This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Argentine province Mendoza now accepts Bitcoin for tax payments

Iran has approved the use of Bitcoin for Trading and Imports

World’s largest Bitcoin ATM firm will list on the Nasdaq

Indonesian GoTo bought a Bitcoin exchange

Russian PM: Russia needs to adopt Bitcoin to "guarantee uninterrupted payment" (UPDATED!)

El Salvador’s Bitcoin Beach is receiving $203 Million

Argentine province Mendoza now accepts Bitcoin for tax payments

In a Saturda statement, the Mendoza Tax Administration (ATM) described the new crypto payment service as fulfilling “the strategic objective of modernization and innovation,” giving “taxpayers different means to comply with their tax obligations.”

The service officially began operation on Aug. 24, but at this stage, it will only accept stablecoins such as Tether (USDT) for tax payments.

Citizens can pay through the portal on the ATM website using any Bitcoin or shitcoin wallets.

Once the user chooses Bitcoin or any other shitcoin as their payment option, the system sends a QR code, with the equivalent amount of stablecoins converted to pesos by an undisclosed online payment service provider.

This is the same transaction like all the other big brands are making with BitPay. They are converting instantly their Bitcoin to a FIAT shitcoin, but this time through multiple steps. It’s a typical FIAT governmental plan who just wants to earn some extra money.

Iran has approved the use of Bitcoin for Trading and Imports

Iran has approved the use of Bitcoin and some shitcoins for trading and importing goods, according to Industry Mines and Trade Minister Reza Fatemi Amin. The approval serves as a measure to circumvent US sanctions imposed on its finance and banking sector.

Earlier in the month, Iran made its first official import cryptocurrency order, worth $10 million. It served as a test run for allowing the country to trade through digital assets that bypass the global financial system. It also served to trade with other countries similarly embargoed by US sanctions.

“By the end of September, the use of cryptocurrencies and smart contracts will be widely used in foreign trade with target countries,” says Alireza Peymanpak, a deputy Iranian trade minister who leads Iran’s Trade Promotion Organization (TPO).

Another proof that sanctions never worked through history.

World’s largest Bitcoin ATM firm will list on the Nasdaq

Bitcoin Depot is planning to go public via a special-purpose acquisition company (SPAC). GSR II Meteora Acquisition Corp. (GSRM) is a SPAC investor and will be merging with Bitcoin Depot while trading under the ticker symbol BTM. The listing will help the company penetrate a larger market, such as bringing their ATMs to New York in the future.

The CEO and founder, Brandon Mintz, stated that “we are always looking to expand our reach so as many people as possible can access cryptocurrency to control their own money and conduct easier and simpler financial transactions.”

Bitcoin Depot ATMs may usually be found at local gas stations or convenience stores. The company reported $623 Million in revenue and over $6 Million in net income over the previous 12 months. Currently, Bitcoin Depot has over 7,000 ATMs operating across the United States (available to around 40% of the U.S. population).

With over half the U.S. underserved, there is still plenty of room to grow for Bitcoin Depot, and this move is an attempt to expedite that process.

Indonesian GoTo bought a Bitcoin exchange

According to Reuters, the biggest technology firm in Indonesia, GoTo Gojek Tokopedia Tbk (GoTo), entered the Bitcoin space by acquiring local exchange PT Kripto Maksima Koin.

“We believe that blockchain technology may play a mainstream role in the future of finance," GoTo said, per the report.

GoTo, which boasts a market cap of over $25 billion after raising $1.1 billion from its initial public offering (IPO), did not detail its future plans for the newly acquired exchange.

Russian PM: Russia needs to adopt Bitcoin to "guarantee uninterrupted payment" (UPDATED!)

The adoption of digital assets is necessary as a “safe alternative” for cross-border payments, Russian Prime Minister Mikhail Mishustin declared at a strategic session on the development of the domestic financial system on Tuesday.

The prime minister added that digital assets (only Bitcoin) provide a good opportunity to ensure uninterrupted payments for imports and exports. Mishustin also pointed out the importance of ensuring tech infrastructure independence and the cybersecurity of financial institutions, stating:

“We need to intensively develop innovative areas, including the adoption of digital assets. This is a safe alternative for all parties that can guarantee uninterrupted payment for the supply of goods from abroad and for export.”

Mishustin’s remarks came shortly after Iran’s Industry of Mines and Trade Ministry approved the use of cryptocurrencies for imports.

(UPDATE 1.: “Russia and Iran will be integrating payment systems. This is very big news. Russia, Iran, and Qatar account for just under 60% of the world’s gas reserves.” by Gold Telegraph )

El Salvador’s Bitcoin Beach is receiving $203 Million

El Salvador’s El Zonte beach is set to receive more than $203 million in investment from the government. The beach is an iconic location, better known as ‘Bitcoin Beach,’ due to El Salvador’s successful adoption of Bitcoin to create a local circular economy.

This investment represents efforts to improve the beach’s infrastructure and give tourists a better experience. It will see the addition of new businesses, roads, and support facilities.

