This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

The mysterious Bitcoin Whale already owns 143,464 Bitcoin with its daily DCA

The fewest Bitcoin on exchanges since 2018

President of El Salvador:”we are buying one Bitcoin everyday starting tomorrow"

The mysterious Bitcoin Whale already owns 143,464 Bitcoin with its daily DCA

“After making a couple of trades (sell at $21k, buy at $18k), the 3rd largest Bitcoin whale wallet BOUGHT THE DIP hard during the BTC sell-off.

4,779 BTC ($76.1M) purchased for avg cost of $15,923.

This wallet now holds 143,464 BTC, surpassing Saylor & officially largest whale.

This whale first started buying Bitcoin in 2019 and have spent $3.2B buying BTC over the years, his/her current cost basis for all 140k+ BTC is $22,624 and carries a unrealized loss of $830M as a result

This whale also trades BTC successfully from time to time for quick profit.

Note, while it's possible this is a cold wallet for exchange like Robinhood, transaction volume & pattern doesn't seem to support this, very inconsistent from other cold wallets. For one, many strategic buy the dip & sell the rally behaviors and clear long term accumulation trend.” by @venturefounder

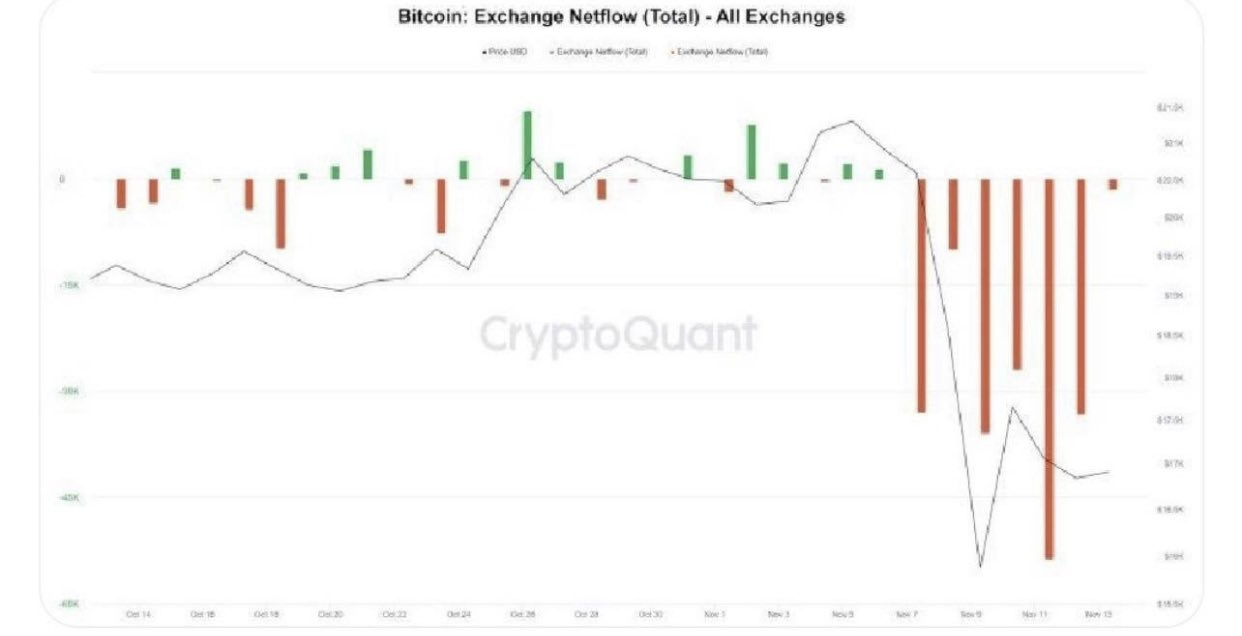

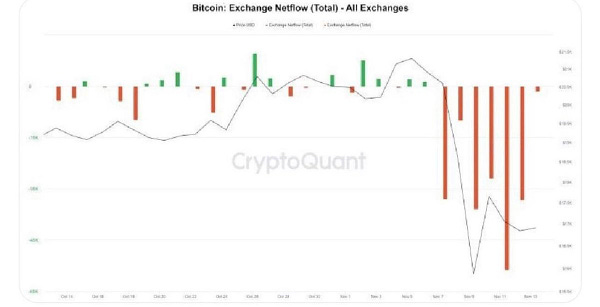

The fewest Bitcoin on exchanges since 2018

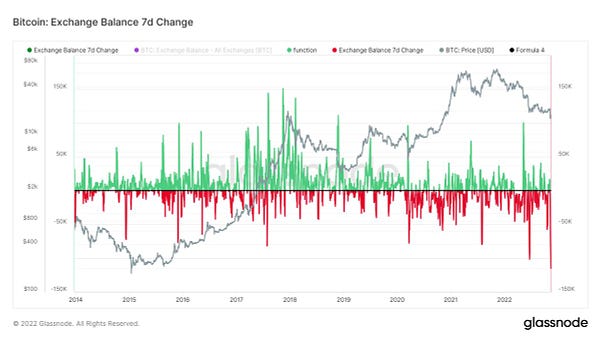

“The BTC balance on exchanges is under 2.3 million for the first time since the end of March 2018.

80.8k BTC have left exchanges over the last 4 days. People are clearly taking their BTC off exchanges to minimize counter party risk.

