This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Russia might become the first country in the world to allow cross-border Bitcoin payments

Central Bank of Bahrain is testing Bitcoin payments via OpenNode

First solar-powered Bitcoin mining facility opened in South Australia

Russia might become the first country in the world to allow cross-border Bitcoin payments

The Russian government is in a rush with pushing Bitcoin (and with slight possibility other shitcoins too) to make it use for international final settlements. Just last week I wrote that the Deputy Finance Minister Alexei Moiseev reported that the Bank of Russia has agreed with the finance ministry to legalize crypto (Bitcoin) for cross-border payments.

The Russian Prime Minister Mikhail Mishustin on Tuesday officially instructed the government to come to a consensus regarding crypto regulation in Russia by Dec. 19, 2022.

The prime minister specifically called on the Duma and other state authorities to come up with coordinated policies on regulating the issuance and circulation of digital currencies in Russia. Mishustin also asked regulators to finalize regulations for cryptocurrency mining and cross-border transactions in digital currencies.

Central Bank of Bahrain is testing Bitcoin payments via OpenNode

The Central Bank of Bahrain (CBB) developed the regulatory sandbox in 2017. It came up with a vision of aiding and developing the FinTech ecosystem in the country. Since the digital economy grew diverse with the popularity of digital assets, the regulatory sandbox made a transition to a more open approach. With the aid of CBB, OpenNode will assist in bringing up payment developments in the country.

Through this sandbox, OpenNode plans to test a bitcoin payment processing and solution for payouts. Even though the Middle East has been reigning with the interest in Bitcoin recently, Bahrain was not so keen on bitcoin until now.

“This is a watershed moment for the people of Bahrain, the Middle East and the Bitcoin economy as a whole. OpenNode’s leading Bitcoin infrastructure solution continues to pave the way for countries, governments and reputable financial institutions to adopt the Bitcoin standard and transact on the lightning network,” stated Afnan Rahman, CEO and Co-Founder at OpenNode.

First solar-powered Bitcoin mining facility opened in South Australia

The steel city of Whyalla has flipped the switch on South Australia's first solar-powered Bitcoin mining center. Operated by Lumos Digital Mining, the 5 megawatt data center will be used to mine bitcoins.

State minister for trade and investment Nick Champion said the fact that the plant could run off solar power showed that bitcoin generation could be more environmentally friendly.

"This is important for decarbonising blockchain, which is a very energy-intensive industry, (...) I think it's the beginning of a new economy out here at Whyalla." by Nick Champion, state minister for trade and investment.

Lumos Digital Mining's Angelo Kondylas said the facility could produce about 100 bitcoins a year, depending on power availability.

While the site was primarily solar powered, Mr Kondylas said it could ramp up production to draw more power from the grid on the days when electricity generation was high.

"[Energy generators may be] spending $10 million because they have to switch off that day because there's too much on the system, (...) We're basically like a sponge; we soak up the excess that's not used." by Angelo Kondylas CEO of Lumos Digital Mining

Global Economic News

TL;DR

Is the Global Housing Market collapse inevitable?

The US Core CPI shows bad news

Soon the EUR/USD parity will be just history

Japan government officially acknowledges the lost of the battle to stop the Yen weakening

Is the Global Housing Market collapse inevitable?

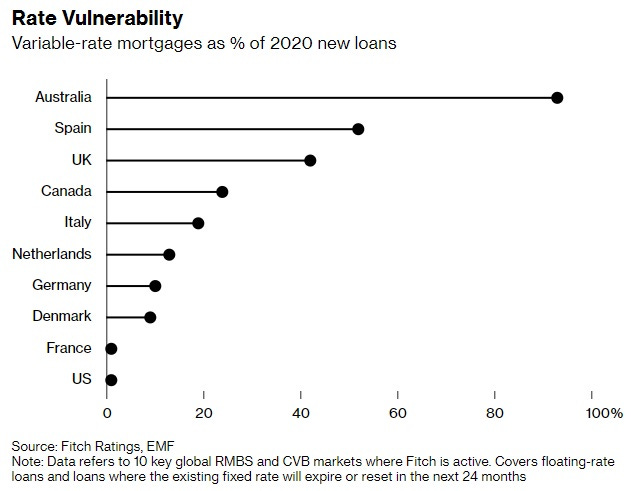

According to BBG, “How exposed borrowers are to rising rates varies notably by country. In the US, for instance, most buyers rely on fixed-rate home loans for as long as 30 years. Adjustable-rate mortgages represented, on average, about 7% of conventional loans in the past five years. By contrast, other nations commonly have loans fixed for as little as a year, or variable-rate mortgages that move closely in line with official interest rates.

