for institutional clients

Apollo Global Management – one of the world’s largest asset managers, with more than $500 billion under management – is breaking into Bitcoin and shitcoins custody through a partnership with digital asset platform Anchorage Digital.

Anchorage, which is the first federally chartered digital asset bank in the U.S., will custody a “significant portion” of Apollo’s crypto portfolio.

“We were drawn to working with Anchorage given their commitment to operating under strict regulatory oversight, their strong emphasis on security and segregation of client assets, and their ease of use for asset managers to hold digital tokens,” said Apollo COO Adam Eling in a statement on Monday.

Mercado Libre has launched Bitcoin trading in Mexico

Mercado Pago is aiming to grow in Mexico with the introduction of cryptocurrency services. The company, which serves as a wallet arm of Mercado Libre, announced on Sep. 27 that it has activated the possibility for customers to purchase crypto with national fiat currency in Mexico. In this way, every customer in Mexico is now able to purchase bitcoin using funds available in Mercado Pago’s native wallet.

“Through this new service we seek to give millions of Mexicans access to the crypto world in an educational, safe and simple way, in order to generate greater technological inclusion.” stated Pedro Rivas Mercado Pago Mexico’s CEO

Simplify Asset Management launches Bitcoin ETF

The most recent addition in the Bitcoin ETF market is Simplify Asset Management’s Simplify Bitcoin Strategy PLUS Income ETF (MAXI). The company was co-founded by CEO Paul Kim and CIO David Burns in February 2020 and focuses on options-based investing strategies for advisers.

Brian Kelleher, the firm’s Chief Revenue Officer explains “we saw an opportunity to provide exposures in a transparent ETF that had only been available to institutional and high-end retail investors via expensive alternative vehicles and structured products.”

MAXI is an active strategy ETF with an expense ratio of 0.97% that uses Bitcoin futures to provide 100% exposure to Bitcoin in a tax-efficient manner. Additionally, the ETF invests any excess cash in U.S. Treasuries and sells put or call option spreads that aim to generate income in the 10% to 15% range.

UnionBank of the Philippines launches Bitcoin trading

The Union Bank of the Philippines, or simply UnionBank — one of the largest universal banks in the Philippines — has launched a pilot program for Bitcoin (BTC) and shitcoin custody and trading services for select retail customers, the firm said in a joint announcement on Nov. 2.

Licensed and supervised by the Philippines’ central bank, Bangko Sentral ng Pilipinas (BSP), UnionBank has been actively exploring the crypto industry in recent years. In 2019, UnionBank launched a payments-focused stablecoin pegged to the Philippine peso.

“We are proud to continue UnionBank’s series of industry firsts, this time being the first regulated bank in the country allowing digital currency exchange features for clients.” said Henry Aguda, chief technology officer and chief transformation officer at UnionBank

Fidelity launching commission-free Bitcoin Trading for Retail Investors

The Fidelity investment brokerage handles upwards of $9.9 trillion in assets and has just announced a wait-list for its new cryptocurrency service. Revealed Thursday morning, the service will offer investment into Bitcoin and other shitcoin through the company.

First reported by CNBC, the newly announced Fidelity Crypto will allow investors to buy and sell the number one and number two ranked cryptocurrencies. The service will require a $1 account minimum and give users access to trading services through their subsidiary, Fidelity Digital Assets.

One of the big draws of the newly developed trading product is that trades made through Fidelity’s new service will be free from commission fees. The brokerage firm, however, will factor in a 1% spread on every trade execution price.

Santander U.K. has placed £1,000 limit on deposits to Bitcoin exchanges

Santander UK has published a new update concerning cryptocurrencies and it warns that investing in such financial vehicles can be “high risk.”

The bank notes that the U.K.’s Financial Conduct Authority (FCA) has warned the public about such risks and the financial institution wants to do everything it can to “protect” customers. “[Santander UK feels] that limiting payments to cryptocurrency exchanges is the best way to make sure your money stays safe,” the bank explains.

The financial institution has placed a £1,000 ($1,120) limit per transaction, and a total limit of £3,000 ($3,360) in “any rolling 30-day period.”

“We’ll be making more changes to limit or prevent payments to crypto exchanges in the future, though we’ll always let you know before we make these changes,” Santander UK’s update discloses.

This is the perfect example of how afraid the financial sector is of Bitcoin. They see a major threat in it so they try to limit the amount of money that can fly out of their hands into Bitcoin. Don’t let yourself be fooled because banks with pro-Bitcoin custody want the same thing as the Santander UK: On a beautiful sunny day they simply (with governmental help) will confiscate your coins like it happened before with Gold. Never forget:”Not your keys, not your coins!”

