This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

French bank Société Générale offers Bitcoin trading and custody

MasterCard offers help for banks in Bitcoin trading and handling

Bitcoin Makes its entry into the Guinness World Records

Bitcoin mining efficiency increased by 23% YoY

German bank N26 launches Bitcoin trading

French bank Société Générale offers Bitcoin trading and custody

French banking giant, Societe Generale’s crypto division, SG Forge, is the latest firm to get regulatory approval from the AMF (Autorité des Marchés Financiers). According to AMF’s website, SG Forge is authorized to offer buying, selling, trading, and custody of Bitcoin and shitcoins from September 27th.

As always: Not your keys, not your coins! Weekly more and more banks are going to offer services for your most precious wealth. Don’t let them get your Bitcoin because one day maybe you won’t get it back!

MasterCard offers help for banks in Bitcoin trading and handling

According to CNBC, Mastercard will work with Paxos to “bridge” the gap between banks and will manage the security and regulatory compliance, two big reasons many banks have stated for avoiding bitcoin and shitcoins.

“There’s a lot of consumers out there that are really interested in this, and intrigued by crypto, but would feel a lot more confident if those services were offered by their financial institutions,” said Jorn Lambert, Mastercard’s chief digital officer.

Lambert told CNBC that despite the bear market, there is still a lot of demand for the asset class. “It would be shortsighted to think that a little bit of a crypto winter heralds the end of it -- we don’t see that,” he said. Also, 60% of respondents to a recent poll said that they would prefer to get exposure to bitcoin and cryptocurrency through their bank. “It’s a little scary to some people still,” he stated.

Mastercard said that its role in this is to ‘keep banks on the right side of regulation by following crypto compliance rules, verifying transactions and providing anti-money-laundering and identity monitoring services.’

Mastercard’s chief digital officer stated “It’s hard to believe that the crypto industry will truly go mainstream without embracing the financial industry as we know it.”

MasterCard is right, most people will use these banking services, but YOUR job (yeah, you the reader) to educate your friends and families, to never ever store their Bitcoin wealth in banks.

Bitcoin Makes its entry into the Guinness World Records

Bitcoin is the largest and first cryptocurrency in the world. It paved the way for thousands of shitcoins that followed suit. The creation of bitcoin is the most remarkable one.

Bitcoin earns the title from Guinness World Records as the first and most valuable cryptocurrency in the world.

“The Bitcoin network is solving the double spend problem with a “trustless” mechanism that does not require any third-party to verify transactions; and it achieves that with validators.”

El Salvador also made its entry into the books as the first country to make BTC a legal tender.

Bitcoin mining efficiency increased by 23% YoY

The Bitcoin Mining Council (BMC), a voluntary global forum of Bitcoin mining companies and other companies in the Bitcoin industry, announced the findings of its third quarter 2022 (“Q3”) survey focused on three metrics: electricity consumption, technological efficiency and sustainable power mix.

“In Q3 2022, Bitcoin mining efficiency increased 23% YoY, and the sustainable power mix was 59.4%, above 50% for the 6th quarter in a row. The network was 73% more secure YoY, only using 41% more energy, and is now 99% of all crypto hashing power.” by Michael Saylor

More details here.

German bank N26 launches Bitcoin trading

A $9 billion European digital bank N26 announced that it is launching a Bitcoin and shitcoin trading service for its customers. Notably, Austria is set to be the first market for the said launch.

The Germany-based bank will make use of crypto exchange Bitpanda’s trading and custody platform to give bank’s customers access to Bitcoin and other shitcoins. The service, called N26 Crypto, is set to become available to the bank′s Austrian clients in the coming weeks.

“Our users are extremely interested in crypto. That interest remains super high, even in a bear market.(...) We want to take a pretty long-term view around this. It’s not like we’re trying to time the launch on how the market is doing.” said by Gilles BianRosa, N26′s Chief Product Officer

However, users looking to leverage N26’s service should note that the bank does not support custodial wallet transfers, meaning users will not be able to move their bitcoin off of the platform.