Australia, Spain, the UK and Canada had the highest concentration of variable-rate loans as a share of new originations in 2020, according to a May report from Fitch Ratings.”

The problem with these are that as the central banks raise the rates these variable-rate mortgages with some delay will go up and up literally until they will cause many defaults. If you have fixed rate mortgages you’re in a safe position, if not it’s time to consult with your bank to switch to a fixed rate (if it’s possible).

According to BBG, the U.S. mortgage rates have doubled this year & have now climbed past 6% for the first time since November 2008.

Nearly in every western country the central bank allowed artificially low interest rates on mostly everything. This was done to show that after the recent lockdown the GDP can still rise like never before because everyone was either buying or building houses on these artificially low rates. But now as the rates are climbing the whole building industry will collapse because no one will invest in housing anymore. The next news shows how bad can be today a Real Estate investment:

“Big Problems ahead for Real Estate Investors. The 6-Month US Treasury now yields basically the same as Buying & Renting Out a House in America (aka Cap Rate).

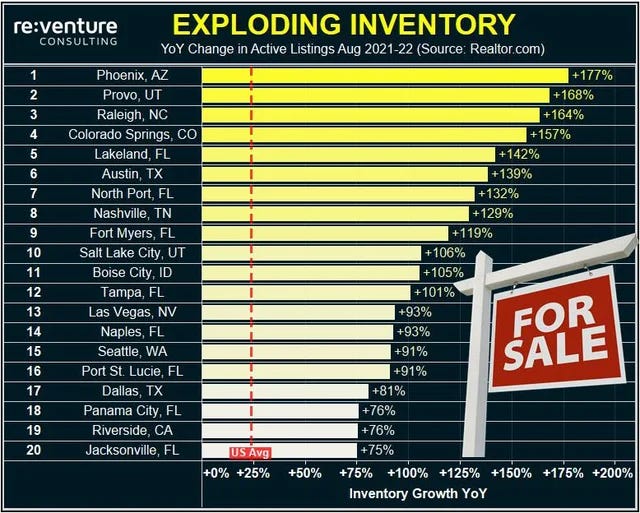

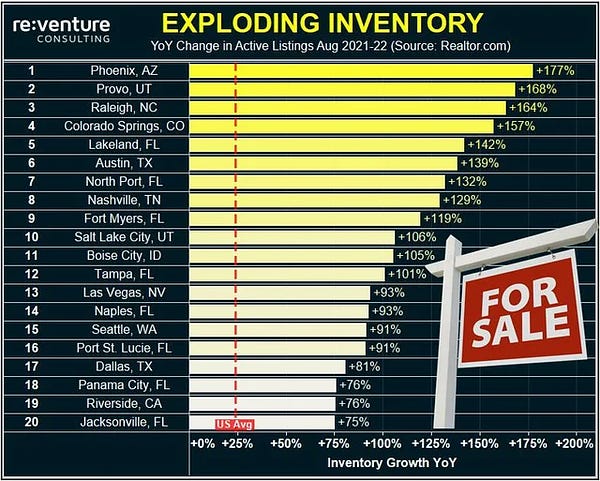

Translation: big Real Estate Investor selloff coming. Especially among Wall Street owners.“ by Nick Gerli CEO & Founder of Reventure Consulting

More details in his Twitter thread.

“Inventory of unsold houses is exploding across many US cities… The US average is up +25% YoY, admittedly from low levels, but several cities are now recording +100% YoY growth in active listings… Phoenix +177%…” by Wall Street Silver

Not just the flexible Mortgage rate and the unsold houses are a problem, but now the investment incentives too as the Treasury yields are rising. What will be if the World will find out about the absolute scarce Bitcoin? For months now I've been warning you all, that in this collapse the Housing market will be down for good because Bitcoin will be the obvious future investment and Housing will be downgraded to a commodity (what really is).

