The 53rd Bitcoinomics Newsletter

30 January 2023 - 05 February 2023 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

DekaBank offers Bitcoin services to its clients

UK releases details on Bitcoin regulation

Australia unveils new plan to regulate Bitcoin

DekaBank offers Bitcoin services to its clients

DekaBank, with over $390 billion in asset management, is reportedly joining Societe Generele and Citibank to develop Bitcoin and shitcoin offerings to its 1.5 million clients. The banking giant will utilize custody tech from the Swiss company once the approval is received. For orchestration, the bank will seek help from Harmonize for asset management operations and asset management.

“Digital assets are a critical part of the future, a radical new way for how assets will be represented, from currencies to real estate. Today we make another important step towards laying the foundation for giving our institutional investors and millions of people in Germany access to this transformational opportunity,” said Andreas Sack, DekaBank’s product owner

UK releases details on Bitcoin regulation

The United Kingdom has announced its plans to regulate Bitcoin and shitcoins within the country.

“We remain steadfast in our commitment to grow the economy and enable technological change and innovation – and this includes cryptoasset technology," said Economic Secretary to the Treasury, Andrew Griffith. “But we must also protect consumers who are embracing this new technology - ensuring robust, transparent, and fair standards.”

The press release, which leans heavily on the words “ambitious” and “robust,” is more focused on intention and the road ahead than it is on methodology.

“As the voice of the UK’s crypto sector we welcome this positive step towards greater regulatory clarity," said Ian Taylor of Crypto UK. “Given the provisions within the proposed legislation, consultation with the industry could not be more critical.”

The announcement highlights a few priorities in the months to come, such as the intention for cryptocurrency exchanges and firms to bear the responsibility of ensuring “fair” standards for customers – a red-hot issue as headlines continue to update on the collapse of groups like FTX and Alameda Group under CEO Sam Bankman-Fried.

“The proposals will also strengthen the rules around financial intermediaries and custodians – which have responsibility for facilitating transactions and safely storing customer assets,” reads the statement. “These steps will help to deliver a robust world-first regime strengthening rules around the lending of cryptoassets, whilst enhancing consumer protection and the operational resilience of firms.”

The consultation (which began on February 1st) will continue until April 30th, 2023, after which the UK government will consider feedback and construct an official response.

Australia unveils new plan to regulate Bitcoin

Just days after the UK announced the next stages of its plan to regulate Bitcoin and shitcoins, Australia seems to have followed suit.

In a new announcement, Australia’s government has unveiled the first step of what is being called a “multi-stage plan” to regulate Bitcoin and shitcoins.

“The multi‑stage approach has three elements,” states the release. “Strengthening enforcement, bolstering consumer protection; and establishing a framework for reform.”

The first stage, strengthening enforcement, is already underway, as the Australian Securities and Investments Commission (ASIC) expands the size of its “crypto team” and buckles down on enforcement measures.

“Unsustainable business models used by some companies dealing in crypto assets have left consumers exposed,” reads the document. “We are acting swiftly and methodically to ensure that consumers are adequately protected and true innovation can flourish.”

For the time being however, with Australia’s multi-stage plan still in an early phase, it remains to be seen how regulation will affect the country’s burgeoning Bitcoin and shitcoin industry.

Global Economic News

TL;DR

The recession of Germany is now undeniable

New signs of the falling US economy

The recession of Germany is now undeniable

“Germany's slide into recession has begun. The Q4 '22 GDP fall of -0.2% q/q is modest. It's the underlying picture that's worrying. Germany is one of the world's export champions, but net exports (purple) subtracted from growth for many quarters now. An export champion no more…” by Robin Brooks, Chief Economist at IIF

Meanwhile the Euro zone economy unexpectedly grows in Q4 but weak 2023 looms.

