Bitcoin News

TL;DR

Governor candidate of Texas announces Bitcoin Policy, Plans to Make Texas the Citadel for Bitcoin (UPDATED!)

NYC Mayor: “The purpose of Bitcoin is to send a message”

UFC Champion was paid $300K Bitcoin for his victorious defense of the Heavyweight title last night!

Rothschild Investment bought another 93,521 shares of Grayscale Bitcoin Trust

Bitcoin miners have the highest percentage of renewable energy usage

Another solo Bitcoin miner with only 86TH just earned 6.25 BTC

$638M leveraged Bitcoin longs liquidated in the last 4 days.

Russian Ministry of Finance proposes to “regulate, not prohibit” Bitcoin

American Express is exploring ways for customers to redeem points for Bitcoin & crypto

IMF urges El Salvador to remove Bitcoin as legal tender

Top ranked German basketball team Ratiopharm Ulm now accepts Bitcoin for merch

Block CEO Jack Dorsey is solo mining Bitcoin

New York State-chartered commercial bank launching Bitcoin buying in Q1

"I’m going to work to make Michigan the most pro bitcoin state in the country." - U.S. Senator Jim Ananich

Thailand will regulate Bitcoin as a payment method.

The Turkish President reportedly instructed the ruling party to explore “cryptocurrencies”

New York's 'Five Star Bank' will allow customers to buy/sell & HODL Bitcoin

President Vladimir Putin: Russia has "some advantages" in Bitcoin mining

Royal Bank of Canada, the country's largest bank, appears to be running its own Bitcoin node

The Biden admin is reportedly preparing to release an executive action to regulate Bitcoin as "a matter of national security"

The Fidelity’s spot ETF rejected by the SEC

Brussels Member of Parliament to convert ENTIRE 2022 SALARY into Bitcoin

Bill Introduced To Make Bitcoin A Legal Tender In Arizona

NBA's LeBron James is launching a Bitcoin & crypto education program for kids!

Flushing Financial Bank will offer customers Bitcoin services by March.

Bulgaria seized 200K Bitcoin from organized crime in 2017 - now worth $7.4b.

Africa is leading the way for global Bitcoin adoption

Google registered the domain http://100millionsatoshis.com

A THIRD candidate for Governor of Texas declares: Texas Will Lead Nation on Bitcoin.

Conservative Republican candidate for Governor of Texas Don Huffines released his plan to make Texas the leading state in America for Bitcoin and other cryptocurrencies. States like Texas will not only flourish by plenty of energy, but they will have financial stability by promoting Bitcoin. Why? Because who cares volatility today, if you are planning in decades? Where will be the USD in decades? Who decides the average citizen how and where to store their wealth? These are serious questions and I think that if citizens have their option to choose then they have the possibility to educate themselves too. Financial freedom is an unquestionable human right!

UPDATE: Texas governor candidate Don Huffines will make bitcoin legal tender in Texas if electedThe New York City Governor is already taking his paycheck into Bitcoin, so he is already down deep into the rabbit hole. I’m not surprised that he said:”The purpose of Bitcoin is to send a message” because he already sees the true power of Bitcoin. The only question is: When is he buying some for the city too? Rio de Janeiro has already been bought, so there is no further excuse.

In the US a lot of sportsmen and women are already getting partially paid in Bitcoin. Another great UFC fighter Francis Ngannou is stacking sats! Congratulations for the win and for the sats!

The Money Elite is not stupid. They first buy indirect Bitcoin (ex. through Grayscale shares) and I’m sure they buy directly without KYC too. The Chicago-based Rothschild Investment already bought 103,059 shares last year in July (before the big price ran to 69K) and now 93,521. They are clever, they buy in the dip.

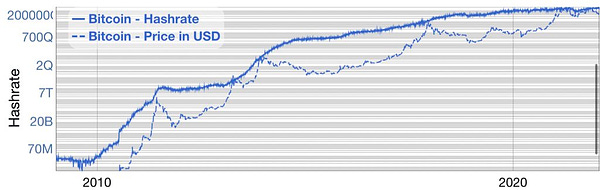

OpenNode research says the Bitcoin miners have the highest percentage of renewable energy usage than any other large scale industry. Interesting not? Why is the expensive renewable energy “wasted” for Bitcoin mining? Why are they not used for the public only? The answer: Incentives! Money will always find the shortest way to make even more money. There are countries (mostly in the rich western countries) where businesses receive a huge amount of governmental subsidy for building renewable energy power plants. Government needs it for statistical marketing purposes. If a company can mine cheaper with renewables, they will mine with it. But no one thinks that they are mining for greenbullshit ideological reasons. Of course there are a lot of old remote dams which are fully- or partially not used and/or not economic for public use (ex. distance from cities) so they are offering cheap energy for local Bitcoin mining. These were mainly in China where they were already banned. If the 56% (Bitcoin renewables energy usage share) said by OpenNode research is still correct today, I think they are coming from renewable power plants built by government subsidies.

