Bitcoin News

TL;DR

New Initiative to Roll Out Mesh Networks in Ukraine Being Led by bitcoiners

Ukraine buys Military gear with donated Bitcoins

Coinbase blocked 25K addresses linked to Russians

The Virginia Senate passed a bill allowing state banks to offer Bitcoin custody services

Thailand approves tax relief for Bitcoin

Bitcoin friendly politician was elected the next President of South Korea

Ontario’s justice ministry seized some of the bitcoin raised in a donation

UK Bitcoin ATMs forced to shut down

Block (formerly Square) Hardware Wallet update

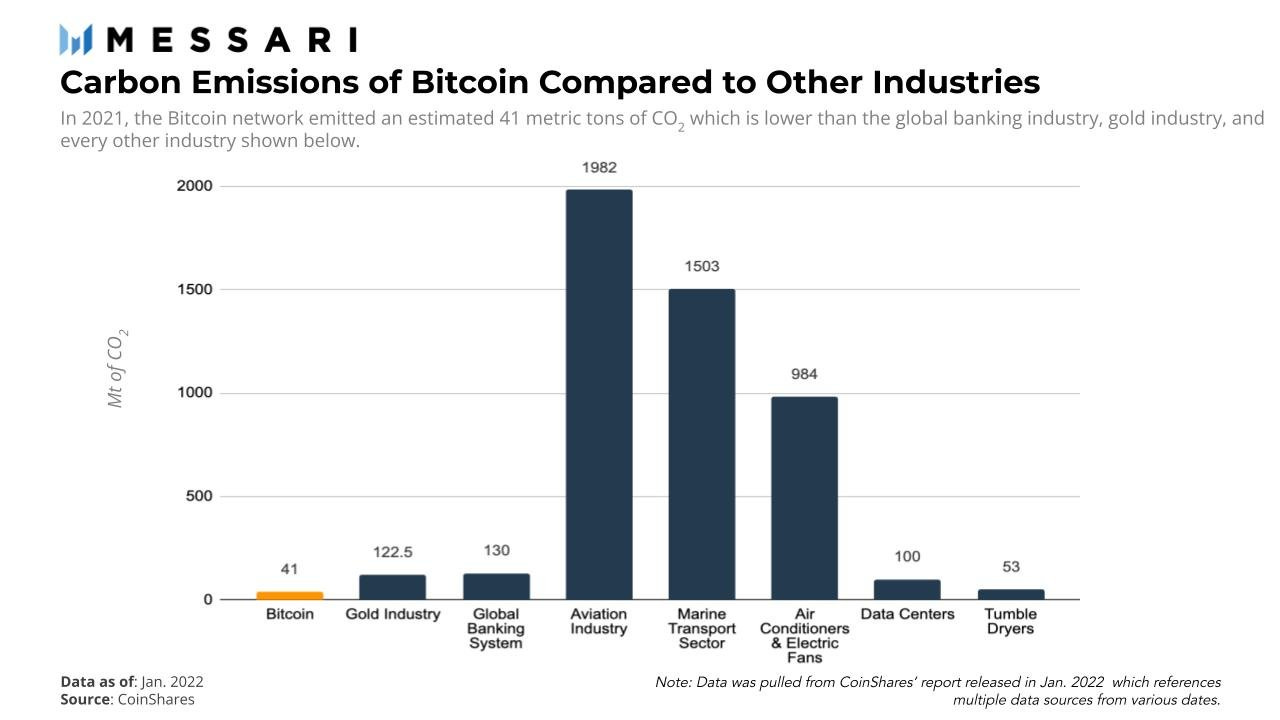

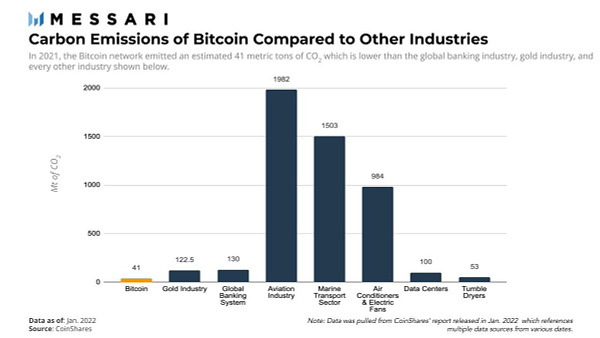

Back in 2010 Satoshi justified Bitcoin energy consumption

New Initiative to Roll Out Mesh Networks in Ukraine Being Led by bitcoiners

The Ukraine internet service is very fragile to the Russian invasion. Clever Bitcoin hardware & software developers are working on building a mesh network in Ukraine. What is a mesh network? A mesh network is a network in which devices -- or nodes -- are linked together, branching off other devices or nodes. In more details, only one of the nodes is needed to be connected to the outside world (internet) and it can relay the traffic from and to the other nodes. It’s not a new thing, just nobody built it in a country under heavy attack. I hope they will succeed. It will help the defense, the civilian people communication and the OSINT too against the terrible desinformation from both sides.

Ukraine buys Military gear with donated Bitcoins

Not long ago Warren Baffet said Bitcoin is “rat poison”. Funny how in a real World situation like a WAR, you are f@cked with gold, EURO, USD, etc. because you can’t easily transact if you are faced with sanctions or just with the sidewind of sanctions. You are forced to use “rat poison” to buy weapons for protecting a country.

“Ukraine has already spent $15 million of the donations it received in cryptocurrencies on military supplies, including bulletproof vests that were delivered Friday, according to Alex Bornyakov, deputy minister of Digital Transformation of Ukraine.” by Time

The world is not understanding today's Bitcoin real value! Act accordingly!

Coinbase blocked 25K addresses linked to Russians

I hope after so many messages I wrote, you are not surprised by the act of Coinbase. A centralized exchange will always do what the actual ruler says. More over not only doing the government orders, but even making the investigators job too:

"For example, we have methods for identifying accounts held by sanctioned individuals outside of Coinbase, even if we don’t have direct access to their personal information."

"Once we identified these addresses, we shared them with the government to further support sanctions..."

Never ever trust a centralized exchange! Not your keys, not your Bitcoin!

The Virginia Senate passed a bill allowing state banks to offer Bitcoin custody services

Delegate Christopher T. Head, Senate member for the state of Virginia, introduced House Bill 263 in early January 2022 to allow traditional banks operating in the Commonwealth of Virginia to offer custodial services for bitcoin and other shitcoins.

“A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws,” the bill outlines. With a total sweep of 39-0, the bill heads for Governor Glenn Youngkin’s desk to be signed into law.

Thailand approves tax relief for Bitcoin

Thailand’s cabinet eased tax regulations, that a 7% VAT for authorized Bitcoin exchanges, as well as the ability to offset one’s annual losses for taxes due to bitcoin and other cryptocurrencies aims to help incentivize further trading and investment strategies in the fast-growing economy,according to an official press release.

Bitcoin friendly politician was elected the next President of South Korea

Yoon Suk-yeol, the next President of South Korea, vowed to deregulate the cryptocurrency business throughout his campaign. Yoon stated at a cryptocurrency conference in January that rules “far from reality and unreasonable” must be revised in order to “realize the unlimited potential of the virtual asset market.” Will see that as a President how he will support Bitcoin in his country. Maybe soon adding it as a legal tender?

Ontario’s justice ministry seized some of the bitcoin raised in a donation

The donations to the so-called 'freedom convoy' have totalled more than 22 bitcoin, worth in excess of $1.1 million. Nicholas St. Louis, an Ottawa man who previously described himself as the “bitcoin team lead” for the protests, said in court filings that he was about to comply with an order from that civil suit to freeze the bitcoin by transferring them into escrow before a joint police task force executed a search warrant on him.

“Officers forcibly removed me from my apartment and took me to an unmarked police vehicle,” St. Louis said. “Police wanted the seed phrases for my crypto wallets. Under police compulsion I provided my seed phrases.”

Luckily the stasi police could only take 0.28 Bitcoin (~$15,000). I can’t express enough how Privacy is important. Please only buy Bitcoin without KYC and hold it with due diligence because the police, or any bad group (who gets your KYC information) can raid your home anytime!

UK Bitcoin ATMs forced to shut down

All Bitcoin cashpoints in Britain have been ordered to shut down after the City watchdog declared them illegal.

