This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

XP Inc. is bringing Bitcoin to millions of their Brazilian customers

Bitmain, Antpool, and Antalpha are offering low-cost loans to help miners

BTG Pactual Bank has just launched a Bitcoin exchange with a focus on education

Riot Blockchain reveals continued expansion for their mining fleet

Revolut wins approval to offer Bitcoin services for their European customers

Houston Texans NFL Team will accept Bitcoin

Hyundai’s Securities affiliate to add Bitcoin data to its Asset Management Platform

XP Inc. is bringing Bitcoin to millions of their Brazilian customers

XP Inc. is Brazil’s largest investment broker by market value and has started offering their customers Bitcoin trading services on August 15th, 2022.

The new digital assets trading platform will be known as XTAGE and was developed in partnership with Nasdaq. ISTOE, a Brazilian publication, reported that the platform’s 3.6 million users will now be able to buy, hold, and sell Bitcoin.

Director of Financial Products at XP Lucas Rabechini is optimistic for the company’s future by emphasizing that “In the medium and long term, the potential is enormous, considering that we currently have more than 3.6 million customers on the XP platform.”

According to an internal XP survey from a few months ago, more than 60% of its customers are interested in purchasing Bitcoin and other shitcoins. Additionally, 80% of those same customers are already investing in these assets outside of the XP platform and said they are interested in using an XP-designed trading platform.

Bitmain, Antpool, and Antalpha are offering low-cost loans to help miners

According to Bloomberg, Bitmain Technologies Ltd., one of the largest manufacturers for Bitcoin mining equipment, and Antpool the second-largest mining pool in the world are partnering with Antalpha to provide a lifeline for Bitcoin mining companies during the current downtrend in the market.

Antalpha, an industry financier, will receive proprietary data from Bitmain and Antpool in order to assess financial risks associated with businesses seeking low-interest loans to pay back equipment loans and reduce borrowing costs.

Additionally, Antalpha will provide Bitcoin miners with a revolving line of credit that may only be used for electricity costs. According to Max Liao, managing director of business development at Antalpha, the low end of these loans has a rate of 6.6%, which is less than half the industry average, while the high end is capped at a maximum of 8.8%.

Liao explains to Bloomberg that “We are taking their biggest cash outflows, electricity cost, and helping them to reduce that burden.” Liao adds that the general consensus throughout the industry is that Bitcoin’s bear market will eventually end soon and the goal for Antalpha’s partnership with Bitmain and Antpool is to ensure that “everybody makes it through the winter.”

BTG Pactual Bank has just launched a Bitcoin exchange with a focus on education

BTG Pactual, the largest investment bank in Latin America, just launched a Bitcoin exchange in Brazil called Mynt.

Mynt will provide direct access to Bitcoin which will place it as one of the first of the largest institutions in Brazil to do so. BTG Pactual reportedly has over $200 billion in assets under custody and will begin to provide educational content for all its users about Bitcoin once they have created an account on their platform.

At Mynt’s launch, customers will not be able to withdraw their Bitcoin from the platform for self-custody but the platform plans to enable this function in the near future.

How funny is that? The Largest Investment Bank in Latin America could’t offer a self-custody option to their clients or the possibility to withdraw their Bitcoin. The evil is behind the details. (hope I’m wrong)

Riot Blockchain reveals continued expansion for their mining fleet

Bitcoin mining company Riot Blockchain boosted the size of its mining fleet to over 44,000 miners while more than 3,000 are ready for deployment. The company sold $14.4 million worth of their Bitcoin treasury and had a 30 million share offering to increase its cash position.

Riot’s report shows that its year-over-year (YoY) BTC production increased by 107%, producing 1,395 BTC valued at around $34 million at the time of publication as opposed to 675 BTC, or roughly $16 million, the year before.

Based on Riot’s update, the company is financially stronger even if the mining company capitulated and sold a portion of its Bitcoin holdings while dumping shares on the market. It is also important to note that Riot still has 6,653 BTC, or around $159 million, in its treasury.

Revolut wins approval to offer Bitcoin services for their European customers

Financial services company Revolut has won approval from the Cyprus Securities and Exchange Commission (CYSEC) to offer Bitcoin services across the European Economic Area (EEA).

The authorization will allow Revolut to provide Bitcoin and shitcoin services to its 17 million customers based in the EEA across the 27 member states of the EU plus Norway, Iceland, and Liechtenstein.