A solo miner added block number 720175 to the Bitcoin blockchain earned over $215,000 in unseizable hard money. This is huge for him, but more importantly to the mining industry. Why? Simply because he or she is the 3rd solo miner who mined with just one or a few miners a whole block alone. This means other people will try too so the Bitcoin mining will be even more decentralized. Hope from last week's news Intel will make an affordable home miner and it will help globally to further decentralize the network. We can’t allow any country to gain 51% dominance in the future.

$638M leveraged Bitcoin longs liquidated in the last 4 days. We see these types of liquidation at every big Bitcoin price move. But I think I should write about it to remind everyone that leverage trading is only for the Pros who can properly calculate the R/R of a trade. Without using a properly calculated stop order is like gambling at a casino. I can’t tell enough: Just buy and Hodl! Never trade with leverage!

The Russian Ministry of Finance wants to regulate and not prohibit Bitcoin. People will say it was inevitable and that’s true. At first everyone will be afraid of Bitcoin because it’s unknown, it’s like a black hole. They see it will destabilize the FIAT system, so their first “solution” will be to ban it. But only the wise ones will see that banning won’t work. The potential positive outcome for their country is huge, so they will try to “regulate” it (they mean tax it). The even wiser ones will allow without burdens and support their citizens to learn and use it, like El Salvador does.

American Express sees that Mastercard and VISA are planning to allow direct Bitcoin payments so they don’t want to miss the train too. This is a rush for these new types of customers (Bitcoin and shitcoin plebs). Will see how the regulators will react to these steps. Maybe that’s why American Express only plans to allow customers “redeem points” in Bitcoin and shitcoins.

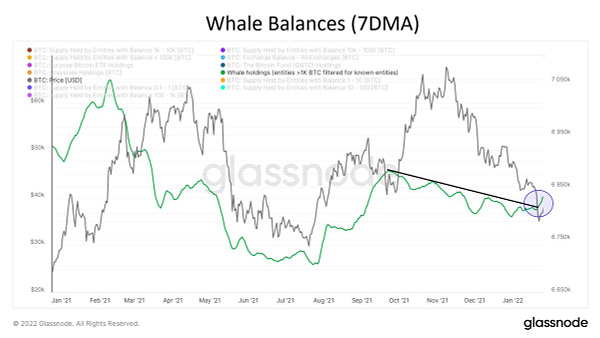

The IMF is afraid, that’s why they urged El Salvador to remove Bitcoin as legal tender. They did everything to cool the “boiling pot”, but as prices are falling and whales are buying sooner or later it will explode. I don’t know if you caught that, but each time El Salvador bought Bitcoin the price after a short rise it plummeted. I think it’s not far from reality to say that a group of wealthy people shorted bitcoin futures which meant the Bitcoin spot price had fallen too. They thought the people of El Salvador will make riots and will demand from their President to drop the Bitcoin as legal tender. But lucky or not lucky, most of the El Salvadoreans don’t have much Bitcoin. The Bitcoin they got initially, most of them instantly sold it for USD, so they didn’t suffer major financial loss from the Bitcoin falling price. Instead they had time to educate themselves and see what’s truly behind the FIAT system. These sentences are of course speculation, but time will tell what’s the real story.

Somehow in group sports the teams are more open to Bitcoin. Maybe because it only needed one Bitcoiner in their team to turn all the others around. Of course the easiest mode for a team to earn Bitcoin is through accepting it for their merch. The German basketball team Ratiopharm Ulm not only accepts Bitcoin, but you can pay through Lightning Network. This is a whole new level because it means they are having somewhere a full node with Lightning on it… or I drank too much “hopium” and they use just a custodial LN service. Hope not. Anyway I’m happy that more and more sporting people will use Bitcoin. They definitely need it because not everyone will have a bright future when their active years end. They need to stash at least part of their income into some easy long-term store of value solution.

Former Twitter CEO now Block CEO Jack Dorsey is solo mining with his S19 Antminer. You couldn’t dream of a better solution to advertise solo mining. As I wrote in my previous newsletter, solo mining is an important next step to diversify even more the mining industry. Of course it’s like gambling, but after already 3 winners, it’s far from an impossible task. Good Luck Jack! Hope others will follow.

