2022/9

14 March 2022 - 20 March 2022 week Bitcoin & Economic News

Bitcoin News

TL;DR

The EU Parliament voted not to ban proof-of-work infrastructure

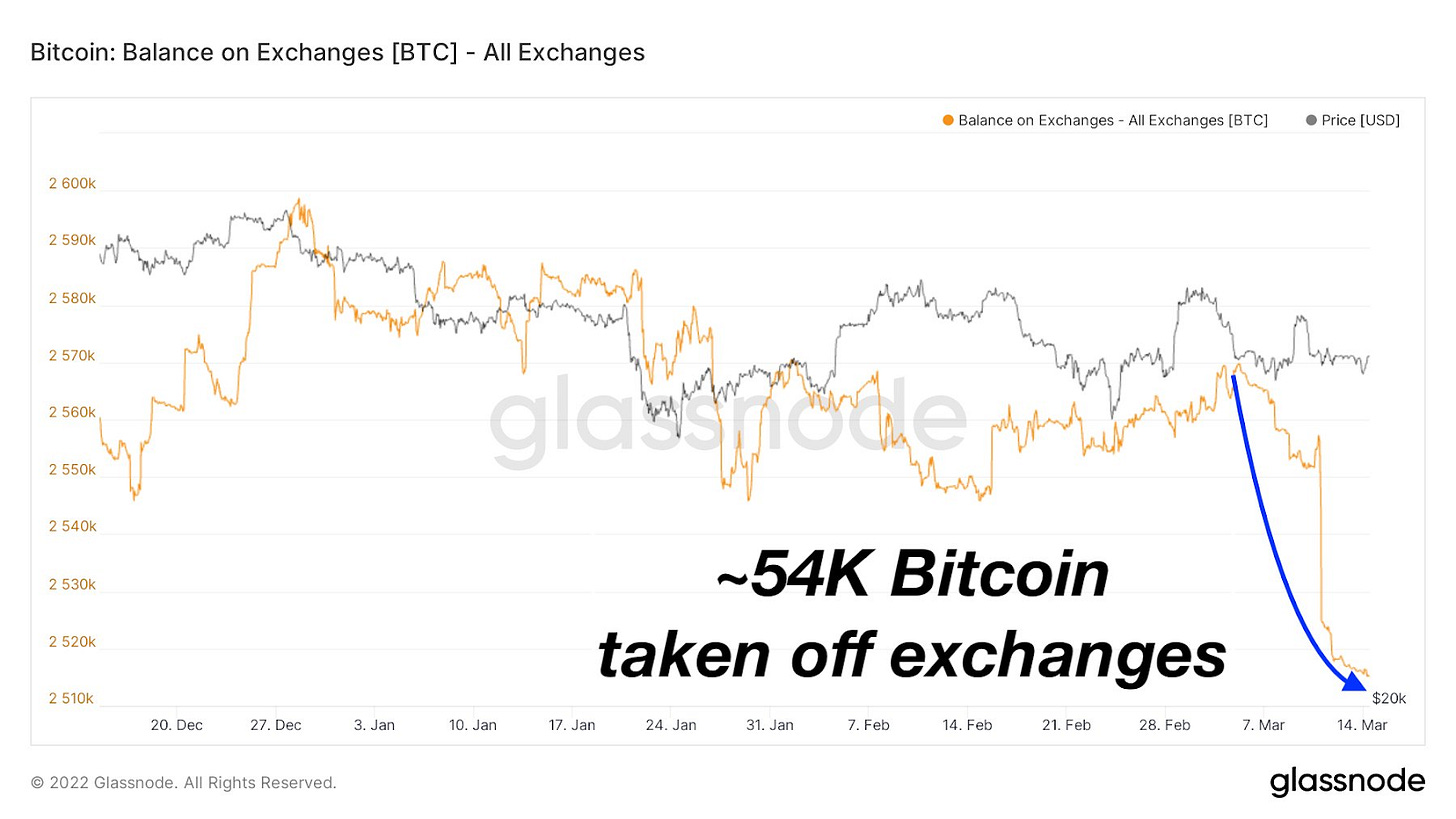

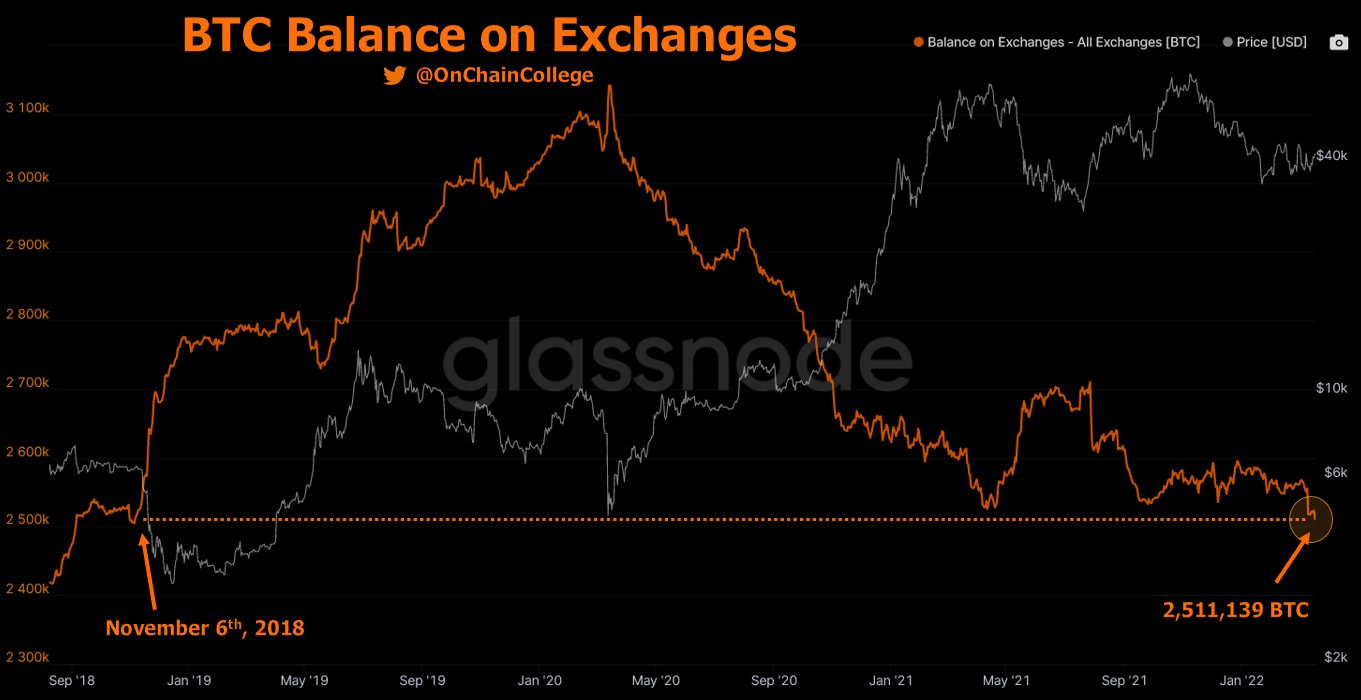

54,000 Bitcoin moved off the exchanges

Lightning Network capacity is at ATH

Kazakhstan has confiscated nearly $200 million in mining equipment

Ukraine has officially legalized Bitcoin

The IMF is afraid of Bitcoin

Over 500,000 Brazilian citizen can buy, sell, and hold Bitcoin

The evolvement of a 700MW Bitcoin mining facility

Hal Finney’s summary and vision from 2013

The EU Parliament voted not to ban proof-of-work infrastructure

In a 32 to 23 vote, the Economic and Monetary Affairs Committee of the European Parliament, which decides upon European Union legislation alongside the Council of the European Union, voted against a Proof-of-Work ban in the body’s crypto regulatory framework, Markets in Bitcoin Assets.

“[The rejected] amendment would have had dramatic consequences on the European crypto market, since it would have pushed EU consumers towards foreign, unregulated exchanges and European companies, capital, and talent out of the EU. All without a noticeable benefit to the stated goal of sustainability… I am glad that the majority voted in favor of the alternative amendment of rapporteur Dr. Stefan Berger. Including mining into the EU sustainability taxonomy is the better solution for addressing sustainability concerns and will hopefully contribute to more and more mining activities being carried out through a renewable-only energy mix.” - said Patrick Hansen, a member of the regulatory committee of Markets in Crypto Assets.

