This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

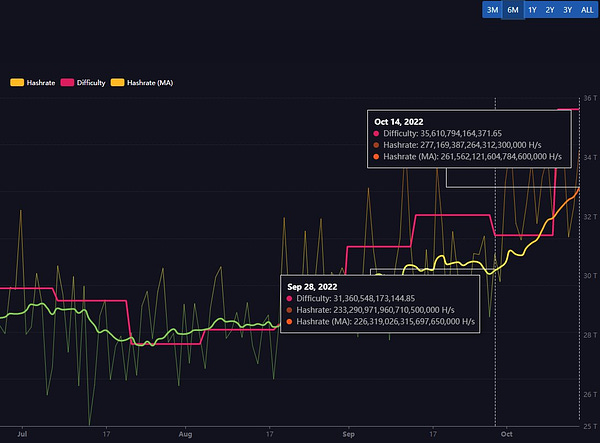

Bitcoin mining difficulty reaches 35.61 trillion a new ATH

Bitcoin Ekasi opens Financial Education Center in South Africa

Google to accept Bitcoin for cloud services

Bitcoin to Come to America’s Oldest Bank, BNY Mellon

Nasdaq Dubai welcomes 21Shares’ Bitcoin ETP

The Bank of Canada: 13% of Canadians hold Bitcoin

Bitcoin mining difficulty reaches 35.61 trillion a new ATH

The latest adjustment that took place on Monday, Bitcoin mining difficulty surpassed the 35.61 trillion mark to create a new record high.

Per data from BTC.com, the latest elevation is the largest since 13 May 2021. The number in August last year, however, stood quite close at 13.24%.

The higher difficulty, on its part, implies an increasing cost of production per unit of Bitcoin mined because more hash power competition is entering the network. This is occurring at a time when miner revenues are already stressed due to the sluggish price of the asset. Theoretically, it should create increased income stress on the mining industry.

“On the 14-day MA Bitcoin network hashrate has increased ~35.2Eh in the last two weeks. That's like 19,340 Whatsminer M50S 130Th ASICs going online every 24-hours for two weeks straight. It takes nearly 1GW of power to run that many ASICs.” by @econalchemist

Who do you think or what kind of entity has 1GW of power to start/upgrade mining in just 2 weeks in a bear market? I’m really interested in your opinion either here in a comment or in our Telegram group chat.

Bitcoin Ekasi opens Financial Education Center in South Africa

According to a press release, a South African circular Bitcoin economy has launched the Bitcoin Ekasi Center to educate local youth, business owners, and entrepreneurs about money management and Bitcoin. The initiative was founded by Hermann Vivier.

Ekasi helped and educated staff for ten local businesses to begin accepting Bitcoin within the area. The education center hopes to double its enrollment in the near future and has already signed up 20 youths in just one week. Additionally, from Tuesday through Friday in the mornings and all day on Saturday, the center is available to the entire community.

Yusuf Nessary, co-founder and director of Built With Bitcoin, states that Bitcoin is an opportunity for a better life. “That all begins with education, and we are delighted to support Bitcoin Ekasi in its mission to enable a local community to take control of its financial future,” he added.

Younger attendees will concentrate more on developing their fundamental math and English skills, while older students will concentrate on answering three questions:

What is Bitcoin? How does it work? Why is it important?

Google to accept Bitcoin for cloud services

Google will start accepting bitcoin and shitcoins as payment for its cloud services early next year. They announced on Tuesday that it had formed a partnership with the largest cryptocurrency exchange in the U.S., Coinbase, to enable the new payment method.

“Powered by Coinbase Commerce — which enables merchants globally to accept cryptocurrency payments in a decentralized way — the new payments experience will benefit Google Cloud’s customers and partners by increasing the optionality of payments for Google Cloud services,” Google said in a statement.

In addition, Google will use Coinbase Prime, the exchange’s institutional cryptocurrency investing and custody platform. Although it is not yet clear what specific services offered by the platform Google will leverage, the company hinted at custody and reporting services in its statement.

The only question is that will this be a BitPay solution (instant convert to FIAT) or they will HODL? I think it will depend on how fast the value of USD against Bitcoin will be deteriorating.

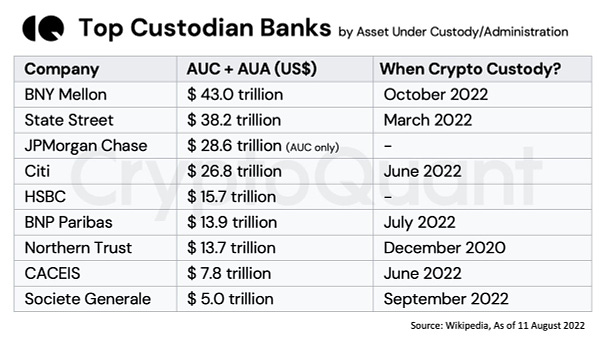

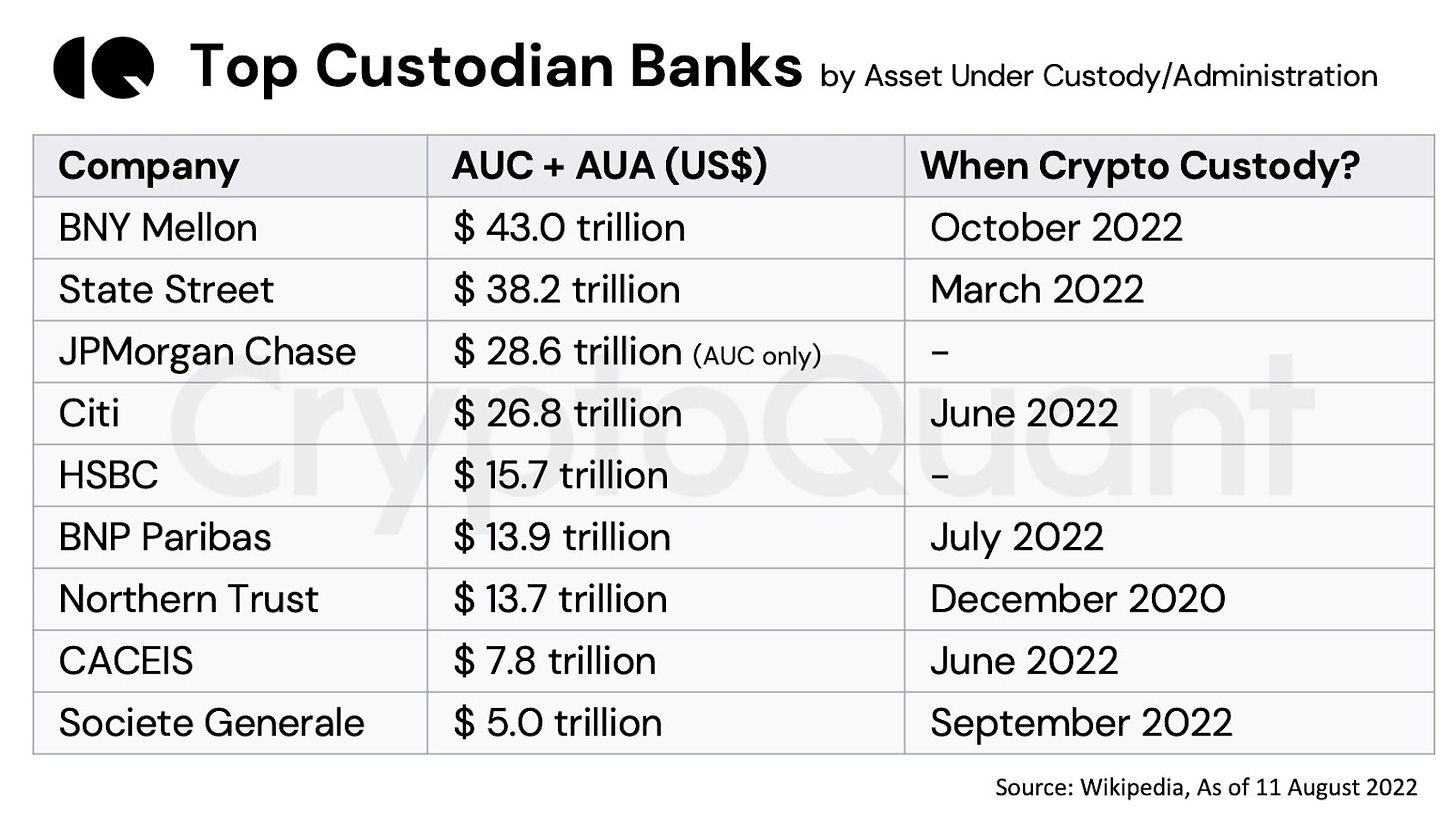

Bitcoin to Come to America’s Oldest Bank, BNY Mellon

With the title above an article on WSJ: Bank of New York Mellon Corp., the nation’s oldest bank, is making the leap into the market for bitcoin, a sign of broader acceptance of the once-fringe digital currency.

The custody bank said Thursday it will hold, transfer and issue bitcoin and other shitcoins on behalf of its asset-management clients. Custodians like BNY Mellon keep track of money managers’ assets—whether they are physical things like real estate or cash housed in an account with another bank—storing some themselves while attesting to the existence of others.

“Digital assets are becoming part of the mainstream,” said Roman Regelman, chief executive of BNY Mellon’s asset-servicing and digital businesses.

“As clients evolve, you need to evolve with them,” said Glenn Schorr, an analyst with Evercore ISI. “Who are you to say, `No one will use crypto’?”

“We have seen a surge in interest and demand from clients, and it is only natural that we bring our legacy of trust and innovation to be a first-mover in bridging the gap between traditional and digital assets,” said Todd Gibbons, BNY Mellon’s chief executive.