Banks know what the cantillon effect means, so they are rushing to offer as soon as possible Bitcoin custodial solutions. I’m not surprised that after the NYC Mayor is converting his paychecks to Bitcoin, NY State-chartered commercial bank will launch Bitcoin buying services in this year Q1. Three news stories before I talked about the “boiling pot” situation which is occurring with Bitcoin prices falling and with whales buying. This can’t be controlled, sooner or later with a lot of onboarding posibilities the price will go to the moon! (this is of course just speculation. :)

Do we need to explain this? U.S. Senator Jim Ananich took the orange pill! We need these types of Senators to help build a Bitcoin friendly environment in the U.S. Senate. Hopefully more will follow!

Not sure how Thailand plans to “regulate'' Bitcoin for “financial stability”, but I think they will try to tax it somehow for the goods and services paid with Bitcoin. Time will tell which way they go.

The Turkish President reportedly instructed the ruling party to explore “cryptocurrencies”. I totally get it. It’s no connection with last week's meeting between Bukele and Erdogan! Or maybe it is? Anyway, Turkey's economy is collapsing, Erdogan is very ill, so he needs to do something in case he wants anyone to inherit his fortune. Maybe Bitcoin will be his exit hatch? Personally I don’t think that after last week's meetings with Bukele, Erdogan will invest in anything other than Bitcoin.

“New York's 'Five Star Bank' will allow customers to buy/sell & HODL Bitcoin through their internet bank accounts in a partnership with NYDIG!” This week this is the 3rd Bitcoin news regarding New York city or state. It’s impressive how Bitcoin is spreading as the Mayor advertised with his own paycheck conversion. BTW I personally thought the City was lost after how they reacted to the Pandemic. But with the help of Bitcoin they can rise from their ashes!

This week the tide was already turning with the Russian Ministry of Finance “regulation” plan, but the biggest news is definitely what Putin said. He said that the Russian Bitcoin mining has “some advantages”. What could these mean? I think you all know that Russia has plenty of cheap resources for generating electricity. Just think about those huge remote fields full of natural gas. Their transport with pipes is expensive, so until the market price is not high enough, they are not even extracted from the ground. These places could be used to mine Bitcoin locally. On the other hand there are a lot of Nuclear Power plants, which must have some spare capacity. Don’t forget, I already wrote last week, that Bitcoin mining could be used to balance the load of the electricity grid! So yeah, Putin knows what kind of “advantages” Russia has. Maybe after the next halving (ca. 2.5 years) will we see a mining war between countries?

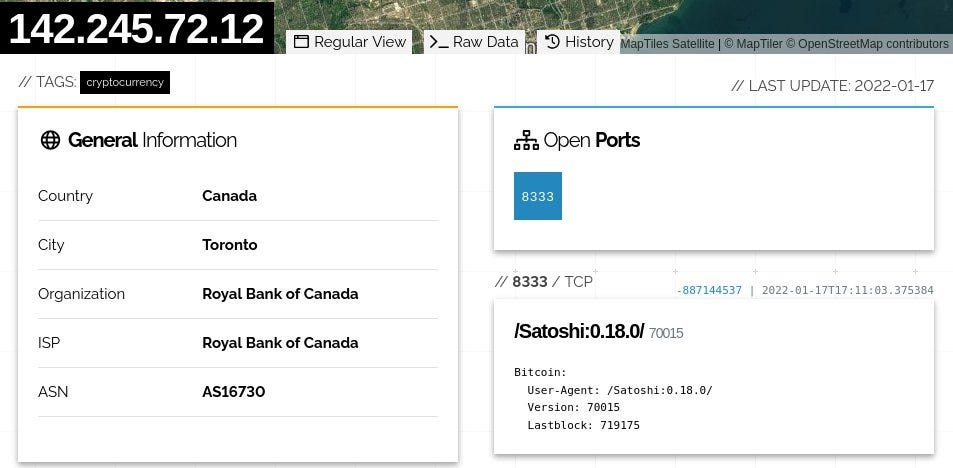

Based on the picture below, the Royal Bank of Canada is running their own Bitcoin node. The node is outdated with the 0.18 version (newest is 22.0), but in case there are not connecting to some sensitive things like an LN node, it’s not a problem. (BTW Guys, you all should update your nodes!) Anyway as US banks want to serve their customers with Bitcoin related services, I’m sure soon will hear the same about Canadian banks too.

