This week (and from now on) I added to the end a “Suggestions” part where I will post those articles and books which I think it’s worth reading.

Bitcoin News

TL;DR

The Ukrainian Government received $1 million worth of Bitcoin from a single donor (UPDATED!)

Bitcoin-ruble trading volumes surged

Bitcoin exchange flows by price

The Canadian Bitcoin Spot ETF on new ATH

Morgan Stanley increased its Grayscale Bitcoin Trust holdings

Details surged about the 2nd gen Intel Bitcoin miner

EU lawmakers: The “Bitcoin ban” removed

Bitcoin vs. Russia Ruble hit fresh ATH

Fed Chair Powell: 'War Underscores Need' for Crypto Regulation

The Bitcoin/Gold parity day

The Bitcoin miners earned $1 Billion last month

The Impervious Browser announcement

Swiss city Lugano wants Bitcoin legal tender (UPDATED!)

Azteco speeds up Nigeria’s and Canada’s Bitcoin adoption

500+ MW Bitcoin mining with 90% zero-carbon energy

10% of all Bitcoin transactions still originate from China

Shake Shack is testing a 15% BITCOIN back customer rewards

Louisiana state has proposed a bill to accept Bitcoin

The Ukrainian Government received $1 million worth of Bitcoin from a single donor (UPDATED!)

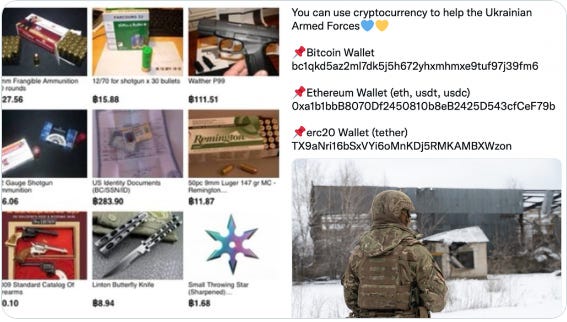

Ukraine Bitcoin donations statistics, totaling more than $11.5 million as of February 28th. From this amount a guy or girl donated $1 million worth of Bitcoin alone! That’s what I call love of Freedom!

(UPDATE: as of March 5th, $54M in Bitcoin and shicoin donations in total went to Ukraine so far)

(UPDATE 2.: We are able to operate internationally because of Bitcoin & crypto - said to FoxNews Alex Bornyakov Ukraine’s Deputy Minister)

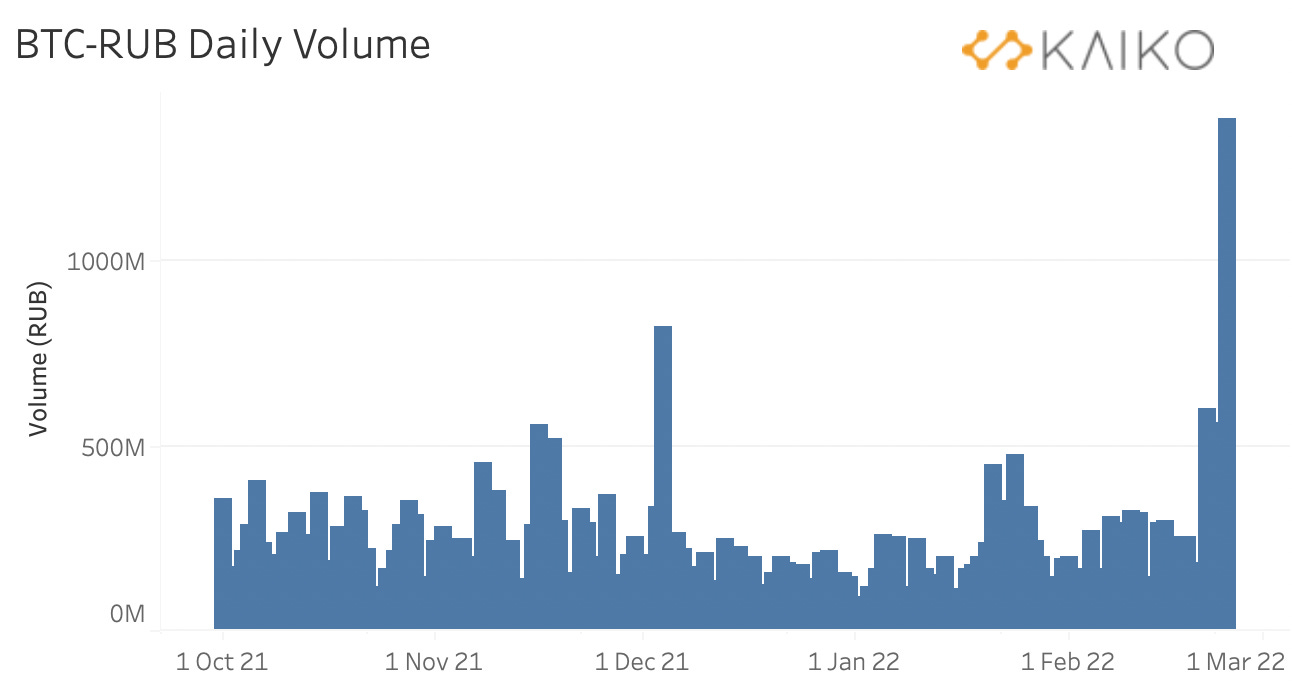

Bitcoin-ruble trading volumes surged

Bitcoin-ruble trading volumes surged as the West's sanctions on Moscow triggered a flight to safety away from the ruble. Data tracked by Kaiko, a Paris-based cryptocurrency research provider, shows that ruble (RUB)-denominated bitcoin volume surged to nearly 1.5 billion RUB on Thursday, hitting the highest since May.

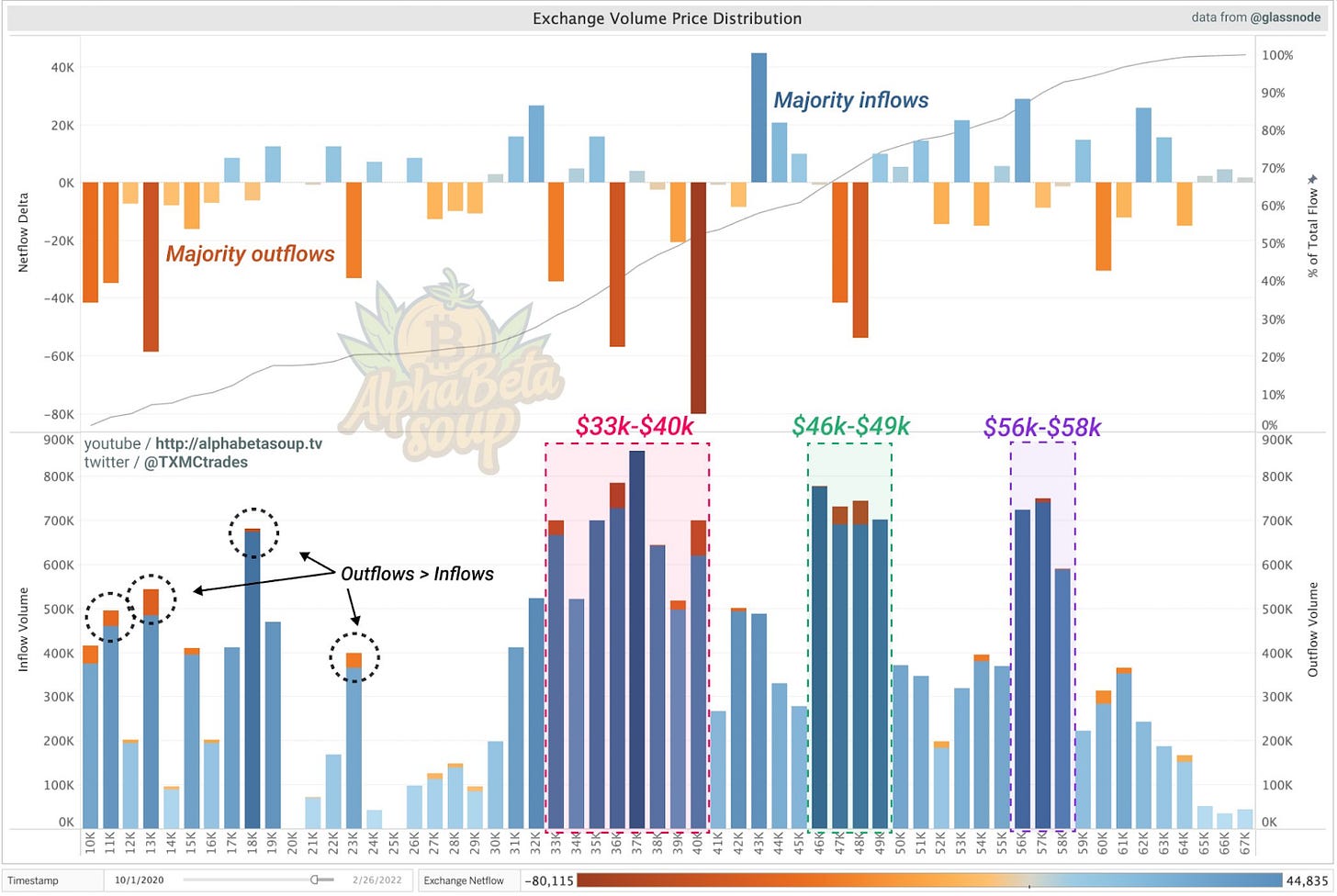

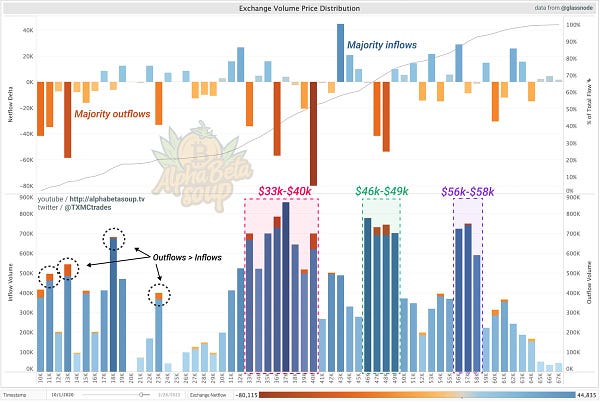

Bitcoin exchange flows by price

Based on the chart below, volumes are highest from $33-49k, dominated by withdrawals (seen peeking over the tops). Flows become more mixed above $50k, likely from profit taking. (blue deposits; orange withdrawals)