BNY Mellon’s announcement marks the first time one of the big custody banks has unveiled a road map for treating digital currencies as any other asset. And the bank hasn’t put limits on the kinds of digital assets it will allow clients to store there. BNY Mellon intends to begin offering these capabilities later this year.

“Bitcoin market cap is just 0.25% of top custodian banks' holdings.And most of them just entered the crypto custody space this year.” by Ki Young Ju, CEO of CryptoQuant

Don’t forget: Not your keys, Not your coins! Never ever store your hard earned Bitcoin at a custodial service like a Bank. Instead start to educate yourself about Cold Storage solutions!

Nasdaq Dubai welcomes 21Shares’ Bitcoin ETP

In a recent announcement, it was brought to light that 21Shares was rolling out the first physically-backed Bitcoin ETP in the Middle East. The firm was listing 21Shares Bitcoin ETP on Nasdaq Dubai under the ticker ABTC.

“Our partners Nasdaq Dubai and Dubai Financial Market share our vision to provide investors with access to new and exciting asset classes. 21Shares will continue to support the Middle East’s ambitions to become a global crypto hub.” by Hany Rashwan, CEO and co-founder of 21Shares

“We are pleased that 21Shares has selected Nasdaq Dubai to list its ETP. This is another testament to Dubai’s open, progressive, and innovation-first approach. Streamlining investors’ access to diversified asset classes is a key pillar in Nasdaq Dubai’s endeavor to attract further investments and stimulate active engagement from various market participants.” by Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market

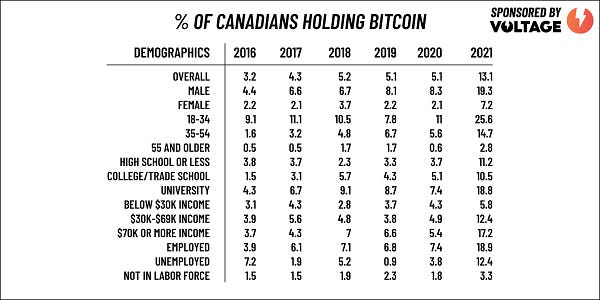

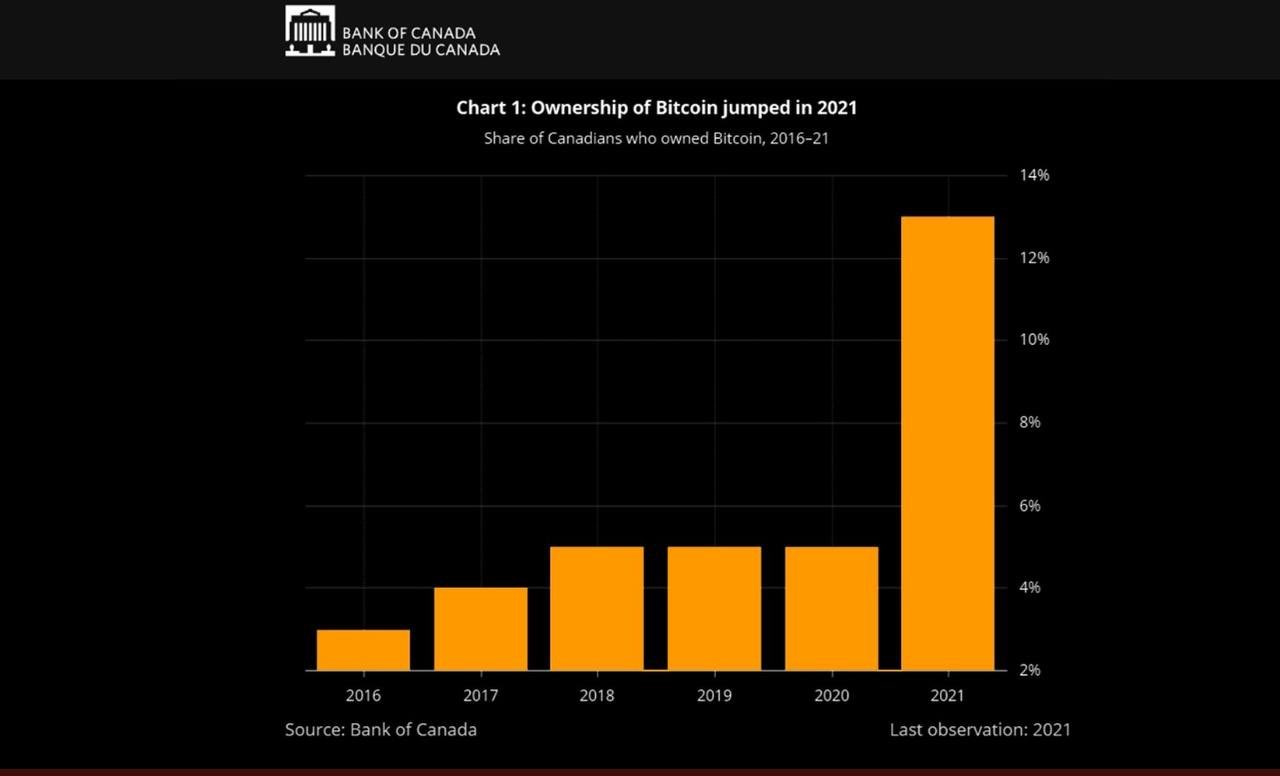

The Bank of Canada: 13% of Canadians hold Bitcoin

“The Bank of Canada just released their Bitcoin ownership survey results, and the numbers are incredible.

13% of Canadians now hold Bitcoin, and over 25% of Canadians between 18 and 34 years old.” by Kevin Rooke

Global Economic News

TL;DR

Bank of England doubles its temporary QE bond purchases

Germany is heading for an inflationary recession with a housing collapse

The US Inflation is higher than expected despite the FED aggressive hike cycle

The Eurozone trade deficit shows how big the problem really is

The Global Bond market is close to a collapse?

Does Switzerland have financial problems?

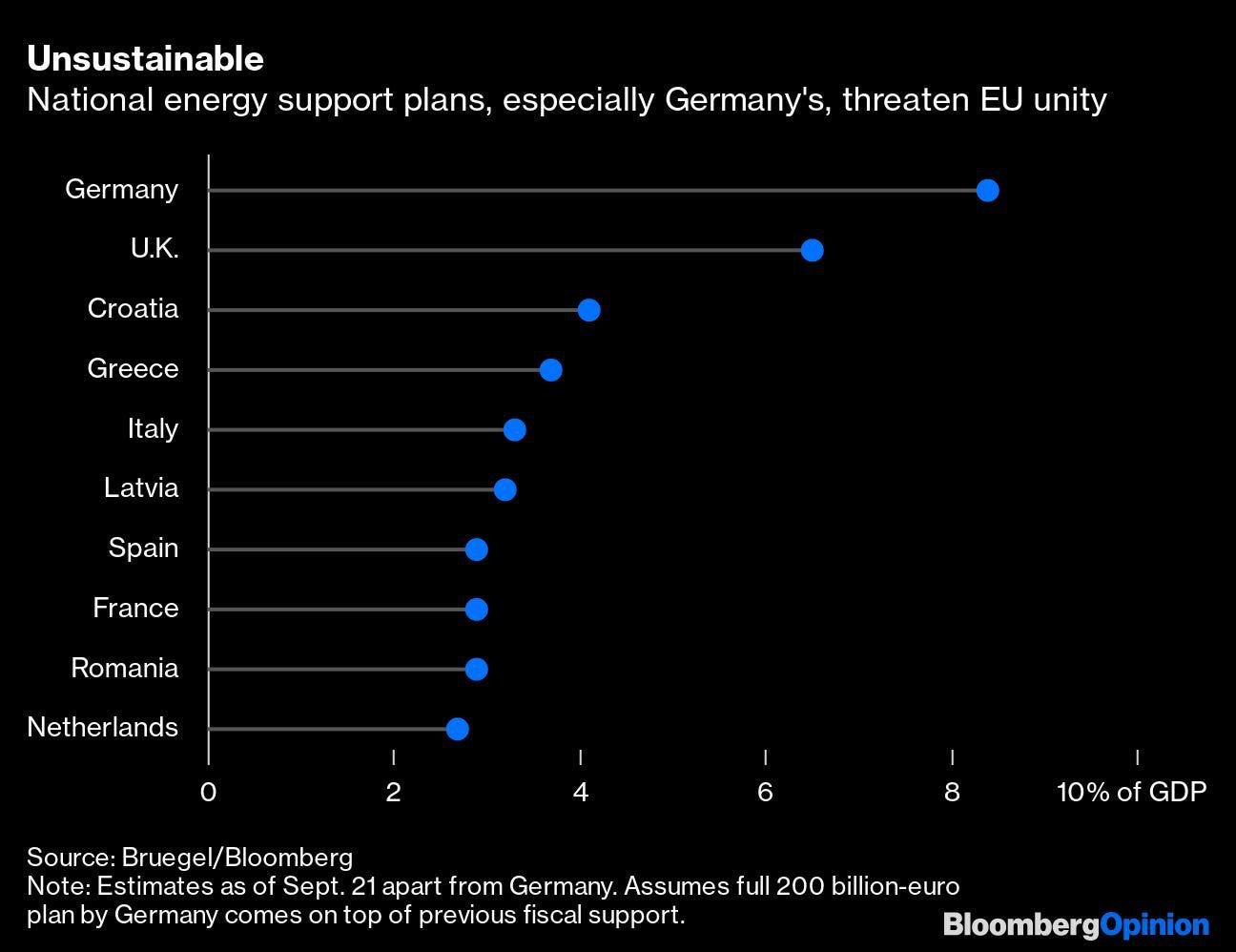

The EU National energy support plans is unsustainable

Russia is already going out of recession?