Short-term exchange data can fluctuate. I imagine this trend will continue as more ppl take custody of the asset and avoid trusting a 3rd party.” by

“Following the collapse of FTX, we've just experienced the largest week over week decline in Bitcoin on exchanges ever: -115,200 BTC” by Dylan LeClair, Senior Analyst at UTXO Management.

This is for a long time the best news I read. I’m working hard to convince people to custody their own coins and after all the shit is happening in the world finally pushes people towards it. I hope this positive trend will continue.

President of El Salvador:”we are buying one Bitcoin everyday starting tomorrow"

There are people who know that with this recent price dip nothing changed in the Bitcoin fundamentals. Still the world's scarcest digital asset, so El Salvador was looking to expand its holdings.

El Salvador currently has 2,381 BTC Bitcoin in its treasury, which is worth more than $39 million. In a recent tweet, El Salvador’s President Nayib Bukele announced that the government would start purchasing one BTC every day.

If you DCA (dollar-cost averaging) buy into Bitcoin in a bear market, it's one of the best solutions to buy at low prices. I even proved this in my own Bitcoin classes that if you invest just 5% of your income every month how huge it means at the end of the chosen period!

Global Economic News

TL;DR

The German economy and housing markets in recession

The US Tech layoff tide is barely started

The US Household debt is climbing steeply while buying conditions for Houses are at lowest in history