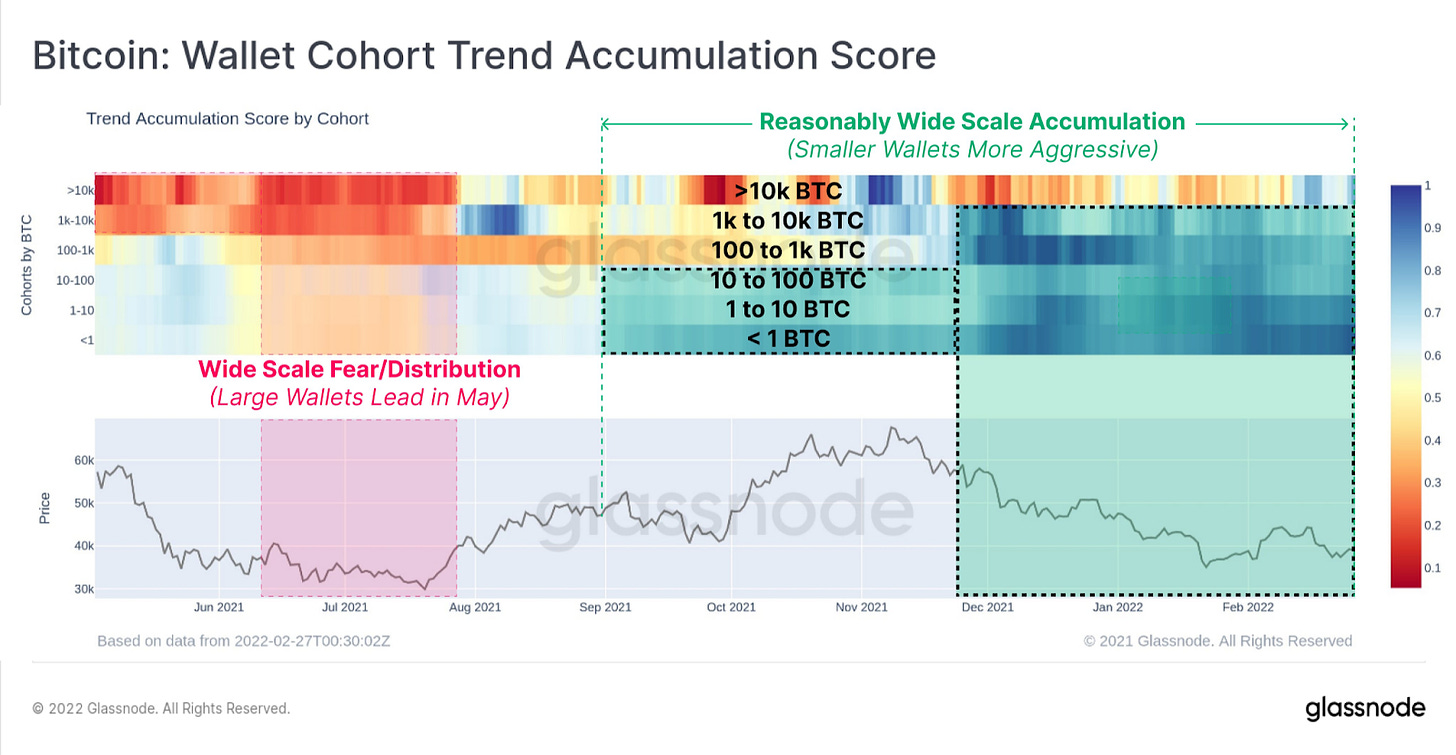

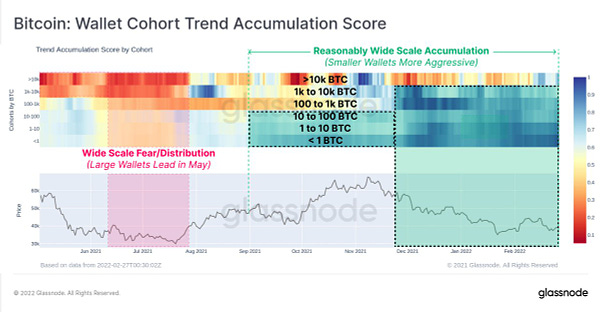

Another visualization shows that most Bitcoin wallet cohorts are now in net accumulation, with smaller holders being the most aggressive. The following heatmap presents the Bitcoin accumulation score for each wallet cohort. Blue indicates entities are adding to their balance. Red indicates entities are not accumulating. BTW this metric excludes the miners and exchanges.

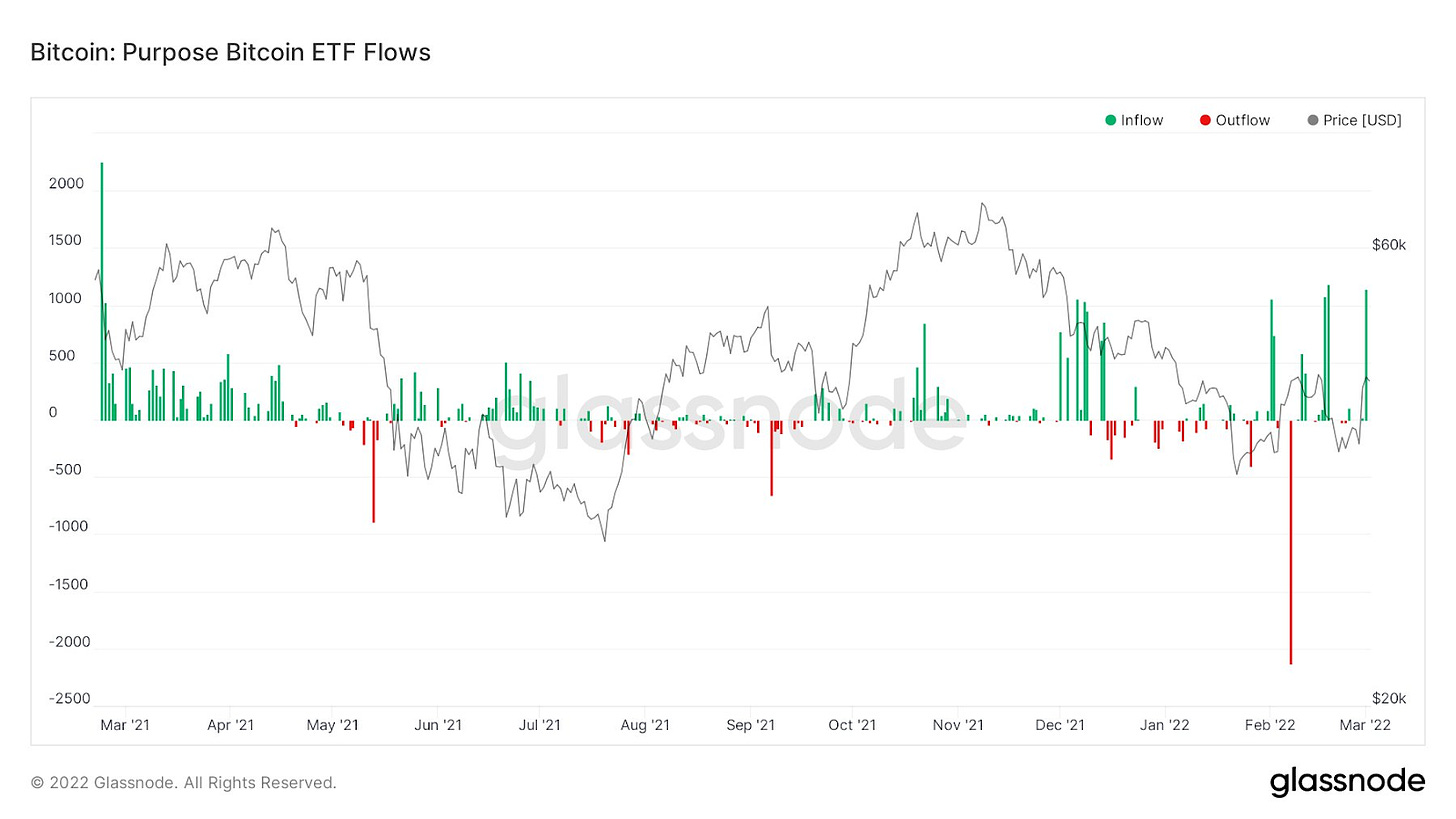

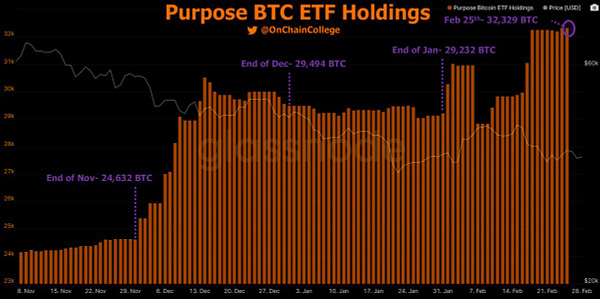

The Canadian Bitcoin Spot ETF Purpose on new ATH

While the U.S. SEC still “doesn't understand” why there is no Bitcoin spot ETF in the U.S., the Canadian Bitcoin Spot ETF Purpose has increased their holdings by 31%, or ~7,700 BTC, since the end of November. The ETF currently holds 33,5K BTC.

Morgan Stanley increased its Grayscale Bitcoin Trust holdings

“According to filings from the United States Securities and Exchange Commission on Tuesday, the Morgan Stanley Insight Fund increased its holdings of Grayscale Bitcoin Trust, or GBTC, shares more than 63%, from 928,051 in the second quarter of 2021 to 1,520,549 as of Sept. 30. In addition, filings on the firm’s Growth Portfolio show it holding 3,642,118 GBTC shares in the third quarter of 2021, an increase of 71% when compared with 2,130,153 shares as of Q2. The Morgan Stanley Global Opportunity Portfolio held 1,463,714 GBTC, a 59% increase from 919,805 shares in three months.” by Cointelegraph

GBTC is not BTC! This is like buying a virtual Ferrari which is paid on a price like a real one. You can never ever drive it. That’s the same with GBTC, it’s an “IOU”. Yeah, I know the Grayscale guys are working hard to convert the Bitcoin trust into a BTC-settled ETF, but first they need to win the battle with the SEC. It wouldn’t be much easier to just simply buy Bitcoin like Microstrategy did?

Details arrived about the 2nd gen Intel Bitcoin miner

If we can trust Tomshardware after the really poor 1st gen the 2nd gen Intel Bitcoin miner is quite promising. With 135 TH/s hashrate to 3510 W consumption, makes an 26 J/TH power efficiency which is not far from the best miner the Antminer S19j XP (21.5 J/TH). The good news is that it will be manufactured in the US which adds more decentralization to the market. GRIID says the new Intel mining systems cost $5,625 per miner. Given that GRIID has guaranteed access to 25% of Intel's production capacity, we expect the company to benefit from volume pricing. The price is quite attractive, but for the average end user it will be way higher. Based on the picture attached below, the miner will be noisy, so sadly it will definitely not be a “home user” compatible miner.

EU lawmakers: The “Bitcoin ban” removed

Ban, not ban, ban, not ban. They are all playing with us. The EU lawmakers just last week wanted to ban Bitcoin “due to environmental concerns”, but this week they already changed their mind. In news that BTC-Echo broke and European MP Stefan Berger confirmed on March 1, the latest version of the EU's "Markets in Crypto-Assets" or MiCA directive has been stripped of a passage that many feared would lead to a ban on cryptocurrencies that use proof-of-work — namely, Bitcoin. Why? The answer is simple. Due to their own interest. They all see that FIAT currencies are fighting for their last breath and they all are moving their assets to more store-of-value solutions. One of these is Bitcoin (more precisely the only one).