The FCA said: “We have warned operators of crypto ATMs in the UK to shut their machines down or face enforcement action. Crypto ATMs offering cryptoasset exchange services in the UK must be registered with us and comply with UK money laundering regulations. None of the cryptoasset firms registered with us have been approved to offer crypto ATM services, meaning that any of them operating in the UK are doing so illegally and consumers should not be using them. We are concerned about crypto ATM machines operating in the UK and will therefore be contacting the operators instructing that the machines be shut down or face further action.”

Some countries help their citizens and some are even blocking them to be able to easily store their value in Bitcoin. Be prepared for more tyrannical pressure as the FIAT money dies in your country!

Block (formerly Square) Hardware Wallet update

“We’re building a wallet that will be easy to use for everyone. In our first post, we covered how we’re accomplishing this: we’re building a combination of hardware and a mobile application that will let you choose how you want to balance the convenience of using the app for transfers and the security of requiring the hardware for authorizing higher stakes money movement.” written in their latest blog post.

What should we know about this new hardware wallet? Their plan is to be a mobile wallet and will only need to interact with the hardware to authorize larger, less frequent transactions. It will have a fingerprint sensor, rechargeable battery and usb-c port. The password (?) will be your fingerprint which if it’s true it’s a very bad decision. Why? Because if this will be a common wallet, people will not only use it for low value transactions, but for storing large amounts of Bitcoin too. If Block thinks that for their customers it’s hard to remember a new PIN, then we can easily suppose that too that people will store everything on this wallet only. Just imagine if someone finds it, he or she will need “only” your finger either attached to your body or not!

Back in 2010 Satoshi justified Bitcoin energy consumption

Here's Satoshi Nakamoto's explanation of why the energy consumption of Bitcoin is justified, posted way back in 2010. Give it a read:

Global Economic News

TL;DR

Russia's state owned Sberbank is to replace VISA and MasterCard

Energy prices in Europe is soaring heavily and why not renewables is the solution

Nickel jumps to record high

Germany stays with Russian oil and Natural gas

Spanish electricity prices are out of the roof

Euro briefly dipped below Swiss Franc parity

Nasdaq and the German DAX indices are officially in bear market territory

USInflation is just temporary

Green is dead?

Visa and Mastercard prepare to raise credit card fees

Russia was downgraded to 2nd lowest rating by Fitch

Saudi Arabia “considers options” of reducing investments in the US

Russia’s Ruble slumped 8% against the dollar

US inflation hits 7.9%

Is Germany losing its global position?

Global funds are moving out of China

US House passes $1.5 Trillion spending Bill with $13.6 billion for Ukraine

El Salvador at least tries to protect its citizens against inflation

Italy's PPI is unstoppable?

Is Germany already in recession?

Russia's state owned Sberbank is to replace VISA and MasterCard

The new "MIR" card system in partnership with China's Unionpay will be used to Sberbank replace VISA and MasterCard. Consumers can still be able to use Mastercard and Visa-branded cards for domestic transactions in Russia. “MIR” it’s not a new invention. Mir has processed most domestic payments in Russia since 2015. The operator – which is 100% owned by the country’s central bank – was established on government orders to protect the economy against sanctions imposed over Moscow’s annexation of Crimea in 2014. With the recent decision from VISA, Mastercard and AMEX, it is expected to accelerate Russian banks’ adoption of MIR’s own cards, which are accepted in a handful of countries including Turkey, Vietnam, Armenia, Belarus, Kazakhstan and Kyrgyzstan.

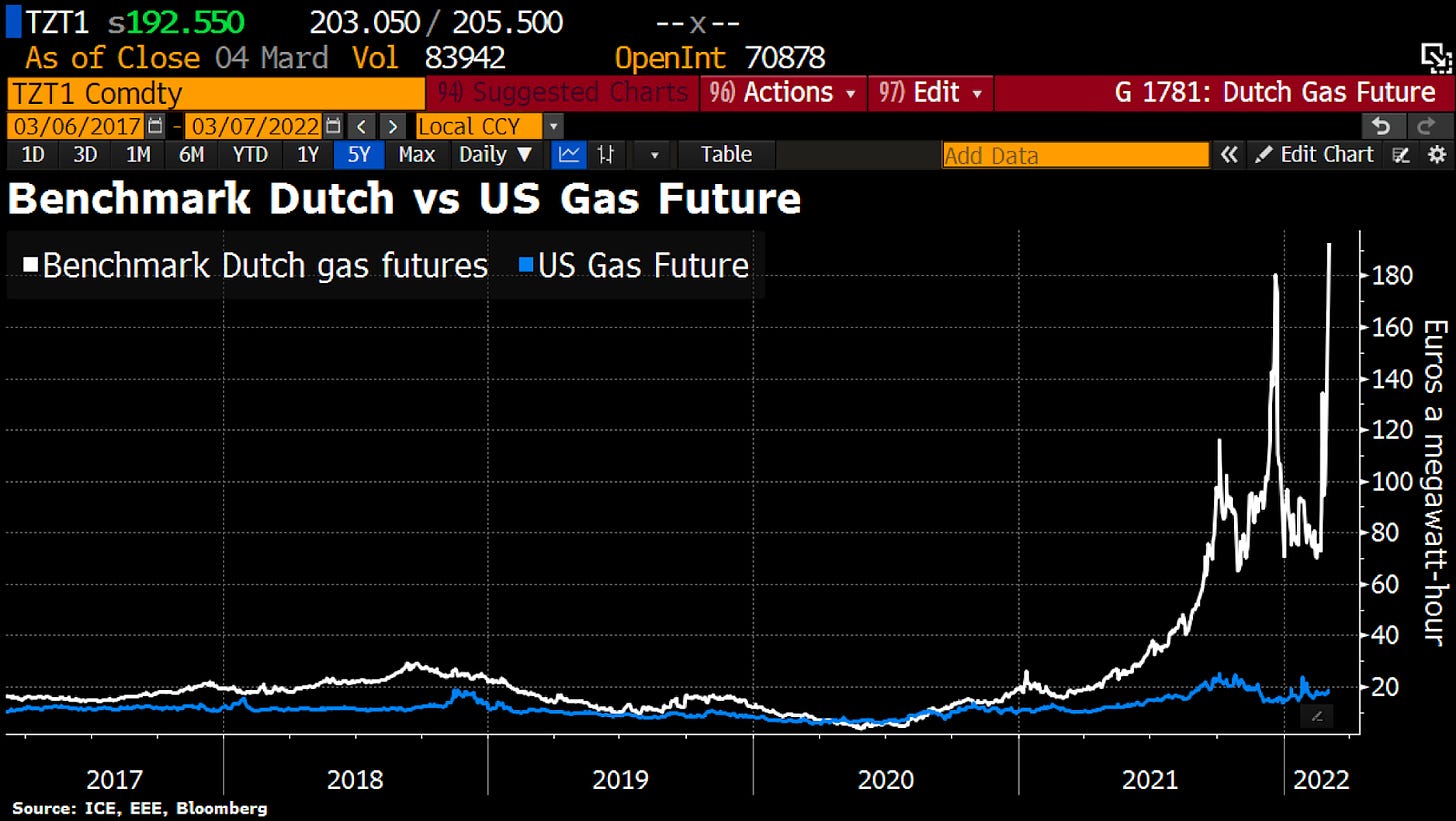

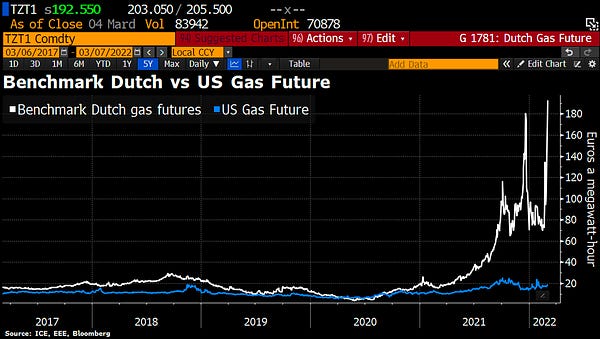

Energy prices in Europe is soaring heavily and why not renewables is the solution

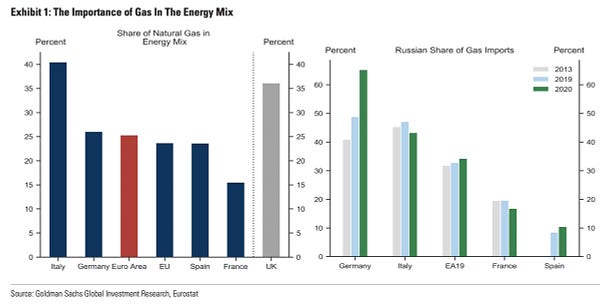

Nothing new here, but in the following chart you can see clearly why Europe is falling further and further behind the US as a business location. Gas prices are 5 times higher in Europe and the European gas price chart looks like a crude cryptocurrency. It's madness that with extraction restrictions, sanctions and last but not least with war a handful of rulers are making everyone's life more expensive. Europe's peoples' lives are most fragile because they are the heaviest importers of fossil energy. Another step to weaken EURO against USD. But is this just a conspiracy, or not?