54,000 Bitcoin moved off the exchanges

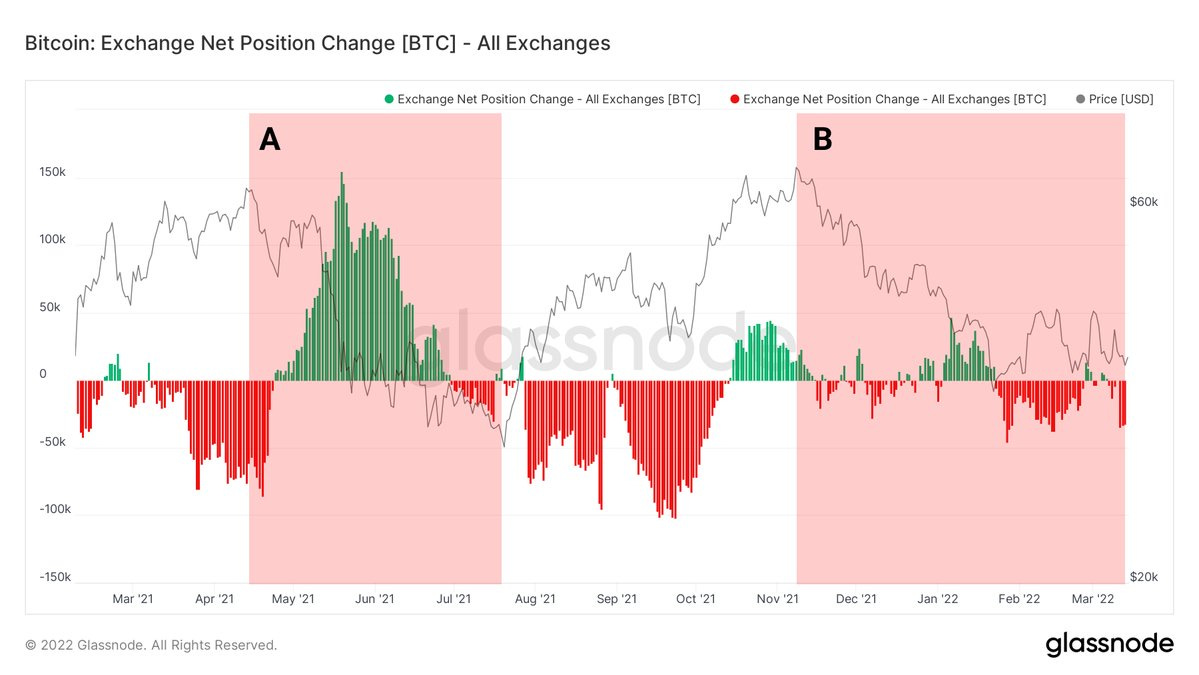

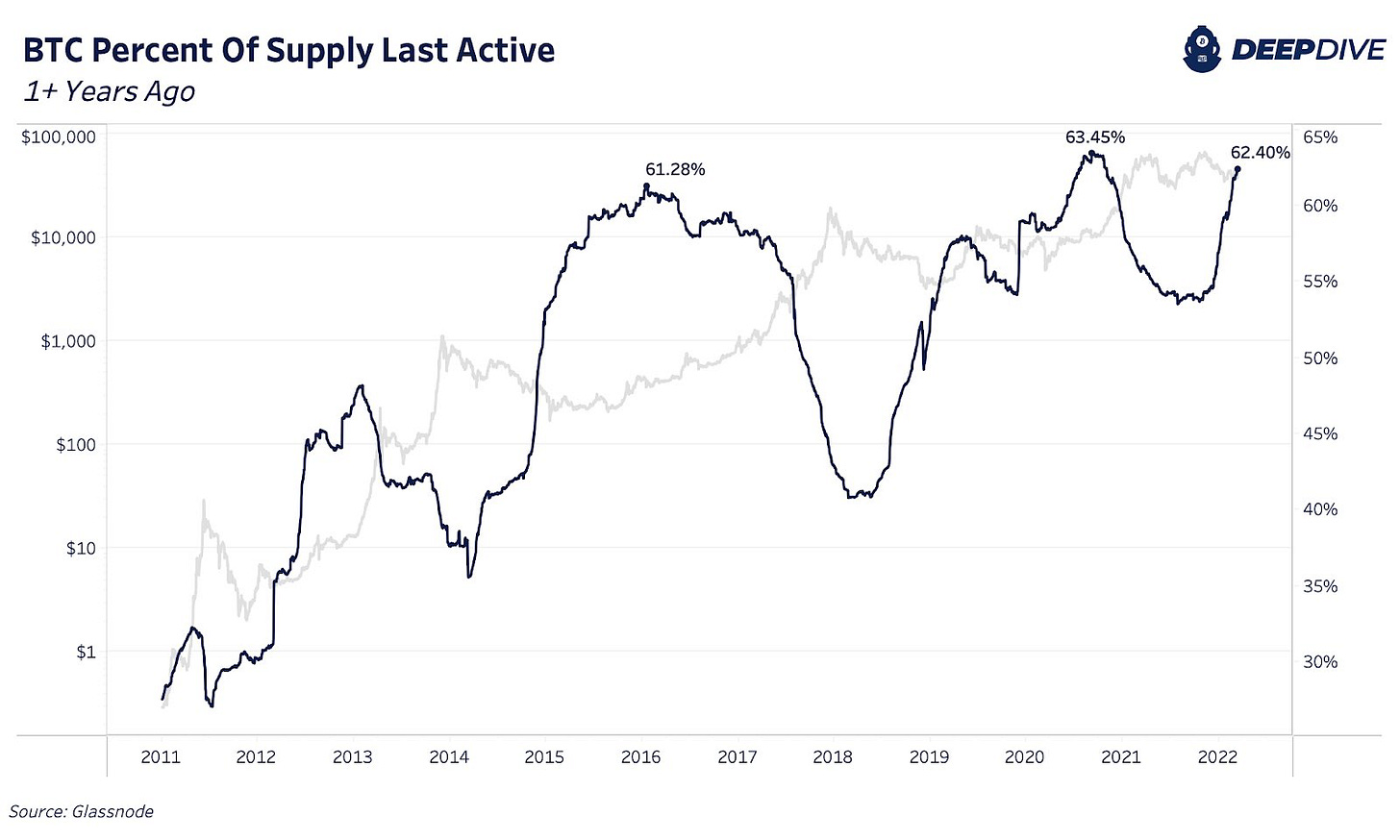

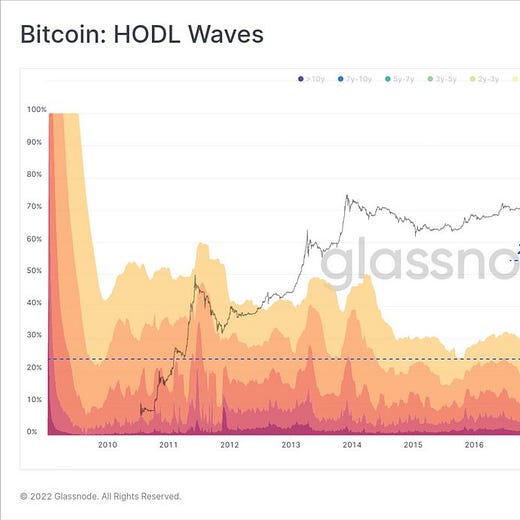

In the last 9 days 54,000 Bitcoin moved off the exchanges. I think this is the best news I got in a long time because people started to learn. They started to take their Bitcoins in their own custody. Check these two charts for visual confirmation:

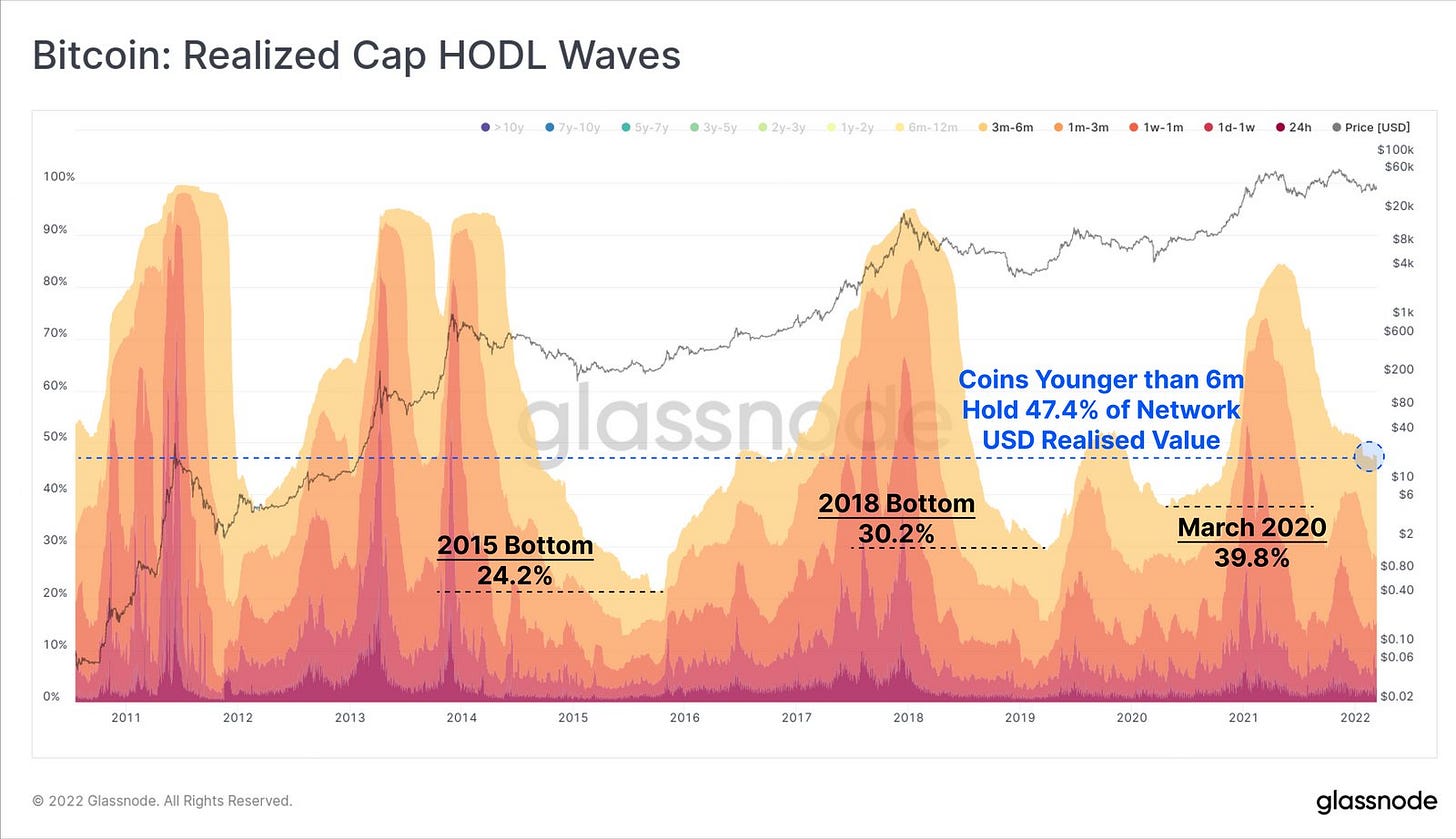

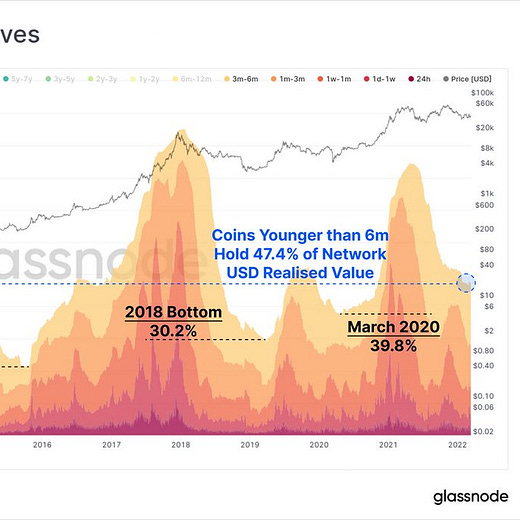

According to Glassnode, the proportion of Bitcoin supply held for less than half a year has hit a record low, about 24.53%. In contrast, the total cost of holding bitcoin for less than half a year accounts for about 47.4%:

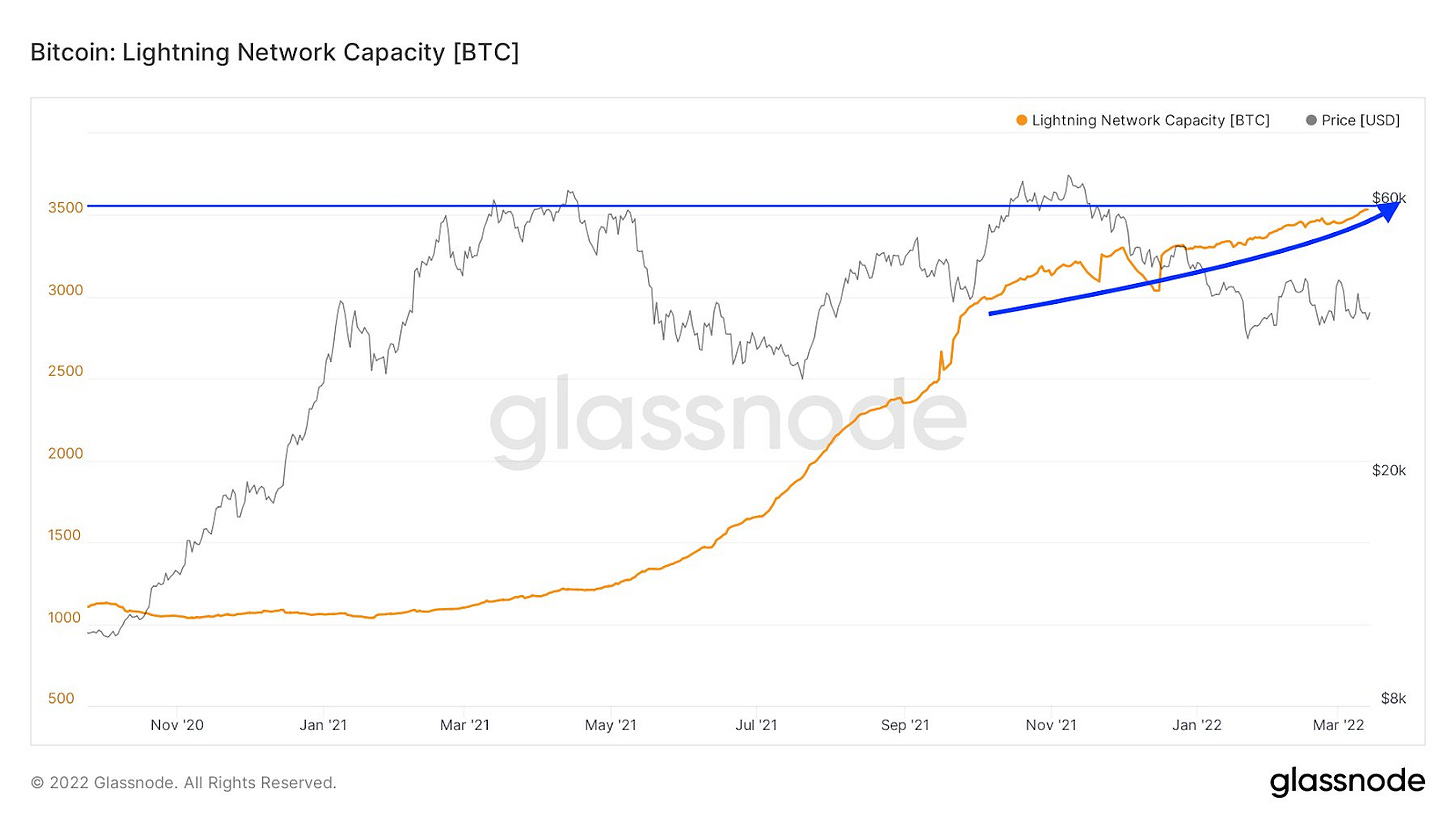

Lightning Network capacity is at ATH

The Lightning Network capacity is now 3,534 Bitcoin, which is a new All-Time High. I think more and more people started to believe in the Bitcoin future. People are taking Bitcoin in their own custody and with Lightning Network, they are preparing for instant payment needs.

Kazakhstan has confiscated nearly $200 million in mining equipment

On March 15, Kazakhstan's Financial Monitoring Agency reported on its overall work to bring the local mining industry to heel. Among its most striking figures is that the agency says it has confiscated mining equipment worth roughly 100 billion tenge, valued at $194 million USD. Those activities included failure to report the start of mining operations to government agencies, illegally connecting to the electrical grid, setting up shop in special economic zones, or failure to pay taxes and customs.

The Kazakhstan government knows the value of these miners and they are not doing the same mistake that China did (letting it leave the country). Of course with so much cheap energy, they can mine with very low cost and get the best payment for it, which is Bitcoin.

Ukraine has officially legalized Bitcoin

Ukraine has officially legalized Bitcoin after President Zelensky signed the virtual assets bill into law. The draft "On Virtual Assets" law was first passed in a near-unanimous vote in Ukraine's parliament in September 2021. The new Law basically allows to legally hold and trade Bitcoin. It’s not the same as with El Salvador making Bitcoin legal tender. Ukraine’s crypto law does not facilitate the rollout of bitcoin as a form of payment and does not put it on an equal footing with the hryvnia, the country’s national currency.

The IMF is afraid of Bitcoin

We can say that the IMF is afraid of Bitcoin and with every right. With the following headline: “The IMF does not want to allow another country in Latin America to adopt bitcoin” we know they are afraid. The day has finally come when the IMF sees Bitcoin true power and it does everything to stop it. It will be a bumpy road, but in the end Bitcoin will win because more and more people see it’s unstoppable. Why? Because it’s a permissionless, borderless sound-money.

Over 500,000 Brazilian citizen can buy, sell, and hold Bitcoin

SoftBank-backed broker Avenue Securities debuted native, no-fees bitcoin trading services on Wednesday through an integration with B2B platform Apex Crypto to meet a growing demand for BTC and cryptocurrency among its over 500,000 Brazilian clients. (via BTCMag.)

The evolvement of a 700MW Bitcoin mining facility

I think this is beautiful, how in just less than 4 years from a 1MW Test facility a 700MW Bitcoin mining facility evolved. If you are interested in details you should check it here.

Hal Finney’s summary and vision from 2013

I think everyone knows who Hal Finney was, if not urgently read this. I won’t summarize his post from 19th March 2013 because it’s a must read piece in its original form. We can’t thank him enough for his work on the early years of Bitcoin, knowing that he was seriously ill for the most part of it!

Global Economic News

TL;DR

Germany Wholesale Price jumps by 16.6% YoY

China signed a $10 billion contract with Saudi Arabia (UPDATED!)

Russia is offering oil to India at a heavy discount

How to imagine the U.S. 7.9% inflation?

Corporations are surrendering their capital

The FED raised its benchmark interest rate by 25 bps + balance sheet reached $9T (UPDATED!)

