This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Santander Bank plans to offer Bitcoin trading to Brazilian clients

Australia's first unlisted retail Bitcoin fund has launched

Honduras launched Bitcoin Valley in the town of Santa Lucia

Bitcoin Miners in Iran can now buy electricity at lower prices from renewable sources

Canaan Bitcoin ASIC manufacturer is ready to begin mining in the US

Babel Finance loses 8,000 BTC and $280 Million of Customer Funds

Santander Bank plans to offer Bitcoin trading to Brazilian clients

Spanish banking multinational Santander (SAN) plans to offer Bitcoin trading to its clients in Brazil in the coming months.

“We recognize that it is a market that is here to stay, and it is not necessarily a reaction to competitors positioning themselves. It is simply a vision that our client has demand for this type of asset, so we have to find the most correct and most educational way to do it”

“We expect to have definitions about it in the next few months, who knows in the next release [of quarterly results], or even before.” Santander Brazil CEO Mario Leao said.

Australia's first unlisted retail Bitcoin fund has launched

Digital asset venture capital firm and fund manager Holon said that the funds will utilize a traditional investment vehicle known locally as a retail managed investment scheme and invest directly into Bitcoin and two other shitcoins. Managed investment schemes involve multiple investors contributing to receive a share of interest and are typically run by a fund manager.

Earlier this year, the country witnessed the launch of its first spot bitcoin and ether ETFs — the 21Shares Bitcoin ETF (EBTC)

Holon is hoping to ride the coattails of previous fund managers‘ success and will leverage Gemini, via a partnership, to provide custody solutions for all three funds. Under New York’s banking laws, Gemini is recognized as a fiduciary and qualified custodian.

“Our partnership with Holon is a great example of Gemini’s commitment to increasing the accessibility of crypto across the globe,” said Alex Philips, senior principal of Business Development Asia Pacific at Gemini. “As interest in cryptocurrencies surge, we will continue to build strategic partnerships that enable investors to safely engage with the digital economy through Gemini’s institutional grade custody.”

Honduras launched Bitcoin Valley in the town of Santa Lucia

Honduras launched “Bitcoin Valley” in Santa Lucia meant to spur more opportunities in the digital asset space and as a result, the tourist town of Santa Lucia has shifted to a Bitcoin city because business owners are adopting crypto payments to boost tourism, according to Reuters.

“It will open more opportunities and attract more people who want to use this currency.” said Cesar Andino, the manager of Los Robles shopping square.

Therefore, the initiative will initially target 60 businesses to be trained about Bitcoin and how to use it as a marketing tool for their services and products. The project is expected to be rolled out to more enterprises in Santa Lucia and nearby areas.

I think this is a really good step, like it was a few years ago in the El Zonte Beach Bitcoin initiative in El Salvador.

What do you think will Honduras go on the same path as El Salvador with making Bitcoin a legal tender?

Bitcoin Miners in Iran can now buy electricity at lower prices from renewable sources

Iran’s Ministry of Energy has changed certain Bitcoin mining regulations to ease access to renewable power for entities authorized to mint digital currencies in the Islamic Republic. A recently issued decree relieves miners from the obligation to use on-site power generation capacities and permits them to buy electricity from renewables from across the country and through the national grid.

More and more countries see Bitcoin not as an enemy, but as a solution for balancing the production of the energy from the unreliable renewables because Iran has been experiencing power shortages during the hot and dry summers and cold winter months too. For these situations you can overplan the energy production and this surplus can be sold to the Bitcoin miners. In situations mentioned before you can simply turn off the miners and free the energy capacity to the public use. In this way Bitcoin mining works like a “battery”.

Canaan Bitcoin ASIC manufacturer is ready to begin mining in the US

Canaan Inc., a Chinese ASIC manufacturer has announced their intent to expand into the U.S. Bitcoin mining scene.

This comes after already having a successful pilot operation in the Bitcoin mining heavy country of Kazakhstan. Canaan has deployed over 10,000 of their own miners. “Mining in Kazakhstan is doing well and moving faster, and we expect big growth as well,” said the mining company executive in an interview with Forkast.

Their plans for a U.S. expansion are part of the CEO’s (Nangeng Zhang) goals for diversifying their revenue streams rather than relying only on manufacturing ASICs. “We believe that our self-operated Bitcoin mining business will help us improve our financial performance as well as expand our business scope and customer base,” said Zhang during the interview.

A new player is arriving to the US Bitcoin mining scene with their own ASIC miners. It will be interesting to see how reliable and affordable it is to mine with these.

Babel Finance loses 8,000 BTC and $280 Million of Customer Funds

Babel Finance, a crypto financial services firm, recently reported a whopping $280 million liquidation loss, which includes losing 8,000 BTC and a significant quantity of another token, according to a report from The Block.