Houston Texans NFL Team will accept Bitcoin

The Houston Texans announced a partnership with Houston-based Bitcoin and cryptocurrency company BitWallet to serve as the team’s official digital currency wallet.

Texans fans will now have the option to use Bitcoin and other shitcoin through BitWallet to buy single-game suites. The Texans are currently the first NFL team to sell a suite using Bitcoin.

“We are proud to partner with BitWallet to offer an exciting option for our fans who are looking to enjoy Texans game day in one of our suites.” said by Texans president Greg Grissom

CEO of BitWallet John T. Perrone expresses that he is “honored” that BitWallet is the first company to provide Bitcoin services for Texans fans.

Hyundai’s Securities affiliate to add Bitcoin data to its Asset Management Platform

Hyundai Motor Group’s securities arm has extended its partnership with the South Korean crypto exchange Bithumb – and will allow its app users to access real-time Bitcoin and (possibly) other shitcoins markets data via MyData asset management platform.

MyData is a much-hyped new service in the South Korean financial sector. The service comprises government-regulated platforms that allow individuals to view all of their assets and liabilities on a single platform. This means that even if customers have accounts at multiple banks, in addition to stocks – and now Bitcoin and shitcoins – they will be able to view them all at once via such a platform.

Global Economic News

TL;DR

US Housing affordability is at its lowest level and the consumer credit card debt at ATH

Europe’s Energy crisis is inevitable

The German Producer Prices at new ATH

US Housing affordability is at its lowest level and the consumer credit card debt at ATH