Germany's debt is rising sharply

Russia default risk tumbles

The US continues to dump its Strategic Petroleum Reserve

Hang Sang Tech Index jumps 7.8%

Germany's housing boom accelerated

Based on EU stocks the Russian invasion already ended

Germany is in a rush for new gas deals

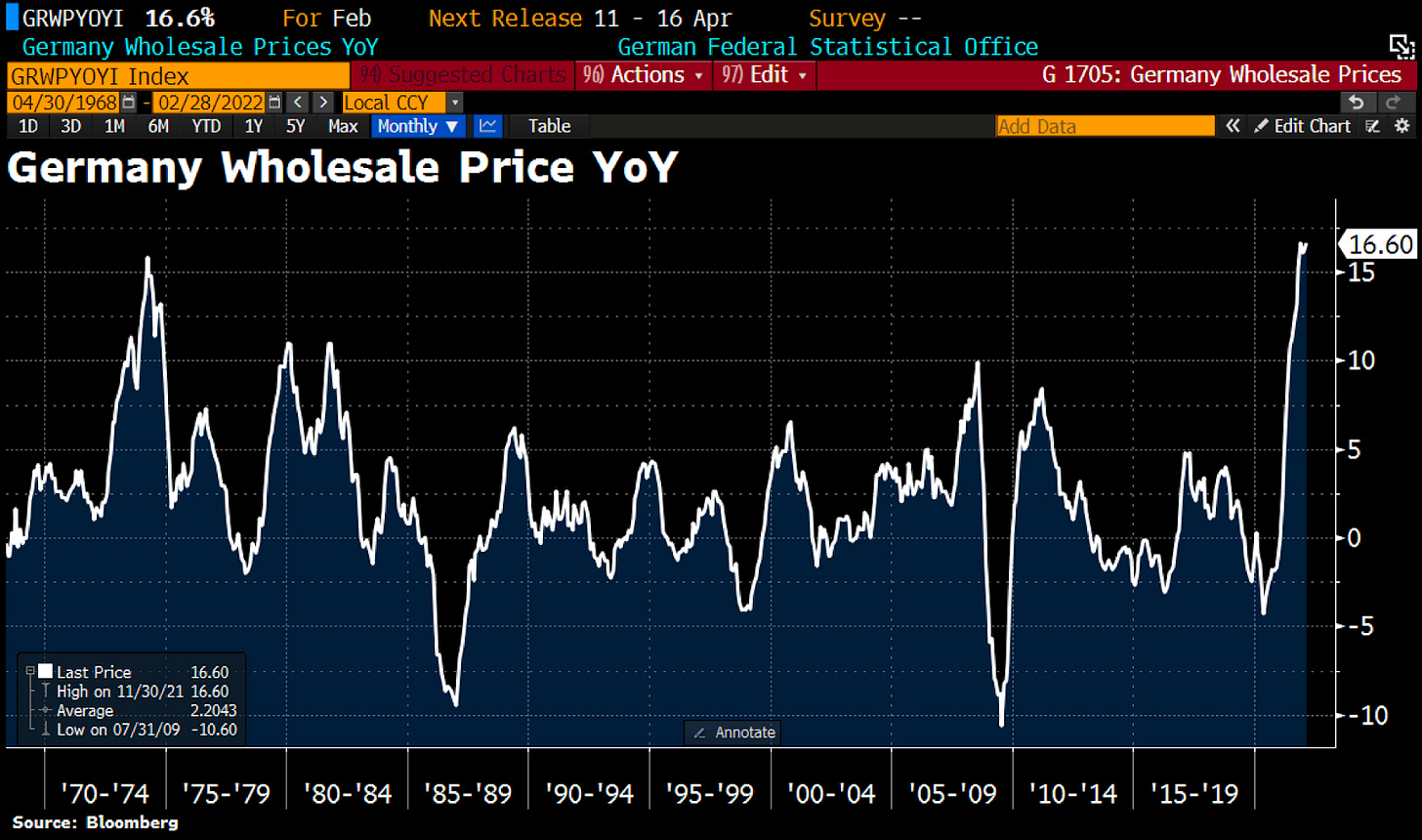

Germany Wholesale Price jumps by 16.6% YoY

In Germany where inflation pressure intensifies, the Wholesale Price jumps by 16.6% YoY even before Russia attacks as latest price developments related to the Ukraine war are not contained in the results as wholesale prices were collected for reference date 5 Feb 2022.

China signed a $10 billion contract with Saudi Arabia (UPDATED!)

$10 billion is not too much on Global scale, but knowing the details it's major news because China has just signed a $10 billion contract with Saudi Arabia to build refineries in China that will be supplied with Russian oil. This deal is yet another sign of the strengthening alliance between China and Saudi Arabia, a development that will worry the Biden administration. You can read the article here.

(UPDATE:The Wall Street Journal is reporting that Saudi Arabia is considering accepting Yuan instead of Dollars for Chinese oil sales.)

Russia is offering oil to India at a heavy discount

India, which imports 80% of its oil needs, usually buys only about 2-3% from Russia. But with oil prices up 40% so far this year, the government is looking at increasing this if it can help reduce its rising energy bill.

"Russia is offering oil and other commodities at a heavy discount. We will be happy to take that," one of the Indian government officials said.

Reuters has reported that Indian officials are trying to set up a rupee-rouble mechanism with Russia to continue bilateral trade.

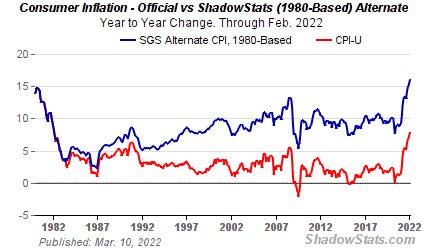

How to imagine the U.S. 7.9% inflation?

This is a brilliant writing from a Twitter user named Croesus:

“You work 40 hours a week.

Inflation at 7.9% means the government is seizing 3.2 hours of your labor every week, on top of all the other taxes. 6.4 hours per week, according to the 1980 formula for CPI

Every single week. All because you use their money.”

That’s the best visualization to understand how the government robs from you the most important thing in your life, time!

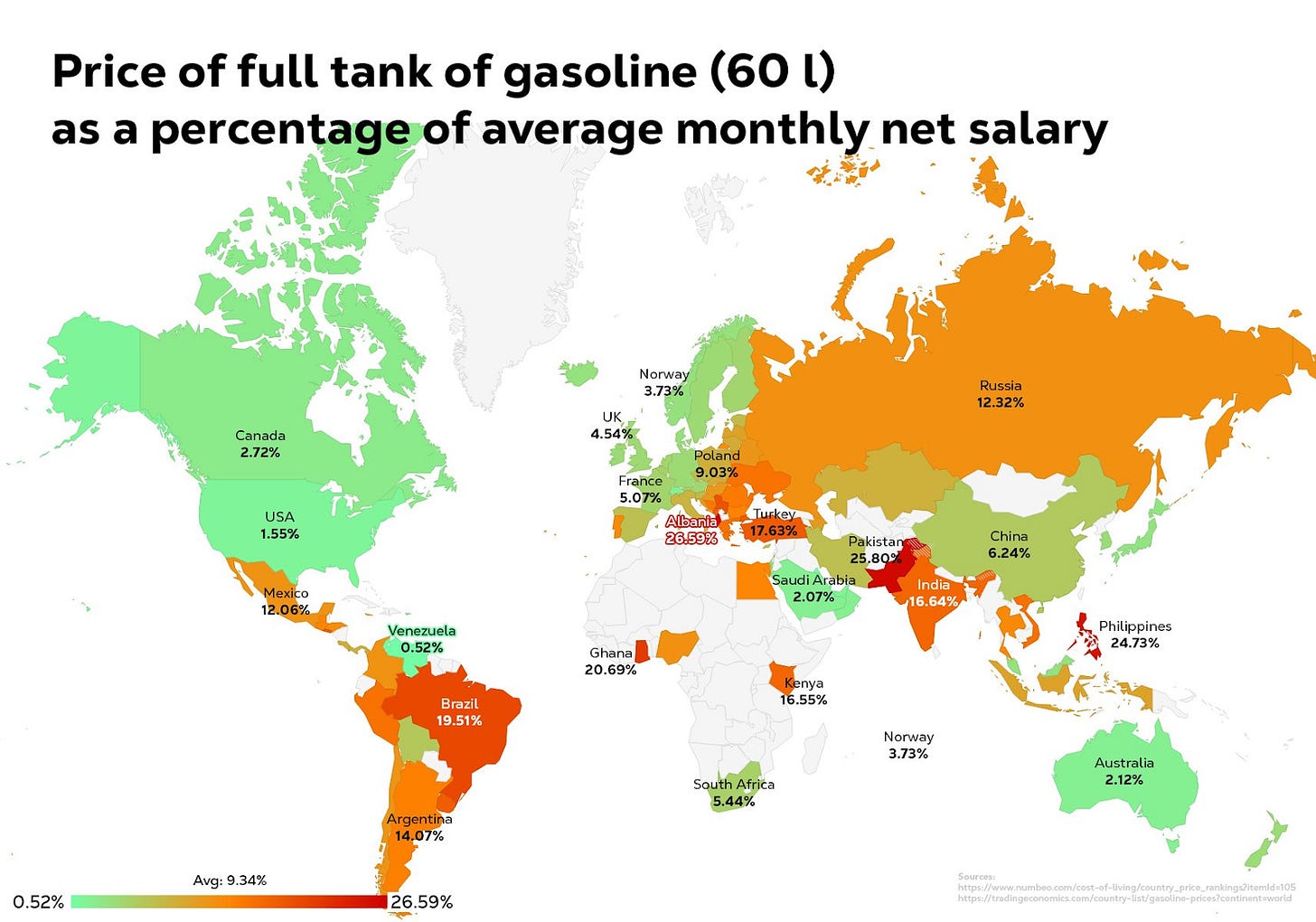

In the following picture you can see that in different countries the recent sanctions are hurting on different levels. Clearly the western wealthy countries are paying much more easily a double GAS price bill than the others.

