2022/47

12 December 2022 - 18 December 2022 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Japan’s largest power company is starting to mine Bitcoin

Hong Kong to list its first Bitcoin based ETF

Bank of International Settlements announces a new policy allowing banks to hold 2% of reserves in Bitcoin

Japan’s largest power company is starting to mine Bitcoin

The Tokyo Electric Power Company (TEPCO) Power Grid is collaborating with a local semiconductor designer and developer, TRIPLE-1, in order to mine Bitcoin using excess energy around the country.

Through its wholly-owned subsidiary Agile Energy X, TEPCO Power Grid, the company’s power transmission and distribution company, is now looking for ways to monetize excess power through Bitcoin mining.

According to the announcement, a pilot project has already been established on the grounds of TEPCO Power Grid’s office in the Tokyo metropolitan area.

“We have started experiments to confirm the system behavior and the impact on the power grid when equipment is operated with a large amount of power on the scale of 1,500 kW, and have confirmed that the equipment can operate normally.” stated by the company

Hong Kong to list its first Bitcoin based ETF

As Bitcoin witnessed a slight recovery Hong Kong opened the doors to its very first BTC exchange-traded funds [ETF].

After raising $73.6 million, these ETFs are expected to make their debut on the Hong Kong stock exchange on Friday. This would be the region’s very first Securities and Futures Commission permitted Bitcoin ETF. Each ETF will trade for HK$780 each on the Hong Kong Exchanges & Clearing.

“Coming after the recent liquidity problems affecting some of the crypto platforms, our two crypto futures ETFs demonstrate that Hong Kong remains open-minded on the development of virtual assets. (...) As the ETFs do not invest in physical bitcoin, and are traded on regulated U.S. and Hong Kong exchanges, there are more regulatory safeguards for investors compared to tokens traded on unregulated platforms.” said Yi Wang, head of quantitative investment at CSOP

Bank of International Settlements announces a new policy allowing banks to hold 2% of reserves in Bitcoin

The Bank for International Settlements (BIS) has just released its Prudential Treatment of Cryptoasset exposure report for December 2022. In it, they have unveiled a new policy that allows banks to hold 2% of their reserves in Bitcoin and shitcoins.

The policy will go into effect on the first of January 2025 and outlines various facets of how crypto assets are to be categorized and treated.

Global Economic News

TL;DR

The US YoY inflation got lower than expected but the FED still threatens markets

Germany’s debt is rising rapidly while the citizens are seeing crazy high prices in the shops

The US YoY inflation got lower than expected but the FED still threatens markets

The US inflation undershot the consensus for November, with the +7.1% YoY CPI (down from +7.7% in prior month & below +7.3% forecast). The core inflation is +6% (down from +6.3% in the prior month and below the +6.1% forecast).

“The Fed downshifts to 50bp hike. Ups key rate to 4.5%, highest since 2007. Projected rates would end next year at 5.1%, acc to their median forecast, before being cut to 4.1% in 2024 - higher level than prev indicated. Investors prior to decision bet rates would reach ~4.8% in May.” by Holger Zschaepitz, journalist at Welt

Jerome Powell, the FED chairman said: "I don't think it would qualify as a recession ... That's positive growth,", so meanwhile the FED is “fighting inflation”, the economy is showing signs that it is collapsing into a deep recession:

“Latest update from Gallup shows 70% of Americans think economic conditions are getting worse, while 24% think they’re getting better … former down from 74% in October and latter up from 20%” by Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co.

“Global recession is coming. Single most important indicator is the oil price, which has fallen despite an OPEC+ production cut in early October, the G7 price cap this month and now China COVID reopening. The fact that prices are down despite all this says demand is super weak…” by Robin Brooks, Chief Economist at IIF

Germany’s debt is rising rapidly while the citizens are seeing crazy high prices in the shops

According to BBG, Germany’s federal government plans to issue a record volume of debt next year to help fund generous aid for households & comps hit by the energy crisis. The government plans to issue ~€539bn of debt in 2023, bonds worth €274bn & €242bn to be sold on the money market.

Without reliable nat-gas suppliers the country is depleting its storages really fast. German gas storage level dropped ~6ppts to 89.2% within one week. But chances of Germany running out of gas this winter seem small, but who knows what will happen next year because with only LNG sources it is impossible to import the same amount as in previous years through the Nord Stream pipeline.

“Germany, where the price of sugar is skyrocketing. In November, the price increased by almost 50% YoY, after 42% in Oct. In September, the price increase for sugar was still 1.6%.” by Holger Zschaepitz, journalist at Welt

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Canada just banned margin/leverage trading on cryptocurrencies

The amount of BTC in long-term HODLer hands is at an all-time high. Nearly 14,000,000 BTC has not moved in over 5 months.

