This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

U.S. Department of Justice seized $3.36 Billion worth of Bitcoin

Japanese Bank set to launch Bitcoin Trading in 2023

Shell to launch a Bitcoin mining initiative at Miami 2023 conference

U.S. Department of Justice seized $3.36 Billion worth of Bitcoin

According to a press release, the U.S. Department of Justice has confiscated approximately $3.36 billion in Bitcoin associated with the Silk Road that has been missing since 2012.

Property developer James Zhong, who stole 51,680.32473733 BTC from Silk Road, has admitted to committing wire fraud in order to obtain Bitcoin from the dark web marketplace.

U.S. Attorney Damian Williams explains that “for almost ten years, the whereabouts of this massive chunk of missing Bitcoin had ballooned into an over $3.3 billion mystery.”

Williams said that tracking down Zhong was due to state-of-the-art cryptocurrency tracing along with “good old-fashioned police work.” He warns that “this case shows that we won’t stop following the money, no matter how expertly hidden, even to a circuit board in the bottom of a popcorn tin.” (whole story here.)

Japanese Bank set to launch Bitcoin Trading in 2023

According to a report from Blockworks, Laser Digital, the recently established Bitcoin and shitcoin division of Nomura, Japan’s largest brokerage and investment bank, aims to increase its staff in order to expand its range of services. A Bitcoin trading platform for institutional clients is expected to go live in 2023.

Over the next three months the subsidiary plans to hire an additional 55 people, a 45% increase in its staff. The company plans to offer a variety of Bitcoin and other shitcoin services along with opportunities for venture capitalist investing in the sector.

The goal of Laser Digital is to increase employment levels in its Swiss headquarters initially, then open further facilities in Dubai and London. After increasing its global workforce numbers, the company will set plans for a location in Japan.

Shell to launch a Bitcoin mining initiative at Miami 2023 conference

One of the largest oil and gas companies in the world, Shell, aims to offer its lubricant and cooling solutions to Bitcoin (BTC) miners.

The giant will sponsor the 2023 and 2024 Bitcoin Conferences, as it signed a two-year partnership with Bitcoin Magazine, the event's organizer.

As per the announcement, the conferences will be attended by Shell representatives who are set to speak on the mining stage about improving the energy costs of bitcoin mining with Shell’s lubricant and cooling solutions.

Darin Gonzalez, US immersion cooling lead at Shell Lubricants, said that this company aims to provide carbon reduction alternatives to its customers, adding that “one of the most important benefits of immersion cooling fluid is sustainability and renewable energy.”

Global Economic News

TL;DR

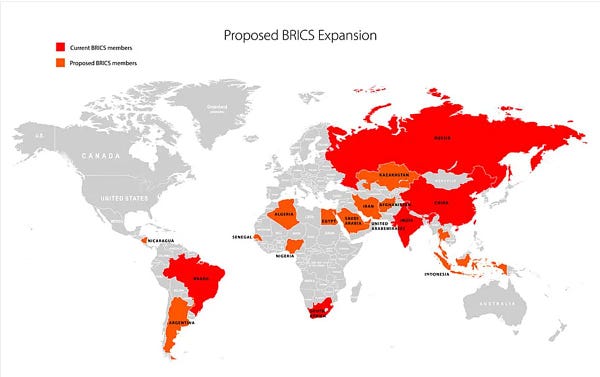

The BRICS is heavily expanding

While Germany’s economy is declining people are suffering from increasing taxes

Are the US markets overhyped?

The BRICS is heavily expanding

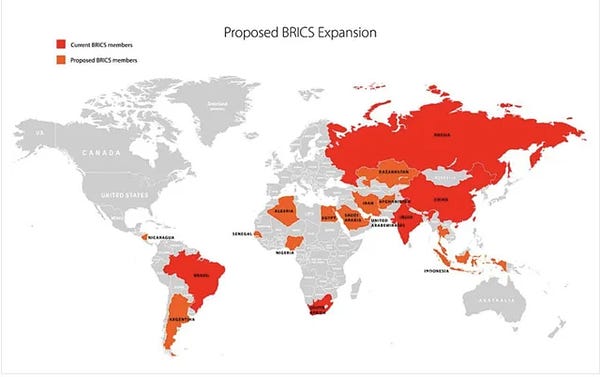

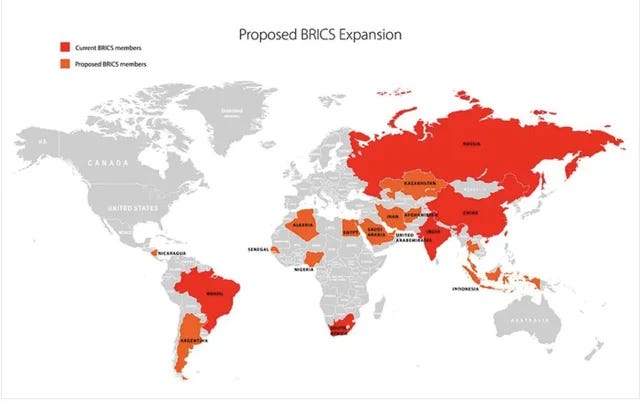

“Algeria formally applied to join BRICS. Algeria is Europe’s largest provider of natural gas after Russia and Norway. Algeria has the 11th largest gas reserves in the world.