Global Economic News

TL;DR

The German Producer Prices and Consumer Prices are on fresh ATH while the economy is sinking

The Swiss Central Bank and the Credit Suisse problems are emerging

The US personal savings rate and Bank deposits have collapsed to 2007 levels

The ECB printing press resumed its “hard work”

Another signal of the inevitable US housing market crash

The Russian economy is rising steeply

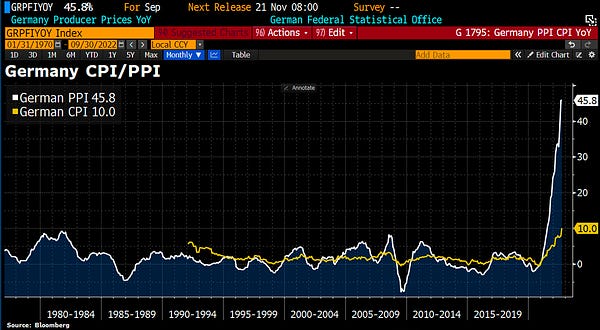

The German Producer Prices and Consumer Prices are on fresh ATH while the economy is sinking

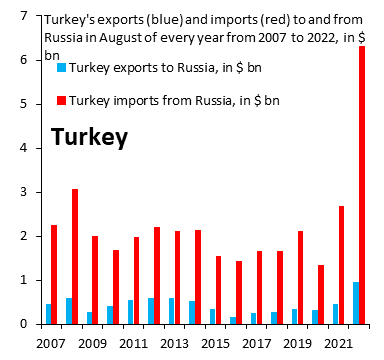

“Producer Prices Inflation hit another fresh record. Sep PPI rose by 2.3% MoM and by an eye-watering 45.8% YoY, mainly driven by energy prices, putting pressure on ECB to keep rates raising.

German Consumer Prices (CPI) are likely to rise further after Producer Prices (PPI) remain at 45.8% in Sep, the strongest increase since 1949.” by Holger Zschaepitz, journalist at Welt