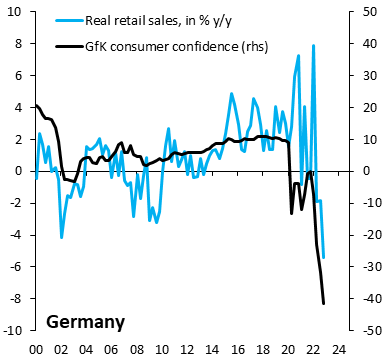

“German recession is the dog that didn't bark in 2022. Well, it's barking now. Real retail sales fell a lot towards the end of 2022, catching down with the big drop in consumer confidence that took place earlier in the year. Recession is coming to Europe, starting with Germany…” by Robin Brooks, Chief Economist at IIF

New signs of the falling US economy

As always a new brilliant thread from Nick Gerli. Worth reading all of them. Here is the first post:

“Home Builders reporting 40% CRASH in Sales. Yet their stock prices are increasing. Near all-time highs. Might be the biggest Stock Bubble out there right now. Check this out…” by Nick Gerli, CEO & Founder of Reventure Consulting

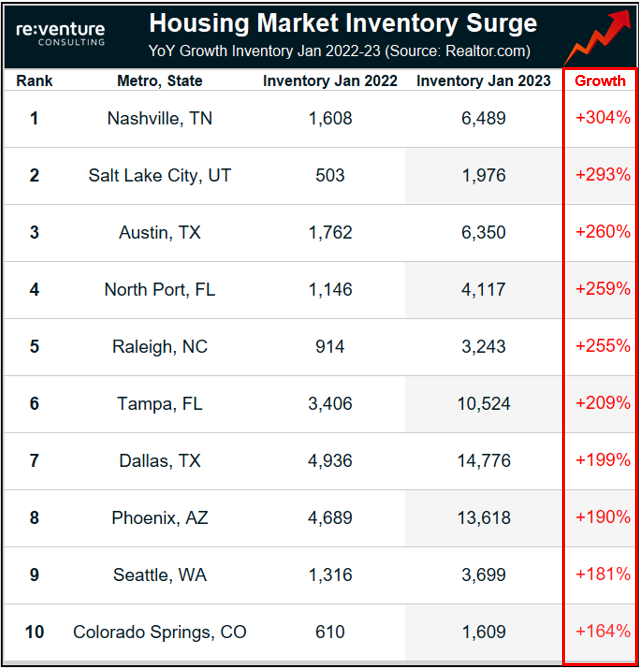

“Inventory on the Housing Market is exploding. Nashville, Austin, and Phoenix have 3x more homes on the market today compared to one year ago. Expect home prices to continue crashing in the metros on this list throughout 2023.” by Nick Gerli, CEO & Founder of Reventure Consulting

Meanwhile the U.S. credit card debt jumps 18.5% and hits a record $930.6 billion.