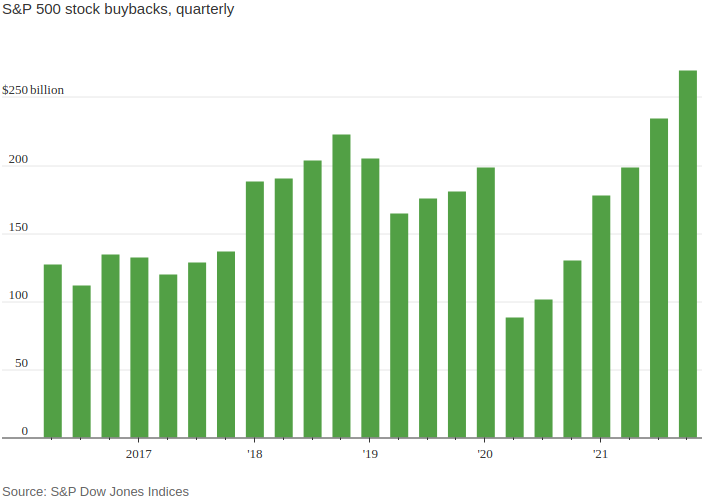

Corporations are surrendering their capital

“Corporations are surrendering their capital because the high monetary inflation rate makes cash and credit toxic to shareholder value. If you want a fortress balance sheet you need to build it with inflation-proof assets like Bitcoin.” by Michael Saylor

According to WSJ, the companies are unveiling plans to repurchase their own shares at a record pace, lending support to the battered stock market.

Firms in the S&P 500 have outlined buyback plans valued at $238 billion through the first two months of 2022, according to data from Goldman Sachs Group Inc., a high for this point in the year.

The FED raised its benchmark interest rate by 25 bps + balance sheet reached $9T (UPDATED!)

While U.S. inflation is rising rapidly and already at 7.9%, the FED thought it is more than enough to raise its benchmark interest rate by 25 basis points to a range of 0.25%-0.50%. BTW this was the first rate hike since December 2018.

Meanwhile the “US Yield curve flattens following hawkish Fed. 2s/10s drop 4bps to 25bps. So, inversion seems to be only a matter of time.” by Holger Zschaepitz

Not just that, but the FED is playing with the rates as their balance sheet reached $9,000,000,000,000. Pretty huge, huh? It’s 10x since the Global Financial Crisis. 80% of all US-Dollar in existence were printed during the COVID-pandemic. From $4 Trillion in January 2020 to $20 Trillion in October 2021. Will see how it accelerates because trust me it will not stop here.

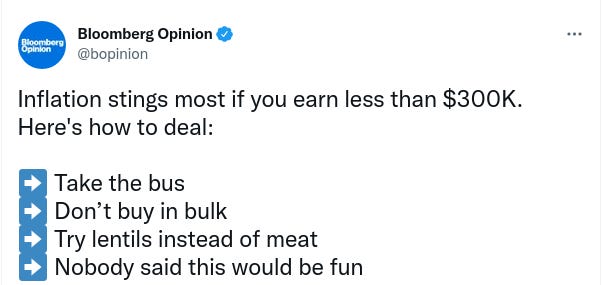

(UPDATE: I can’t decide if Bloomberg thinks this is funny, or they think this seriously? Either way I think they should be ashamed for the following:

Germany's debt is rising sharply

Germany borrows up to €200bn more for defense and climate investments. Chancellor Scholz announced €100bn a special debt-financed fund for defense last month, saying Germany would from now on meet NATO’s target for defense spending of 2% of GDP.

Russia default risk tumbles

According to Bloomberg, JP Morgan has processed the funds that were earmarked for interest payments due on dollar bonds held by the Russian govt and sent the money on to Citigroup. Russian asset prices are rallying hard. Bond prices up to ten points. Interest payments flow through western fin system: Russian bondholders based in the US, Germany, & UK say they got coupon payments in Dollars in a relief to investors who feared the Kremlin would resort to settling debt in rubles.

I hope no one is surprised on this turn because we all know this will happen. They don’t want Russia’s default because then all western banks can say “Bye-bye” for their loans issued to Russia and then “Bye-bye” to the current financial system because all Banks will fall from it like dominos. The current bubble is way way bigger than it was in 2008 or even 1929. Fasten your seatbelt!

The US continues to dump its Strategic Petroleum Reserve

Honestly, don’t you think that the US is driving with their recent administration economic decisions to an energy supply collapse? With all the ESG bullshit and with stopping the domestic “fracking” Oil production, now with the recent news about the Saudis who are pulled towards the china-russia friendship, it’s like they are making economic decisions against the public wellbeing. I hope I’m wrong, but when I’m reading news like:”The government is now down to 33 days worth of oil supply at its current implied demand. That is one of its lowest levels in history.” with the chart attached below, is really frightening. Will see how this will wind up, but don’t allow yourself to be fooled by ESG narratives, renewables won’t resolve this, not in short-, not in long term.

Hang Sang Tech Index jumps 7.8%

“Hang Sang Tech Index jumps 7.8% to extend recovery after Beijing capitulated to mkts. Previously, China didn’t care if western investors couldn’t invest there. But it does need capital, & it doesn’t need collapse. So, on Wednesday word went out that China to be mkt-friendly. (via BBG)” by Holger Zschaepitz

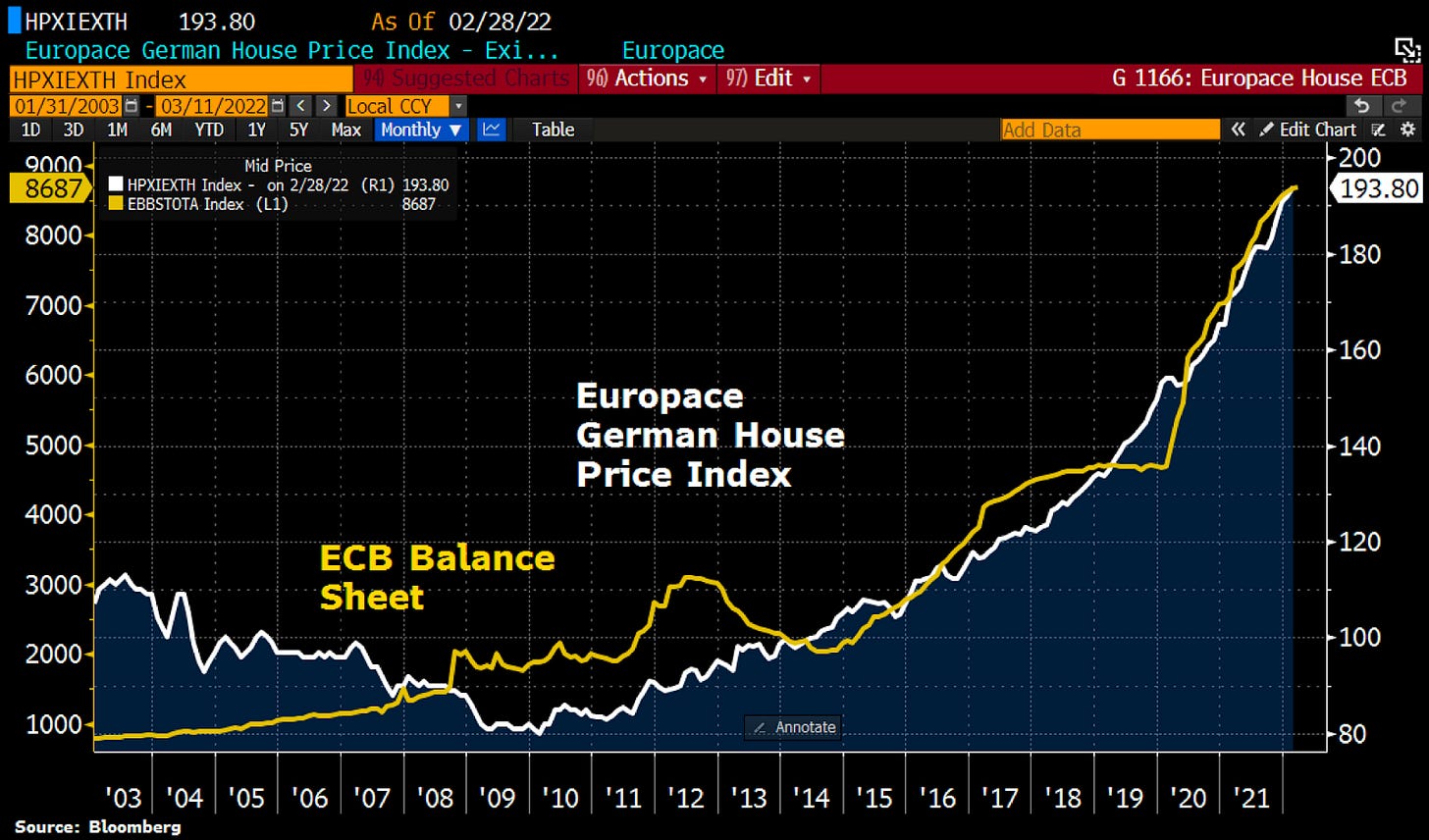

Germany's housing boom accelerated

While the inflation is rising steeply, the German people are afraid of it (with every right!), so they are investing in hard assets. As always in history the investment in real estate is the wealthy people’s option, so until the Bitcoin invention, the poor people had no real defense against inflation. The Europace House Price Index jumped 1% in February. Gained 66% in the past 5yrs. Index has risen in tandem with the ECB balance sheet to new ATHs. I can’t express enough the importance in these times of education about financial safe haven options, moreover about Bitcoin. Act accordingly!