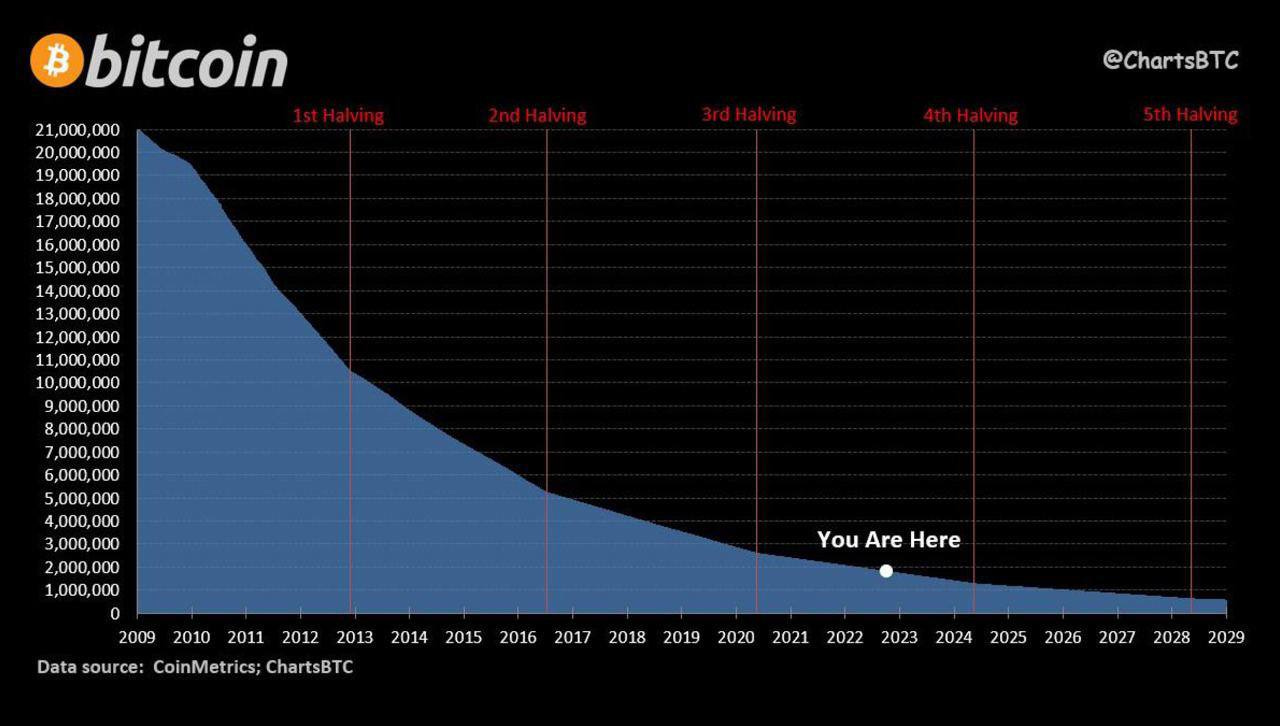

Amount of Bitcoin left to be mined.

US Senator Warren introduces bill to KYC self-custody Bitcoin wallets, surveil users and crack down on privacy tools. A direct attack on freedom and privacy.

Almost 2,000 Bitcoin are being withdrawn from Binance. EVERY SINGLE HOUR.

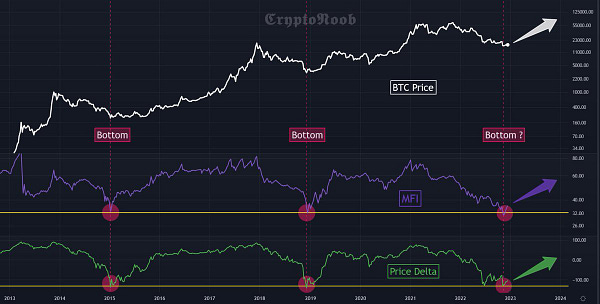

“Two years ago, on December 15, 2018, Bitcoin finished bottoming out at $3,237. No one knows when the bottom will be in for this cycle, but we are definitely close.” by @libertariman

Former U.S. Congressman: "Decentralize the money. End the Fed."

On this day (15th Dec) 12 years ago, Satoshi Nakamoto contributed their last line of code to the Bitcoin network. From that moment on, Bitcoin has had no leader.

Cryptocurrency (only Bitcoin) mass adoption will eventually lead to its use as a "means of payment". “It’s impossible to stop this”- Bank of Russia deputy governor

Suggestions

Interesting articles to read

Sources:

https://www.btctimes.com/news/japans-largest-power-company-will-mine-bitcoin-with-excess-energy

https://watcher.guru/news/hong-kong-welcomes-1st-bitcoin-etf