Nickel jumps to record high

Nickel jumps to record high as supply risk sparks short squeeze. Nickel prices more than double, up 108% at $100,000 a ton amid a short squeeze as Ukraine invasion escalates. The rapid surge will push up costs for EV manufacturers.

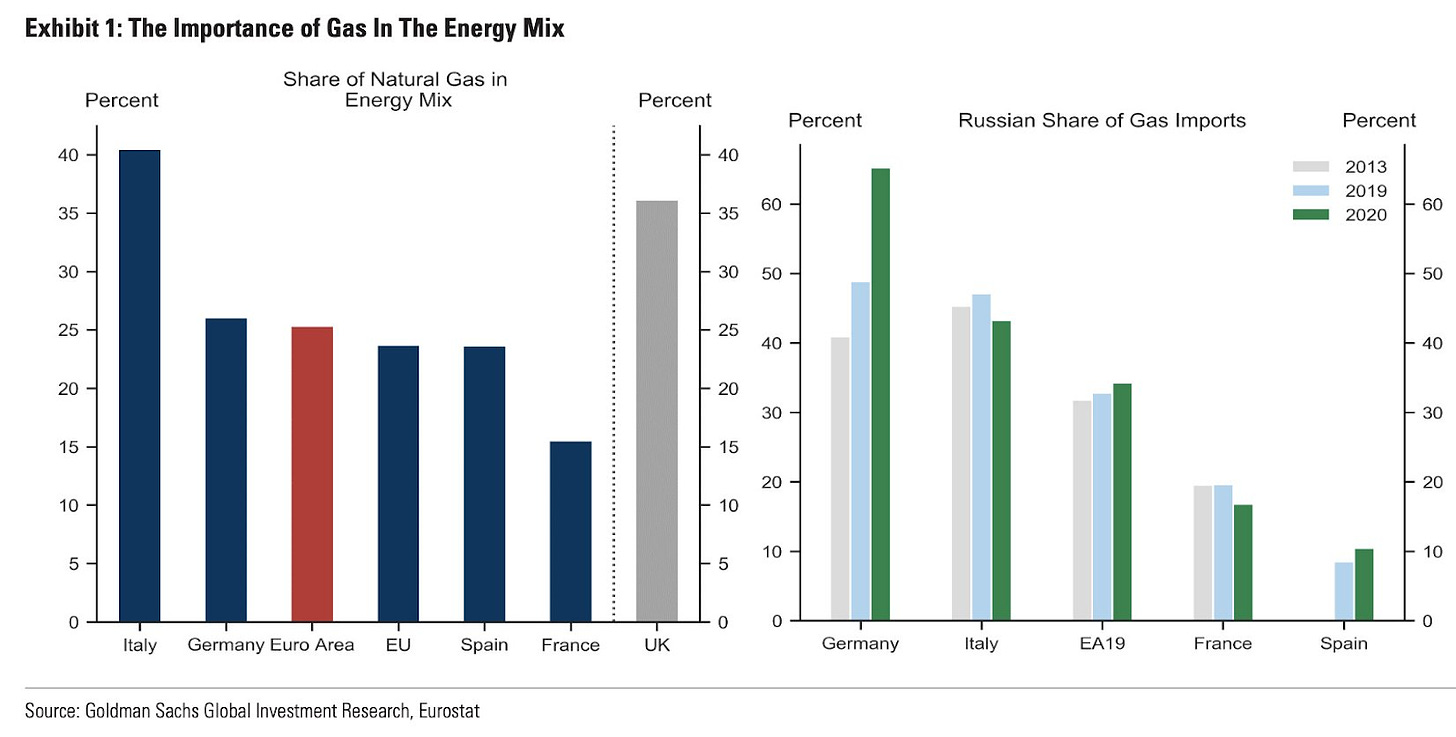

Germany stays with Russian oil and Natural gas

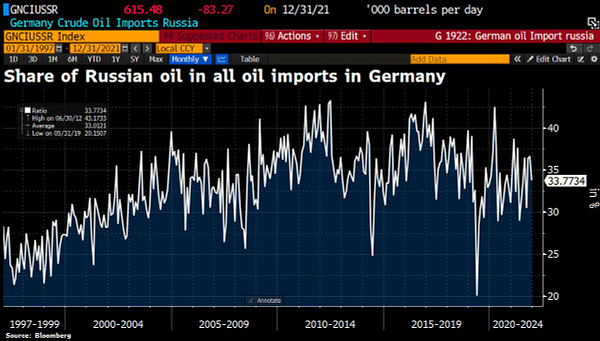

Germany does not want to join American demands of a Russian energy boycott. Olaf Scholz ruled out the restrictions, for now, saying Russian imports were of “essential importance” for the European economy. Germany gets a third of its oil imports from Russia. But Germany heavily depends on Russian natural gas too, with Russia accounting for ~60% of its imports. High dependence of Germany on Russian gas means that Germany’s output is most exposed to any disruptions. Goldman sees -1.5ppt to -5.2ppt 2022 GDP growth hit.

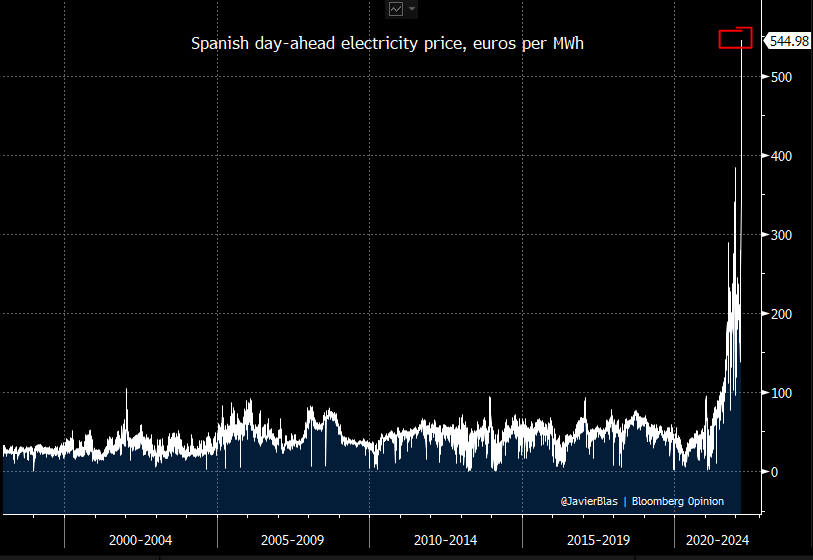

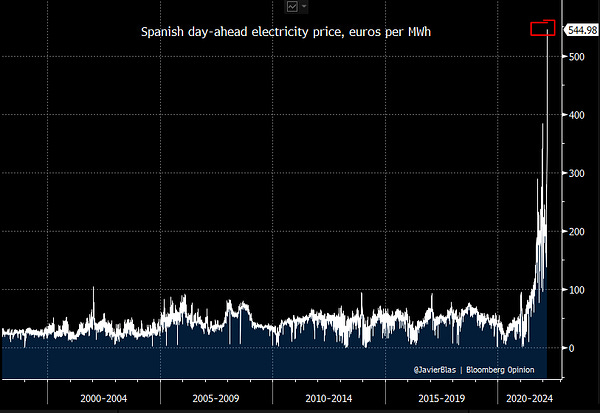

Spanish electricity prices are out of the roof

“The spike in European gas prices has pushed short-term electricity prices (paid most by businesses rather than households) throughout the roof. Spain is an example. I have covered this market since I was a trainee reporter in 1997. I can not believe the chart” by Javier Blas

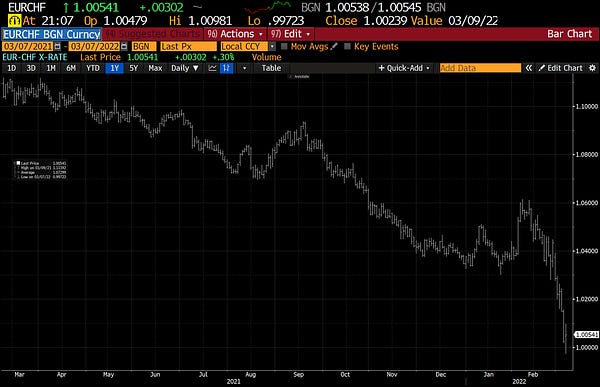

Euro briefly dipped below Swiss Franc parity

Euro briefly dipped below Swiss Franc parity today for the 1st time since the SNB abandoned the minimum Euro exchange rate of 1.20 francs in Jan 2015.