Based on EU stocks the Russian invasion already ended

We live in crazy times. With the ever growing sum of EUR in the financial system, the inflation is out of the roof and with this the wealthy people are pumping up the stock prices. Not just in the EU, but everywhere around the World. It took 3 weeks and the Stoxx 600 was already at the same level as before the Russian invasion. It dropped 10.6% from before the invasion on 24th February to the lowest point on 7th March. It is now right back where it started, after the biggest weekly rally since November 2020.

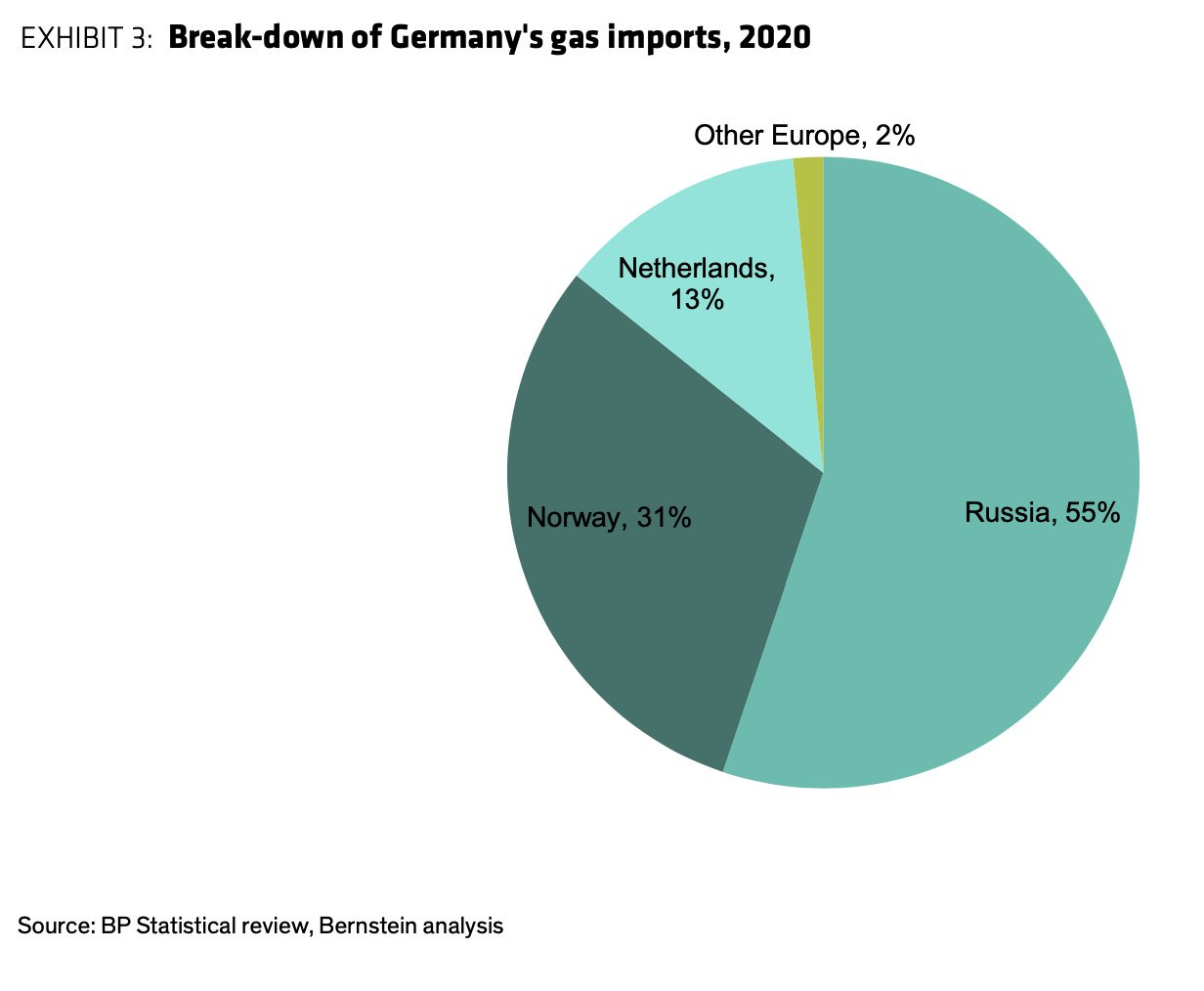

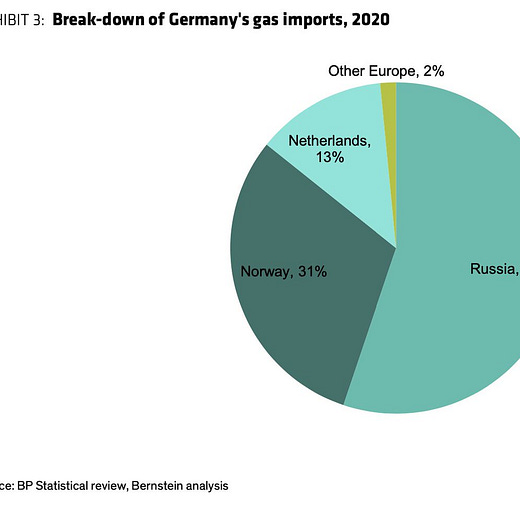

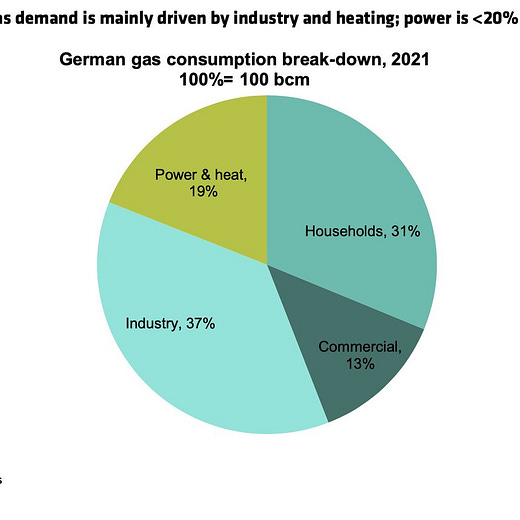

Germany is in a rush for new gas deals

The economy minister Robert Habeck (Greens) headed for Qatar in search of new gas deals. In Qatar, one of world's largest exporters of liquefied natural gas (LNG), Habeck is scheduled to meet with emir, Sheikh Tamim bin Hamad Al Thani. Just to clarify. For importing LNG you need to build terminals at ports. Then there is a huge loss in the conversion process (liquid to gas form) which is around 22% of its energy value. All of these extra fees/price will be paid by the German citizens.

Bitcoin price speculations

These are just speculations, no investment advice!

“The only real move will be when #Bitcoin breaks $46k or falls below $33k. Everything else is just noise!!!” by Matthew Hyland

