This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Applied Blockchain announces a new 180MW Bitcoin mining facility in North Dakota

MicroStrategy has purchased an additional 301 Bitcoin

Nasdaq getting into Bitcoin Custody Services

Colorado now accepts Bitcoin for tax payments via PayPal

Royal Family of Dubai partners with CoinCorner to enable Bitcoin transactions

Russian state departments agree to legalize bitcoin mining

Bahrain approves Bitcoin payments for over 5,000 merchants

Russian Central Bank and Ministry of Finance agree on draft bill on use of Bitcoin in international trade

Estonia grants its first Bitcoin license to Striga bank

UK gov't introduces bill aimed at empowering authorities' to 'seize, freeze and recover' Bitcoin

Israel issues first Bitcoin trading license to a local exchange

Singapores’ largest Bank expands Bitcoin trading for qualified clients

Applied Blockchain announces a new 180MW facility in North Dakota

Applied Blockchain, a designer, builder and operator of next-generation datacenters that provide power to blockchain infrastructure and support High-Performance Computing (HPC) applications, announced the groundbreaking of its 180-megawatt (MW) hosting facility in Ellendale, North Dakota.

Applied Blockchain will host an additional 70 megawatts worth of bitcoin miners for Marathon, extending the deal from the previously announced 200 megawatts.

In total, Applied Blockchain now has 500 megawatts of contracted hosting.

MicroStrategy has purchased an additional 301 Bitcoin

As per the details from the SEC, the firm acquired 301 bitcoins for $6 million in cash. At the time of purchase, BTC stood at $19,851 per coin. As a result, the firm holds 130,000 bitcoin as of September 19, 2022.

The total purchase price of the bitcoins held by the firm stands at $3.98 billion. As per the total amount spent on the purchase of BTC, the firm’s average BTC purchase price stands at $30,639. The purchase was made between August 2, 2022, and September 19, 2022.

Nasdaq getting into Bitcoin Custody Services

First and foremost: Not your keys, not your coins! Never ever store on an exchange or at a 3rd party your Bitcoin wealth!

According to reports, Nasdaq Inc., the second largest stock exchange, is planning an entry into crypto custody services. According to sources, the move to enter the cryptocurrency custody market is currently pending approval.

Nasdaq is also launching a new subsidiary, Nasdaq Digital Assets, that is only dedicated to cryptocurrencies. According to Tal Cohen, Nasdaq Inc’s executive vice president and head of North American markets, the new subsidiary will initially offer custody services to institutional investors for Bitcoin and shitereum.

Colorado now accepts Bitcoin for tax payments via PayPal

The American state of Colorado now accepts Bitcoin and some shitcoins for tax payments via PayPal, Gov. Jared Polis announced on Monday. The option is already available on the state Department of Revenue website.

Payments are accepted only from personal accounts in a single cryptocurrency. Businesses cannot pay their taxes via crypto yet. Payments will be effective on the day they are initiated, although it will take three to five days for the transfer to take place. Payments are immediately converted into fiat.

Royal Family of Dubai partners with CoinCorner to enable Bitcoin

transactions

The UAE is one of the four top countries to promote cryptocurrency utility. Now, the Royal Family of Dubai seems to have taken a keen interest in Bitcoin and intends to move in the same direction. The Royal Family’s firm Seed Group has reportedly teamed up with CoinCorner, a prominent platform that offers Bitcoin and Lightning Network services to boost Bitcoin transactions in the United Arab Emirates.

“Apart from individuals, a large number of companies are ready to embrace Bitcoin and other digital currencies as legal tender for future transactions. The UAE wants to offer a growth-oriented environment to fintech companies by establishing an ecosystem for digital currencies. Companies dealing in cryptocurrencies hold huge potential in the Emirates’ digital economy.” said Hisham Al Gurg, CEO of Seed Group and the Private Office of Sheikh Saeed bin Ahmed Al Maktoum.

“We are committed to making Bitcoin transactions the “new normal” in the UAE with the help of our unique solutions facilitating instant and frictionless payments.” said Danny Scott, CoinCorner’s co-founder.

Russian state departments agree to legalize bitcoin mining

Recent events have resulted in many Russian state departments coming to an agreement to legalize Bitcoin mining in locations where there is an abundance of electricity.

The Russian Chair of Congress finance committee said: “Let them earn money”.