“El Zonte for many is known as Bitcoin Beach; we are going to fix an area of 15,000 square meters, where there will be a shopping center, parking, beach club, treatment plant, to revitalize the area.” said President Nayib Bukele

More details about the Infrastructure investments can be read here in the official statement (Google Translated).

Global Economic News

TL;DR

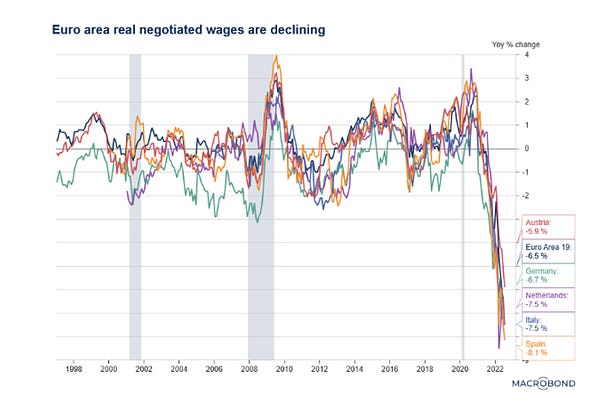

Eurozone inflation is rising and real wages are declining

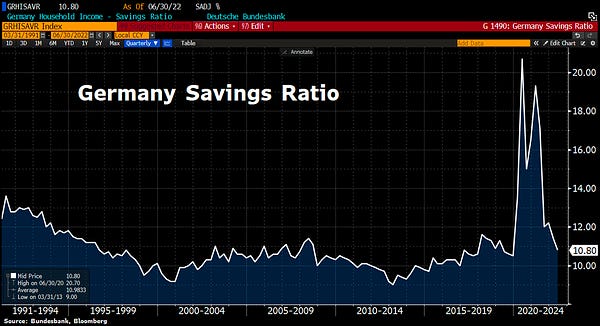

Germany’s savings ratio, housing market, real wages and trading balance collapsed

The hidden problem with the strong USD

The recession barely started based on the global money supply

Eurozone inflation is rising and real wages are declining

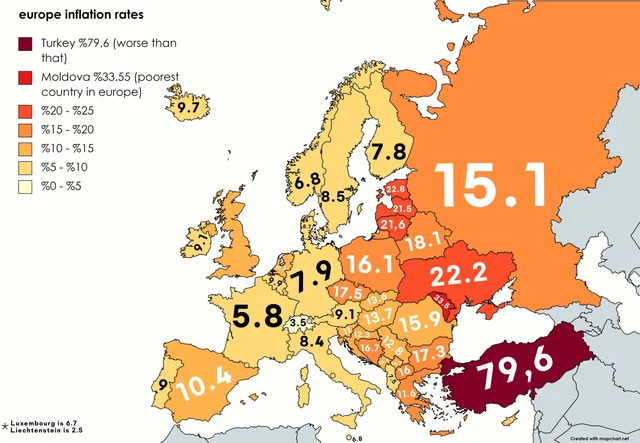

Current Inflation Rates In Europe with Turkey going soon to Weimar level of inflation.

Meanwhile India’s GDP grows at 13.5% in April-June quarter because of cheap Russian and Chinese commodities.

Germany’s savings ratio, housing market, real wages and trading balance collapsed

“Germany where the savings ratio has collapsed to 10.8% b/c German citizens can put aside less and less due to inflation. Will fall even further when the energy crisis hits full force.” by Holger Zschaepitz journalist at Welt

“Real estate stocks are mirroring the doom & gloom in German housing market. Shares of industry leader Vonovia have almost halved in value this year, while TAG Immobilien has lost almost 2/3rd due to higher interest rates & falling property prices.” by Holger Zschaepitz journalist at Welt

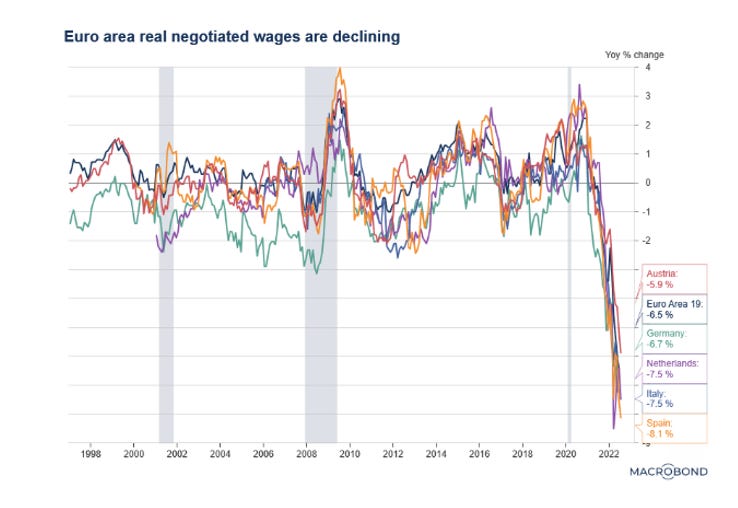

The Real wages plunged 4.4% in Q2 2022, most since the pandemic.