Bitcoin vs. Russia Ruble hit fresh ATH

As the global financial “banhammer” got in motion, sadly the Russian citizens literally faced from one day to another their huge vulnerability to their own currency, like the Germans at the end of the first World War. The war is not over yet, but their currency already lost against the hardest financial instrument ever existed, the Bitcoin. I can’t express the sadness I feel, but we all need to learn from this outcome!

Fed Chair Powell: 'War Underscores Need' for Crypto Regulation

“[The Ukraine-Russia conflict] underscored the need for Congressional action on digital finance including cryptocurrencies,” Powell said. “We have this burgeoning industry which has many parts to it, and there isn’t in place the kind of regulatory framework that needs to be there.” I see they try everything to “regulate” this new financial market, but they can only regulate the centralized shitcoins (BTW which they should!). Regulating Bitcoin in their own favor means leaving some other countries to step ahead and gain on it. With the arrival of Bitcoin, the free market will inevitably win!

The Bitcoin/Gold parity day

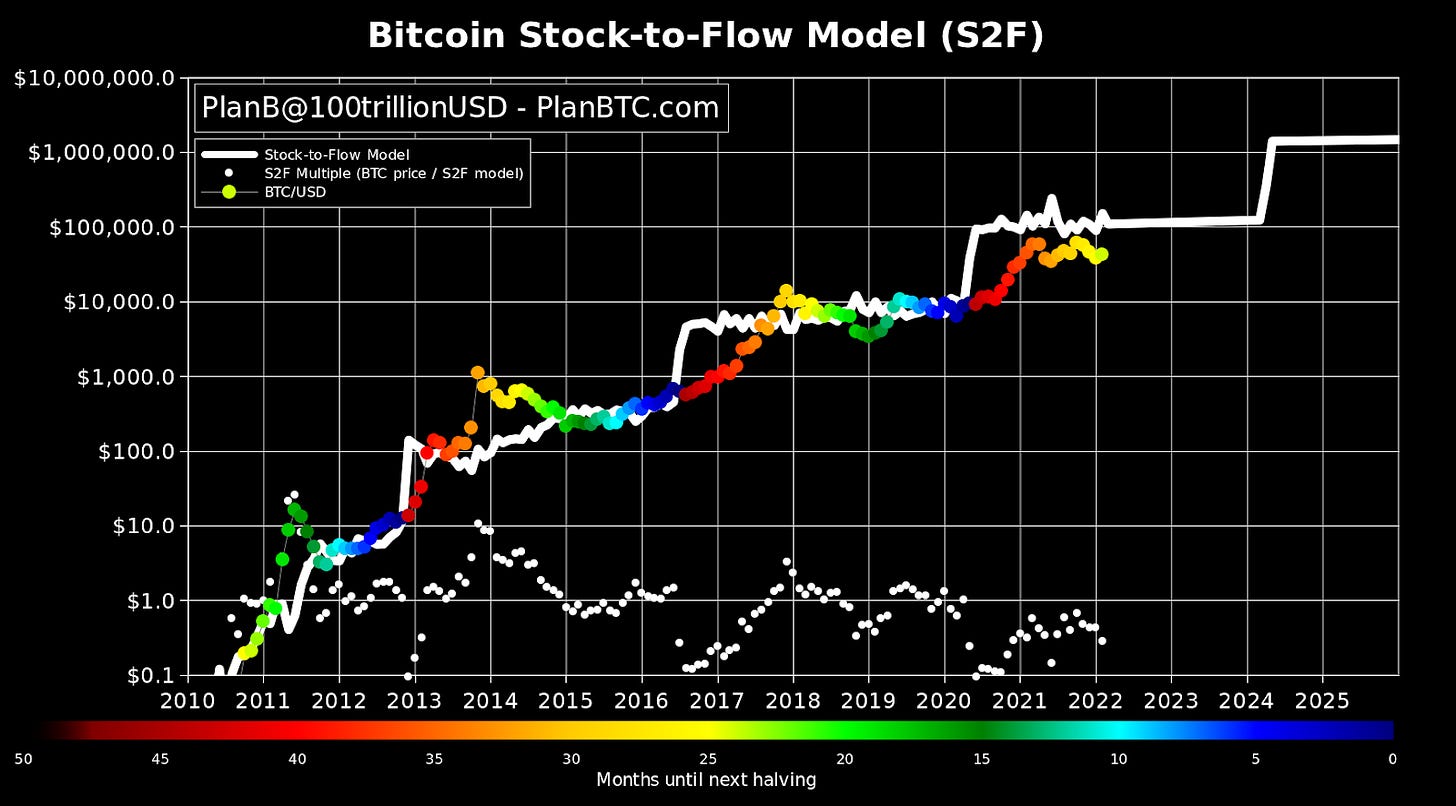

March 2nd in 2017 was the first time when 1 Bitcoin was worth 1 ounces of Gold. I remember this day because as I told everyone around me, no one believed that it meant anything. Today we already know that Gold lost its battle against Bitcoin and that iconic day will never happen again. Now 1 Bitcoin worth around 22 ounces of Gold and if you check the chart below you will see why I say Gold lost its store-of-value.

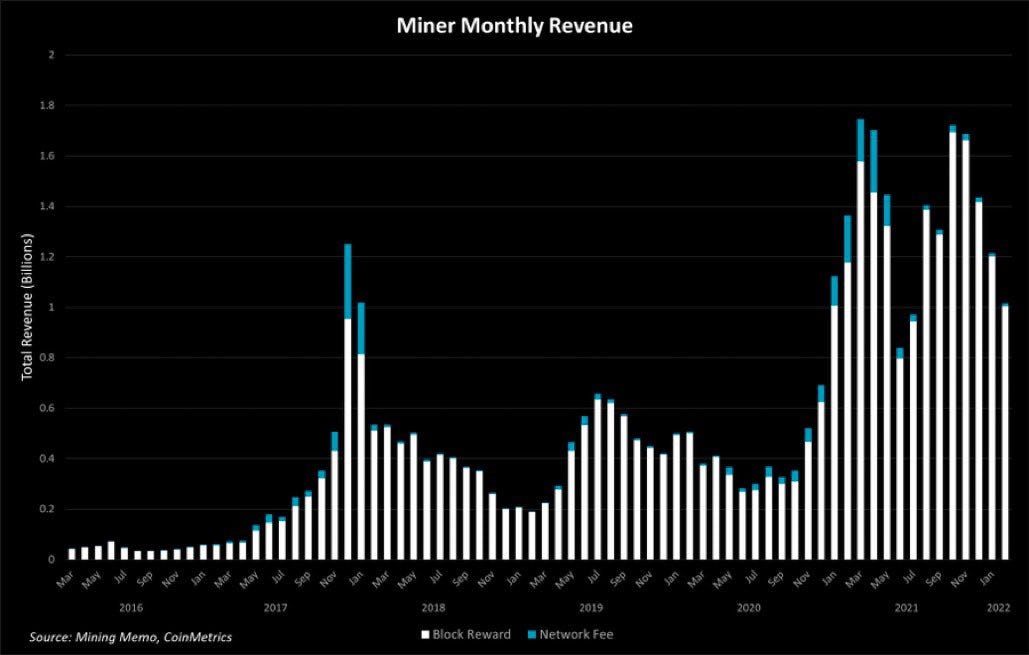

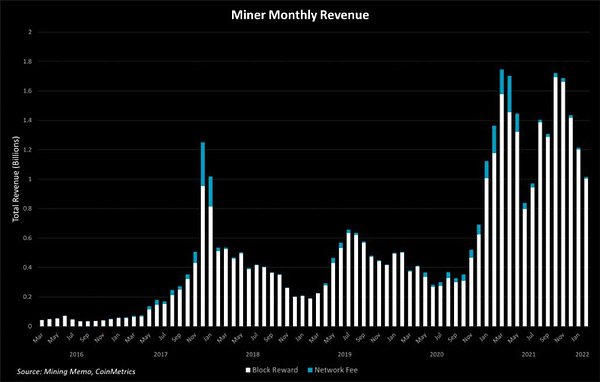

The Bitcoin miners earned $1 Billion last month

With no policy required, Bitcoin is running a monthly $1 billion incentive program to innovate and secure the most efficient sources of energy available.

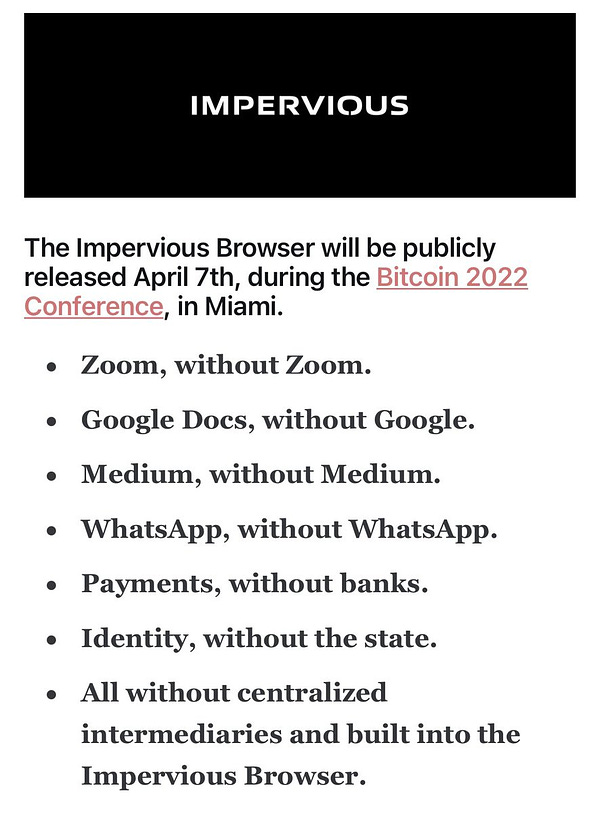

The Impervious Browser announcement

During the Bitcoin 2022 conference in Miami, the Impervious team will release a browser which will be a true freedom fighter tool! The bundled APIs will be built on the Bitcoin Lightning Network (Layer 2), so it will be a “Layer 3” application. With these APIs any application or service can stream cryptographically secure, censorship and surveillance resistant data transmission channels. It offers many brilliant decentralized services from video calls to identity management, so I can’t wait to test it.

Swiss city Lugano wants Bitcoin legal tender (UPDATED!)

Last week I already wrote that Lugano’s mayor wants the city to be “the European Bitcoin capital”. I was a little afraid that with Plan B he was thinking of Plan Blockchain, but no, it was Plan Bitcoin. The city is already working on implementing the Bitcoin Lightning Network (Layer 2) and their goal is accepting Bitcoin for payment of all goods and services and equal with fiat currency, aka making Bitcoin a legal tender. After El Salvador Lugano is the closest now to making Bitcoin a legal tender in their city.

(UPDATE: Lugano will invest in helping university students learn about Bitcoin and Lightning too)

Azteco speeds up Nigeria’s and Canada’s Bitcoin adoption

While Nigeria is the number two leading country in Bitcoin adoption, now with Azteco 600,000 Cash-In locations Nigerians and Canadians will be much more easily invested in Bitcoin.