Experts from the Bitcoin mining sector have recently come together to create a working group with the goal of formulating a standard for successful and energy-efficient cryptocurrency mining in Russia. It is anticipated that the standards would assist developers and operators of data centers in providing better hardware uptime to investors.

Do you wanna talk about any news from this newsletter? Come join our Telegram group.

Bahrain approves Bitcoin payments for over 5,000 merchants

Bahrain’s central bank approved a partnership between EazyPay and Binance enabling 5,000 POS and online payment gateways to accept Bitcoin and shitcoins.

Users in the area looking to use bitcoin as payment will be prompted with a QR code from EazyPay’s terminal, which can then be scanned with the Binance App, allowing almost instant payments with the chosen currency. Additionally, Binance offers convenience for businesses such as EazyPay and the merchants who choose to leverage the platform by enabling instant fiat conversions for the merchants.

Russian Central Bank and Ministry of Finance agree on draft bill on use of Bitcoin in international trade

The Russian Ministry of Finance and its central bank have agreed on a draft bill allowing bitcoin and some shitcoin payments for international trade settlements, per a report from Russian news outlet Tass.

The bill “as a whole writes out how cryptocurrency can be purchased, what can be done with it, and how cross-border settlements can or cannot be made," said Deputy Finance Minister Alexei Moiseev.

The agreement follows a previous report in which Moiseev stated it was impossible for Russia to conduct international trade without the use of bitcoin and shitcoins due to current circumstances concerning sanctions.

No worries, it's only Bitcoin and no other shitcoins. Why? Because as the 2nd largest PoW centralized shitcoin killed its competitiveness with making itself more centralized moreover nearly 60% of it's voting power is in only 4 US related entities, only Bitcoin will be the real alternative in International trades between countries. No shitcoin can be a viable option when serious money and final settlements are at stake.

Estonia grants its first Bitcoin license to Striga bank

First of all the same situation is here like at the new Nasdaq custodial service: Not your keys, not your coin! Never ever trust a bank with your Bitcoin!

Striga, a bitcoin and cryptocurrency banking infrastructure provider, became the first virtual asset service provider (VASP) to gain regulatory approval in Estonia following the country’s revamping of its digital asset legal framework, per an announcement from the Financial Intelligence Unit.

“This means that the legislation does not contain any measures to ban customers from owning and trading virtual assets and does not in any way require customers to share their private keys to wallets,” the Ministry of Finance said.

Essentially, the law requires VASPs to provide identities for their customers, but not private keys. If a VASP cannot provide identification, the provider is expected to “implement real-time risk analysis.”

UK gov't introduces bill aimed at empowering authorities' to 'seize, freeze and recover' Bitcoin

I can’t tell enough times, like just twice in this week's newsletter that “Not your keys, not your coins!”. Here is why it’s the most important thing that to hold in a cold storage your precious Bitcoin:

In a Thursday announcement, the U.K. government said lawmakers had introduced the Economic Crime and Corporate Transparency Bill in Parliament as part of efforts to drive “dirty money” out of the country. The bill contained provisions forcutting down on the “red tape around confidentiality liability” and granting law enforcement the authority “to compel businesses to hand over information which could be related to money laundering or terrorist financing,” including Bitcoin and shitcoins.

“The new law will make it easier and quicker for law enforcement agencies such as the National Crime Agency to seize, freeze and recover cryptoassets — the digital currency increasingly used by organised criminals to launder profits from fraud, drugs and cybercrime,” said the government.”

“Domestic and international criminals have for years laundered the proceeds of their crime and corruption by abusing U.K. company structures, and are increasingly using cryptocurrencies. These reforms — long awaited and much welcomed — will help us crack down on both.” said Graeme Biggar, director general of the U.K.’s National Crime Agency

According to the U.K. government, expanding the authorities’ ability to seize, freeze and recover crypto built upon legislation making it “quicker to impose tough sanctions” on individuals tied to Russian President Vladimir Putin following the invasion of Ukraine.

Today Putin and his group are in their crosshairs, tomorrow maybe your savings. Can you afford this risk?

Israel issues first Bitcoin trading license to a local exchange

The Israeli Insurance and Savings Capital Market Authority (ISCMA) has granted cryptocurrency exchange Bits of Gold the first virtual asset service provider (VASP) license in the country, per a press release sent to Bitcoin Magazine.

Now, Bits of Gold will be able to transact within the legacy financial infrastructure far easier thanks to one of those procedures requiring banks to interact with “crypto-originated transactions” from licensed entities, per the release.