Nasdaq and the German DAX indices are officially in bear market territory

Nasdaq slumps 3.6%, closed down >20% from recent high, and now officially in bear market territory. Germany's Dax starts the week 3.8% lower, now down 22.6% from the recent high and so in bear market territory!

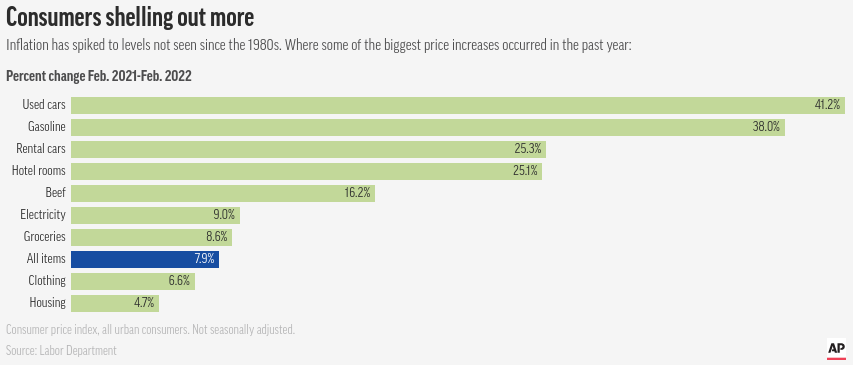

US Inflation is just temporary

Commodity price increases over the last year

Heating Oil: +102%; Wheat: +92%; WTI Crude: +81%; Nat Gas: +79%; Brent Crude +78%; Aluminum: +75%; Coffee: +74%; Gasoline: +71%; Corn: +38%; Cotton: +33%; Lumber: +31%; Palladium: +25%; Sugar: +18%; Gold: +18%; Soybeans: +16%; Copper: +16%; CPI: +7.5%.

Green is dead?

According to Goldman, the EU will soon announce its energy roadmap and has reportedly shifted its short-term focus from decarbonization to energy security, likely relying for now on more coal, more nuclear, and gas generation, and overall allowing for more carbon emissions. Funny how the wind changes? Welcome to the real world!

Visa and Mastercard prepare to raise credit card fees

Mastercard and Visa are preparing to increase the fees paid by large merchants, according to a report from The Wall Street Journal. The fee increases are scheduled to take effect next month, the newspaper said, citing people familiar with the matter. The increases had been delayed for the past two years due to the pandemic.

Ok, so do you believe this? I mean that they delayed the fee because of the pandemic? Like behind all this was a humanitarian thing, not? The truth is they made a fortune during the global lockdown and of course it was more than enough. Now as the pandemic is over and the inflation is rising, they have lower amounts of transactions: Higher prices, fewer buyers, fewer transactions, fewer credit card fees for Visa and Mastercard. Now think again, who will pay the bill for the sanctions on Russia?

Russia was downgraded to 2nd lowest rating by Fitch

Russia was downgraded to 2nd lowest rating by Fitch, which said a default is “imminent” as a result of measures ushered in since the Ukraine war. Fitch cut Russia rating by 6 notches to C, just 1 step above borrowers who had already been driven into default. Market price 84% default probability.

Saudi Arabia “considers options” of reducing investments in the US

Saudi Arabia "considers options" of reducing investments in the US, says crown prince Mohammed bin Salman. The Kingdom's investments in China are less than $100 billion, but growing very fast, he added. This was last week's news, but it’s current because this week the Saudi and UAE leaders declined to have a call with Biden regarding Ukraine and the spike in oil prices. Which maybe means Russia calculated the Russian action in Ukraine will force a new wave of sanctions which unites BRICS and pulls OPEC away from the USD. Indication is that Russia will sell its resources using other means such as gold, gold backed currency or maybe Bitcoin. Time will tell it’s just a conspiracy or a 4D chess game.

Russia’s Ruble slumped 8% against the dollar

Russia’s Ruble slumped 8% against the dollar as local trading reopened for the first time this week. Trading of currency was halted by volatility over the Ukraine war. Bid-ask spread remains wide, signaling thin market liquidity, BBG reports.

US inflation hits 7.9%

“Inflation is caused in part by a huge amount of govt spending. We can address inflation & our national debt by cutting that spending. The upcoming omnibus bill does nothing to help curb inflation and instead simply pours gasoline on an already raging fire.”

The few sentences are from Senator Cynthia Lummis and I couldn’t agree more with them because when the consumer price index (CPI) for February rose 7.9% from a year ago (BTW the highest level since January 1982) people are facing bullshit from the Biden admin propaganda. You will never hear the real reason, but you will pay the real inflated price, not this government calculated CPI. The real one is already for a few months in a two digit section. Prepare yourself for the caused aftermath, like Senator Cynthia Lummis with Bitcoin!

Is Germany losing its global position?

The fall of Germany is visible on stock markets. German total mkt cap as % of global mkt cap has fallen to a low of <2% this week. Only 2 German comps – Linde & SAP – among global Top100 when measured by market cap.

Global funds are moving out of China

According to the Bloomberg article, global investors are losing faith in China’s ability to navigate an increasingly complex maze of challenges. Global funds rapidly reduce China exposure. Country’s stocks among world’s worst since Russia’s invasion. Chinese ADRs down 70% from high.

US House passes $1.5 Trillion spending Bill with $13.6 billion for Ukraine

Unbelievable that just after the recent 7.9% inflation news, the US is “printing” another $1.5 Trillion USD for their expenses. They are sending $13.6 Billion USD for helping Ukraine. This is the marketing behind the fact that they are making every USD user citizen on earth $1.5 Trillion poorer. Yes, these are making inflation way worse!

If the US (for obvious reasons) can’t jump in the war as it did before, they are just spending “some” money on Military companies through the Defense Department: “Some $730 billion has also been allocated for military spending under the Defense Department, and a further $125 billion would go to the Department of Veterans Affairs.” by ZeroHedge

At least we can be happy that WW3 will be postponed because the Military corporations will get their portion.

El Salvador at least tries to protect its citizens against inflation

Just to have some positive news too, El Salvador seems to be the (only?) new free world. The government of El Salvador very focused on the impact of inflation on the population. Just announced the suspension of the $.26 a gallon fuel tax as well as suspension of import duties on food items most consumed by Salvadorans. A small country, but with the help of Bitcoin they are trying to evade the inflation on USD caused by the US government.

Italy's PPI is unstoppable?

Industrial producer prices in Italy jumped 32.9 percent year-on-year in January of 2022, the most on record, accelerating from a 22.6 percent rise in December. Prices advanced 41.8 percent in the domestic market and 10.5 percent in the foreign one. Energy cost recorded the biggest increase (115.6 percent), followed by intermediate goods (19.2 percent), capital (5.8 percent) and consumer goods (5.2 percent). On a monthly basis, producer prices surged 9.7 percent.

Is Germany already in recession?

According to Welt.de, Germany has a growing number of cash-strapped utilities threatened by insolvency due to surging electricity, oil & gas prices at energy exchanges. Uniper, the 2nd largest energy firm applied for govt help.

Bitcoin price speculations

These are just speculations, no investment advice!