“We expect this uptake because Azteco is the most simple method of buying Bitcoin on the market, identical in process to the top-up's everyone on the African continent is used to with adding air-time to Mobile Phones. There is nothing to learn or understand; it just WORKS.”

“At every Canada Post outlet in Canada you can buy an Azteco Voucher right now. Get a Bar Code from azte.co/paypoint take it to your local post office and the instant you pay, your voucher will arrive in your recipient's email. It's simple, safe, fast, secure and private.” by Azteco

500+ MW Bitcoin mining with 90% zero-carbon energy

TeraWulf has announced the commencement of Bitcoin mining operations at its Lake Mariner facility in upstate New York using more than 90% zero-carbon energy. The Lake Mariner facility is expected to reach over 500 megawatts of capacity once complete. The Company also continues to expect to begin mining at its Nautilus Cryptomine facility in Pennsylvania early in the third quarter of 2022 where it aims to have 300 megawatts of gross mining capacity using 100% zero-carbon energy once complete. The objective 800 megawatts of mining capacity deployed by 2025, enabling over 23 exahash per second of expected hashrate.

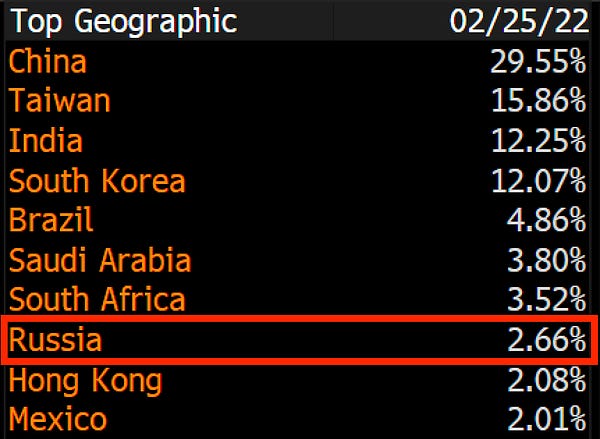

10% of all Bitcoin transactions still originate from China

Despite the official ban of any kind of business with Bitcoin, 10% of all Bitcoin transactions still originate from China. Here is the central bank (BoC) official announcement translated with Google Translate:

“... the global proportion of bitcoin transactions in China has rapidly dropped from more than 90% to 10%.” The 10% is huge and I think that knowing how the World turned towards Bitcoin, a big portion of these transactions are made by wealthy people (government officials) to protect their wealth value.

Shake Shack is testing a 15% BITCOIN back customer rewards

A month ago I wrote about Everbowl switching to the Bitcoin Standard. Now another fast food chain Shake Shak is opening to Bitcoin. They chose a different road, by allowing their buyers to get a 15% cashback in Bitcoin with a cash card. They want to appeal to a younger audience which is interested in Bitcoin.

“You’re always trying to place your bets on those things that truly will be meaningful and not waste resources on the ones that won’t,” Jay Livingston, chief marketing officer, explained to WSJ.

Louisiana state has proposed a bill to accept Bitcoin

Louisiana has proposed a bill to accept Bitcoin as payment for taxes. The resolution, passed by the state House on Wednesday and signed by Speaker Clay Schexnayder (R) on Thursday, formally commends Bitcoin “for its success in becoming the first decentralized trillion dollar asset” and pushes for “state and local governments to consider ways that could help them benefit from the increased use of this new technology.”

Global Economic News

TL;DR

Bank of Russia raises key rate to 20% from 9.5%

Brent oil jumps back >$100/bbl

Germany changed decades-long aversion to military spending

MSCI says removing Russia from indexes is a "natural next step."

Russia banned sending >$10,000 in foreign currency

Bloomberg Commodity Index jumps to ATH

Germany's inflation accelerates to 5.1%

Italy’s (HICP) inflation surged to a record (again)

Nasdaq and 10Y-2Y are signaling a top?

In Germany the financial repression intensifies

The price of wheat jumped ~30%

The German power price jumps another 28%

Turkey's inflation surged to 54%

DAX and Stoxx Europe 600 fell to a 52 week low

The Credit Suisse CDS is flying

The DZ Bank has radically cut Germany's 2022 GDP forecast

Global equities have lost $2.9tn

Bank of Russia raises key rate to 20% from 9.5%

With the Russian Ruble falling to the lowest level ever and according to Bloomberg, the Bank of Russia raised the key rate to 20% from 9.5% in emergency measures and it also temporarily banned brokers from selling securities held by foreigners. The Bank of Russia says external conditions for the Russian economy have drastically changed. Says rate hike is necessary to make ruble deposits attractive. Restrictions on the Russian Central Bank target its access to >$600bn in reserves the Kremlin has at its disposal, hindering its ability to support the ruble.

“Russian authorities have to prevent fire-sales of Russian securities to prevent panic,” said Commerzbank AG strategist Ulrich Leuchtmann. It’s “something which is certainly harmful in the long run, but which Russian authorities seem to prefer given the risk of an even more significant ruble collapse”.

The ruble opened 40% lower against U.S. dollars on Monday. Russia's state-owned Sberbank is "failing or likely to fail," the European Central Bank said in a prepared statement.

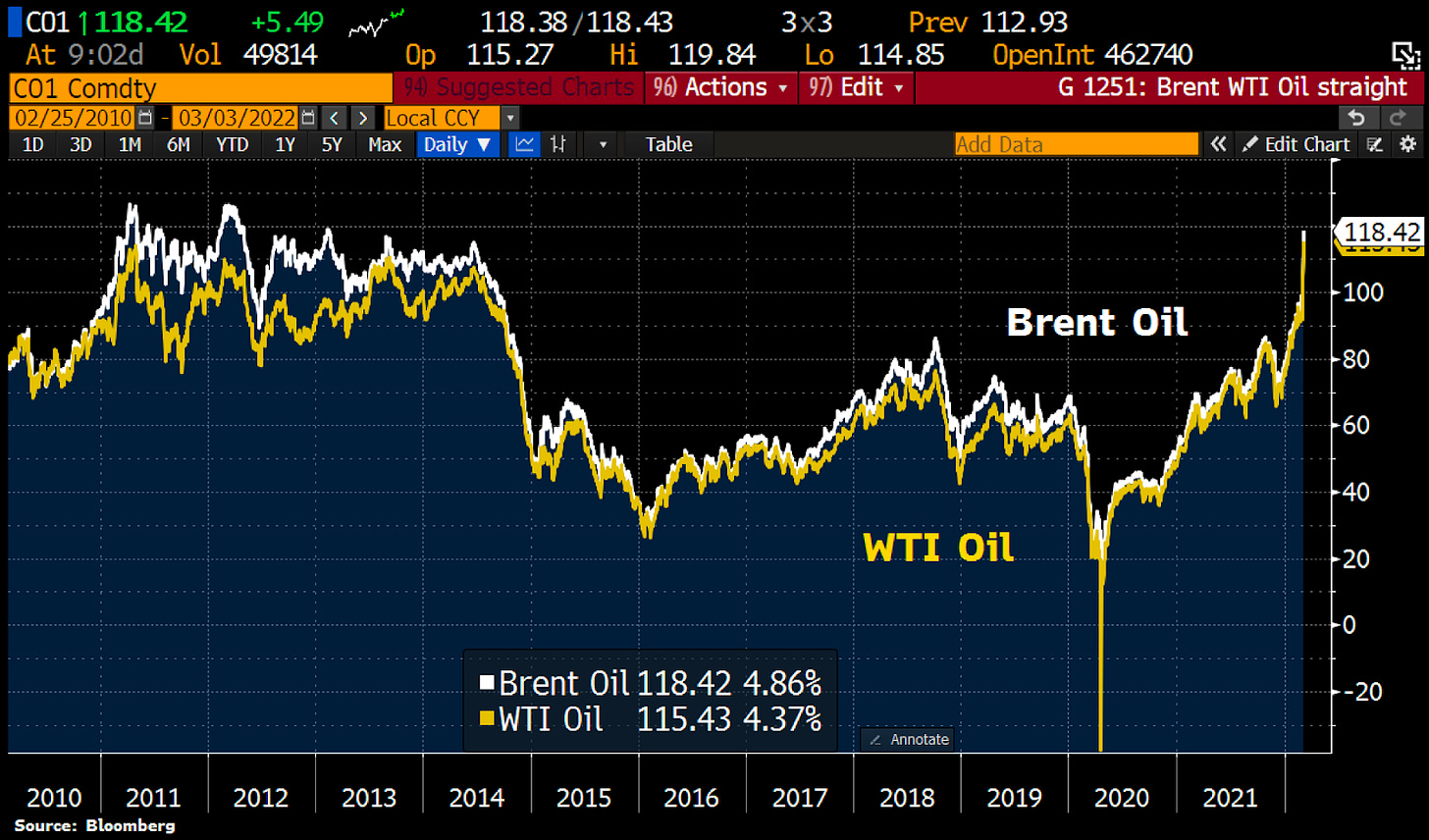

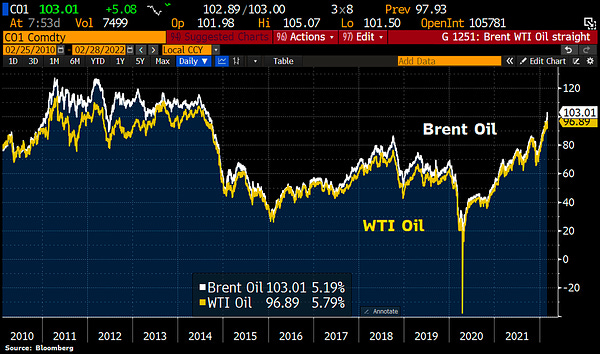

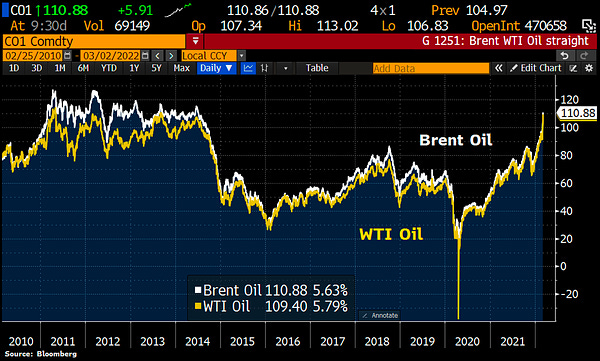

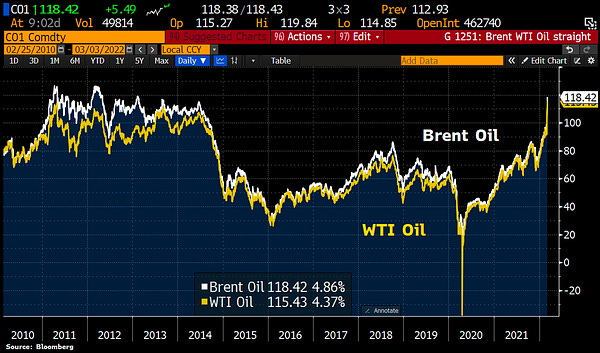

Brent oil jumps back >$100/bbl

As more and more Russian sanctions are coming the Brent oil jumped back to >$100/bbl.