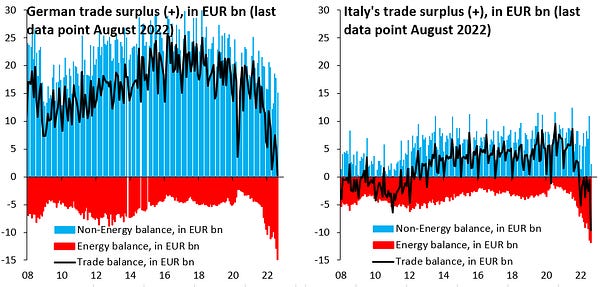

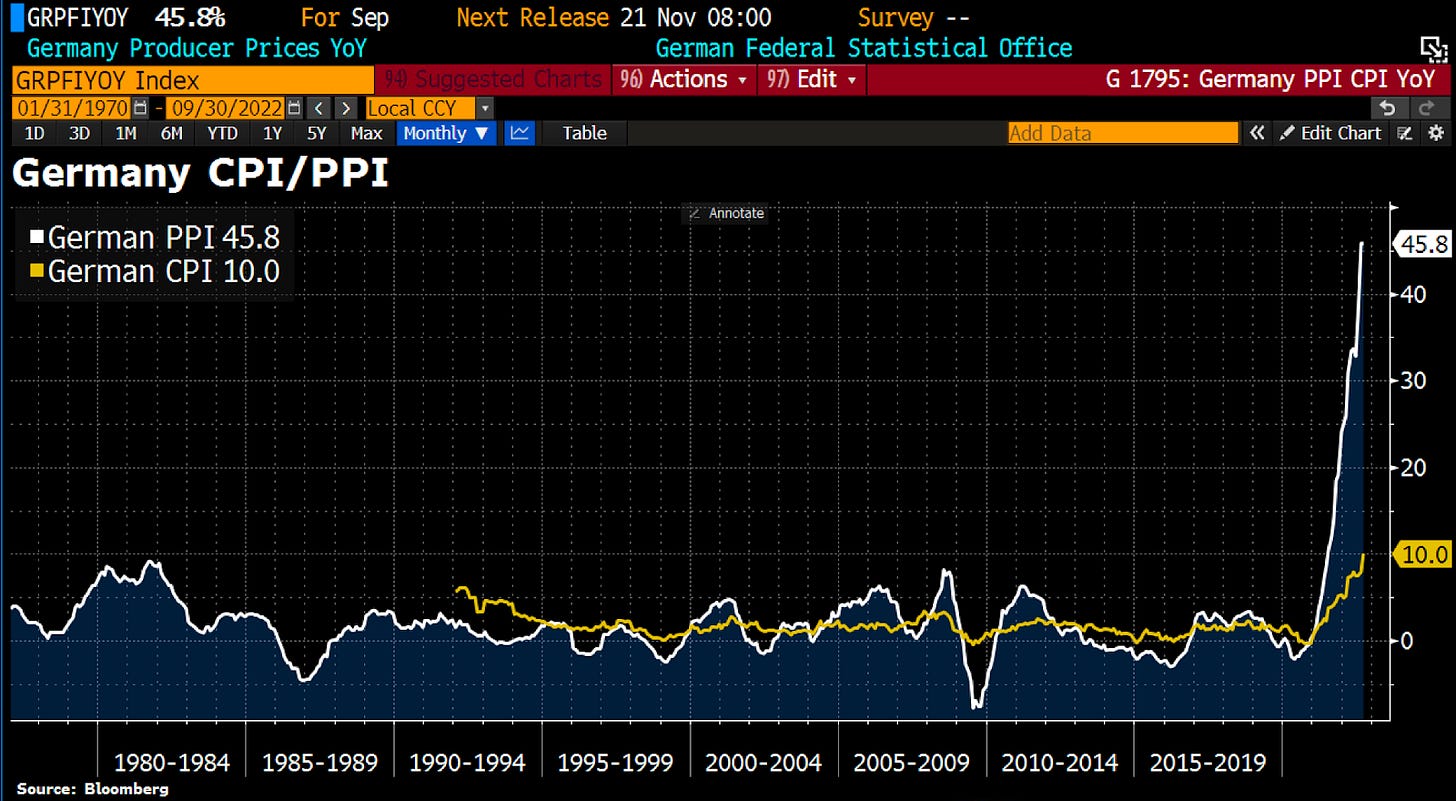

“Germany used to have a huge trade surplus that many thought of as structural. That's over. The trade surplus has fallen to zero (lhs). The same basic thing is going on for Italy (rhs), only that the trade surplus going into 2022 was much smaller, so now there's a big deficit…” by Robin Brooks, Chief Economist at IIF

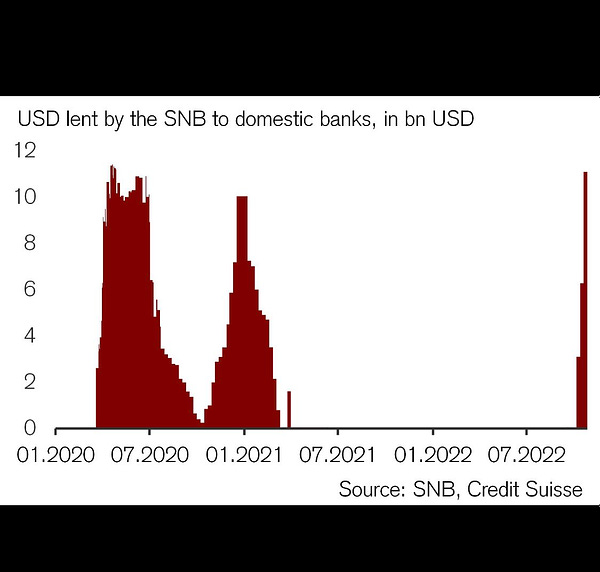

The Swiss Central Bank and the Credit Suisse problems are emerging

The $1.5 trillion-asset manager Credit Suisse reportedly is exploring finance restructuring options.