Furthermore, following the approval, the exchange plans to launch its custodial service, Bits of Gold Wallet, which will be insured. Additionally, the company will launch Bits of Gold Connect, a system of integrations which will allow fintechs, banks and other institutions to offer their clients access to bitcoin or shitcoins via Bits of Gold.

It’s interesting how this week many legacy financial companies started to offer custodial solutions. But you already know why you should never ever trust these custodial services with your Bitcoin!

Singapores’ largest Bank expands Bitcoin trading for qualified clients

According to BBG, The Development Bank of Singapore [DBS] has expanded access to a Bitcoin and shitcoins trading service on its members-only digital exchange. In a statement issued on Friday, the bank stated that its wealth clients were increasingly choosing self-directed investment routes, thus the expansion.

Around 100,000 of the bank’s accredited investors and clients will be able to access the said service with a minimum investment of $500. Worth noting here is that the service was previously limited to corporate and institutional investors, family offices, and clients of DBS Private Bank and DBS Treasures Private Client.

Global Economic News

TL;DR

The US Treasuries losing its Chinese and other buyers

The price of relying on unreliable renewable energy sources in Europe

The unaffordable US Housing market

The German Producer Prices are in record highs while economic expectations are record low

The World Bond Index shows it’s already worse than 2008

The US Treasuries losing its Chinese and other buyers

“China has been a net seller of US Treasuries for over a decade and now holds only 4% of all outstanding US Treasuries--down from 14% 10 years ago, per data from the US Treasury.” by Jeffrey Kleintop Chief Global Investment Strategist at Charles Schwab & Co., Inc.

“Remember the endless claims about capital outflows in China by western experts?

China's foreign capital inflows rose 20.2% YoY, in equivalent USD terms, to $138.5bn from January to August.” by The Sirius Report

“US 30Y - US 02Y = MEGA MOMENTUM INVERSION. Has run GFC's inversion lows.

We don't do normal 'recessions' anymore.

Buckle up kiddies.” by TheMarketSniper, Renegade Trader, Technical Analyst

“The last time the 2 year yield hit 4% was on October 17, 2007.

US debt was $9 trillion in Q4 2007.

US debt now stands at $30.5 trillion as of Q2.

61% debt to GDP in 2007 vs 122% debt to GDP now.” by Sven Henrich, Founder of NorthmanTrader

You should know, that in case of a “bank run”:

“The Federal Deposit Insurance Corporation (FDIC) is responsible for insuring bank deposits in the US. Their reserve ratio stands at 1.25%. FDIC only has enough currency to cover a tiny fraction of all bank deposits. Confidence is the only thing holding up this house of cards.” by @Ben__Rickert

The price of relying on unreliable renewable energy sources in Europe

“Energy costs as a % of GDP in 2020, 2021 and 2022 in Europe (and the world average)” by Andreas Steno Larsen, Macro aficionado, investment analyst

The crazy sanctions, political decisions made the energy market look like it’s malfunctioning. But the sad story is that Europe right now is walking back into the Stone Age. Why? Because they first dismissed for decades Nuclear energy the most energy dense source we know, then cheap natural gas and oil. Now they are burning wood and coal. There is no more climate hysteria, like it was before, they’re just protecting at every cost the unreliable renewables while killing their own economy.

Because for decades coal mining was not a priority (for obvious reasons) for a short period of time it skyrocket it’s price, that’s why the following could happen:

“Wanna see something crazy?...If my energy conversions are correct, Newcastle Coal is now pricing $2.37/MMBtu OVER Brent crude oil, and $3.47/MMBtu over WTI crude oil. Yes, you read that right COAL > Crude oil…” by Mason Hamilton, Special Assistant to International Energy Forum

The expensive energy due to the stupid energy polcies it will cause massive famine around the World! How? Because the record low global fertilizer production will result bad/low amount of crops, which will drive prices to the sky and in poor countries mass famine. This will literally kill millions of people in poor countries because they would need to compete with the wealthy westerner countries for the scarce fertilizers.

Meanwhile the European governments spend half a trillion euros on energy crisis - report.