Bank of England doubles its temporary QE bond purchases

The United Kingdom markets over the last week witnessed nothing but chaos. Pension funds had to provide billions of pounds in security as the price of government bonds plummeted. Investment managers were compelled to sell everything they could in order to raise money, even further government bonds in certain situations. As a result, yields increased even further, paving the way for a new round of collateral calls. The pressure on the Bank of England soon started building.

The Bank of England stated that it would acquire up to £5 billion in gilts every day, or £65 billion over the life of the program. However, the maximum has now been raised to £10 billion.

“[It was] prepared to deploy this unused capacity to increase the maximum size of the remaining five auctions above the current level of up to £5bn in each auction. The maximum auction size will be confirmed each morning at 9 am and will be set at up to £10bn in today’s operation.” said in a bank statement.

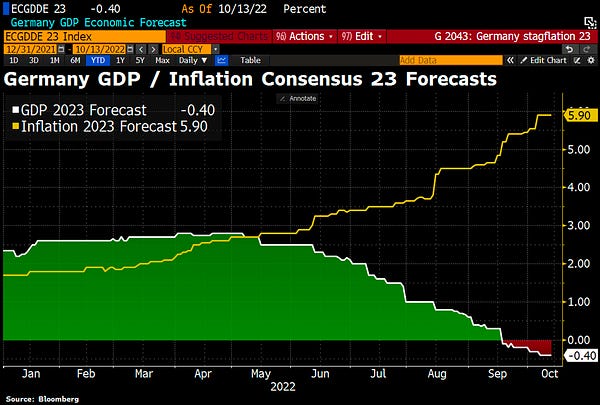

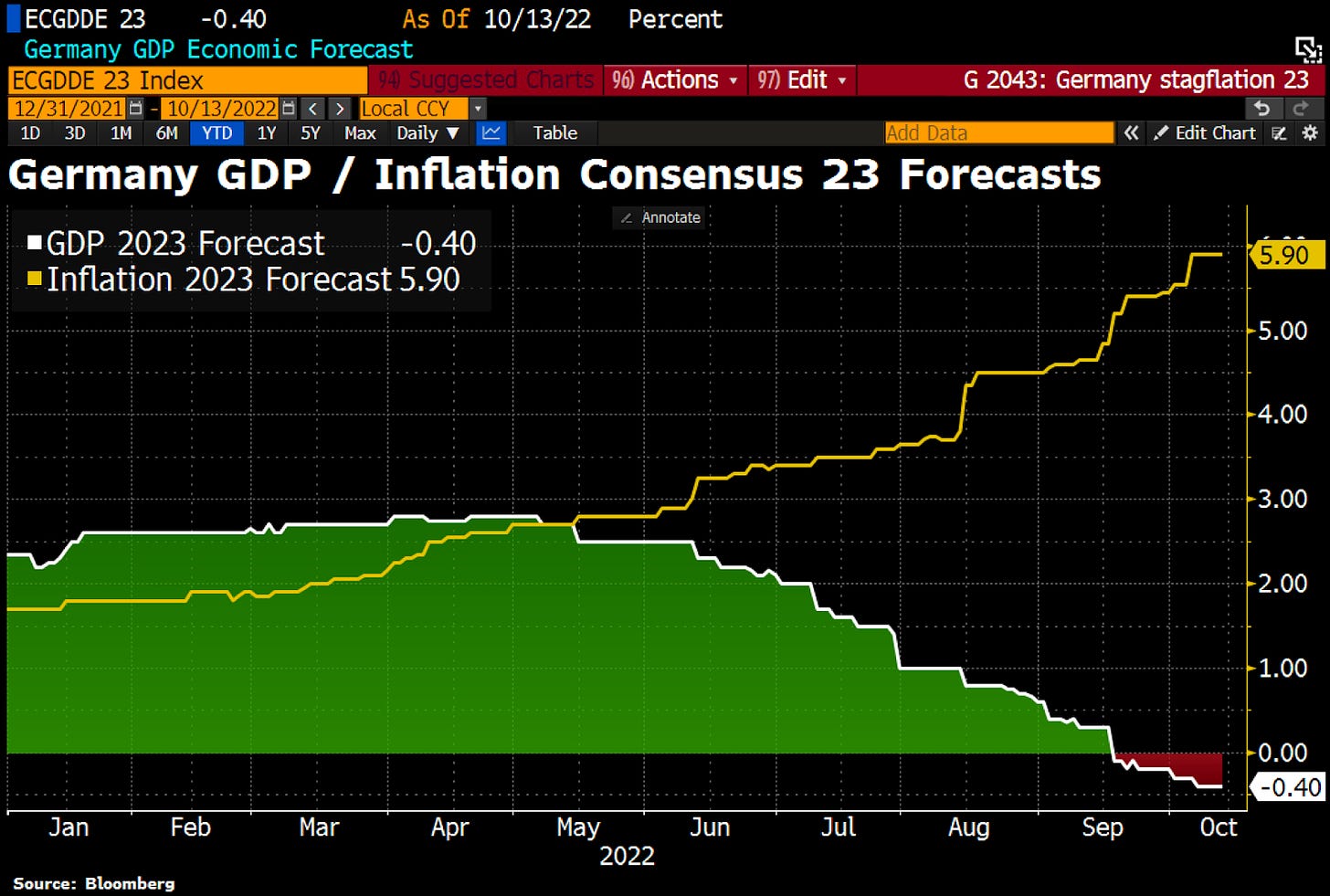

Germany is heading for an inflationary recession with a housing collapse

“Germany, which is heading for an inflationary recession, also called cyclical stagflation on steroids. Meanwhile, the consensus forecast for 2023 sees economic contraction for Germany while inflation expectations for the coming year continue to rise.” by Holger Zschaepitz, journalist at Welt

“The Chart of Doom of the German housing market. The price-to-book ratio of the German real estate giant Vonovia has fallen below 1 this year for the first time ever and is now in free fall. The chart suggests that the German real estate market is heading for a sharp correction.” by Holger Zschaepitz, journalist at Welt