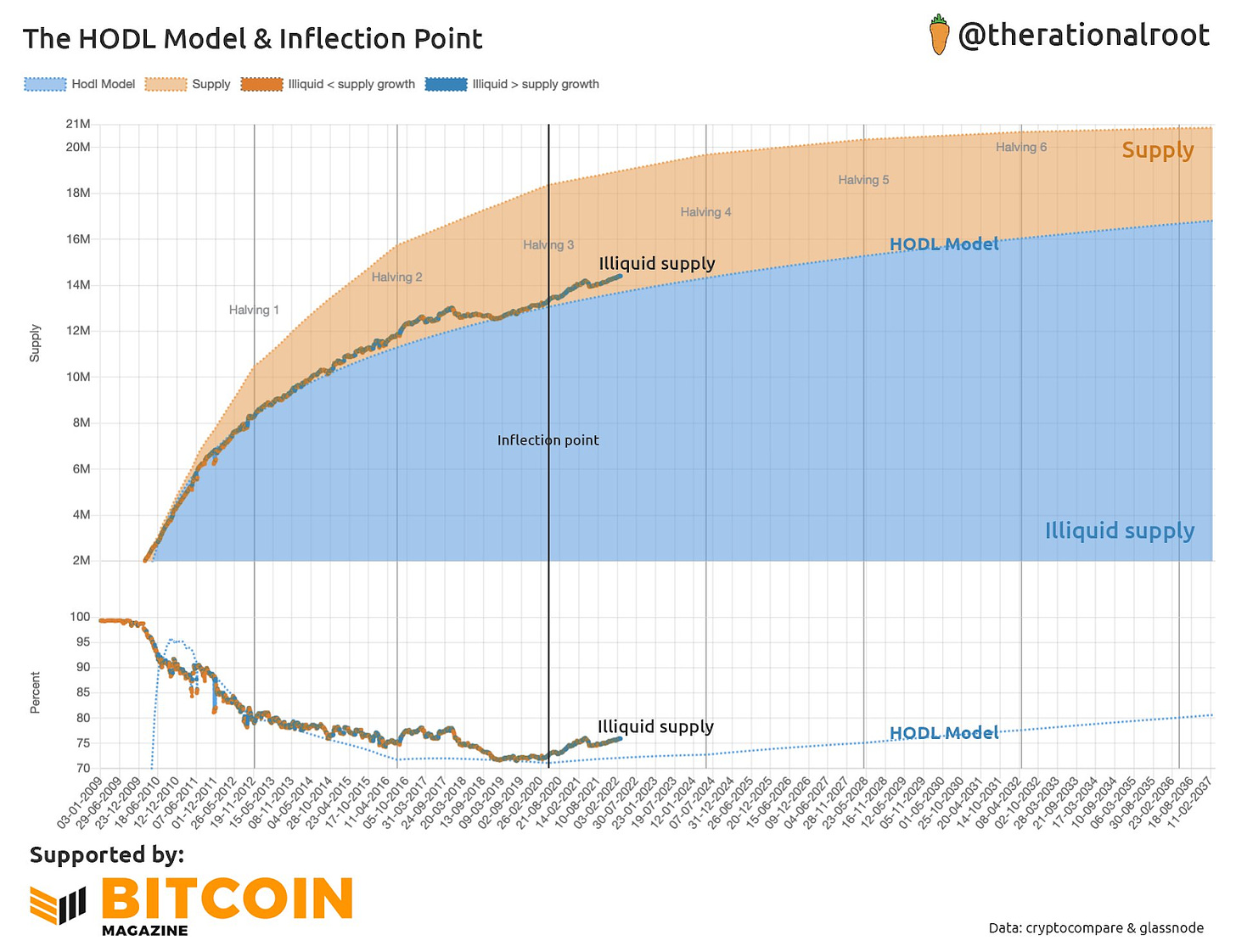

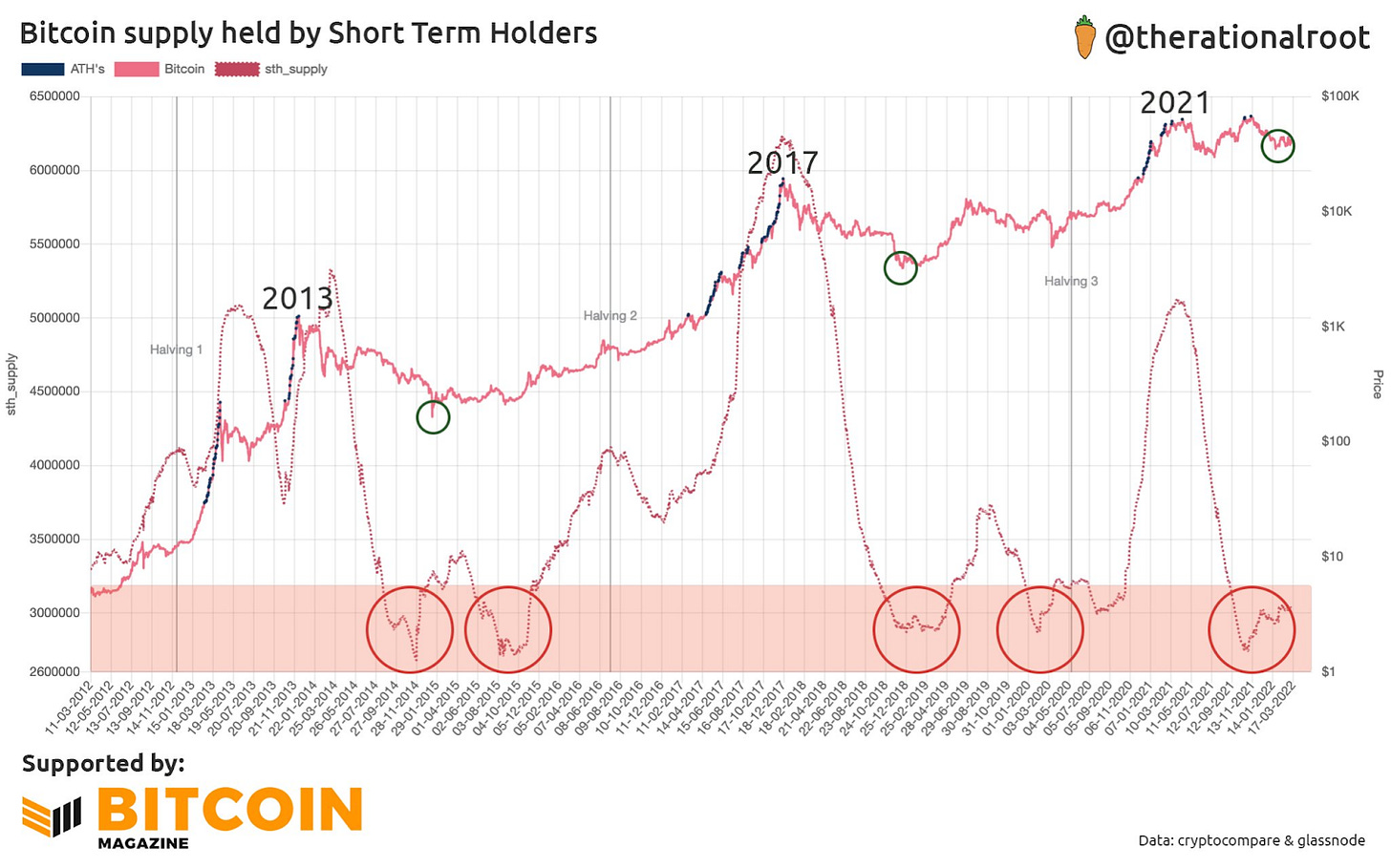

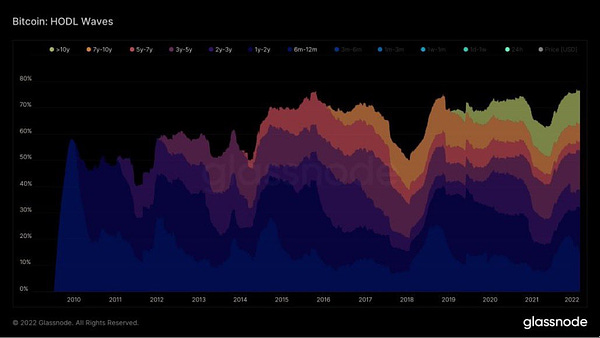

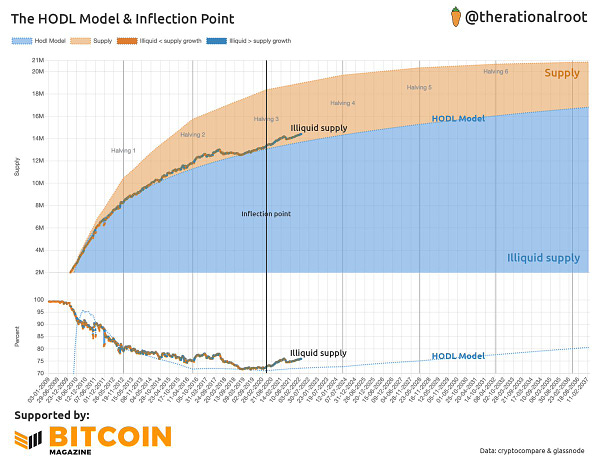

“The HODL Model: Bitcoin's illiquid supply is outpacing supply issuance. As illiquid supply rises, so do the market impacts of bitcoin's digital scarcity.” by Root

“Bitcoin 2021 vs 2022 Drawdown slightly smaller but over a longer period. Looks like a bottom is forming.” by Bitcoin Archive

“Ultimately $46k is the price you want to see Bitcoin break through to mark a trend reversal:” by Matthew Hyland

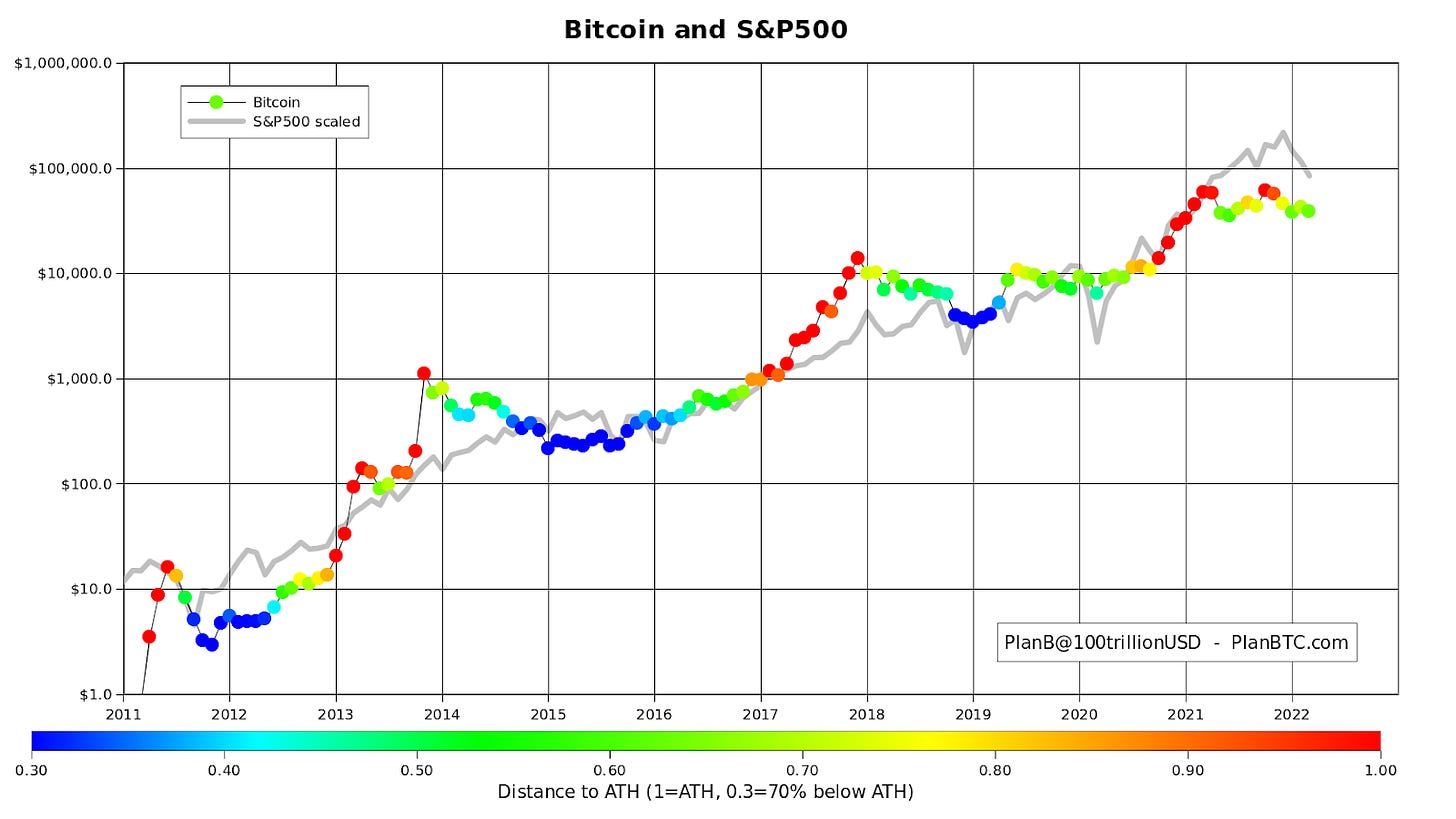

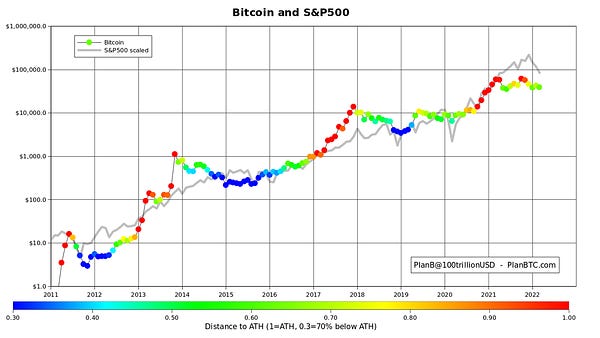

“IMO BTC's first dip from 60k to 30k in 2021 was caused by China's mining ban. The second dip from 60k to 30k in 2021 was caused by inflation combined with possible rate hikes & QE ending. Currently the odds of rate hikes & QE ending seem low..” by PlanB

“Bitcoin and S&P500” by PlanB

“The MPI shows that Bitcoin could be pumping soon. This chart from @OnChainCollege shows the MPI which is a relative measure for miner outflows. After a year of low outflows, we maybe saw the same spike that happened before a big bitcoin run (miners sell into strength)” by BTCfuel

