2022/37

03 October 2022 - 09 October 2022 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Russia to supply electricity to Bitcoin miners in Kazakhstan

NYDIG raised $720 million from institutions to buy Bitcoin

McDonald’s accepts Bitcoin in Lugano, Switzerland

World's largest banks ask for 5% Bitcoin allocation cap

Bitcoin mining is bringing new jobs and boosting tax revenue in Texas

EU announces ban against Russian Bitcoin Assets & Services (UPDATED!)

Grayscale just launched a Bitcoin mining investment vehicle

Argentina's state-owned energy company moves into Bitcoin mining

Russia to supply electricity to Bitcoin miners in Kazakhstan

New arrangements will allow Kazakhstan’s miners to buy electricity directly from the Russian power generation and distribution giant Inter RAO.

Bitcoin mining enterprises operating in Kazakhstan will be able to rely on electricity produced in neighboring Russia to power their energy-hungry hardware. To allow that, the two partnering nations will amend a bilateral agreement governing the coordinated operation of their energy systems.

In accordance with the new arrangements, Inter RAO, which holds a monopoly on the export and import of electricity in Russia, will be able to sell in Kazakhstan under contracts concluded on commercial terms directly with the mining firms working there.

NYDIG raised $720 million from institutions to buy Bitcoin

The New York Digital Investment Group (NYDIG) has successfully raised $720 million from 59 investors who remain unnamed for its new Institutional Bitcoin Fund, confirming a filing with the United States Securities and Exchange Commission (SEC) published last week.

NYDIG ranks among one of the biggest Bitcoin firms in the world, and it announced its Bitcoin Fund in 2018 when it was originally named "Institutional Digital Asset Fund." In June 2020, the firm raised around $190 million for the Bitcoin Fund, as per an SEC filing.

In October 2020, the firm officially confirmed purchasing around 10,000 Bitcoins which were worth $115 million at the time as a part of its treasury reserves. This turned NYDIG into one of the biggest holders of Bitcoin around the globe in 2020.

"I view Bitcoin as a border-agnostic, uniting force for good. Bitcoin can propel global citizens that opt in towards a brighter, and fairer, financial future. From an investment perspective, we've long viewed Bitcoin as superior to cash," Ross Stevens, founder of SRHG and founder and Executive Chairman of NYDIG, said at the time of purchase.

McDonald’s accepts Bitcoin in Lugano, Switzerland

In the 63,000-person city of Lugano in Switzerland, the multinational fast food giant McDonald’s began to accept Bitcoin (BTC) as a form of payment. This development came via Bitcoin Magazine today when it posted a one-minute video on Twitter showing how to purchase food from a McDonald’s digital kiosk and pay for it using a mobile app at the counter.

World's largest banks ask for 5% Bitcoin allocation cap

A recent study published by the Basel Committee on Banking Supervision (BCBS) explains that the world’s top banks are exposed to around $9 billion worth of Bitcoin and shitcoins (mostly Bitcoin with 56.1%). The BCBS is a global organization made up of members tied to the world’s central banks and financial institutions from a myriad of jurisdictions.

The BCBS shows that 19 banks worldwide submitted data for the research, and approximately ten financial institutions derived from the Americas. Seven banks stemmed from Europe, and two banks came from the rest of the world. Corrias notes that the banks represent a small group of financial institutions out of the collective 182 banks the BCBS considered for its Basel III monitoring exercise.

According to the Bitcoin Magazine, “World's largest banks ask for a 5% Bitcoin and crypto allocation cap in letter to Bank of International Settlements instead of the 1% suggested in June. That's $9 TRILLION”

Banks are seeing the end of the FIAT system (The Dow Jones 30 is more volatile than Bitcoin) and they need to have a bigger escape hatch.

Bitcoin mining is bringing new jobs and boosting tax revenue in Texas

Texas political leaders have been promoting the state as a destination for companies producing bitcoin and other shitcoins, touting the state’s reputation for low taxes and cheap power. Around 30 have come in the past decade, and dozens more have expressed interest in moving to Texas.

Crypto companies have been welcomed by many small towns hungry for an economic boost. Argo Blockchain opened its 125,000-square-foot Helios facility in Dickens County in May and hired a couple dozen locals, including Rodriguez. It has also added $17 million to the local tax base, according to Kevin Brendle, the county judge. The county’s overall assessed property tax value is $283 million, he said.

That economic infusion has allowed Dickens County to cut county property taxes by around 1.5%, give small raises to county staff, and purchase new equipment for the sheriff’s office and for road and bridge improvements.

“The end result is enhanced services to the community,” Brendle said. “We’re going to be able to do a better job of serving them, and we’ll be able to be competitive in our wages.”

In Milam County, northeast of Austin, a large crypto facility owned by Riot Blockchain that opened in 2020 has added hundreds of new jobs and millions of dollars for the local tax base, according to County Judge Steve Young. He said the boost in taxes has allowed the county government to pay for basic services such as road improvements. When the crypto company needed to employ contractors for various projects, it hired locally, he added. (more details in this article.)

EU announces ban against Russian Bitcoin Assets & Services (UPDATED!)

The new sanctions package “extends the list of restricted items which might contribute to the Russian Federation’s military and technological enhancement or to the development of its defense and security sector,” the new EU sanctions regulation noted.

”The existing prohibitions on crypto assets have been tightened by banning all crypto-asset wallets, accounts, or custody services, irrespective of the amount of the wallet.”

What will this mean? Russia will still adopt Bitcoin as the only non-confiscatable (!) currency and will sell its commodities for those people willing to pay in Bitcoin, Ruble or in other shitcoin. This ban is just proving how bigot and uneducated the EU leaders are and that sanctions are stupid because as always in the history they’re not working.

(UPDATE: Russia can "easily bypass" the EU's new Bitcoin and shitcoin sanctions - Chairman of Congressional Finance Committee)

Grayscale just launched a Bitcoin mining investment vehicle

Grayscale Investments has formed a private, co-investment opportunity dedicated to Bitcoin mining hardware such as computer rigs, the digital currency asset manager said in a release Thursday.

The entity is now available for eligible individual and institutional investors at a minimum stake of $25K, according to a Bloomberg report. The funding is expected to end before the end of Q4, Grayscale CEO Michael Sonnenshein told the news outlet.

“Our team has long been committed to lowering the barrier for investing in the crypto ecosystem – from direct digital asset exposure, to diversified thematic products, and now infrastructure through GDIO,” Sonnenshein said in a separate statement.

The launch comes as firms seek to capitalize on the embattled crypto mining space as suppressed token prices and high energy costs reduce mining hardware prices. CleanSpark (CLSK), for instance, recently acquired 10K additional Bitmain Antminer S19j Pro mining rig for $28.0M, taking advantage of a steep discount.

Argentina's state-owned energy company moves into Bitcoin mining

YPF, Argentina's state-owned energy company, is supplying power to an undisclosed international Bitcoin mining company, the firm said on Sunday.

The renewable energy arm of YPF – YPF Luz – three months ago commenced a 1 megawatt (MW) pilot operation that provides power generated from waste gas left over from oil production, YPF Luz CEO Martín Mandarano told the national news agency Télam.

The company plans to open a second pilot – this one 8MW in size – before the end of the year, Mandarano said.

“We started to develop this generation pilot for cryptocurrency mining with a vision of sustainability and business from flare natural gas, which cannot be harnessed during exploration and at the beginning of the production of an oil field,” Mandarano added.

What do you think about the news above? I think this week's news is really bullish on every level. I’m interested in your opinion either in comment or in our Telegram group.

Global Economic News

TL;DR

Germany faces with huge economic loss

The US is losing heavily its foreign Bond buyers

Big banks’ Credit default swap rates are rising sharply

China is an energy hungry giant

Where is the bottom?

Germany faces with huge economic loss

“Just 15,000 German stores facing bankruptcy due to soaring energy costs ......” by Wall Street Silver

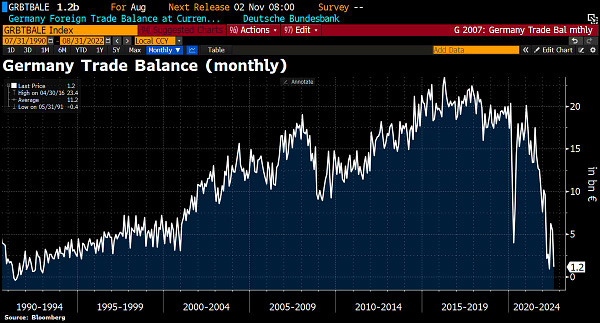

“Germany, which is not benefiting from the weak Euro. The export nation's trade balance slipped to a slim €1.2bn in Aug because imports are becoming more expensive & exports are not growing accordingly. The terms of trade are thus deteriorating sharply.”

by Holger Zschaepitz, journalist at Welt

“Germany where factory orders dropped in Aug as econ teeters on brink of recession. Demand fell 2.4% MoM. Industrial Production Index now <2007 level, signaling industrial production is no longer growing in Germany, i.e. that country is slowly de-industrializing.” by Holger Zschaepitz, journalist at Welt

“Germany where inflation pressures keep rising. Import prices were 32.7% higher in Aug YoY, the highest increase since Mar 1974. Energy imports were 162.4% more expensive YoY, +18.9% MoM. The largest influence had the price increase of natural gas w/+306.3% YoY” by Holger Zschaepitz, journalist at Welt

The US is losing heavily its foreign Bond buyers

According to BBG, JPMorgan Is worried about who’s going to buy all the Bonds:

“We remain concerned about the (lack of) structural demand for Treasuries.”

“Foreign Central Banks reduced Treasury Holds by $42B last week & $143B over the past year. The demand for Treasuries is falling, despite the largest interest rate increases in 30 years. Who is going to buy the $8T worth of notes & bonds the Treasury has to issue during fiscal 23?” by Garic Moran, Moran Tice Cap Mgmt - RIA - Precious Metals Equities Specialist.

Perfect article about the size of the Bond liquidity problem on Zerohedge: Tchir: Darkest Before The Dawn?

While the interest in Bonds are falling the U.S. national debt tops $31 trillion for the first time.

Big banks’ Credit default swap rates are rising sharply

Credit Suisse CDS spread spiking again! Others are already at 2020’s Covid top levels. This is still just the beginning of a recession.

China is an energy hungry giant

“Remarkable chart, China is generating more electricity from coal than the US from all sources. And we are discussing plastic drinking straws.” by Michael A. Arouet analyst

Their energy generation from Coal is planned to increase even further:

While the western countries are still pushing the (unreliable) renewables which is a total disaster, China thinks that cheap electricity is above anything else. We can argue about the pollution, but it’s way worse to freeze in the Winter and/or to stop the country’s whole industry because there is not enough reliable electricity. (BTW China is building the most Nuclear reactors now because they know this is the cheapest long term reliable energy source).

It's not much better in the USA either (especially in "green" California):

Where is the bottom?

Nick Gerli, CEO & Founder of Reventure Consulting made a great Twitter thread 1 and 2. I copied here the key points:

“$80 Trillion - combined value of US Housing + Stock Market

$25 Trillion - GDP

There's a lot more Wealth Destruction to go.”

“2) How much pain? Well to simply get back to a "normal" level of Asset Prices / GDP, we'd need a further 40% Combined Correction in Housing & Stocks. But of course…”

“4) How did Asset Prices go so high to begin with? Two words: Interest Rates. Low interest rates over the last 20 years caused Asset Prices to explode.”

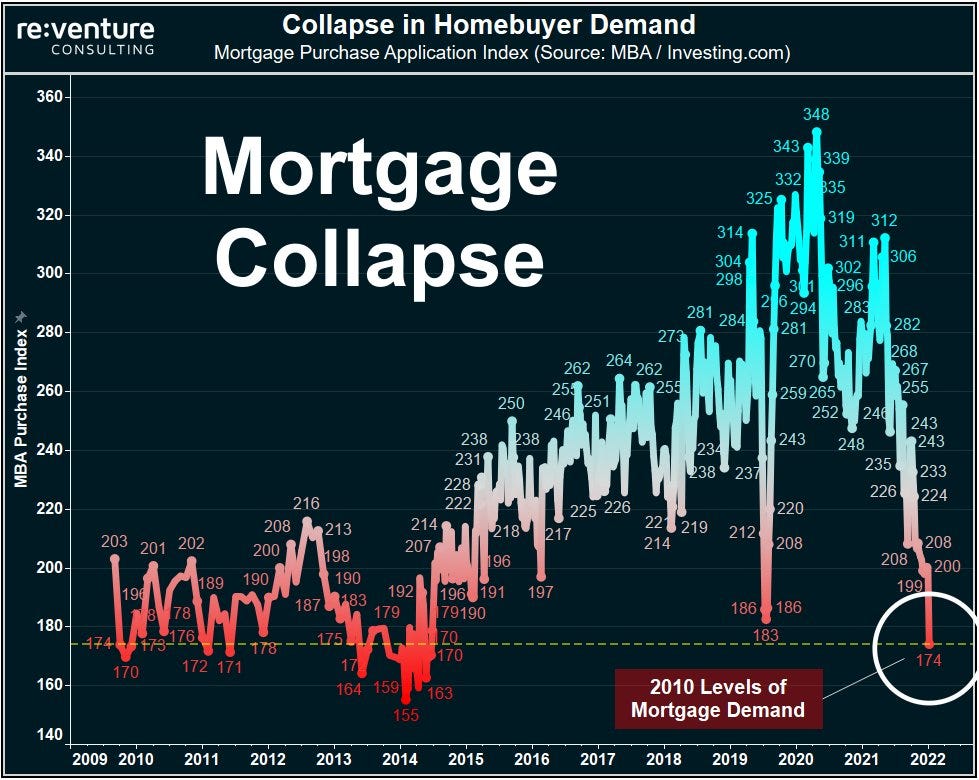

“Purchase Demand at lowest level in a DECADE. Comparable to lows in 2010 during last Housing Crash.”

I’m not so optimistic as Nick is because I don’t think that the bottom will be after another 40% of asset price fall. Why? Simply because this time there will be a multi-currency monetary global crisis too. This will cause the collapse of the whole Bond market (we already see the massive selloff), all the forreign currencies are falling against USD and the interest rates hikes are killing the Banking credit market too which causes big banks to default (see CDS rate hikes just two news above). These things were never before or at least not at once. Not in 2007 and not in 2000. So the sad news is that this time there is a huge possibility that the stop won’t be near to 40%, it will be way over. Not to mention Bitcoin which will price the Housing market as a commodity not as an investment, like I told this many times before.

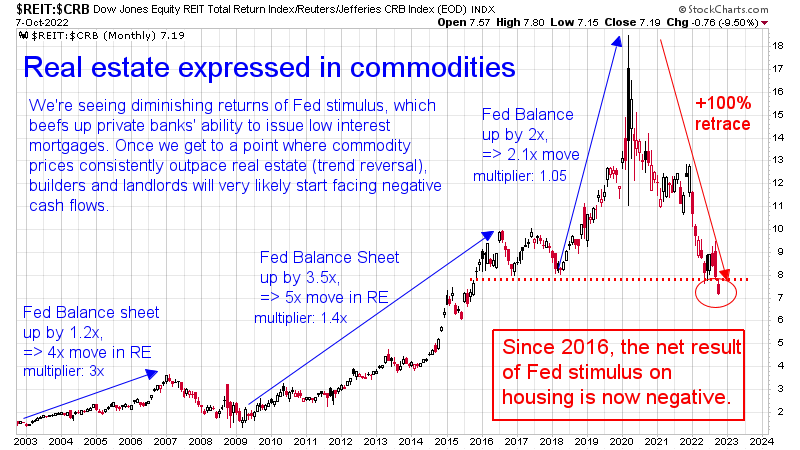

“This explains the housing market of the last few decades: cheap liquidity from the Fed.

If real estate dropped 70% against commodities from here, we'd only be back at valuations of circa 2011.” (Twitter thread) by Tuur Demeester, Editor at satoshipapers.org.

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Lightning now holds over 5,000 BTC a new ATH

BARCLAYS: We remain positive about Bitcoin long-term.

The bitcoin mining hashrate reached 321.15 Exahashes per second on October 5, 2022. Setting an all time high.

“The largest bitcoin mining facility in the world only has 4% of the hashrate” by Documenting Bitcoin

Bloomberg Intelligence: Bitcoin will outperform most assets when the economic tide turns

“It took BTC 413 days to bottom post-2013. It took BTC 365 days to bottom post-2017 peak. If BTC had bottomed this past June 2022 then that would've been just 217 days post-Nov' 2021 peak. How likely is it that BTC bottomed in just over half the typical time?” by @rektcapital

Paying with Bitcoin at Subway in Berlin. (video)

“I built this out of trash. Yes of course I’m terrified but you can hear units go brrr so I’m happy.” by @dirtyshotya (video)

12 years of open-source Bitcoin development (video)

The first website to buy Bitcoin went online 13 years ago today- You could buy 1,309 $BTC for $1.00 USD. (picture)

Suggestions

Interesting articles to read

Nearly Half Of Americans Making Six-Figures Living Paycheck To Paycheck

LNG Shipping Rates "Shooting For The Stars" At $500,000 Per Day

Escobar: The Whole Chessboard Is About To Be Radically Changed

How Nation-states will use Bitcoin in the Power projection game

The $31 Trillion Dollar Question – Can The Fed Afford To Pivot?

Sources:

https://news.bitcoin.com/russia-to-supply-electricity-to-kazakhstans-cryptocurrency-miners/

https://www.ibtimes.com/nydig-raises-720-million-its-bitcoin-fund-59-investors-3619897

https://sports.yahoo.com/barclays-remains-positive-bitcoin-sees-132455747.html

https://watcher.guru/news/eu-announces-ban-against-russian-crypto-assets-services