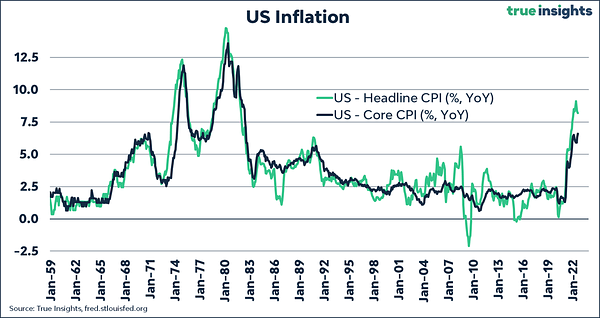

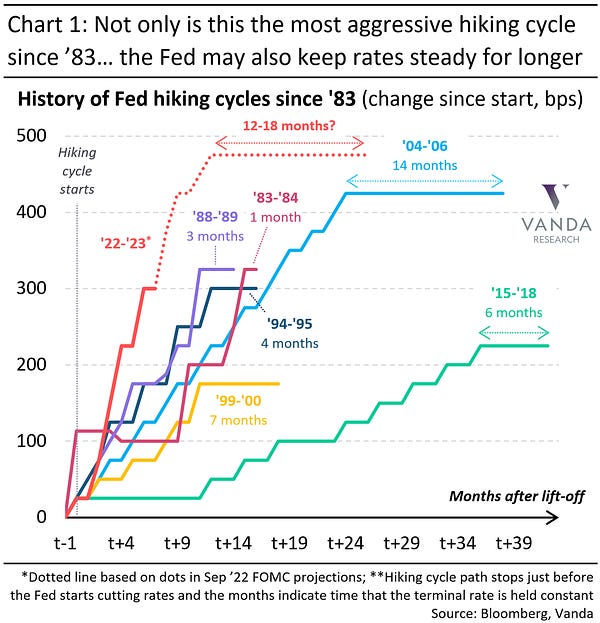

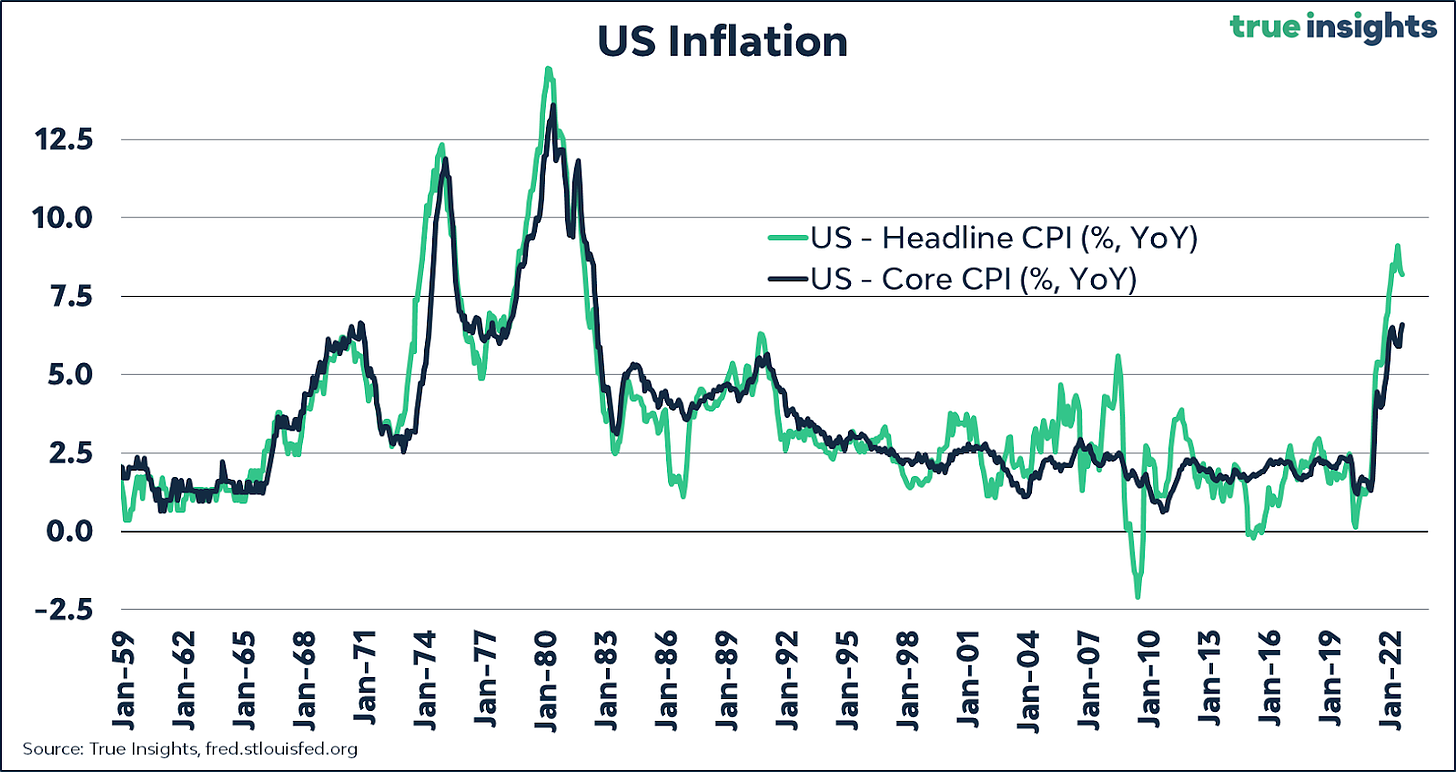

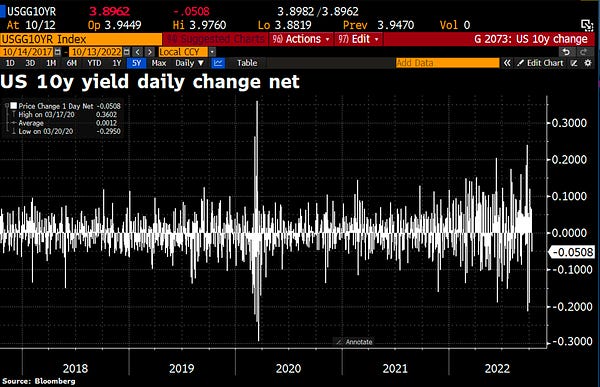

The US Inflation is higher than expected despite the FED aggressive hike cycle

US headline inflation: 8.2%, HIGHER than expected

US core inflation: 6.6 %, HIGHER than expected

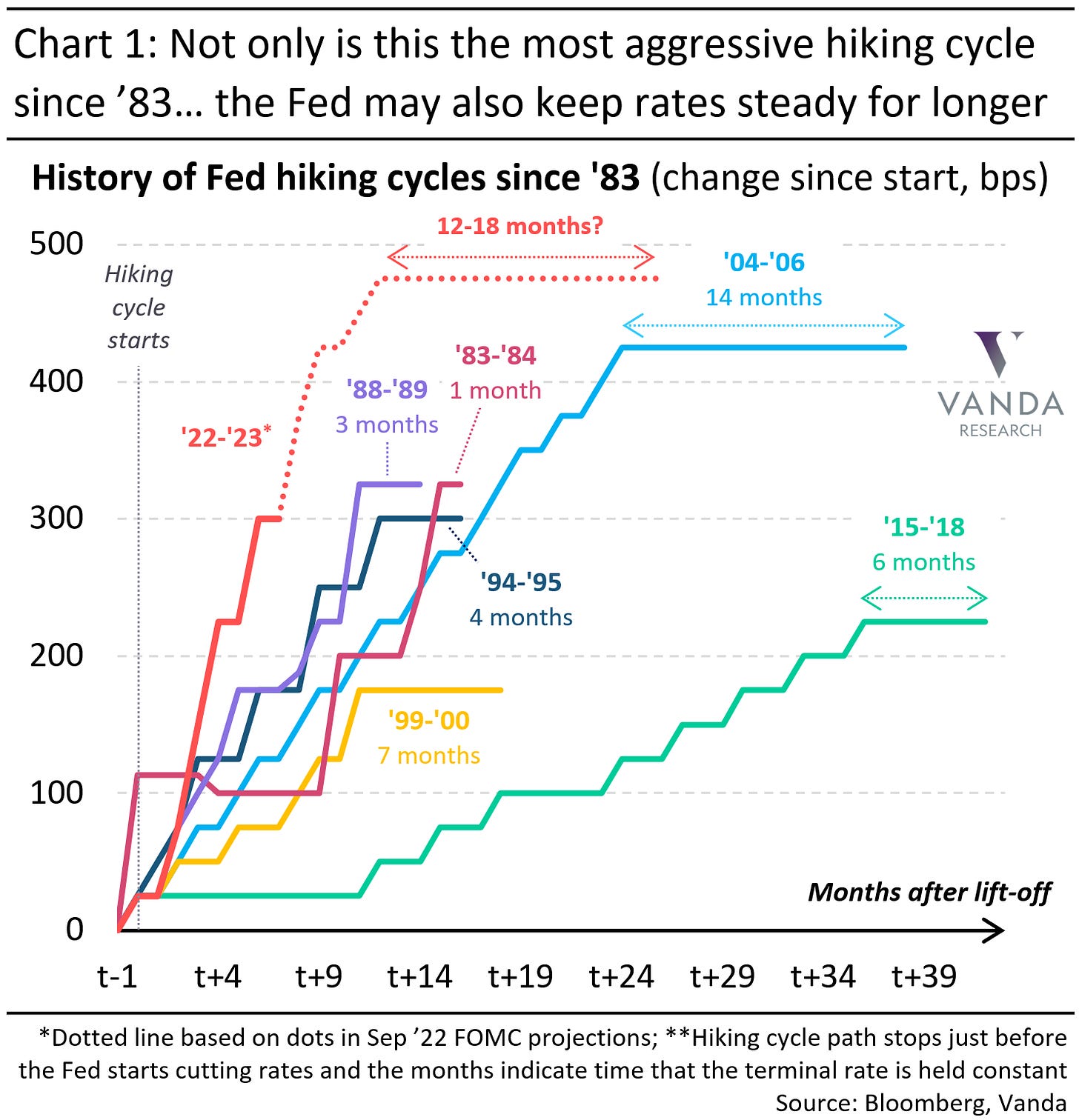

“'22 Fed hiking cycle is the most aggressive in 40 years. But even more unique is that the Fed wants to keep rates on hold for >12 months. They usually start cutting within 6 months of the last hike. Closest example of higher for longer is '04-'06... and we know how that ended USD” by Viraj Patel, FX & Global Macro Strategist

“Today's CPI means the Fed will be forced to raise higher and faster to avoid long-term elevated rates (at the risk of crashing the economy). Why? At a terminal rate of 5%, the cost to refinance the *current* $31T of debt is ~$1.5T of annual interest expense. 3.75X today's cost.” by James Lavish, reformed hedge-fund manager