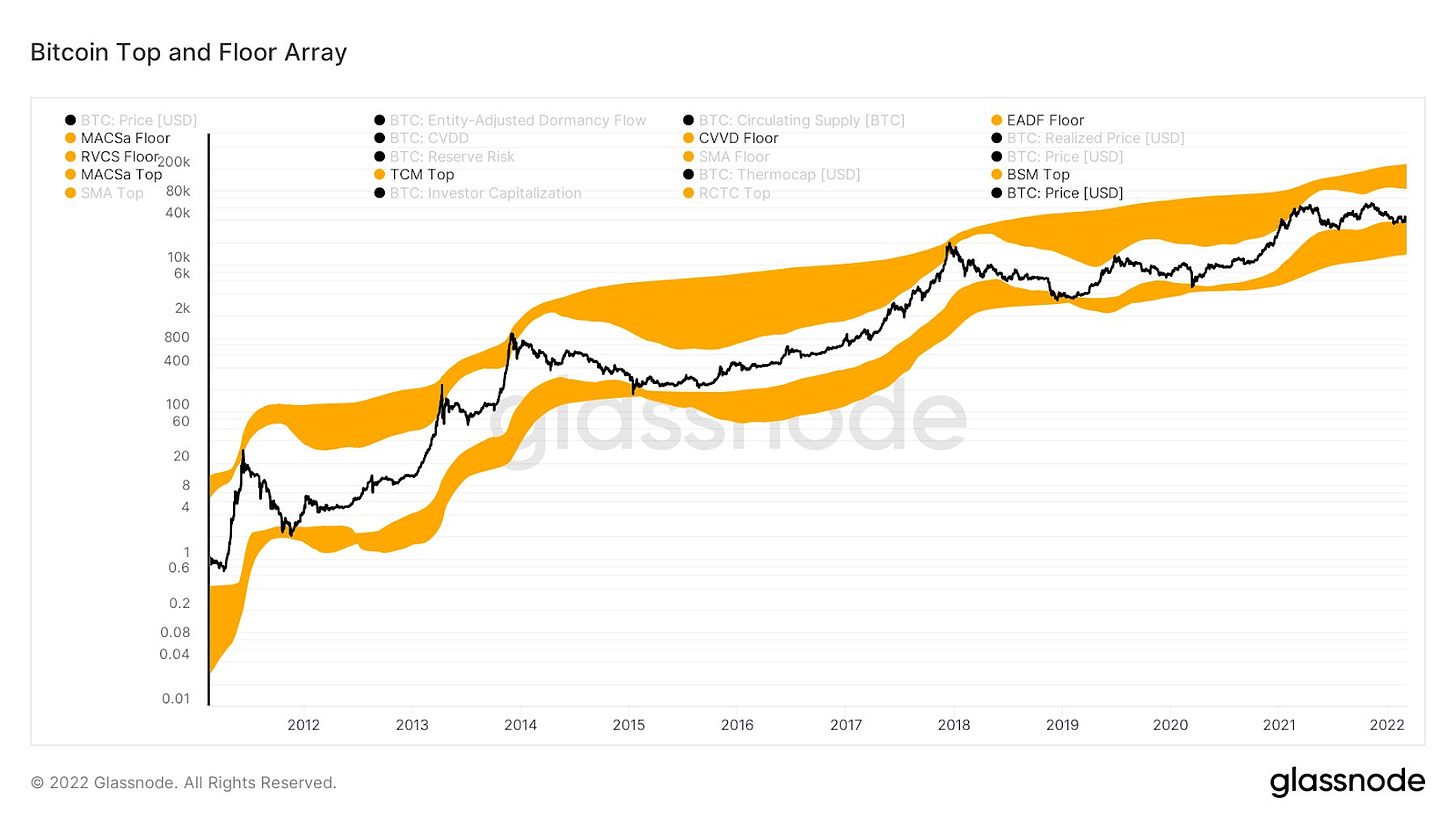

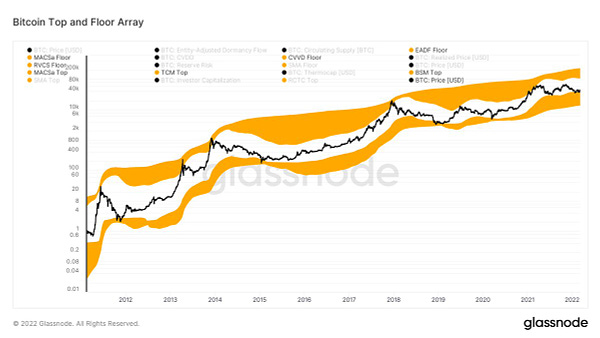

“Watch all the indicators. This chart shows some well-known top and floor models combined.” by @paulewaulpaul

“Updated view on the Bitcoin Daily RSI Symmetrical Triangle” by Matthew Hyland

“Still very likely the macro-bottom is in.” by Root

Bitcoin Shorts

Funny Bitcoin short stories

“A record 76.5% of all bitcoin has not moved in at least six months.” by Documenting Bitcoin

“Bitcoin is the only "pure-gold" cryptocurrency” by Steve Wozniak Apple co-founder

“Wrong then. Wrong today.“ by Bitcoin Magazine

“The number of addresses holding at least 1,000 Bitcoin is 2,261, it’s highest level in 11 months.” by @WatcherGuru

“Bitcoin is so much cleaner…” by @nvk

73% of institutional investors and wealth managers believe Bitcoin is a viable hedge against inflation - survey

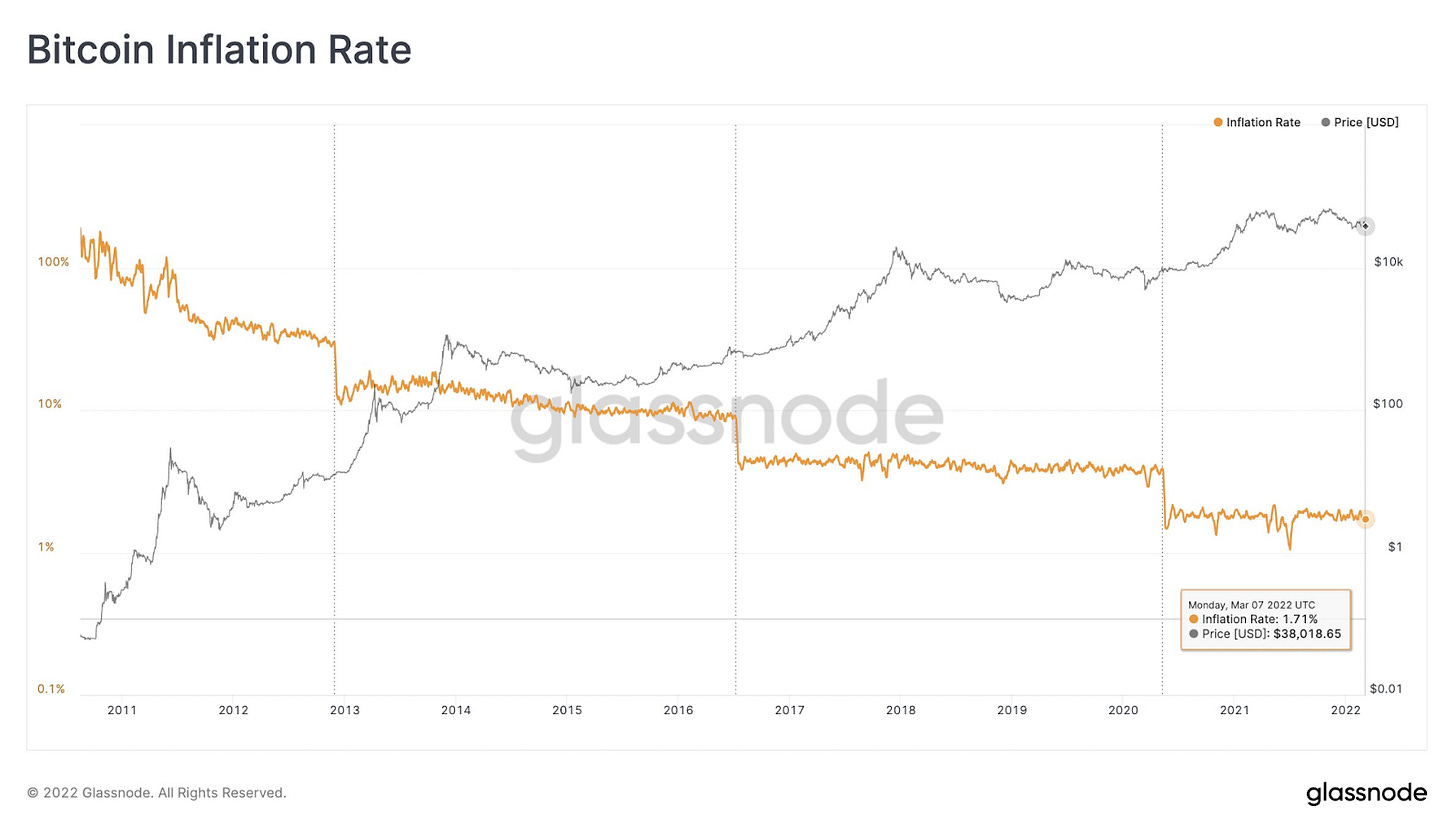

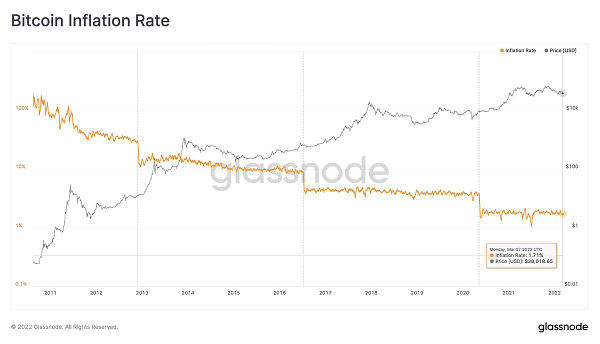

“Bitcoin inflation rate currently sitting at 1.7%, continues to follow its preprogrammed, fully predictable downwards trajectory.” by @n3ocortex