The German economy and housing markets in recession

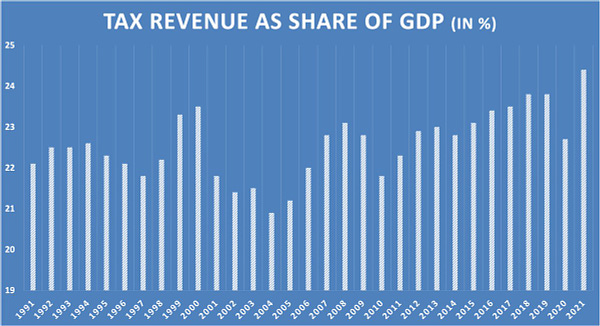

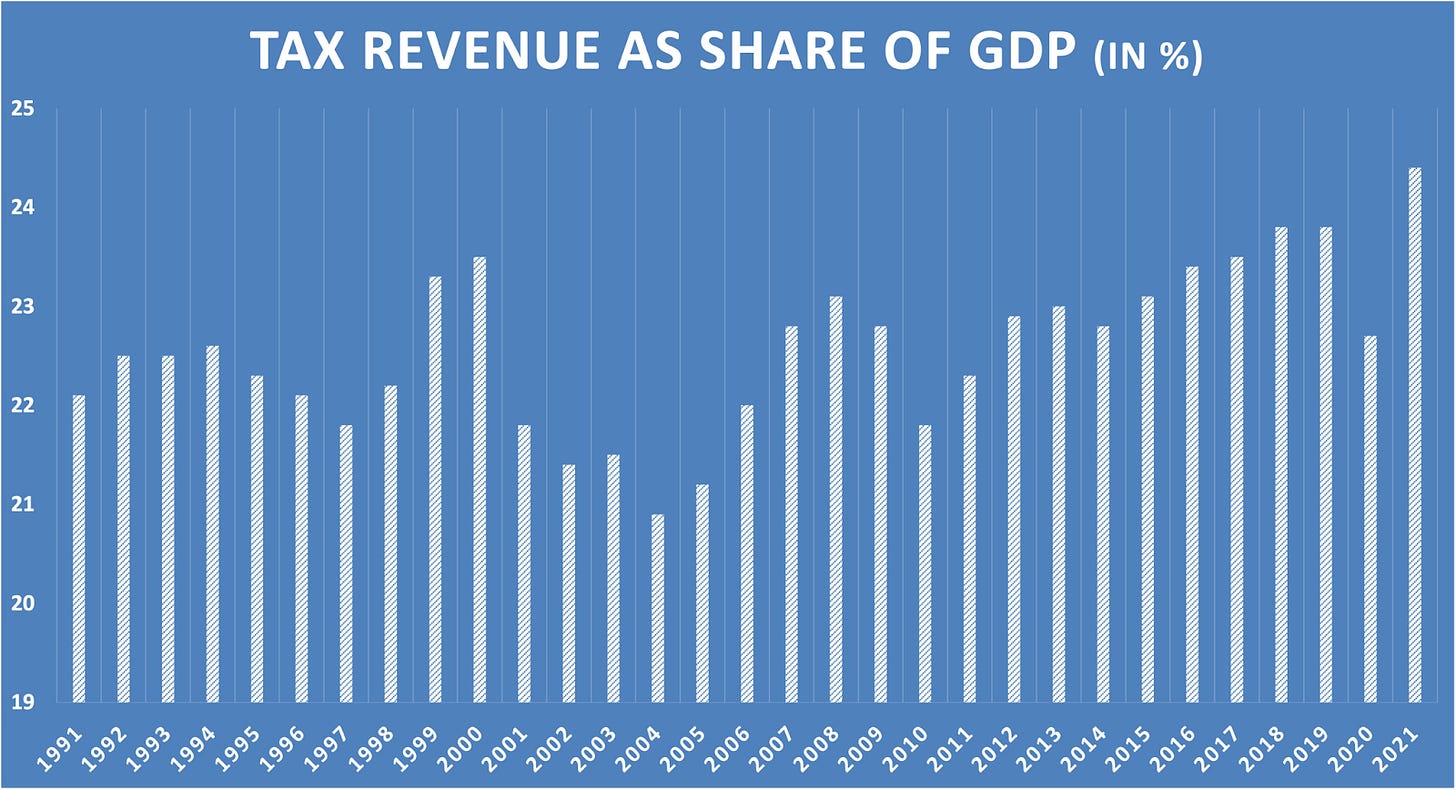

The TAX ratio against the GDP is the sign that shows clearly that the German economy is already starting to fail. The quarter of the GDP is from the people's taxes.

“The tax quota has reached a fresh ATH. Tax revenues as % of GDP have risen to 24.4% in 2021, higher than ever before. The tax and duty ratio, which also includes social security contributions, rose to 42.2%, a fresh record as well.” by Holger Zschaepitz, journalist at Welt

“Mind the gap: Even after housing prices in Germany have now fallen for several mths, the gap w/rents is still striking. In other words, the return on German real estate is still ridiculously low, especially since rising financing costs have further reduced attractiveness.” by Holger Zschaepitz, journalist at Welt

“German rents are already lower than current mortgage rates, but the new real estate climate neutrality laws with mandatory refurbishment investments make real estate investing even further uneconomic. One must be nuts to invest in housing in Germany at the moment.” by Michael A. Arouet