As Goldman's Damien Courvalin writes, writing about the release of 60 mb of emergency oil reserves following Russia's invasion of Ukraine "we do not view this as sufficient relief, representing an only 1-month offset to a potential disruption to one-third of Russia's 6 mb/d seaborne oil export flows, for example, consistent with the rally in prices after today's announcement." As such, Goldman reiterates its view that only demand destruction - through even higher prices - is now likely the only sufficient rebalancing mechanism, with supply elasticity no longer relevant in the face of such a potential large and immediate supply shock. The global crude market is suffering what’s starting to look like the biggest disruption since the 1990-91 Gulf War. A decision by OPEC+ to continue its plan to gradually increase output on Wednesday also did little to calm investor's nerves. This price will be paid by everyone on Earth.

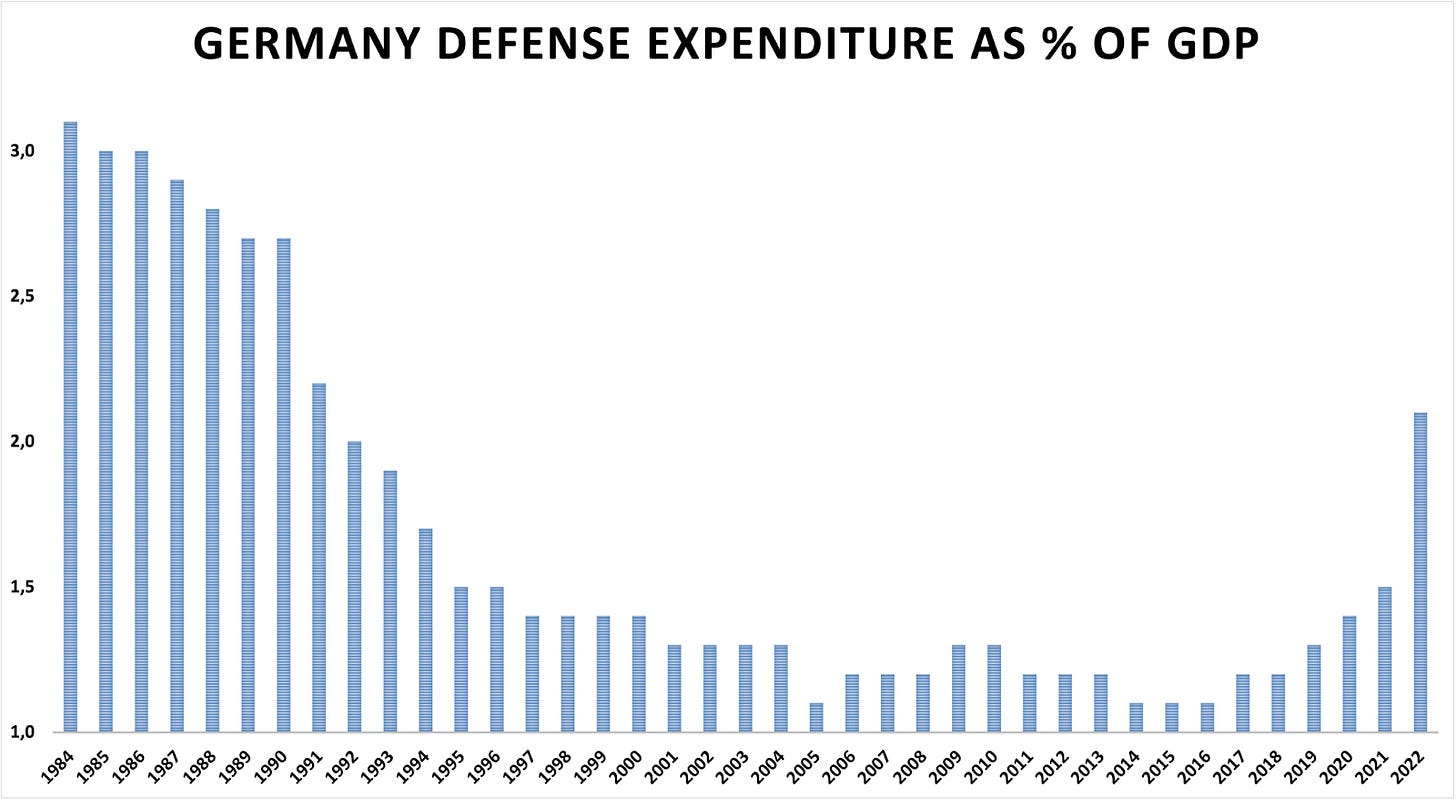

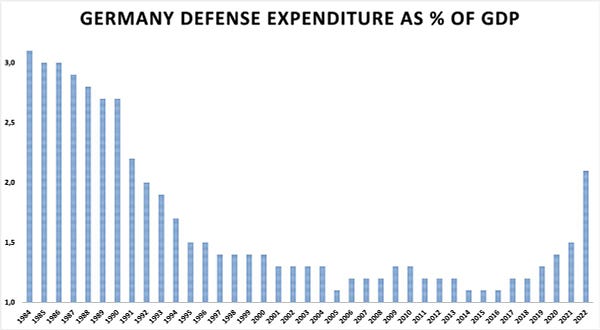

Germany changed decades-long aversion to military spending

As the Ukrainian crisis evolves, Germany will channel €100bn this year into funds to modernize the military. By 2024, the government will spend at least 2% of GDP each year on defense in line with NATO targets that Berlin consistently failed to meet.

As the German government boosted its military spending plans, Rheinmetall (German military industry giant) shares rose 48%.

MSCI says removing Russia from indexes is a "natural next step."

Russia's stock market is "uninvestable" after stringent new Western sanctions and central bank curbs on trading, making a removal of Russian listings from indexes a "natural next step", a top executive at equity index provider MSCI said on Monday.

"It would not make a lot of sense for us to continue to include Russian securities if our clients and investors cannot transact in the market," Dimitris Melas, MSCI's head of index research and chair of the Index Policy Committee, told Reuters.

“More than $920bn is in EM ETFs alone. Russia has a weighting of 2.7% in EM ETFs. In other words, ~$24.5bn would automatically flow out of Russian equities” by Holger Zschaepitz

Russia banned sending >$10,000 in foreign currency

As the Russian economy gets worse, they try to do everything they can to stop moving wealth out of the country. By doing so, they were banned from transferring >$10,000 in foreign currency. Knowing the Russian banking sector is dead, it could be only done via cash. I think at the border crossings never ever was so strict the search for money, gold as before. Don’t get fooled, if they find Gold in your pocket worth >$10K they will confiscate as it is done many times in peace time by U.S. customs too. They can’t confiscate from you the memorized 12 or 24 seed words!

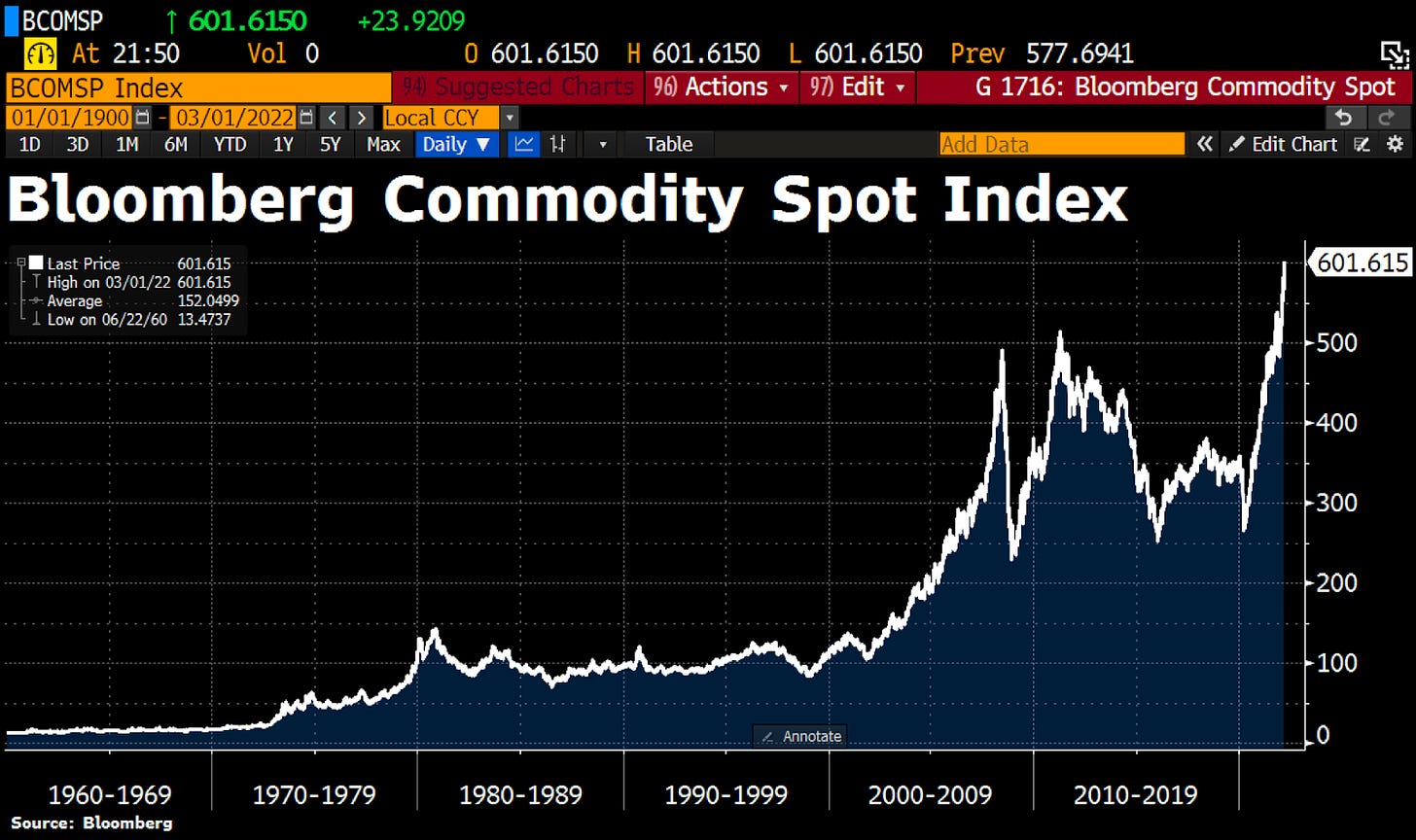

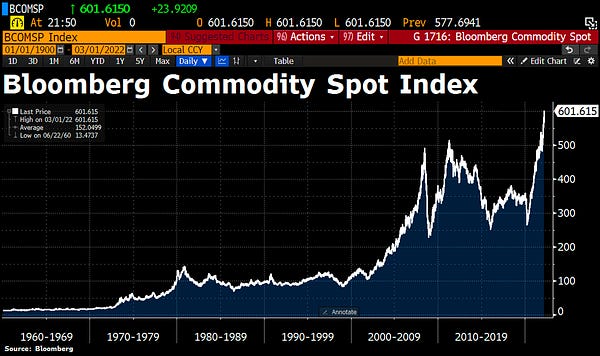

Bloomberg Commodity Index jumps to ATH

First, do you know what BCOM is? If not, here is the definition. Knowing this, the following chart shows that we are manipulating markets like never before! This intensity is mainly driven by the CB’s virtually printing like no tomorrow. We stepped into unknown territories which will sadly end badly for many of us. If you don’t want to be on the wrong side, educate yourself and your family too!