Global Economic News

TL;DR

New possible metric to check for the end of recession

Eurozone inflation is 10.7% a new ATH

England falls its longest ever recession

The Fed newest 0.75% rate hike and how this kills the economy

Russia's account surplus goes vertical

New possible metric to check for the end of recession

I think the US gasoline demand chart can be used to see how everyone’s standard of living is rising or falling. It’s clear to see that people are driving less and less because they’re not just consuming less fuel, but everything else too (for the same or more amount of money). I think from time to time if we check the following chart we can make assumptions about the exit point from the recession.

“According to GasBuddy data, weekly (Sun-Sat) US gasoline demand fell 2.5% last week, its biggest WoW drop (excluding holidays) since January. We peg demand at 8.61mbpd.” by Patrick De Haan, oil & refined products analyst

Eurozone inflation is 10.7% a new ATH

“Prices jumped by record 10.7% in Oct, far exceeding the 10.3% BBG median estimate. Core Inflation accelerated to 5%, a fresh record as well.” by Holger Zschaepitz, journalist at Welt

England falls its longest ever recession

The Bank of England has warned the UK risked being plunged into the longest recession in 100 years after it pushed up the cost of borrowing to 3% in the biggest single interest rate rise since 1989.

A 0.75% increase, the latest in a series of eight interest rate rises since last year, would not be enough to guarantee victory in the war against double-digit inflation, the Bank said, as it cautioned further action would be needed. More details in the article.

The Fed newest 0.75% rate hike and how this kills the economy

The Fed continues to “combat” inflation, and that contest has taken yet another turn with the recent 0.75% rate hike.

As the rate hike is done the S&P 500 made its worst final 90 minutes:

“The gap between 2-year & 10-year Treasury yields is the most inverted, the most negative, since the early 1980s.” by Lisa Abramowicz

What does it mean? The U.S. curve has inverted before each recession since 1955, with a recession following in six to 24 months. It offered a false signal just once at that time.

As the interest rates go higher the “strong” USD will kill itself with the ever increasing US debt. The $31 Trillion US debt interest payments went vertically!

“We are entering a debt death spiral. Interest on the debt will double if they leave rates above 4% for about 3 years. All of the debt maturing rolls over at higher rates.” by Wall Street Silver

With the raising interest rates the stocks prices are shrinking and this will cause massive loss in their performance:

“Big Tech's crash in a chart: The combined market cap of FANGMAN (Facebook, Apple, Microsoft, Amazon, Netflix, Google) is only 20% of the S&P 500 market cap. Not long ago, Big Tech had a weight in the index of 27%.” by Holger Zschaepitz, journalist at Welt

Meanwhile “the Biden administration provides over $13 BILLION in aid to help American families pay energy bills” - CNBC, which means more printing while the FED tries to do QT.

Why are they doing all of this “fight” against inflation if it hurts so much? Well either they are completely out of their mind or here is a possible (conspiratorial) theory:

“We have an illusion of freedom. But governments all over the world are moving towards central bank digital currencies which would fundamentally strip away our civil liberties and potentially act as a conduit for social credit systems. We are sleepwalking towards this. “ by James Melville

Russia's account surplus goes vertical

“In the first 9 months of 2022, Russia's current account surplus was +$200 bn, four times the average surplus between 2007 and 2021. To all those that whinge about the G7 price cap, what do you propose instead? Pretend like nothing's happening & keep giving Putin his war windfall?” by Robin Brooks, Chief Economist at IIF

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

14 years ago today (October 31, 2008), Satoshi Nakamoto published the Bitcoin white paper

“Bitcoin is currently trading at $1.25 million US dollars” in Zac Efron’s new movie: Gold (video)

“~ 66.4% OF BTC HAS NOT MOVED IN OVER 1 YEAR” @IIICapital

“The Bitcoin White Paper is poetry.” by @Jack (video)

South Africa's 🇿🇦 largest grocery store and supermarket, Pick n Pay now accepts Bitcoin (video)

Mr. President Nayib Bukele’s full interview with Tucker Carlson (video)

Chinese govt holds $3.9B Bitcoin despite its anti-Bitcoin policies - CryptoQuant

Bitcoin Lightning⚡️ payment chain (video)