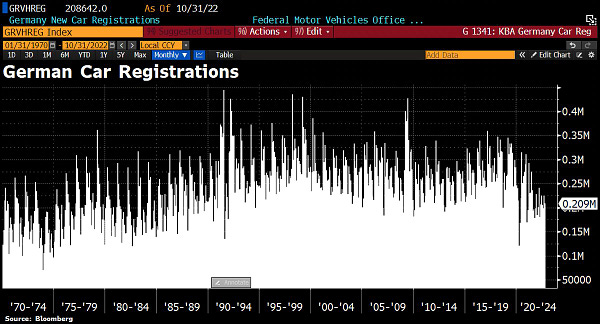

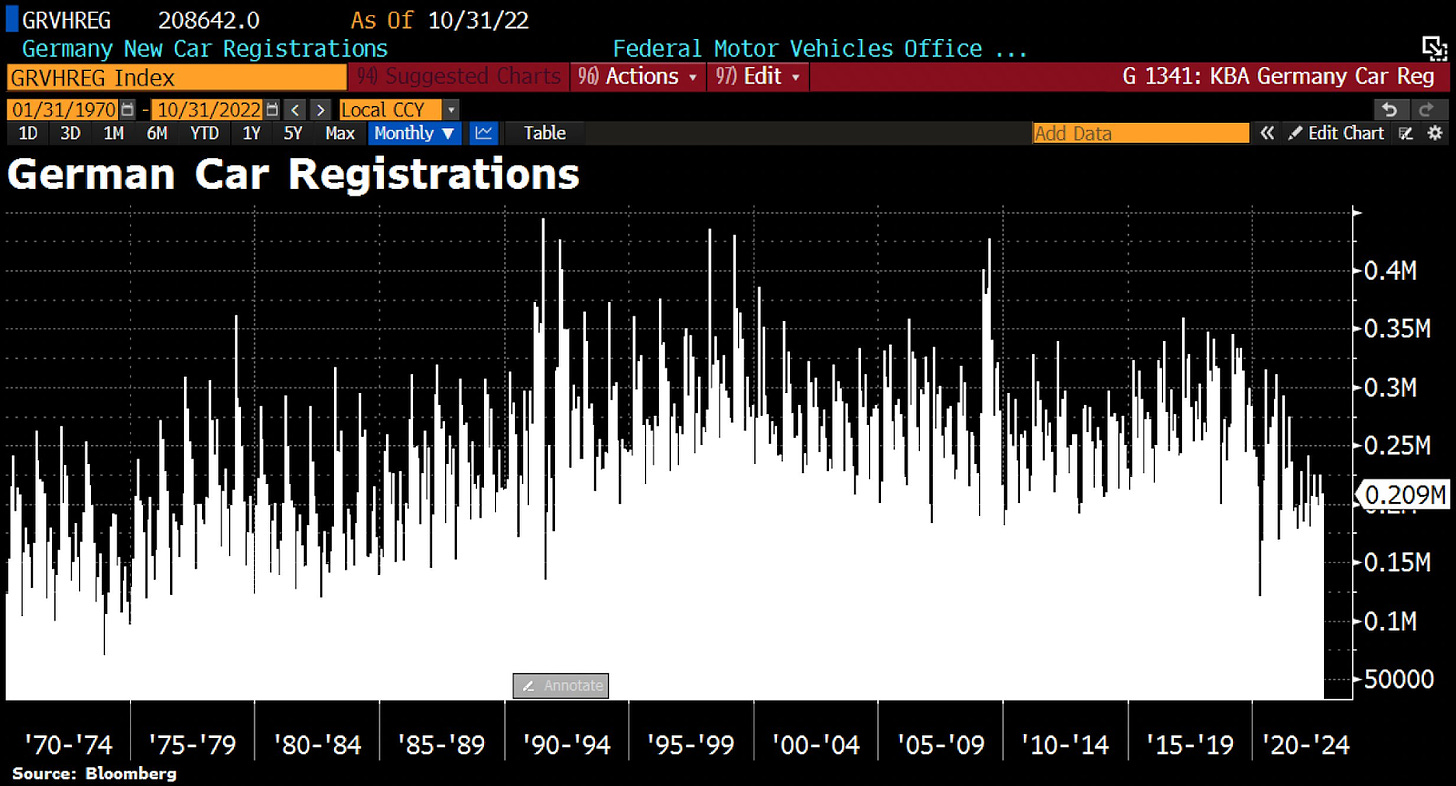

“New passenger car registrations jumped 16.8% YoY in Oct to 208,642 units. However, this also means that the number of cars sold is only at the level of the 1980s.” by Holger Zschaepitz, journalist at Welt