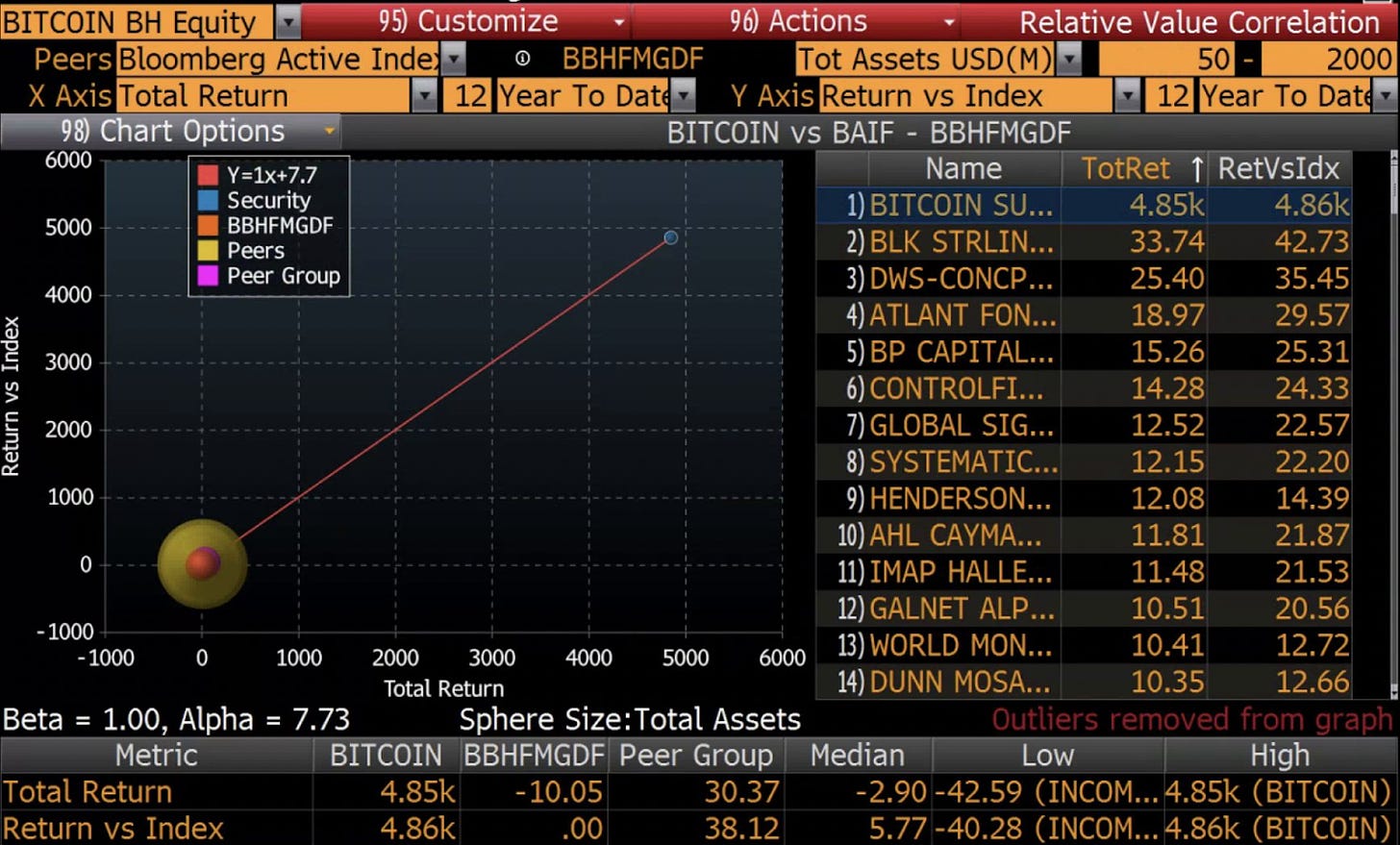

“9 years ago today, first-ever Bitcoin hedge fund launches with 80,000 BTC - 4,000% returns the first year” by @pete_rizzo_

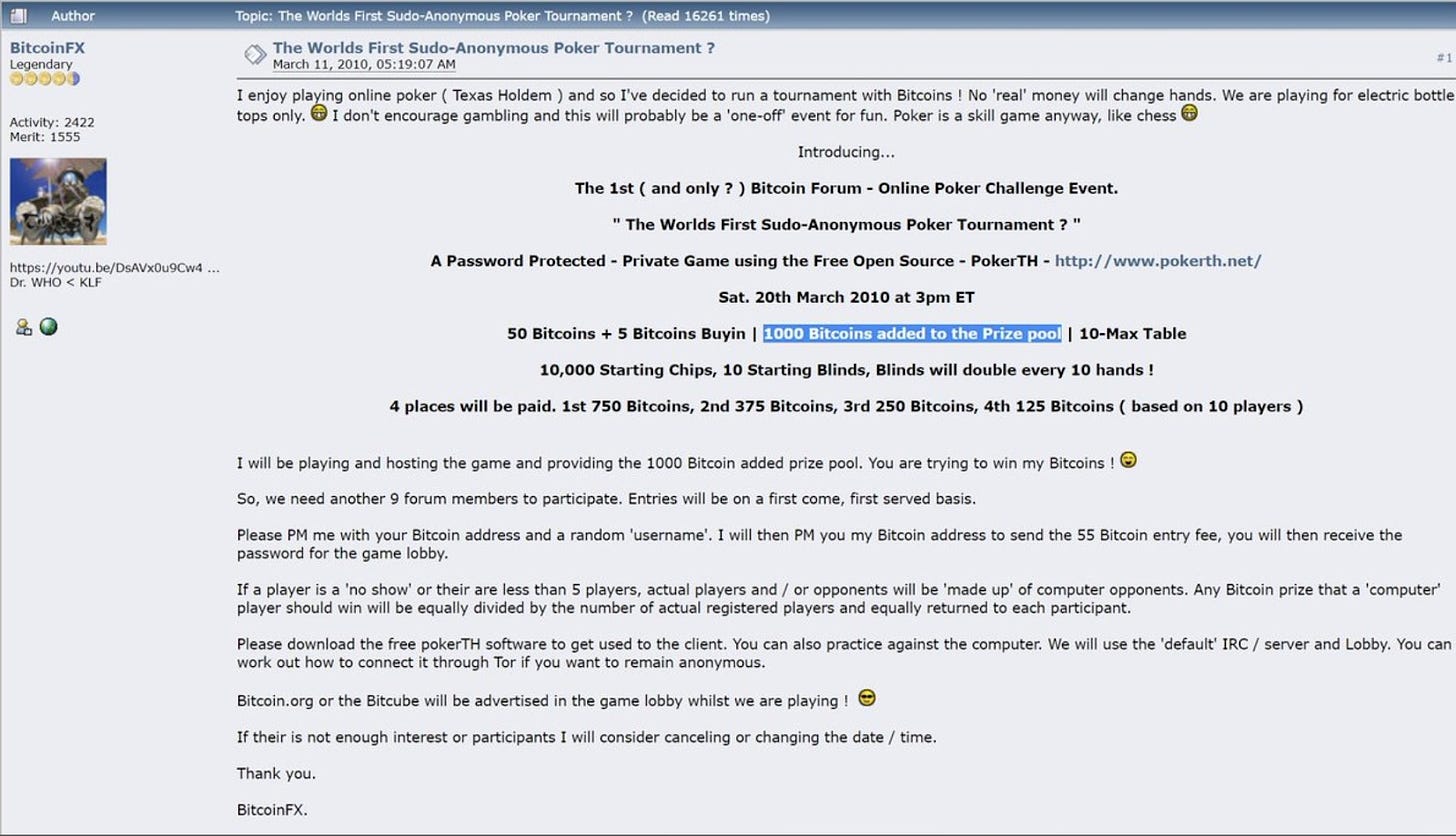

“1,000 Bitcoin poker tournament 12 years ago today” by @pete_rizzo_

Suggestions

Interesting articles, books to read

Elon Musk Calls For Europe To Restart Nuke Plants, US To Boost Oil & Gas Output "Immediately"

Western Economies On Brink Of Recession As Russia Sanctions Escalate

On BSV Scalability (A story about how wrong is unthoughtful block size increase)

Bitcoin wallets for beginners – The Importance of Self-Custody

Sources:

https://nitter.net/L0laL33tz/status/1500467902289522688

https://time.com/6155209/ukraine-crypto/

https://www.eia.gov/outlooks/aeo/tables_ref.php

https://bitcoinmagazine.com/business/virginia-state-banks-receive-green-light-to-custody-bitcoin

https://bitcoinmagazine.com/markets/thailand-approves-tax-relief-for-bitcoin-investors

https://www.zerohedge.com/political/house-passes-15-trillion-spending-bill-136-billion-ukraine

https://www.telegraph.co.uk/business/2022/03/11/bitcoin-cashpoints-forced-shut-declared-illegal/