This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Andorra green lights Bitcoin with Digital Assets Act

The Cleveland FED says Lightning Network is turning Bitcoin into money

The Central African Republic will hold Bitcoin as a reserve asset

The Southland Credit Union now allows members to buy Bitcoin

The BNP Paribas will offer Bitcoin Purchases

Chub Cay island in the Bahamas is seeking to adopt the Bitcoin Standard

Andorra green lights Bitcoin with Digital Assets Act

A small light of progress shines from Andorra, a tiny European country nestled between France and Spain. The country’s government, the General Council of Andorra, recently approved the Digital Assets Act, a regulatory framework for digital currencies and blockchain technology. The act is split into two parts. The first regards the creation of digital money, this would allow the Andorran state to create its own shitcoin. The second half of the act refers to digital assets as financial instruments and intends to create an environment in which blockchain and distributed ledger technologies can be regulated. They are far behind in making Bitcoin a legal tender, but at least they are stepping towards it. But first they want to burn themselves with FIAT and with their own or others shitcoins.The Cleveland FED says Lightning Network is turning Bitcoin into money

Going unnoticed for about a month, the Federal Reserve Bank of Cleveland released a paper on June 21st, 2022 discussing the Bitcoin Lightning Network and its uses.

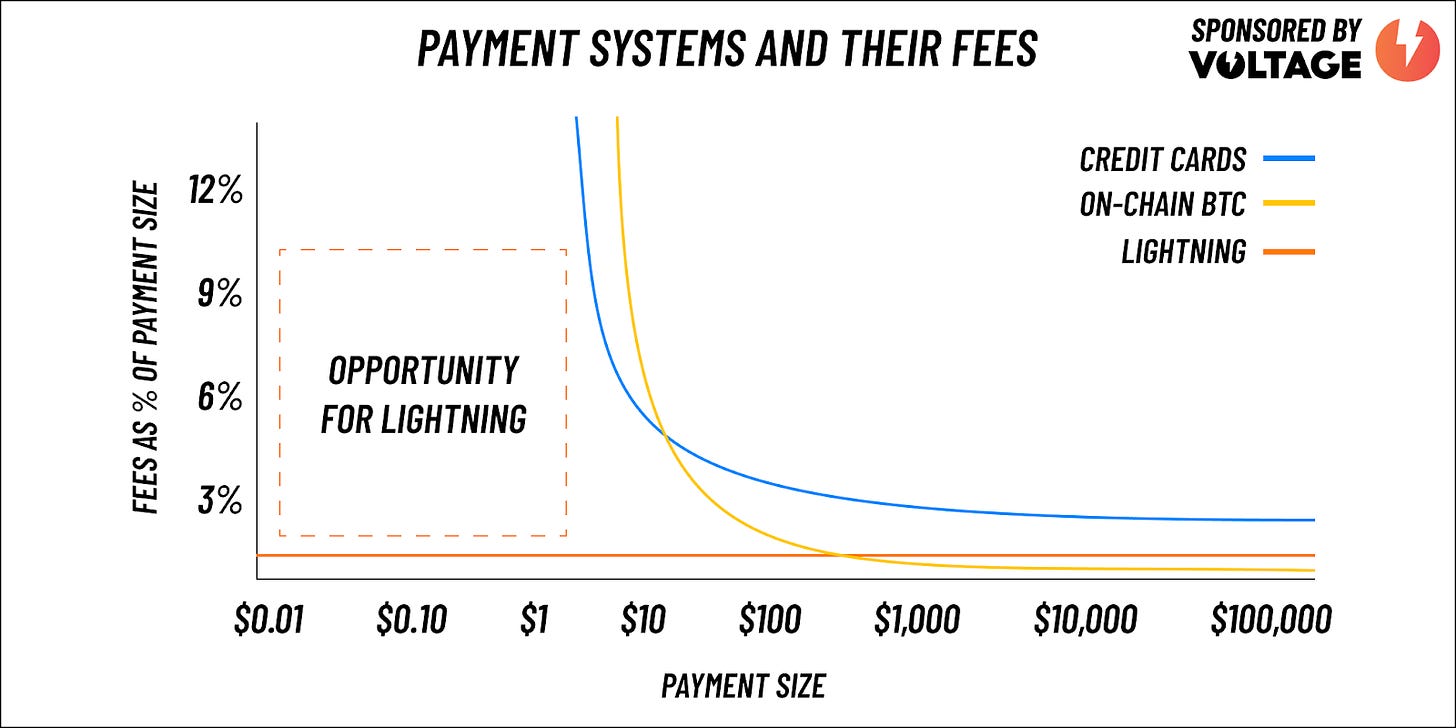

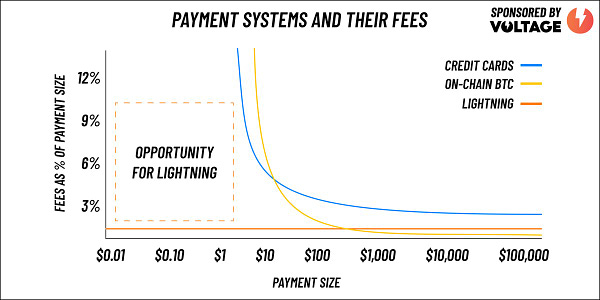

The working paper focuses on the transactions per second compared to today’s solutions of Visa and Mastercard. The paper claims that if Bitcoin will one day become a successful medium of exchange, the throughput for transactions cannot be constrained by the main on-chain seven transactions (on average) per second for confirmations.

The Fed recognizes that Lightning may be the solution for the scalability problem and might “help Bitcoin achieve its potential as a large-scale payments system.”

The Fed authors also highlight that Lightning allows for less energy consumption.

“Second, since fewer transactions need to be recorded on the blockchain, less memory and energy are needed to run a Bitcoin node. …Third, by reducing fees, the LN reduces the incentive for Bitcoin miners to use large amounts of computing power, meaning less energy use and positive consequences for the environment.”

