Bitcoin News

TL;DR

Nigeria’s Bitcoin P2P trading jumped +16% and diversifying away from USD

Kazakhstan floats 500% tax increase on Bitcoin miners

Lightning Network capacity is at ATH

Tatarstan wants to be first public test zone for Bitcoin regulation

Bitcoin Is Funding Ukraine's Defense

US Gov arrests couple and seize $3.6 billion in hacked bitcoin funds

The Russian government and central bank says Bitcoin is a currency

Wells Fargo bank: Bitcoin is nearing a "hyper-adoption phase"

Russia shares plan to regulate Bitcoin (UPDATED!)

Tennessee lawmaker proposes bill to allow the state to invest in bitcoin

BlackRock planning to offer Bitcoin trading

New iPhone feature will enable Bitcoin 'tap to pay' transactions

Bitcoin for Truckers: 21 BTC already donated (UPDATED!)

Missouri State Rep has tabled a bill to exempt Bitcoin from property taxes

Uber CEO: We will “absolutely” accept Bitcoin in the future

Idaho Gov. Candidate: When I become governor I will make Idaho a safe-haven for Bitcoin!

Bitcoin balance on exchanges just hit a 3-year low.

New details arrived about Intel's upcoming Bitcoin mining chip.

Nigeria’s Bitcoin P2P trading jumped +16% and diversifying away from USD

We are not surprised that in Africa for a good few years now the most adoption to Bitcoin is in Nigeria. I think with their shitty currency each day more and more citizens are getting familiar with the use of Bitcoin. The critical mass is I think already reached because in a 2020 survey 32% of the population already owned Bitcoin. In the past two years I think this should be already over 50%. The more interesting part is that they want to ditch USD and switch to China’s yuan as a reserve currency. I think the Chinese want the same thing to happen with the Yuan as it happened after the Bretton Woods agreement with the USD: Chinese Yuan to be a global reserve currency. China is already “buying up '' Africa, some South American and east European countries too by lending cheaply a lot of money, but of course with politics involved there is a huge price embedded in it. Nigeria is Africa’s largest oil producer and 5th largest LNG exporter in the World, so the resource hungry Chinese government wants to get their resources as cheap as possible. Can you imagine a trade more cheaper than it is denominated in a currency you are printing it? Funny not, how Nigeria fell from one trap to another. Luckily the citizens are already stacking some sats!

Kazakhstan floats 500% tax increase on Bitcoin miners

There is an estimate that around 12% of the global hashrate is located in Kazakhstan. Kazakh authorities are looking into increasing the tax on electricity for cryptocurrency miners from one tenge to five tenge ($0.0023 to $0.012). This huge raise of tax is not understandable because there are already around 1GW of “gray” miners who are not registered by the government. Kazakhstan is next to Russia, so if this tax raise reaches an unworthy amount, then the miners will easily move out from the country. I think the “gray” miners will move to a country with more stable taxation and that location could be even the US. But it will be easier to go to Russia if their new mining regulations are competitive. This increase of tax could make mining still profitable, which depends only on the price of electricity they get.

