2022/33

05 September 2022 - 11 September 2022 week Bitcoin & Economic News

This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Prince Philip of Serbia and Yugoslavia joins Bitcoin startup JAN3

Russia to legalize use of Bitcoin in International trade

Human Rights Foundation donates $325K to Bitcoin development

Bloomberg Intelligence: Bitcoin will be one of the best performing assets over the next decade

Fidelity is launching Bitcoin trading for retail customers in November

CleanSpark purchases 10,000 Bitcoin Mining machines

Singapore's DBS Bank aims to expand Bitcoin services

Nigeria sets plans to launch a special economic zone for Bitcoin

MicroStrategy's is considering to purchase more Bitcoin

Prince Philip of Serbia and Yugoslavia joins Bitcoin startup JAN3

His Royal Highness Hereditary Prince Philip of Serbia and Yugoslavia, also known as Prince Filip Karađorđević, will serve as Chief Strategy Officer (CSO) for Bitcoin startup JAN3.

He has an extensive background of working in London’s financial sector, assisting clients with macrotrend analysis, comprehension of their implications, and critical capital allocation decisions. His experience with the legacy banking system has made him aware of the outdated inefficiencies within the industry.

In his new role, Prince Philip will engage with prominent figures and coordinate strategic initiatives to accelerate Bitcoin adoption among individuals and nation-states.

“I can’t think of anyone more qualified than Prince Philip to help us drive these strategic conversations and initiatives at a nation-state level, in Latin America and worldwide.” said Samson Mow CEO of JAN3

Russia to legalize use of Bitcoin in International trade

Russia is pushing hard to evade the sanctions because just last week I wrote that “the prime minister added that digital assets (only Bitcoin) provide a good opportunity to ensure uninterrupted payments for imports and exports.” Now here comes this week's news:

The Bank of Russia and the country’s Ministry of Finance have reconsidered their positions toward Bitcoin and shitcoins, per a report by local news outlet TASS.

According to TASS, the two government bodies have agreed that “it is impossible” to continue without enabling cryptocurrency as a legal payment method for international trade.

In March, the chairman of the country’s Congressional energy committee, Pavel Zavalny, said the country was open to taking payments for natural gas and other natural resources exports in bitcoin.

“When it comes to our ‘friendly’ countries, like China or Turkey, which don’t pressure us, then we have been offering them for a while to switch payments to national currencies, like rubles and yuan,” Zavalny said at the time. “With Turkey, it can be lira and rubles. So there can be a variety of currencies, and that’s a standard practice. If they want bitcoin, we will trade in bitcoin.”

I think these sanctions with confiscating (stealing) Russia’s USD reserves proved to everyone that “not your keys, not your coins”. It’s inevitable that this will push every other country towards Bitcoin.

If you want to talk about it, come and join the new Bitcoinomics Telegram group.

Human Rights Foundation donates $325K to Bitcoin development

The Human Rights Foundation (HRF) has announced its latest round of donations totalling $325,000 in BTC, focused on furthering key elements of the Bitcoin ecosystem, per a press release sent to Bitcoin Magazine.

With this round of bitcoin donations, HRF is focusing on censorship-resistance, open-source custody solutions, Bitcoin Core development, Chaumian e-cash, and education across the globe.

If you want to read the details on which projects spent this money here you can.

Bloomberg Intelligence: Bitcoin will be one of the best performing assets over the next decade

Mike McGlone, a senior commodity strategist at Bloomberg, shared Bloomberg’s Crypto Outlook report on LinkedIn discussing bitcoin’s next bull run as it relates to the broader economy.

“Bitcoin is at a discount within an elongated bull market,” reads the report.

Furthermore, the report explains that it’s only a matter of time before the Federal Reserve has to switch its current monetary policy of quantitative tightening. In short, once the increase of rates seems to return to normalcy and large amounts of borrowing funds return, large influxes of borrowed cash tends to flow into traditional assets.

“Bitcoin and cryptos are going to keep doing what they do best, outperforming most traditional assets with declining volatility.”

Fidelity is launching Bitcoin trading for retail customers in November

Fidelity, whose full name is actually Fidelity Investments, is a US financial services giant, so much so that it is by far one of the largest asset managers in the world, with more than $4.5 trillion in assets under management and $24 billion in revenues. Among other things, it is well known for managing large pension funds.

