This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Bitwage makes it easier for everyone to be paid in Bitcoin

Michael Saylor moves to Chairman Role to focus more on Bitcoin

Banking platform Galoy raises $4M for Bitcoin-backed synthetic Dollar

The Oxford City Football Club allows fans to pay with Bitcoin

The Roman Catholic Church of Washington will accept donations in Bitcoin

BlackRock is offering Bitcoin investment to their investors

Ebonex and Mastercard are launching a Bitcoin reward card in Australia

Investview to increase hash rate by 50% from true renewable energy sources

Bitwage makes it easier for everyone to be paid in Bitcoin

Bitwage, a Bitcoin payroll provider, has partnered with Bitcoin security company Casa as well as Edge Wallet to streamline the process for onboarding businesses to a Bitcoin standard, according to a press release sent to Bitcoin Magazine.

Bitwage explains that throughout its time cooperating with governments and businesses, one of the most prominent obstacles preventing Bitcoin adoption through a payroll option is the lack of Bitcoin education among employees. The main challenge outlined by Bitwage is that when users are asked to provide a Bitcoin address to the wallet they wish to receive payment from, those unfamiliar with the ecosystem feel confused and intimidated.

Casa and Edge helped Bitwage with their user interface and QR code integration to facilitate a much better user experience, especially for those users new to the ecosystem.

“We’re excited about this seamless integration making it simpler and safer for Bitwage users to hold the keys to their Bitcoin, which protects them against many of the custodial security risks we’ve seen highlighted in our industry this year,” said Christian Wallin, VP of product and design at Casa.

Michael Saylor moves to Chairman Role to focus more on Bitcoin

MicroStrategy CEO Michael Saylor will transition from his CEO position to Executive Chairman of the company, according to a statement released on August 2nd, 2022. Phong Le currently serves as the company’s president and will be taking over Saylor’s CEO position while also serving as a member of the Board of Directors.

During the summer of 2020, MicroStrategy adopted Bitcoin as its main treasury reserve asset, making it the first publicly traded business to do so. As Executive Chairman, Saylor will prioritize innovation and long-term company strategy. He will also continue to serve as the Chairman of the Board's Investments Committee and oversee MicroStrategy's Bitcoin acquisition strategy.

“I believe that splitting the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding Bitcoin and growing our enterprise analytics software business. As Executive Chairman I will be able to focus more on our Bitcoin acquisition strategy and related Bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations.” said by Michael Saylor Chairman of MicroStrategy