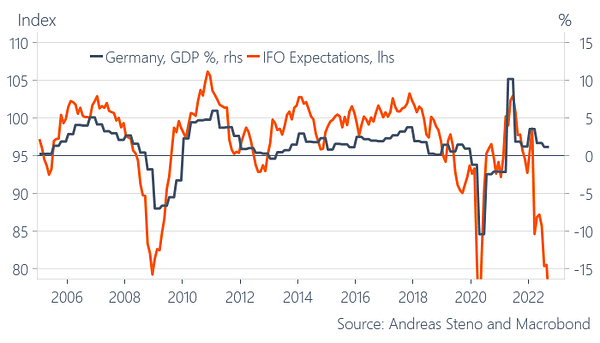

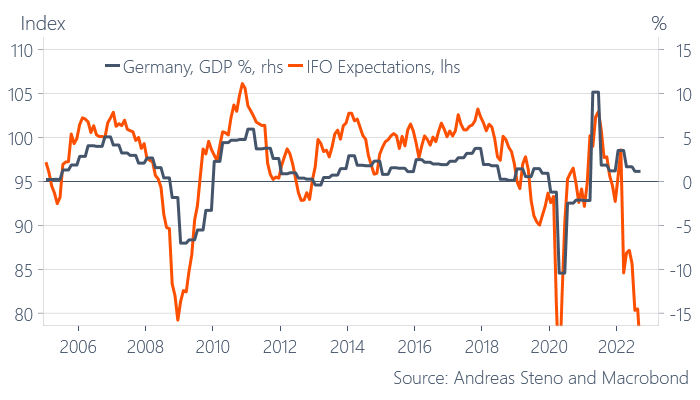

“Either we are in a bubble of NEGATIVE expectations or else the German economy will fall apart this Winter…” by Andreas Steno Larsen, CEO at Steno Research

The US Tech layoff tide is barely started

“Tech Layoff

Meta - 11k (13%)

Twitter - 3.7k (50%)

Intel - 20%

Snap - 20%

Netflix - 450

Robinhood - 30%

Stripe, Lyft - 13%

Salesforce - 2k

Amazon - 10k

120k+ layoffs. 2000-01 dot com layoffs were ~107k. Q4 layoffs have just begun.

A brutally cold tech winter is coming.” by Deedy, Founding engineer at Glean

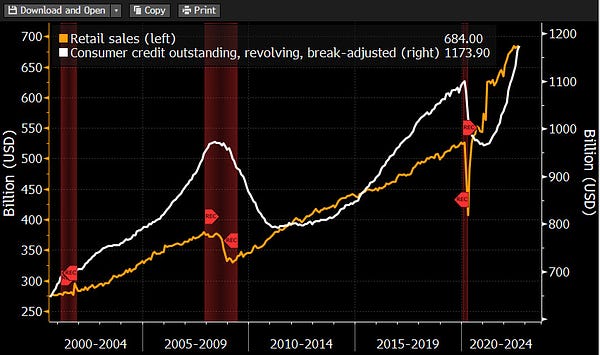

The US Household debt is climbing steeply while buying conditions for Houses are at lowest in history