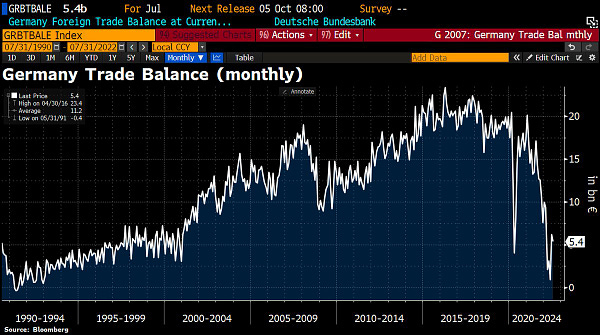

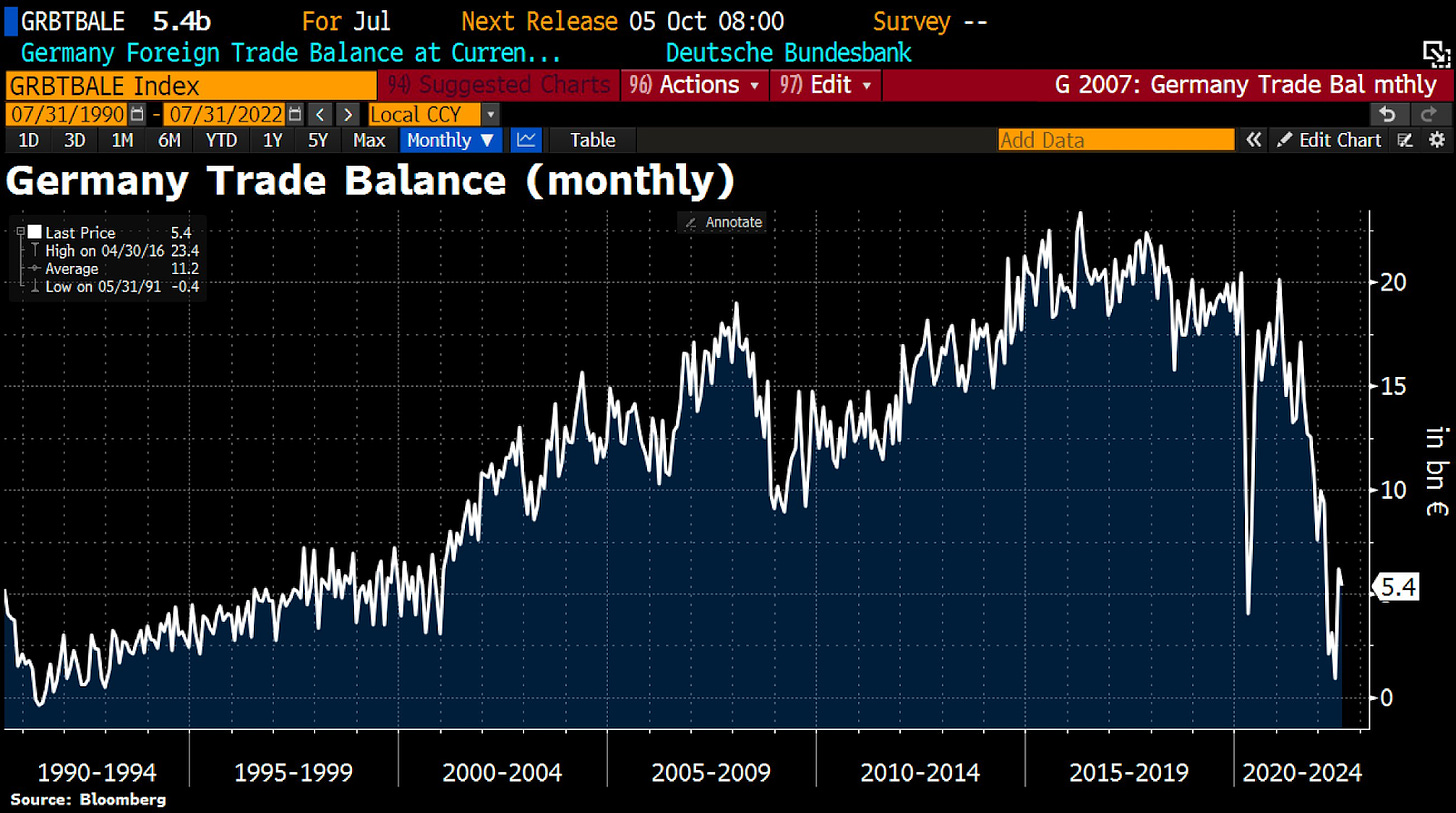

“Germany's trade surplus narrowed in July as exports fell at a greater pace than imports. Balance of exports & imports was €5.4bn, narrowing from €6.2bn in Jun. Surplus has shrunk significantly in the past months.” by Holger Zschaepitz journalist at Welt

Meanwhile the German inflation (official, not the real one) accelerated to 7.9% in Aug from 7.5% in July.