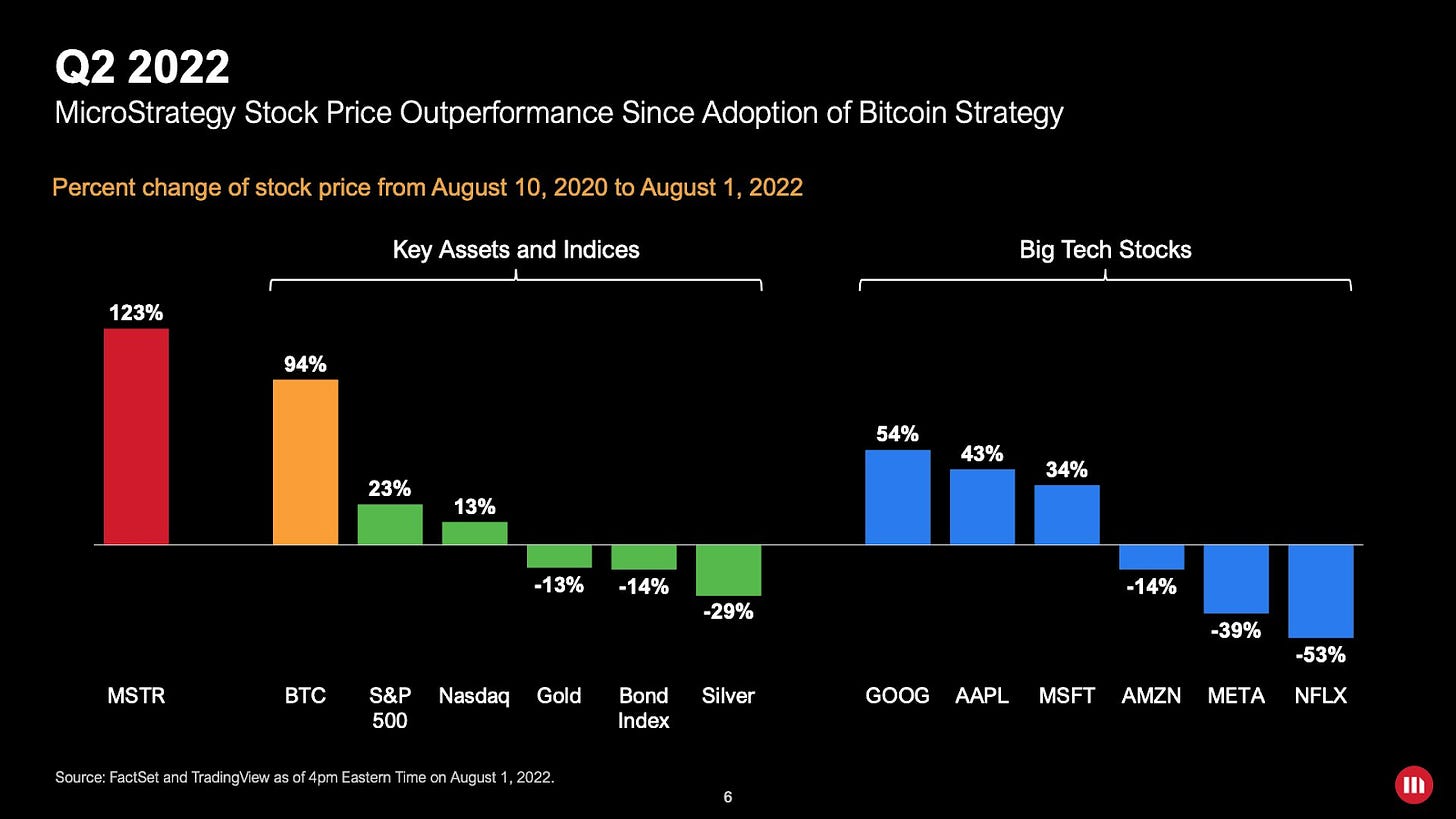

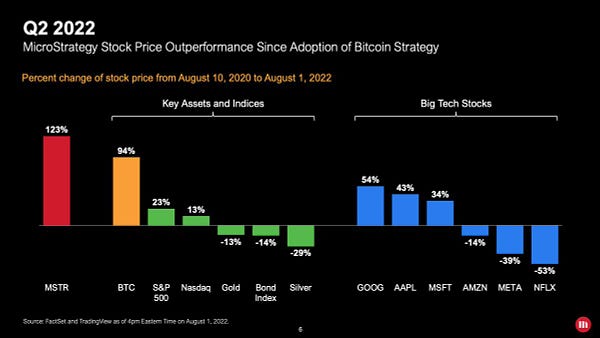

Finally for the haters:

“Since @MicroStrategy adopted a Bitcoin Strategy, its enterprise value is up +730% (+$5 billion) and $MSTR is up +123%. Performance of BTC is +94%, S&P 500 +23%, Nasdaq +13%, Gold -13%, Bonds -14%, Silver -29%. GOOG +54%, AAPL +43%, MSFT +34%, AMZN -14%, META -39%, NFLX -53%.” by Michael Saylor

What do you think what’s behind Michael Saylor’s move?

Banking platform Galoy raises $4M for Bitcoin-backed synthetic Dollar

Disclaimer: When I first read this news I thought well this is another invented shitcoin, but now on the Bitcoin network. At first because of my No shitcoin policy I decided to not write about it. But after a few minutes I changed my mind because this synthetic USD (while the FIAT world is existing) will help many unbanked people with the possibility to use on the Bitcoin Layer 2 level the USD shitcoin which can be a lifesaver for those who can't afford Bitcoin's short term volatility. Of course if something happens with Galoy Bank or any other custodial service your funds are at risk. Now back to the news:

Galoy, the company behind the open-source banking platform that powers El Salvador’s Bitcoin Beach Wallet, started offering its Stablesats product with a $4 million capital raise to enable further development of its core GaloyMoney bitcoin banking platform.

Stablesats is intended to provide an alternative to current stablecoin infrastructure and regular-way bank integration by using derivatives contracts to create a bitcoin-backed synthetic dollar pegged to the U.S. dollar.

“Bitcoin has brought digital transactions to previously unbanked communities across Latin America, Africa and beyond,” said Galoy CEO Nicolas Burtey in a press release. “However, its volatility makes managing financial obligations difficult. With Stablesats-enabled Lightning wallets, users are able to send from, receive to, and hold money in, a [U.S. dollar] account in addition to their default BTC account. While the dollar value of their BTC account fluctuates, $1 in their USD account remains $1 regardless of the bitcoin exchange rate.”

For more information how Stablesats works check their website.

The Oxford City Football Club allows fans to pay with Bitcoin

The Oxford City Football Club, nicknamed ‘The Hoops,’ are now the first National League club to accept Bitcoin for matchday payments. Oxford City and CoinCorner, an Isle of Man-based company that will also be City's back of shirt sponsor this season, have entered a multi-year partnership.

With CoinCorner's ‘Bolt Card,’ a contactless Bitcoin card, fans may now buy tickets at turnstiles and pay for refreshments seven days a week.

Justin Merritt, director of football for City, believes that using Bitcoin will “become the new normal in English football.”

Merrit goes on to explain that “More than 3.3 million people living in the U.K. now own digital currency, an increase of approximately one million people in the last year alone.”

This one is a good step because it’s not an “instantly Bitcoin-to-Fiat” solution like all the other fancy brands which partnered with BitPay. We don’t know for how long, but at least for the short term they will hold Bitcoin.

The Roman Catholic Church of Washington will accept donations in Bitcoin

The Archdiocese of Washington, D.C. of the Roman Catholic Church will begin accepting donations in Bitcoin and some shitcoins as part of an effort to grow its ministries.

"The Roman Catholic Archdiocese of Washington, D.C. seeks to leverage technology to engage parishioners in new and exciting ways, making it easier for the faithful to fulfill the mission of the Church," said Joseph Gillmer, executive director of development for the archdiocese.

BlackRock is offering Bitcoin investment to their investors

BlackRock, the world's biggest asset manager, has formed a partnership with publicly traded crypto exchange Coinbase (COIN) to make Bitcoin directly available to institutional investors.

Mutual customers of Coinbase and BlackRock’s investment management platform, Aladdin, will have access to Bitcoin trading, custody, prime brokerage and reporting capabilities, according to a blog post Thursday.

BlackRock had $8.5 trillion in assets under management as of the second quarter of 2022, while Aladdin has more than 200 institutional users, including insurers, pensions, corporations, asset managers, banks and official institutions, according to a Thursday note from Oppenheimer.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets,” Joseph Chalom, global head of strategic ecosystem partnerships at BlackRock, said in the blog post.

“BlackRock’s deep expertise in investment management technology, combined with Coinbase’s integrated and secure trading, custody and prime brokerage product suite will facilitate greater institutional access and transparency to digital asset investing," Coinbase President Emilie Choi said in an emailed statement.

Literally now nearly $10 trillion of wealth is one click away from Bitcoin. Of course nothing works like that, but in case of a major “signal” which can be anything from collapsing of the USD to a major country making Bitcoin a legal tender then huge amounts of money will be poured into Bitcoin. Don't forget the only absolute scarce asset on Earth is only Bitcoin and nothing else! Exciting times will come.