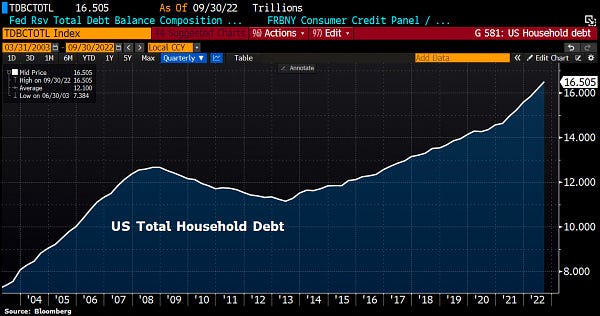

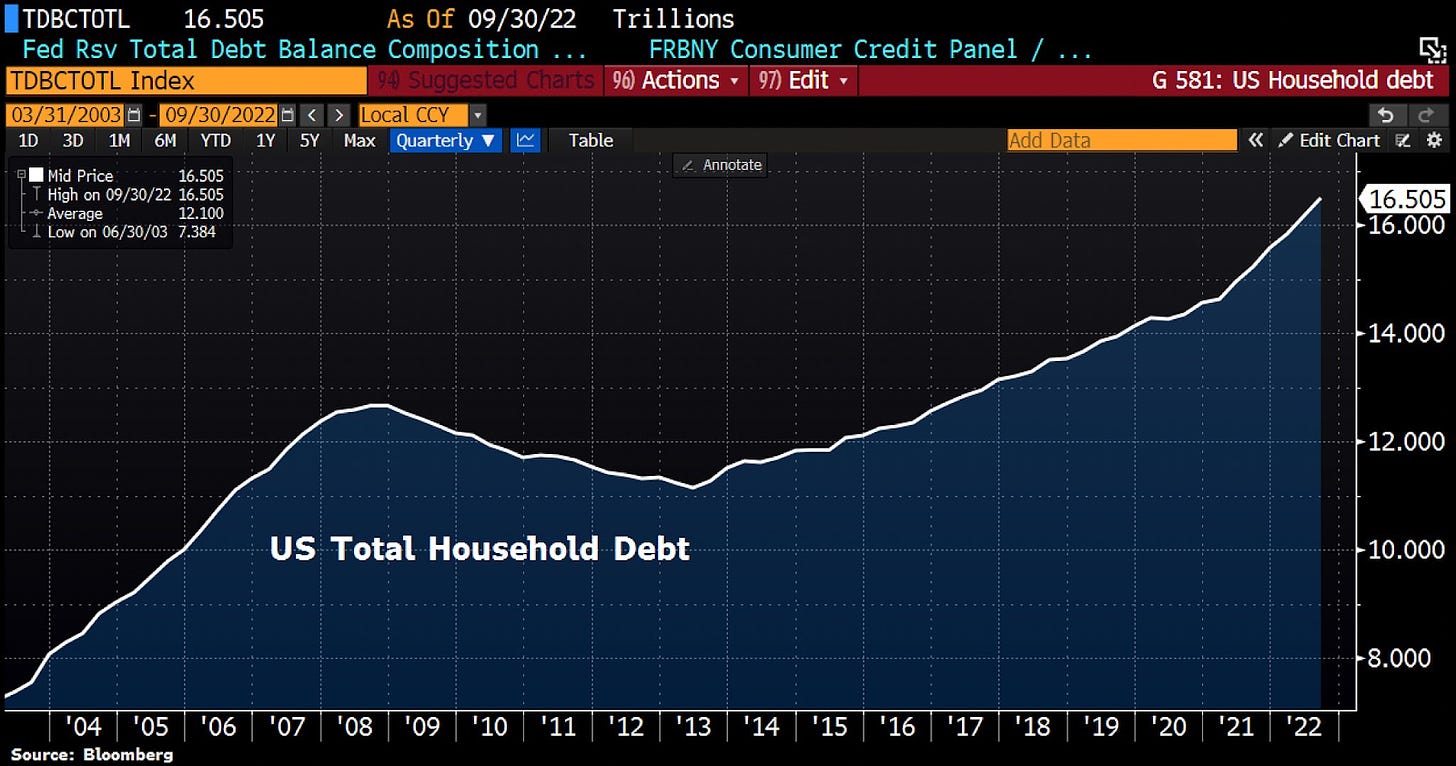

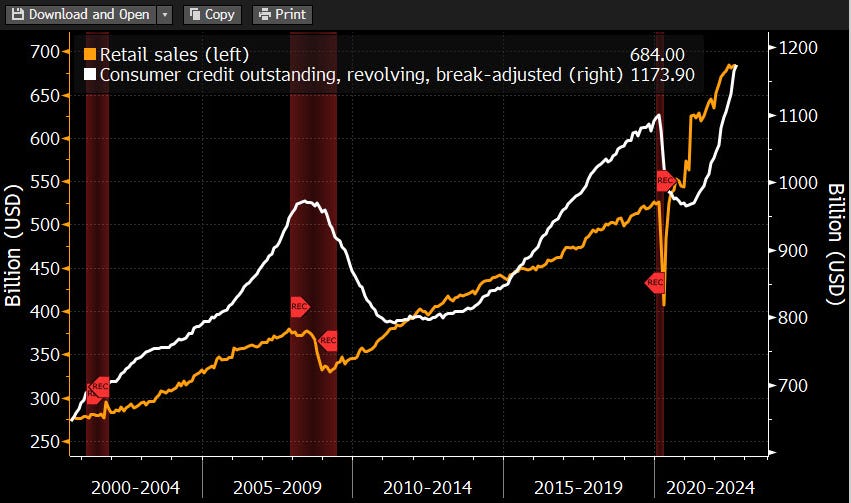

According to BBG, “the US household debt climbed at the fastest annual pace since 2008 in Q3 w/credit-card balances surging even as interest rates hit multi-decade high. Households added $351bn in overall debt, taking the total to $16.5tn. Most of the latest increase came in mortgage debt.” by Holger Zschaepitz, journalist at Welt