“Our findings suggest that the off-chain netting benefits of the Lightning Network can help Bitcoin to scale and function better as a means of payment.”

Even the title speaks for itself and it's really huge news because now already the FED sees the huge potential in the Lightning Network!

What do you think what's the main motives behind the Cleveland FED “layer 2 love”?

The Central African Republic will hold Bitcoin as a reserve asset

CAR's decision to fully deploy the largest cryptocurrency by market capitalization, Bitcoin (BTC) as a part of its national reserves comes on the heels of a wider policy that is geared towards the legalization of BTC in the country.

The nation became the first jurisdiction in Africa to approve Bitcoin (BTC) as legal tender in April.

But don’t forget that CAR followed up the Bitcoin legalization bill with a project known as Sango, which is promoting their own future shitcoin to their nation.

The Southland Credit Union now allows members to buy Bitcoin

Southland Credit Union – a billion-dollar institution – is now the second credit union in Southern California to enable its customers to purchase bitcoin through its mobile banking app, according to a press release.

Bitcoin purchases were enabled through a partnership with bitcoin bank NYDIG, which specializes in offering infrastructure to companies and institutions looking to broker bitcoin services to their customers. Users will be able to buy, sell and hold their bitcoin in NYDIG’s custodial platform. However, currently users cannot transfer bitcoin from one wallet to another through the NYDIG’s service. But, users can still sell their bitcoin and withdraw the funds if they wish.

The BNP Paribas will offer Bitcoin Purchases

According to a Coindesk report, BNP Paribas will be working with Bitcoin and crypto custody specialist Metaco, a Swiss digital custody firm. Metaco has recently been one of the top Bitcoin and shitcoin providers for banks and institutions that are looking to get into the space.

No comment was given about the partnership and it is currently unclear if Metaco will serve as BNP Paribas’ custodian or offer consultation services. However, it was reported that Mateco will provide services for the tokenization of assets like stocks and other financial products in addition to focusing on Bitcoin and other shitcoins.