Ebonex and Mastercard are launching a Bitcoin reward card in Australia

The Australian crypto exchange Ebonex was partnering with Mastercard. This collaboration was specifically designed to formulate a new Bitcoin-linked card. With this, Ebonex garners the status of being Mastercard’s Principal Member for the issuance of Bitcoin-funded payment cards of the firm.

With this card, the customers of the crypto exchange Ebonex would be able to spend their Bitcoin and other shitcoins wherever Mastercard is accepted. This process will reportedly not require the conversion of Bitcoin or shitcoins into fiat.

“Joining the Mastercard network will provide us with the opportunity through Ebonex to drive innovation in the crypto and payment space in Australia. We believe that the ability to collaborate directly with Mastercard, a global leader in payment technology, will foster the creation of solutions, which will enable customers, merchants, and businesses to move digital assets through the global Mastercard payment network.” said by Dong Hu, CEO of Ebonex

This is only interesting in regard to a “last resort” solution when you need to sell your precious Bitcoin and you don’t have other KYC free options. Don’t forget that this is a custodial solution with KYC implemented, so your private keys are in the hands of others who know who you are. Privacy is really important, if you can, always search for non-kyc and non-custodial related services.

Investview to increase hash rate by 50% from true renewable energy sources

Investview will expand its mining operation through its SAFETek subsidiary where it “has entered a transaction to expand its Bitcoin mining farm operation through the purchase and planned deployment by the end of its third quarter of 1,705 new Whatsminer M30s ASIC mining servers.”

The aim of this deployment is to have the majority of their miners be fueled by low-carbon and renewable energy sources. Once all infrastructure is set up, the company will have 99.50% of its mining operation using the latest generation miners.

The European company is proud to be powering almost 100% of its mining capacity via geothermal and hydro electricity.

Do you see? There is no Sun or Wind mentioned because those are Unreliable energy sources. If you can’t build a 24/7 Bitcoin mining company on these unreliable ones, then how could you lean on these with the country's energy grid?

Global Economic News

TL;DR

Germany’s financial meltdown is intensifying

The US job openings are falling

China and relative scarcity

Germany’s financial meltdown is intensifying

“While inflation remains high, at 7.5% in July, 10y German yields have fallen <1% again. Real yields (10y Bunds-inflation) dropped to -6.8%, near All Time Low. Real yields now NEGATIVE for 75 consecutive months” by Holger Zschaepitz, market maniac at Welt.

“Germany 1-year forward baseload electricity surges >€400 per MWh for the first time ever. We are truly into crunching territory for the country's energy-intensive manufacturing industry. The current price is ~1,000% higher than the €41.1 per MWh 2010-2020 average.” by Javier Blas, Energy and commodities columnist at Bloomberg.

The following article perfectly fits here: Europe Has Lost The Energy War.

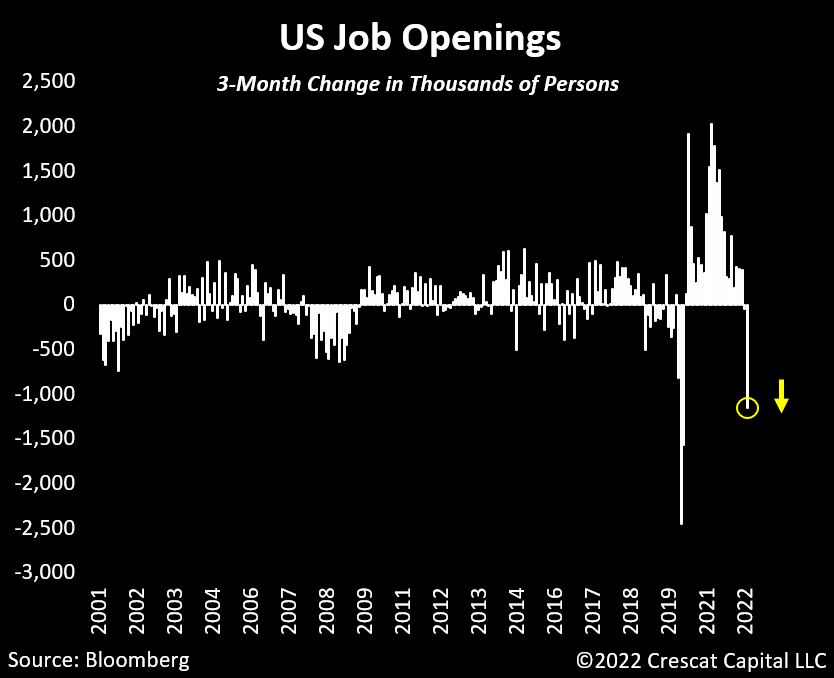

The US job openings are falling

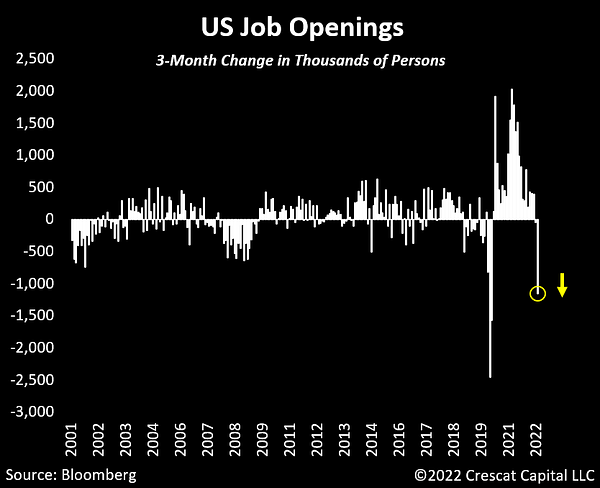

“We just saw the largest 3-month decline in job openings in the history of the data, excluding the initial shock of the pandemic. Probably just the beginning. Fed tightening with PMIs already at GFC levels will be the kiss of the death for the economy.” by Otavio Costa, Crescat Capital portfolio manager.