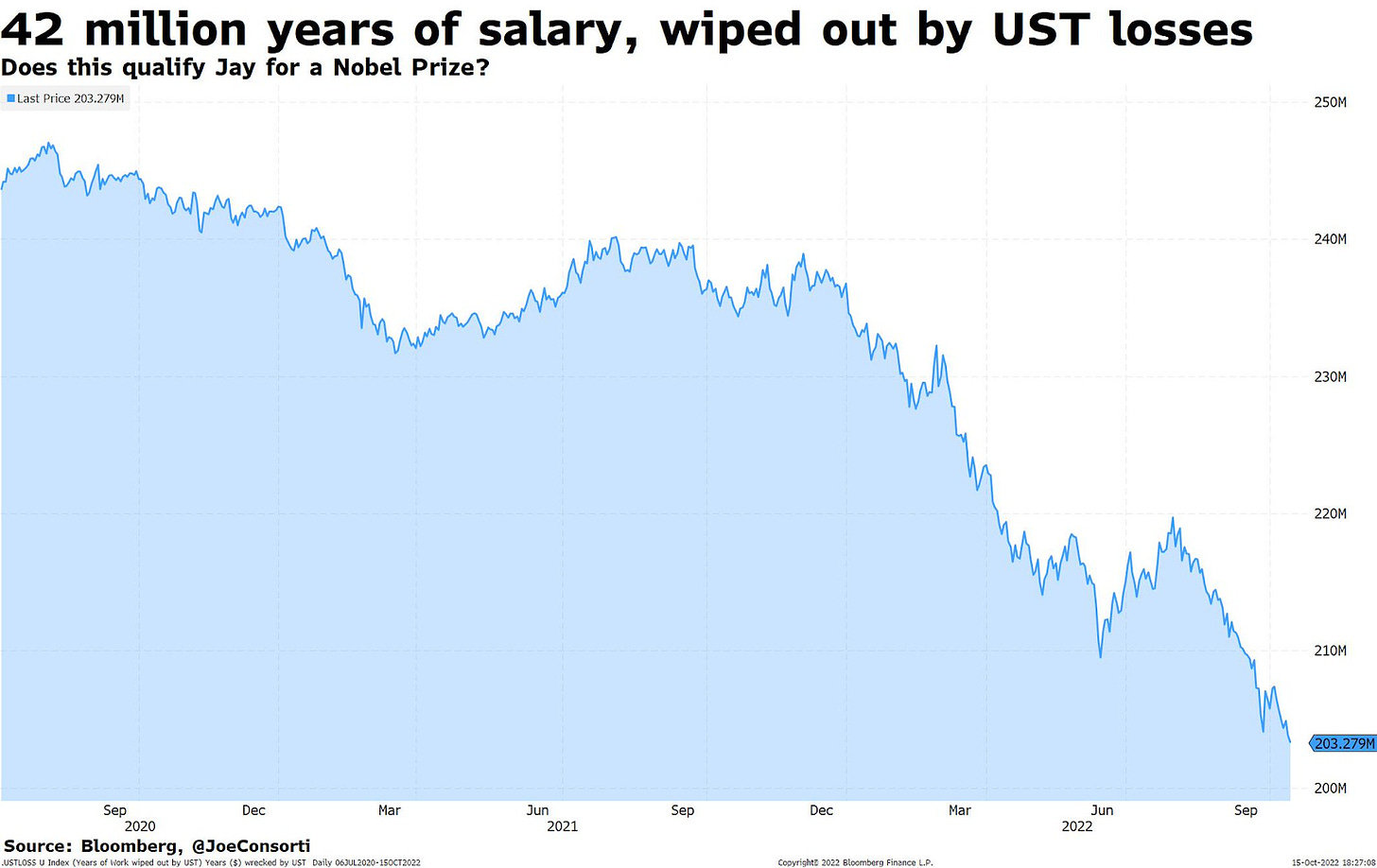

“42 million years of average US salary has been wiped out in UST losses since 2020.

$2.3 trillion in returns, vaporized.” by Joe Consorti, market analyst

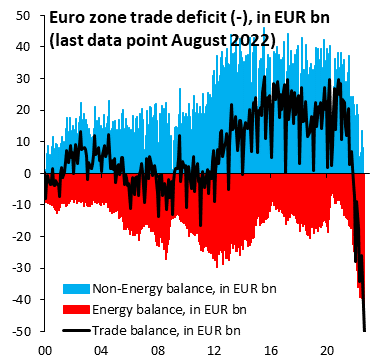

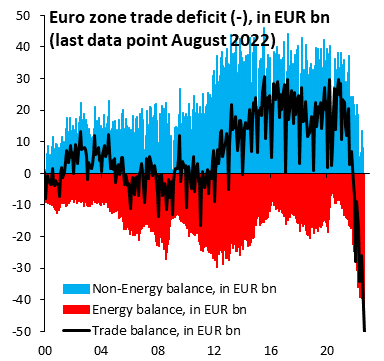

The Eurozone trade deficit shows how big the problem really is

“The Euro zone trade deficit for August was published today. It's a monster. We've never before had sustained deficits of this size. When you're tempted to think the Euro has fallen too much, keep this picture in mind. The shock hitting Europe is massive. Euro will keep falling…” by Robin Brooks, Chief Economist at IIF

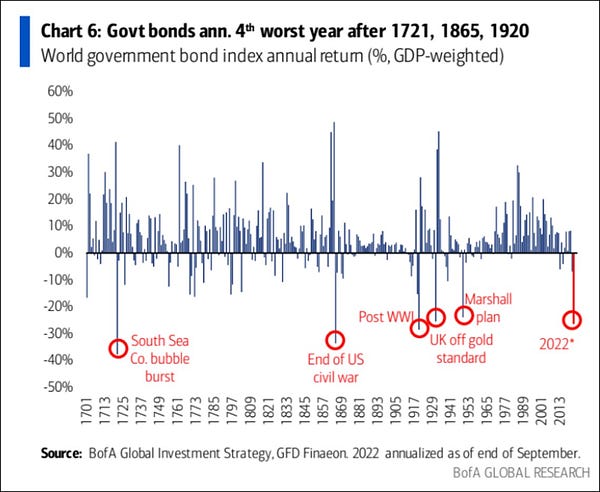

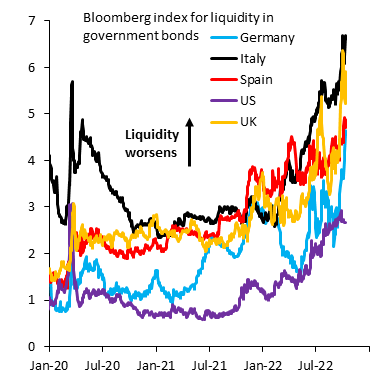

The Global Bond market is close to a collapse?

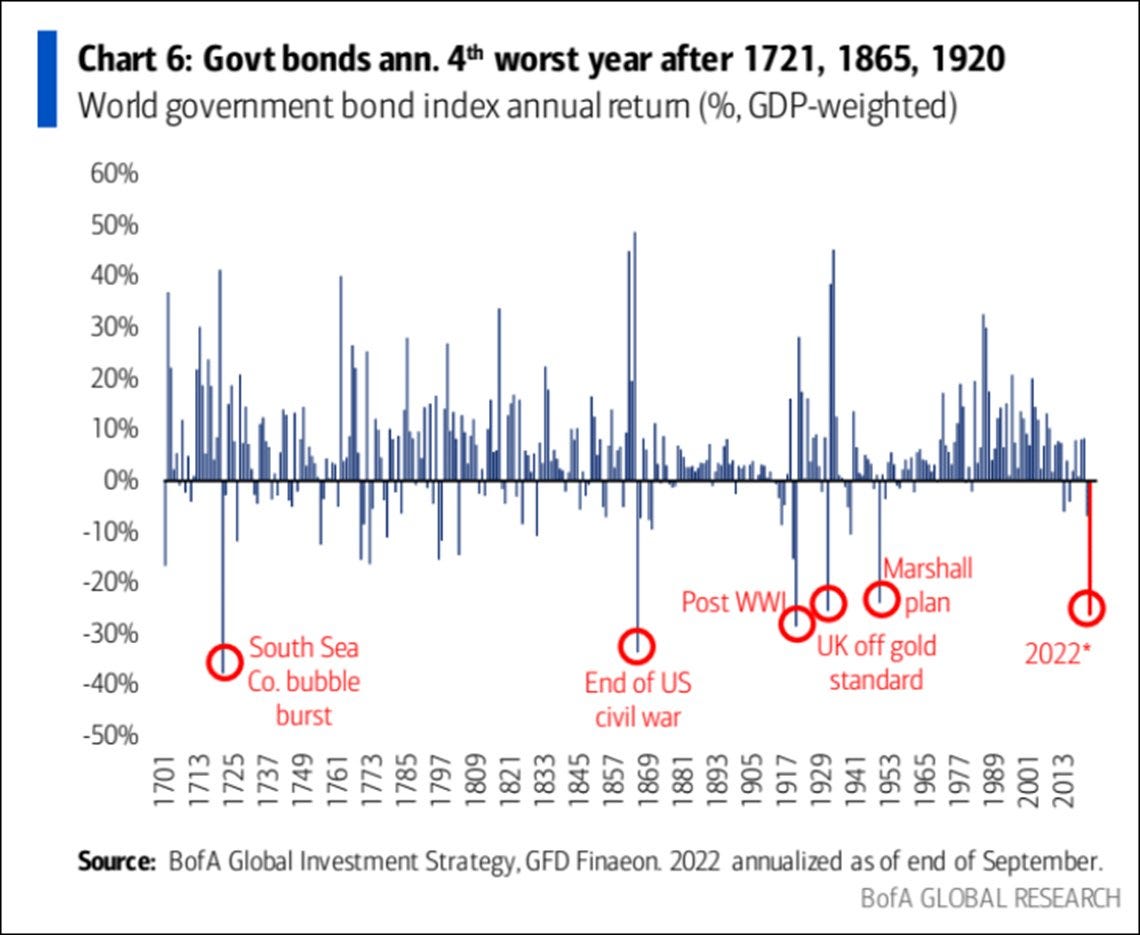

“It always amazes me that the majority of the public focuses primarily on the turmoil in the stock market… What is happening in the bond market this year is even more striking: This is the fourth worst year (after 1721, 1865 and 1920) in the last 322 years!” by Ronnie Stoeferle, Fund Manager and author

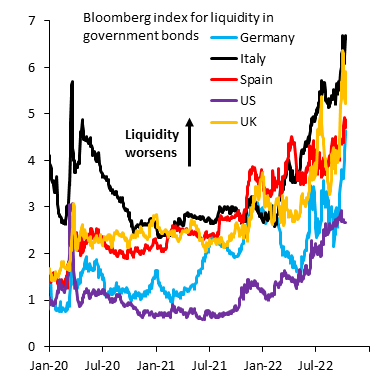

“Financial stability concerns are front and center in discussions at and around the IMF / World Bank meetings. Lots of anxiety that G10 central banks are overtightening, including in the US, and that bond markets just aren't in a place where they can take it…” by Robin Brooks, Chief Economist at IIF