In the end this could be the joke of the year, but unfortunately she means it: Switzerland's Environment Minister Suggests People Shower Together To Save Energy

The unaffordable US Housing market

“The median American household would need to spend 44.5% of their income to afford payments on a median-priced home in the US, the highest % on record with data going back to 2006.” by Charlie Bilello, Founder and CEO of Compound Capital Advisors

While you try to somehow spare money for a new home you need to pay record high taxes:

“Federal tax collections are approaching an all-time high of 20.5 percent of GDP set in 1943 during World War II.” by Tax Foundation

According to NAR, “Existing-home sales decreased for the seventh straight month to a seasonally adjusted annual rate of 4.80 million. Sales tailed off 0.4% from July and 19.9% from the previous year.”

Based on last week's news, the Housing market is a true Bubble which will explode with dire consequences for the masses. Hope you won’t be between them!

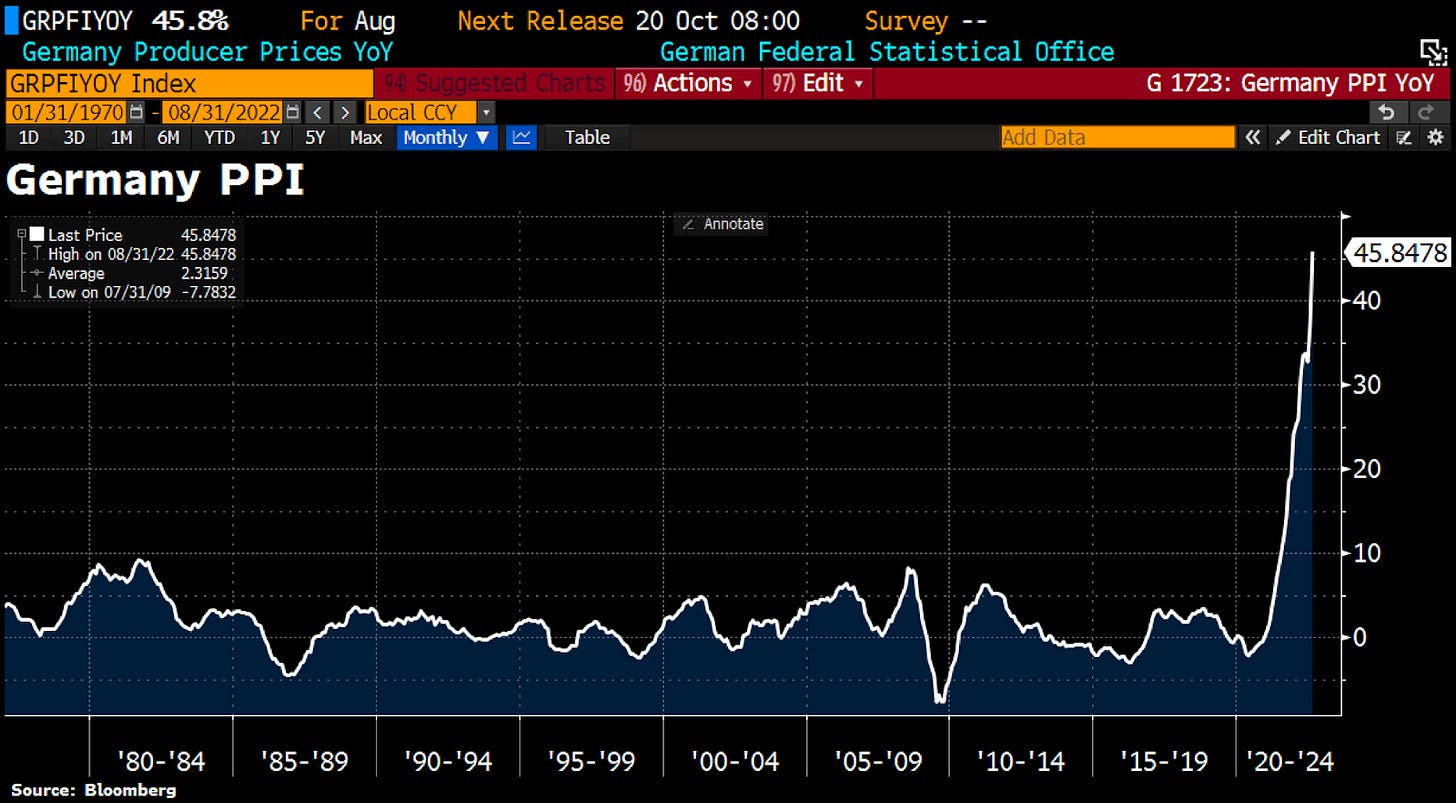

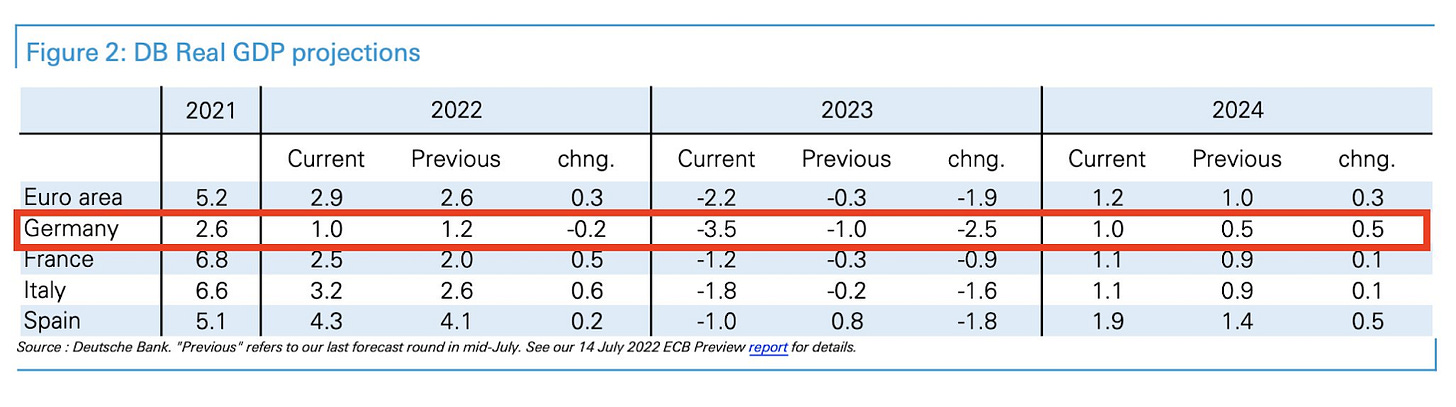

The German Producer Prices are in record highs while economic expectations are record low

Germany's producer prices rose strongly 45.8% on year in August from a year earlier, driven by higher energy prices which rose 139.0% from a year earlier, posting the biggest increase ever recorded, the German statistics office Destatis said.