The US Core CPI shows bad news

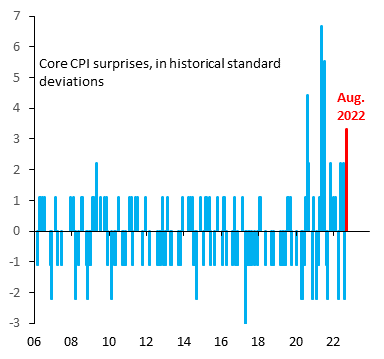

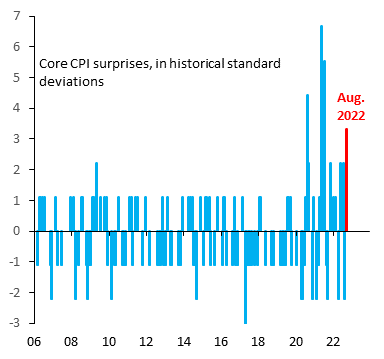

“By the standards of inflation surprises, today's core inflation surprise is a monster: 3 standard deviations. The 75 bps hike at the next meeting was always a given. But now the press conference is unlikely to be as dovish as we had hoped. We were dead wrong on inflation slowing…” by Robin Brooks Chief Economist at IIF

Soon the EUR/USD parity will be just history

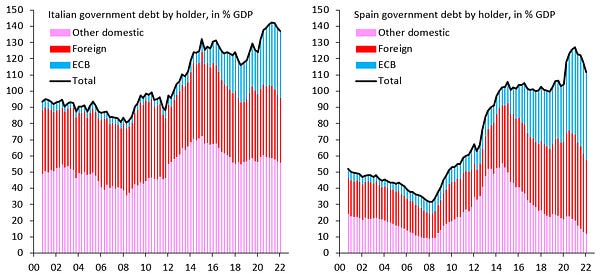

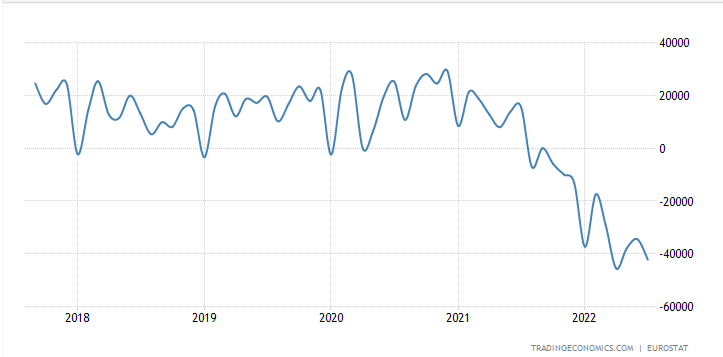

As for obvious reasons the EU leaders kill with their stupid sanctions their own energy grid stability and with it their whole economy, there are other market signals which shows that the EUR/USD parity will be soon gone for a long long time (probably never again):

“Don't look at EUR/$ (white) to see if the Euro is undervalued. It's trade-weighted Euro that matters (orange), because the strong Dollar has dragged up Euro in trade-weighted terms so much, including yesterday after the CPI surprise. EUR/$ needs to fall a lot more to offset that...” by Robin Brooks Chief Economist at IIF

The following German Business Newspaper addresses the following: "Without cheap gas, Europe's industry cannot survive. Factories all over Europe are currently shutting down production. And many will never start up again."

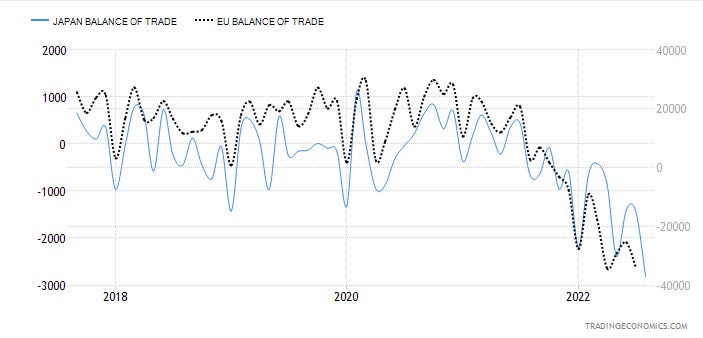

This worsens the problem that the Balance of Trade is trending in negative terms ( importing more than exporting) shows an evident death spiral of a country’s economy. The following chart is the whole EU’s Balance of Trade:

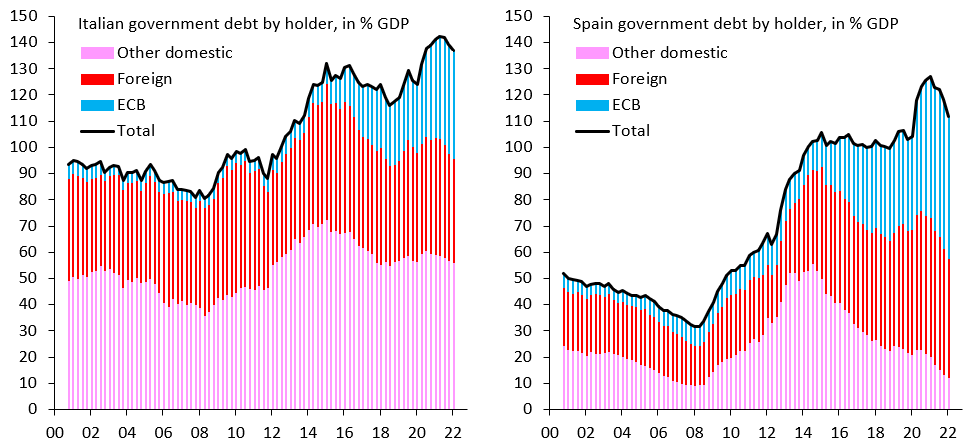

“Europe can reform its fiscal rules, but if the ECB is the only buyer - the situation for the past decade - it's a bit like having a conversation with yourself. What's needed is a conversation with markets to find out why they're no longer buying & what steps are needed to fix that…” by Robin Brooks Chief Economist at IIF

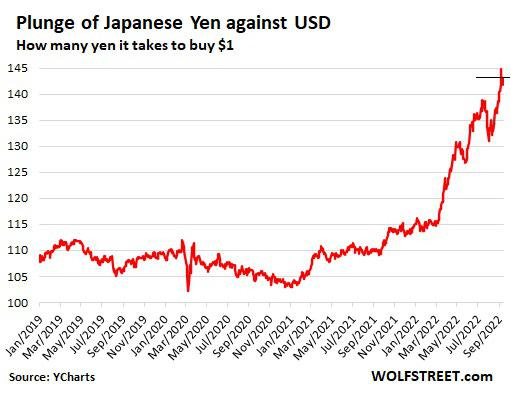

The Japanese government officially acknowledges the lost of the battle to stop the Yen weakening

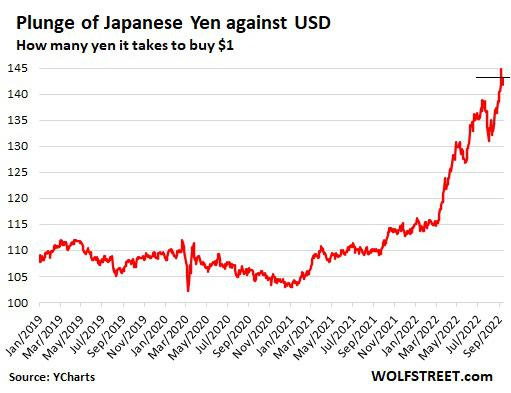

In my 15th newsletter, I already speculated about the fall of the Japanese Yen with the following title: “Will the Japanese Yen be the first hyperinflating major currency? (UPDATED!)”. Since then many times I have shown that the cause of their currency’s inevitable death is the crazy money printing they did.

Now just this week's news was the following: “Japan's Katayama: The country lacks sufficient tools to battle the yen's steep decline.”

Of course with the help of the Western countries (accumulating more debt) they can evade for a short period of time the inevitable.

The Japanese Balance of Trade shows the same pattern as the EU Balance of Trade. Both are trending in negative terms and because both economies need to import energy to produce their goods, the current energy prices make their economies crumble. From my point of view I still think the Japanese economy will fall first from the G7 countries and maybe the EU will follow it soon.