Some of us warned people many months or years before, but now others are trying too:

Shell CEO is warning that Europe’s energy crisis will last for several years…

The Belgian Prime Minister said Europe is in for 5 to 10 difficult winters…

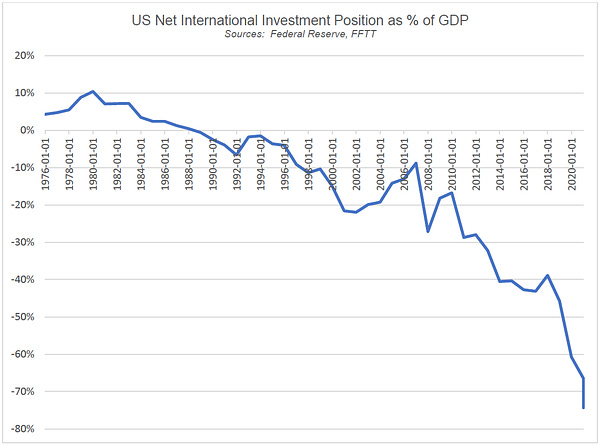

The hidden problem with the strong USD

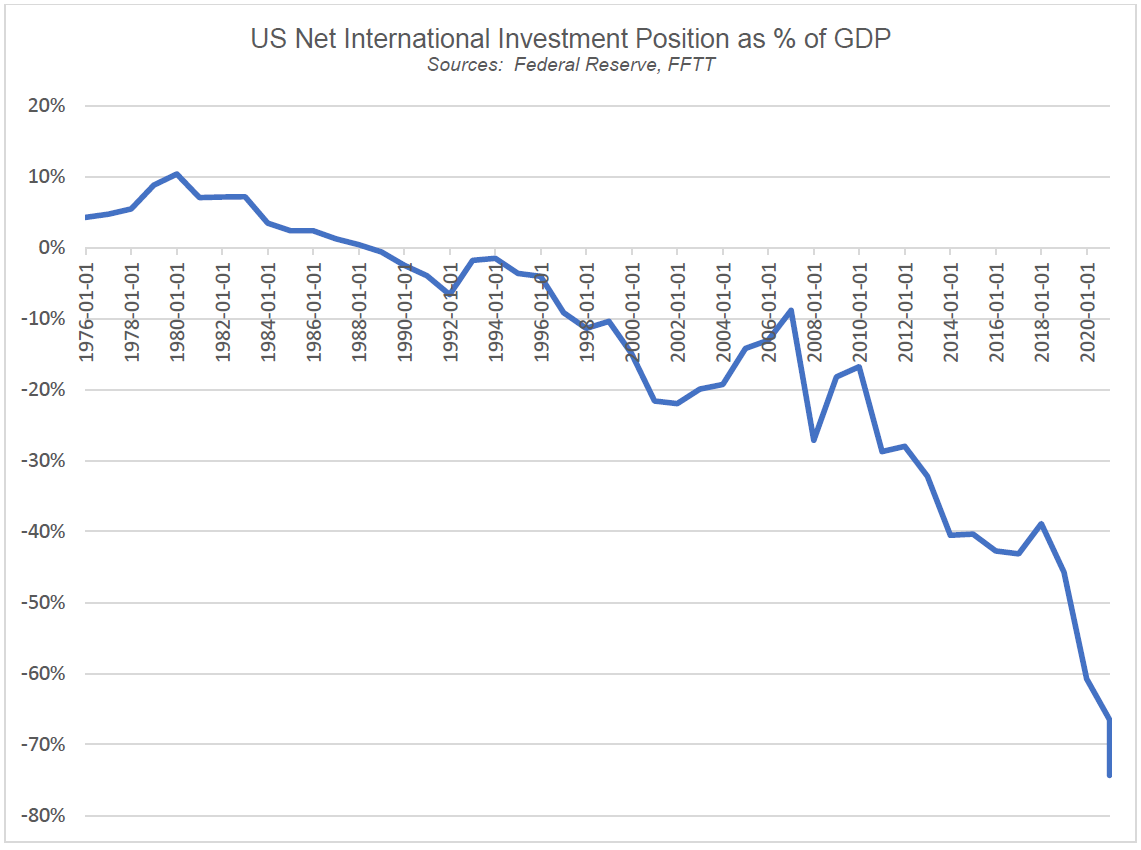

“Foreigners own $17T net (~$40T gross) in USD-denominated assets. They will sell it all if they must raise USDs to "cover their USD short position." The US stock market drives marginal US consumption, GDP, & tax receipts. Let's watch.” by Luke Gromen Founder & President, Forest for the Trees (FFTT)