“Deutsche Bank expects severe recession due to gas shock. DB expects Germany to see -3.5% GDP growth in 2023, 3rd worst year since WWII behind only 2009 & 2020. An even sharper downturn cannot be ruled out in case of colder-than-usual weather.” by Holger Zschaepitz, journalist at Welt

“Deep Euro zone recession is coming. German consumer confidence keeps falling and is now lots below 2020 levels during the first COVID wave. Russia's invasion of Ukraine - and the risk that the war could escalate - are a huge source of uncertainty that's weighing on consumers…” by Robin Brooks, Chief Economist at IIF

The World Bond Index shows it’s already worse than 2008

“Here's that World Bond Index expressed in dollars—one of the ugliest charts I've ever seen.” by Tuur Demeester, Economics, History, News. Editor at satoshipapers.org

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

The Bitcoin Lightning Network capacity has surpassed 4,800 $BTC ($92 million).

Bitfarms hashrate exceeds 4 EH/s milestone as it commences production at its first warehouse in Argentina (video)

Bitcoin has been declared "dead" over 461 times

Global Bitcoin adoption in 2022: 1. Vietnam 🇻🇳; 2. Philippines 🇵🇭; 3. Ukraine 🇺🇦; 4. India 🇮🇳; 5. U.S 🇺🇸; 6. Pakistan 🇵🇰; 7. Brazil 🇧🇷; 8. Thailand 🇹🇭; 9. Russia 🇷🇺; 10. China 🇨🇳; 11. Nigeria 🇳🇬; 12. Turkey 🇹🇷; 13. Argentina 🇦🇷; 14. Morocco 🇲🇦; 15. Colombia (more details here)