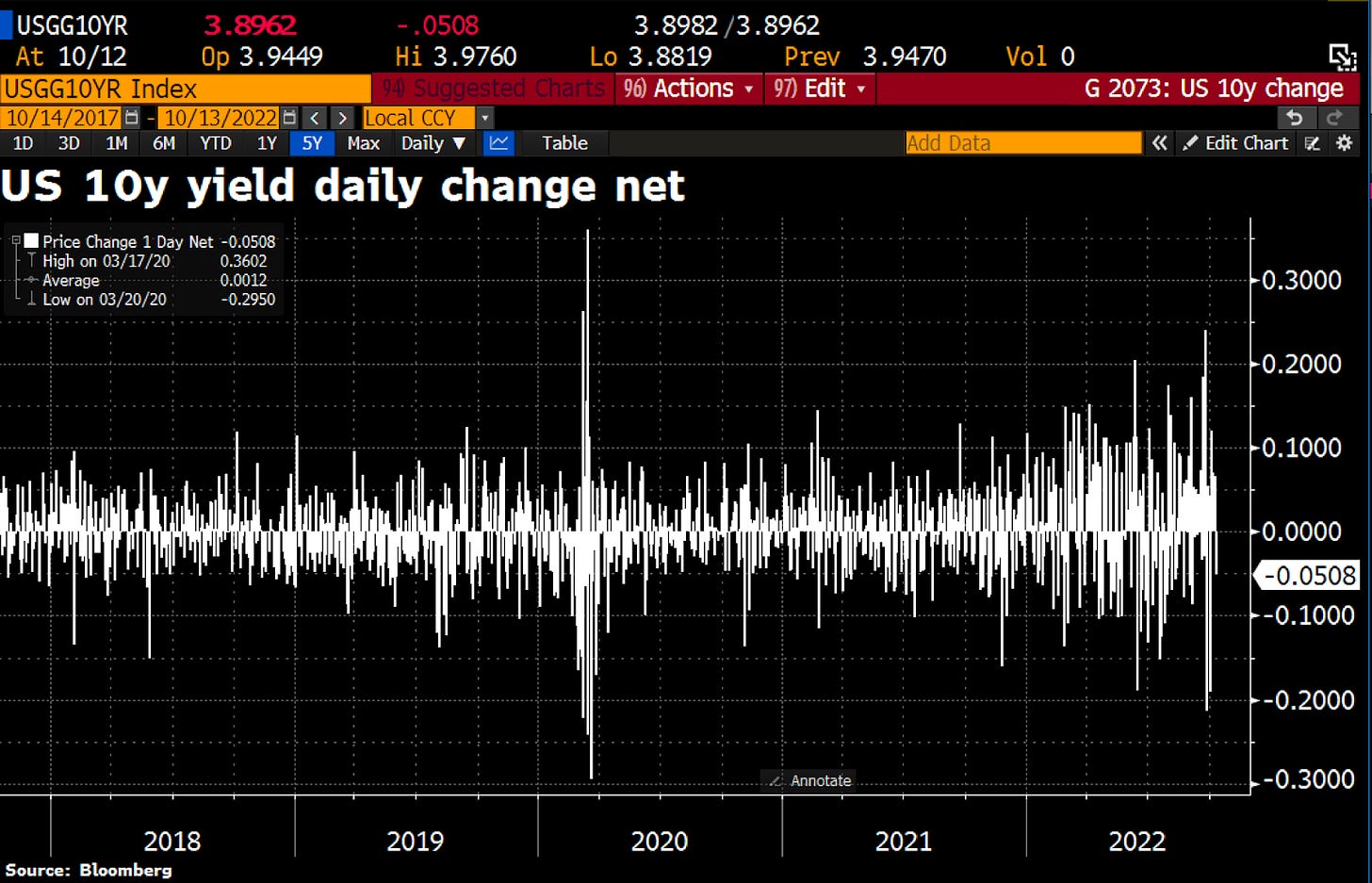

“Treasury Secretary Yellen worries over loss of adequate liquidity & the potential for a breakdown in trading of US Treasuries, as her department leads an effort to shore up that crucial mkt. Daily Volatility has risen in recent weeks.” by Holger Zschaepitz, journalist at Welt

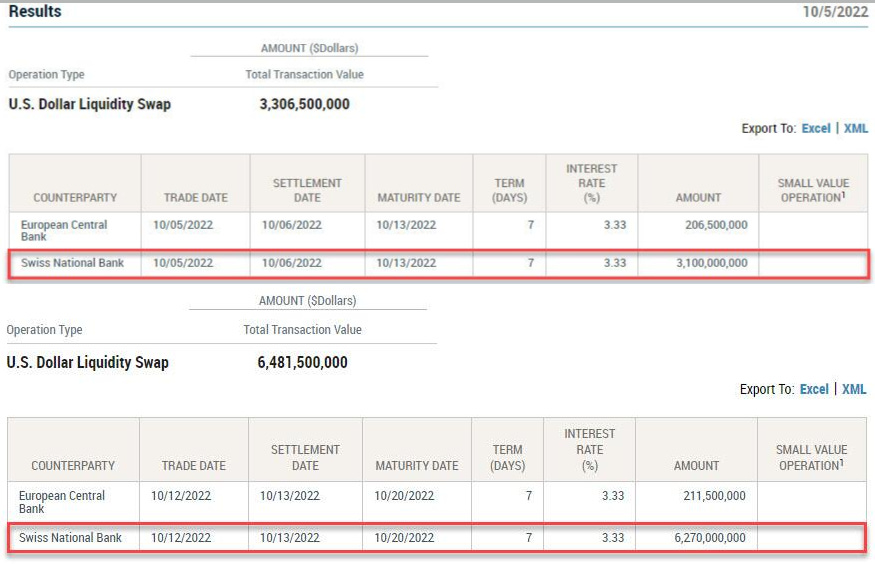

Does Switzerland have financial problems?

“The U.S. Federal Reserve has sent $9.3 Billion USD to Switzerland via "Liquidity Swaps" in 2 weeks with zero real Congressional oversight.

Switzerland was recently deemed a currency manipulator and still exceeds thresholds for possible currency manipulation under US trade law!” by @OccupytheFeds

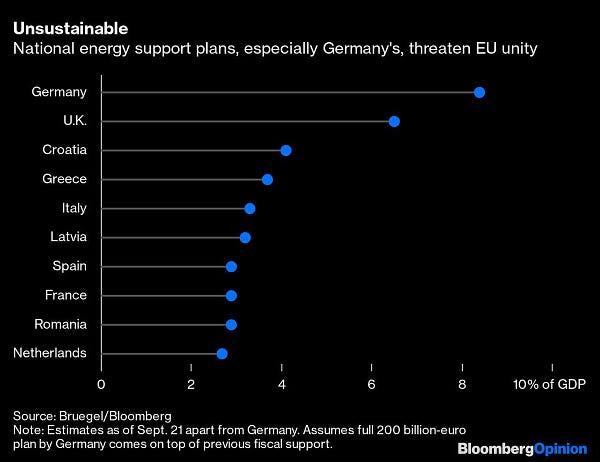

The EU National energy support plans is unsustainable

“Dear ECB, good luck with QT. If not you, who will absorb all this additional debt?” by Michael A. Arouet analyst

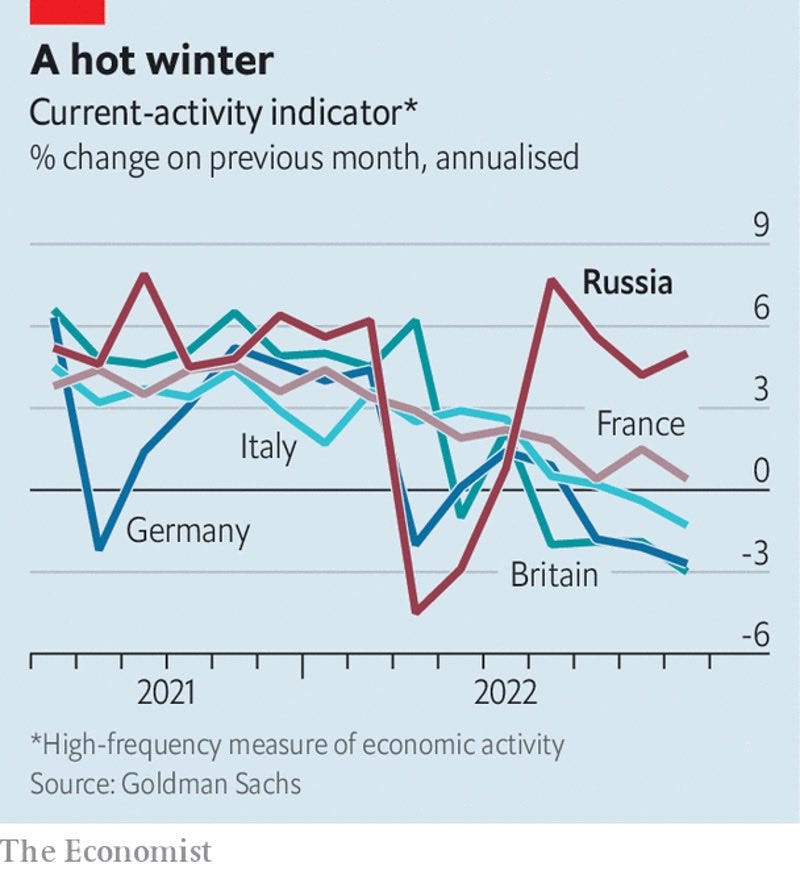

Russia is already going out of recession?

“The West imports lots of finished goods from China. China imports lots of energy to assemble those goods from Russia (black). A big topic at this week's IMF / World Bank meetings is how to uncouple the West as quickly as possible from large EM current account surplus countries…” by Robin Brooks, Chief Economist at IIF

According to The Economist, while Russia is emerging from a recession, Europe teeters on the brink of one – in no small part due to sanctions.