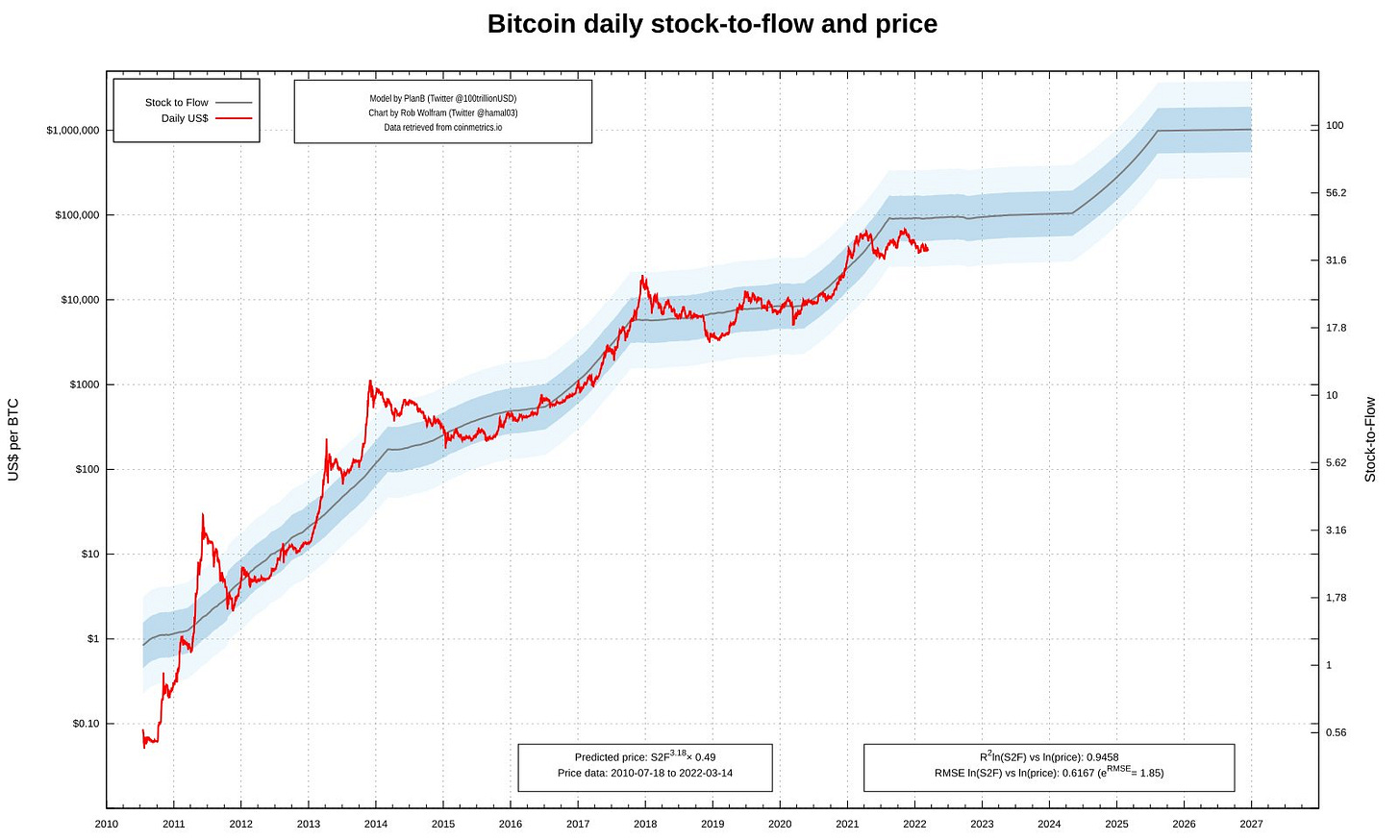

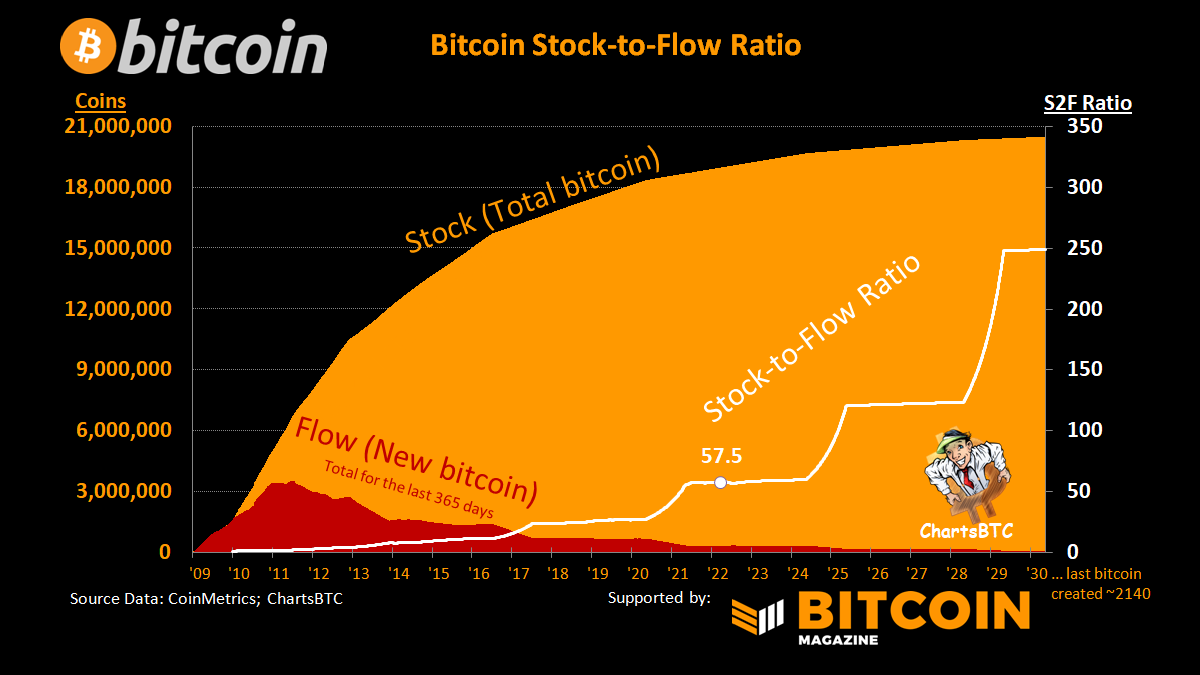

“BTC is 60% below S2F model value. Some think S2F is dead. Others know we have 2 more years to reach the $100K average. Your choice.” by PlanB

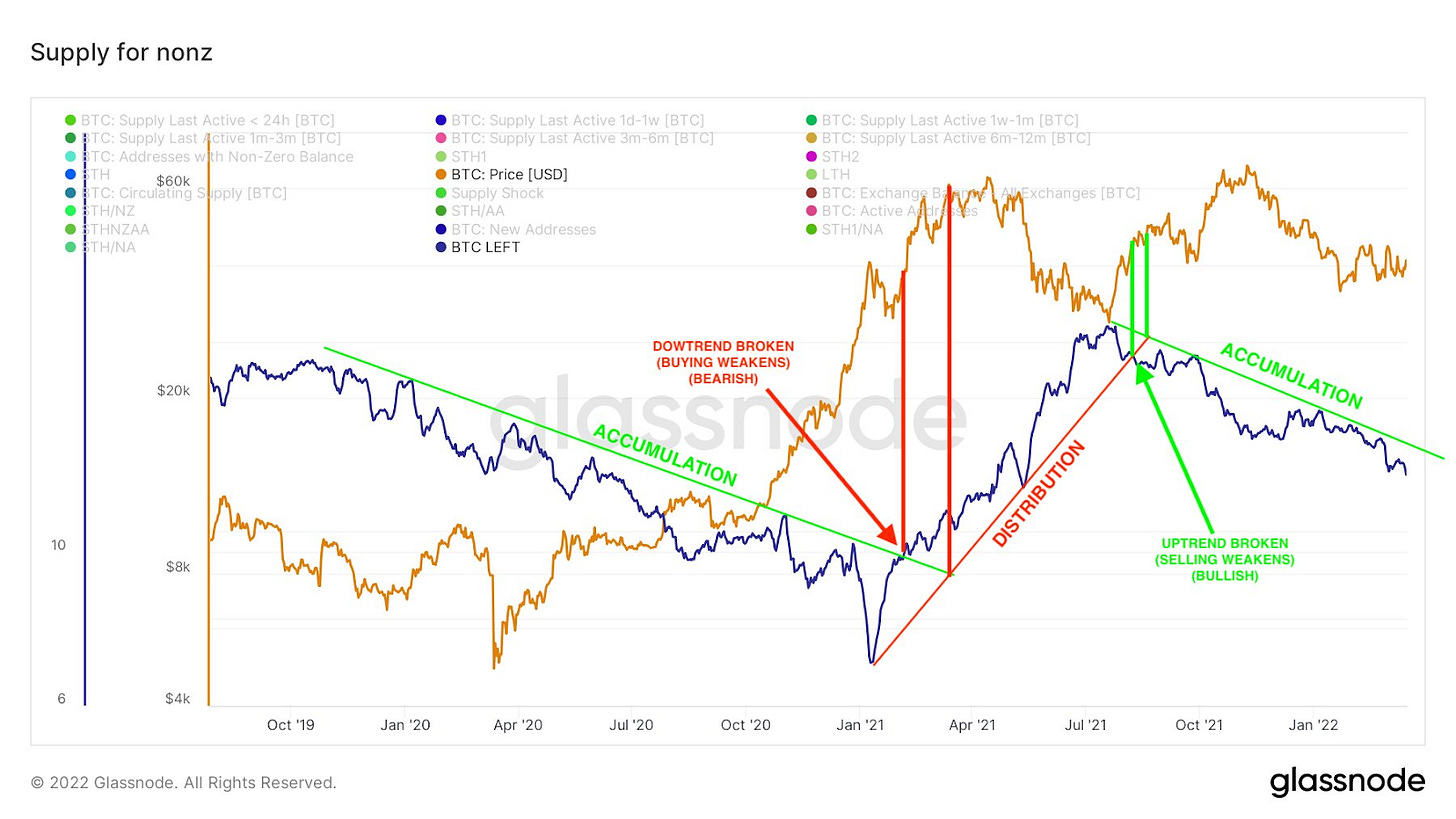

“this shows how much supply is left for each new addresses on average and how the supply is available for STHs. Less and less coins left for STHs aka the supply is dying up since the 29k bottom.” by @xbt_blvrg