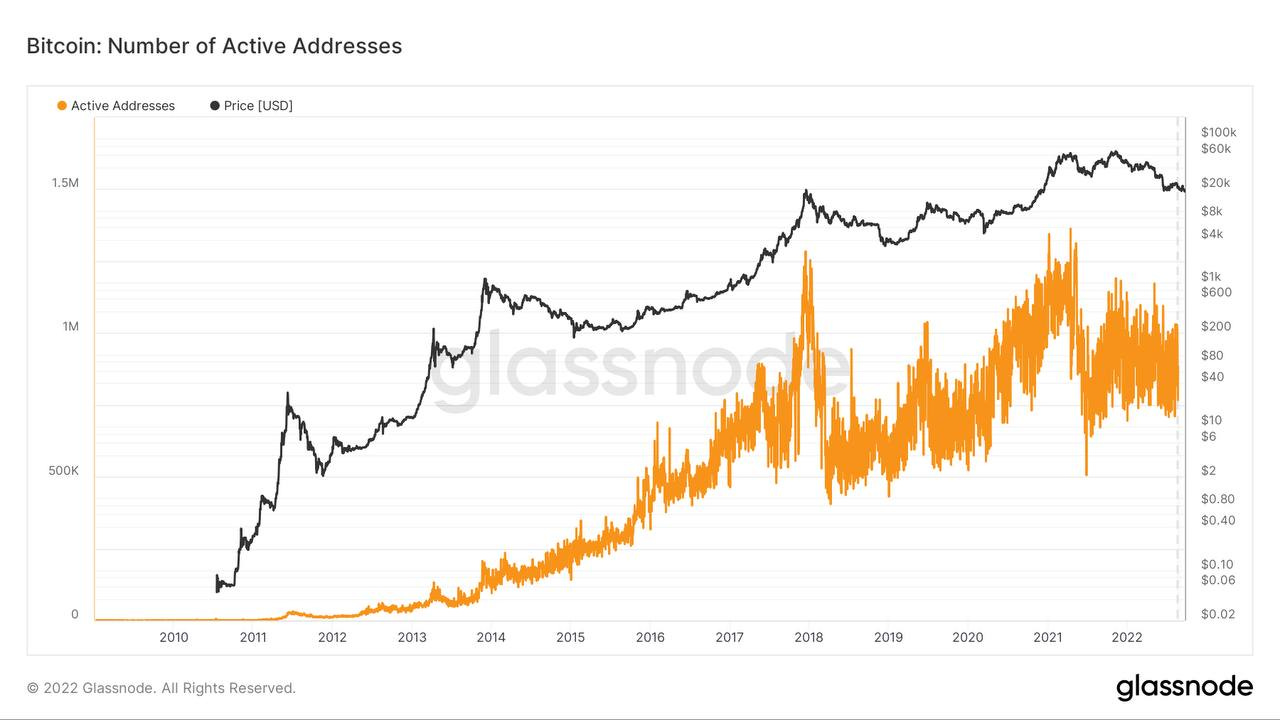

The current number of bitcoin active addresses is 918,372.

“Bitcoin is political. Get over it.” by @BashCo_ (video)

In 24 hours, more than 166,000 Bitcoins have been transferred from cryptocurrency exchanges to unknown wallets, according to Whale Alert. The total amount of all registered transactions exceeds $3.12 billion.

“Bitcoin went from $43,000 to $19,000 in the last six months. 77.7% of all bitcoin did not even move.” by Documenting Bitcoin

South Africans receiving bitcoin using the Lightning Network on cheap feature phones. Banking the unbanked! (video)

Celebrating Bitcoin reaching $111 all-time high back in 2013. (video)

“Just paid with Bitcoin at The Lazy Dog bed & breakfast here on Boracay Philippines” by @BitcoinIslandPH (video)

Suggestions

Interesting articles to read

Widespread Bitcoin Adoption, Digital Freedom Can Only Happen Through Lightning

Should Bitcoiners Support Nayib Bukele’s Attempt At Re-Election?

Banks Are About To Face The Same Tsunami That Hit Telecom Twenty Years Ago

Sources:

https://finance.yahoo.com/news/applied-blockchain-announces-groundbreaking-180mw-120000728.html

https://watcher.guru/news/microstrategy-scoops-up-301-bitcoin-for-5-7-million

https://watcher.guru/news/nasdaq-to-launch-crypto-custody-services

https://watcher.guru/news/bitcoin-dubais-seed-group-partners-coincorner-to-boost-btc-transactions

https://www.nasdaq.com/articles/bahrain-approves-bitcoin-crypto-payments-for-over-5000-merchants

https://bitcoinmagazine.com/legal/estonia-approves-first-bitcoin-crypto-bank-striga

https://bitcoinmagazine.com/business/bits-of-gold-becomes-first-active-crypto-exchange-in-israel

https://watcher.guru/news/singapores-largest-bank-expands-crypto-trading-for-qualified-clients