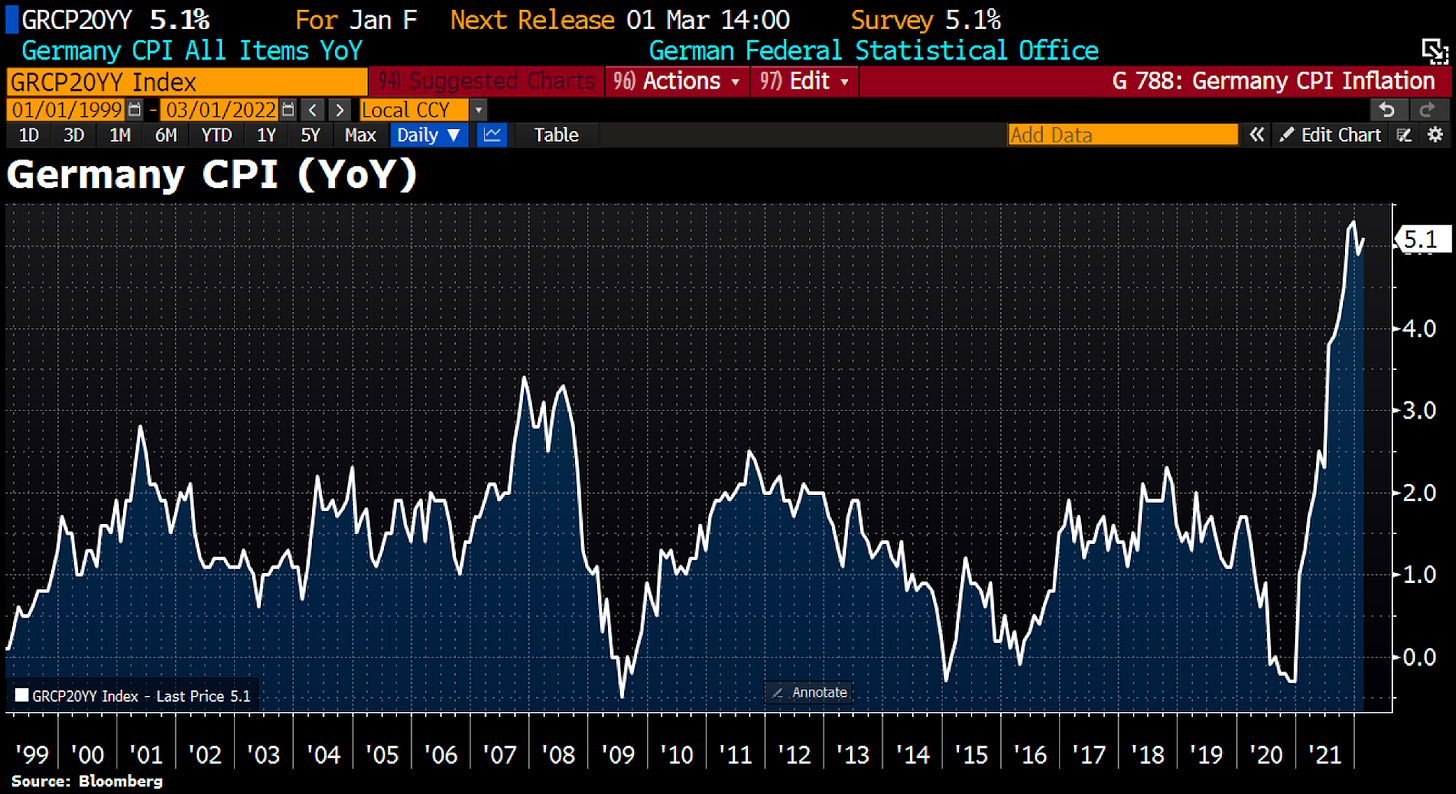

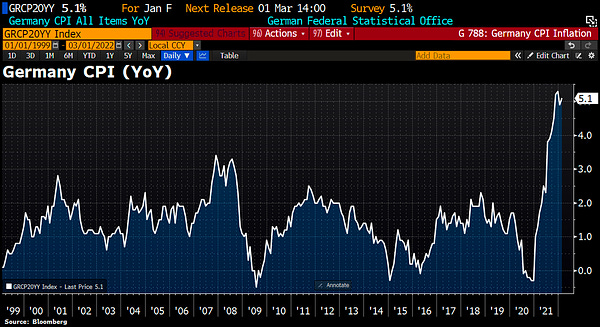

Germany's inflation accelerates to 5.1%

While Germany is spending a crazy amount of money on Military defense, their inflation jumped from January 4.9% to 5.1% in February. Don’t let yourself be fooled, these are just official numbers, the real ones are way in the two digits.

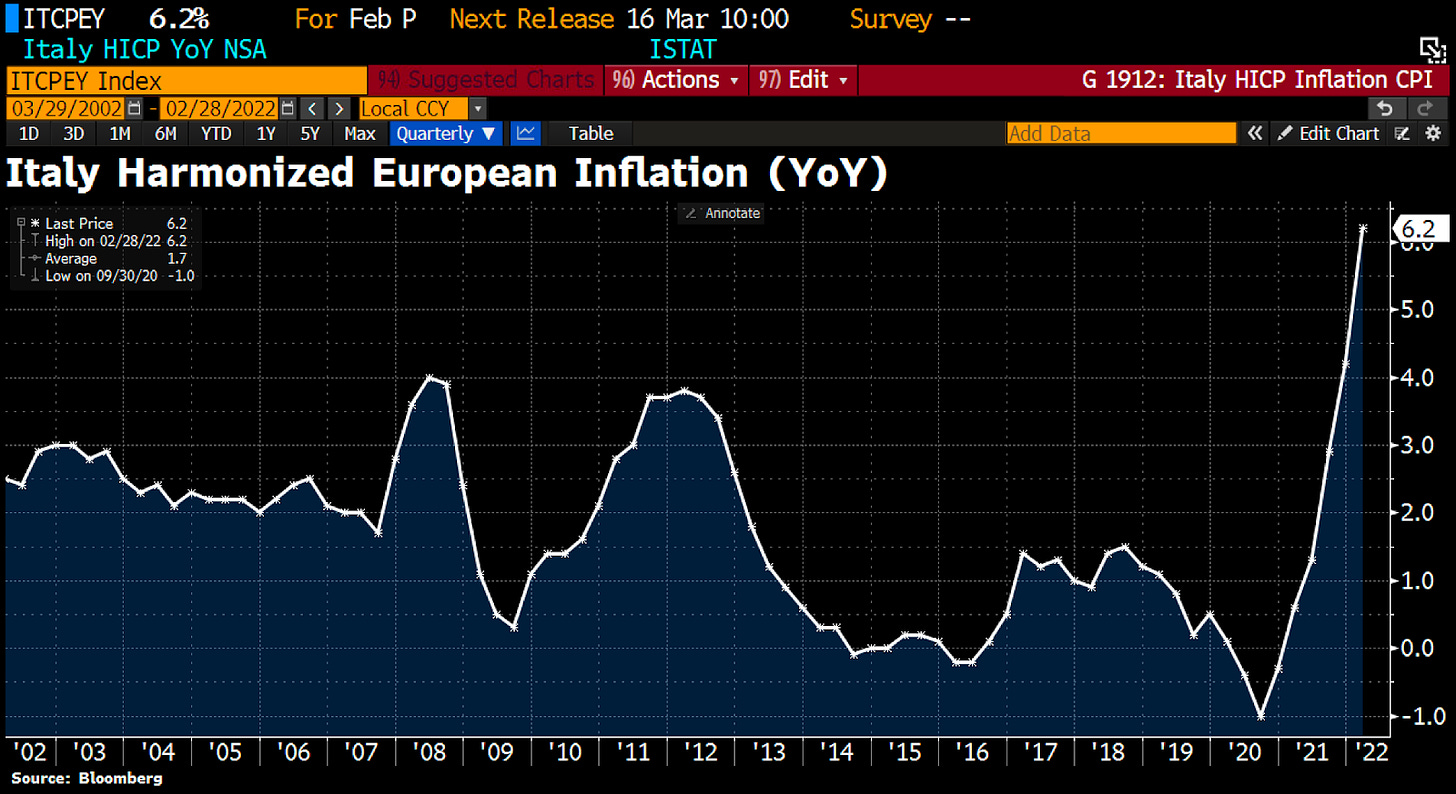

Italy’s (HICP) inflation surged to a record (again)

“Italy's (HICP) inflation surged to a record for 3rd straight month, heaping more pressure on the ECB after higher-than-expected readings from Spain & France. CPI jumped 6.2% YoY in Feb way above 5.5% expected, mainly driven by energy w/costs soaring 27.3%. (via BBG)” by Holger Zschaepitz