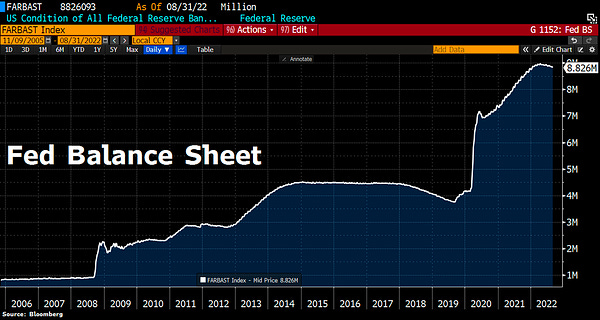

“Fed Quantitative Tightening (QT) has more than doubled last mth. Total assets have shrank $64bn in Aug after $24bn in Jul, $700mln in June & $25bn in May. Accelerating runoff of Fed's bond holdings sucks liquidity out of mkts - that increases the risk for an awful end to the year.” by Holger Zschaepitz journalist at Welt

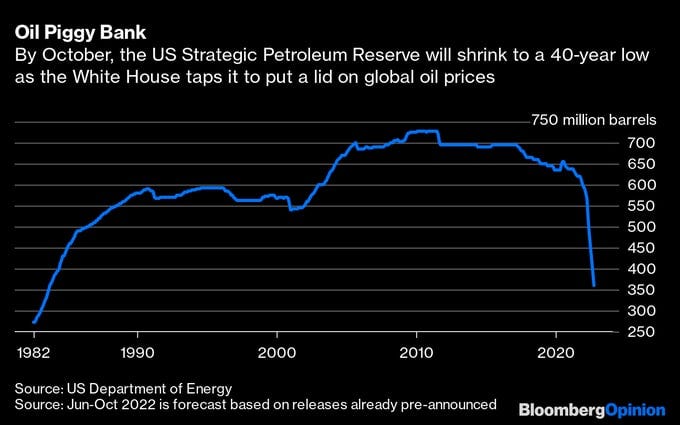

Meanwhile the Biden administration has drained the U.S. Strategic Petroleum Reserve to its lowest level since 1984.

The sad reality: US life expectancy has fallen from 78.8 years to 76.1 years, the largest drop in 6 decades and has fallen for the second year in a row.