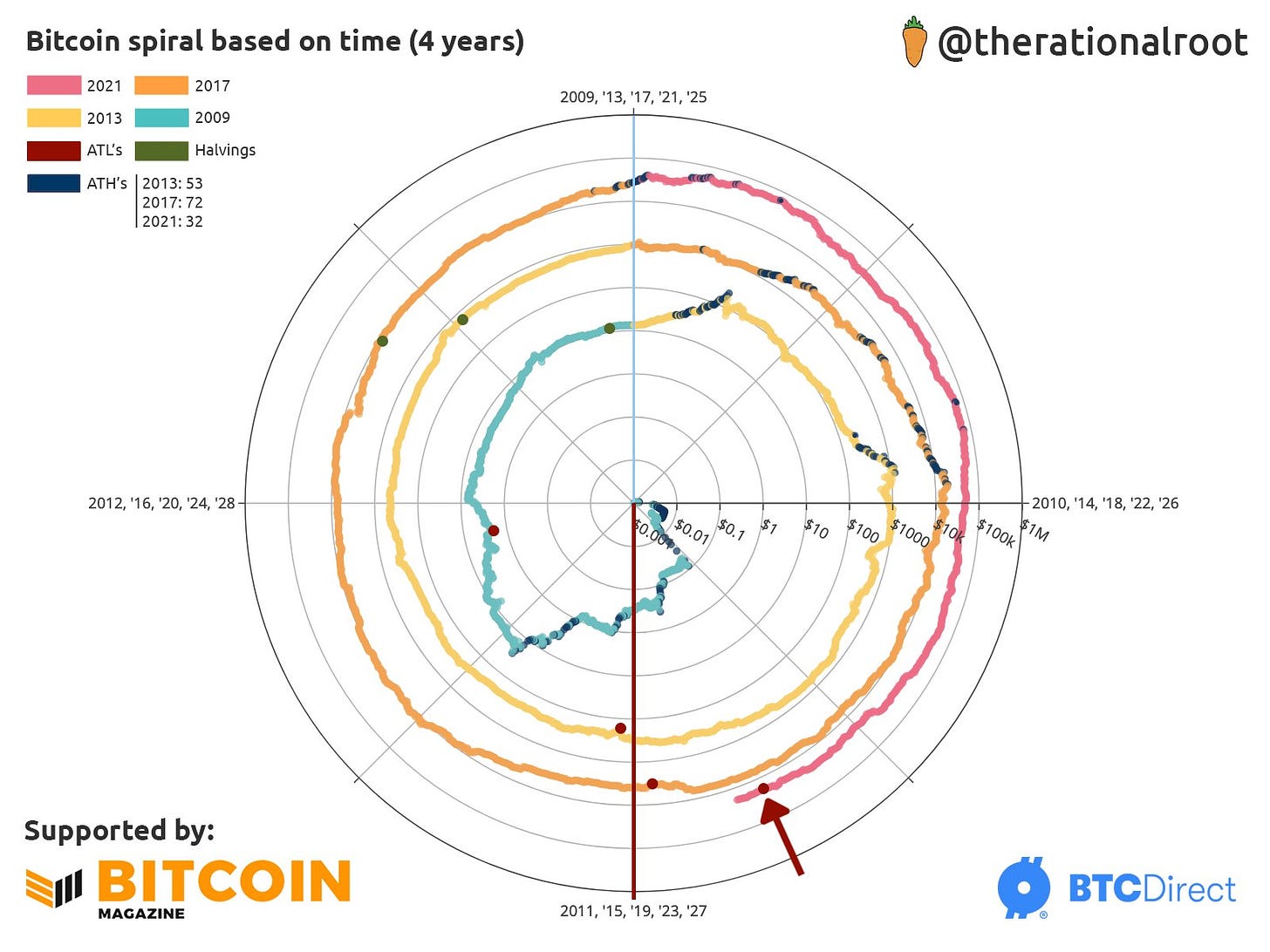

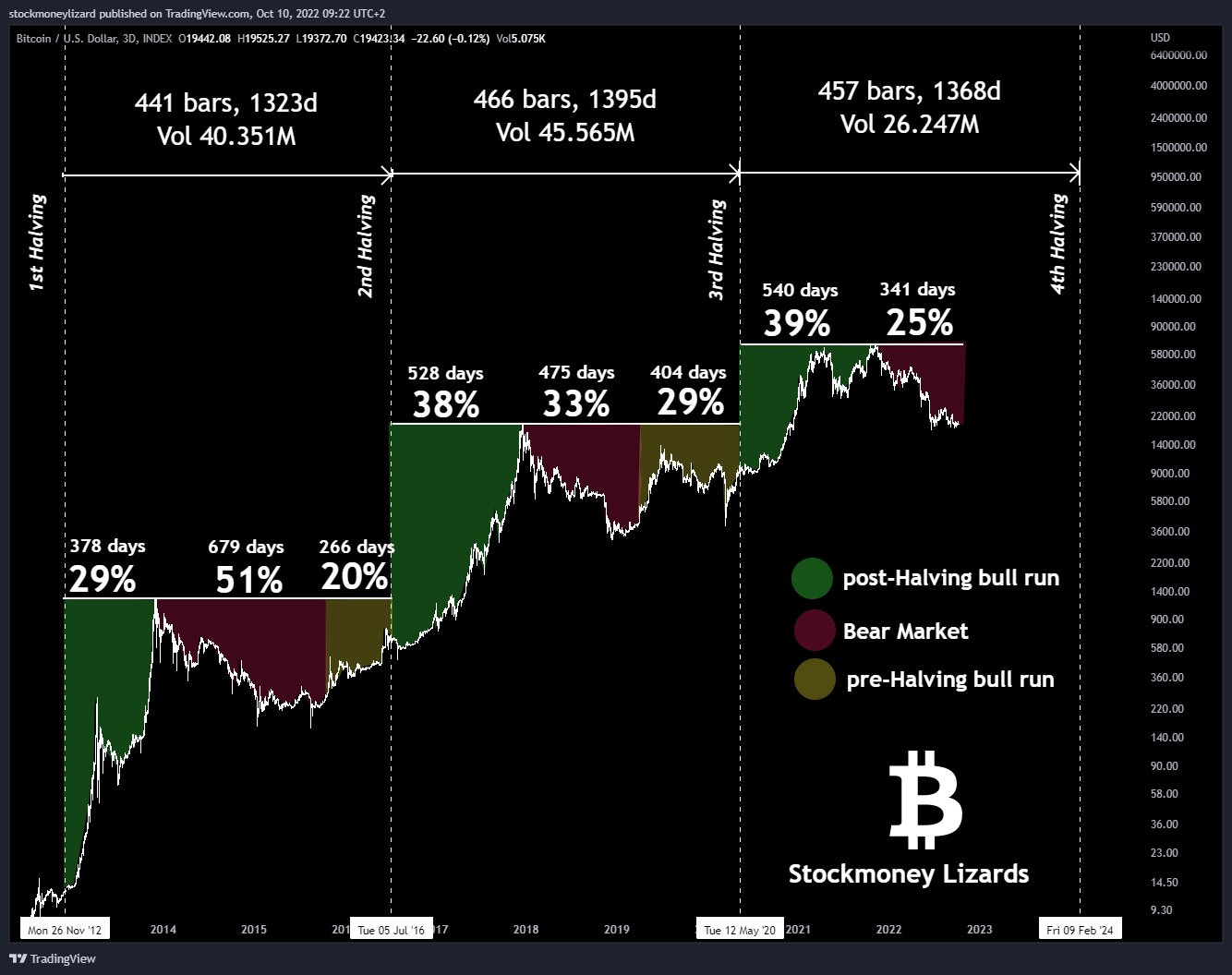

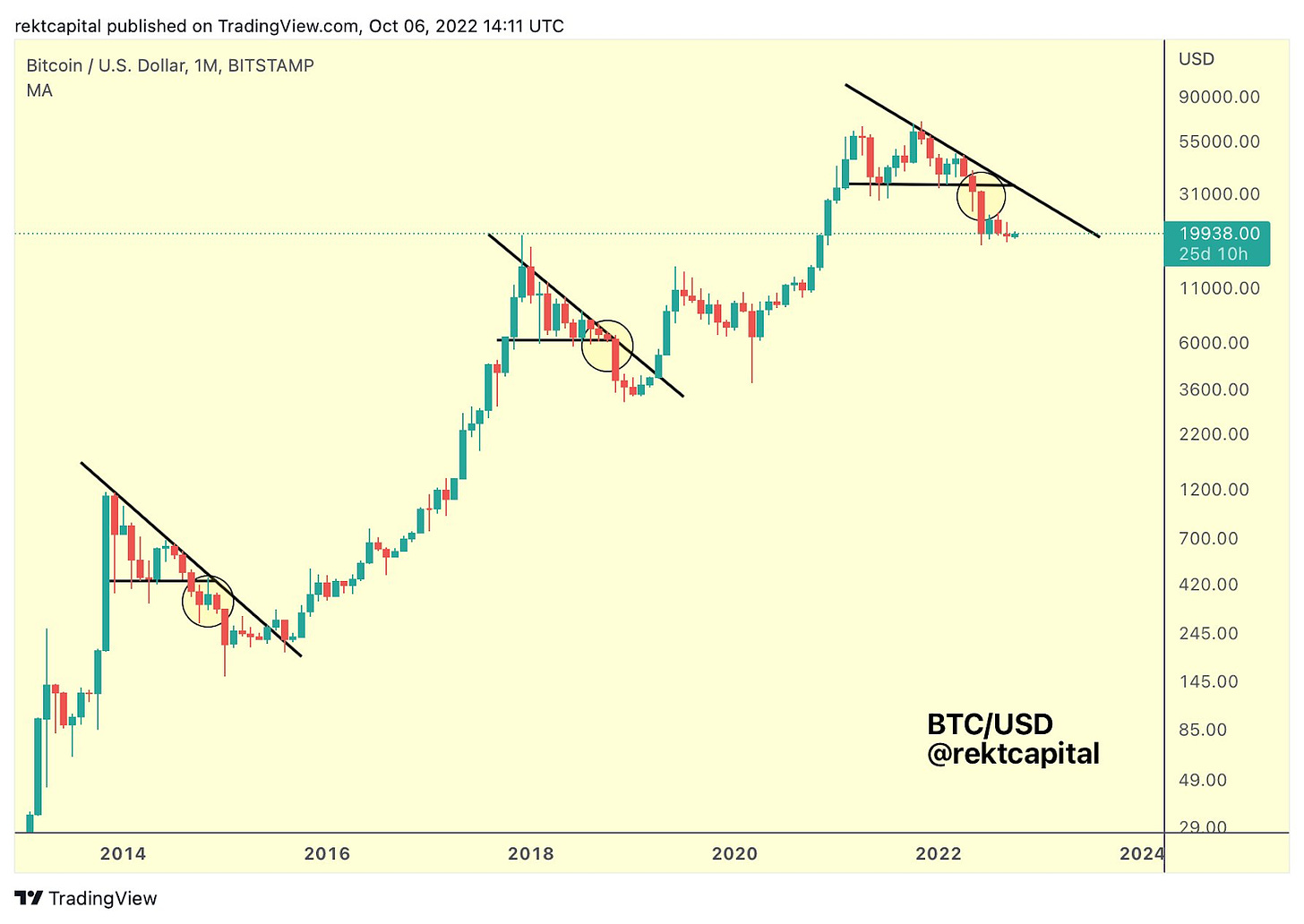

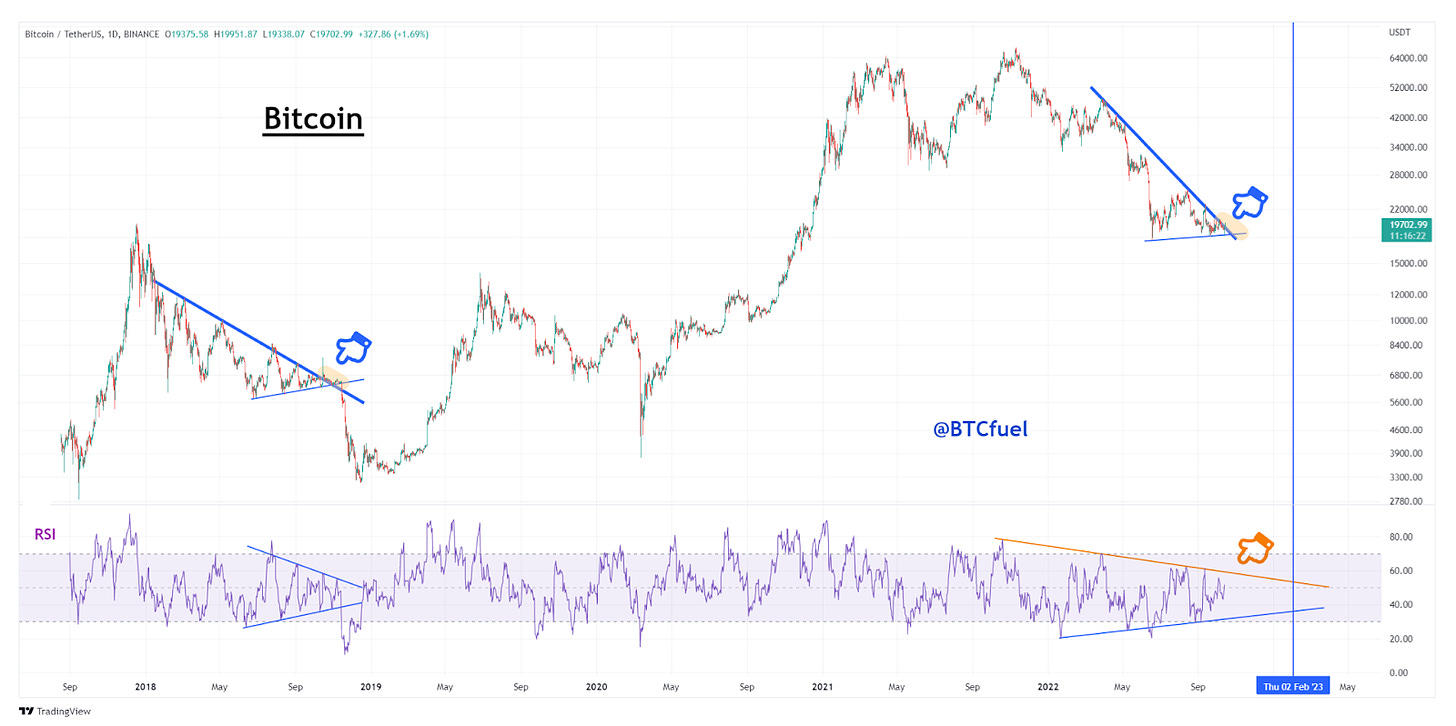

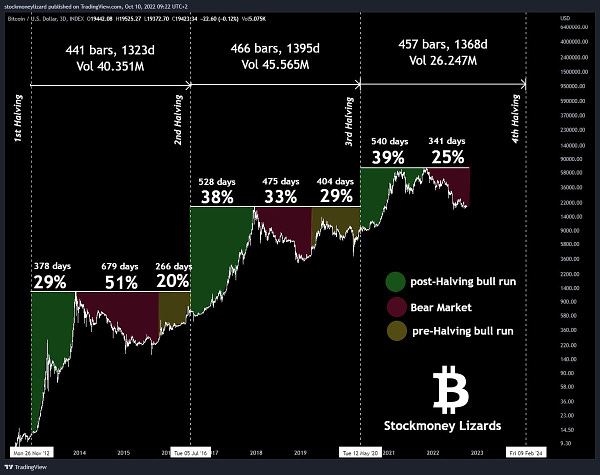

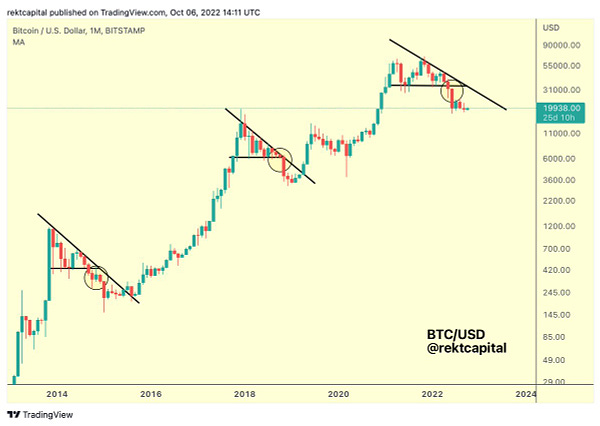

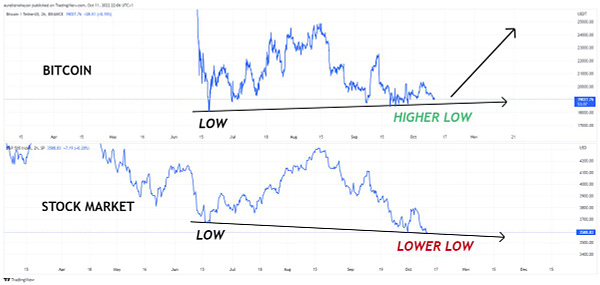

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Hydro-powered mini grids in Kenya reduce power costs by 90% mining bitcoin with surplus energy (pictures)

Legendary investor Paul Tudor Jones: I still own Bitcoin

Over 12K Brazil companies declare Bitcoin holdings in record high

“Real Estate is a $326.5 trillion market worldwide. $326.5 Trillion / 21 Million = $15,547,619 per Bitcoin. Keep printing guys.” by @BritishHodl

“Bitcoin is approx -75% from it’s previous all time high - something it’s done five time previously. Hash rate is at all time highs. Monetary policy remains immutable. ~900 BTC issuance tomorrow and the next, and will programmatically halve again in 2024. Your move, fiat” by @DylanLeClair_

“Number Go Up?” by @gergzaj1

GRAYSCALE has filed an opening brief in their lawsuit against the SEC, challenging their decision to deny their application to convert GBTC to a spot Bitcoin ETF.

“PayPal: we will seize your money

JP Morgan: we will close your accounts

Trudeau: we will freeze and seize your money

Do you understand why we Bitcoin yet?” by @utxo_one

Mastercard: We are working to turn Bitcoin into an everyday way to pay

Bitcoin will become a trusted means of exchange in Europe - Nigel Farage

Growing flowers with Bitcoin mining (video)

Suggestions

Interesting articles to read

Bitcoin's Calm Amid Soaring Bond Market Volatility Points to 'HODLer'-Dominated Crypto Market

Dark Days Ahead For Europe As Lack Of Russian Oil Could Spark 'Worst Energy Crisis In Decades'

FASB Settles on Fair-Value Accounting for Measuring Crypto Assets

Sources:

https://watcher.guru/news/bitcoin-mining-difficulty-attains-new-ath-largest-spike-since-may-2021

https://watcher.guru/news/bank-of-england-increase-bond-purchases-to-10-billion-day-till-oct-14th

https://www.btctimes.com/news/bitcoin-ekasi-opens-financial-education-center-in-south-africa

https://bitcoinmagazine.com/business/google-cloud-to-accept-bitcoin-crypto-payments

https://watcher.guru/news/nasdaq-dubai-welcomes-21shares-bitcoin-etp