Let’s think a little bit. The Biden administration is trying to “regulate” Bitcoin because it’s already “a matter of national security”. Is it? Just check from this week Global Economic News no.6 in which I inserted a Youtube video about Inflation. After watching it, think about it’s content because at the other end of the World Russia tries to “regulate” Bitcoin to make some additional income (tax) from it or/and to get some share from mining too. All of these differences are because 2 years ago Russia cleverly converted 100% of their USD reserve to Chinese yuan, Euro and Gold. Are they afraid of Bitcoin? Maybe, but not like the Biden administration which is FULL with USD (they printed way more you can imagine) and they can’t even think of ditching it. You don’t need to have a big imagination to think about how they plan to regulate Bitcoin, but it will be really hard to push it through. They will face a lot of Bitcoin friendly/invested Senators and States too. The genie is out of the bottle.

After reading the previous news, I’m not surprised that the SEC declined the Fidelity spot ETF request. They can’t allow investors to easily hold real Bitcoin like buying anything else on a stock exchange. Huge amount of money would fly in. The question is only the consequences of this decision. In Canada there is already a Bitcoin spot ETF with ever growing volume. El Salvador already implemented Bitcoin as a legal tender. Russia is opening to Bitcoin. Other cities like Miami, Rio de Janeiro are investing into Bitcoin. States governors are in favor of Bitcoin. What will happen if the USA as a government is “banning/prohibiting” Bitcoin for too long? We saw what happened with India being the last to switch to the gold standard.

Christophe De Beukelaer (Brussels member of Parliament) is not playing with one or two paychecks to convert into Bitcoin. He is converting his entire 2022 salary into Bitcoin. These are the kind of actions we haven't seen in Europe yet, but I hope more will come!

This news rocks! Senator Wendy Rogers has introduced a bill proposing to make bitcoin a legal tender in the U.S. state of Arizona. After El Salvador, Arizona could be the next one. No shitcoin, just purely Bitcoin. I think the Biden administration will do anything they legally can to stop this, but thank God the United States are still governed by laws and not by autocrates. Next question is, who will be first, Texas or Arizona? Race is already begun!

NBA star LeBron James is launching a Bitcoin & crypto education program for kids. Hope “crypto” word is used to just present the kids “what not to do” and they are NOT teaching them some gambling solutions! James, shitcoins are no bueno! Hopefully James' fame will help the next generation to learn about Bitcoin, as the only exit strategy from the FIAT system.

Another US Bank jumping on the Bitcoin train. The 92 year old American Bank, Flushing Financial will offer customers Bitcoin services by March. This is the 4th Bank this week which wants to offer a Bitcoin buying solution for its customers.

I was thinking hard to write about this news because it isn’t quite related to this week. Five years ago Bulgaria seized 200K Bitcoin from organized crime. The funny thing is that till today no one knows where the private keys are. It’s like a traditional boating accident. They catched the “hardware” (meaning anything from PCs to wallets) + 20ish people, but no one knows anything about the private keys. Interesting not? I think after a few years of jail time someone will be really, I mean at least 7.4 BILLION USD wealthy! This is the perfect example why everyone should protect their private keys! You never knew what would happen tomorrow.

Africa is leading the way in the global Bitcoin adoption. Why? Because they face great poverty and they don’t have any other solutions for it. Kenya, Nigeria, South Africa and Tanzania ranking in Chainalysis’ Top 20 Global Crypto Adoption Index. If you want to eliminate CO2 pollution in the world, rich countries should help as fast as they can to help poor countries to reach a better wealth state. Instead what are they doing? Prohibiting poor countries the use of fossil fuels and forcing them to use unreliable renewable energy sources, so only Bitcoin can help them leave poverty behind.

Google registered the domain http://100millionsatoshis.com, which is basically the equivalent of Bitcoin.com. You can’t translate this domain to any other shitcoin; it's purely Bitcoin. Google will make a huge step in case they implement Bitcoin into Google Pay or they build some service which is working like Paypal just on Bitcoin.

Allen West a third (!) candidate for Governor of Texas declared “Texas will lead the Nation on Bitcoin.” Soon there won’t be any candidate left in Texas who is not wanting to implement Bitcoin. If Bitcoin as a legal tender in Texas happens the price will lift off and other states will definitely follow. The governor election in Texas will be this year on November 8th. I think we will have a beautiful Christmas!