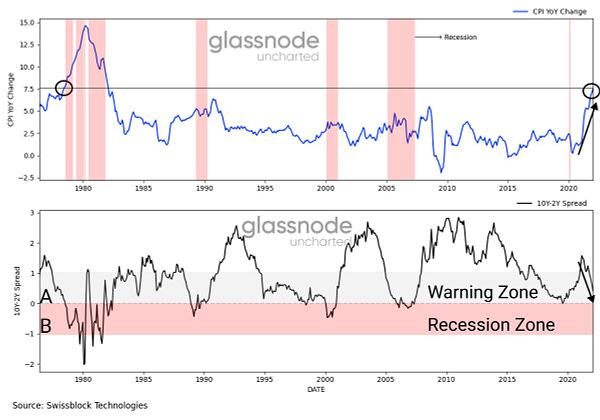

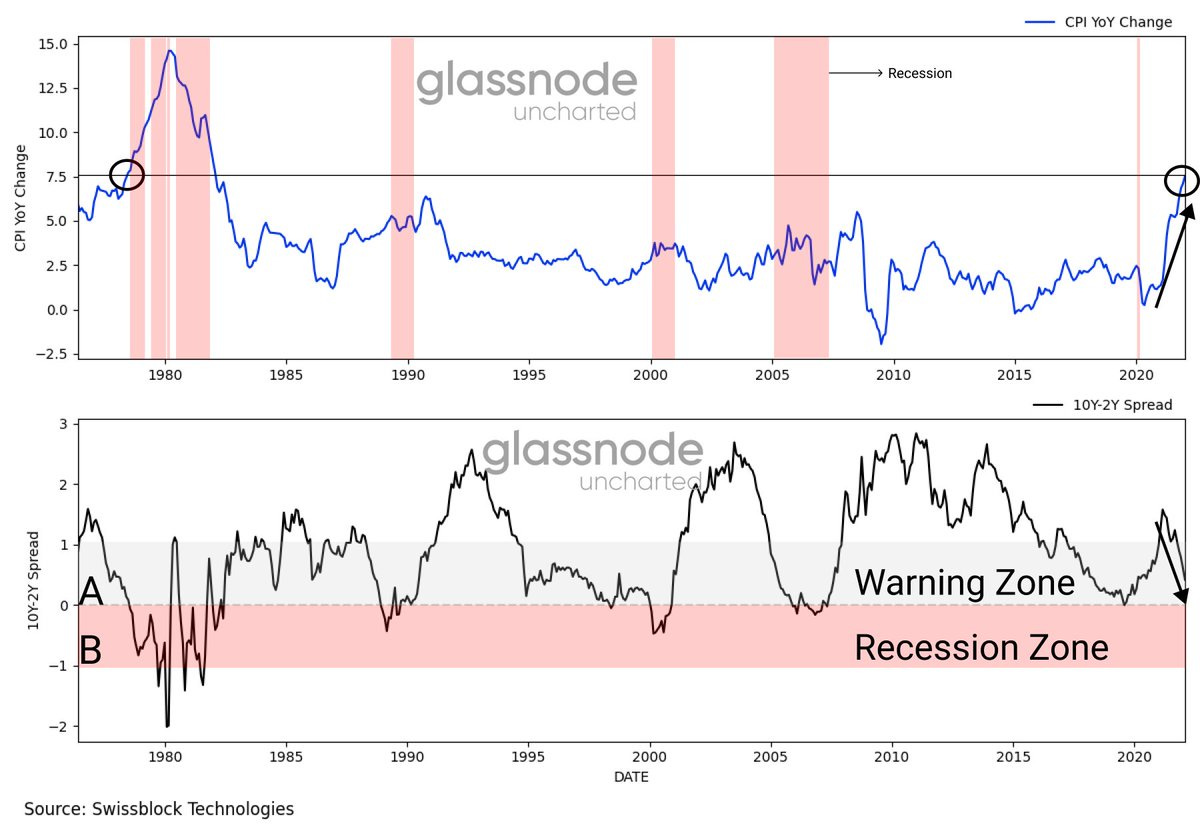

Nasdaq and 10Y-2Y are signaling a top?

“Nasdaq 100 has produced a bearish "death cross" on Wed, for the 1st time in ~2yrs. A "death cross" appears when the 50d MA, short-term trend tracker, crosses below 200d MA, longer-term trend guide. Many chart watchers view death cross as marking spot that pullback transitions to downtrend.” by Holger Zschaepitz

“Fed faces inflation while 10y-2y spreads are entering the warning zone.” by Negentropic

In Germany the financial repression intensifies

“In Germany the real yields (10y Bunds-inflation) drop to -5.2% near All-Time Low as 10y yields have turned negative again & inflation accelerated to 5.1% in Feb from 4.9% in Jan. Real yields are now NEGATIVE for 70 consecutive months.” by Holger Zschaepitz

The price of wheat jumped ~30%

Since the start of the Ukraine war the price of wheat jumped ~30% and just in these two months ~72% (YTD). What’s the connection? Russia and Ukraine are significant producers and exporters of wheat.

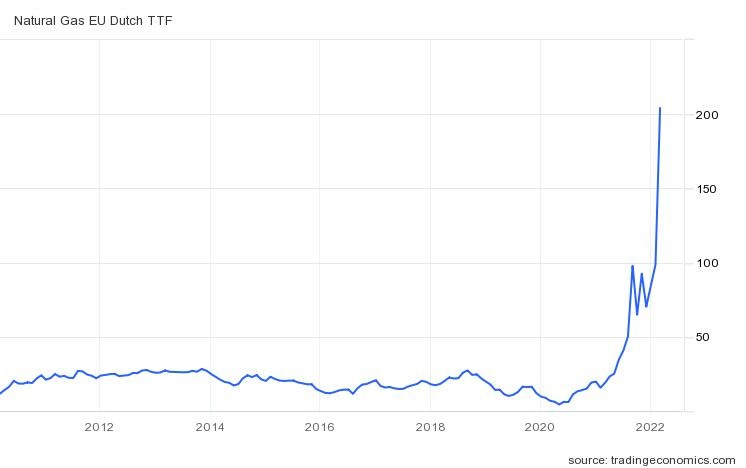

The German power price jumps another 28%

As the financial repression intensified the German power price jumped another 28% to €395/MWh. Germany is spending another €100 Billion on defense, inflation is sky high and the Russian war against Ukraine pushes their energy prices again to the roof. Maybe this time won’t stop there and it will make an ATH. Why? Because they are out of cheap options. Just week’s ago the EU voted that Natural Gas is a “green” energy source. Of course it’s “green” because with closing the last remaining 3 nuclear reactors Germany will gain their >50% energy from NatGas. But how will they pay the electricity bill price if the trend below continues?

Turkey's inflation surged to 54%

Turkey's annual inflation jumped more than expected to a two-decade high of 54.4% in February, fuelled by a crash in the lira last year and soaring commodity prices that are expected to climb higher due to Russia's invasion of Ukraine. The central bank said in January it expects inflation to peak around May, when it is seen rising to around 55%, but Russia's invasion has raised the prospect of even higher inflation. (via Reuters)

Previously countries said that bad economic winds are caused by Covid, now by the Ukraine invasion. I totally understand the political power behind it, but let’s put it bluntly, the pandemia and the recent war is just a catalyst to the already worsening economy made by virtually printing money like no tomorrow!

DAX and Stoxx Europe 600 fell to a 52 week low

The German benchmark index (DAX) and the Stoxx Europe 600 fell to a 52 week low. The Stoxx600 and the DAX (lost 17%) have a sharp contrast to the S&P 500, which have a more limited exposure to Russia & Ukraine. According to Bloomberg, this is a major shift from expectations at the beginning of the year when strategists said that European stocks would outperform the US in 2022. Investors are turning their backs on Europe as the risk of stagflation increases. This means that Europe's comeback has failed yet again.

The Credit Suisse CDS is flying

First let’s define what a CDS is: “Credit Default Swaps, popularized during the global financial crisis, are contractual agreements that allow its buyer to 'swap' credit risk with the seller. Higher spreads on a CDS indicate a growing likelihood of default”

Now let’s see what the following chart shows:

Are we on the edge of the abyss?

The DZ Bank has radically cut Germany's 2022 GDP forecast

The DZ Bank has radically cut Germany’s 2022 GDP forecast from 3 to 1.9% due to war in Ukraine and harsh sanctions against Russia. Other experts are likely to follow suit with their forecasts. Germany is threatened with stagflation.

Global equities have lost $2.9tn

“Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary shock. Economists cut their growth forecasts & raise inflation projections. Global stock mkts now worth $110tn, equal to 130% of global GDP, which looks expensive for current situation” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

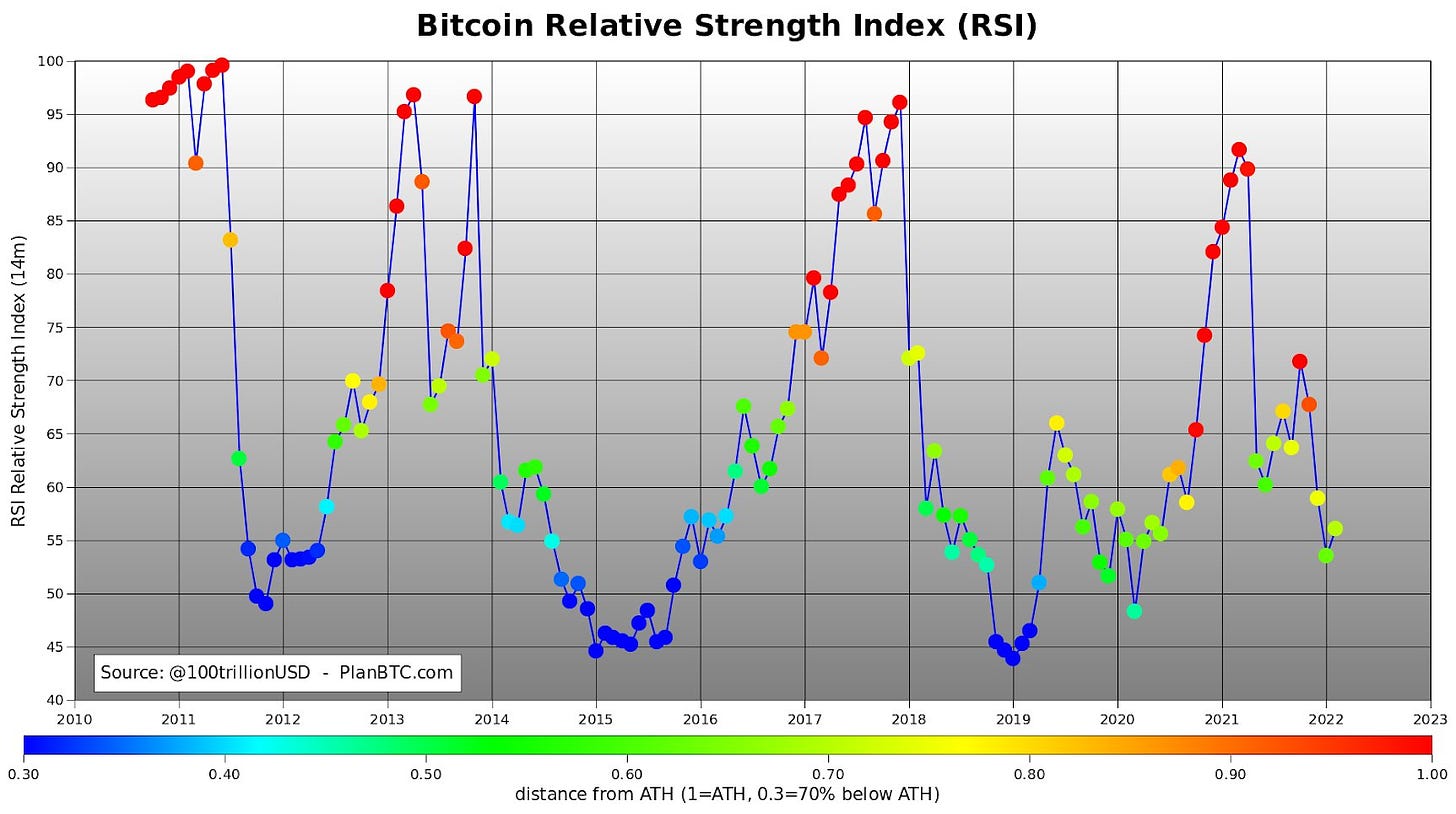

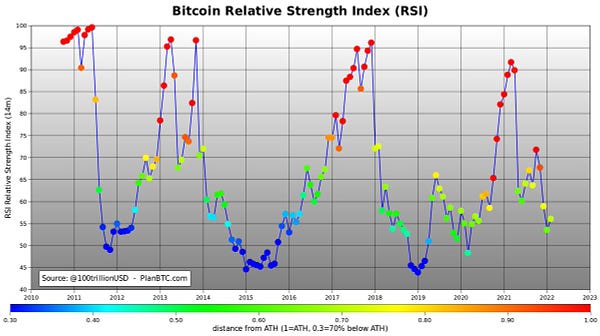

“Bitcoin 4 Hour RSI retested the breakout of the multi-week descending channel” by Matthew Hyland