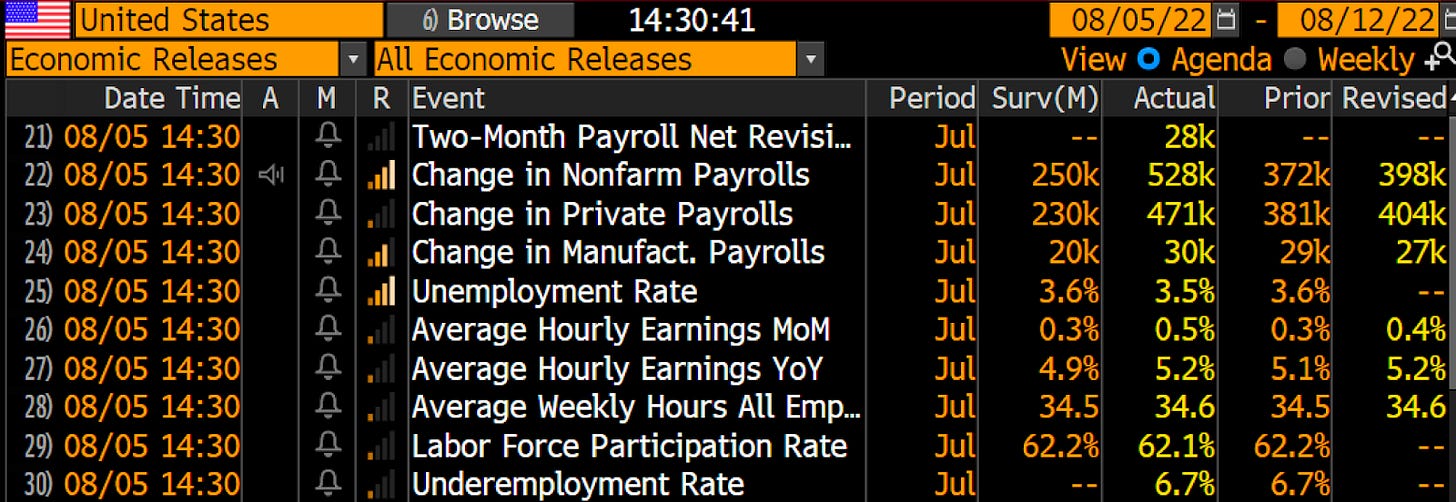

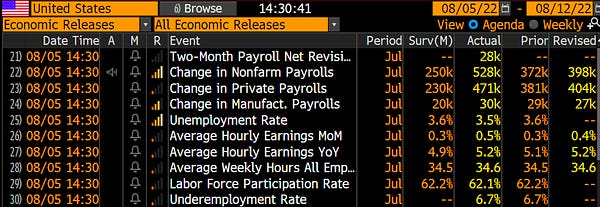

“Recession with full employment and decent wage gains? US adds 528k jobs in July, more than double estimates while US unemployment rate dips to pre-pandemic low of 3.5%. AHE rose 0.5% MoM faster than expected.” by Holger Zschaepitz, market maniac at Welt.

Just to explain why I think the US economy is already falling: We don’t need to explain the falling Job openings, but the“US adds 528k jobs in July” should be detailed. While the economy during higher pressure (ex. Higher credit rates) kills companies and with this the jobs too (negative job openings numbers), the money printing causes high inflation which makes people take a 2nd or 3rd job. That’s why the “US adds 528k jobs in July” because more and more people need an extra job to pay the bills. The recession is inevitable and the Fed's only "solution" will be to stop QT and resume QE with money printing.

Last but not least: “Americans opened 233 million new credit card accounts during Q2 2022, the most since 2008.” by @WatcherGuru

What could possibly go wrong?

China and relative scarcity

While the mainstream media is changing their "shitposting tapes" from Russia to China, the Chinese economy trade balance shows some interesting data:

“China July data

Yuan-denominated trade balance 682.7bn yuan, est 600bn yuan, prev 650bn yuan.

Imports 7.4% y/y, est 5.7%, prev 4.8%

Exports 23.9% y/y, est. 19.6%, previous 22.0%.

Jan-July imports 5.3% y/y, exports 14.7%, trade surplus 3.14tn yuan.” by The Sirius Report

I want to explain the same situation that I previously explained with the Russians, but now with the Chinese economy.

Maybe in China there is the same housing boom as in the western world. Maybe their economy will at the end fall apart like all other FIAT currencies.

BUT their trading balance shows an evergreen rule: Relative scarcity will always win against money printing.

Like Russia, China can’t print out of thin air what they produce (like silicon chips, batteries, rare earth metals, etc.), but the westerners for these goods can print any amount of FIAT currencies. The problem is with the trading where the cantillon effect kicks in. The prices of relatively scarce goods (like oil, nat-gas, etc.) go up because ever more printed money arrives for it to the market. The same is happening in China too where the trading balance is not just in the number of exported pieces rising really fast, but in USD terms too because they can produce for the international market with higher sell prices.

In the Western World this is happening completely in the opposite way. Pairing a negative trading balance with money printing is one of the fastest ways for an economy to collapse.