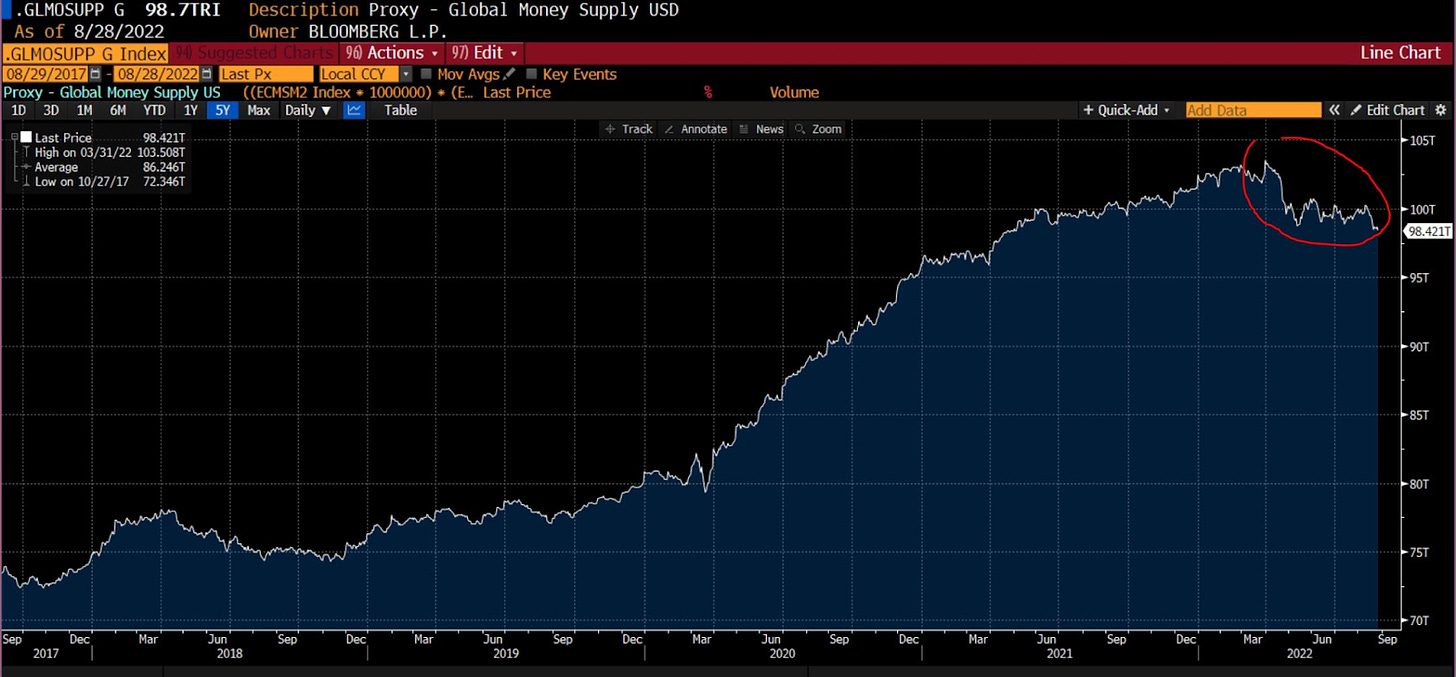

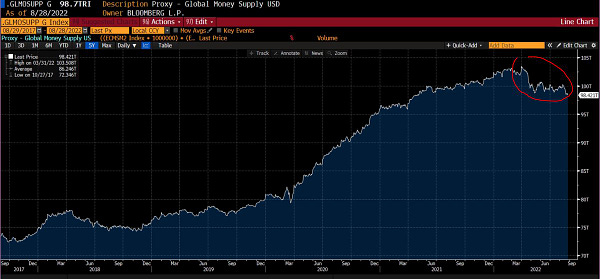

The recession barely started based on the global money supply

The Global money supply contraction and the current "normalization" shows that we barely scratched the surface of the recession which is coming.