“Bitcoin stock-to-flow” by ChartsBTC

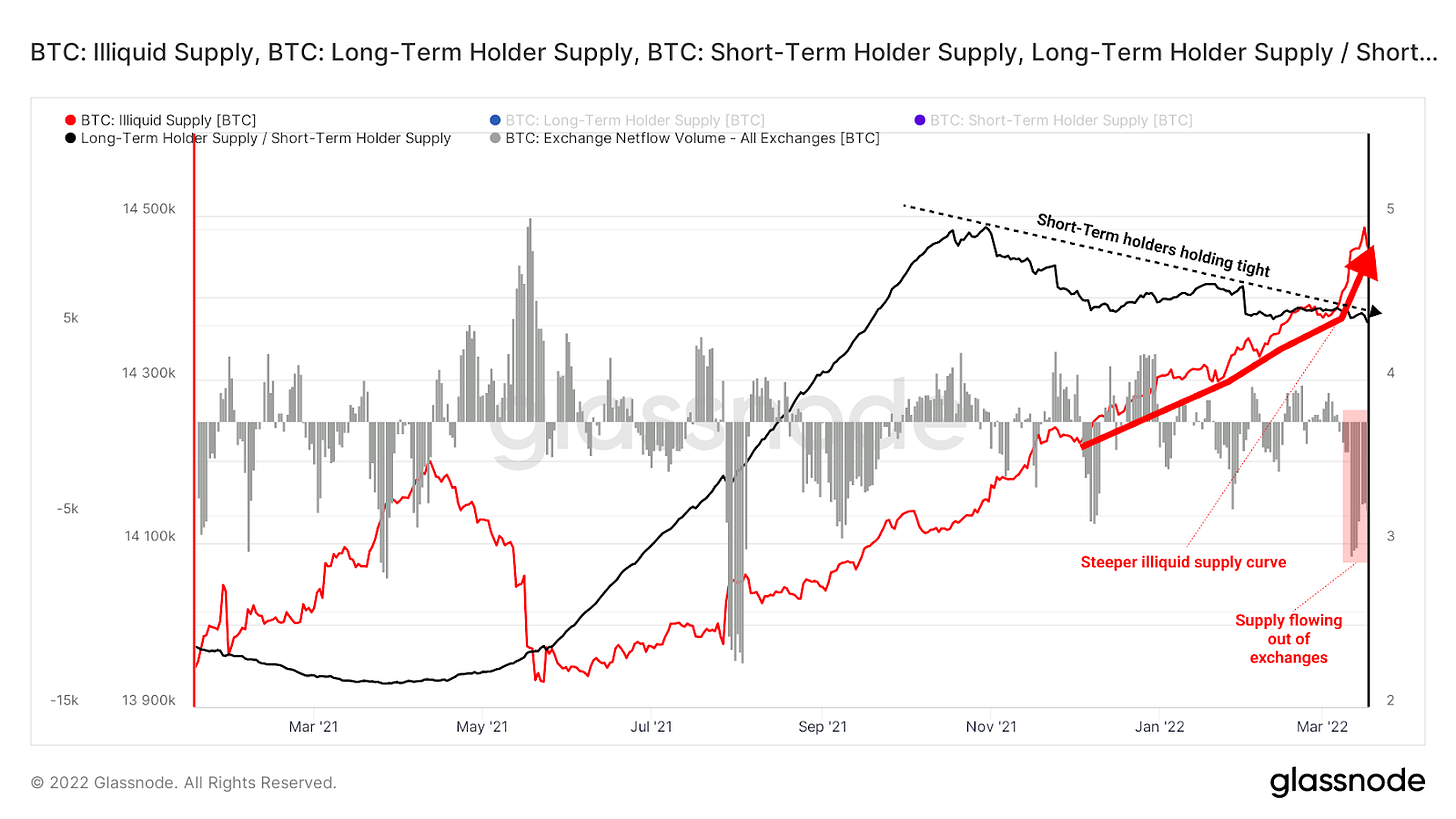

“Intense upward pressure forming for Bitcoin

1. Short-term holders holding tight

2. 37k BTC flowing out of exchanges

3. Illiquid supply curve steepens” by @Negentropic_

“The last time the Bitcoin Balance on Exchanges was this low was 1,229 days (or 3 1/3 years) ago.” by @OnChainCollege

“Observations on the new #Bitcoin Accumulation Trend Score. Closer to 0 (darker) = larger entities distributing or not accumulating. Closer to 1 (brighter) = larger entities accumulating” by @TechDev_52

Bitcoin Shorts

Funny Bitcoin short stories

Third richest man in Mexico: "I own only #Bitcoin and I’m not selling." by Ricardo Salinas Pliego

“Bitcoin percentage supply last moved in 1+ year is quietly creeping to all time highs.” by Dylan LeClair

“Someone transferred $86,720,000 in Bitcoin and paid a fee of $2.49.

That’s a transaction fee of 0.0000028712%

No government bank or third party had to verify the transaction, nor could they have STOPPED IT, if they wanted to.” by @WatcherGuru

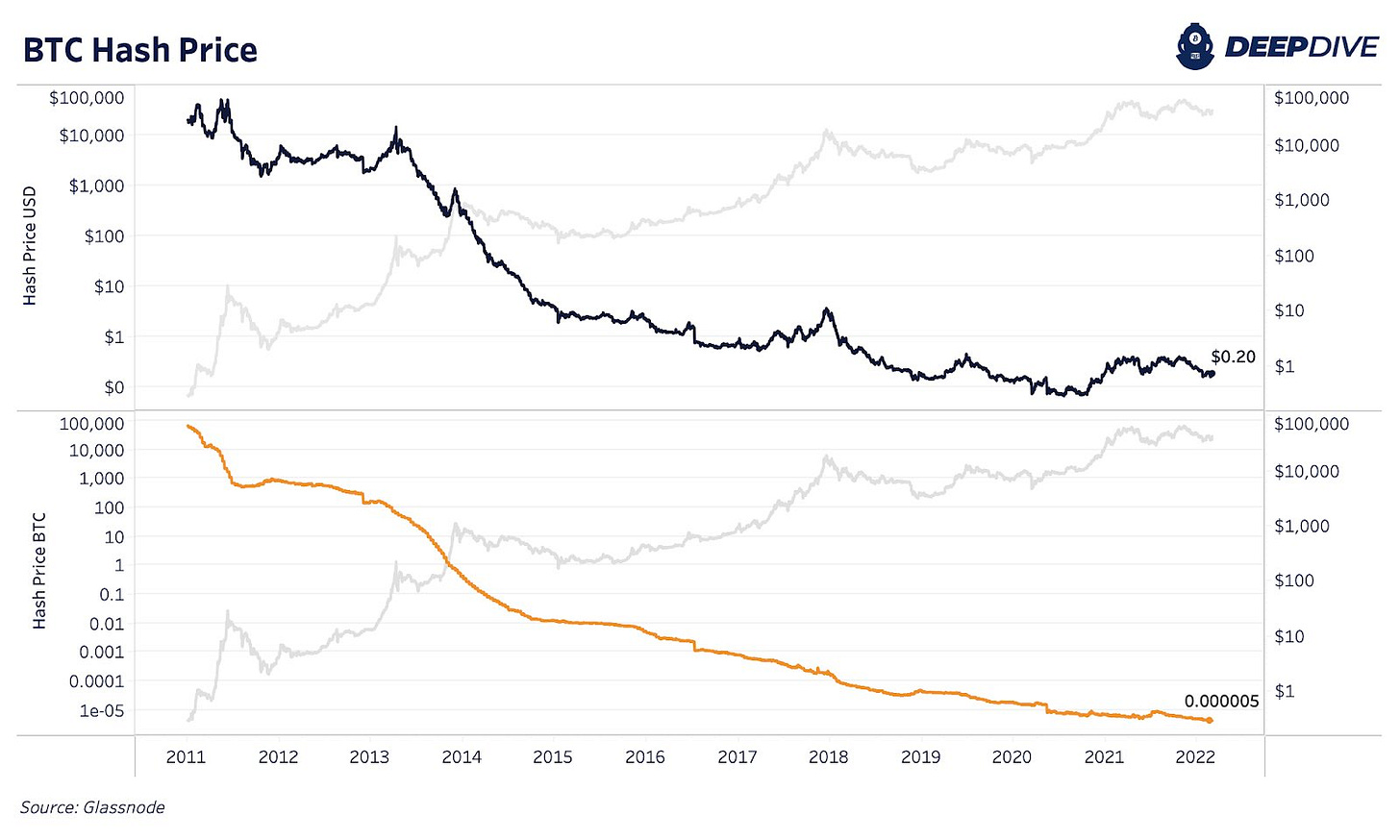

“It’s going to become harder to produce bitcoin, forever.” Explanation here. by Dylan LeClair

Suggestions

Interesting articles, books to read

Is Russia's Ukraine Invasion Bad News For China's Belt And Road Ambitions?

China Orders 51 Million Into Lockdown As COVID Numbers Spike

Just As All Hope Seemed Lost, China Reports Miraculously Good Economic Data

So Many Russians Are Buying Gold That Central Bank Halts Bank Purchases

"Guilty Until Proven Innocent" - Biden Signs New Backdoor Gun Control Into Law

World Economy Braces For Supply Chain Chaos As COVID Closes China

The Stagflation Trap Will Lead To Universal Basic Income And Food Rationing

The NYT Now Admits the Biden Laptop -- Falsely Called "Russian Disinformation" -- is Authentic

New crypto sanctions bill targets publishing code, facilitating transactions

Sources:

https://bitcoinmagazine.com/business/softbank-backed-broker-avenue-debuts-bitcoin-trading