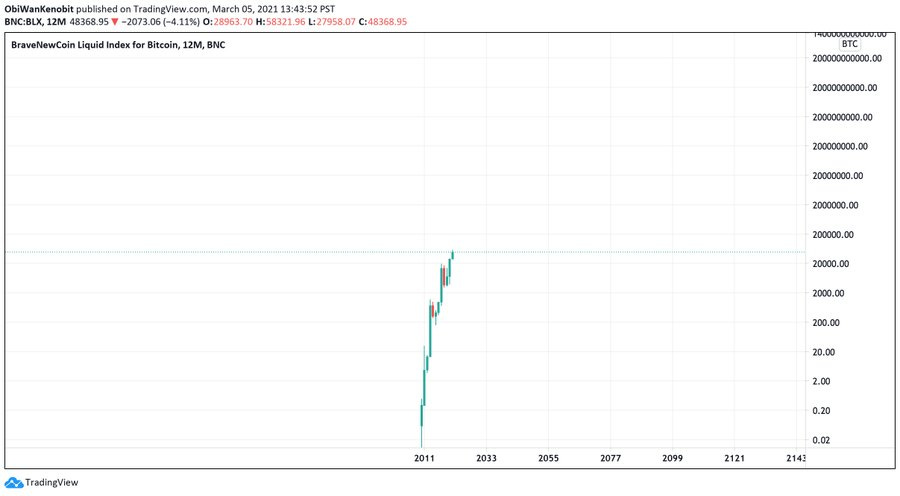

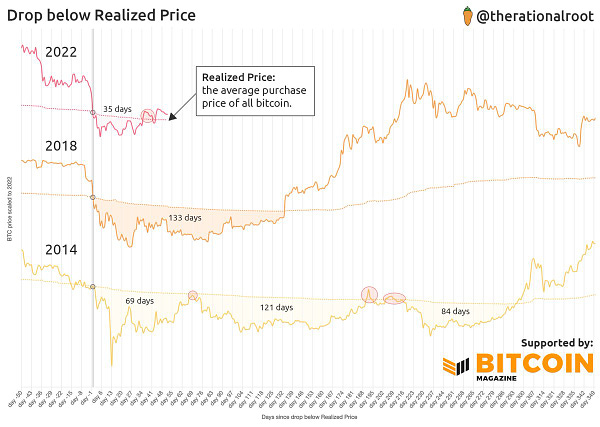

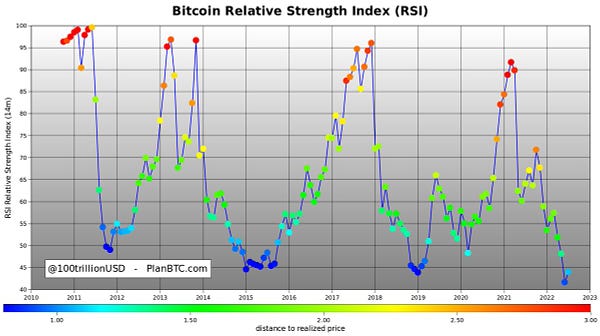

Bitcoin price speculations

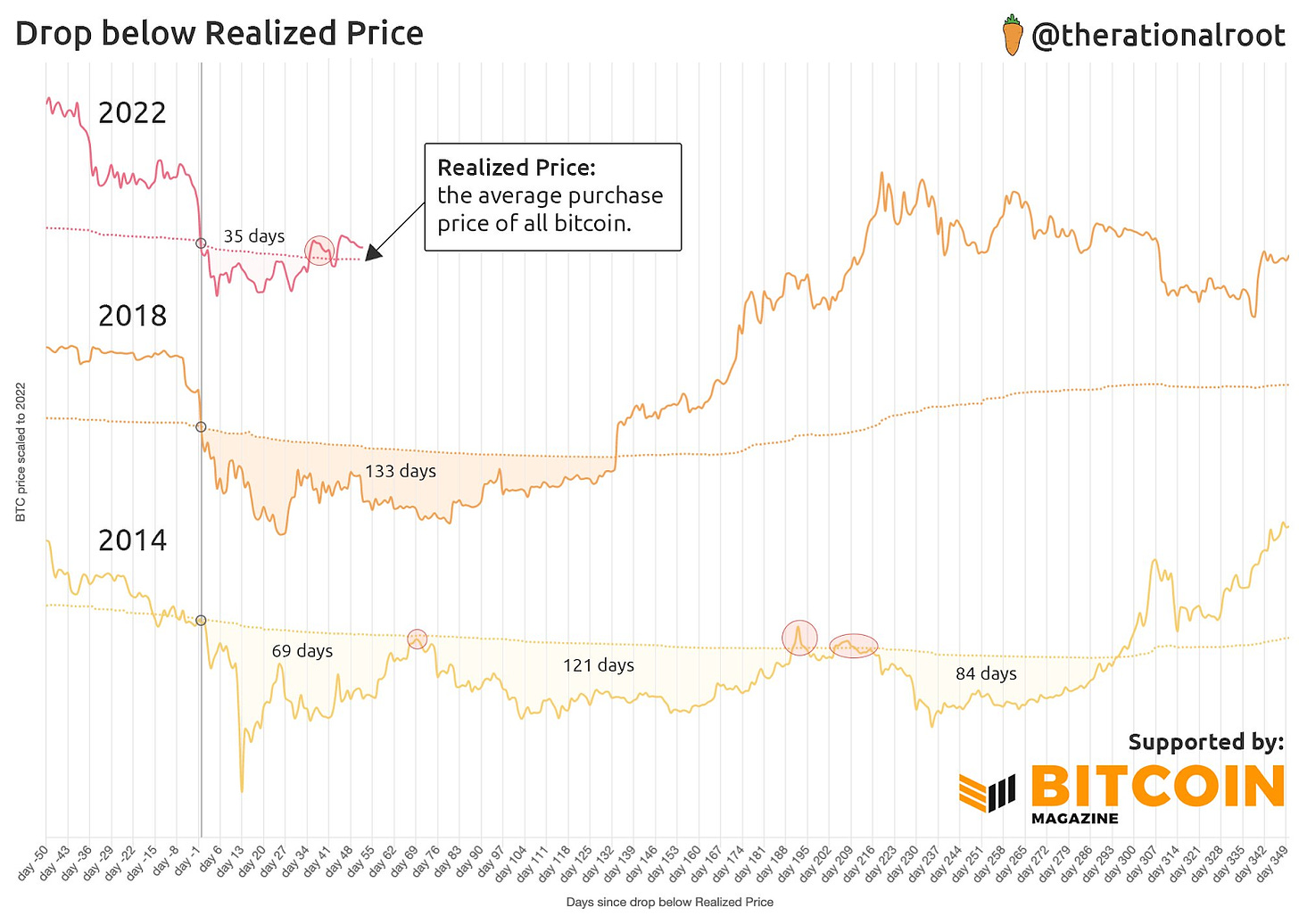

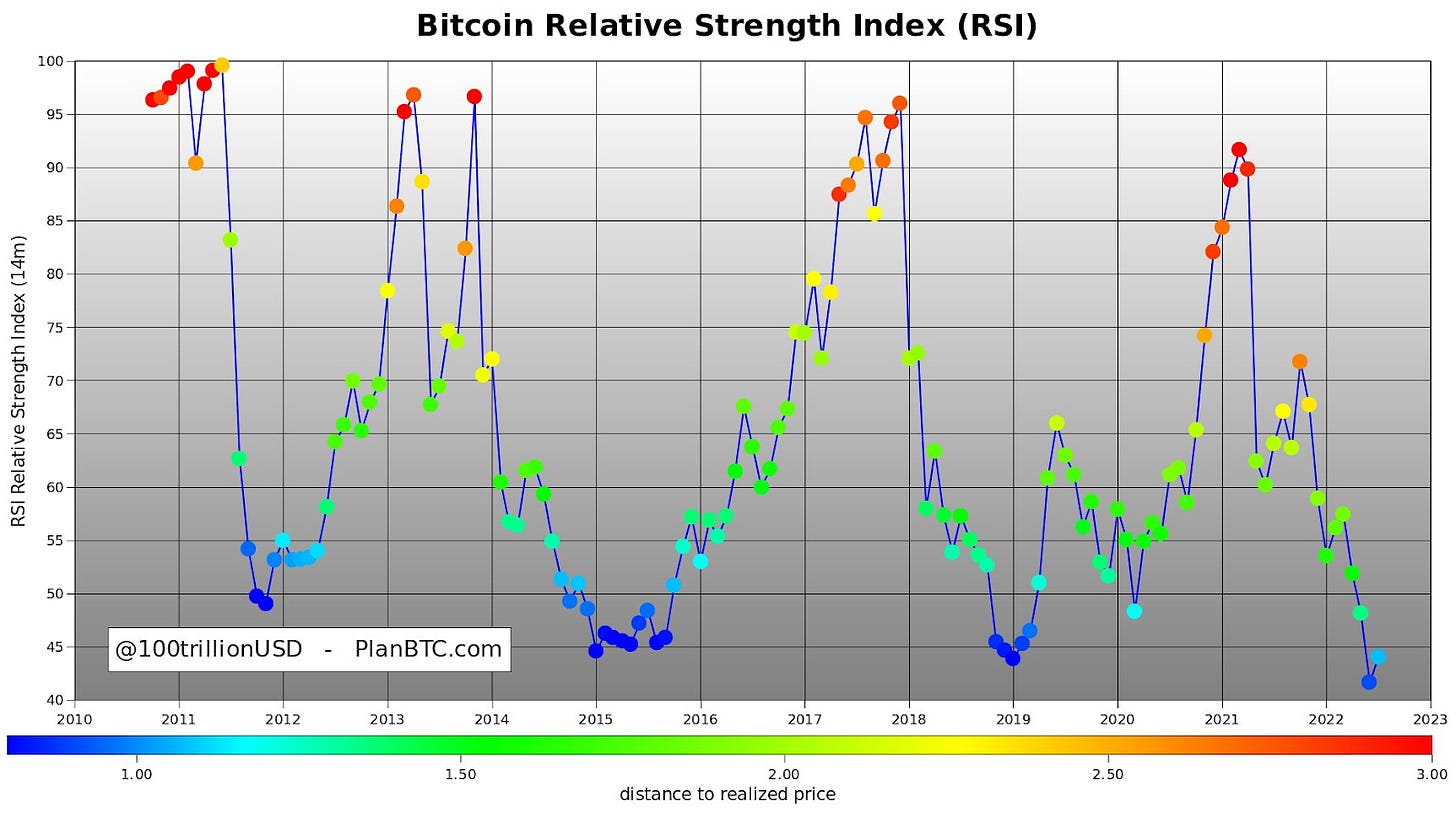