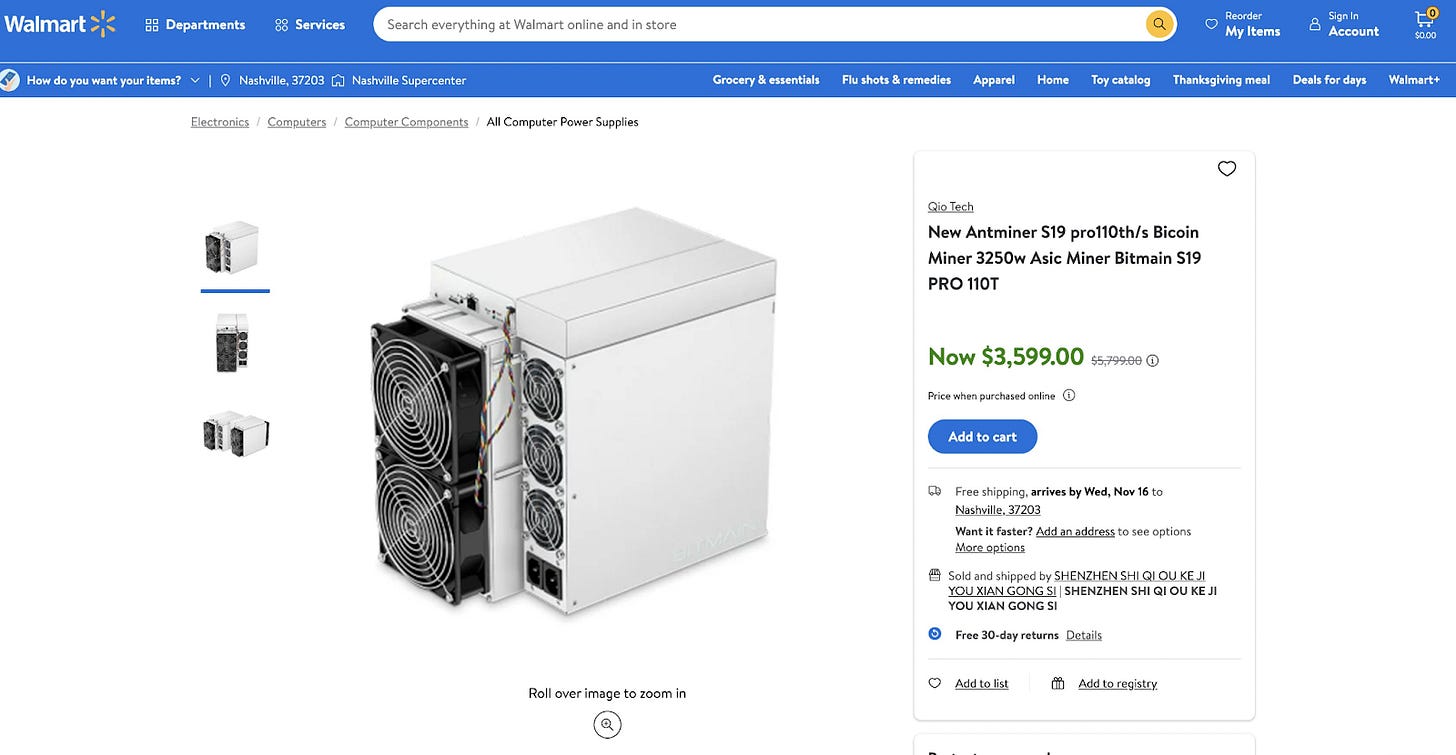

Walmart is now selling Bitcoin miners on its website

CashApp is censoring Bitcoin transactions to wallets of Cuban residents due to sanctions, a user reports. (Not your keys, not your coins!)

No bank account? No internet? No problem. Merchants at a market in Lilongwe, Malawi using Bitcoin (video)

South African solar power company Sun Exchange is paying out dividends to investors in Bitcoin

Suggestions

Interesting articles to read

"Let's Get Out Of NATO": Discontent Soars Across Europe As Russian Sanctions Backfire

Lebanese are mining Bitcoin and using it to store wealth amid hyper-inflation

Sources:

https://news.bitcoin.com/mercado-pago-launches-cryptocurrency-trading-services-in-mexico/

https://www.btctimes.com/news/simplify-asset-management-launches-bitcoin-etf-with-income-strategy

https://cointelegraph.com/news/union-bank-of-the-philippines-launches-bitcoin-and-ethereum-trading

https://watcher.guru/news/fidelity-launching-commission-free-crypto-trading-for-retail-investors