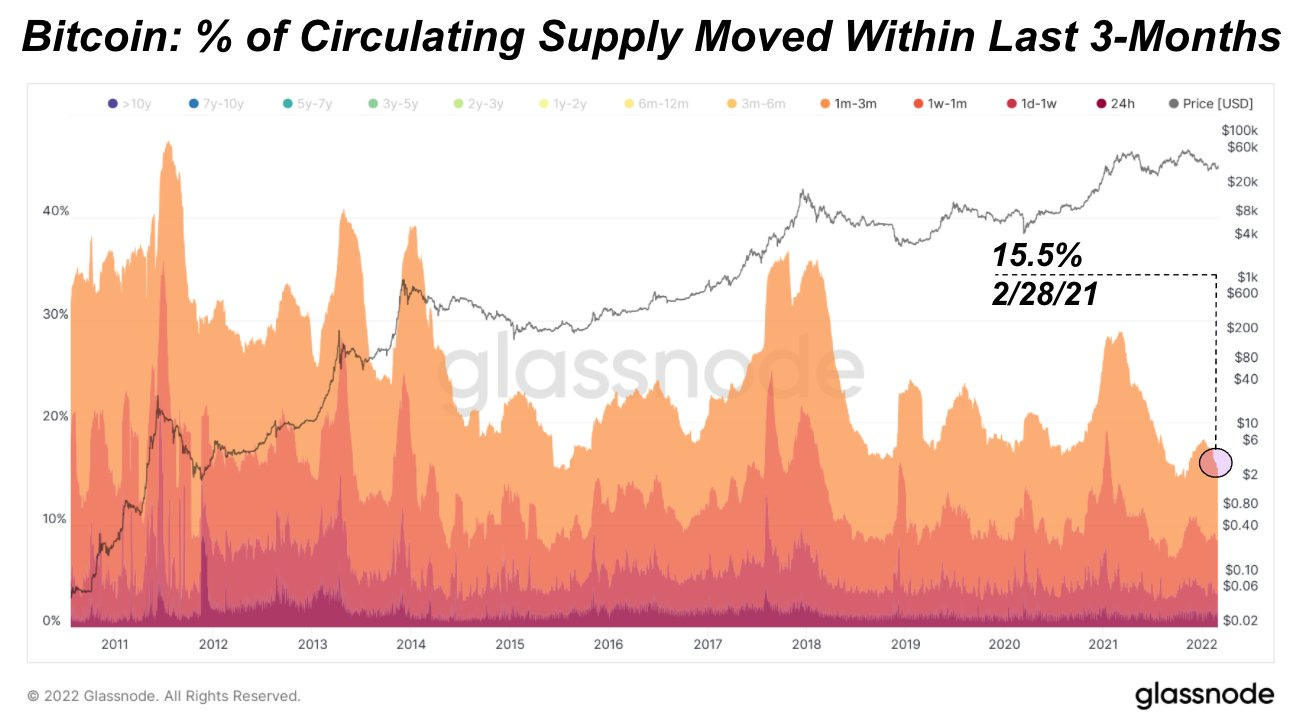

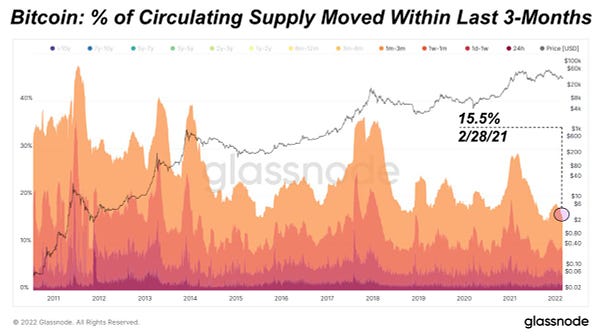

“Only 15.5% of the Bitcoin circulating supply has moved in 2022 despite rising levels of macroeconomic uncertainty. HODLers are completely unfazed. Quite astonishing when you think about it.“ by Dylan LeClair

“Bitcoin vs NASDAQ: RSI & MACD (Weekly) look very interesting right now…” by Matthew Hyland

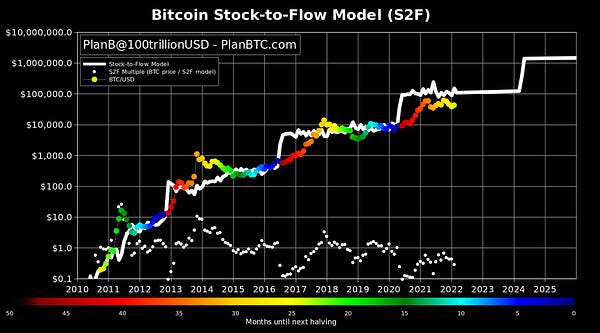

“Bitcoin February close: $43,178” by PlanB

“Bitcoin RSI 56. Up again, like 2020?” by PlanB

“Bitcoin closed the month with a BULLISH divergence” by BTCfuel

“Case for Bitcoin to form an Inverse Head and Shoulders reversal pattern. The next shoulder should be formed without falling below the support at $40k, otherwise its invalidated” by Matthew Hyland

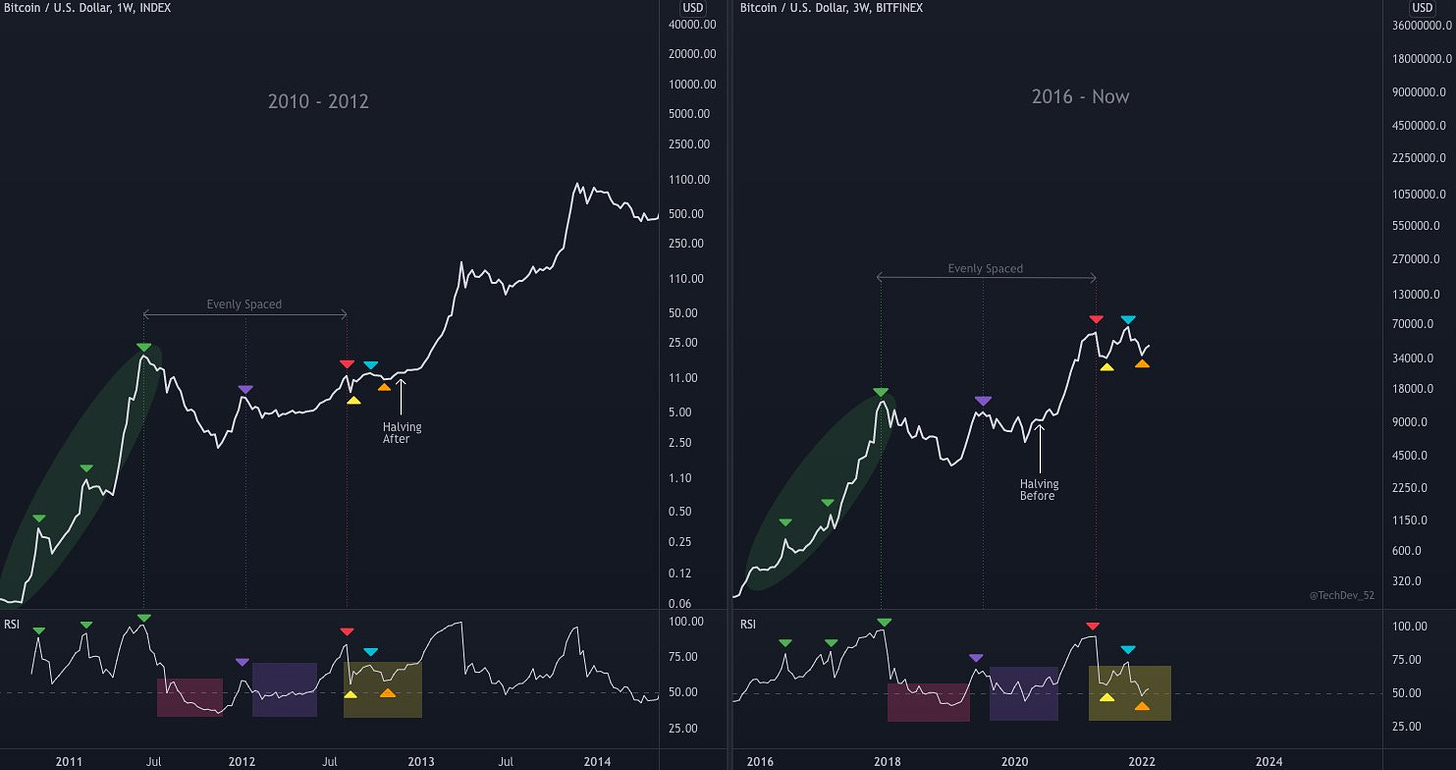

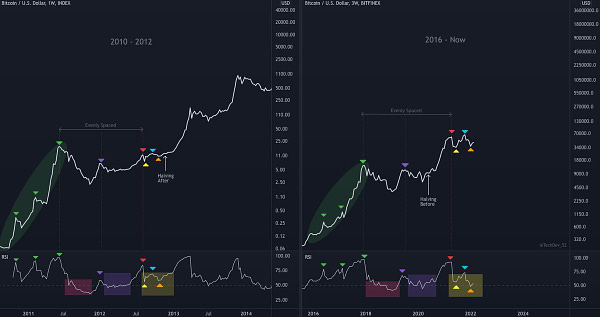

“Bitcoin 2010-2012 1W vs. 2016-Now 2W” by @TechDev_52

Bitcoin Shorts

Funny Bitcoin short stories

"The computer can be used as a tool to liberate and protect people, rather than to control them. Unlike the world today" — Hal Finney, 17 years before receiving the first Bitcoin transaction

“100 Bitcoin in 2011: Funding a personal arsenal

100 Bitcoin in 2022: Funding a national army” by @pete_rizzo_

“As banks close, ATMs run out of money, threats of personal savings being taken to pay for war, SWIFT is weaponised, the case for Bitcoin has been laid bare.” - CEO deVere Group

“Bitcoin is up about 6,000% since Warren Buffett dismissed it for the first time” by Bitcoin Magazine

Suggestions

Interesting articles, books to read

If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock

Nuclear Power, Gold As Money, And The Forced Pragmatism Of Wartime's Harsh Reality

Driving Bitcoin Donations, Ukraine-Russia Conflict Showcases Separation Of Money And State

Sources:

https://www.tomshardware.com/news/intels-second-gen-bitcoin-miners-performance-and-pricing-listed

https://bitcoinmagazine.com/business/shake-shack-is-testing-bitcoin-rewards