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

5-year-old paying for ice cream with Bitcoin. (video)

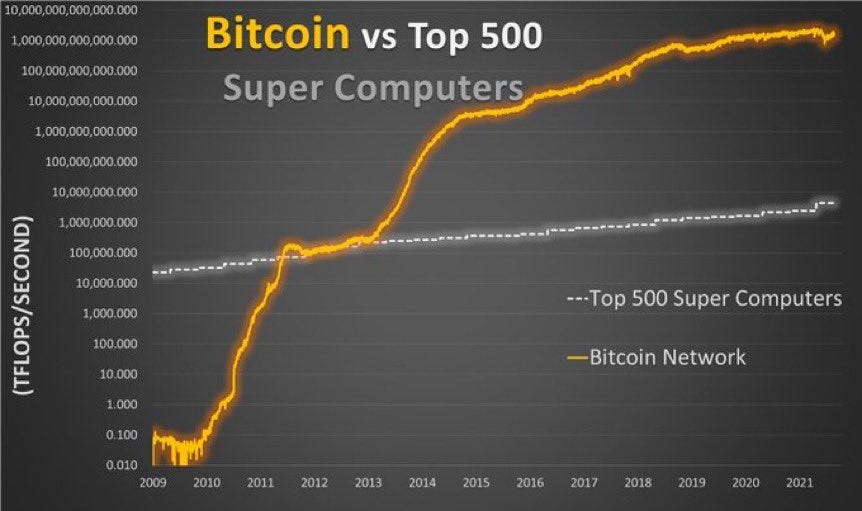

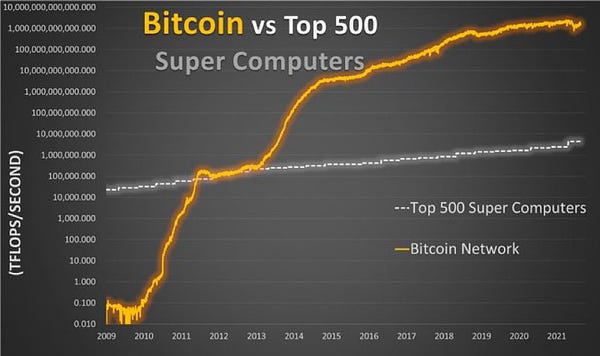

“Bitcoin beat the top 500 supercomputers COMBINED in only 4 years.” by Documenting Bitcoin

