2022/40

24 October 2022 - 30 October 2022 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

U.K. Legislators have voted to recognise Bitcoin as regulated financial instruments

Compass Mining has signed a 27 MW hosting deal

Stone Ridge launches first ever Bitcoin accelerator focused on Lightning

VISA to launch Bitcoin wallet

Costa Rica lawmakers propose cutting all taxes on Bitcoin

El Salvador is opening a “bitcoin office” in Lugano Switzerland

New mining bill permitting cross-border Bitcoin payments filed in Russian Parliament

U.K. Legislators have voted to recognise Bitcoin as regulated financial instruments

The vote was passed by the House of Commons, which is the Parliament’s lower house. The topic was discussed for a line-by-line reading of the proposed Financial Services and Markets Bill. The bill also discussed the inclusion of Bitcoin and shitcoins as regulated financial services, which was put forth by Andrew Griffith. The bill includes the regulatory details for the inclusion of stablecoins.

“The substance here is to treat them [crypto] like other forms of financial assets and not to prefer them, but also to bring them within the scope of regulation for the first time,” Griffith, the financial services and city minister.

Griffith also mentioned that the treasury will consult various stakeholders and industry personnel to execute the framework and assess its risks and benefits. As of now, the regulations have to get final permission from the House of Lords. This is needed as the final power vests in the hands of the royal King Charles III.

Compass Mining has signed a 27 MW hosting deal

Bitcoin mining hosting and brokerage services firm Compass Mining will place 27 megawatts (MW) worth of bitcoin miners at the Texas facility of solar-powered mining startup, Aspen Creek Digital Corp. (ACDC).

Compass will host about 9,000 Antminer S19 XP and S19j Pro units at the facility on behalf of its clients starting in the fourth quarter of this year, according to a statement. Aspen Creek’s Texas facility has a total of 30MW worth of mining capacity, making Compass the largest hosting client for the start-up miner.

“Compass Mining continues to seek out high quality hosting providers such as ACDC that benefit our mining clients uptime and reliability,” co-founder and co-CEO Thomas Heller said in the statement. “ACDC’s pairing of cost effective, renewable energy with mining operational excellence is difficult to find in today’s current market,” he added.

Stone Ridge launches first ever Bitcoin accelerator focused on Lightning

Stone Ridge Holdings Group, parent company of NYDIG, has launched Wolf’s Clothing, a New York City (NYC) based Bitcoin start up dedicated to the Lightning Network.

Wolf aims to bring founders and startups from all over the world to NYC for eight weeks at a time to “to focus on the development, growth, and funding of companies building on Lightning.” The program will accept companies building on Lightning and Taro across a broad range of themes and is open to all applicants.

“We are launching Wolf to empower the best founders and teams from around the world to build that future. If you have an idea, a proof-of-concept, or an early-stage business that touches Lightning, Wolf can help you build and scale," said Kelly Brewster, CEO of Wolf.

Wolf will provide accommodations and transportation from anywhere in the word for accepted applicants and they will receive a guaranteed investment of $250,000, except for one winner per cohort which will receive $750,000. More details in the article.

VISA to launch Bitcoin wallet

Visa has filed two trademark applications with the United States Patent and Trademark Office (USPTO).

“Visa has filed 2 trademark applications claiming plans for managing digital, virtual, and cryptocurrency transactions, digital currency + cryptocurrency wallets, NFTs + virtual goods, providing virtual environments … and more.” tweet by Mike Kondoudis, a USPTO-licensed trademark attorney.

Costa Rica lawmakers propose cutting all taxes on Bitcoin

Lawmakers in Costa Rica are working to make the Central American country a Bitcoin-friendly nation, with significantly lower taxes.

This week, Costa Rican lawmaker Johana Obando presented a bill to Congress for regulating the Bitcoin market in the Central American country.

Obando, who now has a laser eyes meme on her Twitter page, said that the Cryptoassets Market Law (MECA) would “give protection to individual virtual private property, to the self-custody of crypto-assets and to decentralization” without interference from the country’s central bank—but in “perfect harmony” with it.

Presented along with Congressmen Luis Diego Vargas and Jorge Dengo, the bill would not allow the government to tax cryptocurrencies when used to buy goods. It also wouldn’t let the government tax crypto sitting in cold storage—and crypto produced by the mining industry wouldn’t be subject to profit tax, either. Profits from crypto trading, however, would be subject to income taxes under the bill.

“Does this bill propose the same as El Salvador? Absolutely not,” Obando said on Twitter. “MECA introduces cryptocurrencies as a private virtual currency, of free access and circulation, and does not oblige the State to acquire or replace them.”

El Salvador is opening a “bitcoin office” in Lugano Switzerland

The country of El Salvador and the Swiss city of Lugano have signed a memorandum of understanding (MOU) aimed at boosting bitcoin adoption in their own regions as well as neighboring states and countries.

Appearing at Lugano’s Plan B Forum on Friday, Milena Mayorga, El Salvador’s ambassador to the U.S., also announced her country’s opening of a “bitcoin office” in Lugano staffed with a new Honorary Consul to proselytize for bitcoin in the city, Italy and Europe.

New mining bill permitting cross-border Bitcoin payments filed in Russian Parliament

Russian lawmakers will review a new legislative proposal for the legalization of Bitcoin mining, which has seen significant growth over the past few years. Announcing the filing of the bill on Sputnik radio, the Chair of the parliamentary Financial Market Committee Anatoly Aksakov pointed out that the document authorizes the use of Bitcoin and shitcoins as a means of payment outside the country.

“We have introduced a bill that legalizes mining, that is the issuance and circulation of cryptocurrencies. But cryptocurrencies can only be employed as a means of payment outside of our country, in foreign jurisdictions,” Aksakov explained, also quoted by RBC Crypto. In experimental mode, the digital assets may also be used to pay for parallel imports, the deputy added and emphasized:

“This is a step that speaks of a new direction in the development of financial markets in our country.”

Global Economic News

TL;DR

Credit Suisse Bank financial problems are widening

BoE needs Treasury help

Is the ECB too already out of possibilities?

The Tulip mania 2.0 in Amsterdam

The US National Home sales already plummeting with ever increasing consumer loans

Germany inflation unexpectedly accelerated

Credit Suisse Bank financial problems are widening

Credit Suisse to pay $233 million to settle tax fraud and money laundering cases in France.

The $1.5 trillion-asset manager Credit Suisse to lay off 9,000 employees as part of a “radical restructuring.”

“Credit Suisse has posted a MASSIVE third-quarter net loss of $4.09 billion. It is getting ugly. The bank is planning to raise $4 billion. This is one of the biggest banks in Europe.” by Gold Telegraph

Credit Suisse is the next Lehman(?): Pimco, Apollo To Buy Credit Suisse Securitized Products Unit

BoE needs Treasury help

According to BBG, the UK Treasury to Transfer £11 Billion to Bank of England to Cover QE Losses.

The capital transfer was detailed in an update to the “Central Government Supply Estimates” published on Tuesday by the Treasury. The new £11.175 billion injection is listed under “assistance to financial institutions - payment to the Bank of England.”

As the BOE’s purchases are indemnified by the Treasury, the loss will be borne by the taxpayer.

“Global recession is coming. The country with the biggest hit to manufacturing is the UK (pink). We scale forward-looking orders - inventories by their historical volatility & control for different means across countries. Once we do that, the UK has by far the weakest data…” by Robin Brooks, Chief Economist at IIF

Is the ECB too already out of possibilities?

“The ECB is not only very late in raising interest rates. The ECB is also hopelessly behind when it comes to reducing its balance sheet, as a comparison w/Fed, Bank of England or SNB shows.” by Holger Zschaepitz, journalist at Welt

“Northern creditor countries in the Euro zone need a plan. Recent years saw bad shocks hit. The South lacks fiscal space, so it calls for explicit (via joint issuance) or implicit (via the ECB) debt mutualization. The North resists, gets called anti-European and finally caves…” by Robin Brooks, Chief Economist at IIF

“The Euro (black) will keep falling no matter what the ECB does. It's fall so far in 2022 has been AGAINST interest rate differentials, which have risen sharply in favor of Euro because the ECB has been more hawkish than other central banks. Markets are looking through the ECB…” by Robin Brooks, Chief Economist at IIF

“According to the GS financial conditions indices, Euro zone financial conditions (yellow) are as tight as in 2011 at the height of the Euro zone debt crisis and tighter than in the UK (orange) or the US (white). Deep recession is coming to the Euro zone…” by Robin Brooks, Chief Economist at IIF

The Tulip mania 2.0 in Amsterdam

“A friendly reminder of how insane property prices are. Here is 400 years of data from Amsterdam. We're living through the biggest real estate bubble ever.” by Edmund Simms, Equity fund manager and writer

The US National Home sales already plummeting with ever increasing consumer loans

“Woosh: August saw largest monthly decline in national home prices since March 2009 per S&P CoreLogic CS Index” by Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co., Inc.

“Personal excess savings from Covid stimulus are all gone… Meanwhile consumer loans are increasing at a very steep angle…This will end well…” by Wall Street Silver

Meanwhile the Federal government spending interest payments are going vertically. In a few years the whole budget will be gone just for paying the interest. You know what’s coming after that…

Germany inflation unexpectedly accelerated

“German inflation unexpectedly accelerated in Oct. Consumer prices rose 10.4% YoY, most since 1951, HICP rose 11.6%, most on record vs. 10.9% expected.” by Holger Zschaepitz, journalist at Welt

“Germany, where supermarket prices are rising much faster than in other Eurozone countries. German Food CPI jumped 20.3% YoY in Oct, the highest food price inflation since the start of the statistic. In Italy, food inflation is just 13.8%, in Spain 14%.” by Holger Zschaepitz, journalist at Welt

“Germany where financial repression is not easing. Although nominal yields have risen to almost 2%, inflation has also increased to 10.4%. Real yields (Avg Bund yields-inflation) at -7.9%, still near All Time Low. Real yields now NEGATIVE for 78 consecutive mths” by Holger Zschaepitz, journalist at Welt

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

"Interest in Bitcoin surges among the super-rich in Hong Kong and Singapore" - Finbold

22% of U.S women plan to buy Bitcoin or crypto in the next 12 months - BlockFi Survey

Global Bitcoin payments to grow 16.3% yearly from 2022 to 2031 - Allied Market Research

Bitcoin computes this math 236,000,000,000,000,000,000 times every second

Bank of America: Investors “may view bitcoin as a relative safe haven” amid macro uncertainty

The Lightning Capacity is already on a new ATH with 5,100+ BTC!

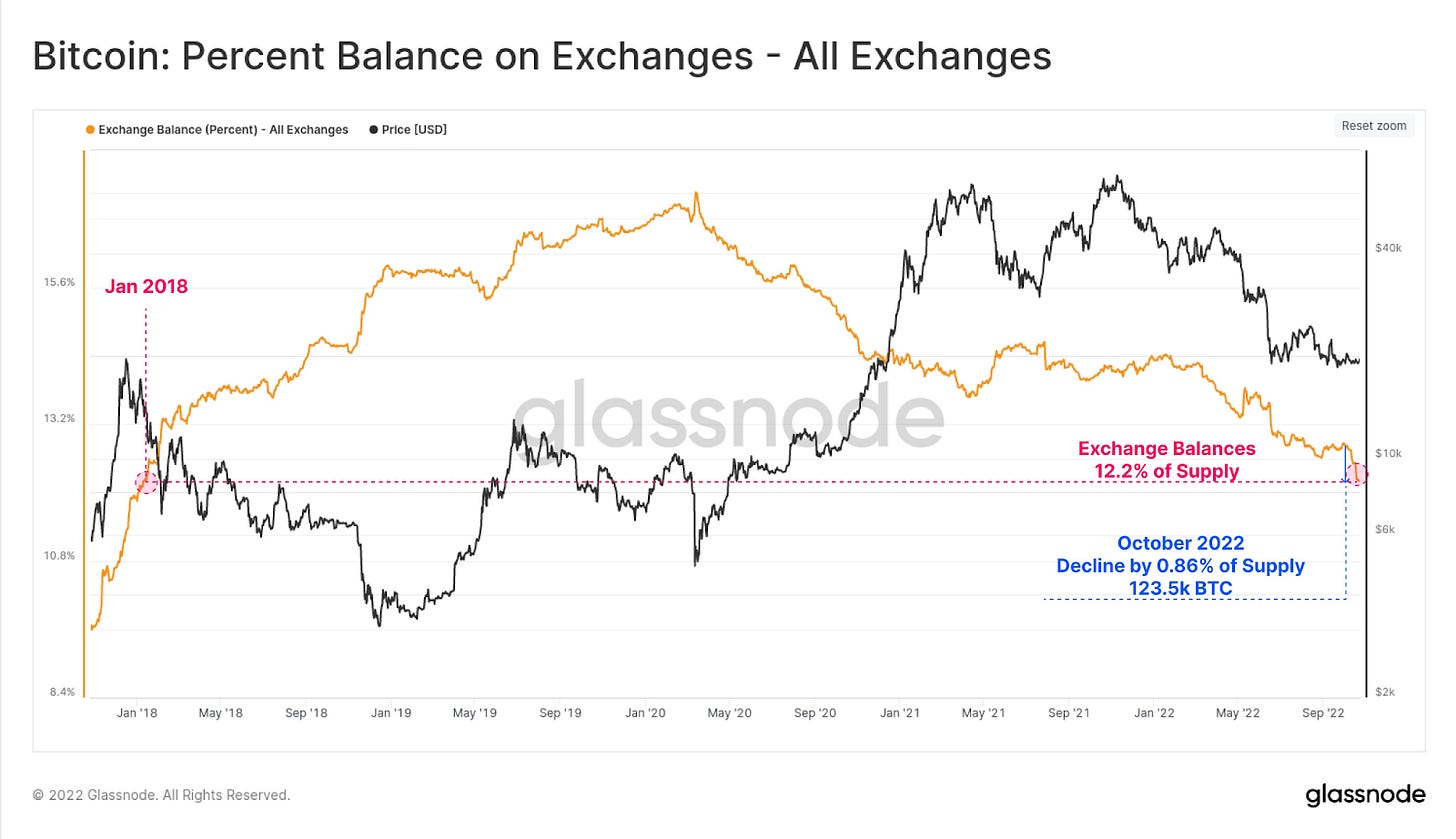

The amount of Bitcoin on exchanges just keeps dropping!

Bitcoin adoption as legal tender is only a matter of time - Mexican Senator Indira Kempis

Fidelity Digital Assets: 74% of institutions plan to buy Bitcoin in the future

First McDonald’s in El Salvador. Now McDonald’s in Lugano (video)

In Talipapa market in Boracay where we have about 8 vendors accepting Bitcoin (video)

Bank of America explains why you should own Bitcoin

Exactly 8 years ago today, $500,000 in free Bitcoin is distributed among every student at MIT

“Every Satoshi counts!” by @SatsPlaceholder

Suggestions

Interesting articles to read

Germany Could Witness A Cash Renaissance As Its Economy Continues To Deteriorate

US Wants To Break Up Taiwan's Chip Hub To Shield Supply Chains In Event Of China Invasion

Biden Administration Wants To Make It Easier To Seize Bitcoin Without Criminal Charges

U.S. LNG Cannot Replace The Russian Natural Gas That Europe Has Lost

Sources:

https://watcher.guru/news/uk-votes-in-favor-of-recognizing-crypto-as-regulated-financial-instruments

https://news.yahoo.com/costa-rican-lawmakers-propose-nixing-190122492.html

https://news.yahoo.com/el-salvador-lugano-sign-agreement-160021145.html