“Consumers are borrowing an increasing amount of money to fuel purchases as their incomes fail to keep up with inflation. “ by Lisa Abramowicz (BBG)

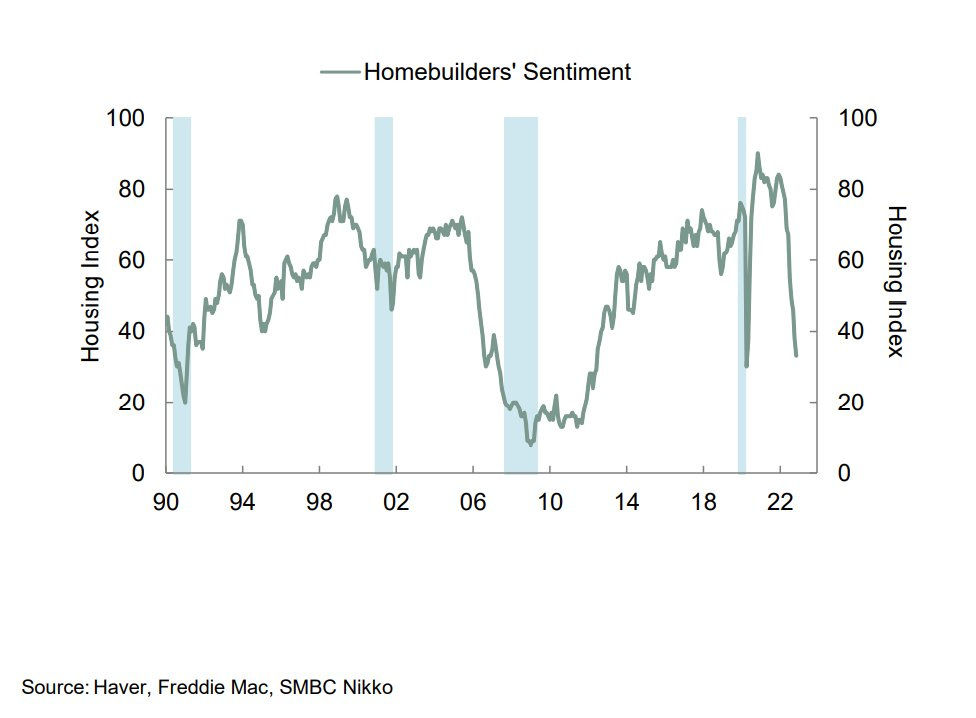

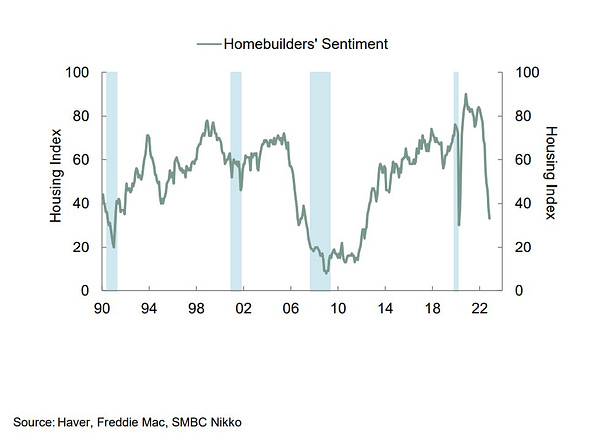

“Buying conditions for houses declined to the lowest in history… Everything is fine …” by Wall Street Silver