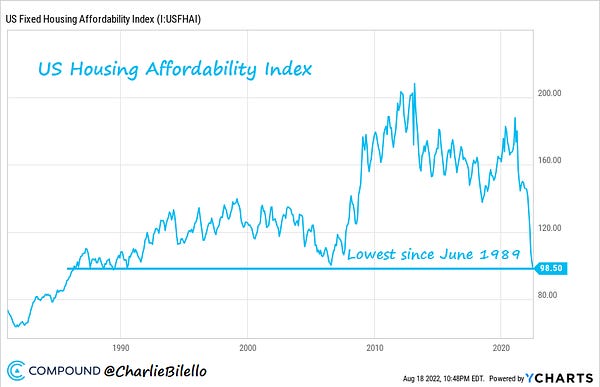

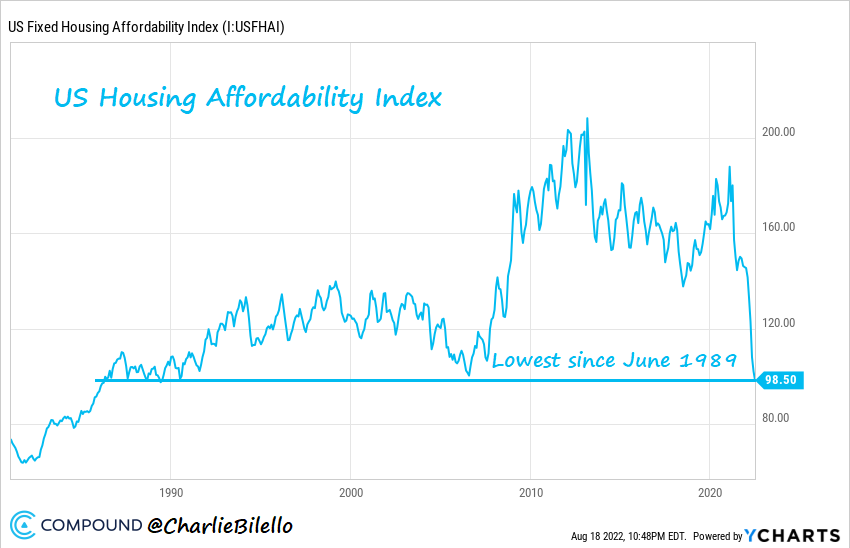

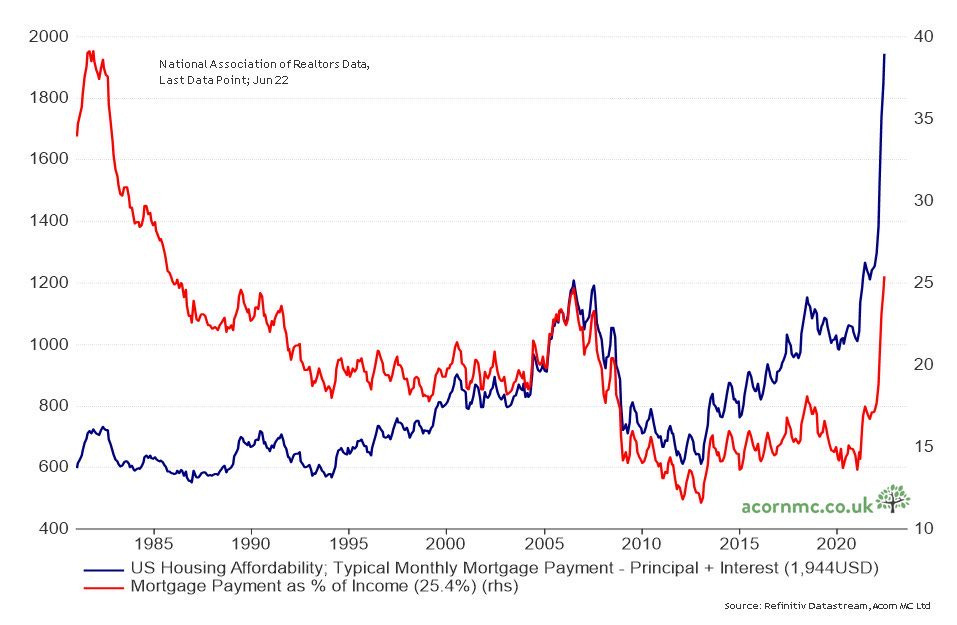

“US Housing Affordability is at its lowest level in 33 years, below the July 2006 low which was at the peak of the last housing bubble. Back then, national home prices subsequently fell 25% to their low in Dec 2011. Today, the price declines have just begun.” by Charlie Bilello, Founder and CEO of Compound Capital Advisors

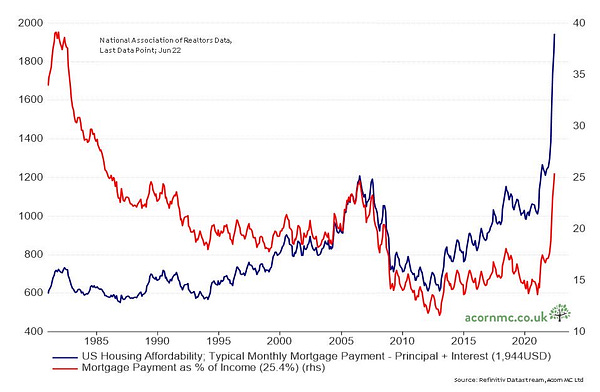

“US mortgage payments as a percentage of income are higher than at the top of the subprime bubble. What could go wrong?” by Michael A. Arouet analyst