"In that volatile week of June when BTC fell precipitously from 30k to 20k, unhedged positions in [proprietary trading] accounts chalked up significant losses, directly leading to forced liquidation of multiple Trading Accounts and wiped out ~8,000 BTC …," the deck reportedly reads.

Never ever forget: Not your keys, Not your coins! Really, at least in these volatile times when Bitcoin can anytime dip another 5 - 10K USD don’t trust a 3rd party with your precious Bitcoin! If they’re gone they’re probably gone for good.

Global Economic News

TL;DR

Germany is in stagflation

Global wealth inequality from a different perspective

The US Mortgages are a the brink of default

The ECB is printing again

The FED hiked rates to 2.5% and the US economy shrank again

The proof of UBI’s side effect

Germany is in stagflation

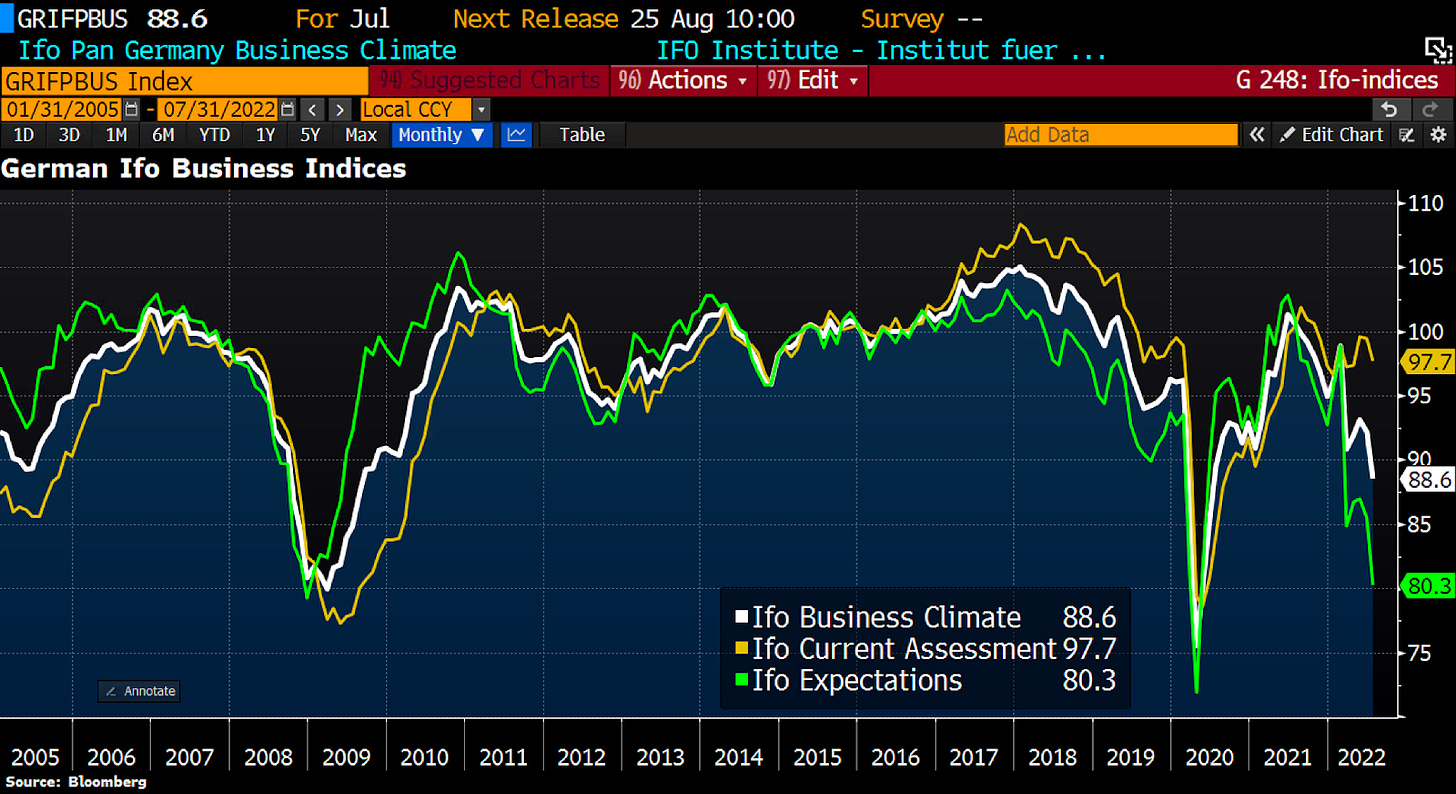

“Another econ indicator sounds the recession alarm. July Ifo Index shows econ mood in Germany down by quite some mileage. In particular, the expectations component hit hard. There hasn’t been a single sector, which did stick out positively. "Simply sea of red", Ruland Research highlights.” by Holger Zschaepitz

According to BBG, Germany is in stagflation while the rest of Europe smashed growth expectations, showing the continent on an uneven footing as surging inflation & possible Russian energy cutoff threaten to tip Germany into recession. Spain & Italy both reported Q2 growth of 1% or more. For the full year, the consensus now expects GDP growth of only 1.5% but inflation of 7.6%.