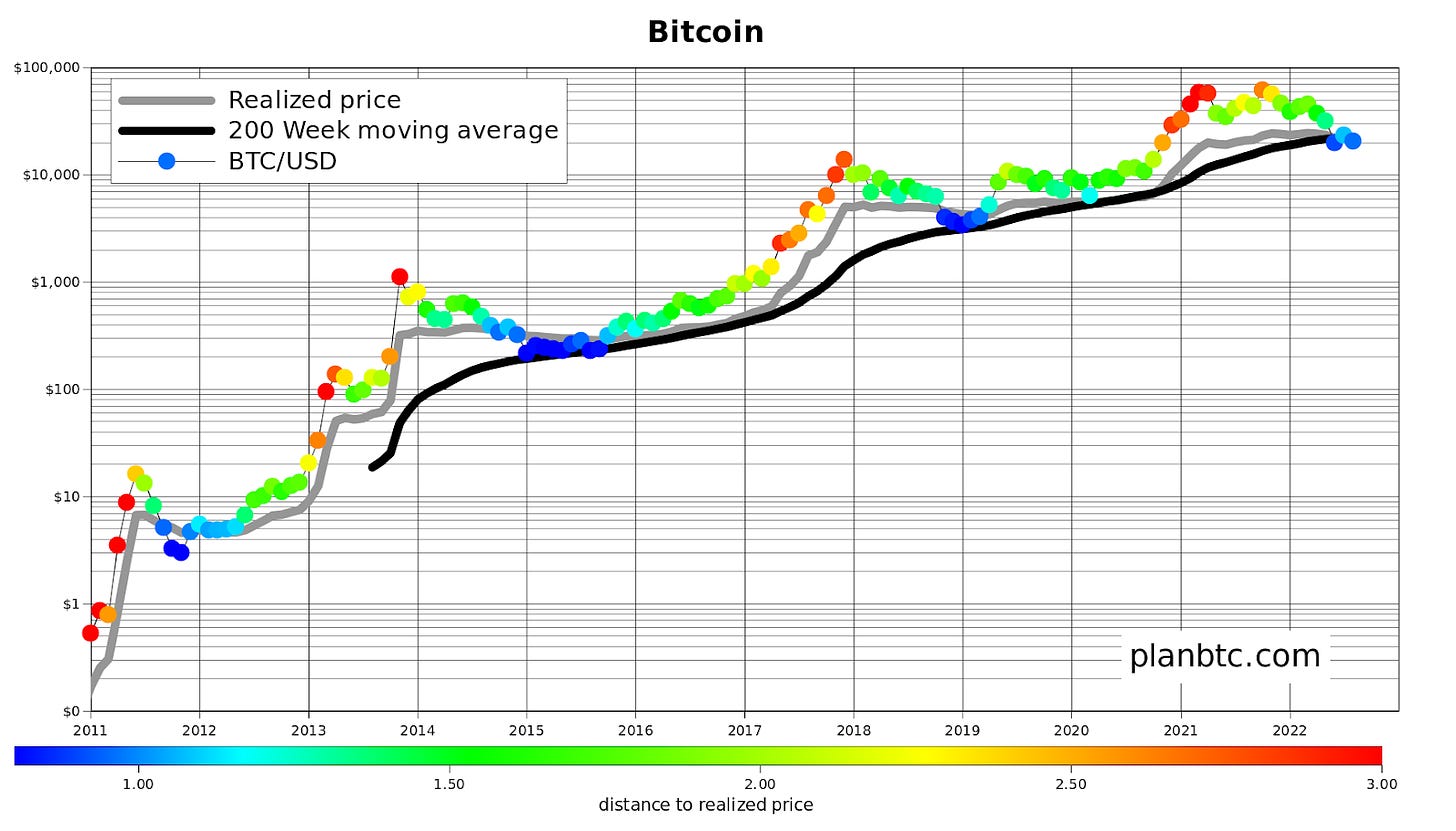

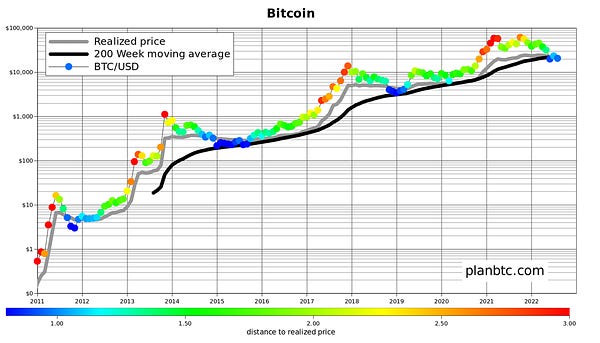

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

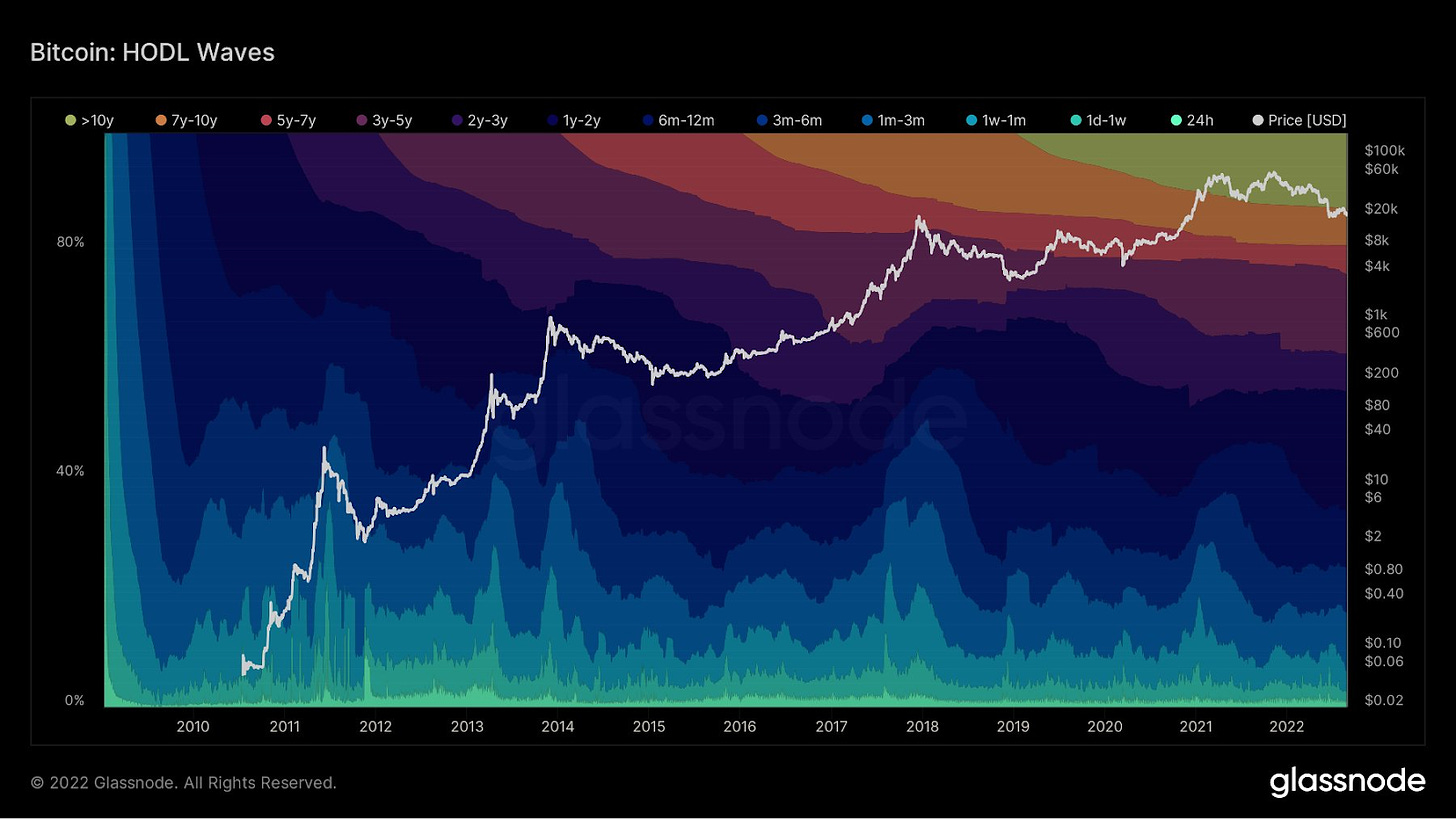

“65% of all the Bitcoin has not moved in over a year” by Documenting Bitcoin

U.S. Senator Ted Cruz toured the largest North American Bitcoin mining facility: Says he is “proud to fight” for the industry.