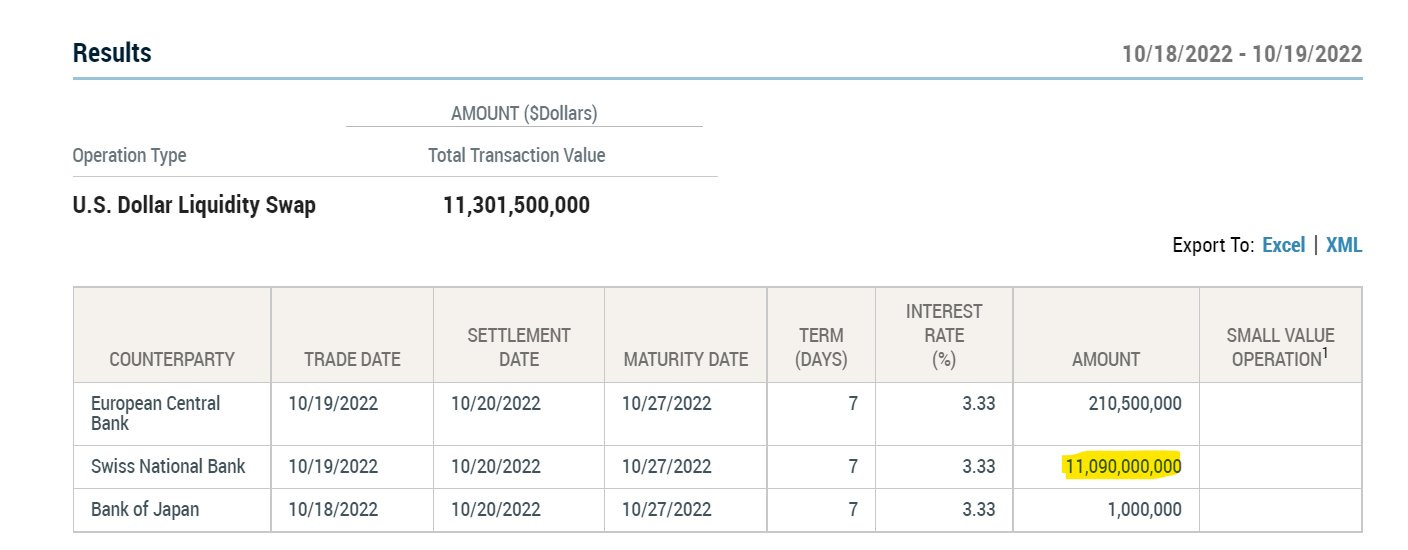

Meanwhile another $11B+ USD "liquidity swap" to the Swiss with smaller swaps to ECB and now Bank of Japan from the FED without any congressional approved.

“Swiss National Bank (SNB) has lent $11.1bn for one week to 17 domestic banks… financed by an increase in swap lines with FED from $6bn to $11bn… the need for liquidity seems to be increasing…” by Wall Street Silver

The global economic meltdown seems to have started or just some illegal money laundering is going behind the back of the congress. I don’t think the latter one is happening.