This is a great article: Why Home Prices Haven't Crashed Yet

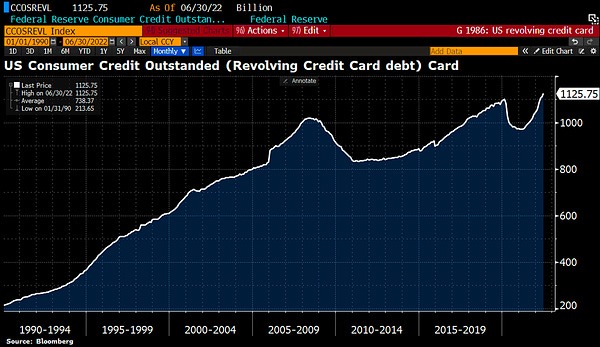

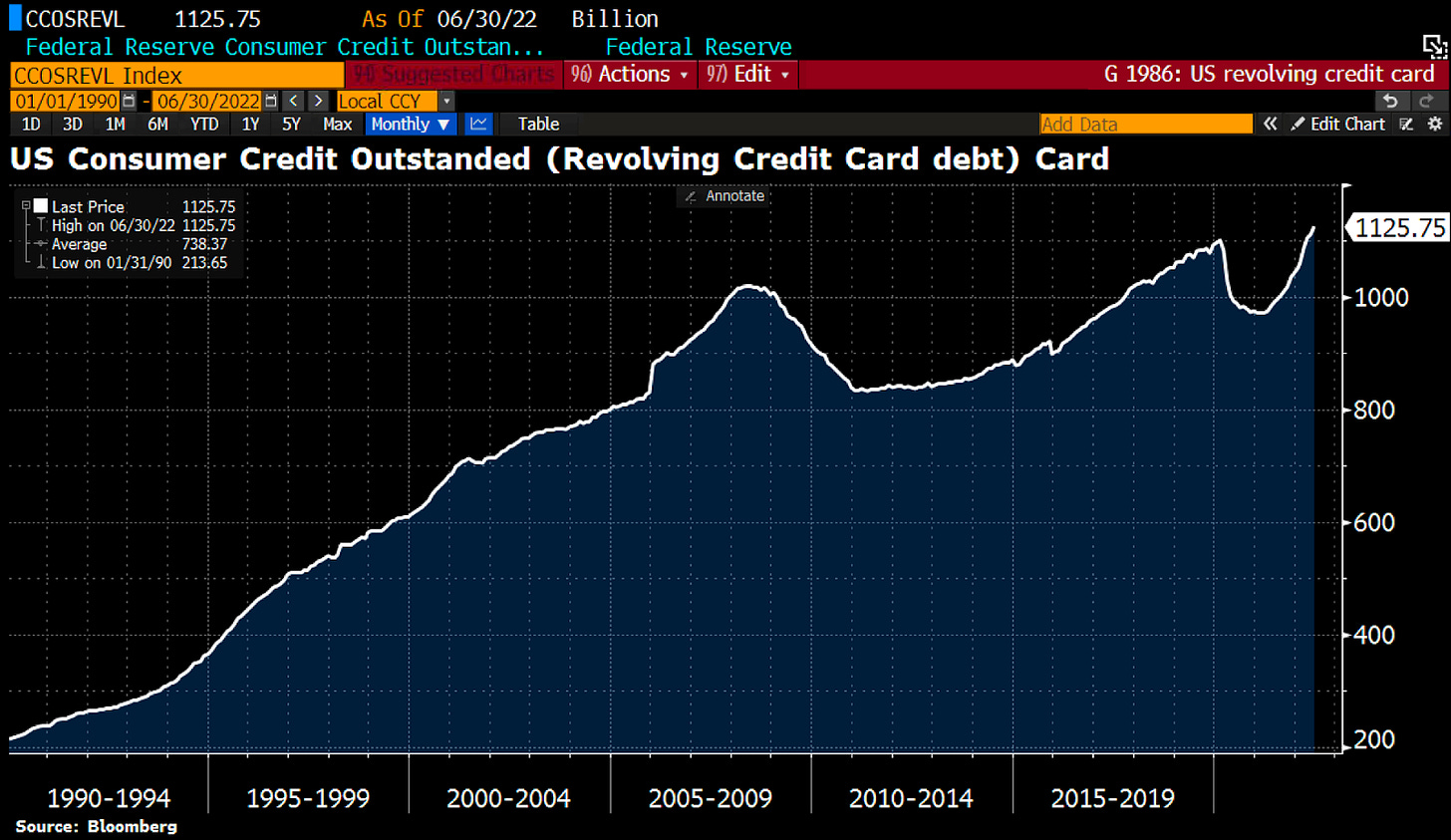

“Total US consumer credit card debt hit fresh ATH at $1.13tn "as consumers choose violence rather than cut back on spending in the face of inflation," 'Big Short' investor Michael Burry posted on Twitter on Aug12.” by Holger Zschaepitz, journalist at Welt

Europe’s Energy crisis is inevitable

“German and French electricity prices keep climbing, hitting fresh records.” by Holger Zschaepitz, journalist at Welt

“Natural gas prices in Europe rise to a new record high.” by Disclose.tv

Meanwhile Saudi Aramco made $48.4B Q2 2022 (almost $88B on the year) , nearly as much as the five biggest western energy majors combined. That is almost $19M a minute.

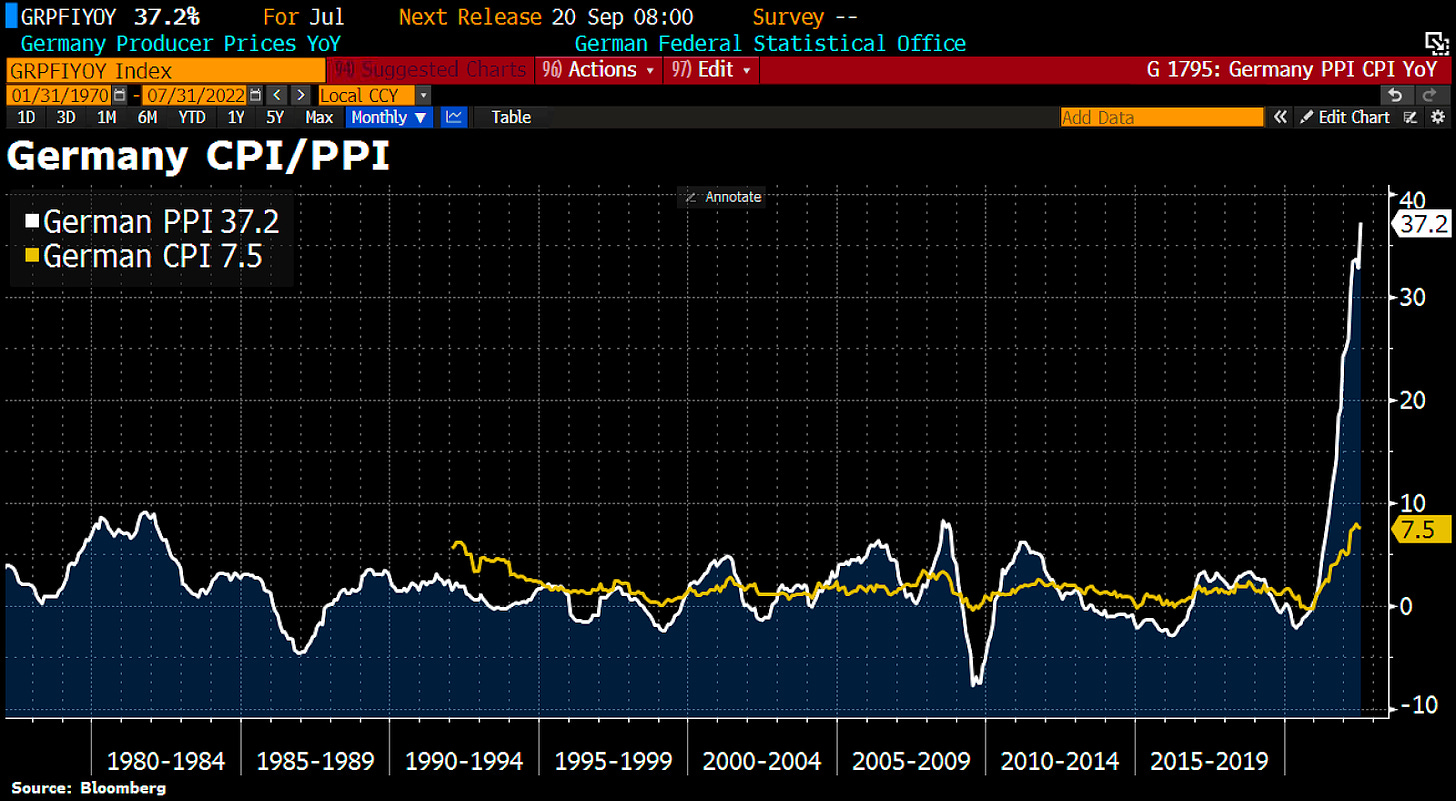

The German Producer Prices at new ATH

“German Producer Prices accelerated to 37.2% in July, a fresh record. Meaning: Consumer prices will not have seen their peak yet. Perhaps Germany will also experience double-digit inflation rates like the UK.” by Holger Zschaepitz, journalist at Welt