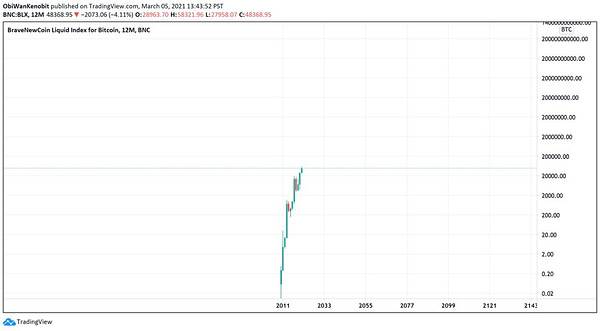

91% of the 21 million Bitcoin supply has now been mined. Only 9% left to be mined over the next 118 years!

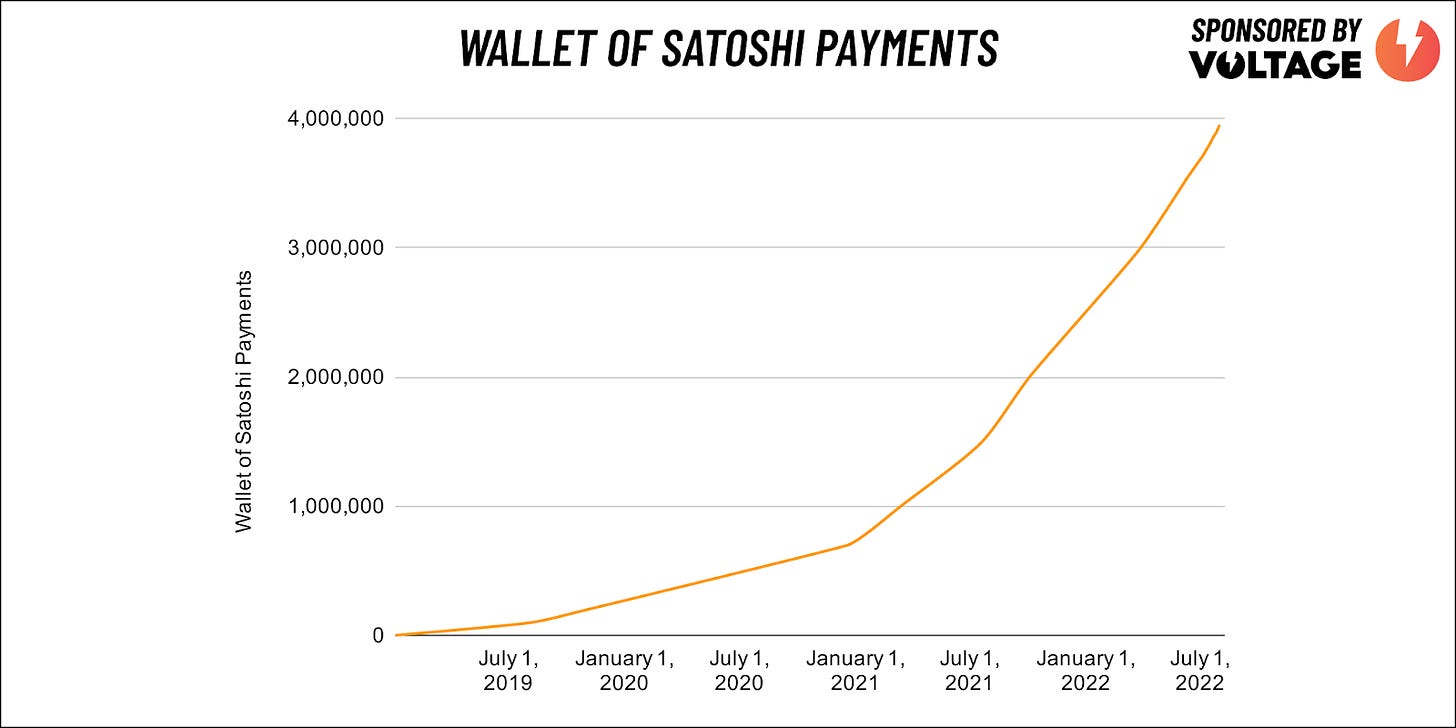

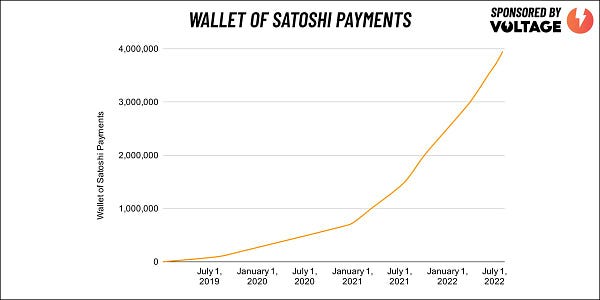

“Wallet of Satoshi did 266,000 Lightning payments in the last month, and at this pace they'll do over 3,000,000 payments this year. That's almost as many payments as they've done since they launched in Jan 2019.” by @kerooke

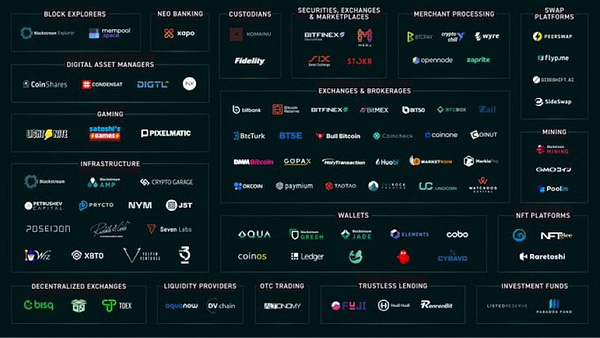

“Nobody is building on Bitcoin L2.

Meanwhile the Liquid Network:” by @gaborgurbacs

Bitcoin ATMs are back in Japan for the first time since 2018.

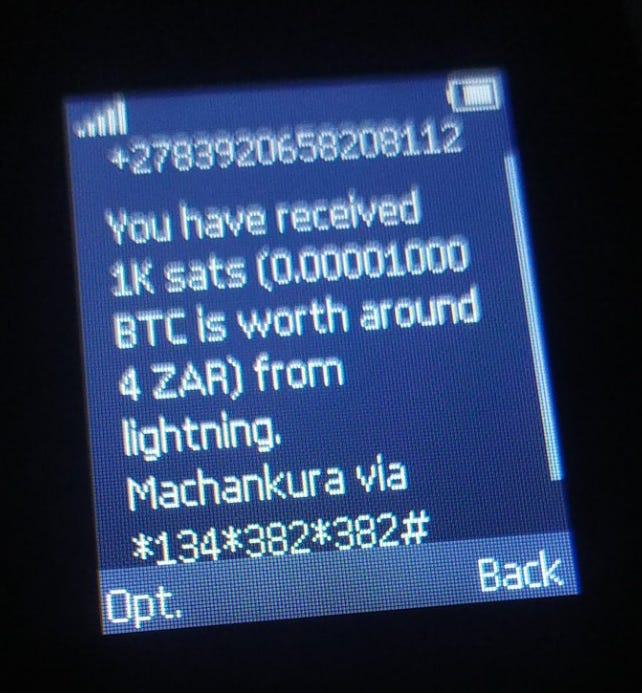

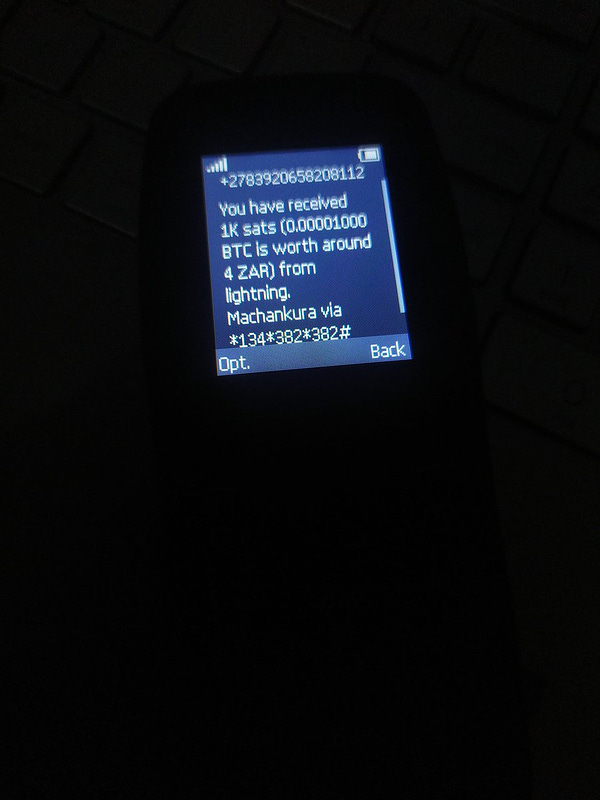

Sending Bitcoin through SMS in South Africa.

A Smartwatch with a Bitcoin wallet. (video)

Bitcoin mining doesn’t waste energy.

Bitcoin mining rescues stranded & wasted energy. (video)

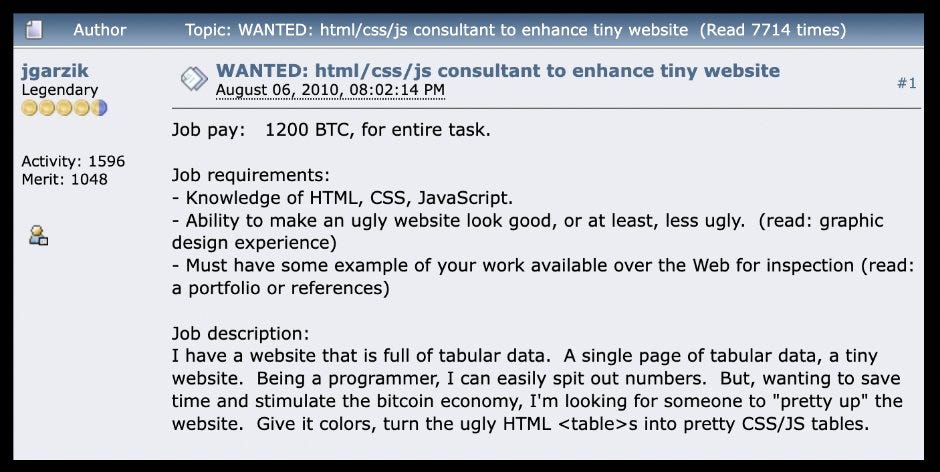

“12 years ago today, someone made 1,200 Bitcoin for building a single website” by @pete_rizzo_

Suggestions

Interesting articles to read

"Give Up Your Yacht Before Lecturing": Bolsonaro Sinks DiCaprio In Titanic Twitter Thread

An Argument Against KYC Bitcoin That Everyone Can Understand

Sources:

https://finance.yahoo.com/news/banking-platform-galoy-raises-4m-120000616.html

https://www.btctimes.com/news/british-soccer-club-allows-fans-to-pay-with-bitcoin

https://watcher.guru/news/mastercard-to-bring-bitcoin-to-australia-crypto-linked-card-underway/

https://www.btctimes.com/news/investview-to-increase-hash-rate-by-50-from-renewable-energy-sources