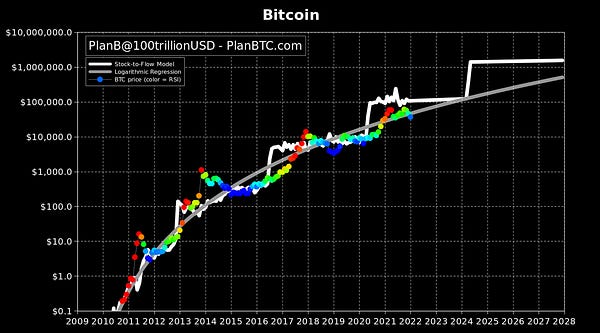

I think for the summary of this week’s Bitcoin news it allows me to speculate about Bitcoin's future. PlanB’s thought that this phase of Bitcoin will be about the onboarding of the Institutions. I personally think that because of the Pandemia everything just went at warp speed. They, ( here I mean not only institutions, but countries, states, cities too) want to get a slice of the Bitcoin pie, the Safe Haven. They know that under the Pandemia, "printing like no tomorrow" just worsened the already weak global financial system. This year will be magical for all of us!

Global Economic News

TL;DR

Global stocks have lost $4.2tn in market cap last week

Duma Deputy Chair Insists Gold-Backed Stablecoins & Crypto-Mining Be Allowed In Russia 'To Circumvent Sanctions'

ECB Balance sheet jumps >€8,600bn for 1st time

Germany energy crisis continues

Powell: ”inflation will be transitory” (April 2021)

Powell: Fed balance sheet is much bigger than it needs to be

Fed leaves benchmark funds rate target in 0 to 0.25% as expected.

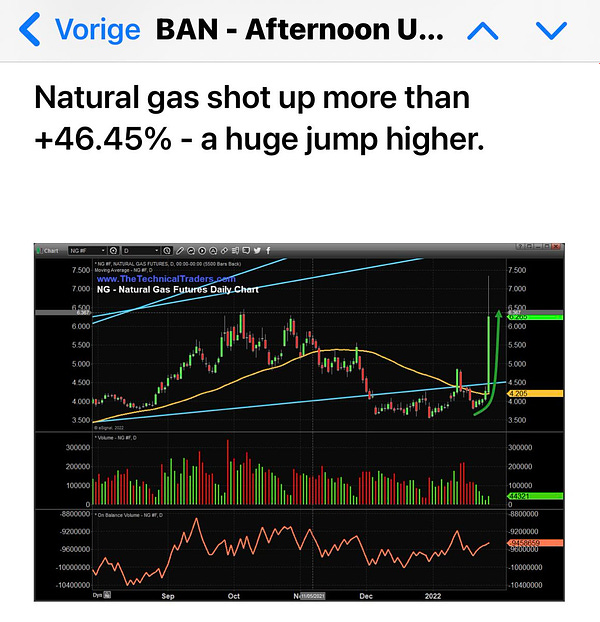

Natural Gas shot up +46.45% in one day

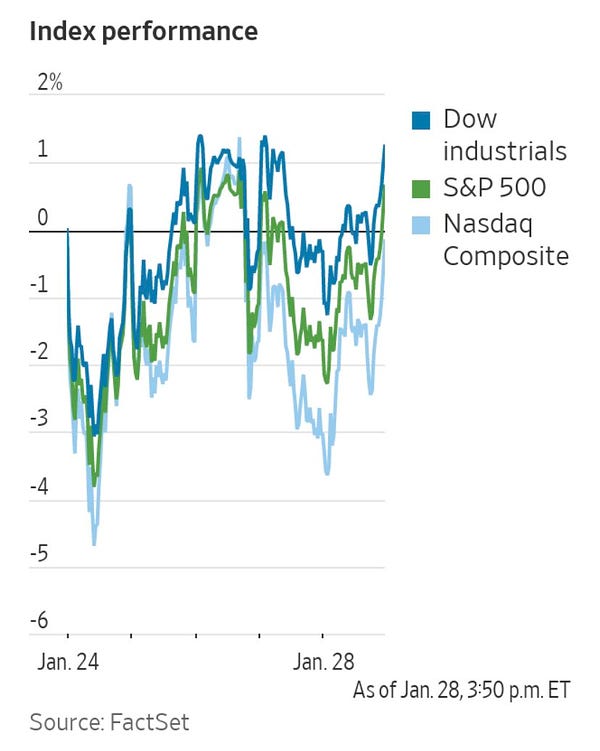

This week big movements in the Indices

Germany where retail deposits have hit fresh ATH at >€2.64tn

“Global stocks have lost $4.2tn in mkt cap this (last) week, most since Oct2020 on tech rout & as investors reacted to signs that growth may be slowing at some of Value stocks they had been rotating into earlier this year. Global stocks now worth 136% of global GDP down from 144% in Dec.” by Holger Zschaepitz

The Duma Deputy Chair Insists Gold-Backed Stablecoins & Crypto-Mining Be Allowed In Russia 'To Circumvent Sanctions'. Similar to this happened many times before. My favorite one is how North Korea is buying western (prohibited) stuff with Bitcoin. Russia will (maybe) face some sanctions if they attack (again) Ukraine. For this case Bitcoin will be some really useful tool. Crazy idea: If Biden bans Russia from the USD SWIFT system means Russia can’t use the USD anymore. They already converted all of their USD reserved to Chinese yuan, Euro or Gold so they will need to switch to a highly liquid digital money. What will happen if by help of forreign political force the ECB will ban Russia from the SEPA system too*? The Chinese yuan is not supported by western countries. Trivial to make a Gold-Backed stablecoin, but who will believe in it outside of Russia? Who will audit it? Will anyone use it? If they issue some shitcoin they will face a lack of liquidity. The only possible solution is Bitcoin.

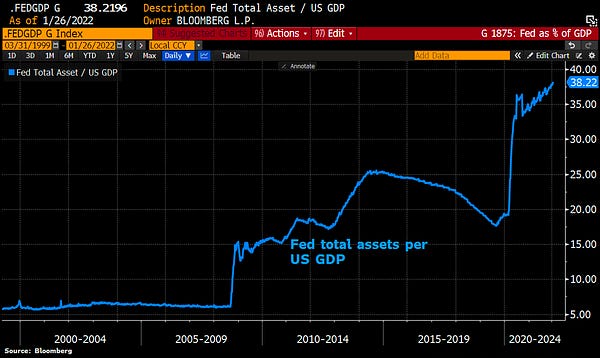

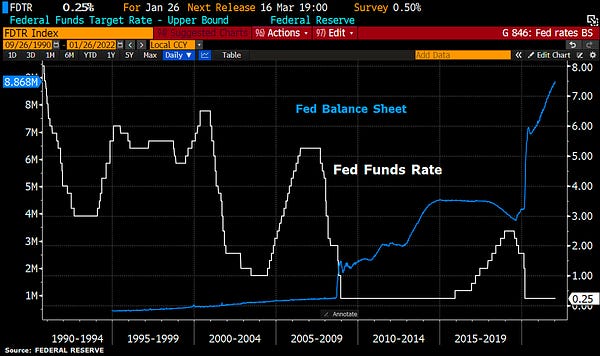

*Because of Germany’s natural gas needs, this won’t ever happen.Yeah, Lagarde can’t stop the virtual printing press so the ECB Balance sheet jumped over 8,600 Billion EURO! Like the FED, the ECB can’t turn the wheel to the other direction because it will collapse our modern society or at least all the markets for long long years. This huge floating balance will cause inflation like many of us in the past predicted. The official (not real!) inflation is already 5% in the EUROzone. The ECB balance sheet now equals 82% of Eurozone GDP vs Fed’s 38.2%, and BoJ’s 134.5%. You can see just from the GDP numbers, that in the least shit situation is the USD with the Fed’s 38.2%.

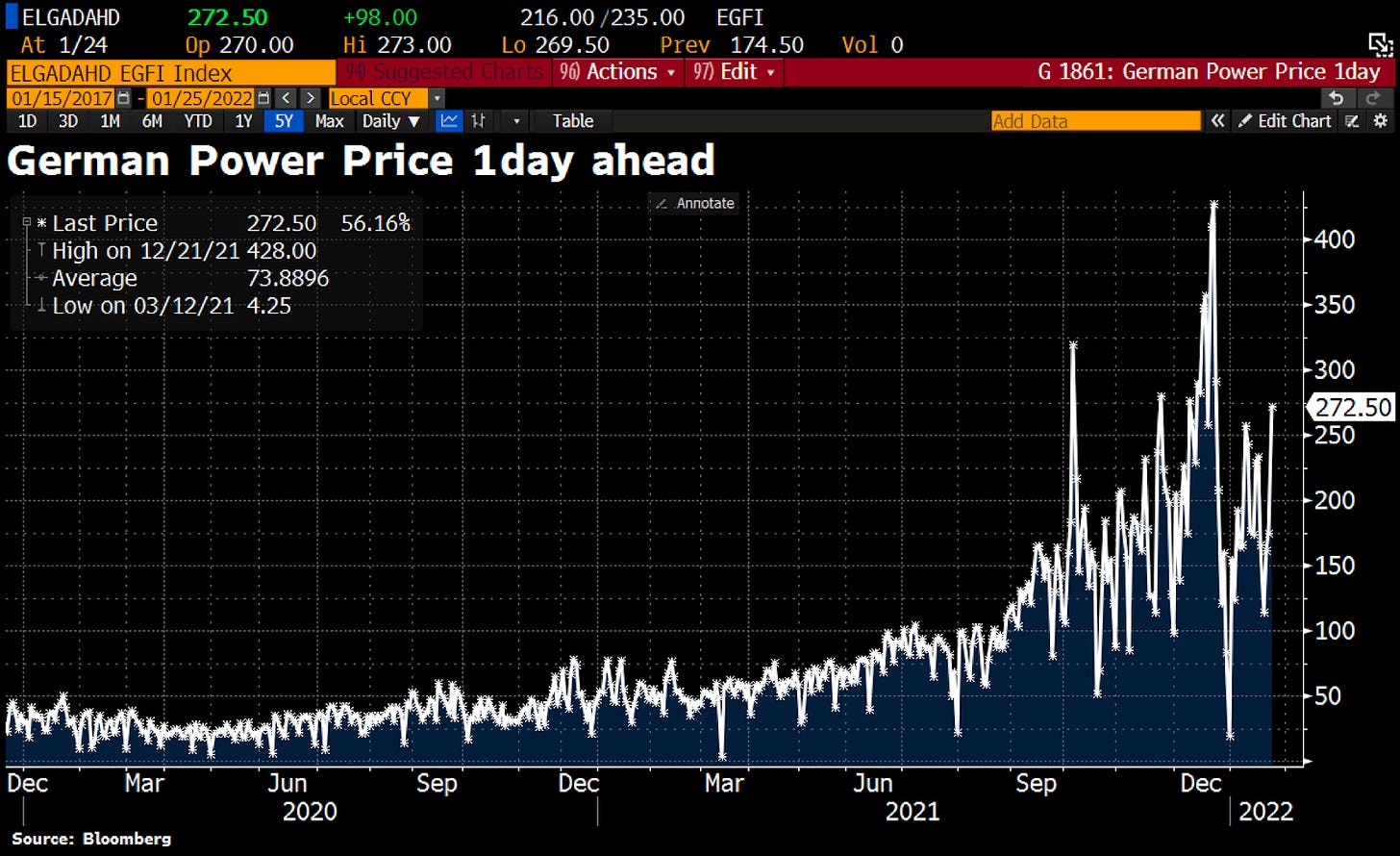

Germany had for a long time reliable energy production problems. They worsened this with shutting down 3 Nuclear Reactor sites and only remaining 3 by the end of 2021. The remaining 3 will be turned off at the end of this year. This is madness! Under the Merkel era they thought after the Fukushima disaster caused fear they would simply turn off all the nuclear reactors and use only “green” (just see their Eco footprint) renewable energy sources. This is a beautiful ideological idea, but what will happen if the sun is not shining and the wind is not blowing? What will happen if both (like happened many times before) are happening at the same time? The energy grid gets huge stress even if there is an overproduction (too much wind and solar) energy produced. They now suffer with the consequences. Growing energy prices and even more stress on the whole European energy grid. BTW have you heard that Germany wants natural gas sources to be stamped “Green''? Funny, not?