“You can send Bitcoin via radio” by Documenting Bitcoin (article)

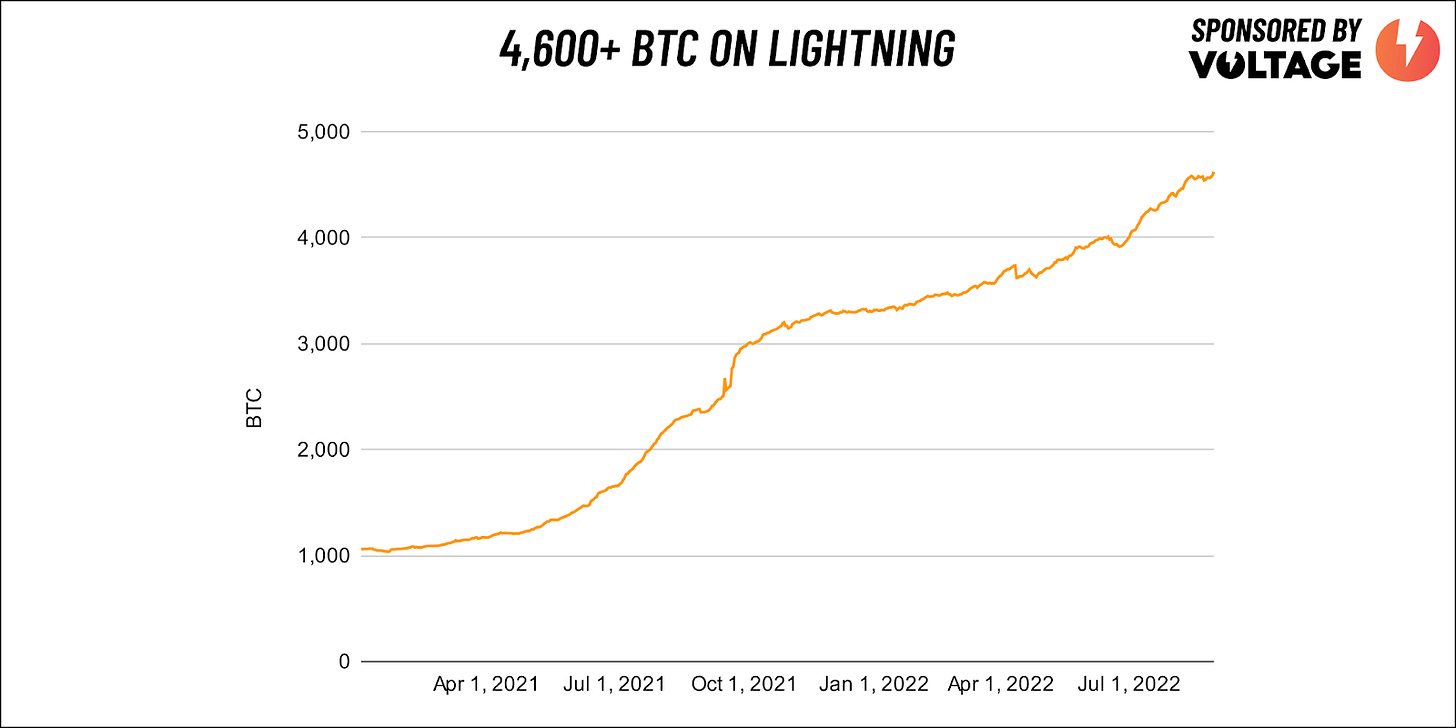

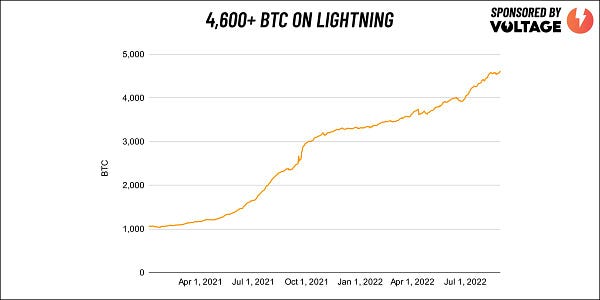

Lightning Network is UNSTOPPABLE! The capacity is already 4,600+ BTC.

Bitcoin is a Trojan Horse for freedom dressed up as a 'get-rich-quick scheme'. (video)

Bitcoin mining difficulty has increased by 9.26% to 30.98 trillion.

Luxury watchmaker Jacob & Co launches limited edition Bitcoin watch (video)

Bitcoin is hope for the small town of Rockdale, Texas (video)

“A global monetary network that requires only 406 GB memory space, transferred over $100 trillion in total value for an average transaction fee of $0.3 and all this P2P, without a single intermediary. Bitcoin is fucking amazing.” by CarlBMenger

Suggestions

Interesting articles to read

Sources:

https://cointelegraph.com/news/argentina-s-mendoza-province-now-accepting-crypto-for-taxes-and-fees

https://watcher.guru/news/iran-has-approved-the-use-of-crypto-for-trading-and-imports

https://www.btctimes.com/news/worlds-largest-bitcoin-atm-firm-will-list-on-the-nasdaq

https://cointelegraph.com/news/russian-pm-takes-cue-from-iran-s-crypto-payment-permit-for-imports

Russia's flip flopping is definitely interesting to read.