The US personal savings rate and Bank deposits have collapsed to 2007 levels

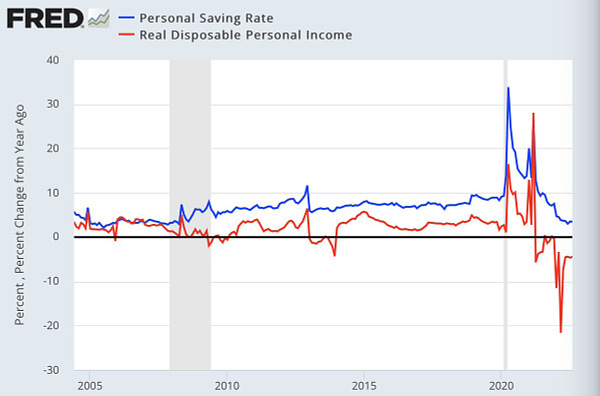

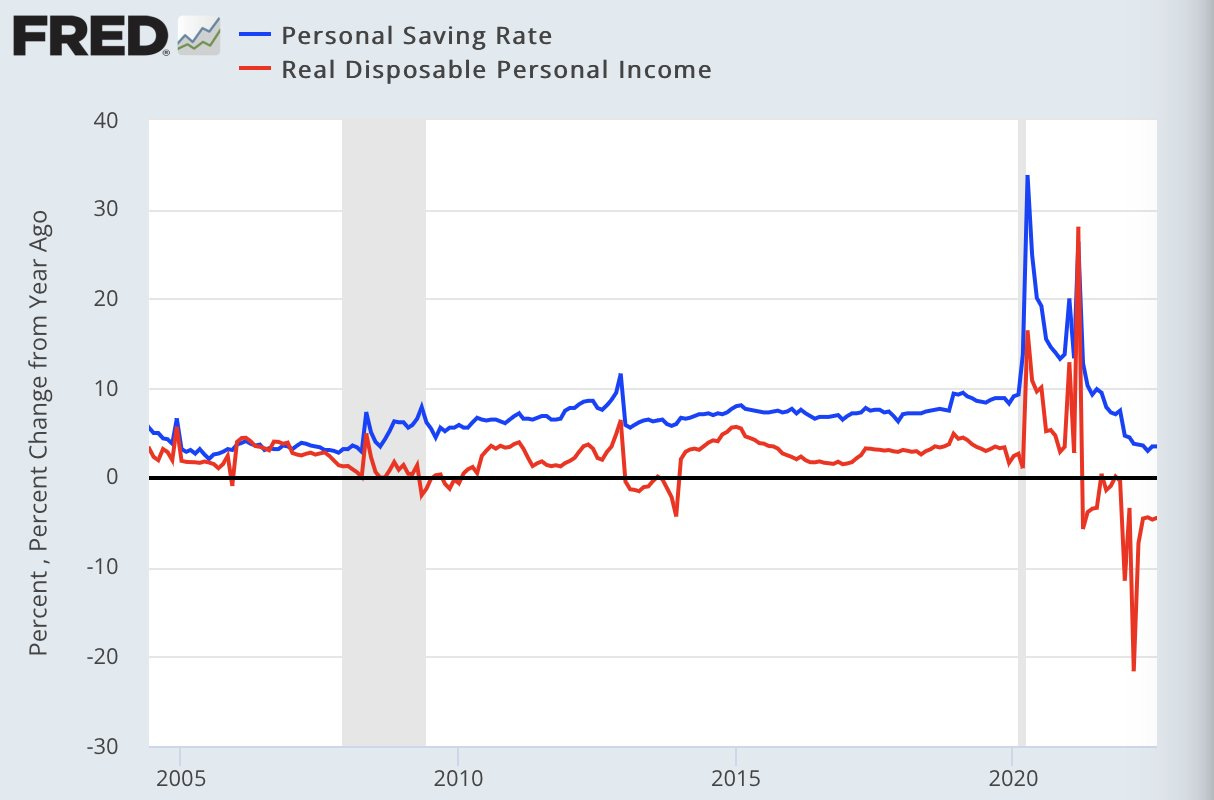

“The personal savings rate has collapsed to 2007 levels as stimulus savings have evaporated.

Real disposable personal income has run negative since April 2021.

Looks to me the consumer is not strong but increasingly at the edge of sustainability.

This needs to change fast.” by Sven Henrich, Founder of NorthmanTrader

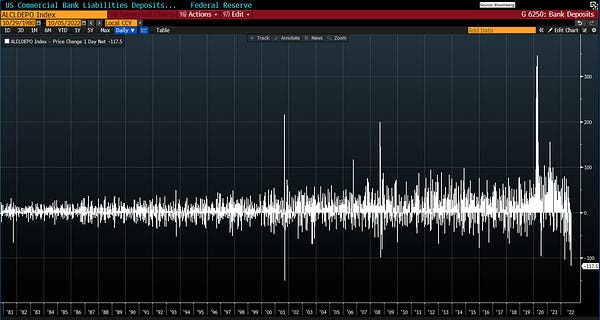

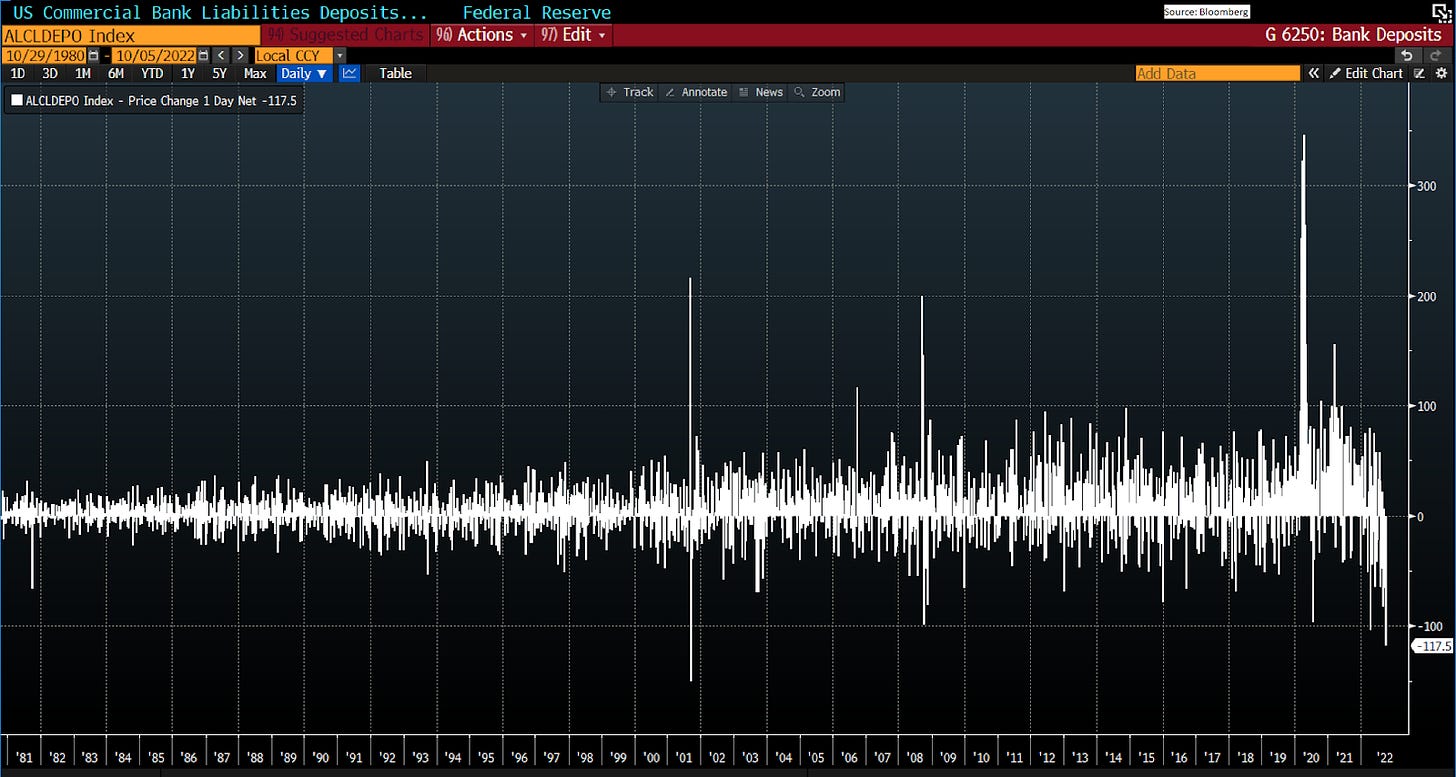

“Bank deposits down another 117b dollars last week and 325b in the last 6 weeks. The only week in the last 40 years greater than last week was the week after 9/11. M2 is falling quickly.” by Jordi Visser, President and CIO of Weiss Multi-Strategy

The ECB printing press resumed its “hard work”

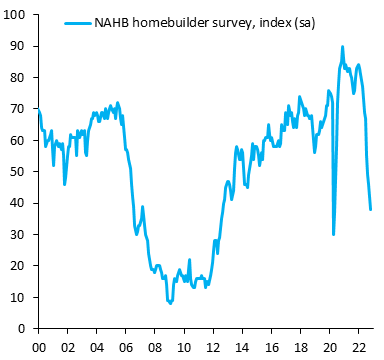

“Global recession is coming. We've flagged for a while that the US housing market is already in deep recession. Today's NAHB survey of home builders underscores just how bad things are. The index fell to 38, which is almost at the COVID low of 30 in April 2020. Things are bad…” by Robin Brooks, Chief Economist at IIF

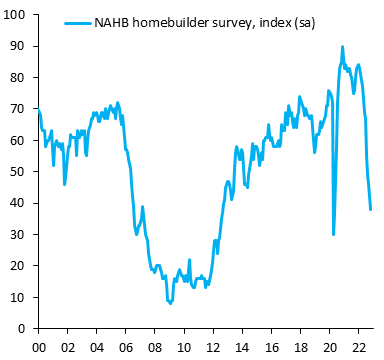

Another signal of the inevitable US housing market crash

“Global recession is coming. We've flagged for a while that the US housing market is already in deep recession. Today's NAHB survey of home builders underscores just how bad things are. The index fell to 38, which is almost at the COVID low of 30 in April 2020. Things are bad…” by Robin Brooks, Chief Economist at IIF

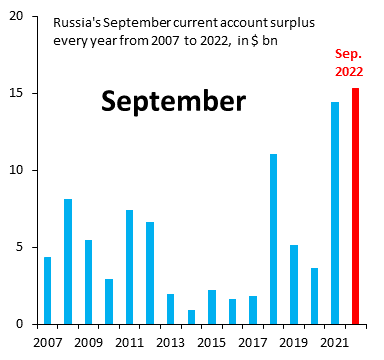

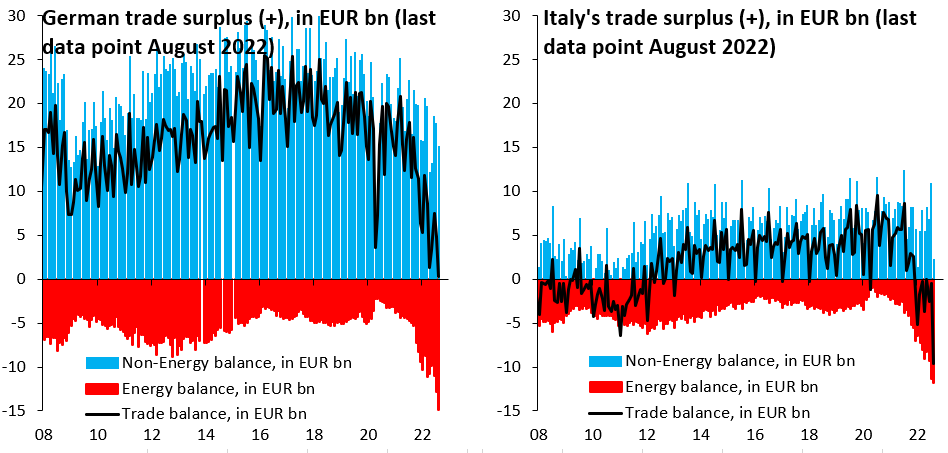

The Russian economy is rising steeply

“So much misinformation has been spread about Russia's current account surpluses, the most egregious of which is that Putin can't spend those Dollars. (...)” by Robin Brooks, Chief Economist at IIF

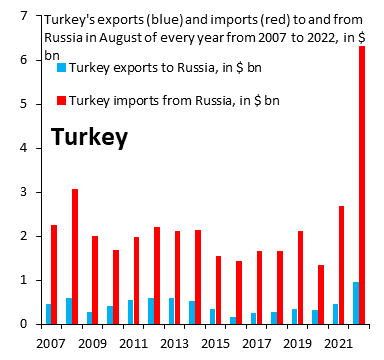

“Turkey's exports to Russia are up massively. The total value of exports in August 2022 (blue) was 110% above August 2021 and above any previous peak. Markets are focused on the changing trade relationship between Turkey and Russia, with much of that focus on exports, not imports.” by Robin Brooks, Chief Economist at IIF

“China was supposed to publish September trade data days ago, but this release was delayed indefinitely alongside Q3 GDP. Sensitivity of China's trade data has gone up lots, because they show a huge rise in exports to Russia, with August exports near their all-time high (blue)...” by Robin Brooks, Chief Economist at IIF