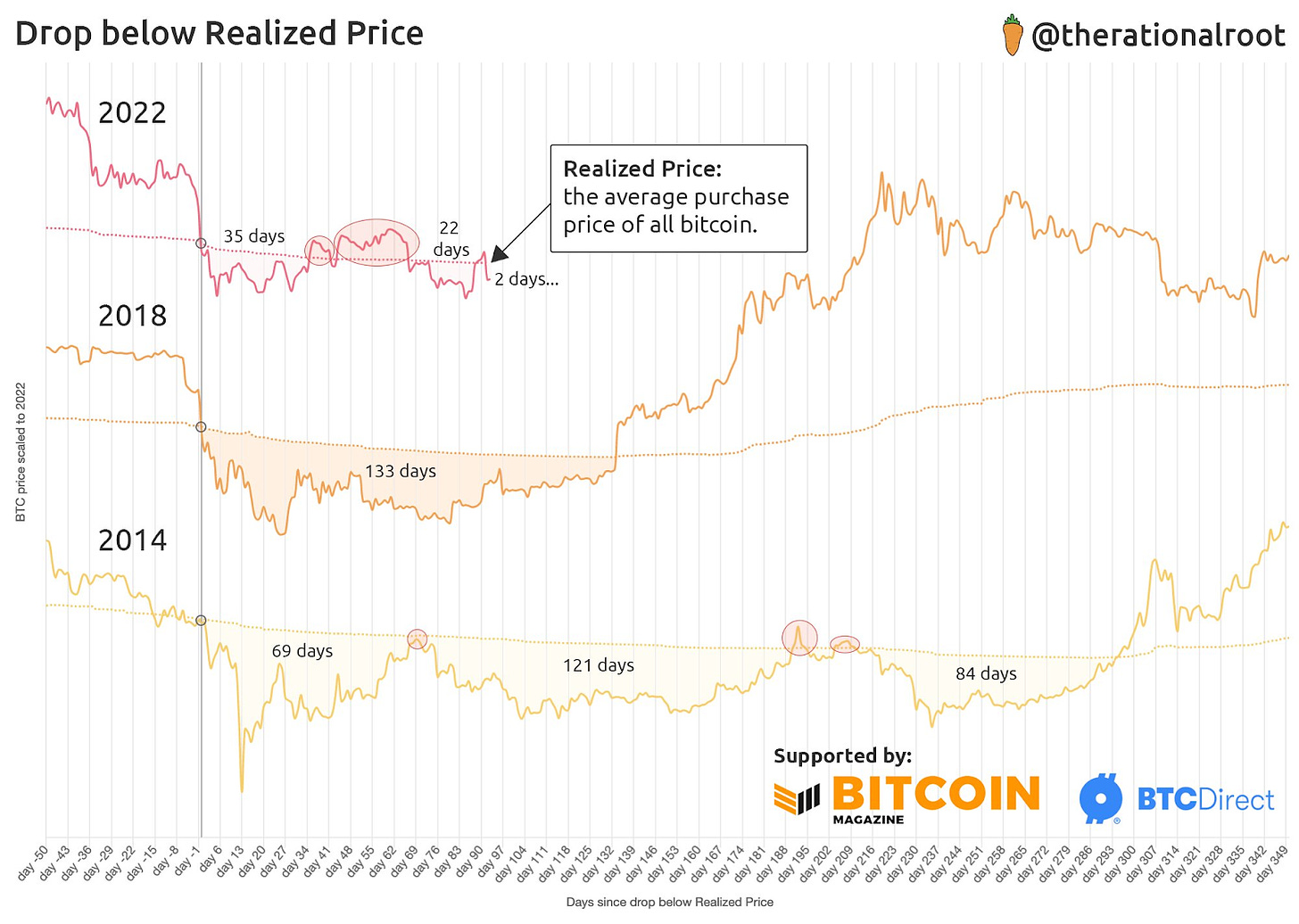

Bitcoin price speculations

These are just speculations, no investment advice!

From time to time I will share my own speculations about the expectations of when the Bitcoin bull market will start. I always use the simplest things in my chart technical analysations, so I won’t get confused with a lot of indicator noise.

Bitcoin Shorts

Funny Bitcoin short stories

“BAM! New ATH BTC hash rate - 75% above when Bitcoin was $69k last November...and - not a typo - 2700% above when Bitcoin was $20k in December 2017! NEVER before so undervalued - NOT EVEN CLOSE!” by @Andy_Hoffman_CG

Suggestions

Interesting articles to read

Why The EU Is Struggling To Bring Its Energy Crisis Under Control

Price Controls Have Failed for 4,000 Years—and Humans Still Haven’t Learned

Sources:

https://watcher.guru/news/central-bank-of-bahrain-to-test-bitcoin-payments-via-opennode

Solid work! Keep it up!