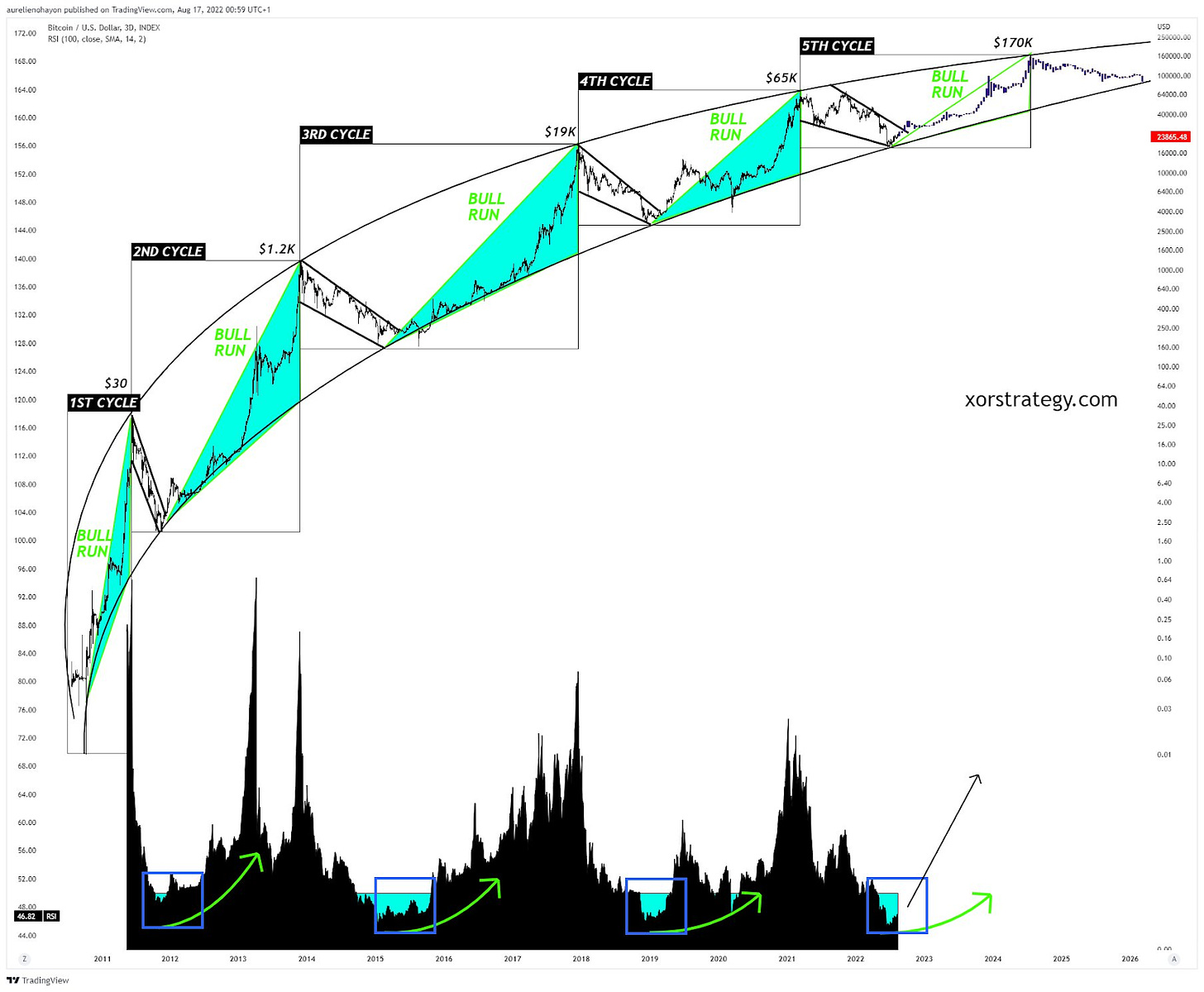

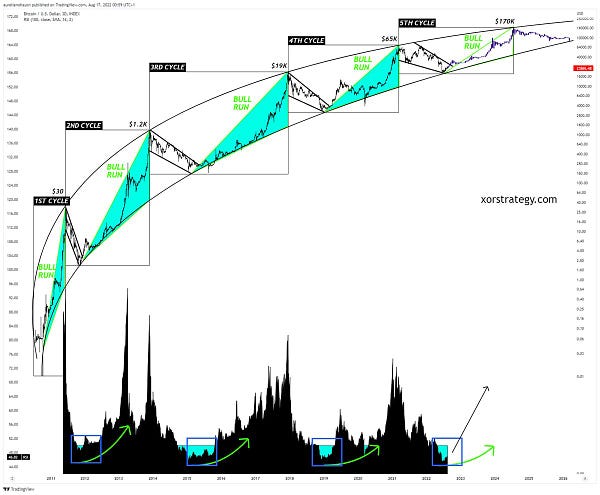

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

This was the first Bitcoin website.

Luxury resort chain Soneva now accepts Bitcoin as payment in Maldives and Thailand.

Suggestions

Interesting articles to read

Private Jet Usage "Flies" To Record Highs, Even Among Climate Outrage

Built With Bitcoin Completes Clean Water Project For 1,000 Nigerian Villagers

Holepunch Demonstrates Importance of Censorship Resistant Apps

The analysation of the "2022 Global Gas Flaring Tracker Report" (thread)

Sources:

https://www.btctimes.com/news/brazils-largest-investment-broker-now-offers-bitcoin-trading-services

https://www.btctimes.com/news/bitmain-and-partners-will-offer-low-cost-loans-for-troubled-miners

https://www.btctimes.com/news/revolut-wins-approval-to-offer-bitcoin-services-in-europe

https://www.btctimes.com/news/houston-texans-are-the-first-nfl-team-to-accept-bitcoin-as-payment