"The epic surge in mortgage rates has led to a collapse in NAHB home builders' sentiment...Since the Fed began raising rates in March-2022, NAHB is down a stunning 46 points. This is the largest eight-month decline in the history of the data:" Joseph A. LaVorgna, Former Chief Economist of The White House National Economic Council

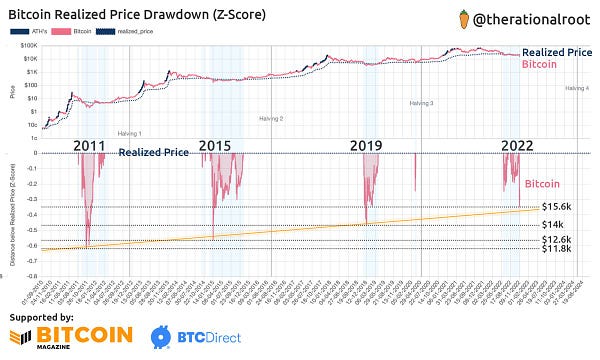

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

When you hear “no one is using Lightning Network” (in the deepest bear market):

“The last 24 hours of LNBIG:

Amount transactions: 32779

The sum of transfered BTC: 12.2864738

Last 24 hours fee earning: 20254 sat (0.00020254 BTC)” by LNBIG

This is one of the biggest node operator, but even this sum is just a portion of the whole LN.

Bitcoin on Lightning⚡️ is the future of Digital Money. (video)

Home heating with mining Bitcoin (video)

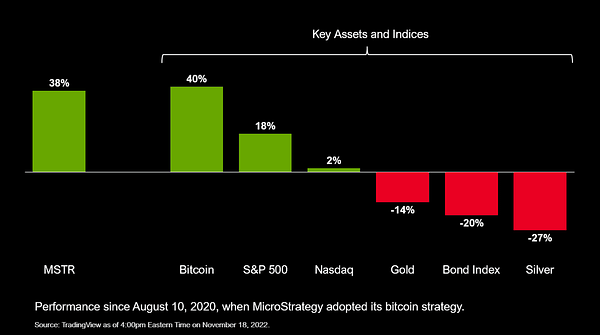

“For those keeping score, Bitcoin is still winning.” by Michael Saylor

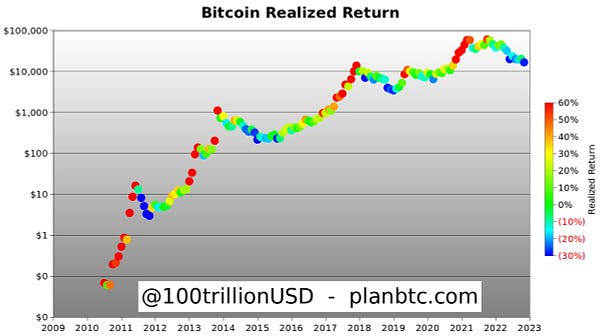

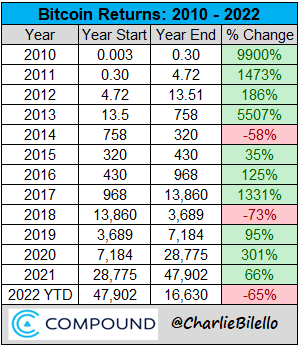

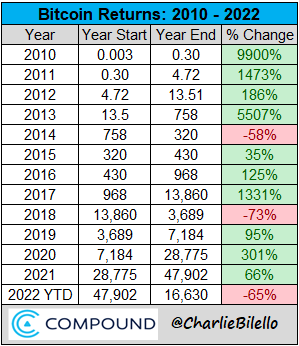

“Bitcoin Returns since 2010…” by Charlie Bilello, Founder and CEO of Compound Capital Advisors

Suggestions

Interesting articles to read

How World Economic Forum, others are hiding their past ties with FTX

WEF's Klaus Schwab Gives Speech To G20 On The "Need To Restructure The World"

Banking giants and New York Fed start 12-week digital dollar pilot

The US Accounts For Nearly Half Of Global Diabetes Drug Sales

Not So Fast Elon: Europe Warns Musk He Must Hire Hundreds Of Moderators To Limit Free Speech

Sources: