This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Satsback connected to the Bitcoin network over 5,550 stores in the EU

Bitcoin miner Aspen Creek raises $8M despite bear market

50 Million users in Kenya now have access to Bitcoin

Spain’s largest Telecom company accepts Bitcoin for payment

Citizens of Kazakhstan can now legally buy Bitcoin with local currency

EU cancels KYC requirement when transferring Bitcoin to a private wallet

Satsback connected to the Bitcoin network over 5,550 stores in the EU

“In May, we connected over 2,800 stores in Spain, Italy, and Norway. Today, we're excited to announce that we've connected an additional 2,750 online stores in Denmark, Sweden, Czech Republic, and Finland. (...)

More than 100 million people living in those countries can now earn precious sats while spending their depreciating Euros and Kroners on things they need.” by Satsback.com

If you are buying from your FIAT money anything in the EU it’s worth checking their website to possibly get some sats back. More details here (not paid advertisement).

Bitcoin miner Aspen Creek raises $8M despite bear market

A new solar powered bitcoin miner, Aspen Creek Digital Corp. (ACDC), raised $8 million in a Series A funding, led by crypto financial services company Galaxy Digital and blockchain investment firm Polychain Capital.

The miner will use the proceeds for its second Texas mining facility, which will have 30 megawatts (MW) of mining capacity and be co-located with an 87MW solar farm, the company’s CEO Alexandra DaCosta told CoinDesk. The facility is on track to be operational later this fall.

“When investors saw the markets reeling from the run up in energy prices, the fall in the price of bitcoin, and how exposed a mining company can be – those dynamics actually made our story go from a PowerPoint to real life,” Da Costa said.

The company also has a third project in the pipeline, which will have 150MW mining capacity and be co-located with a 200MW solar farm. The facility is also located in Texas and expected to come online next summer.

50 Million users in Kenya now have access to Bitcoin

50 Million users in Kenya now have access to Bitcoin and Lightning payments through M-PESA and Bitnob integration. It's huge news for one of the poorest countries on Earth! Why? First, it should be noted that Kenya is one of the largest economies in East Africa: $41 billion in GDP. Except that poverty in this region has not yet decreased. In Kenya, 50% of the population is still below the poverty line, and 75% of them are farmers.

Hence phenomena such as the gradual abandonment of physical money in favor of digital currencies emerged and Safaricom developed M-PESA (“M” = mobile and “Pesa” = money, in Swahili) in 2007. M-PESA presents itself as a payment system fast and reliable which implies easy access by Kenyans to bitcoin and other shitcoins.

M-PESA has quickly become a platform where you can buy BTC, and make Bitcoin withdrawals in Kenya.

Bitnob also recommends the same facilities to the people of Kenya. TIt offers Bitcoin payments and transactions through the Lightning Network and aims to reach as many Africans as possible with a view to mass adoption on the continent.

Spain’s largest Telecom company accepts Bitcoin for payment

Telefónica, the largest telecommunications company in Spain, now accepts Bitcoin and shitcoins as payment, with a purchase minimum and limit set between $200 and $500, respectively..

According to their announcement, The payment method was added to Telefónica’s online tech marketplace Tu.com in a partnership with Bit2Me, the largest bitcoin exchange in Spain. Additionally, Telefónica has reportedly invested in Bit2Me. Details of the investment are expected to be released in the coming weeks.

Upon the completion of the checkout process, Bit2Me automatically converts the chosen form of payment into euros in realtime, so it’s not different from what BitPay does. It’s an instant Bitcoin to FIAT converter. They will soon regret this!

Citizens of Kazakhstan can now legally buy Bitcoin with local currency

According to the Inform Buro, Kazakhstan’s first Bitcoin purchase with its local currency, the tenge, took place today as the country considers “full legal recognition” of the asset class.

"At the site of the Astana International Financial Center, cryptocurrency conversion is already underway on a special pilot project,” said Kazakhstan’s President, Kassym-Jomart Tokayev, speaking at the international forum Digital Bridge 2022.

The pilot is expected to be in a test phase until the end of 2022 as the nation-state continues to study its demand and security.

“If this financial instrument shows its continued demand and security, it will certainly receive full legal recognition," President Tokayev concluded.

EU cancels KYC requirement when transferring Bitcoin to a private wallet

There has recently been moved by the EU to regulate Bitcoin and shitcoins. Some of those new rules have been highly controversial and clearly showed that they did not know how Bitcoin and shitcoins actually worked. One of those rules was that you would now need KYC to just transfer Bitcoin to a private wallet. Thankfully that has been removed now!

But now I have more questions than answers. If I need to pass a KYC (KnowYourCustomer) process to use an exchange, on what level is it good for me that I don’t need to do a KYC procedure when I move it to my own wallet? Does this mean that I can use exchanges without KYC? Because with the initial KYC requirement this is just a nonsense feature.

Global Economic News

TL;DR

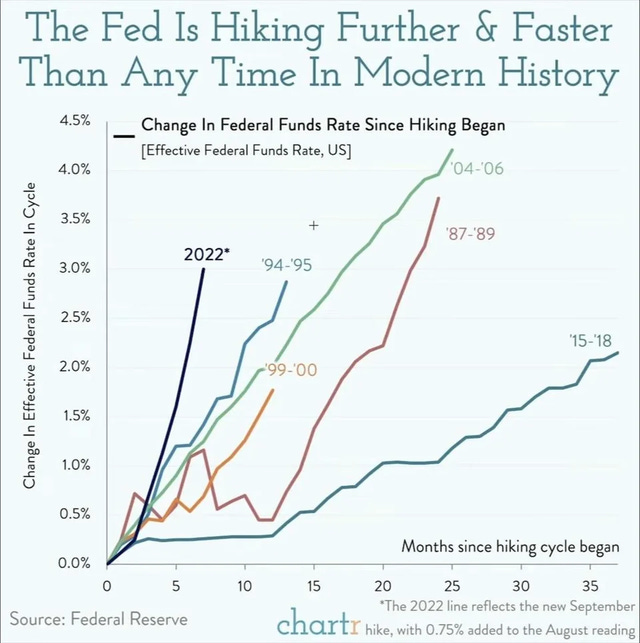

The FED is hiking further and faster than any time before which destroys markets (UPDATED!)

Will Credit Suisse be the first major bank to default?

The BoE started the GBP's death spiral

Based on German Consumer Confidence citizens are in depressed mood

The FED is hiking further and faster than any time before which destroys markets (UPDATED!)

“This is the fastest Fed hiking cycle in many decades, if not ever.” by Markets & Mayhem

This extreme hike from the FED motivates investors to sell all their investments for USD which causes the S&P 500 futures net positioning to be extremely bearish. Such a level has only been seen 4 other times since 2008.

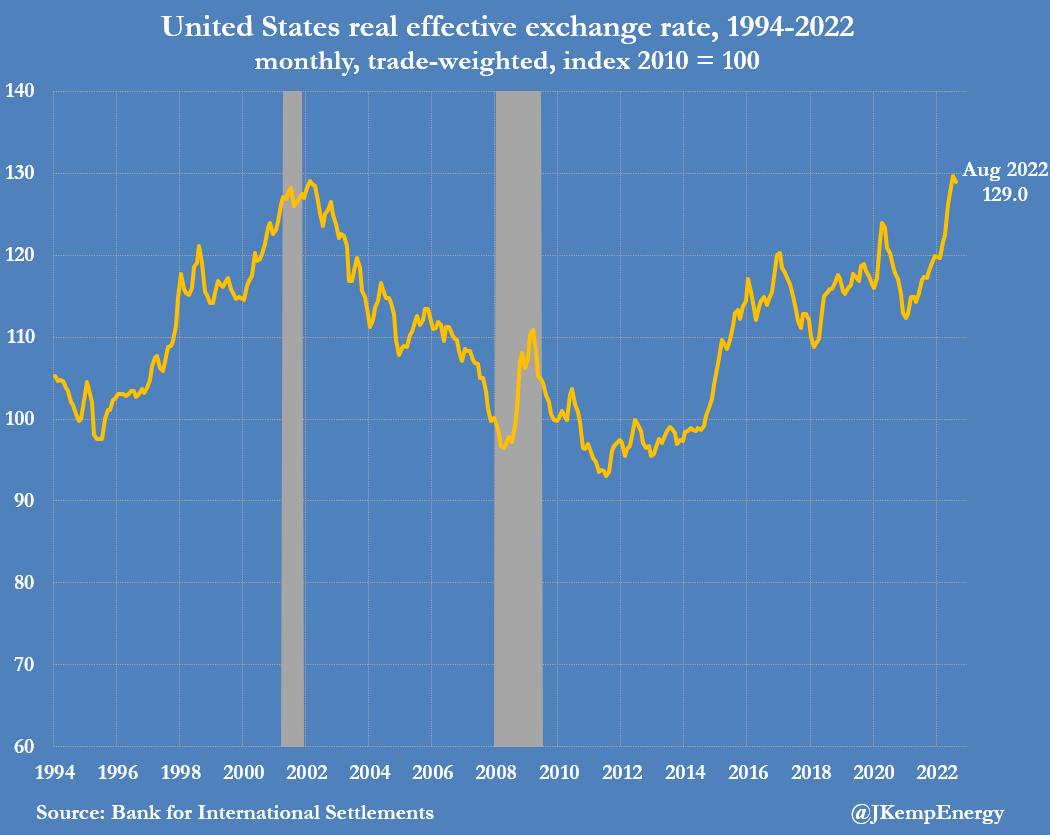

“DOLLAR SHOCK - The United States is exporting its inflation problem via rising interest rates and currency appreciation. Rising yields in the core of financial system (in this case USA) ripple outwards and cause instability on the periphery (UK, EU, China, emerging markets etc):” by John Kemp, Energy analyst at Reuters (more details in this thread)

“Market drawdown in US Trillions. Of course a USD is not worth the same as in 2008 or 2020, but still” by Andreas Steno Larsen, Macro aficionado, investment analyst

“When the largest market in the world is selling off at this speed and trading with this level of volatility, blow ups happen. Who would have predicted the near catastrophic U.K. pension crises before yesterday? Unknown, unquantifiable risk is layered everywhere.” by Dylan LeClair, Senior Analyst at Bitcoin Magazine Pro

Related Zerohedge article: Collapse In Money Supply Is Still A Major Risk For The Market

Meanwhile the US economy (GDP) shrinks 0.6% in the second quarter, the second straight quarterly contraction, official data shows.

(UPDATE: Tomorrow (October 3, 2022) there will be an Emergency Fed Meeting, of course behind closed doors. I wonder what the subjects will be…)

Will Credit Suisse be the first major bank to default?

“Default insurance (CDS) on Credit Suisse is approaching the same level as during the collapse of Lehman Brothers.” by @Ben__Rickert

Fresh news: “Credit Suisse examines options to scale back investment bank including largely withdrawing from the United States.”

“Credit Suisse. Rest in Peace” by Tuur Demeester, editor at satoshipapers.org

The BoE started the GBP's death spiral

“Global bond yields turned lower after the Bank of England announced a kind of yield curve control. The Bank of England said it would step into the market to buy long-dated govt bonds starting Wednesday to help restore order to the market.” by Holger Zschaepitz, journalist at Welt

Zerohedge article: Bank Of England Capitulates: Restarts QE Due To "Significant Dysfunction" In Bond Market, "Material Risk" To Financial Stability

According to FT, BoE warns of risk to UK financial stability as it intervenes in the bond market. Emergency action follows sell-off in UK govt bonds. Gilts rallied. UK 30y yields, which earlier touched 20y high >5%, fell by 0.75ppts to 4.3%, biggest daily drop in yields ever.

“BOE joins Japan. We now have three groups. ▪️The ones suppressing rates at the cost of their currency: Japan & BOE ▪️The ones protecting their currency and at the cost of their bond market: US & Brazil ▪️The ones letting their currency and bond market collapse: ECB & others” by Otavio Costa, Crescat Capital portfolio manager

“While all eyes are on the Gilts market and Sterling, UK manufacturing is slipping into recession. The forward-looking orders - inventories in the manufacturing PMI for the UK (lhs) is almost as negative as that for Germany (rhs). We forecast a deep recession across Europe in 2023.” by Robin Brooks, Chief Economist at IIF

Why did I choose the title “The BoE started the GBP's death spiral”? In “normal” cases the UK govt bonds yields are rising when there are less and less people/entities interested in investing in it, so the rising yields are for making it “more attractive”. But the >5%+ yields rang the alarm bell at the BoE leaders, so they jumped in as a buyer. Why is this a problem? If I control the money printer and I will be the buyer too for the IOU’s (which controls the amount to be printed) then soon I will be the only buyer (because of artificial low yields) which causes a never ending death inflationary spiral for the GBP.

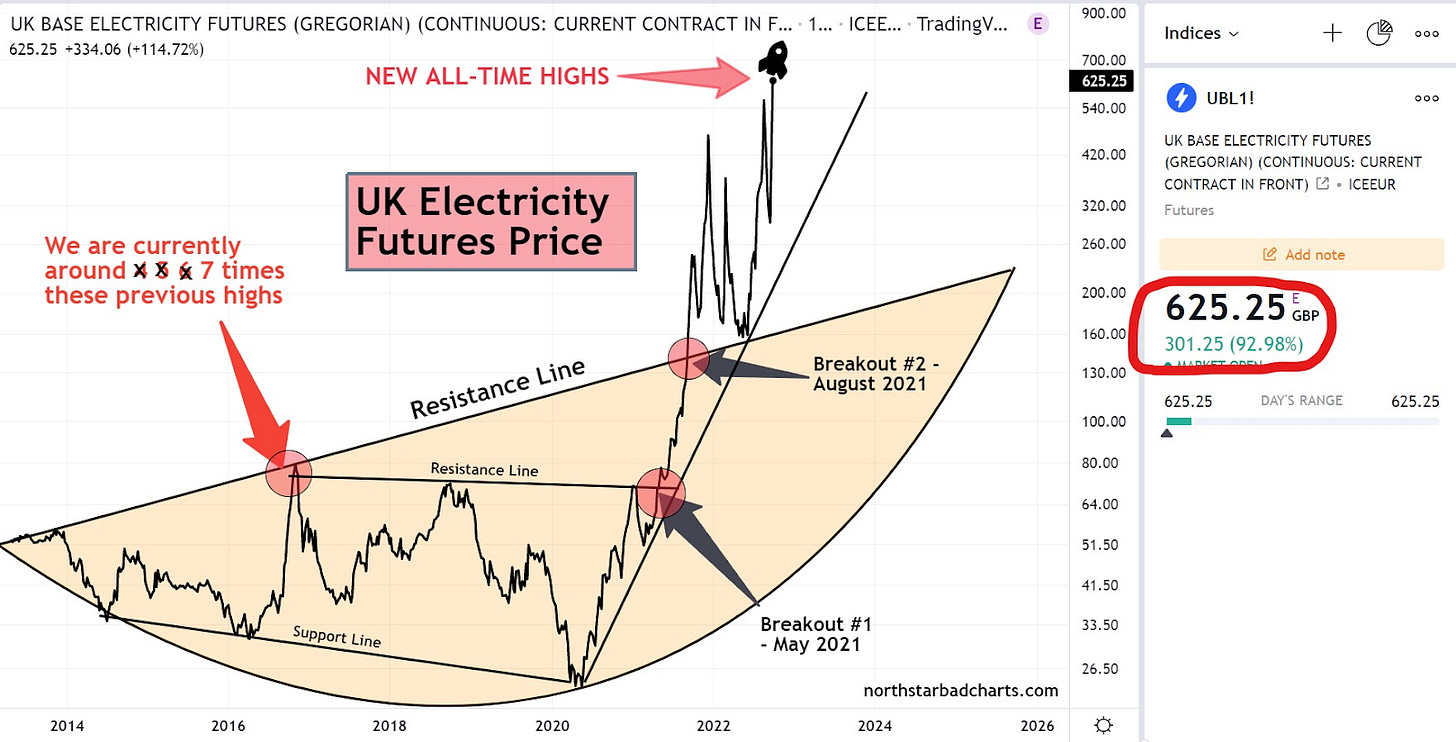

Meanwhile the “UK Base Electricity prices just jumped 93% in a day. We were hours from a pension system collapse this week. Contagion is spreading across the whole of Europe quickly. Collapse happens slowly then all at once. Risk is VERY high. Prepare.” by @NorthstarCharts

Finally something very very interesting happened on the GBP/BTC market. The Trading volumes spiked while the recent GBP/USD sudden fall to the 1.03 range. This could mean that a group of investors moved some wealth from the Pound into Bitcoin because on 23rd and 26th of September when the Pound fell against the USD the Bitcoin moved in the same range. This could be a coincidence, but I think more and more investors think that Bitcoin reached its local bottom while the over pumped FIAT money has just started to fall...

What do you think? This is just a coincidence, or? I’m really interested in your opinion, so please write your thoughts either in a comment here or in our Telegram group.

Based on German Consumer Confidence citizens are in depressed mood

While the (official) inflation CPI has risen by 10.1%, which is a record in the statistics,

“the Consumers are in a depressed mood as disposable incomes fall. GfK German Consumer Confidence slumps to -42.5 in Oct vs -39 expected. Income expectations component plunged by 22.4 points to record low of -67.7, implying reduction in consumer spending” by Holger Zschaepitz, journalist at Welt

Meanwhile the “Supermarket prices are rising much faster than in other Eurozone countries. Food CPI jumped 19% YoY in Sep, the highest food price inflation since the start of the statistic.” by Holger Zschaepitz, journalist at Welt

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

The New York Times recognizes that Bitcoin is holding strong as fiat currencies fail.

FUN FACT: 12 years ago today, you could buy 15,000 Bitcoin for $0.20 each

Bitcoin explained in a simple way (video)

“4,900 BTC. The relentless growth across the entire Lightning ecosystem is going to catch so many people by surprise.” by @kerooke

Despite a 57% price crash, 78% of all Bitcoin has NOT MOVED in over 6 months.

Tap to pay with lightning NFC cards is the smoothest payments UX (video)

“Americans drying their socks 🧦 emits more CO₂ than Bitcoin mining” by Documenting Bitcoin

Bitcoin miners generated $511 million in revenue in September 2022.

Dhruv Bansal's "Bitcoin Astronomy" translated into a 132-page Bitcoin Sci-Fi Graphic Novel (link)

Suggestions

Interesting articles to read

Sources:

https://glebecoins.net/blog/bitcoin-btc-m-pesa-and-bitnob-density-in-kenya/

https://bitcoinmagazine.com/business/spains-telef%C3%B3nica-begins-accepting-bitcoin-crypto-payments

https://bitcoinmagazine.com/legal/kazakhstan-completes-first-crypto-purchase-with-local-currency

whats your twitter?