Although there is no official confirmation yet, a recent press release posted on the company’s website explicitly hints at something similar.The launch of the Fidelity Hedged Equity Fund (FEQHX) was announced, which is mutual funds, as stated in the official press release, can include alternative investments such as “distressed debt, real estate debt, private equity, and Bitcoin.”

Through funds such as this, Fidelity is able to offer its retail clients the ability to take a position on, for example, the price of Bitcoin, thus in some way to trade on the price of BTC, without having to directly buy and hold them.

CleanSpark purchases 10,000 Bitcoin Mining machines

CleanSpark Inc. (Nasdaq: CLSK) has recently purchased 10,000 brand new Bitmain Antminer S19j Pro ASIC miners from Cryptech Solutions for $28 million.

“During the tail end of the bull market last year, we strategically focused on building infrastructure instead of following the then industry trend of pre-ordering equipment months in advance.” said by Zach Bradford CEO of CleanSpark

Throughout the summer, CleanSpark has been accumulating a large number of miners. 1,800 units were bought by the company in July, while 1,000 more were acquired the month before. According to the announcement, the mining company bought more than 6,000 ASIC miners between June and August.

With an increase in profits and revenue from this move, the company notes that the recent acquisition and deployment of these machines was done sooner than expected. All of the purchased miners should be delivered and operational by November of this year.

CleanSpark’s fleet of 37,000 miners currently produces 14.9 BTC on average per day across all of its locations with a capacity of 3.8 exahashes per second (EH/s).

Singapore's DBS Bank aims to expand Bitcoin services

DBS Group Holdings is the largest bank in Singapore and has recently announced that they plan to expand their Bitcoin and other shitcoin services to 300,000 of its wealthiest clients. As of the end of 2021, DBS holds $488 billion in total assets. The bank currently has less than 1,000 members on the exchange.

The expansion includes an upgrade for their mobile app to be easier to manage. The upgrade will also allow clients to manage digital assets on the app. The clients of DBS include accredited investors, private banks, and exchanges. These clients, primarily from Asia, already manage funds on the app but will now have the ability to manage digital assets like Bitcoin and other shitcoins.

The bank’s brokerage arm last year received a cryptocurrency license from the Monetary Authority of Singapore, allowing its institutional and wealthy clients access to its DBS Digital Exchange by invitation.

DBS has reported a doubling in transactions from April to June and a quadrupling of Bitcoin transactions in particular.

Nigeria sets plans to launch a special economic zone for Bitcoin

Nigeria is pursuing to create the first economic free zone for Bitcoin and other shitcoins in West Africa through the Nigeria Export Processing Zones Authority (NEPZA), according to a press release.

Talent City specializes in building special economic zones and is working alongside Binance and NEPZA.

According to NEPZA’s managing director, Adesoji Adesugba, "our goal is to engender flourishing virtual free zones to take advantage of a near trillion dollar virtual economy in blockchains and digital economy."

MicroStrategy's is considering to purchase more Bitcoin

Publicly traded software company MicroStategy (MSTR) is already the single largest corporate holder of Bitcoin, with over 129,000 BTC in its coffers.

In a prospectus filed with the SEC on Friday, MicroStrategy said the firm has entered an agreement with investment bank Cowen & Co. to sell up to $500 million in shares of its Class A common stock.

"We may use the net proceeds from this offering to purchase additional Bitcoin (…) We have not targeted any specific amount of Bitcoin holdings," the firm said. "We will continue to monitor market conditions in determining whether to conduct debt or equity financings to purchase additional Bitcoin." the company said in the filing.

Global Economic News

TL;DR

Russia and China's economic ties are stronger than ever

ECB hikes interest rates by record 75 basis points while the Eurozone goes into deep recession

The Pound is at historic low against the USD

With record CPI numbers the US Household Wealth suffers record fall in Q2 while strong USD worsens the debt problem

Russia and China's economic ties are stronger than ever

According to Markets Insider: “Russia's top banks are switch away from SWIFT and now using an equivalent Chinese system called CIPS.

EU & USA sanctions are pushing Russia into the Chinese financial eco-system where the $80 trillion in commodity Russia commodity reserves will be traded and supplied via Asia.