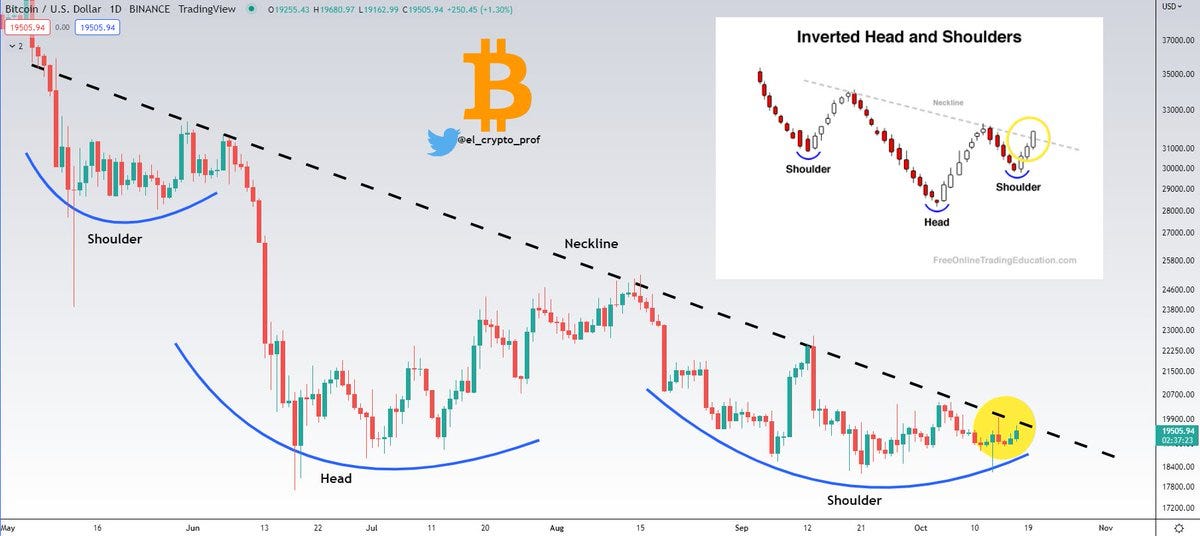

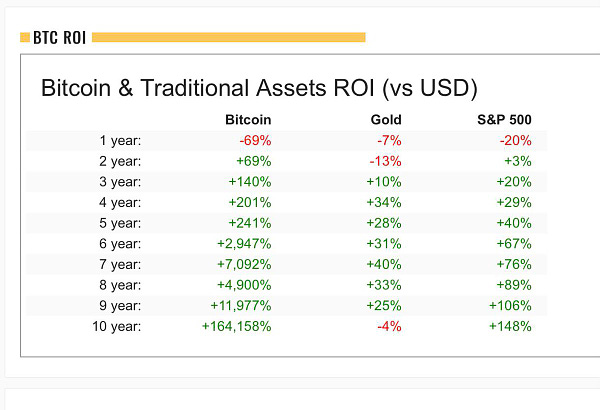

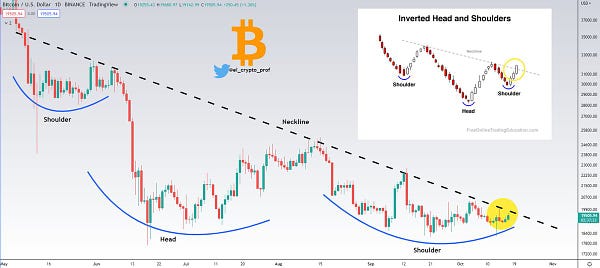

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

“Bitcoin is the first properly engineered monetary system.” tweet by Michael Saylor

“When Bitcoin is down 69% you might be mistaken in thinking that *every* Bitcoiner in the world is dramatically underwater. But the truth is that every purchase has its own individualized performance, and those who have been buying for years have tons of high-performing buys.” by @chowcollection

Former CEO of Morgan Stanley, "I own Bitcoin". (video)

Kanye West spotted wearing a Satoshi Nakamoto hat after being de-banked by JPMorgan (photo)

Fidelity Digital Assets: Bitcoin "has no counterparty risk and has a supply schedule that cannot be changed."

“Can we all agree?“ by @moon_dot_gov

“You are not prepared… Bitcoin visual by @w_s_bitcoin” (video)

Michael Saylor Keynote Speech @ The 2022 Atlas Society Gala (video)

Giant Bitcoin sign spotted in Milan, Italy

Bloomberg Intelligence: "Bitcoin is showing signs of bottoming and divergent strength"

“Marmalade sold for 125 Bitcoin 12 years ago” by @pete_rizzo_

The number of addresses with over .01 Bitcoin hit a new ATH.

Bitcoin volatility is now lower than the Nasdaq and S&P 500 for the first time since 2020.

The Bitcoin white paper spotted on the streets of Scotland

Suggestions

Interesting articles to read

Liz Truss Is Not To Blame For UK's Market Turmoil. The Bank Of England Is

Inflation-Driven Social Security Increase Could Lead To More Inflation

The Middle Class Is Dying! 50% Of All American Workers Made Less Than $3,133 A Month Last Year

Sources:

https://bitcoinmagazine.com/business/mastercard-to-help-banks-offer-bitcoin-and-crypto-trading

https://watcher.guru/news/bitcoin-makes-its-entry-into-the-guinness-world-records

https://watcher.guru/news/germanys-9b-worth-n26-bank-to-launch-bitcoin-ethereum-trading

https://bitcoinmagazine.com/business/european-digital-bank-n26-enables-bitcoin-trading