Chub Cay island in the Bahamas is seeking to adopt the Bitcoin Standard

Chub Cay – an island nested within the Berry Islands district of the Bahamas – is a private island seeking to adopt a bitcoin standard, and they need a strong Lightning Network wallet service provider to bridge infrastructural gaps, per a recent interview with Bitcoin Magazine.

The employees of the resort, including locals, noted a desire for access to bitcoin due to extreme difficulties associated with operating on a fiat standard. A high percentage of the locals on the island are unbanked and lack financial literacy, which is worsened when one considers the lack of access to traditional banking institutions for many islanders in the Bahamas.

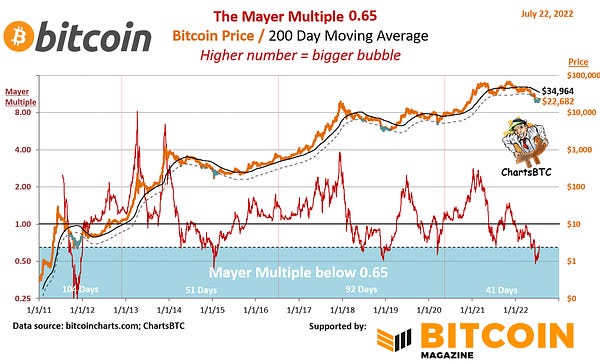

I really like the idea of a Bitcoin circular economy! I think it’s a no-brainer to start at the (possible) lowest point of the Bitcoin price. They will see a massive upscale on their wealth.

Global Economic News

TL;DR

China is selling its U.S. Treasuries

The U.S. New Home demand is falling

China is selling its U.S. Treasuries

A few weeks ago in the 22nd newsletter I already shared the following chart:

Now just after a month the new data shows that the trend continues and China’s holdings of U.S. debt have fallen below $1 trillion for the first time in 12 years amid rising interest rates that have made Treasurys potentially less attractive.

If you want a bullshit “official” answer on this, read the CNBC comment: “The decline in China’s share also has been attributed to Beijing working to diversify its foreign debt portfolio.”

I think that behind this is the fallen trust in the U.S. economy. The importance of this step is that without the Chinese huge U.S. Treasury buys the U.S. can easily go default. Why? Because if the trust is fallen and even the Chinese are not buying but selling no one will support externally the "work" of the U.S. printing press. This is another sign of the falling FIAT World.

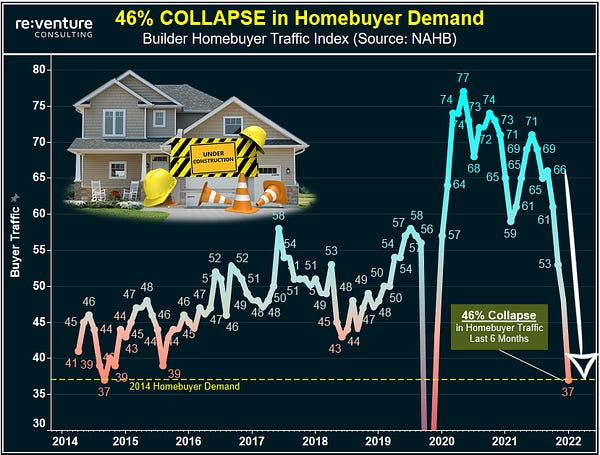

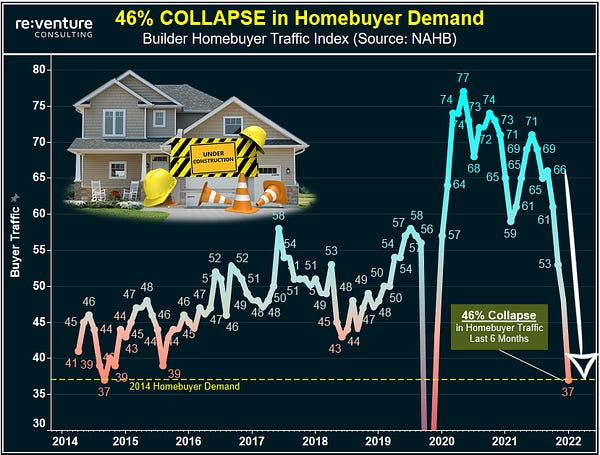

The U.S. New Home demand is falling

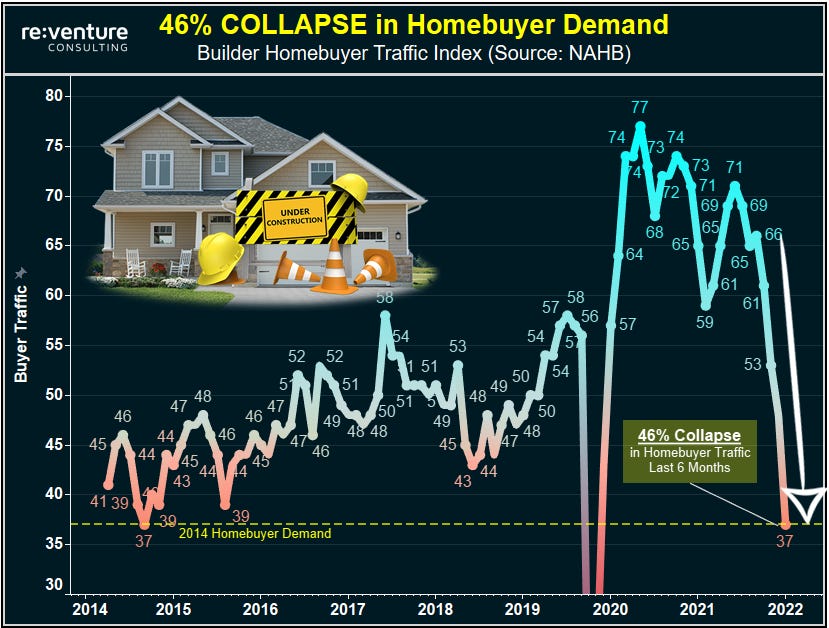

Just after last week's news another important metric shows too that the U.S. Home Market bubble has exploded and it’s already sharply deflating:

“Home Builders in deep trouble. NAHB reported a 46% COLLAPSE in Homebuyer Traffic in the last 6 Months. Buyer Demand for New Homes crashing back to 2014 Levels. Yikes.” by @nickgerli1

The FED needs to raise rates to try to stop the inflation (can’t), but with this the Mortgage sector will be killed. We already see the cracks in this system, but the FED rates hikes barely began.

“ Mortgage demand drops to a 22-year low as higher interest rates and inflation crush homebuyers” by NBC News

Meanwhile the House Market Crash in Australia is inevitable too: According to the DailyMail, “Australian banking giant ANZ is now predicting borrowers will sustain FOUR 50 basis point interest rate rises by November. “

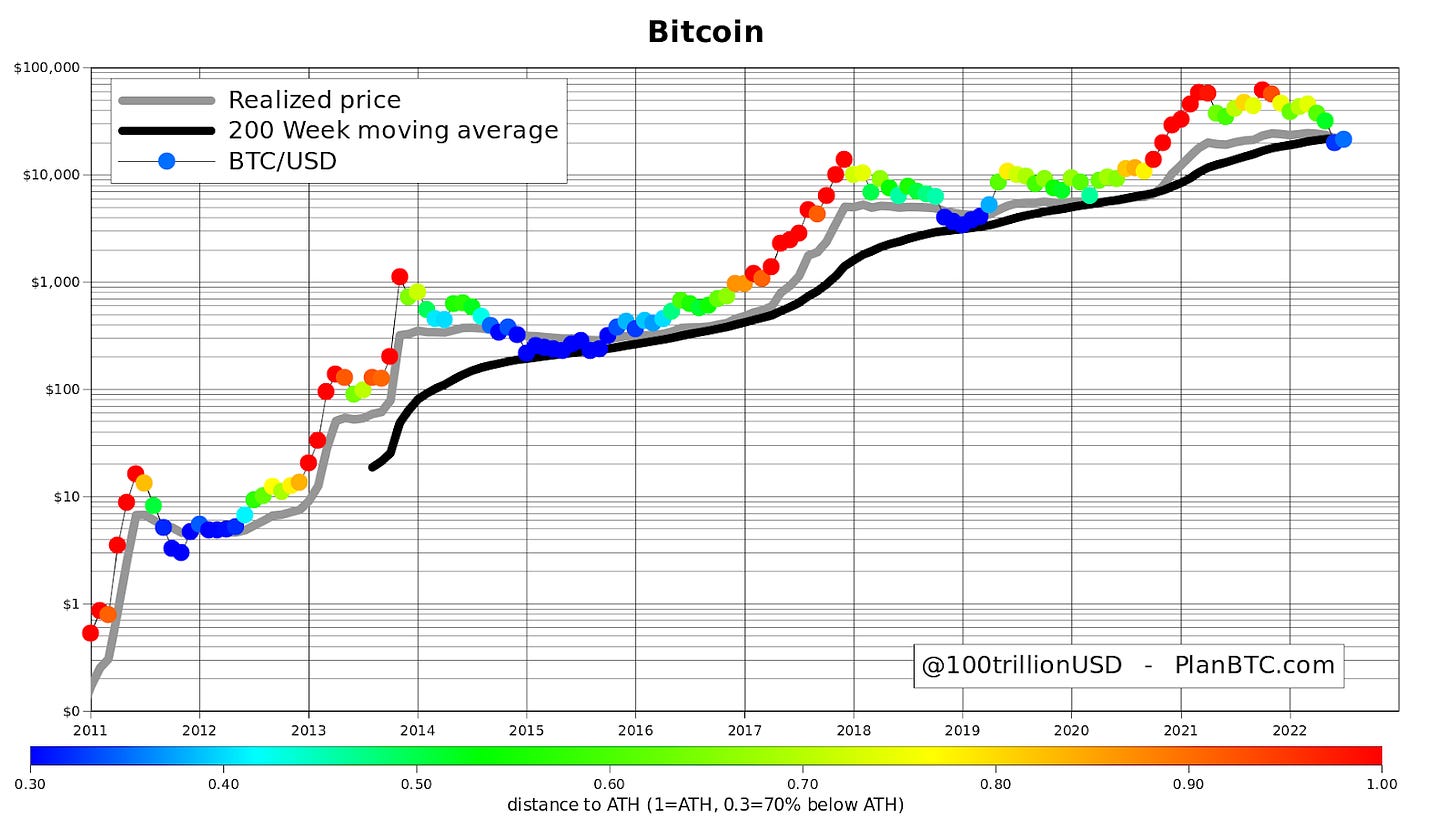

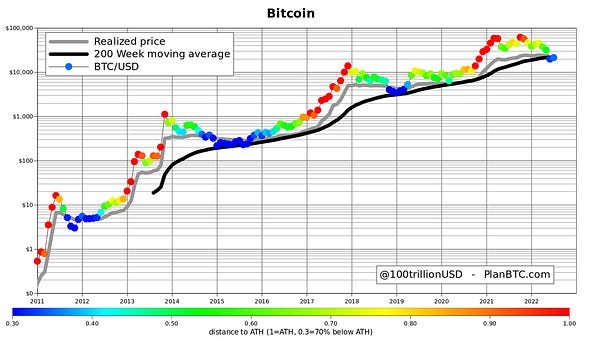

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

“38,262 $BTC ($802.33 million) has been taken off exchanges in the last 30 days.” by @WatcherGuru

“Today the annual inflation rate of Bitcoin is 1.72%. One year from today the annual inflation rate of Bitcoin will be 1.69%. Good luck getting this level of predictability from a central bank issued currency.” by @lopp

“In Q2 2022, Bitcoin mining efficiency surged 46% YoY, and sustainable power mix reached 59.5%, above 50% for the 5th quarter in a row. The network was 137% more secure YoY, only using 63% more energy. It is hard to find an industry more clean & efficient.” by Michael Saylor

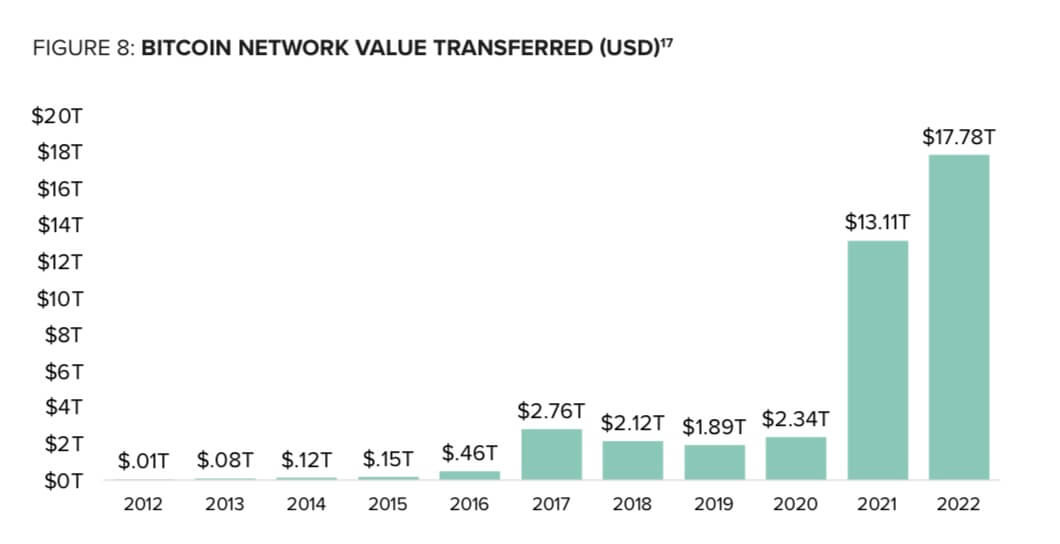

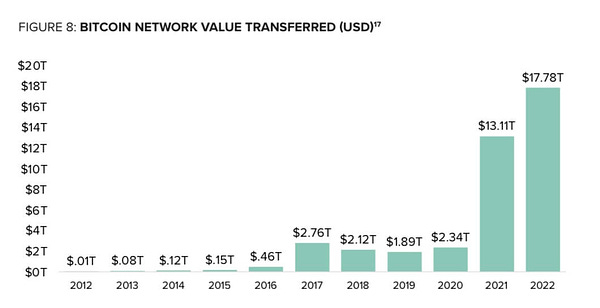

“Bitcoin Network has transferred $17.78T in 2022 already. Smashing the record from 2021.” by @BTC_Archive

Finland Customs has liquidated 1,889 $BTC seized in drug busts, raising €46.5 million.

Can’t imagine their face on the next Bitcoin top. But anyway the rules are the rules even if they’are made by stupid politicians.

"Bitcoin uses too much energy"

Home Depot-"Hold my beer" (video)

We can eliminate inflation with Zero-Tax Bitcoin - Bryan Solstin, US Senate Candidate

“Credit cards can't support small payments. Blockchains can't support small payments. Lightning can.” by @kerooke

Suggestions

Interesting articles to read

Iran and Russia ready to drop US dollar in bilateral trade: Kremlin

How can Bitcoin bonds influence the future of financial instruments? (Thread)

Did Russia And China Just Announce A "New Global Reserve Currency"?

Sources:

https://cointelegraph.com/news/andorra-green-lights-bitcoin-and-blockchain-with-digital-assets-act

https://bitcoinmagazine.com/business/southland-credit-union-nydig-partner-for-bitcoin-services

https://www.btctimes.com/news/banking-giant-bnp-paribas-will-offer-bitcoin-purchases

Solid newsletter as always! Keep up the great work.