This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

A new physically backed Bitcoin ETN launches in Germany

Fifth largest Swiss Bank will allow Bitcoin trading

30 million Brazilian PicPay customers may now buy Bitcoin

South Africa Reserve Bank to bring Bitcoin into mainstream with supportive regulation

NYDIG has partnered with the New York Yankees

Bitcoin is now officially banned as a means of payment in Russia

Paraguay allows Bitcoin miners to use the country’s excess energy at lower prices

Bitcoin addresses hit 1 billion

A new physically backed Bitcoin ETN launches in Germany

German financial services company EQONEX Limited (NASDAQ: EQOS) has launched its first investor product with a new physically backed exchange-traded note (ETN) on the Deutsche Börse XETRA Exchange, according to a press release.

The EQONEX Bitcoin ETN allows German investors to use standard brokerage services to trade back and forth between the asset while also allowing investors the opportunity to redeem actual bitcoin for free with a Digivault custody account. Digivault is a Financial Conduct Authority (FCA) registered custody provider for digital assets and is one of only 35 total entities that currently hold this accreditation.

“Germany makes an ideal, strategic launchpad for our Investment Products business, given its sophisticated and highly educated investment community. We see the German market as fertile ground for what is likely to be a growing suite of EQONEX exchange-traded products,” EQONEX CEO Jonathan Farnell said.

Fifth largest Swiss Bank will allow Bitcoin trading

PostFinance is the fifth largest financial services bank in Switzerland while also serving as the banking arm for the country’s post office. The company announced that they will be offering 2.69 million of their customers the option to buy, sell, and hold Bitcoin by the year 2024.

Head of Retail Banking Sandra Lienhart states that the company is meeting the demands of their customers and “Given the growing institutionalization [of cryptocurrencies] in the last 18 months, this is the ideal time to enter the market.”

30 million Brazilian PicPay customers may now buy Bitcoin

In a statement released on Monday, Anderson Chamon, the vice president of technology and products at PicPay, announced, “PicPay will enter the crypto market to lead its popularization not only as an investment, but also as a way to decentralize payments and other financial services.”

The platform will allow its 30 million active customers to buy Bitcoin and other cryptocurrencies once it goes live in August 2022. More details here.

South Africa Reserve Bank to bring Bitcoin into mainstream with supportive regulation

South Africa Reserve Bank (SARB) deputy governor Kuben Naidoo has confirmed that the country is set to roll out cryptocurrency regulations that will partly support the sector.

Speaking during a webinar on June 12, Naidoo stated that the laws will likely be released within the next 18 months and will not identify Bitcoin and shitcoins as a payment option but as a financial product that can be utilized in the mainstream sector.

“We are not intent on regulating it as a currency as you can’t walk into a shop and use it to buy something. Instead, our view has changed to regulating (cryptocurrencies) as financial assets. There is a need to regulate it and bring it into the mainstream, but in a way that balances the hype and with the investor protection that needs to be there,” he said.

NYDIG has partnered with the New York Yankees

NYDIG, a leading bitcoin company, today announced a multi-year partnership with the New York Yankees to become the team’s official Bitcoin Payroll Platform. The deal aligns the world's most iconic sports franchise with the most trusted name in Bitcoin by offering employees of the Yankees organization access to NYDIG’s Bitcoin Savings Plan (BSP).

BSP is a workplace benefit that allows for employees to convert a portion of their paycheck to bitcoin via the NYDIG platform. As part of a NYDIG Bitcoin Savings Plan offered by a participating employer, employees do not pay any transaction fees nor any fees for secure bitcoin storage.

Bitcoin is now officially banned as a means of payment in Russia

Vladimir Putin has signed a law banning Bitcoin and cryptocurrency as a means of payment in Russia. It bans the use of Bitcoin and other shitcoins as a means of payment for goods, services and products in Russia. After so many China bans, the market did not even move a tiny bit on this news. The difference between China and Russia is that in Russia for investment Bitcoin is not banned only for domestic payments.

Paraguay allows Bitcoin miners to use the country’s excess energy at lower prices

Paraguay's Senate approved a bill that would allow Bitcoin miners to use the country’s excess energy at lower prices.

Miners – either individuals or companies – will need to request authorization for industrial electricity consumption and then apply for a license, the bill notes.

According to the bill, Paraguay consumes only a third of its energy producted and, if regulated, crypto mining activity could reach “the electricity consumption of thousands of megawatts that Paraguay currently has as surplus.”

I love to see how small countries open to Bitcoin because either they see their only option for a decent future or at least from their own intentions a good business in mining it. Either way this is really good for the Bitcoin network!

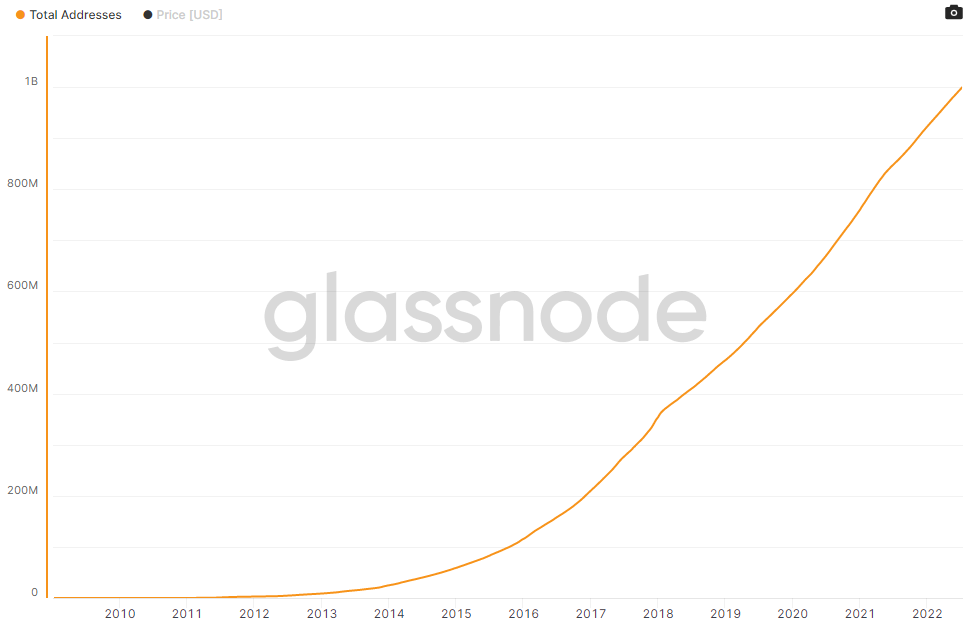

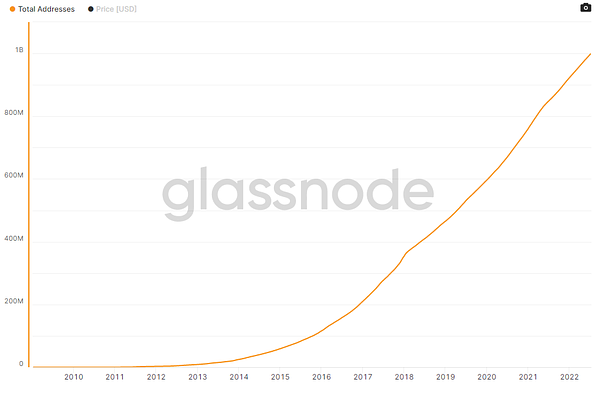

Bitcoin addresses hit 1 billion

First let’s step back for a little bit. Meanwhile we are in a deep bear market, all the fundamentals of Bitcoin are still not only working, but even Rising and Growing. Rising because we already hit the 1 BILLION bitcoin addresses mark without even being in hyperbitcoinization so this growth of addresses then it will be even steeper!