Just to be sure they and the whole EU will drift into recession they imposed rules without calculating with the consequences:

“The EU decided all cars should be EVs from 2035

They only forgot to check the amount of copper (and other metals) needed

DISASTER waiting to happen!!

PS- every EV uses 100kg of copper, 6x as much as a normal car. Only silver could be a good substitution” by Willem Middelkoop

Only the wealthiest ones will be able to afford buying (producing of these cars requires plenty of energy) and charging these EVs because the EU gas prices just recently broke a record:

When you think stupidity can't go further: “Berlin has approved a plan to invest $180bn over the next four years to transition to a green economy.” by @thesiriusreport

But in reality they’re stepping back into the Stone Age:

“German Cities Turn Off Hot Water And Cut Lighting At Government Buildings”

Global wealth inequality from a different perspective

“Wealth inequality is a well-known and sad phenomenon, but this pyramid puts it even more in context:

64% of the world's adult population controls < 2% of global wealth (wealth < USD 10,000)

0.8% (!) of the world's adult population instead controls almost 45% (!) of global wealth” by @MacroAlf

The US Mortgages are a the brink of default

“US mortgage payments-to-income ratio (blue, left hand side) at the same level as in 2007.

The rate of change is even more impressive: almost +60% increase against 12 months ago.

Housing affordability is as bad as it can get.” by @MacroAlf

“Prices of new houses plunge. Clearly, potential buyers are now having second thoughts, given the spike in mortgage rates, and homebuilders are responding to this decline in demand and the surge in cancellations by piling on incentives and cutting prices:” by @WallStreetSilv

The ECB is printing again

While the Inflation hits record high of 8.9% the ECB is printing again:

“The ECB balance sheet has grown again after 3 weeks of shrinkage. Total assets rose by €2.6bn to €8,769.3 in the past week as QE reinvestments > QE redemptions. The ECB balance sheet now equals 82% of Eurozone GDP vs Fed’s 36.5%, BoJ’s 135.4%.” by Holger Zschaepitz

“EU Consumer Confidence Crashes To Record Lows As German CPI Unexpectedly Re-Accelerates. Economic contraction is on the horizon in 11 of the euro zone's 19 countries.” by @WallStreetSilv

The FED hiked rates to 2.5% and the US economy shrank again

The Fed’s move will raise its key rate, which affects many consumer and business loans, to a range of 2.25% to 2.5%, its highest level since 2018.

“FOMC rate decision proved to be “buy the news” event, leading S&P500 to close >4000 for 1st time since Jun. Fed delivered on widely-exp & 2nd 75bp hike. Chair Powell remains sanguine on econ. Risk assets lauded move BUT bonds holding on to some skepticism: 2s10s remains inverted.” by Holger Zschaepitz

They’re positive regarding inflation's future, but don’t forget that $9 trillion in debt has been added since 2018. To understand how much power is in the huge amount of printed money which slowly but surely arrived to the markets check the following:

After the big sell off because of the positive vibe of the FED the S&P 500 gained 9.1% in July, boasting its best month in 2yrs. This massive amount of money is always searching for relative scarcity. Just imagine what will happen when it finds the absolute scarcity: Bitcoin.