BRICS is turning into the world's source for commodities. If they can figure out a BRICS currency…

Russia announces 12 more countries want to join BRICS. If all are accepted BRICS will have 50% of the world population… and an even larger share of commodities such as oil, gas, metals, etc...” by Wall Street Silver

“The end of US hegemony and the US dollar as the world's reserve currency is near. The next expansion of BRICS+ will have a GDP 30% larger than the US, over 50% of the global population and 60% of oil and gas reserves. Multipolar is inevitable. “ by Kim Dotcom

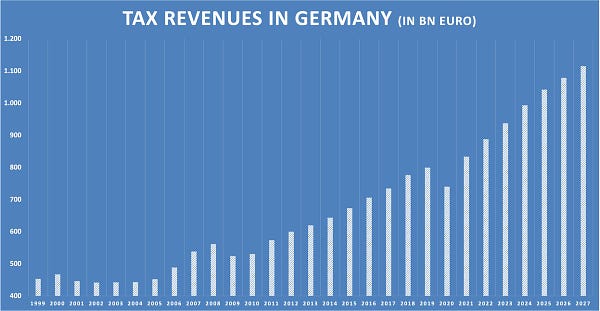

While Germany’s economy is declining people are suffering from increasing taxes

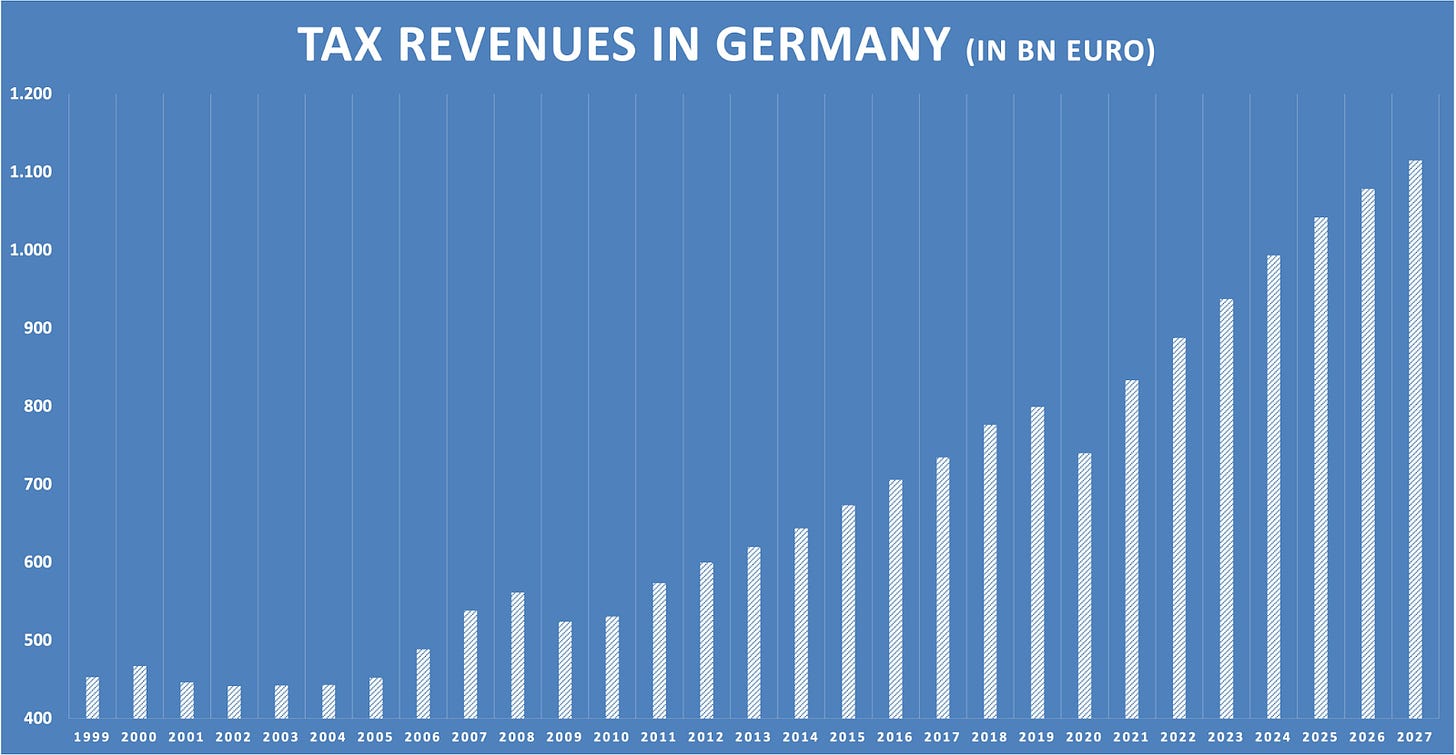

According to Reuters, Germany's economic advisory council will recommend that the government raise taxes on the wealthy to help finance multi-billion Euro relief packages it has agreed to fight the energy crisis. Tax revenues could jump >€1tn as early as 2025. Would be a doubling within 20yrs.

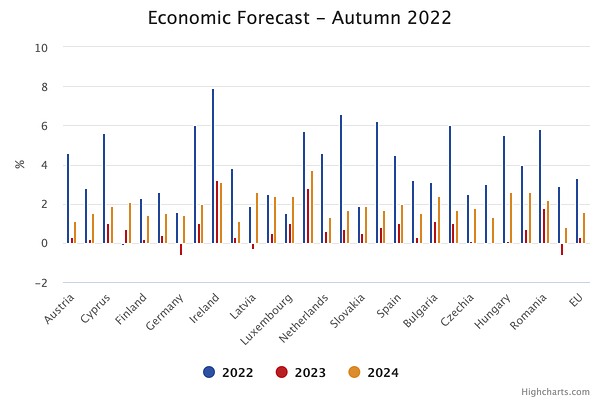

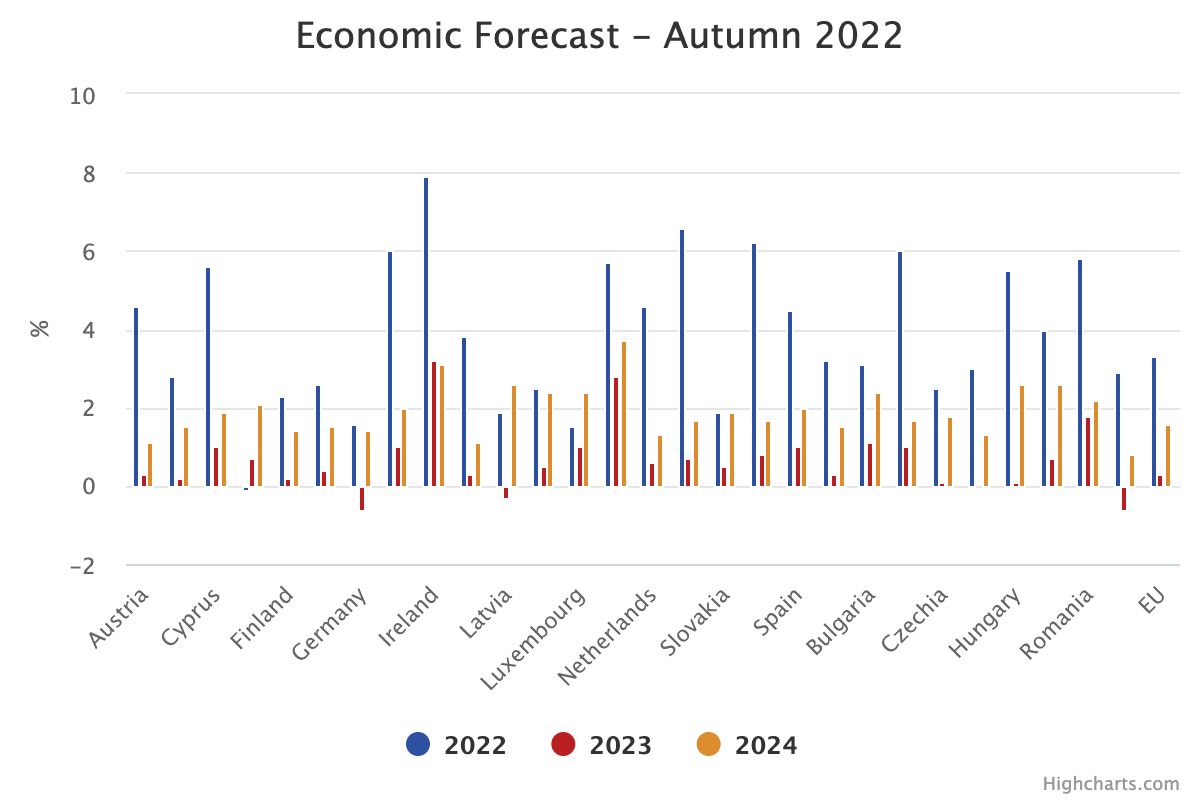

“Looks like Germany is the new sick man in Europe again. EU cuts 2023 Eurozone GDP outlook to +0.3% from +1.4%. Sees Germany's GDP shrinking by 0.6% in 2023, most in Eurozone.” by Holger Zschaepitz, journalist at Welt

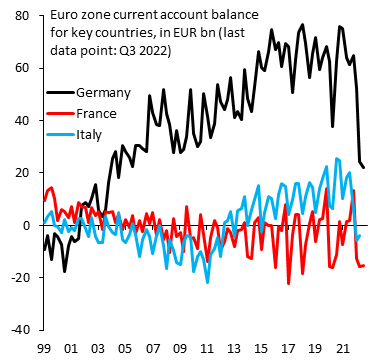

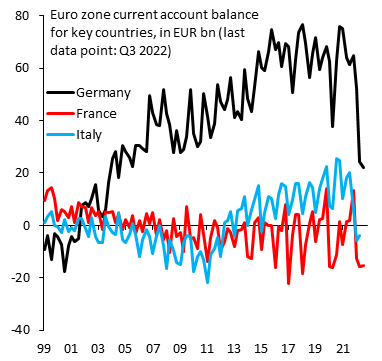

“Germany's current account surplus is down to a third of its pre-war level (black). France is back in deficit after being roughly in balance (red) and Italy is heading for a large deficit also (blue). The new normal for the Euro zone: less export competitiveness and less growth…” by Robin Brooks, Chief Economist at IIF

Are the US markets overhyped?

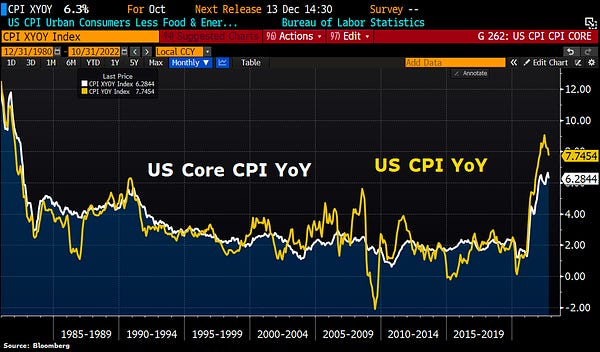

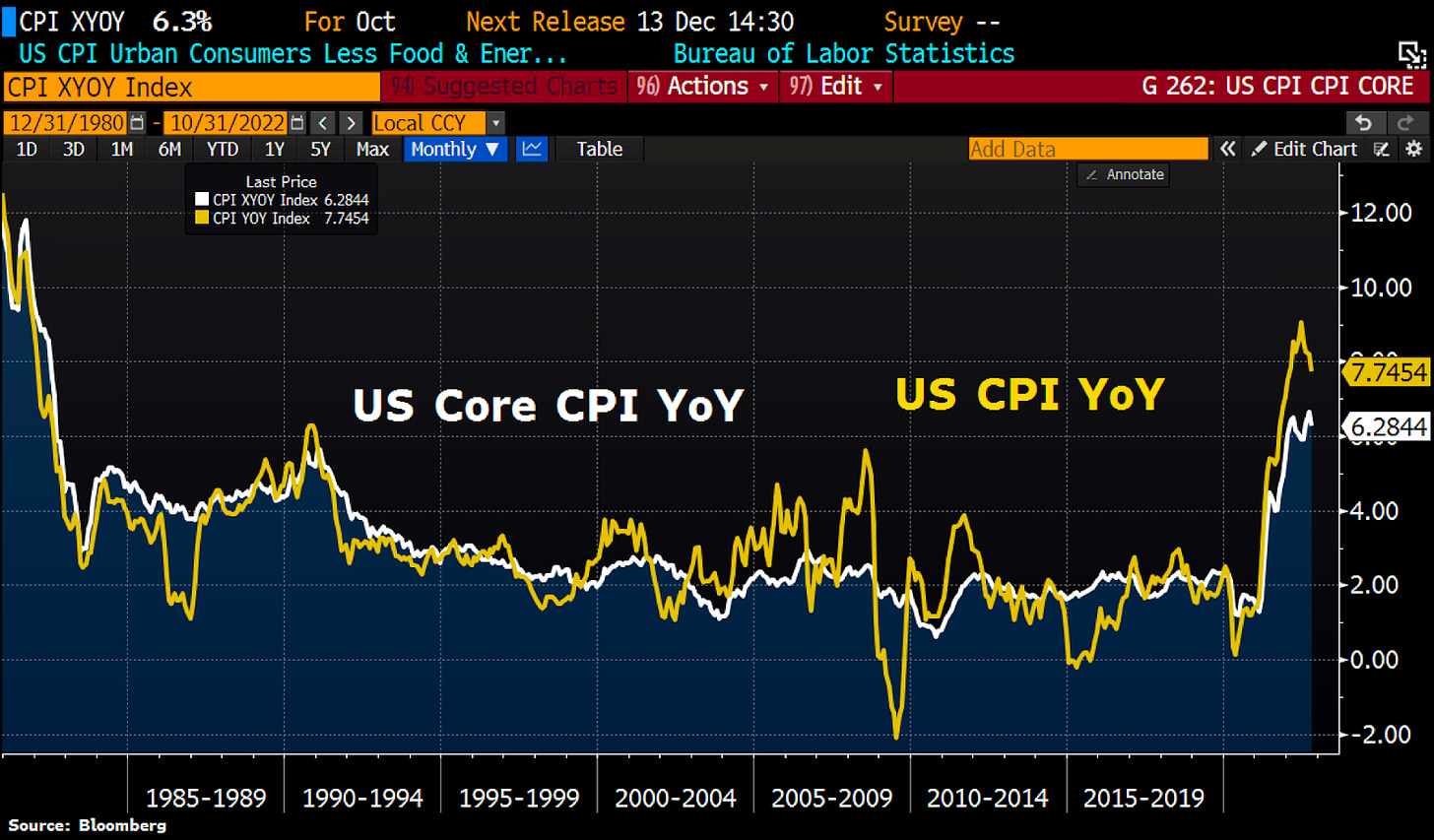

The US inflation cooled in October because overall inflation as measured by CPI rose only 7.7% YoY, way below the 7.9% estimate. Core CPI, which excludes volatile food and energy prices, increased 6.3% YoY, below the 6.5% YoY change economists expected to see.

The market went crazy after the CPI YoY metric fell with an extra 0.2%. How crazy went? Suddenly the USD get weaker by around 10%. This amount was flying into multiple assets. For example:

US 10y yield plunges <4% after weaker US CPI data.

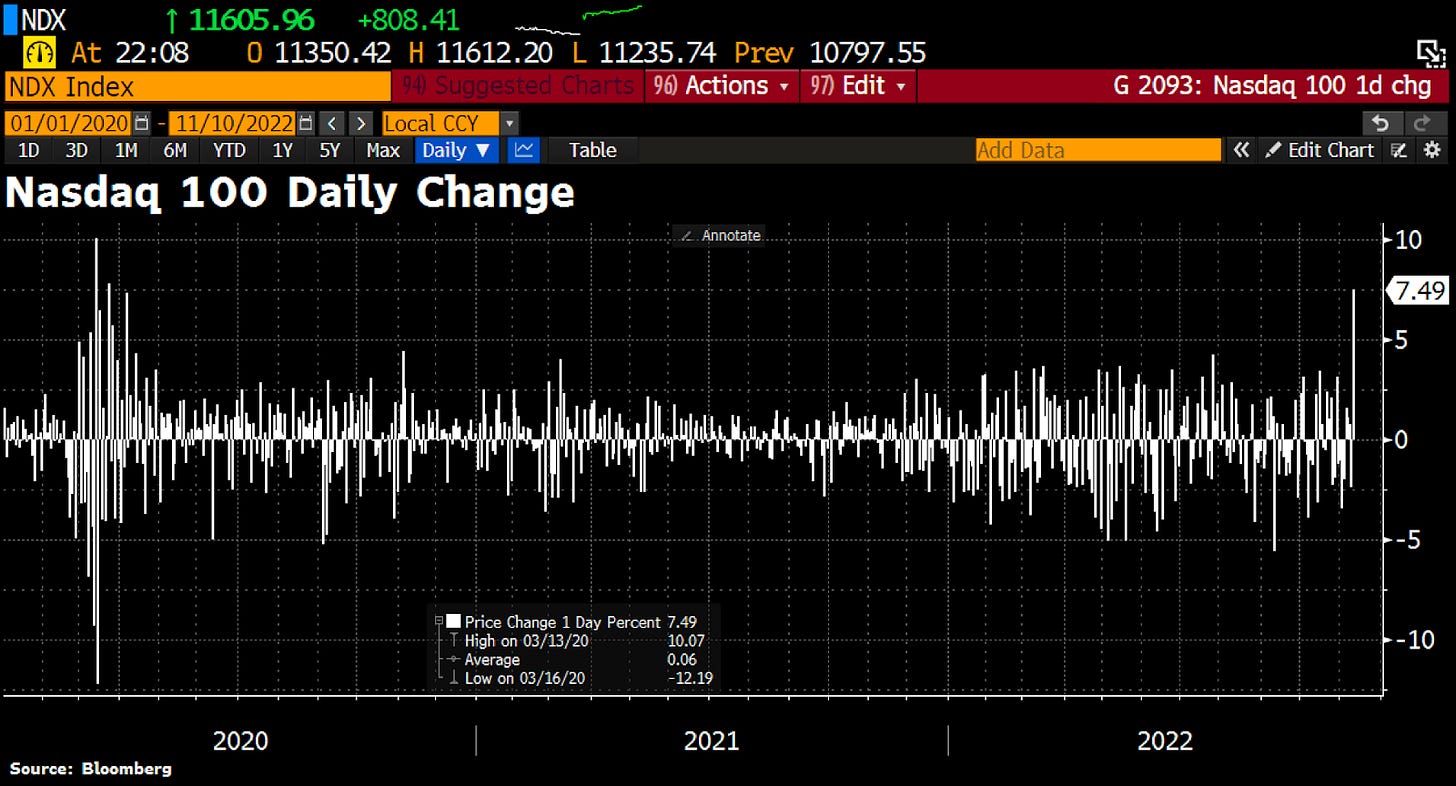

“Nasdaq 100 jumps 7.5% in the biggest gain since March 2020 as inflation eases. Investors bet that the Fed will pivot away from tightening monetary policy & shift from interest-rate increases to rate cuts as early as next year.” by Holger Zschaepitz, journalist at Welt

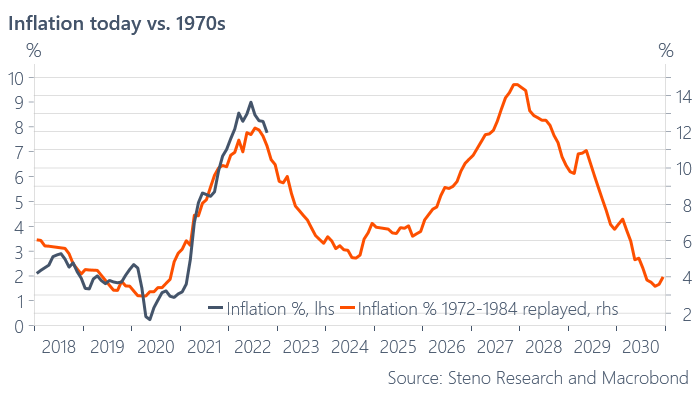

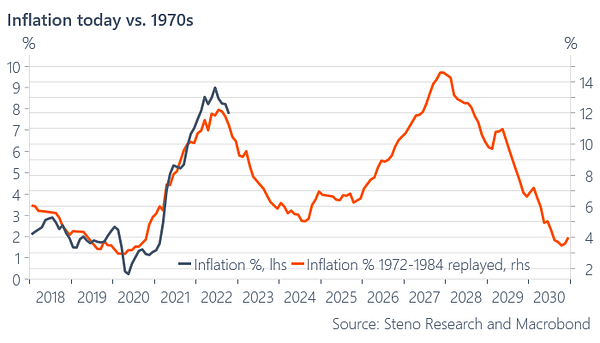

“Don't celebrate a 7.7% inflation rate too early or else this is likely going to happen. The double-top inflation picture looks increasingly likely to me given the animal spirits that we unleash as soon as the inflation decelerates.” by Andreas Steno Larsen, CEO at Steno Research

Couldn’t agree more with Andreas because we are far from “defeating” inflation (like it would be a living Monster to defeat). Why? Because in around 2 weeks the US strategic diesel reserves will be depleted and soon the whole SPR will be too. I think when most of the domestic diesel trucks will be stopped and the price of diesel will skyrocket the food and other transportable goods (literally everything) price will go vertically upwards. The inflation will kick back with even higher numbers like it was before.

Great article: Death To Cheap Credit Zombies

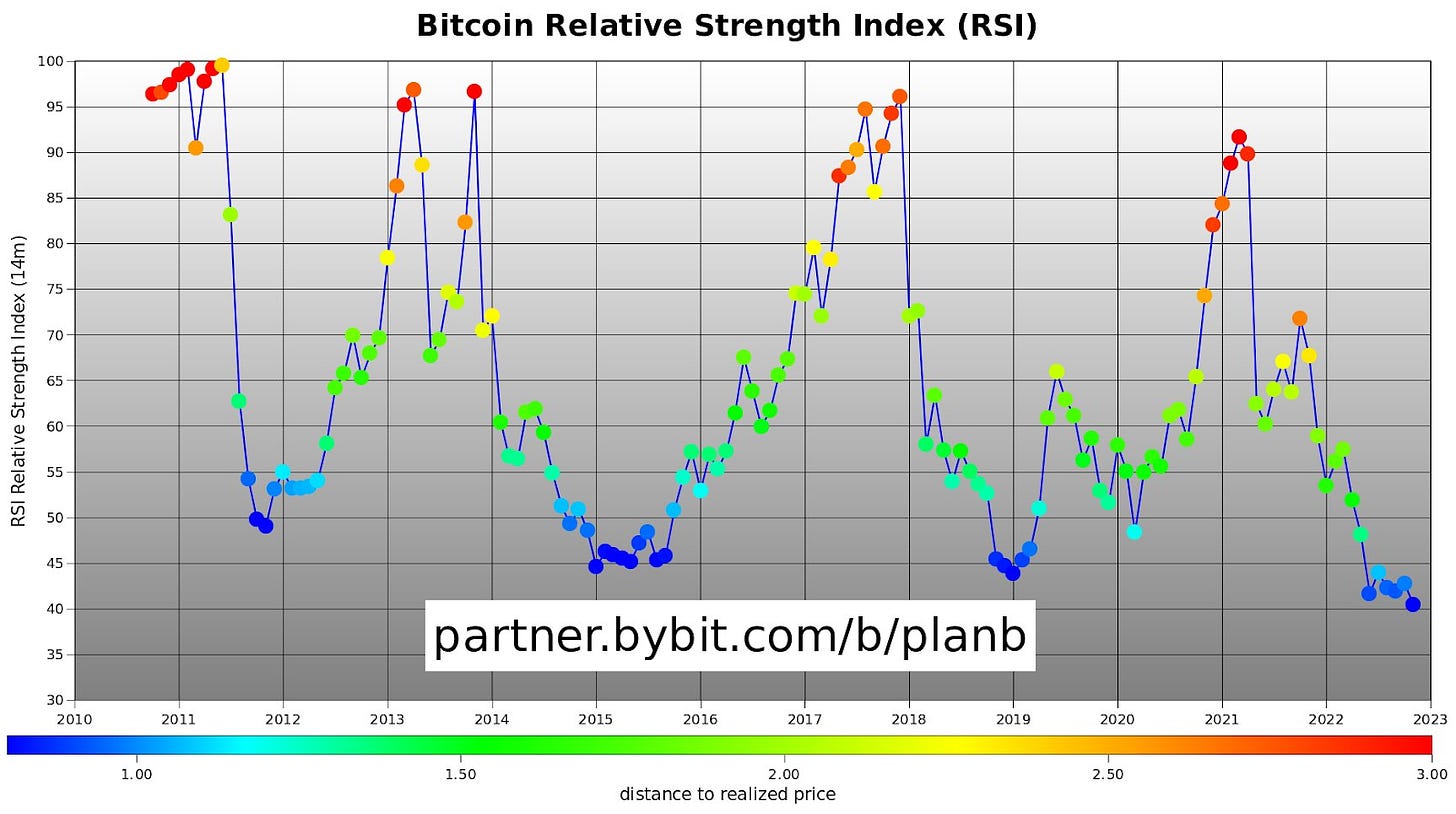

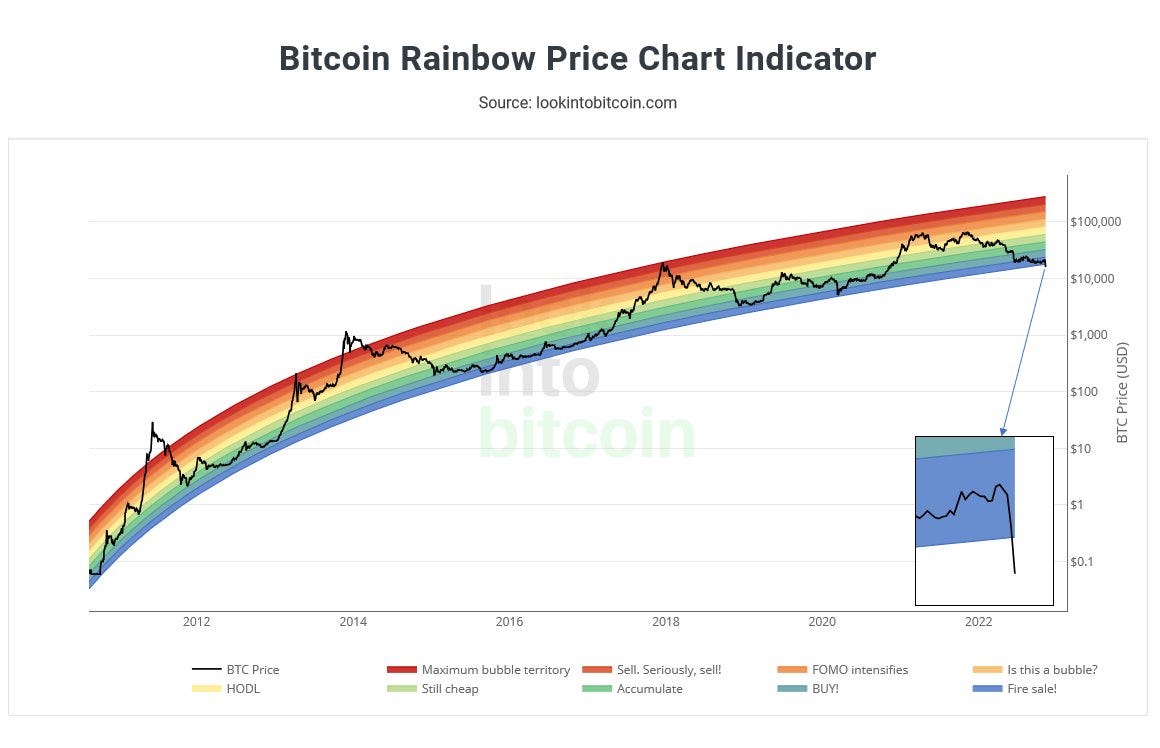

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Europe is turning into full tyranny with their new CBDC shitcoin:

“Digital euro may have transaction limits and saving caps, ECB executive board member says - The Block.”

52% of adults globally say they are somewhat or very likely to buy Bitcoin in the next year - Block survey

One year ago today (Nov 10, 2021), Bitcoin reached an all-time high of $69,044.

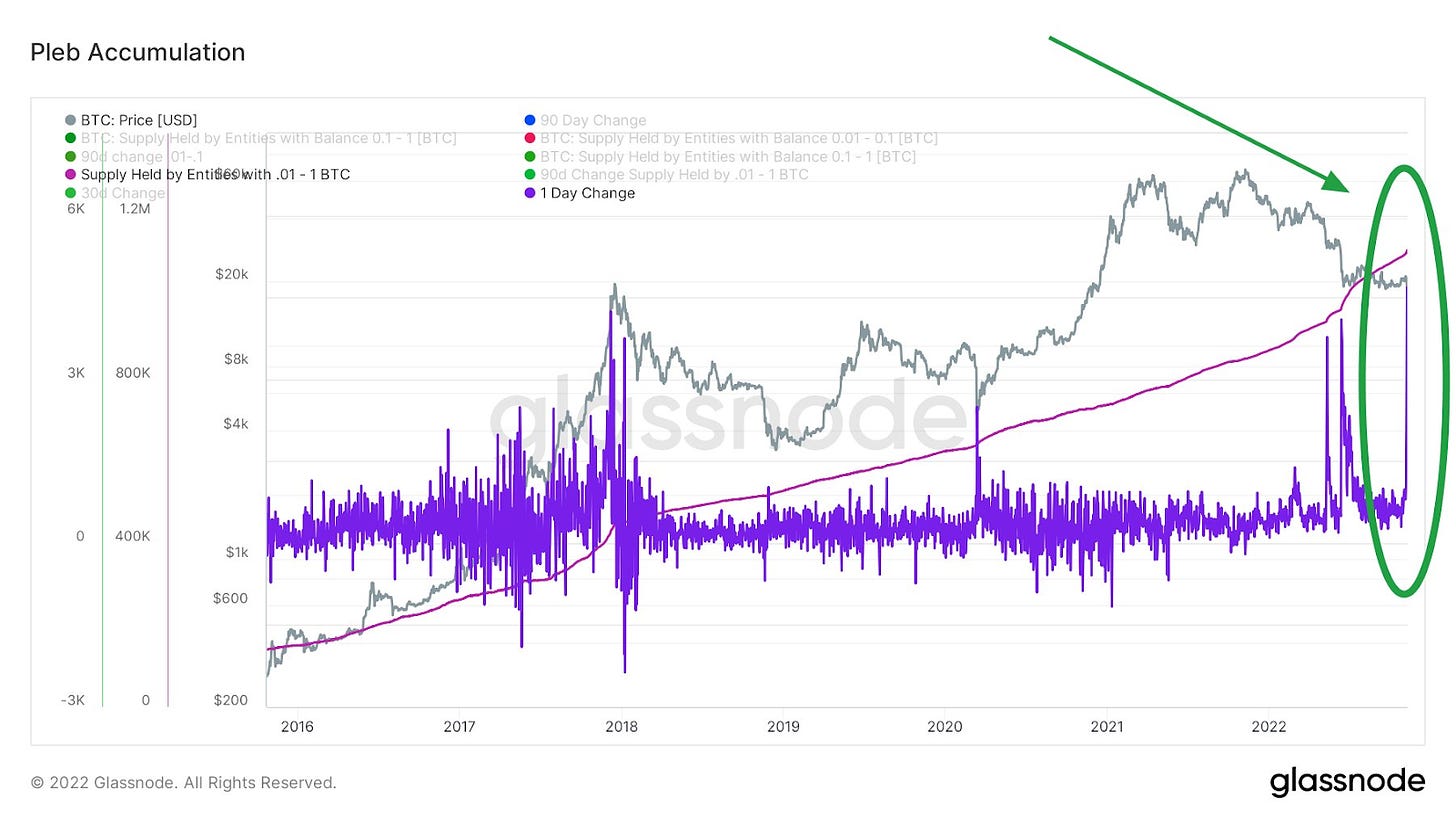

“Yesterday was the largest single-day change in the supply held by entities with .01 - 1 BTC of all time” by @MitchellHODL

“Principles of Bitcoin — You do not trust a CEO. You do not trust a company. You do not trust a custodian. You do not trust a bank. You hold your own keys. You run your own node. The Bitcoin network will run for the next 1,000 years”, explains Michael Saylor

Bitcoin Mining powered by 100% thermal energy in El Salvador (video)

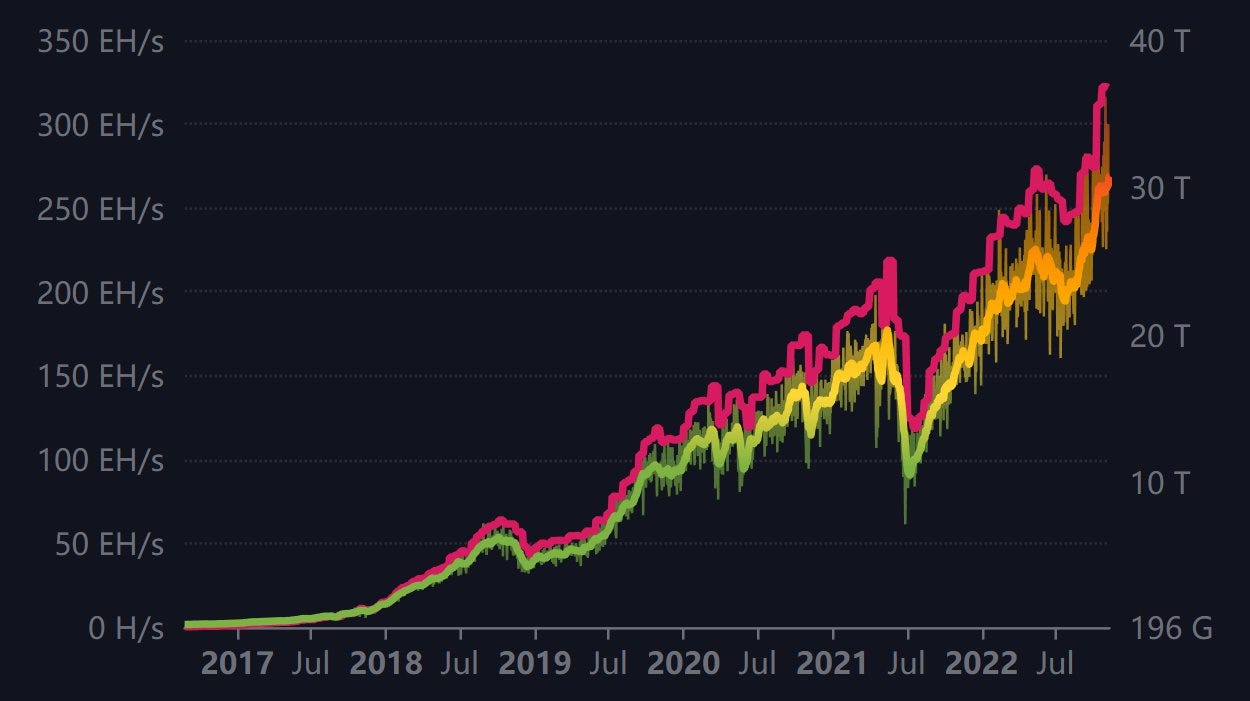

New record Bitcoin hashrate:

280,000,000,000,000,000,000 computations per second

Suggestions

Interesting articles to read

FTX Held Just $900MM In Liquid Assets Vs $9BN In Liabilities As Video Emerges Confirming Alameda Knew It Was Pilfering Client Funds (Not your keys, not your coins!)

EU Needs $460 Billion Investment To Maintain Nuclear Power Capacity

Sources:

https://www.btctimes.com/news/japanese-bank-set-to-launch-bitcoin-trading-in-2023