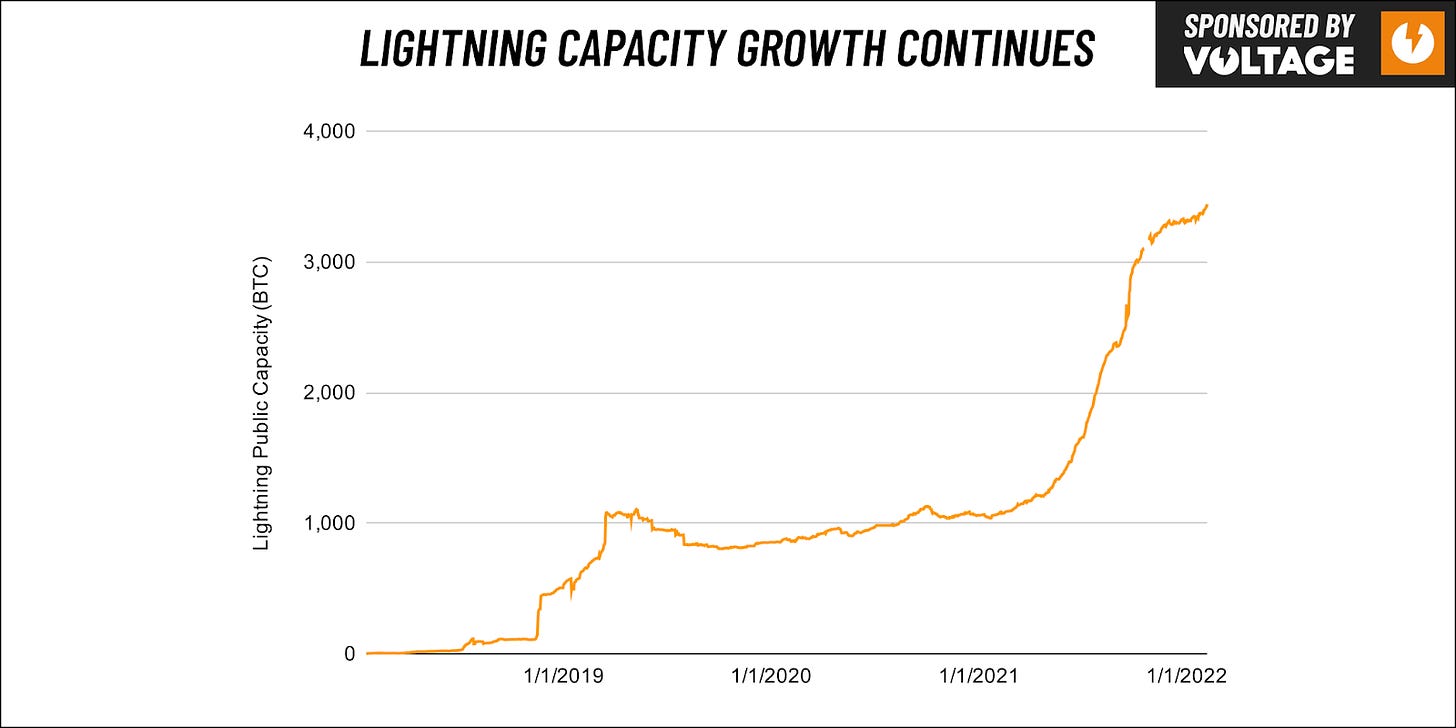

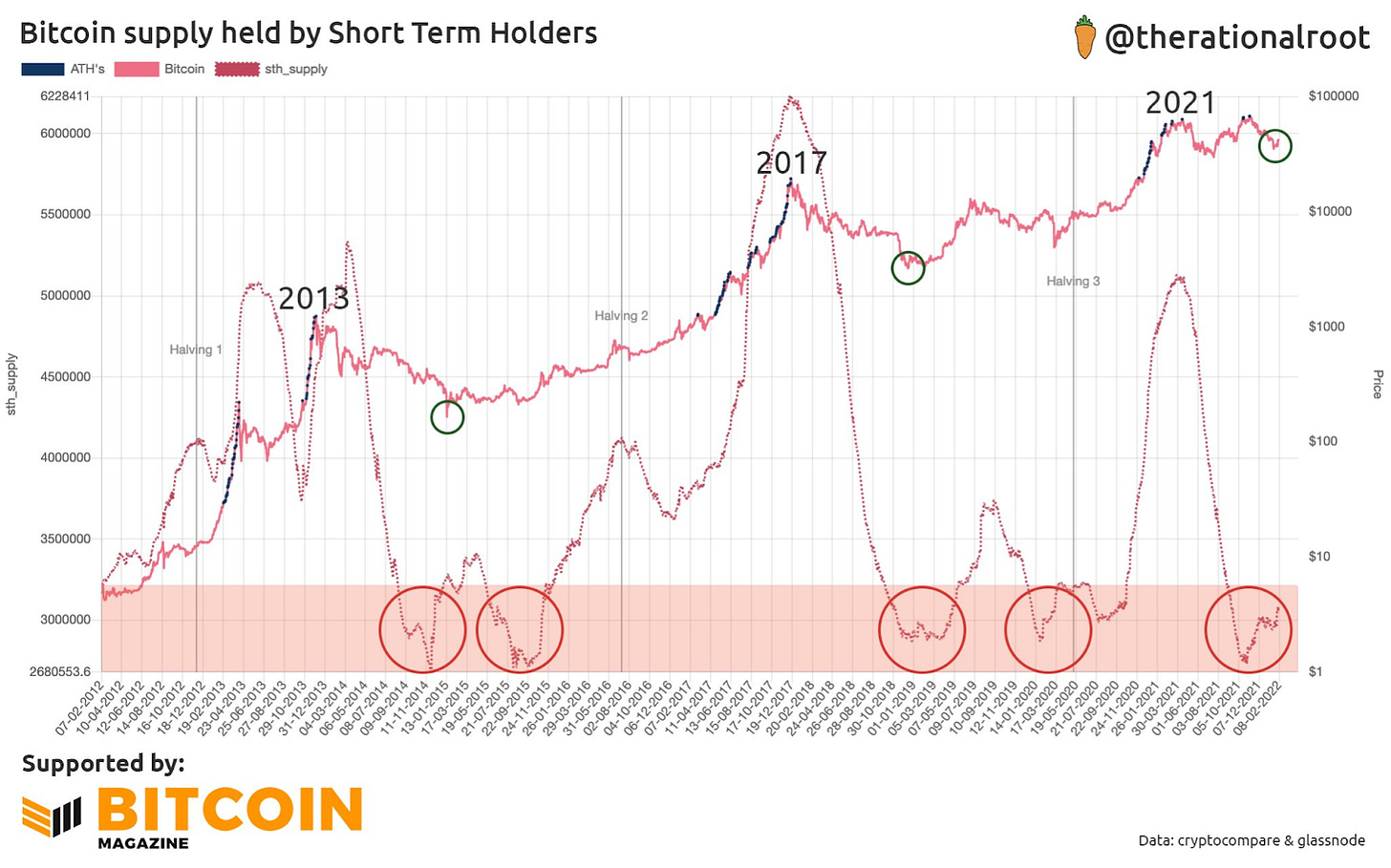

Lightning Network capacity is at ATH

The public Lightning Network capacity growth is accelerating again and it’s already at ATH. As more and more tyranny is in the world like what’s happening with the Canadian truckers and citizens, with services like Tallycoin (a donation service), Lighting Network solutions getting more and more attraction. On the other side capacity is growing because the node owners are preparing for a way bigger mempool size, when cheap payment solutions like LN offer will be essential.

Tatarstan wants to be first public test zone for Bitcoin regulation

“Kazan should be made a pilot zone for testing mechanisms to regulate the cryptocurrency market in Russia, according to a proposal by the head of Tatarstan's Digital Development Ministry Airat Khairullin said at a summary meeting of the ministry's board on Wednesday… I propose that in coordination with the Central Bank, FSB, and Russian government as part of the two federal laws on experimental legal regimes and digital financial assets a pilot zone be implemented in Kazan so that we can see how these infrastructure elements [the cryptocurrency market] operates under the control of the state and the regulator," Khairullin said.

Russian Digital Minister Maksut Shadayev took part in the board meeting via video conference.” by Interfax

Bitcoin Is Funding Ukraine's Defense

“Cryptocurrency payments to military and hacktivist groups in Ukraine aimed at countering Russian aggression against the country spiked sharply in the second half of 2021, according to cryptocurrency tracing and blockchain analysis firm Elliptic. Crowdfunded payments to those organizations in bitcoin, litecoin, ether, and other cryptocurrencies the company tracks reached a total value of around $550,000 last year, compared with just $6,000 or so in 2020 and less still in previous years, even at the height of Russia's 2014 invasion of the country.

… Cryptocurrency exchanges that convert donated bitcoin into dollars or Ukrainian hryvna, on the other hand, are often far less closely regulated. And Elliptic's Robinson argues that cryptocurrency offers advantages to donors, who may not want their banking records to show that they sent money to organizations that might be perceived as paramilitary groups.” by Wired

US Gov arrests couple and seize $3.6 billion in hacked bitcoin funds

Last week I already wrote about these 10,000 stolen Bitcoins move and I was saying that hopefully this time they won’t be so stupid to use the coins without proper wash. They were on some level clever because they used multiple anonymizing solutions, but they were making huge mistakes too, like mixing coins together after proper anonymizing. I don’t know the details, only the official news, which is that a husband and wife from New York stole 119,754 Bitcoins from a 2016 Bitfinex hack. The DOJ could seizure 94,000 from this amount (BTW their largest single seizure in their history). Now with this, the US is the biggest Bitcoin holder government. I think this will not be for long because either they will give back these coins or they will sell it like in the past. They should not allow us to suspect that Bitcoin is considered as a reserve currency.

The Russian government and central bank says Bitcoin is a currency

The Russian government and central bank have just reached an agreement on cryptocurrencies, according to Russia's Kommersant. Both organizations will treat bitcoin and crypto assets as currencies. They are speeding things up. In just the last two weeks they are doing major steps from banning to legalizing Bitcoin in their country. Making Bitcoin a legal tender is the next step, but I think for this we should wait a little bit longer. The government is doing now everything they can to stash as much Bitcoin they can, but without making too big announcements to move the price up. Making it as a legal tender will boost the price too high before they can get as much as possible on these low prices.

Wells Fargo bank: Bitcoin is nearing a "hyper-adoption phase"

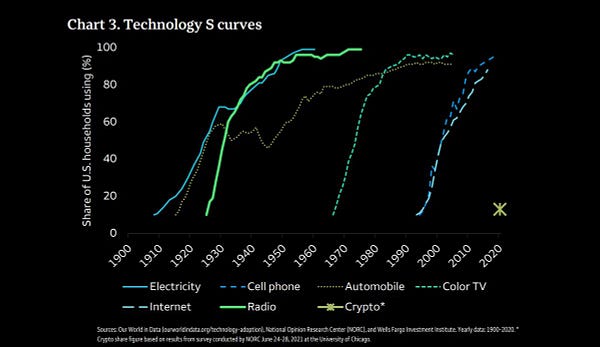

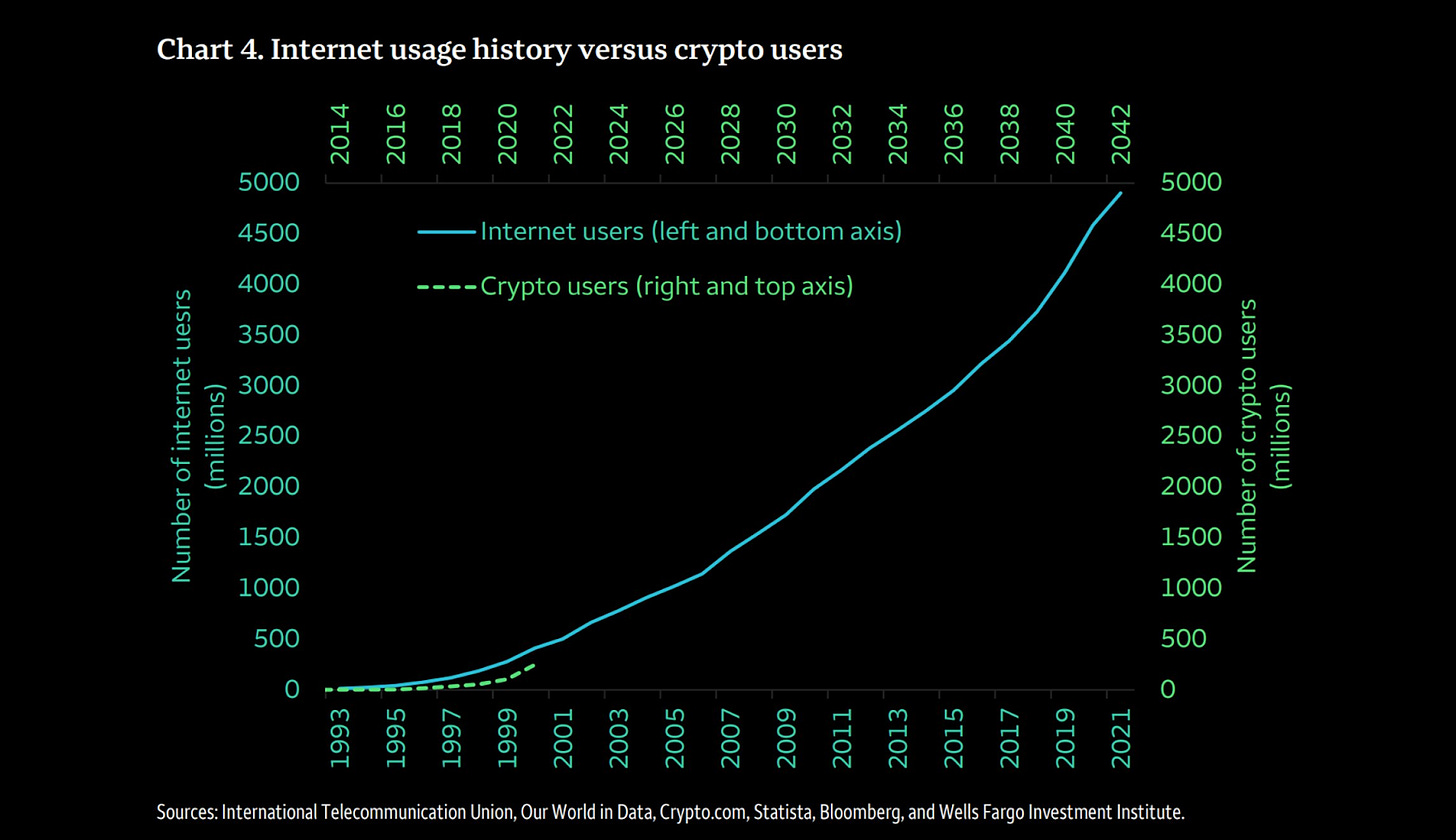

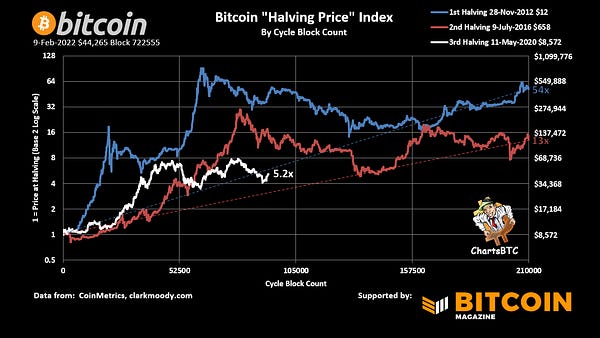

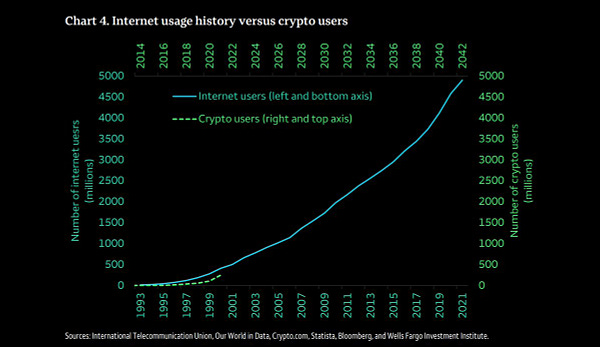

The bank shared some pretty impressive charts:

"We understand the 'too late to invest' argument but do not subscribe to it." by Wells Fargo

They are comparing Bitcoin to the Internet in the mid-to-late 1990s. The summary of this chart is that they are saying that Bitcoin is nearing a “hyper-adoption phase”, like the Internet did 25 years ago. The hardcore Bitcoin believers are not surprised on this conclusion because we already know this, but I think the non-believers will be surprised that a bank from the FIAT World came to the same conclusion too. Interesting years will come!

Russia shares plan to regulate Bitcoin (UPDATED!)

Russia finally on Tuesday night shared their plans about regulating Bitcoin in their country.

“...The new document published reflects that intention as it realizes that Bitcoin cannot be stopped and instead seeks to put laws and restrictions in place to empower watchdogs and ensure the government gets the taxes owed by citizens and businesses.State efforts will also include licensing exchanges and banks interested in providing Bitcoin services to ensure they have “liquidity cushions,” the document said. Only financial institutions that get a license will have the right to open cryptocurrency-related accounts for individuals.The document also provisions the usage of a “Transparent Blockchain” monitoring system, which will identify and classify people, organizations, and wallets that use, sell or deal with cryptocurrencies in Russia. Transparent Blockchain can create models between different transactions and scan the internet and the darknet to reveal wallets connected to suspicious activities, including money laundering, terrorism financing, and weapon distribution in the country. It appears individuals will be able to use self-custody wallets but would need to register it with the Transparent Blockchain beforehand to connect the wallet to the person using it.

Foreign exchanges interested in providing cryptocurrency services in Russia would also need to abide by local regulations, which include the need to have a representative in Russia and implement a system to prevent customers from withdrawing funds into wallets not registered with the Transparent Blockchain system.

The new Russian regulation would treat Bitcoin similar to a foreign currency, according to a report by local newspaper Kommersant. At least part of the new legislation is expected to come into effect in the second half of 2022 or by next year, the report said.” by Bitcoin Magazine

(UPDATE: Russia Ministry of Finance: Domestic Bitcoin exchanges will be open to foreign investors too)

Tennessee lawmaker proposes bill to allow the state to invest in Bitcoin

After Arizona, now Tennessee wants to invest into Bitcoin. The democrat representative Jason Powell introduced on February 2 a draft bill to allow the state of Tennessee and other municipalities to invest in Bitcoin. Will see how the vote of the bill will go.

BlackRock planning to offer Bitcoin trading

BlackRock the $10 Trillion worth asset investment giant wants to offer Bitcoin trading solutions. The funny part is that we always thought the US Bitcoin spot ETF would boost the Bitcoin price when the giants like BlackRock could invest directly into Bitcoin. But as the “impotent” SEC is always delaying or denying the Bitcoin spot ETF requests, the BlackRock found the solution to be able to onboard their clients. Just imagine for a moment: BlackRock’s total assets worth is 10 (!) times bigger than the Bitcoin market cap today. If only 10% goes into Bitcoin it will double today's price! I always say that money will always find the shortest way where it can multiply itself.

New iPhone feature will enable Bitcoin 'tap to pay' transactions

Apple Pay users will technically be able to use iPhone’s Tap to Pay feature to make Bitcoin payments with the help of NFC (near-field communication technology) across mainstream merchants and businesses.

“We just introduced Tap to Pay on iPhone, a great way for millions of small businesses to accept contactless payments right from their iPhone. It’s easy, secure, and will be coming out later this year.” by Tim Cook (CEO of Apple)At the end of January Google also said that they are testing the integration of Bitcoin into Google Pay. Practically with this feature Apple and Google simply will make it possible for millions of it’s users to use Bitcoin practically as a currency.

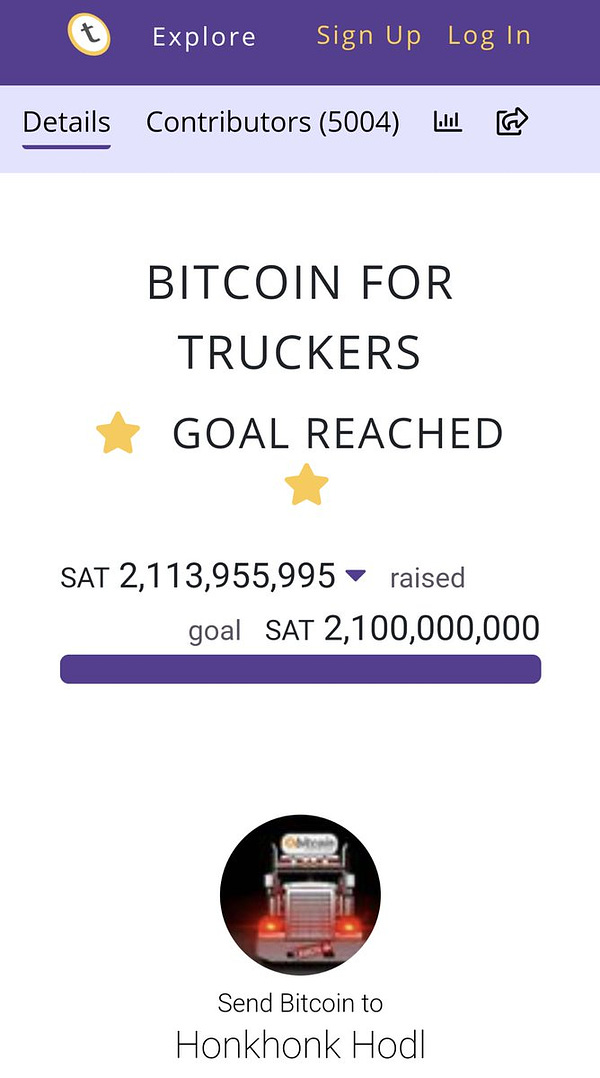

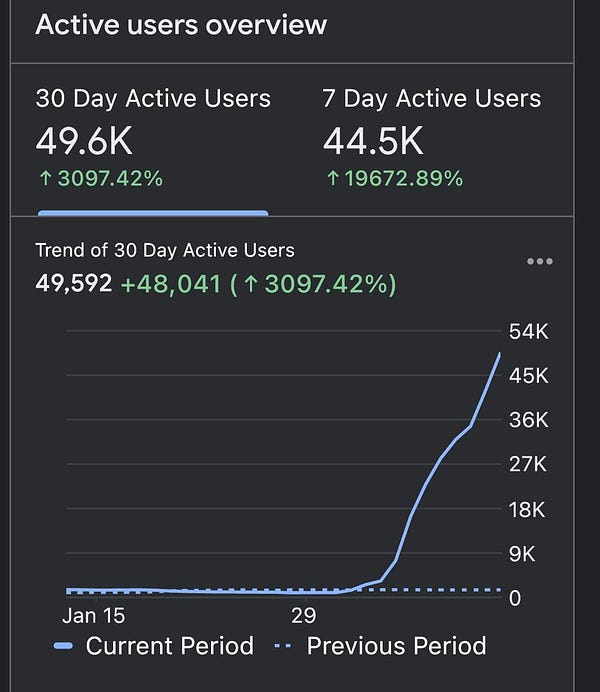

Bitcoin for Truckers: 21 BTC already donated

In times where GoFundMe blocked the donations and GiveSendGo is under legal “attack”, then comes Bitcoin and saves the day. This is an important milestone because 1/1,000,000th of ALL Bitcoin that will ever exist have been already donated to a single cause, to support freedom and body autonomy. It is the last resort because tyrannical rulers in Canada are doing everything they can to take away the gas, wood or money from the protesters. Bitcoin is the true help for the freedom fighters!

(UPDATE: TD Bank freezes bank accounts that received $1.4-million in support of convoy protests. Can’t express enough how important it is to hold your keys/money in your own hand. If you deposit in a bank it’s not yours anymore! I think these lectures show what kind of world will be with the CBDC’s.)

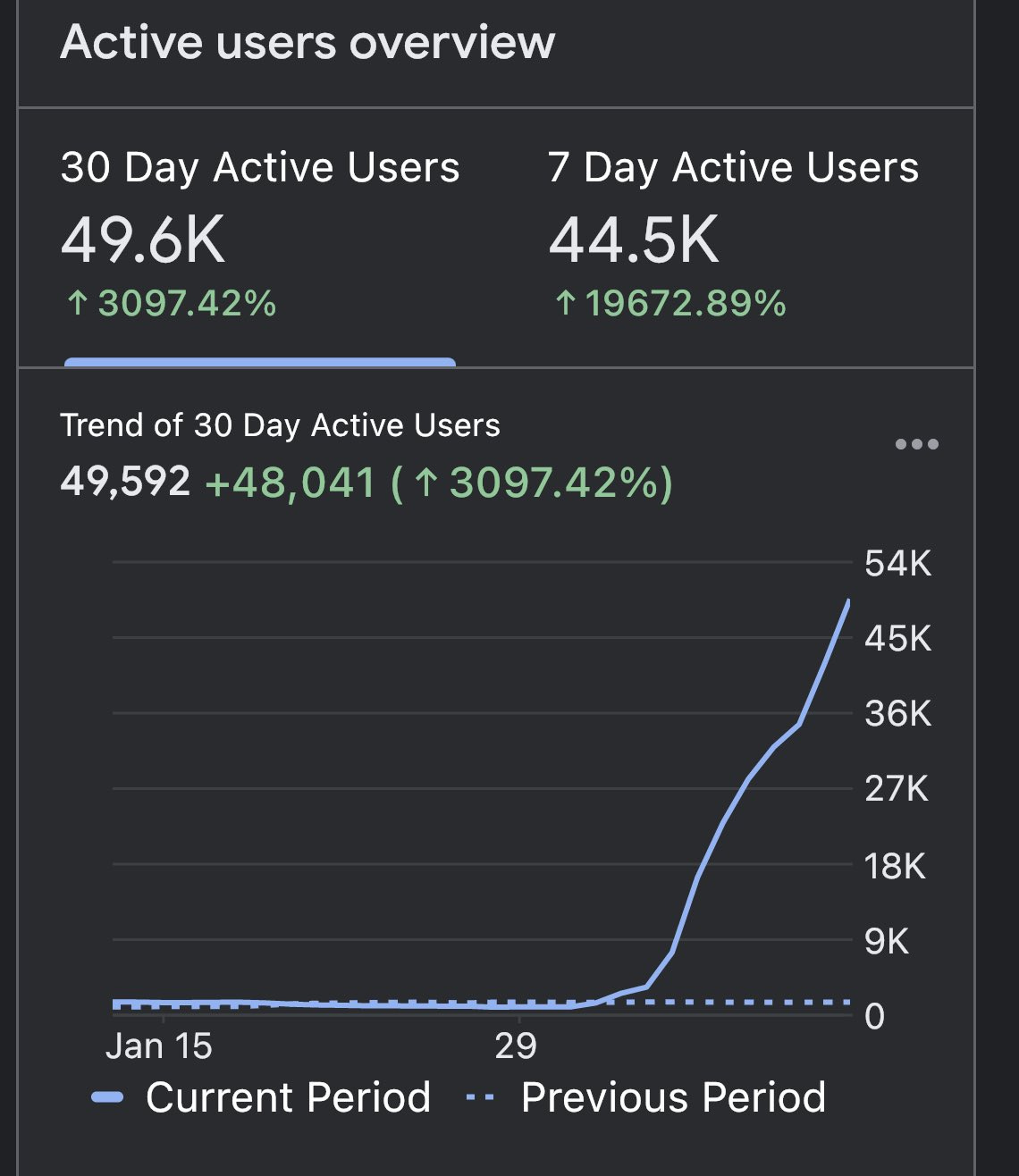

(UPDATE2: Tallycoin stats update: 7 day active users up 19,000%. That’s why I’m in love with Bitcoin. It brings Freedom to places and causes you never dreamed!)

Missouri State Rep has tabled a bill to exempt Bitcoin from property taxes

Missouri State Representative Phil Christofanelli introduced a bill seeking to exempt bitcoin from property taxes not just at the state, but county, and local levels too.

“My goal is to ensure Missouri is open to innovation and opportunity as Bitcoin, other cryptocurrencies, and blockchain applications come to the market... “...This industry has great potential to enhance Missouri’s push to create greater economic and political freedom and I hope to advance this legislation and further proposals over the next few years.” Rep. Christofanelli said in a statement.

Uber CEO: We will “absolutely” accept Bitcoin in the future

In a recent interview Dara Koshrowshahi, CEO of Uber said that Bitcoin is “quite valuable as a store of value” (said some other bullshit too, which means he needs to educate himself a little more). In the future UBER will accept Bitcoin and some other shitcoins too.

Idaho Gov. Candidate: When I become governor I will make Idaho a safe-haven for Bitcoin!

Janice McGeachin, a candidate for governor of Idaho, has stated that if elected, she will make Idaho a “safe haven” for Bitcoin.

Nowadays each week around one or two governors or candidates announce their support for Bitcoin. They see how wrong is the FED direction with it’s rumbling printing press, so as a good patriot they are frontrunning Bitcoin adoption!

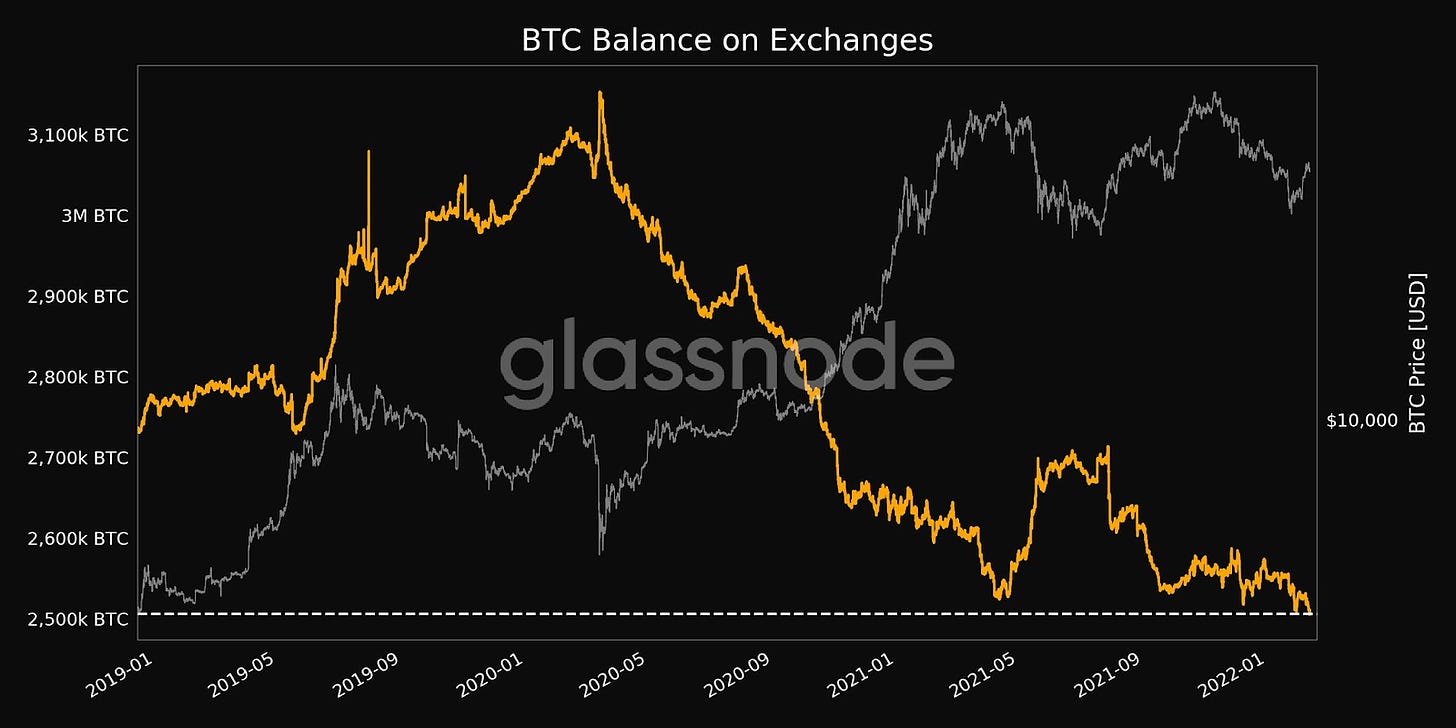

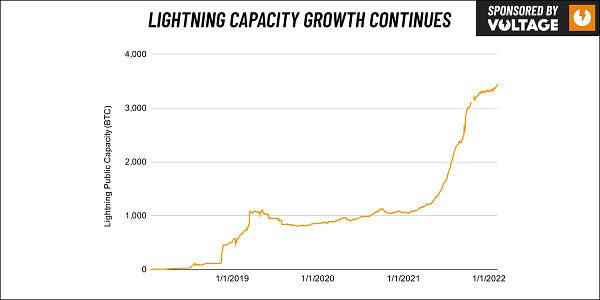

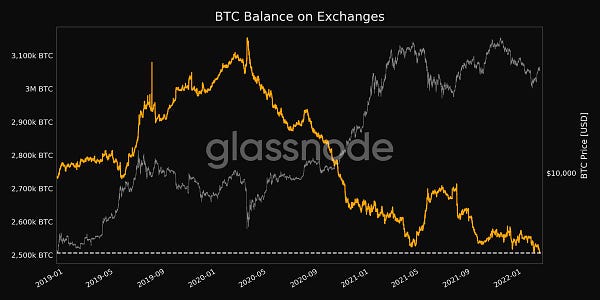

Bitcoin balance on exchanges just hit a 3-year low.

As Bitcoin value (price) is going up, less and less coins will be held on exchanges. Beside that, more and more users are aware that holding coins on exchanges are a big risk for a hack, exit scam or confiscation. Hopefully soon the decentralized exchanges (like Bisq) will have more users too.

New details arrived about Intel's upcoming Bitcoin mining chip.

I already wrote in my first newsletter about the upcoming Intel Bitcoin mining hardware. At that time we only know about their first client (GRIID) who will buy 25% of Intel’s ASIC building capacity till May 2025. In Intel’s latest press release I found out that not just GRIID, but Argo Blockchain and BLOCK (formerly known as Square) are their first customers too. Their ASIC miner will be released later this year.

“Intel Labs has dedicated decades of research into reliable cryptography, hashing techniques and ultra-low voltage circuits. We expect that our circuit innovations will deliver a blockchain accelerator that has over 1000x better performance per watt than mainstream GPUs for SHA-256 based mining. You will be able to learn more about our circuit innovations at the International Solid State Circuit Conference (ISSCC) this month.” By Raja M. Koduri (Senior Vice President of Intel)

Hopefully based on the quoted text, there will be a home user compatible version too.

Global Economic News

TL;DR

Global stocks have gained $3.1tn in market cap

In Germany positive yields are becoming the norm again

Meta loses another $33bn in market cap

Market Cap to GDP is at 191%

ECB balance sheet hit fresh ATH

The German power prices jumped (again)

Fitch Downgrades El Salvador to ‘CCC’

U.S. inflation jumps to 7.5% year over year

Macron: France to build up to 14 new nuclear reactors by 2035

Gold prices extended gains, bringing weekly gain to >3%

FED balance sheet hit fresh ATH

The German 2022 inflation forecast is >4%

Global stocks have gained $3.1tn in market cap

“Global stocks have gained $3.1tn in mkt cap this week on the back of strong results from comps across the econ & as US Dollar weakens vs Euro (-2.7%), making equities from non-dollar area, such as Europe, more valuable. Global stocks now worth $116tn, equal to 137% of global GDP.” by Holger Zschaepitz

In Germany positive yields are becoming the norm again

In Germany for a long time the 5 years and above yields are becoming positive again. Of course only “Nominal” yields only. The real ones are not!

Meta loses another $33bn in market cap

Meta loses another $33bn in market cap as EU leaders buck at threats to shutter Facebook & Instagram. Meta threatened to pull FB & Instagram from Europe if it is unable to keep transferring user data back to the US, amid negotiations to replace scrapped privacy pact. Personally hope that this falling there will continue and it will just die like Blockbuster. But for that to happen we need way more attraction to other decentralized social services. Time is not there yet.

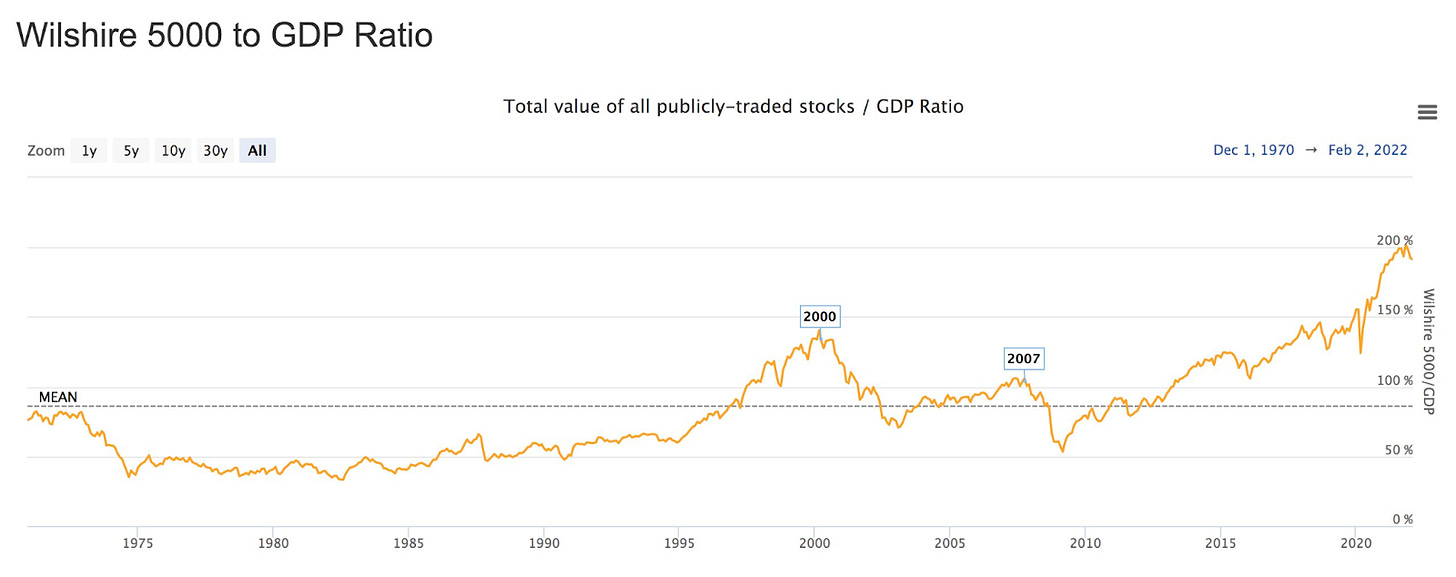

Market Cap to GDP is at 191%

“'Market Cap to GDP' is a measure of the total value of all publicly-traded stocks in a country, divided by that country's Gross Domestic Product. As you can see, the average is about 75% with a few spikes over 100% and some periods below 50%. Currently we are at 191%. Bubble.” by @Ben__Rickert

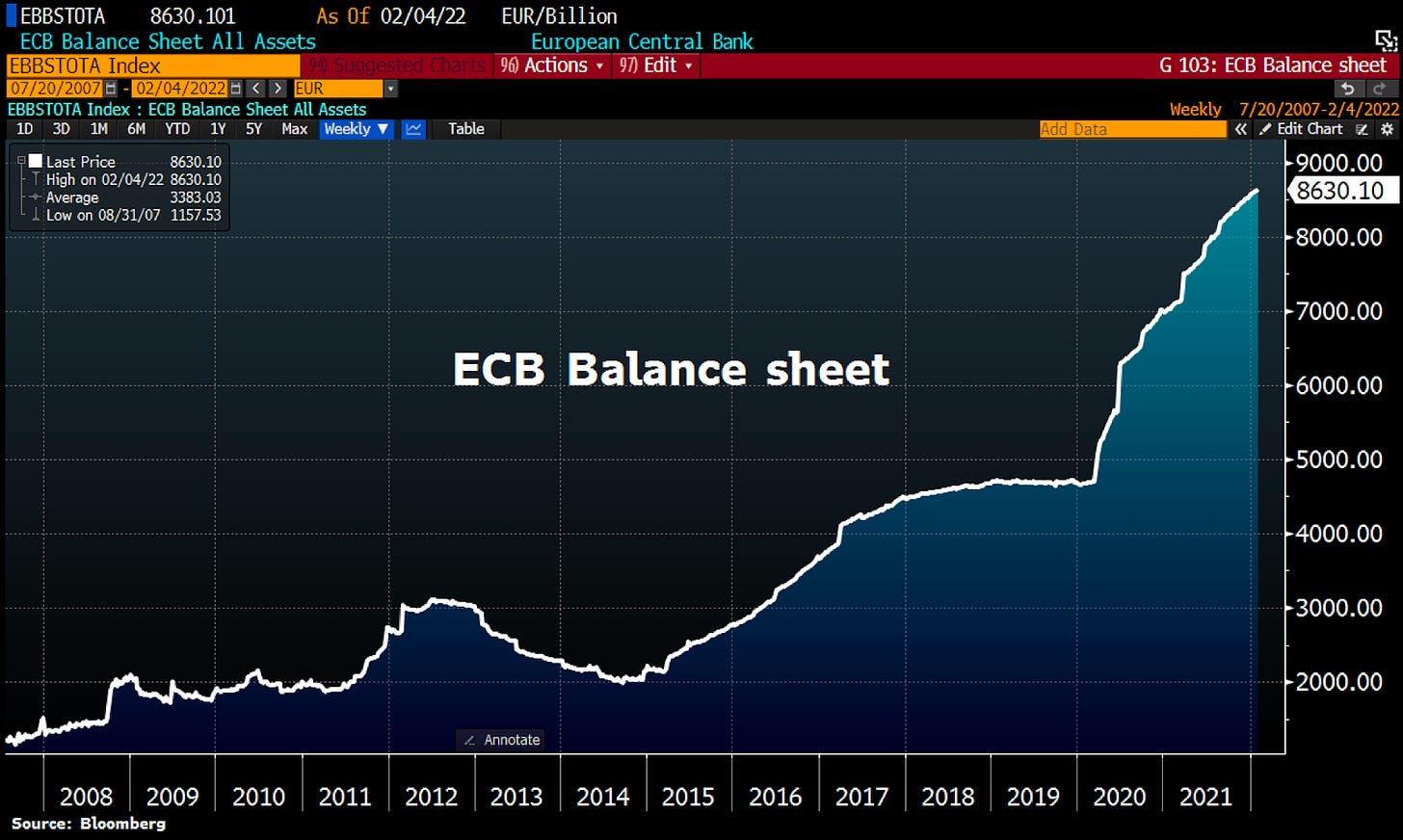

ECB balance sheet hit fresh ATH

“ECB balance sheet hit fresh ATH after last week's meeting as Lagarde keeps printing press rumbling regardless of rising inflation. Total assets rose by another €7.5bn to €8,630.1bn, equal to 81.8% of Eurozone GDP vs Fed's 37%, BoJ's 135%, BoE's 42%.” by Holger Zschaepitz

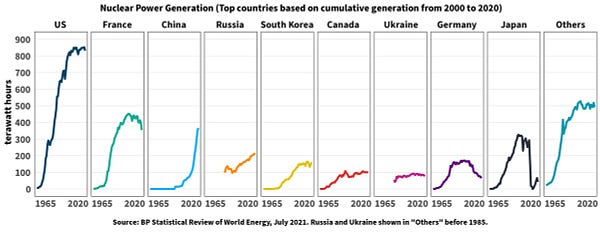

The German power prices jumped (again)

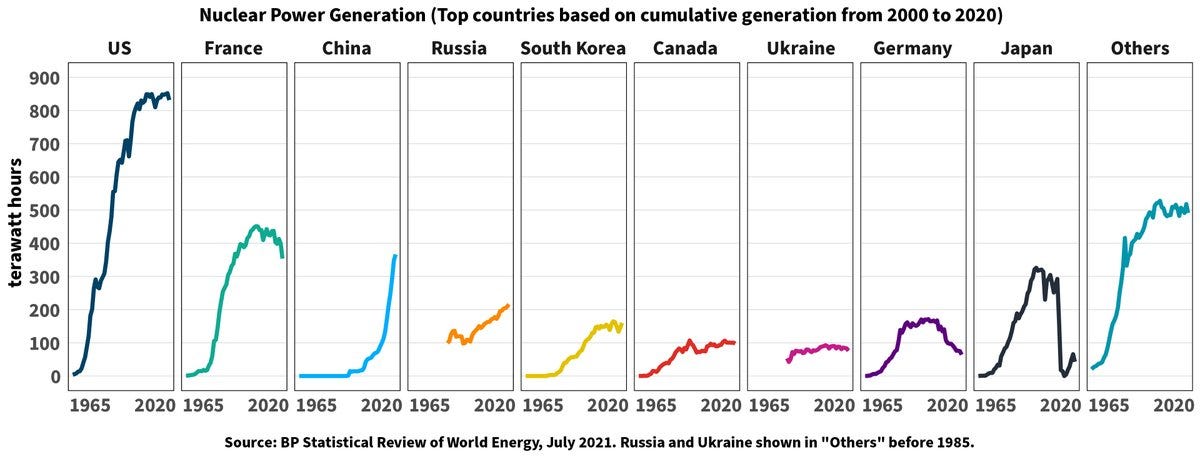

Germany is in big trouble because they will close their remaining last 3 nuclear reactors at the end of this year. These are giving more and more stress to their energy grid as they remain with only Natural Gas and renewable energy sources. Now as France cuts their nuclear forecast because with reactor outages even they have been forced to import sometimes electricity = the German energy prices jumped again. France was Europe’s biggest net exporter of power in the second half of last year, sending the equivalent of 10% of its demand abroad, according to industry consultant Enappsys Ltd. Morgan Stanley sees France a ‘meaningful likelihood’ of 2023 output cut. This means even worse news for Germany because they can’t rely on energy imports from their neighbor France. That’s why the German and other European power prices jumped.

Fitch Downgrades El Salvador to ‘CCC’

The ratings agency Fitch has downgraded El Salvador’s long term foreign currency issuer default rating (IDR) to ‘CCC’ from ‘B-’ just weeks before the country starts issuing its bitcoin bond. The hardcore Bitcoiners will say:”Cry harder b****”!

The whole situation is very funny because a few months ago the IMF declined the loan for El Salvador because El Salvador made Bitcoin a legal tender. In this response El Salvador will issue on March 15-20 week a Bitcoin backed bond solution with Blockstream to get the needed funds from individual investors. This made the IMF totally obsolete and all you needed was Bitcoin and some line of code. BTW President Bukele (aka El Hodlador) doesn’t give a sh*t about Fitch’s or other companies ratings because the investors are hungry for some valuable Bitcoin backed bonds. Don’t forget that in the world still at the most countries are offering negative yield bonds!

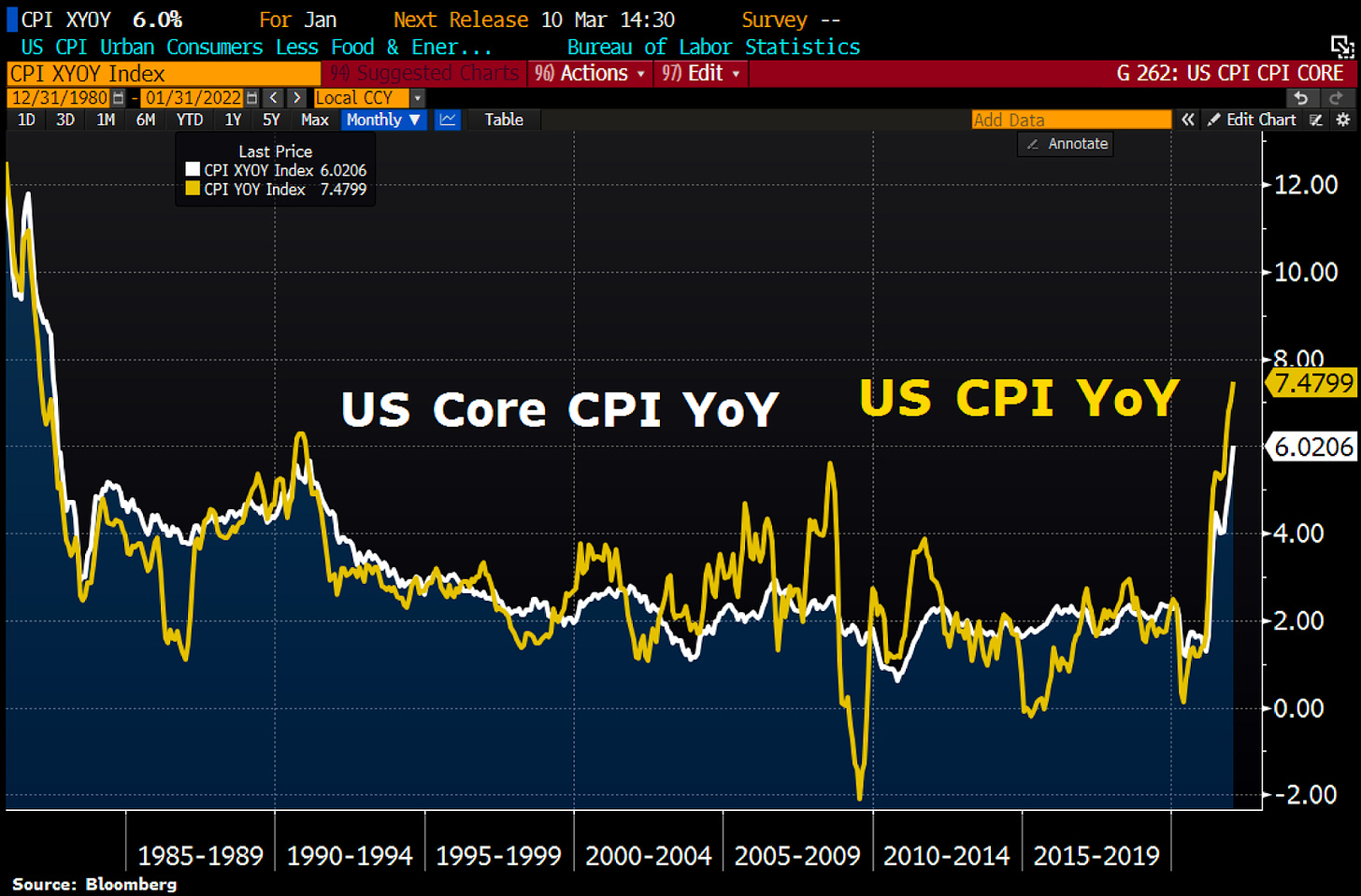

U.S. inflation jumps to 7.5% year over year

The US official inflation jumps to 7.5% year over year in January, a 40 year high and more than expected.

BUT! Here are some price changes since January 2021:Nat gas +81%; Oil +66%; Agricultural commodities +24%; Rent +13%; Used car prices +44%; Gasoline +36%; Cattle prices +20%; Lumber +15%; Coffee +92%; Hotel Prices +37%

This is a clown world, educate yourself or you will die broke.

Macron: France to build up to 14 new nuclear reactors by 2035

I totally understand Macron's decision because just this week's news was that even France needs to import electricity sometimes. These are weird times because the world is pushing Green socialism (EVs with government subsidies), but if you check the chart below it’s like some countries are running with these subsidies to a total blackout. Turning back a nuclear plant is not trivial. There is no easy way back! It’s time to wake up because without stable reliable electricity there is no modern economy and prosperity!

Gold prices extended gains, bringing weekly gain to >3%

“Gold prices extended gains, bringing weekly gain to >3%, touching the highest level since November as concern about geopolitical tensions over Ukraine helped spur demand for the metal as a haven asset. Bullion also helped by betting inflation to remain elevated. Gold gained” by Holger Zschaepitz

I really like Holger's statements about the actual financial news (that’s why I share them), but I think we need to examine Gold’s chart from a different angle too. While the market is only focusing on Gold mostly around market crashes or inflationary times, it’s worth to mention that in the past two years the price was between $1,700 and $2,000 (now around the middle $1,850). While the Gold is moving between that range, just in these 2 years the U.S inflation (CPI) went from near 0% to 7.5% and Bitcoin from $10,000 to $69,000. The Bitcoin price jumped nearly 7x, but today it’s newsworthy to say that Gold gained >3%. I think just these 2 years numbers show that Gold is no more a store of value.

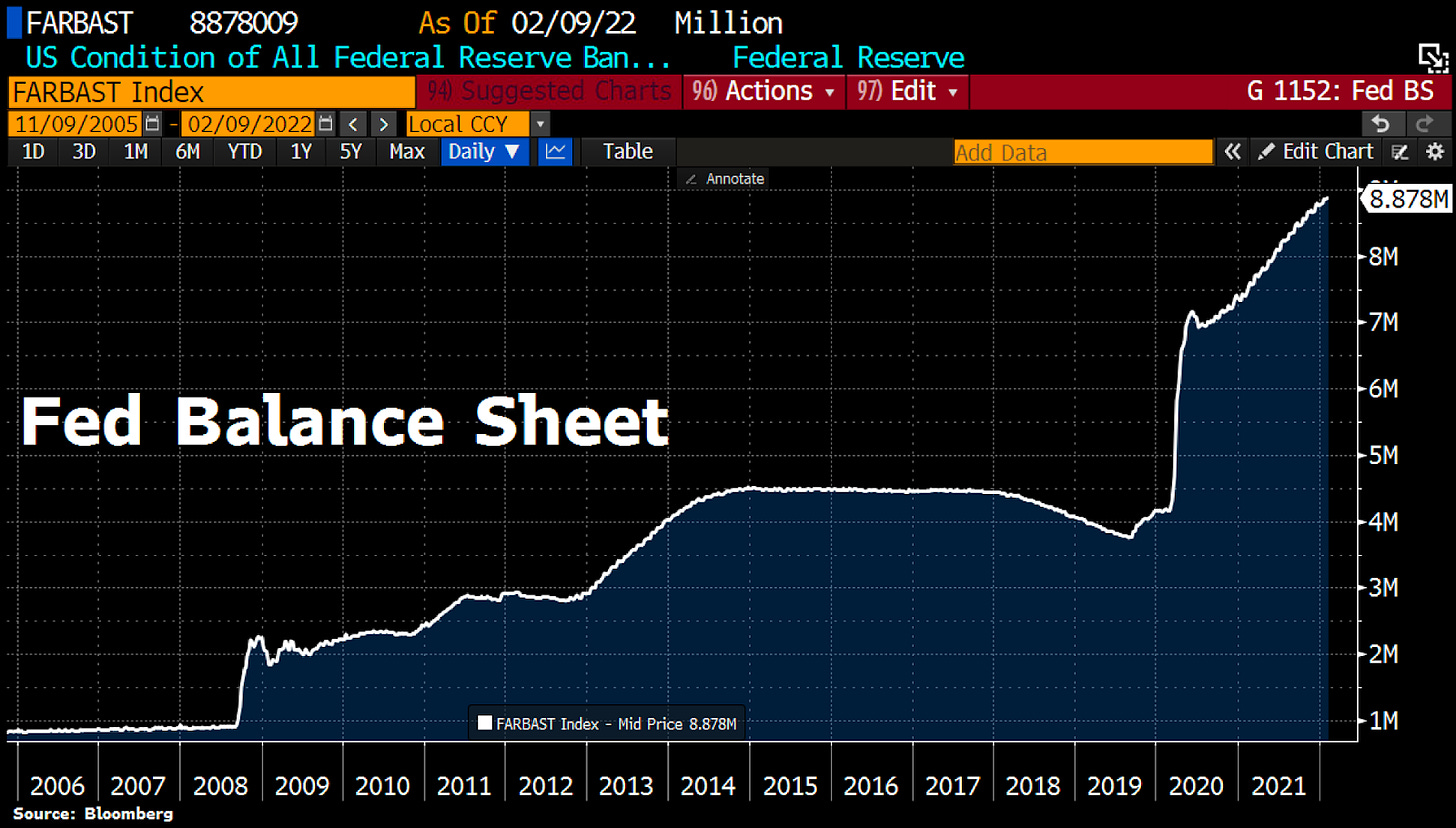

FED balance sheet hit fresh ATH

The FED balance sheet hit fresh ATH at $8,878bn, so the total assets rose by another $4.8bn despite raging inflation. Now the FED's balance sheet is now equal to 37% of US's GDP vs ECB's 81.8%, BoJ's 134.7%.

You probably can’t imagine how absurd this situation is. They [the FED members] are perfectly informed about the real inflation in the country, but still they are pumping their balance sheet, like between the two would have no connection. Of course they are afraid to stop because it will cause a recession, but printing like no tomorrow causes even bigger problems. They are simply stealing the average citizen’s wealth with it.

The German 2022 inflation forecast is >4%

The inflation forecasts in Germany keep rising. The nation was historically extremely sensitive to rising prices. The Ifo Institute has lifted German 2022 inflation forecast to >4% (0.8ppt above consensus) as German businesses plan on raising prices even further.

Bitcoin price speculations

These are just speculations, no investment advice!

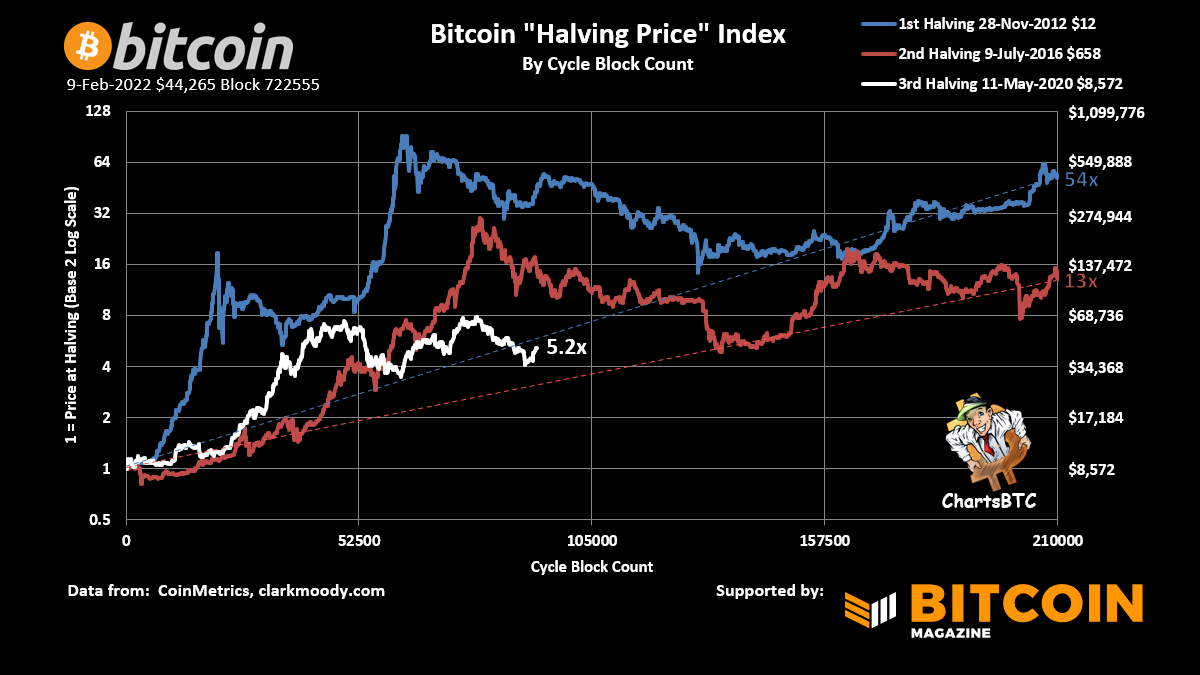

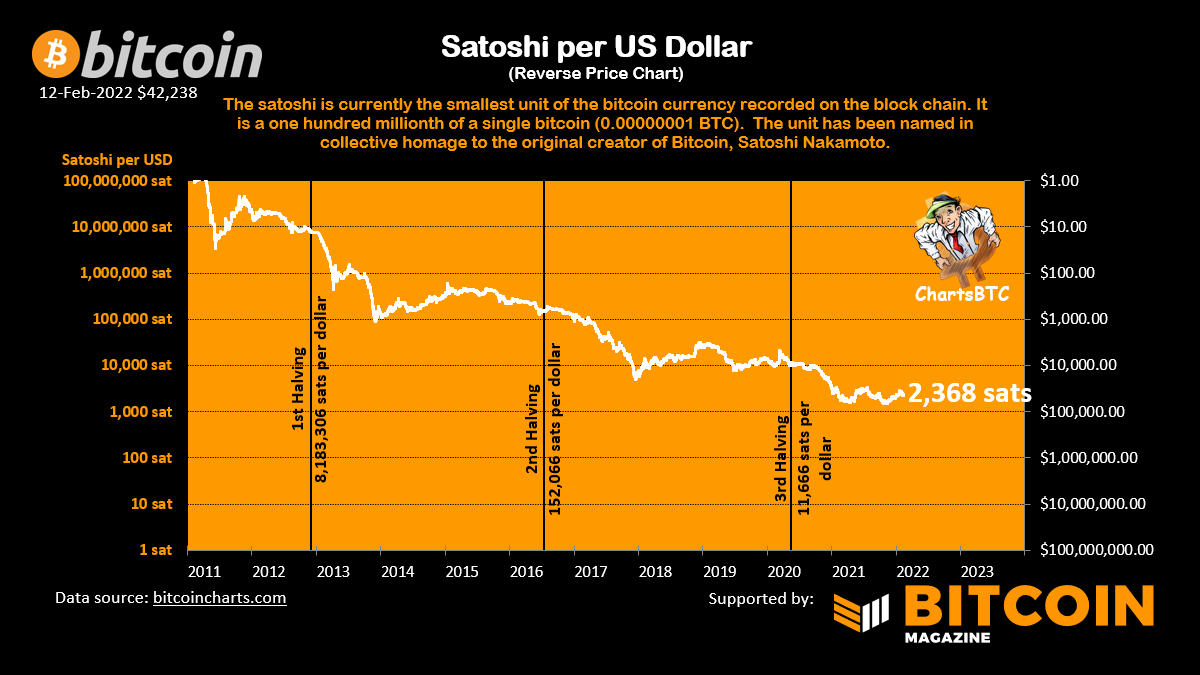

“Likely the macro bottom is in. Bitcoin Who could have known.” by Root

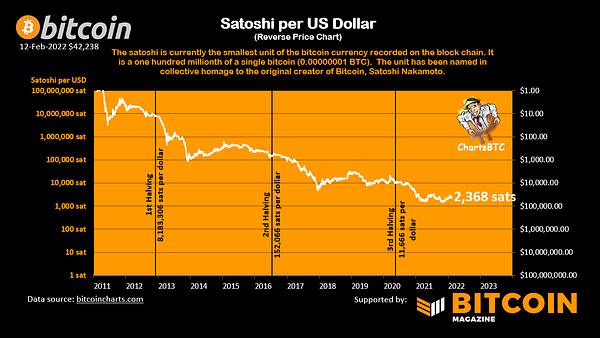

“Bitcoin halving index” by ChartsBTC

“Bitcoin sats per dollar” by ChartsBTC

Bitcoin Shorts

Funny Bitcoin short stories

“The largest bitcoin mining facility in the world only has 1% of the hashrate.” by Bitcoin is Saving

“Eleven years ago today, the price of bitcoin reached $1” by Documenting Bitcoin on 9th February 2022.

“Bitcoin and Lightning ⚡️ removes bank fees, card fees, currency exchange fees, merchant fees, account fees, withdrawal fees, deposit fees, maintenance fees, balance fees, money transfer fees, convenience fees, intermediary fees, and remittance fees for 7.9 billion people.” by Documenting Bitcoin

Sources:

https://interfax.com/newsroom/top-stories/73713/

https://www.wired.com/story/ukraine-russia-cryptocurrency-donations-hacktivism/

https://www.washingtonpost.com/national-security/2022/02/08/bitfinex-hack-bitcoin-arrests/

https://bitcoinmagazine.com/markets/russia-shares-plan-to-regulate-bitcoin-crypto

https://bitcoinmagazine.com/markets/bill-introduced-to-let-tennessee-buy-bitcoin

https://www.coindesk.com/business/2022/02/09/blackrock-planning-to-offer-crypto-trading-sources-say/