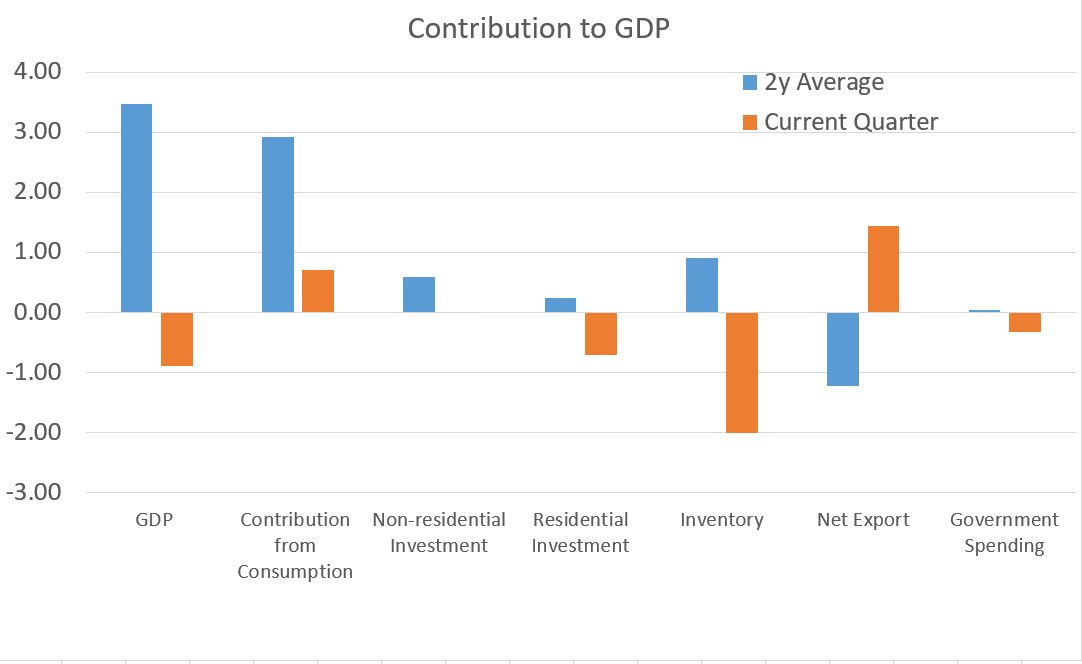

According to the Washington AP, “The U.S. economy shrank from April through June for a second straight quarter, contracting at a 0.9% annual pace and raising fears that the nation may be approaching a recession. The decline that the Commerce Department reported Thursday in the gross domestic product — the broadest gauge of the economy — followed a 1.6% annual drop from January through March. Consecutive quarters of falling GDP constitute one informal, though not definitive, indicator of a recession.”

According to Zerohedge, the consumers entering the recession with zero cash buffer:“Personal Savings Rate collapses to 5.1%, lowest since August 2008”

New York Mayor Eric Adams says the United States is "in a recession" and "Wall Street is collapsing."

If you ever thought the FED will stop printing read this article: What Happens If The Fed Doesn't Capitulate On Interest Rates?

The proof of UBI’s side effect

When you give Helicopter Money to your citizens there you will cause market disruptions. One of these is the unemployment statistics. The Biden admin says that there is no recession because of the record low unemployment stats. But wait a minute, when you receive free money without any work why would you work or search for a job? These people are not shown in the unemployment statistics. How am I sure of this? Check the following chart:

Since 2020 something weird has happened. The correlation between unemployment and the Buying Conditions for Large Household Durables has ended. What has changed? Either after decades consumers changed their buying habits or the unemployment stats are misleading.

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

“SOUTH AFRICA: ~50% would invest in Bitcoin and crypto if banks offered such services.” by Bitcoin Archive

Digital assets on the way to becoming a part of mainstream American portfolios, says CFTC Chairman

Bitcoin Lightning vs Mastercard (video)

A Bitcoin TapCard payment video on the Isle Of Man

27,878 $BTC ($644.8 million) has been taken off exchanges in the last 30 days.

Seven stores serving 8 MILLION Gibraltar tourists a year now accept Bitcoin

Bitcoin P2P trade in Nigeria has increased +258% in 7 days.

1.1 MW Waukesha generator fueled by wasted flare gas based energy rolling and ready to mine btc! (video)

Mobile Bitcoin miner (hard stuff). (video)

“4,400 BTC. Lightning public capacity is not only growing, it's accelerating. Up 10% in just the last month.” by @kerooke

German retailer giant REWE installs Bitcoin ATM in-store. It has 3,700 stores.

“Bitcoin is the most powerful computing network in the world. It has never been hacked, and has an uptime of >99.98757087985%.” by @mcshane_writes

$6 billion in Bitcoin to be invested in El Salvador through global platform Bank To The Future - Ambassador to the US of El Salvador

Suggestions

Interesting articles to read

World Economic Forum calls to reduce private vehicles by eliminating 'ownership'

UN, World Economic Forum Behind Global 'War On Farmers': Experts

China Is Issuing The Same "Red Line" Warnings About Taiwan That Russia Issued About Ukraine

Sources:

https://blockworks.co/australia-gets-first-unlisted-crypto-fund-safeguarded-by-gemini/

https://www.btctimes.com/news/santander-bank-will-offer-bitcoin-and-crypto-services-in-brazil

https://news.bitcoin.com/iran-amends-regulations-to-ease-crypto-miners-access-to-renewable-energy/

https://armantheparman.com/why-should-you-run-your-own-bitcoin-node/

https://www.btctimes.com/news/chinese-asic-manufacturer-canaan-to-begin-us-mining-operation

https://www.btctimes.com/news/babel-finance-loses-8000-btc-and-280-million-of-consumer-funds