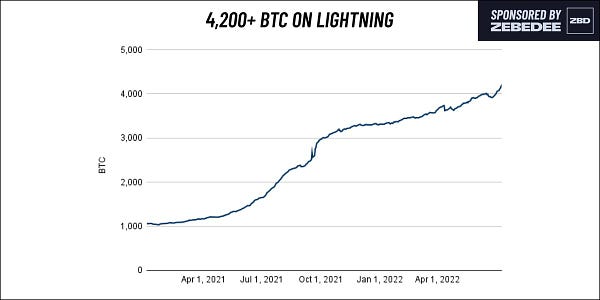

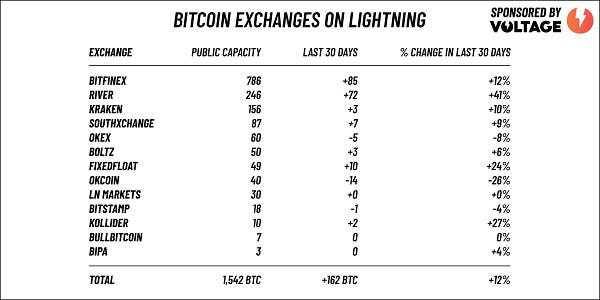

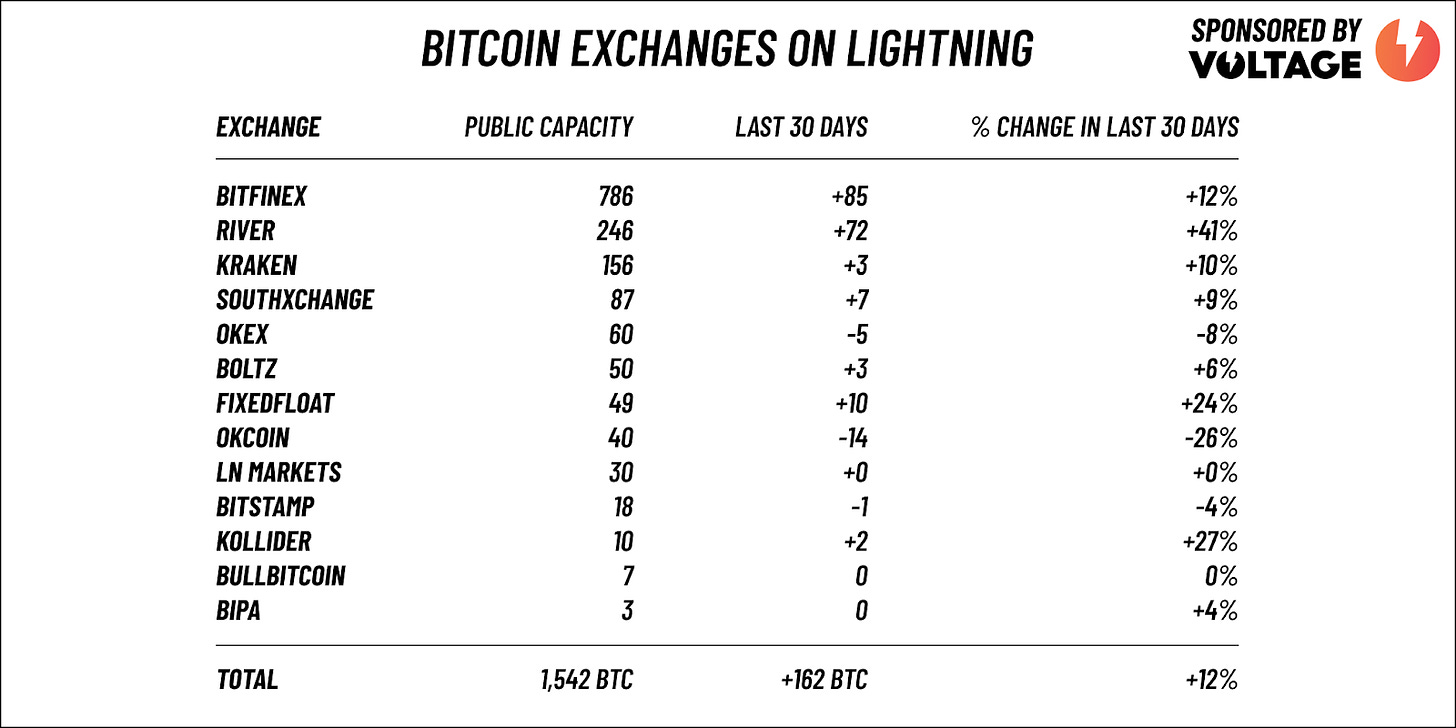

Growing because the Lightning Network is on a new ATH with 4,300+ BTC capacity and the Bitcoin exchanges now have over 1,500 BTC of public capacity on Lightning, or 36% of all public capacity on the network.

This is the best proof of Bitcoin usefulness because even in a Worldwide Recession it’s still Rising and Growing!

Are you afraid of the current Bitcoin price level? Or you’re a Maxi who only focuses on fundamentals? I’m really curious about your opinion!

Global Economic News

TL;DR

The U.S. economy faces with the greatest Recession and the Housing Market crash already started (UPDATED!)

Is China in economic trouble too?

Germany is heading for a recession with no energy and huge debt (UPDATED!)

The EUR lost for good against the USD?

Why is ESG a poison?

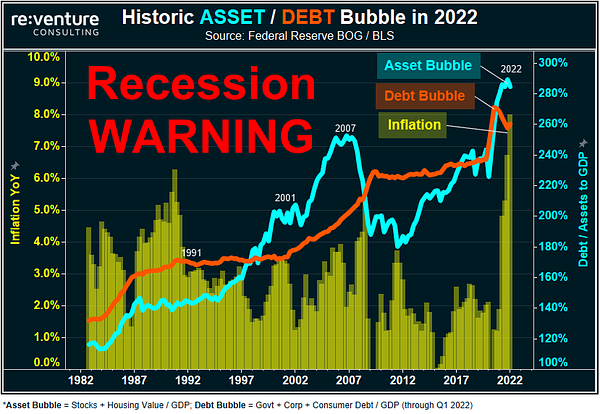

The U.S. economy faces with the greatest Recession and the Housing Market crash already started (UPDATED!)

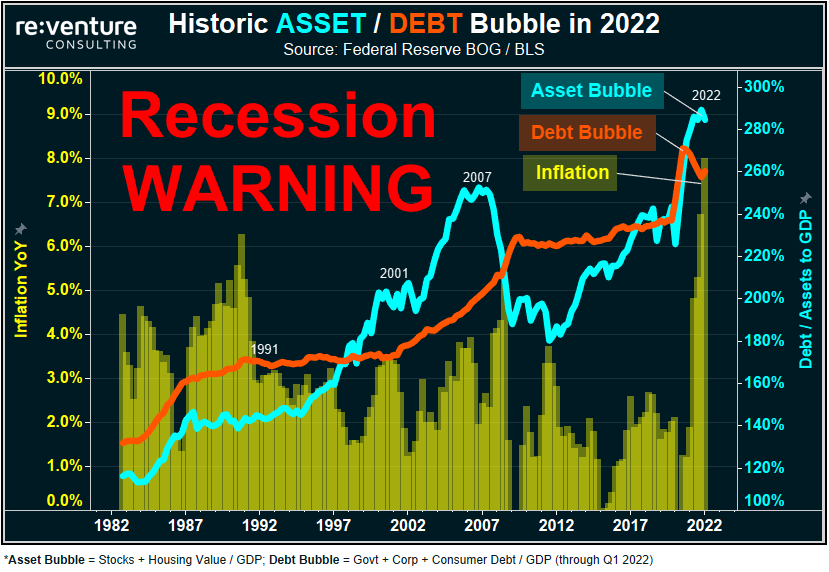

2022 = FIRST time in US History where the following are occurring simultaneously:

1) Asset Bubble 🔵

2) Debt Bubble 🟠

3) Inflation 🟡

Fed is trapped. No easy way out. Asset Crash / Layoffs / Bankruptcies just beginning. More details here.

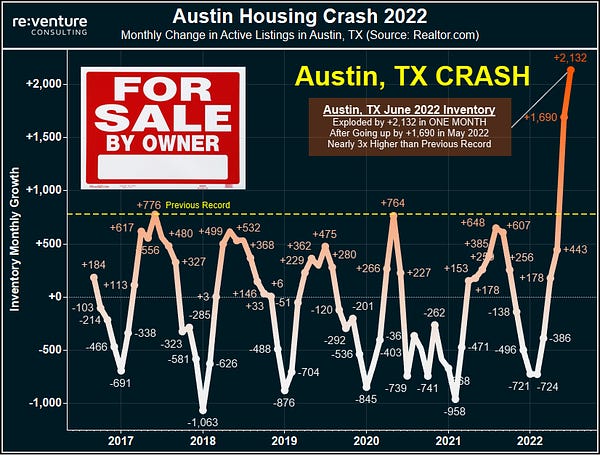

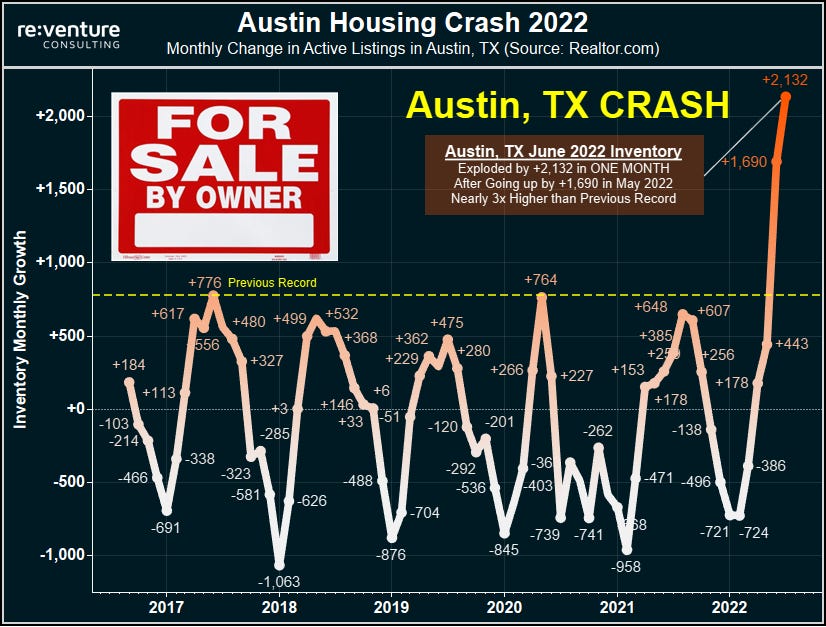

“Housing Crash in Austin, TX is getting EPIC. No buyers. Selling liquidating. Inventory piling up in record fashion. June 2022 Inventory Gain of +2,132 was nearly 3x previous record. And it's just getting started…” by @nickgerli1

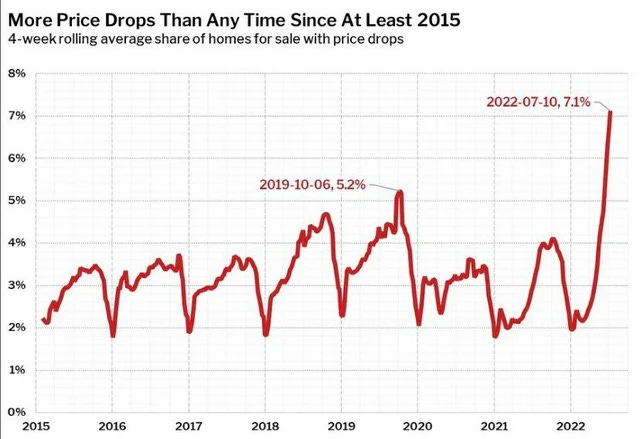

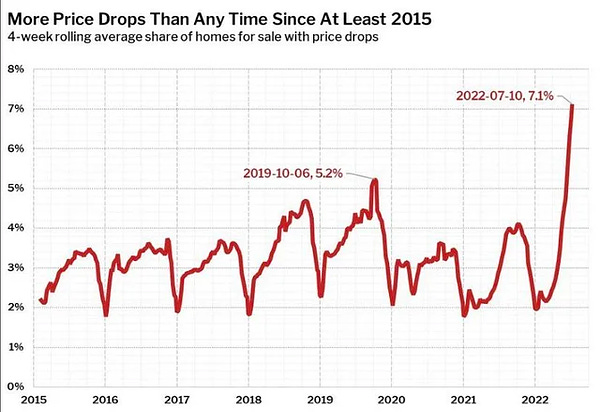

“7.1% of homes had a price drop - record high since 2015” by @WallStreetSilv

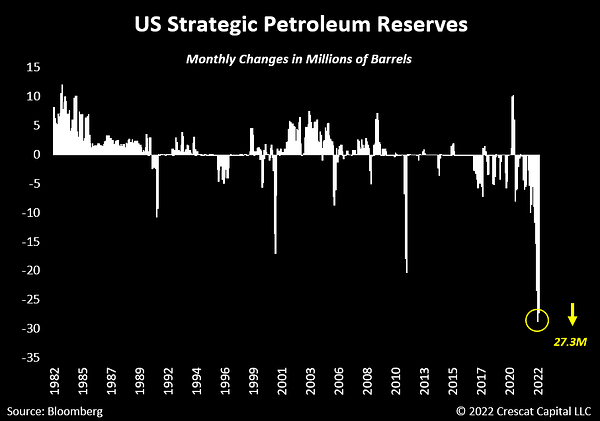

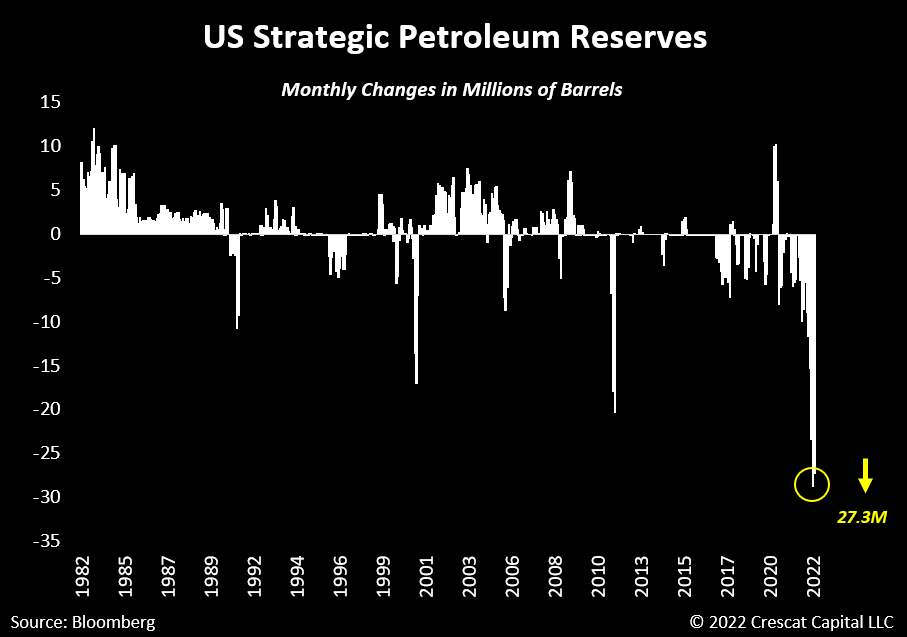

“In case you think the selling pressure in oil is solely driven by recession fears: The US government just sold another 27M barrels of oil just in the last month. At this pace, strategic petroleum reserves will be zero in 18 months. Completely unsustainable and will end badly.” by @TaviCosta

Meanwhile, according to Reuters, Sanctions are making some very weird things possible. Saudi is buying Russian crude at a huge discount to BURN FOR POWER and then exporting their own to Europe. We are living truly in a Clown World!

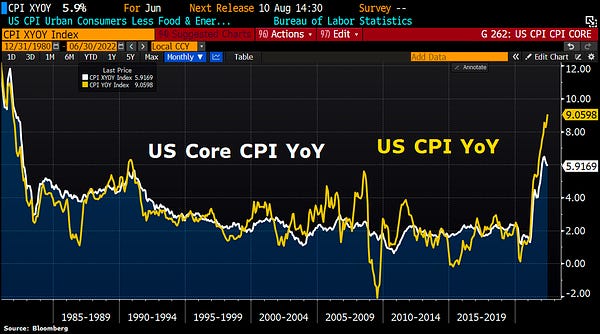

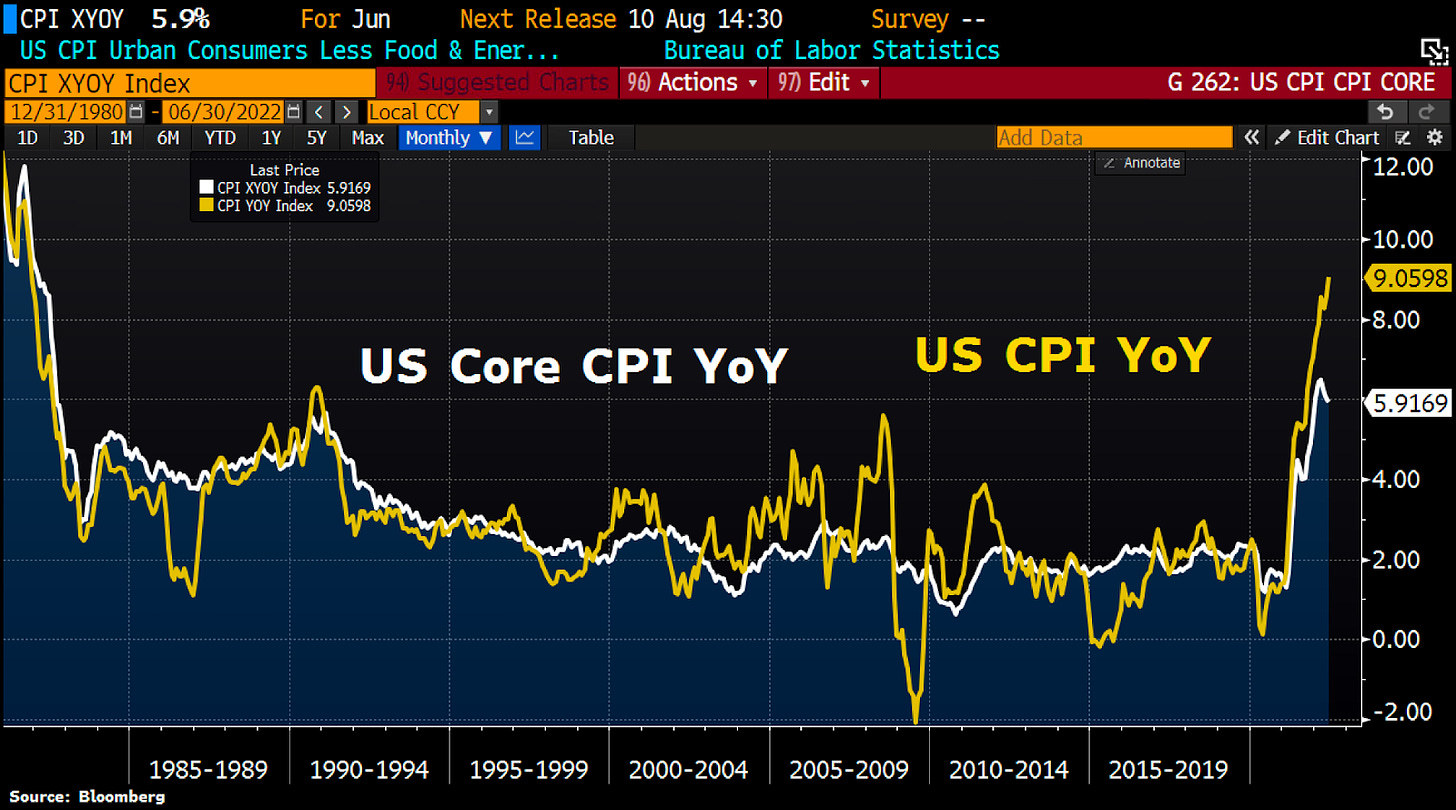

(UPDATE: The Inflation reaches 9.1%, the highest the US has seen in 40 years. The Core CPI dropped to 5.9% vs 5.7% expected.)

Is China in economic trouble too?

“Nasdaq China Index plunges >7% due to the negative COVID headlines out of the country. Pinduoduo down 10%, Alibaba -9.4%, Baidu -5.7%.” by Holger Zschaepitz

From a different (export) view China is flying:

“In H1 2022, China's foreign trade reached 19.8tn yuan, increasing 9.4% yoy, with exports up 13.2% and imports up 4.8%.” by @thesiriusreport

The newest report of China GDP Growth Plunges In Q2 and the unemployment rate hit 12.5%.

The mass Mortgage defaults reached China too: "The Damage Could Be Huge": Chinese Banks Tumble, Swept Up In Mortgage Nonpayment Scandal As Borrowers Revolt.

Germany is heading for a recession with no energy and huge debt (UPDATED!)

“Germany where the number of private debt deals hit a record in H1 2022. Firms launched 95 Schuldschein transactions that beat the last record of 91 set in H1 2019, according to BBG. Schuldschein costs up 25%, but nonetheless less pricey for issuers to raise cap than bond mkt.” by Holger Zschaepitz