Even after the Ukraine war, I very highly doubt that Russia is coming back to do regular banking and trading with Europe and the USA.

It doesn't make sense for Russia to build up assets in Euros or Dollars ever again. SWIFT and USD weaponized.” by Wall Street Silver

“China's exports to Russia (black) continued to ramp up in August. This is a major rotation in global trade, with China stepping up as the world's leading exporter to Russia.” by Robin Brooks Chief Economist at IIF

“China's imports from Russia this August swamped the same month in previous years (red). That's mostly a price effect & is going on more broadly across countries. What's not going on more broadly is that China's August exports to Russia reached an all-time high (blue) this year…” by Robin Brooks Chief Economist at IIF

Meanwhile Rosneft (Russian Petroleum refineries company) has agreed with Mongolia on building a pipeline to China via Mongolia.

ECB hikes interest rates by record 75 basis points while the Eurozone goes into deep recession

“Raises Main Refinancing rate by 75bps to 1.25%, raises deposit rate by 75bps to 0.75%. Expects to raise rates further over next meetings. No QT announced: PEPP reinvestments to run until at least end of 2024” by Holger Zschaepitz journalist at Welt

“ECB communications conundrum

1. We're hiking 75 bps, but that's front-loading

2. We're hawkish, but not taking rates restrictive

3. We're tightening, but doing QE for Italy & Spain

4. Growth is a lot weaker, but we see no recession

5. All this boils down to Euro falling further

The Euro zone narrative is shifting. A few months ago it was: "there won't be a recession." Recently it shifted to: "there'll be recession, but it'll be shallow." This weekend we began to make the final shift: "we're heading for a deep recession." Euro is going to fall a lot more…” by Robin Brooks Chief Economist at IIF

The Pound is at historic low against the USD

According to Bloomberg, On her first days on the job, UK PM Liz Truss has managed to evoke the memory of Margaret Thatcher in at least one regard: the sterling-dollar exchange rate. Pound briefly dropped to its lowest level vs the Dollar since 1985. Pound now down 15% ytd.

“The markets are seemingly relishing the opportunity to bash the British pound,” said Valentin Marinov, head of G-10 currency research at Credit Agricole in London.

UK taxpayers will be on the hook for as much as £200 billion ($230 billion) over the next 18 months to cover the cost of Truss’s plans to contain energy prices, according to people familiar with the policy. (Great article: Incoming PM Truss Drafts Colossal £130 Billion Plan To Freeze UK Power Bills)

This is a true Socialist move. They are manually controlling the commodity prices paid by their citizens on the market which will cause market disruption. To “repair” these disruptions they will print money which will just make things worse.

Meanwhile the UK Bond Yield curve shows the economy has structural problems and the bonds can be sold only with raised yields.