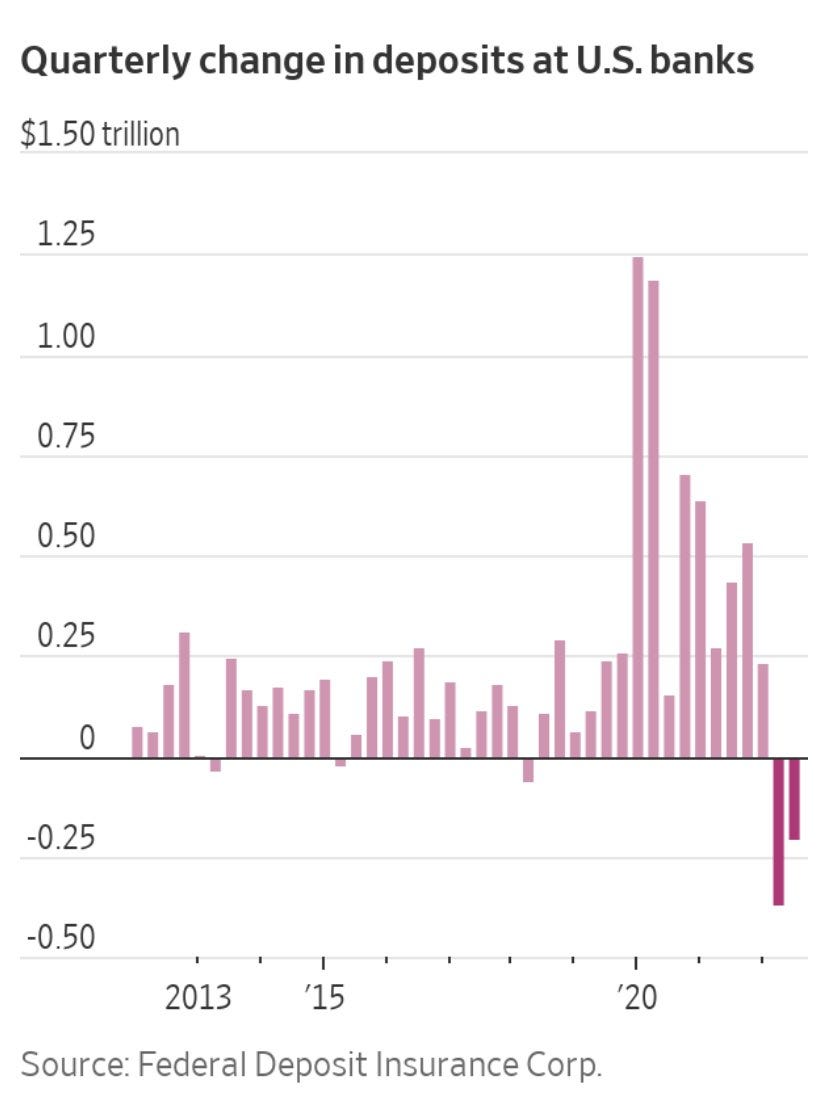

“U.S. banks bled deposits at the fastest rate on record in Q2 & Q3 last year as consumers sought out higher yielding securities: FDIC data going back to 1984. That marked the first time since 2010 that there were two consecutive quarters of declines.“ by Lisa Abramowicz, Economist at BBG

And Cardboard Box Demand Plunging At Rates Unseen Since The Great Recession.