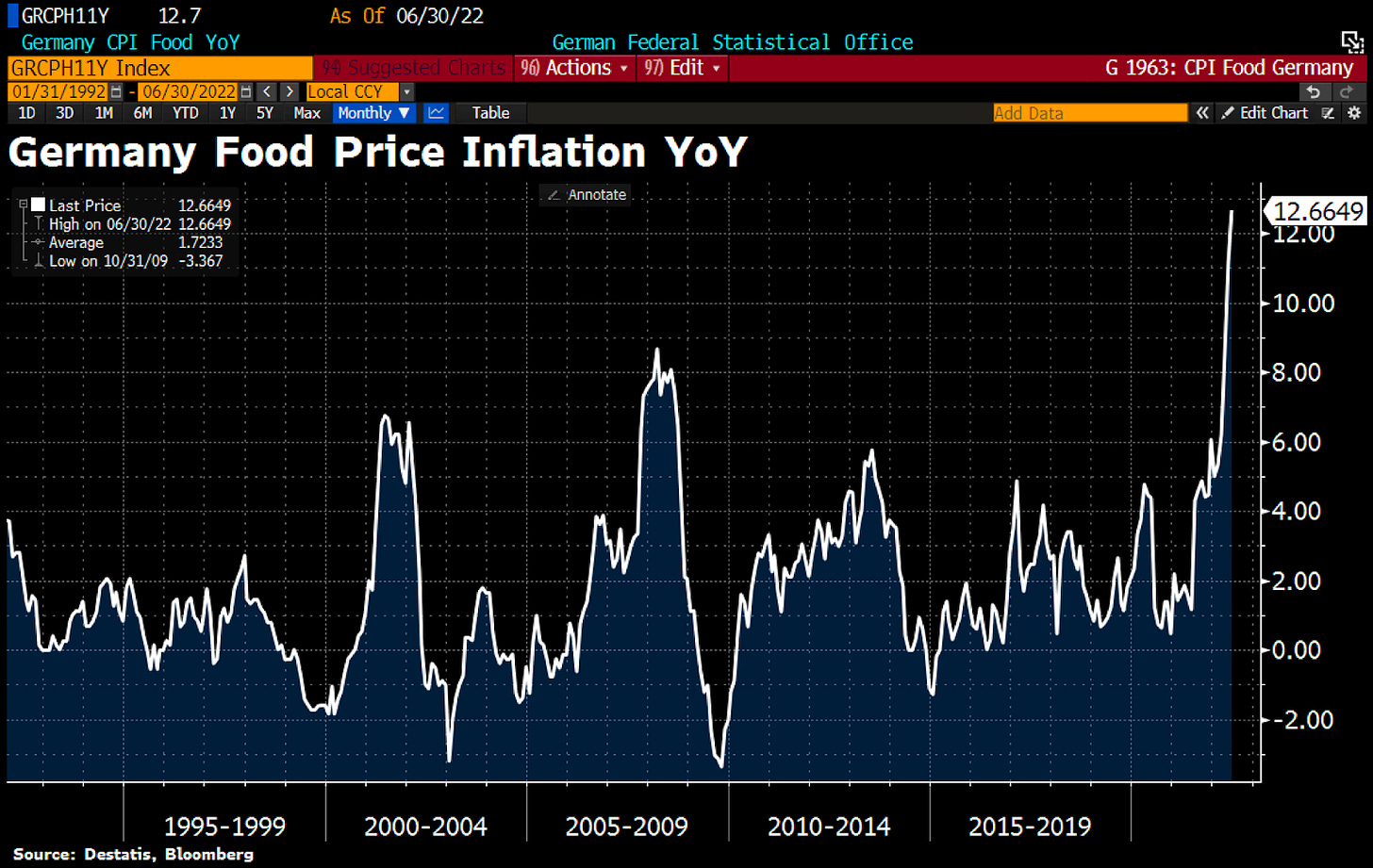

While people are spending like no tomorrow they are faced with never seen food prices: The food prices jumped 12.7% YoY in June, the highest food price inflation since the start of the statistics.

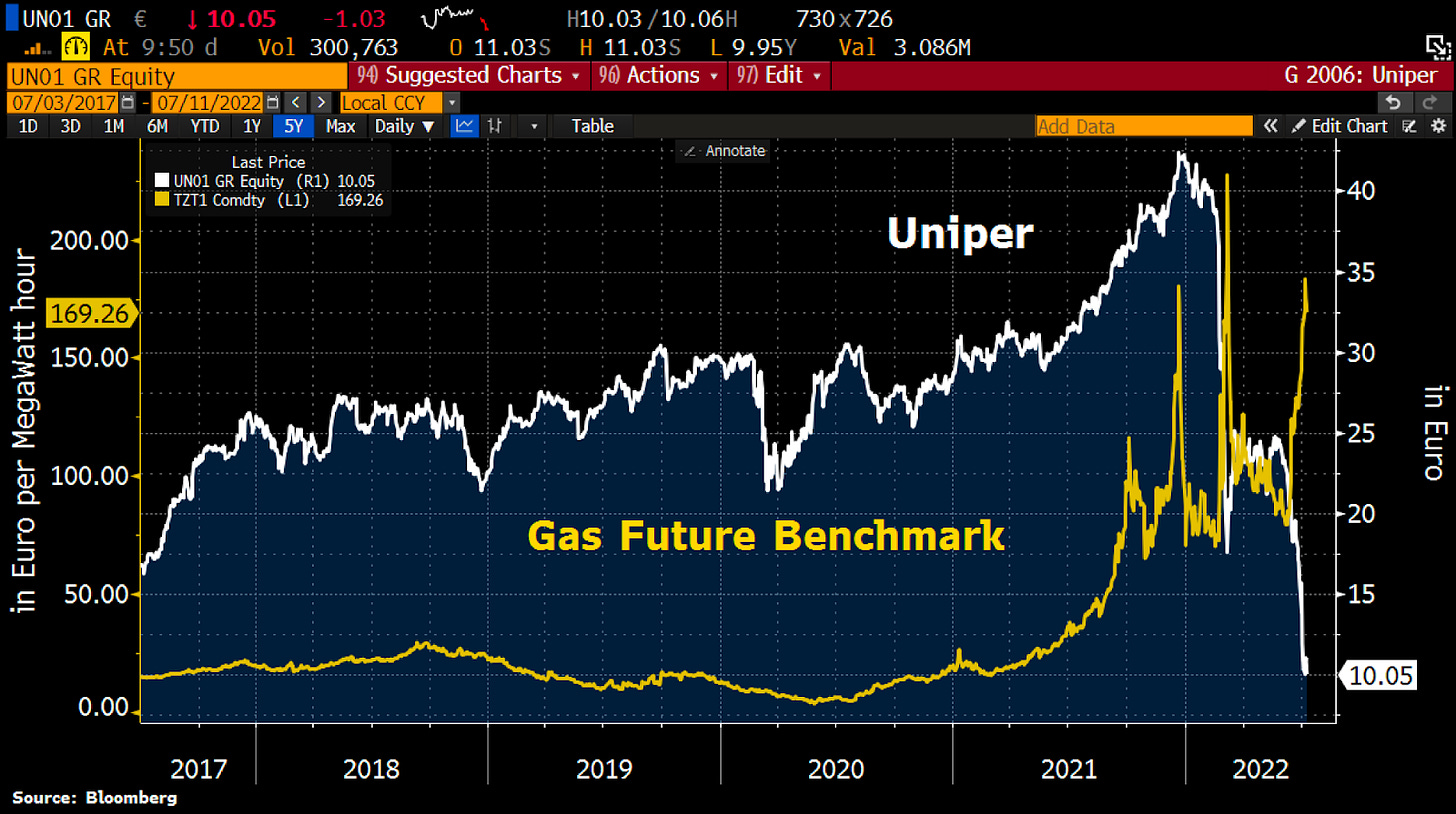

According to the WSJ, Utilities are often prized by investors for offering steady, predictable returns. In the European power sector, that view is starting to seem rather quaint. Dwindling gas supplies from Russia triggered drama for Europe’s power provider. Uniper is now 76% below high.

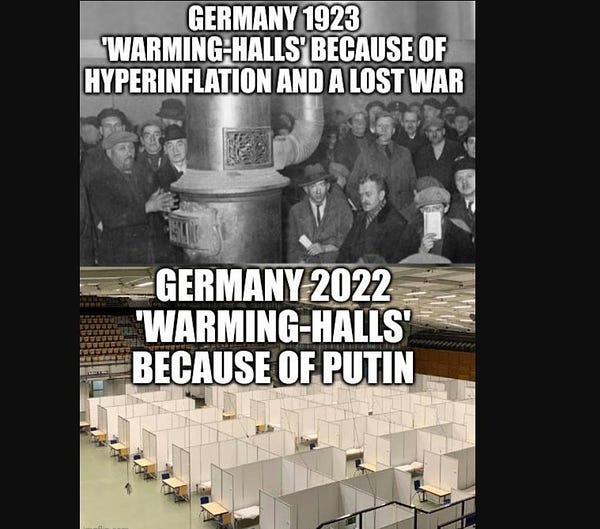

“WEIMAR 2.0: German authorities plan 'warming halls' for the upcoming winter where people can warm themselves for a few hours before they return to their cold unheated homes.” by @WallStreetSilv

To understand why I gave the title “no energy”: Germany struggles to stay above water with the (green?) Coal plants and maybe save the last 3 nuclear reactors too, in the meantime there is a huge possibility that Russia answers on sanctions with closing down the gas valve for good. This article explains why Germany’s politically main energy source the unreliable renewables are just a really expensive pile of s**t.

(UPDATED: When you think stupidity can’t be bigger than you face with the following article: Germany To Halt Russian Coal Imports Next Month)

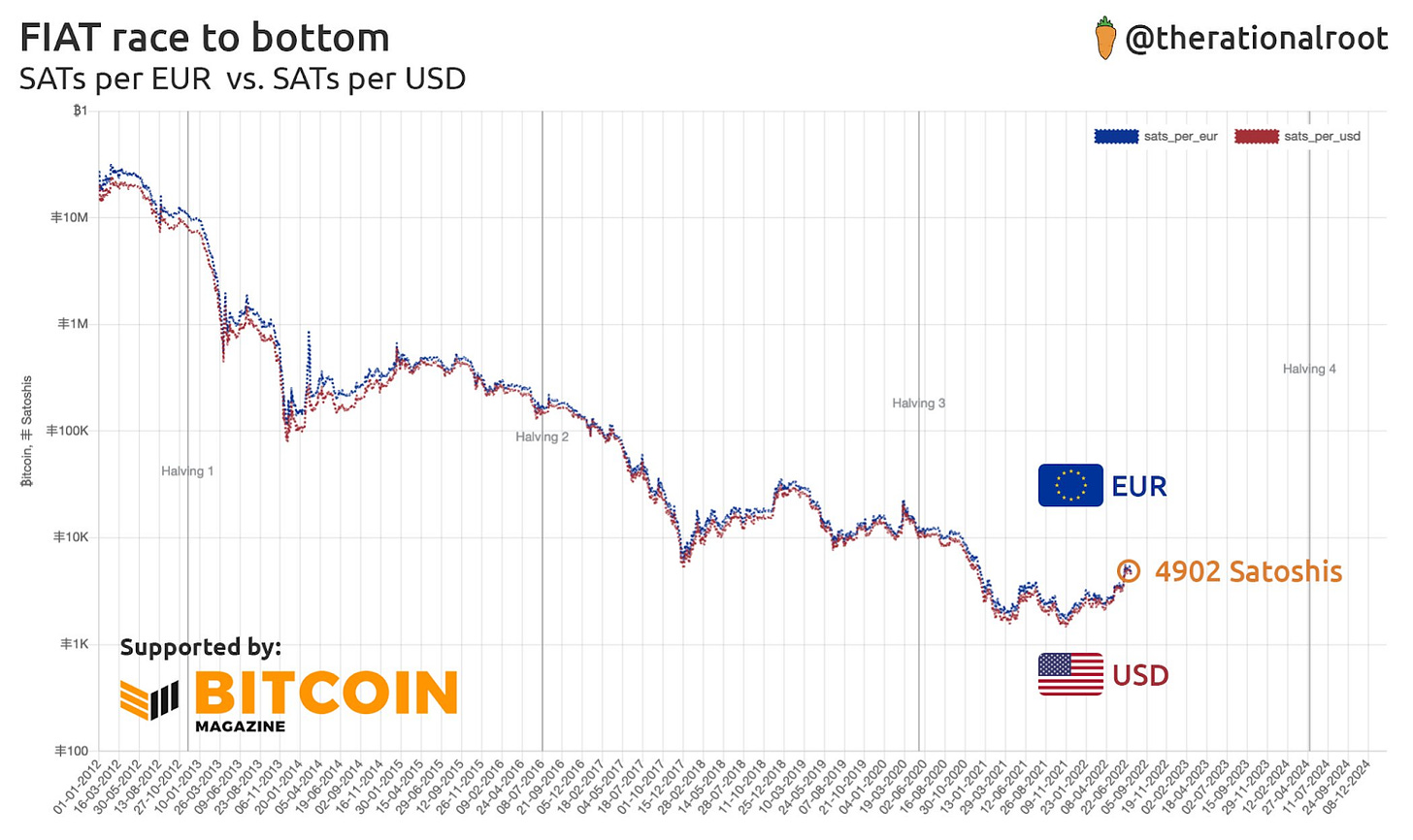

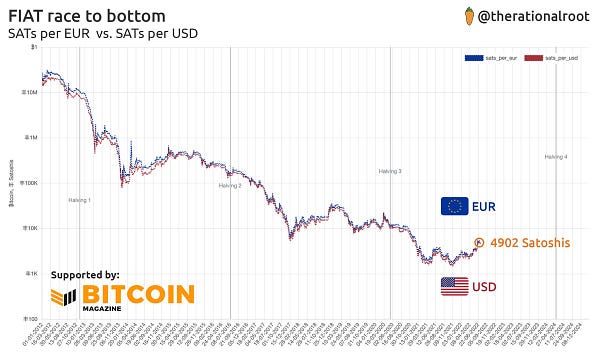

The EUR lost for good against the USD?

Euro falls equivalent to the US Dollar for the first time in 20 years.

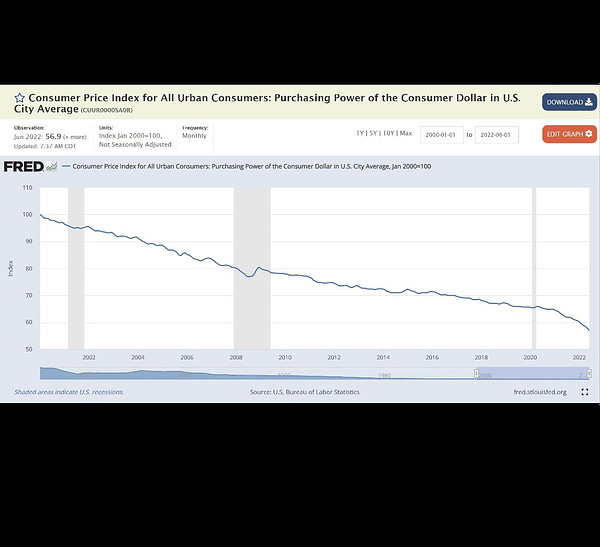

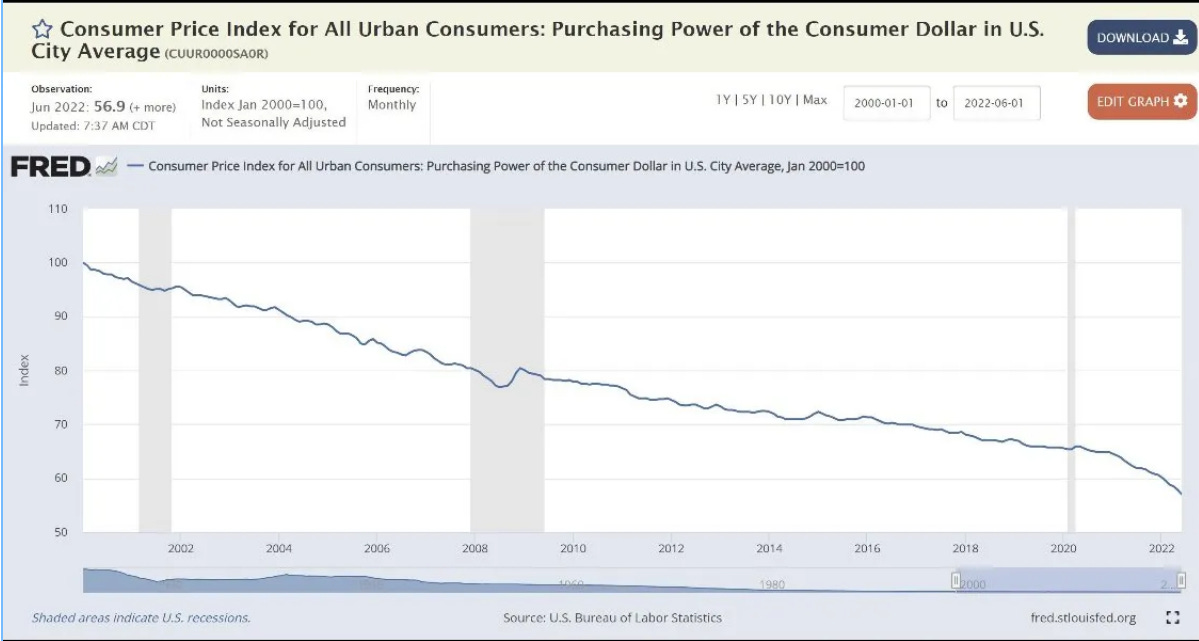

To put things into perspective not the USD is getting stronger, but the EURO is getting weaker because the purchasing power of $100 from January 2000 dropped to $56.90 in June 2022.

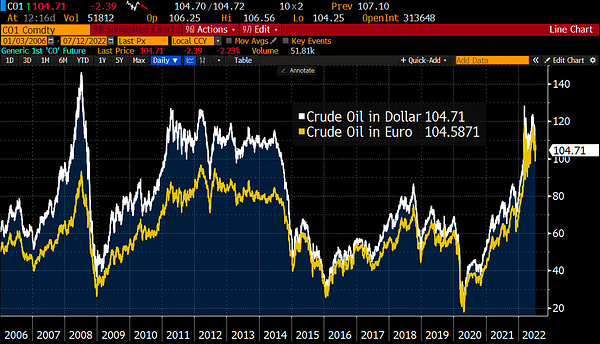

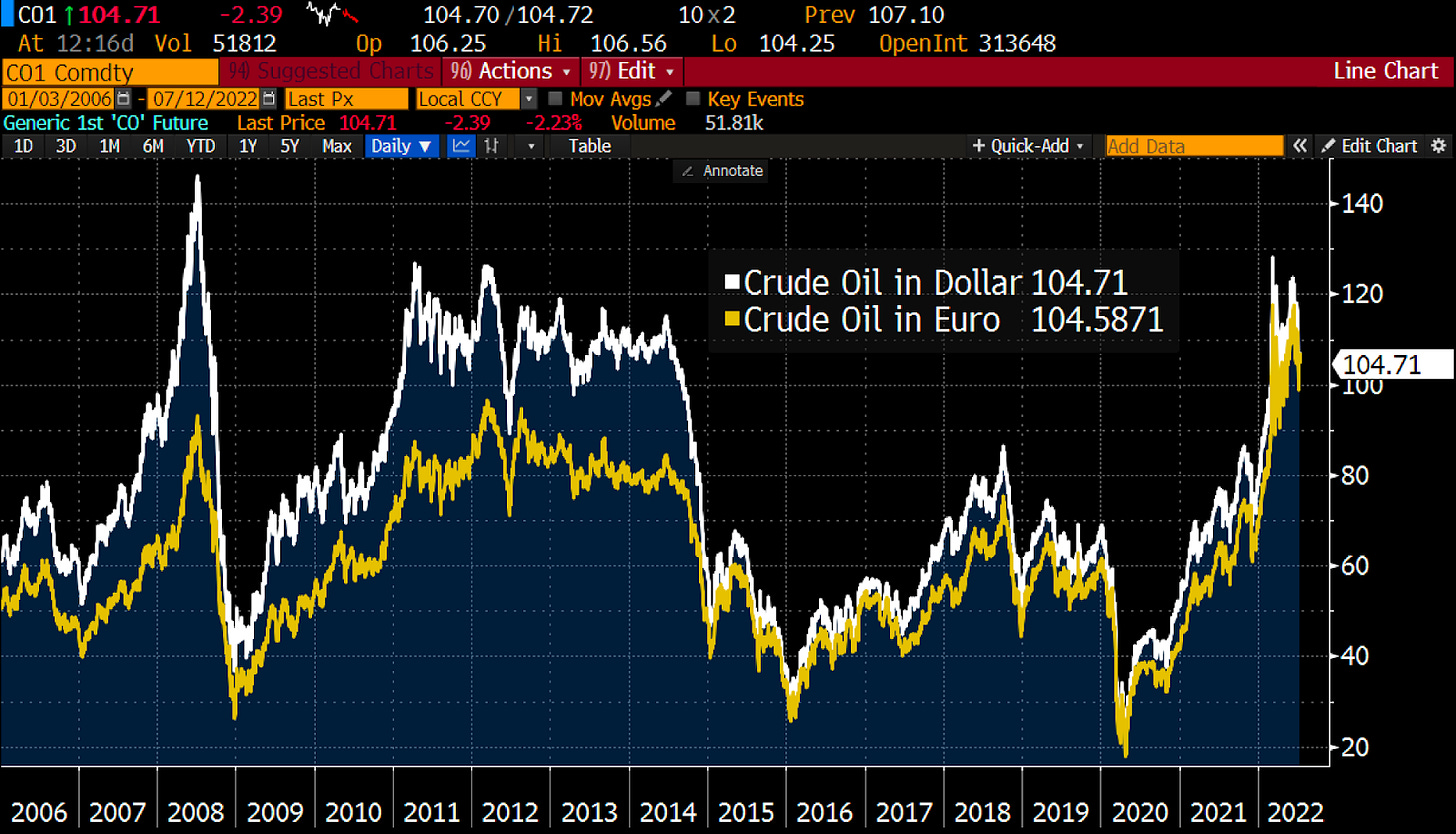

“For those who think a cheap currency would be good for an economy, this chart: oil in Euros is trading near record highs right now, so the cheap Euro is fueling inflation, while a strong Euro in 2008 saved the Eurozone from high oil prices.” by Holger Zschaepitz

Why is ESG a poison?

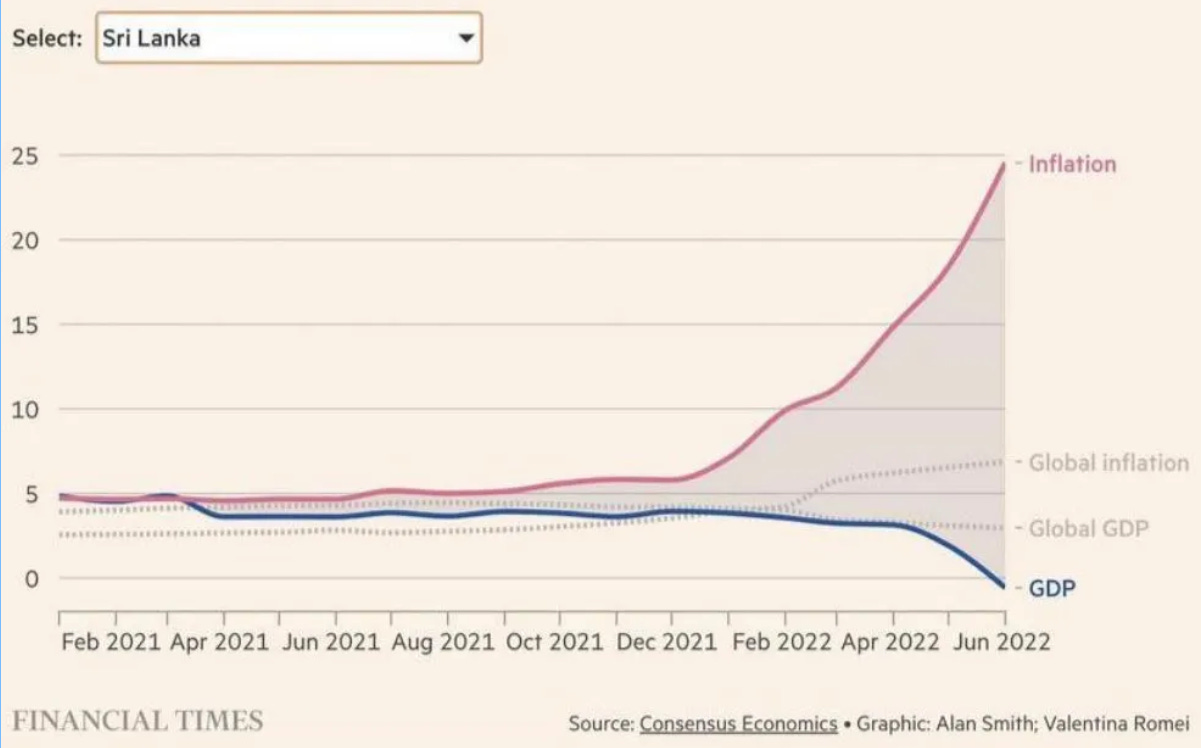

“There are currently three countries in the world with an ESG score over 90:

Sri Lanka, where the government just collapsed.

Ghana, where the national power supply has shut down.

Netherlands, where farmers have revolted against the state

Green energy is a deadlier virus than covid.” by @realmichaelseif

“Sri Lanka went on a money printing spree and had to witness the music slowing down. Inflation and out of control government spending were factors plus the decision to ban chemical fertilizers. “ by @WallStreetSilv

You could ask what’s the connection between ESG and Sri Lanka’s collapse? Answer: ESG round-up: Sri Lanka launches green taxonomy with IFC

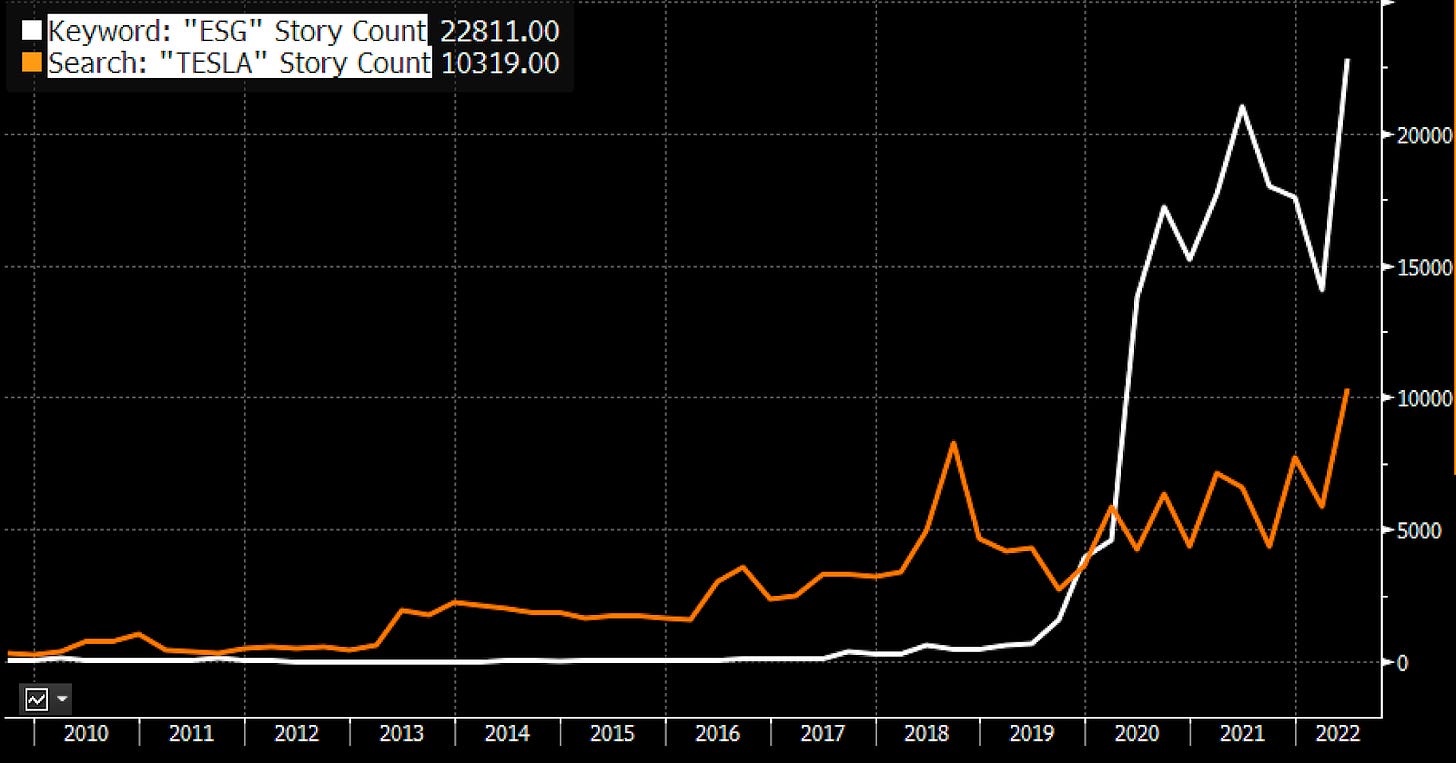

“Mentions of "ESG" in the media hit an all-time high in Q2 with 25,000. I've never seen a higher media-to-assets ratio in all my years doing this. For context, mentions of "Tesla" got mentioned less than half as much (altho it also hit an all time high).” by @EricBalchunas

There is no coincidence that the most problematic countries are deep into ESG. But not just the above-mentioned 3 countries, but most of the westerner ones too. The graph above shows how strongly the mass propaganda is changing your mind. Just think about the stupid decisions against nuclear in favor of unreliable renewables or sanctioning countries which supplies you with the most needed energy source. We can continue the list with many more, but I think these examples on ESG narratives are more than enough to see why I think ESG is a poison!

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

How beautiful is it to see when the right incentives meet each other: with excess energy Bitcoin mining and with the created heat either drying stuff (like beef jerky) or heating homes, greenhouses etc. Great future for Bitcoin mining!

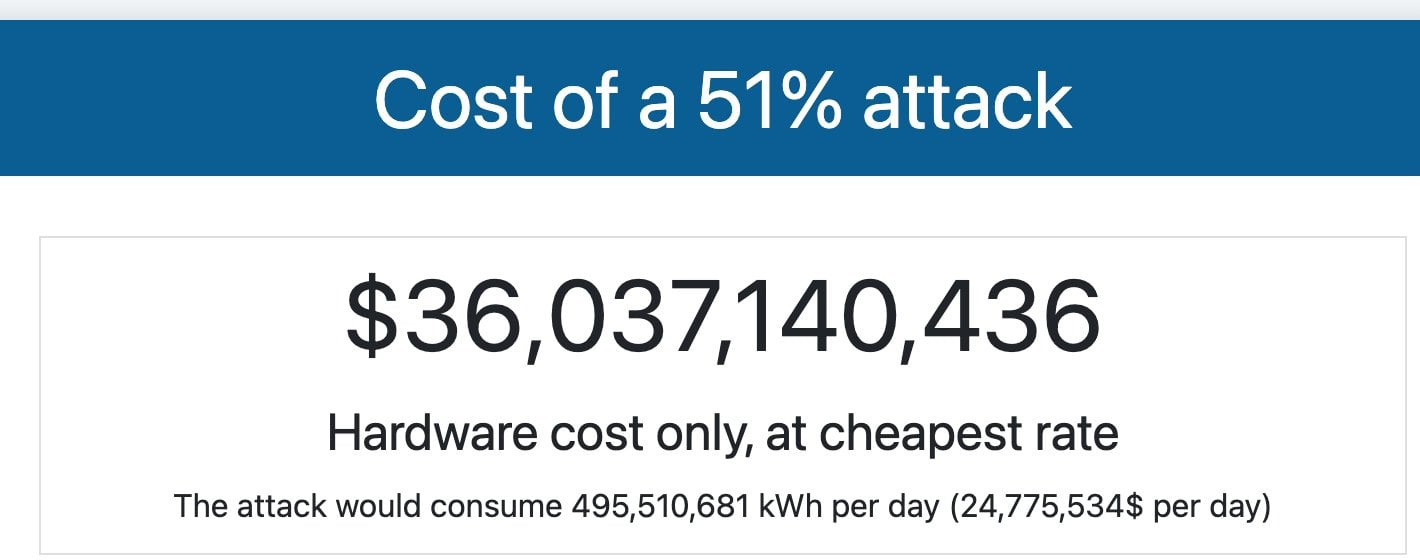

“36 billion just on hardware, assuming they could get the hardware made…All for 1 double spend” by @DWhitmanBTC

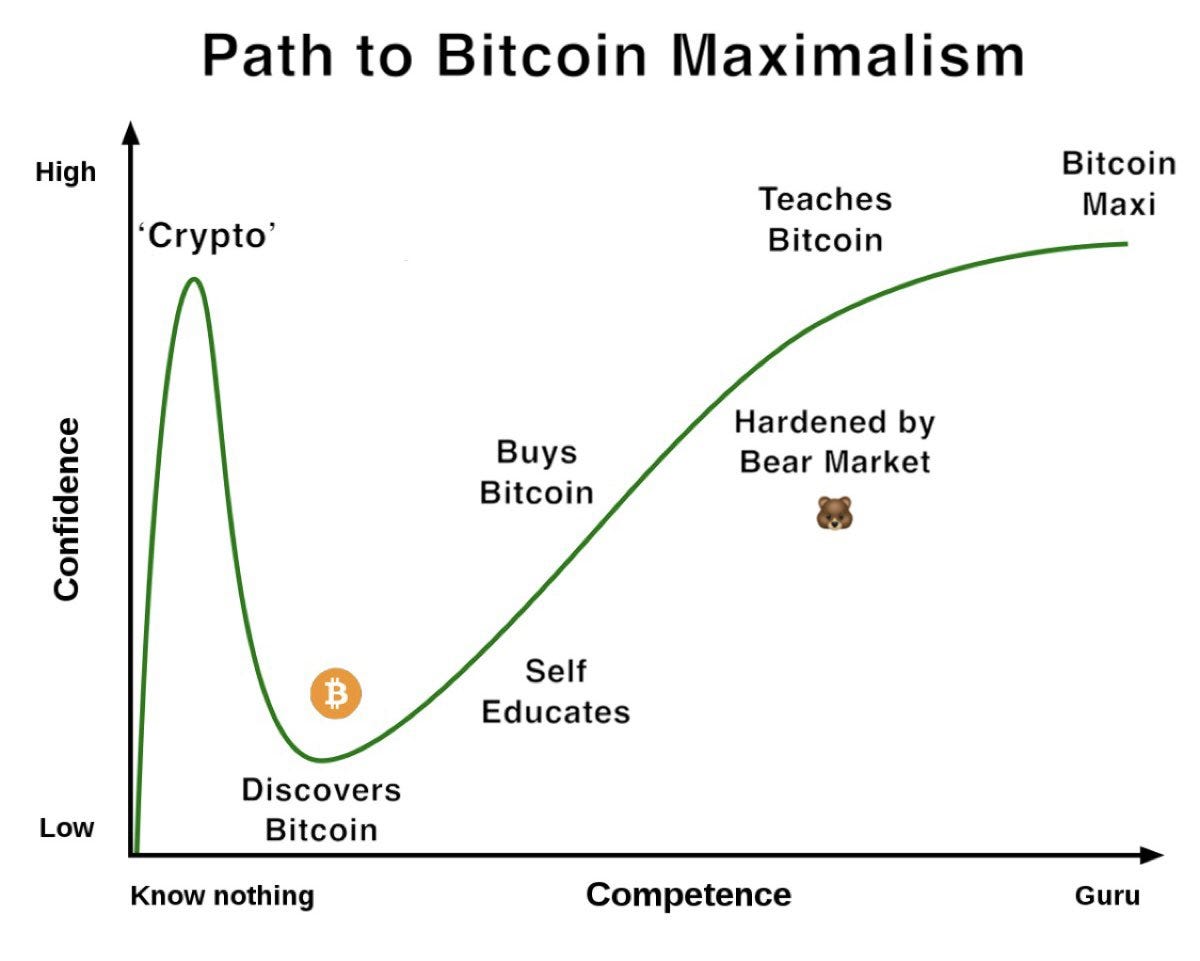

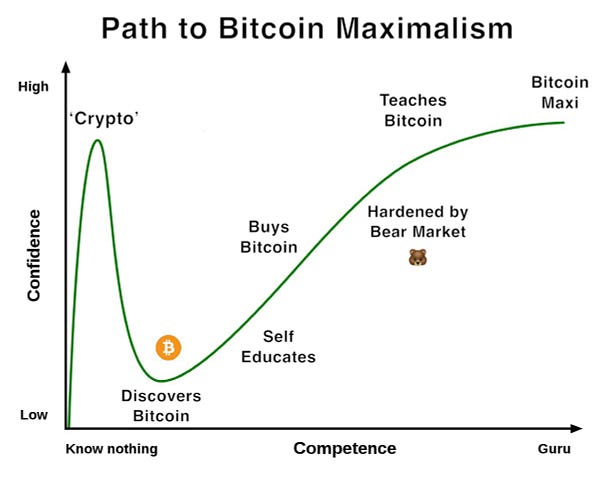

The path to Bitcoin Maximalism. Where are you on this road?

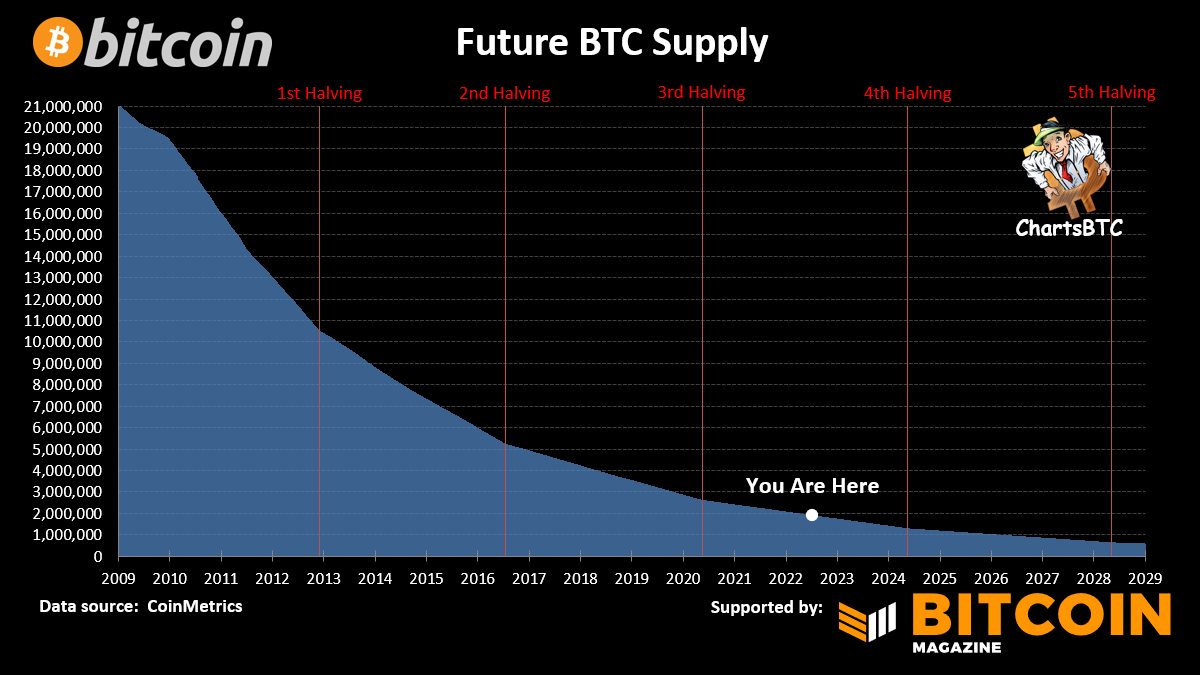

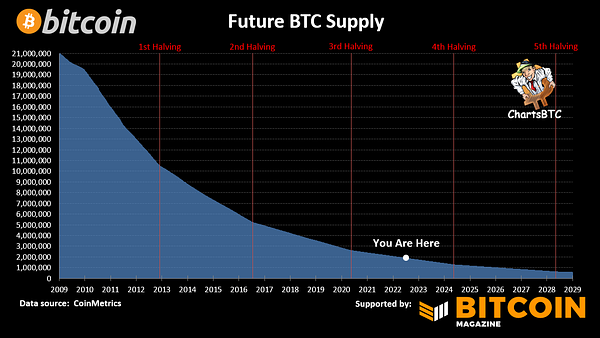

Bitcoin’s future supply

“USA is home to 88% of the total Bitcoin ATMs worldwide.” by Bitcoin Archive

“Someone transferred $69,990,000 in Bitcoin and paid a fee of $5.77. That’s a transaction fee of 0.000008244%” by @WatcherGuru

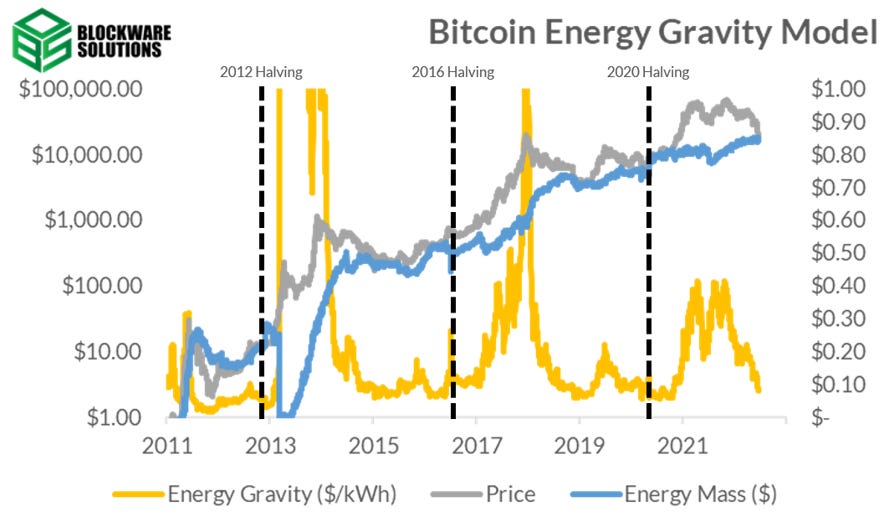

JPMorgan reported that the cost of Bitcoin production globally dropped from $24,000 at the start of June to $13,000 now.

Bitfinex exchange has donated 36 Bitcoin and 600,000 $USDT to support economic development in El Salvador.

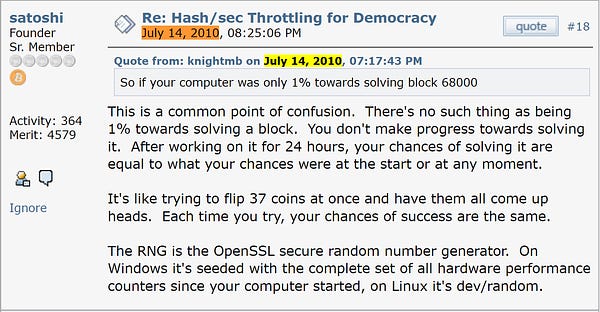

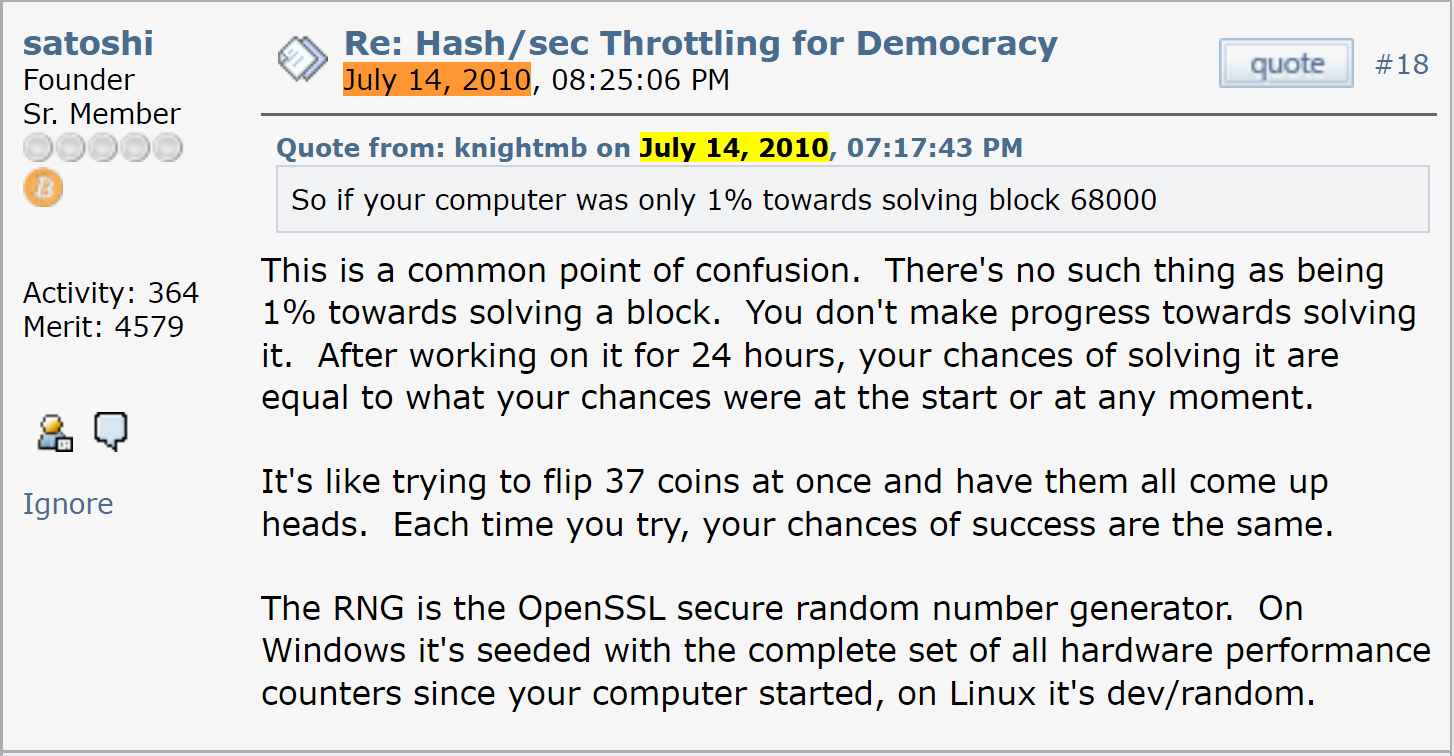

“Satoshi Bitcoin engineering fact: Mining is not "solving math problems". It is guessing an immensely large number. You can not cheat it, beat it, or break it. The only option you have is to do the work and go through all of the possible guesses, one at a time” by Documenting Bitcoin

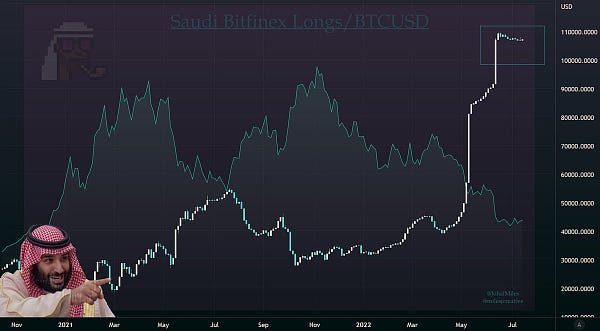

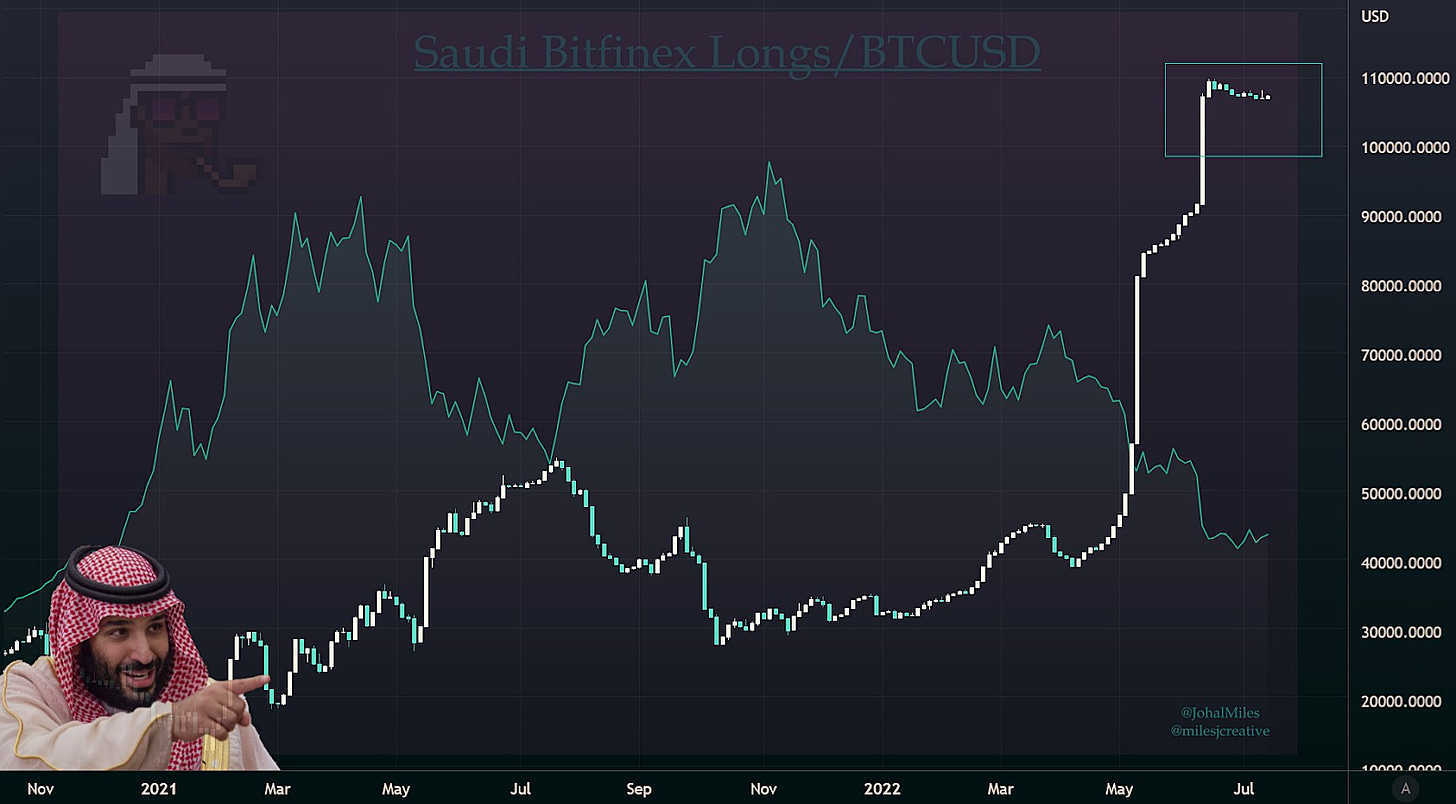

“So I bet you thought while you weren't looking that the Saudis on Bitfinex closed all their longs and ran for the hills. No, positions maintained. My anonymous, reliable source says they will only close them once 130k is achieved.” by @JohalMiles

Suggestions

Interesting articles to read

Majority Of Europeans Unwilling To 'Pay The Price' To Defend 'Democracy' In Ukraine

Escobar: Russia & China Haven't Even Started To Ratchet Up The Pain Dial

Sources:

https://bitcoinmagazine.com/markets/eqonex-launches-physically-backed-bitcoin-etn-in-germany

https://www.btctimes.com/news/fifth-largest-swiss-bank-will-allow-bitcoin-trading

https://www.coindesk.com/policy/2022/07/15/vladimir-putin-bans-digital-payments-in-russia/

I only focus on the fundamentals. In fact I don't like NGU that much since it reduces my stacking goals.