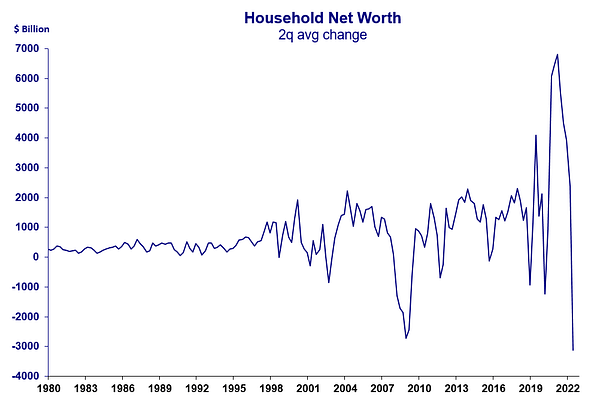

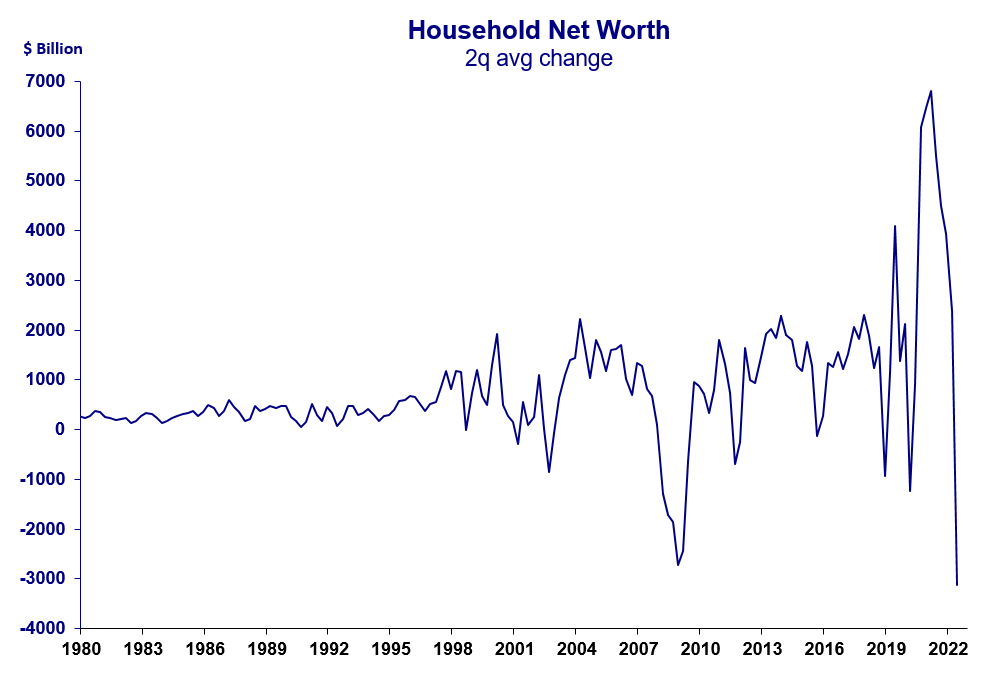

With record CPI numbers the US Household Wealth suffers record fall in Q2 while strong USD worsens the debt problem

Household net worth fell to $143.8 trillion at the end of June. It originally sat at $149.9 trillion at the end of March, marking its second consecutive quarterly decline. According to a Federal Reserve report observed by Reuters, as of June, Americans’ collective wealth had fallen by more than $6.2 trillion from a record $150 trillion at the end of 2021.

“The historic surge of inflation visualized using CPI data going back over 70 years.” by @Mayhem4Markets

“Interest paid on the $30 trillion in US govt debt was $562 billion during 2021 the average percentage rate on all debt was 1.5%. Now rates are above 3% and heading to 4%. Are you ready for over $1 trillion annually in interest payments?

Roughly $6 T to $7 Trillion in debt matures annually and gets refinanced by the government at the new higher rates. We will quickly see these numbers get above $1 trillion and within 2-3 years reach $1.5 trillion in interest payments to service debt.

Total US govt revenue in 2021 was about $4 trillion. $1.5 trillion interest payments on $4 trillion in revenue is about 37.5% of all govt revenue servicing the debt. This is getting sort of crazy and something is gonna break. Just my opinion.” by Wall Street Silver

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

“Everyone wants a killer app. A Bitcoin LN wallet. Savings account in #bitcoin, checking account in tether.“ by Michael Saylor (video)

“In 2011 Bitcoin fell below $20.

In 2015 Bitcoin fell below $200.

In 2017 Bitcoin fell below $2,000.

In 2022 Bitcoin fell below $20,000.

You already know what’s coming..” by @MMCryptoOne year ago today, El Salvador adopted Bitcoin as legal tender. (2021.09.07)

“El Salvador is Bitcoin country. Where else in the world do 16 year old high school students get taught about elliptic curve cryptography as part of their diploma “ by Stacy Herbert

An 84 years old Woman buys Bitcoin. (video)

Suggestions

Interesting articles to read

Sources:

https://bitcoinmagazine.com/markets/bloomberg-analyst-bitcoin-is-a-wild-card-set-to-outperform

https://en.cryptonomist.ch/2022/09/09/fidelity-bitcoin-trading-retail-clients/

https://www.btctimes.com/news/cleanspark-purchases-10000-bitcoin-mining-machines

https://www.btctimes.com/news/singapores-dbs-bank-aims-to-expand-bitcoin-services

https://watcher.guru/news/us-household-wealth-suffers-record-fall-in-second-quarter

https://decrypt.co/109410/microstrategy-is-considering-buying-even-more-bitcoin