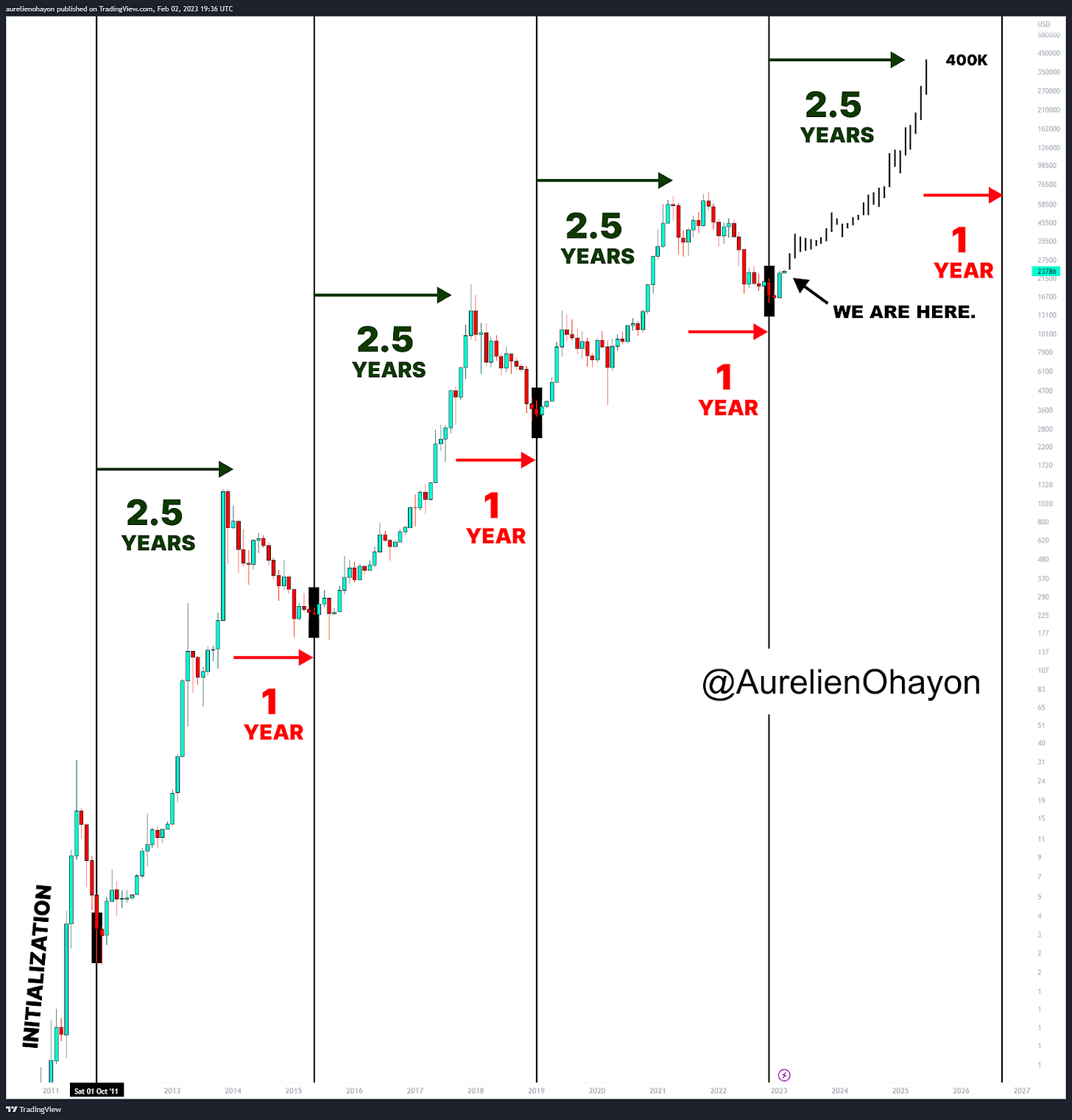

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Price of Bitcoin is up 98% and has outperformed all major global assets since the first public company, MicroStrategy added it to their balance sheet.

Boxes filled with bitcoin mining computers are recycling ~60,000 cubic feet of harmful methane gas emissions every day and making a profit. (video)

“FUN FACT: 13 years ago today, 1 laptop could mine 50 #Bitcoin in under 24 hours” by @pete_rizzo_

Even nurses are mining Bitcoin in Russia. In the attic of a psychiatric hospital in the Irkutsk region, two mining farms were discovered at once, connected to the power grid of a medical institution. (Photo made by prosecutor's office of the irkutsk region)

78% of Bitcoin supply is in the hands of long-term holders

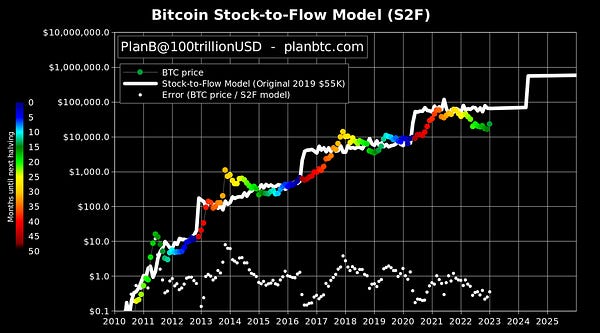

“~ $150B worth of gold is mined annually. If $150B worth of Bitcoin is mined annually after the 2024 halving then 1 BTC will be worth ~ $400,000.” by @IIICapital

Nigeria leads the world in #bitcoin adoption and sets new record of Google searches

Suggestions

Interesting articles to read

Dr Jordan B Peterson Tells Joe Rogan Of Plan For Alternative To World Economic Forum

Russia's "Sanction-Proof" Trade Corridor To India Frustrates The Neocons

EU Chat Control Law Will Ban Open Source Operating Systems Including All Linux Distros

"Who Needs Bitcoin?" Lebanon To Devalue Currency by 90% On February 1st

If You're A Warehouse Worker. This Boston Dynamics Video Might Be An Ominous Sign

Sources:

https://watcher.guru/news/german-banking-giant-dekabank-to-offer-crypto-services-to-its-clients

https://www.btctimes.com/news/uk-releases-details-on-bitcoin-and-cryptocurrency-regulation

https://www.btctimes.com/news/australia-unveils-new-plan-to-regulate-bitcoin-and-crypto