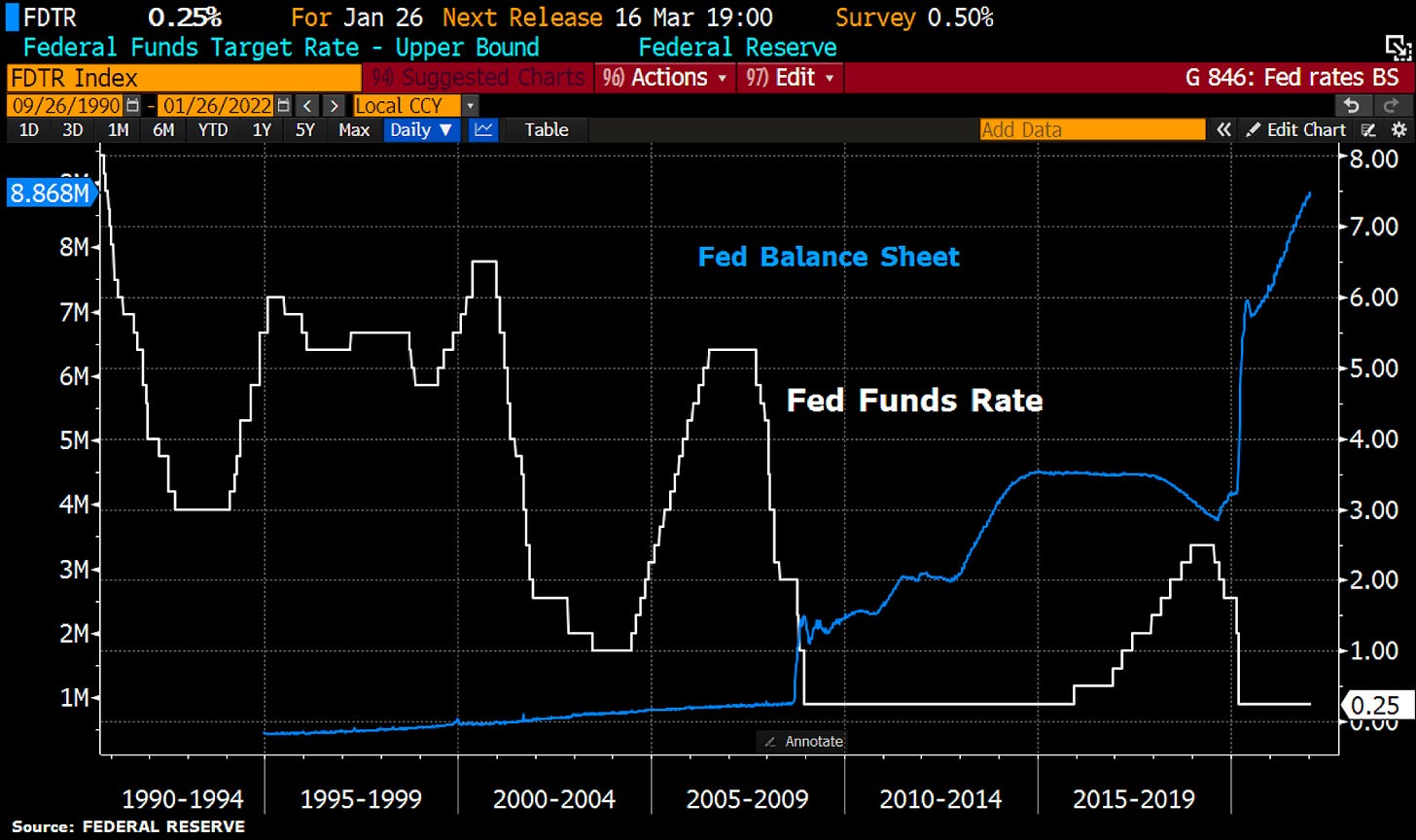

Powell: ”inflation will be transitory” (April 2021). When I first heard this I thought that this will hurt even more than the Pandemia will and it will not be “transitory”, it’s just the beginning! Why? Knowing the FED’s balance sheet growing vector numbers from the beginning of September 2018 I thought in one and a half years (this is the amount of time needed to feel the inflation from the start of the printing press) people will feel the inflation. Of course they mask it with the Pandemia, but at the end (as always) the average person needs to pay the ever growing bill at the grocery store. That’s why I’m telling all my friends to start educating yourself for long-term store of value solutions because this is just the beginning.

Yeah, I totally agree with Powell, that the FED balance sheet is much bigger than it should be! Do you want to know the real numbers? One of the best video I ever watched about it:

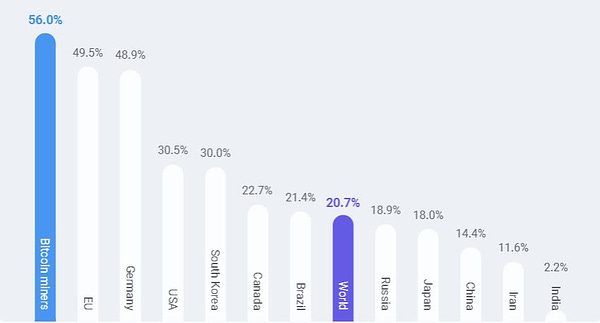

The FED is playing with fire. As you can see in the picture below they lost the control above their balance sheet and they still have not raised the funds rate from 0.25%. Range says asset purchases to conclude in early March. Says it ‘will soon be appropriate’ to raise funds rate, so signal for March rate-hike liftoff. The analyst expect to raise the funds rate to 0.5% on 16th of March.

Natural Gas shot up +46.45% in one day. Will the upward trend continue? If yes, Russia like producers will be happy and will have even more bargain positions against any US Sanctions. The EU will face hard times, more specially Germany with the Economy using unreliable renewable energy and soon their only reliable energy source will be only Natural GAS. Natural gas is getting more and more expensive.

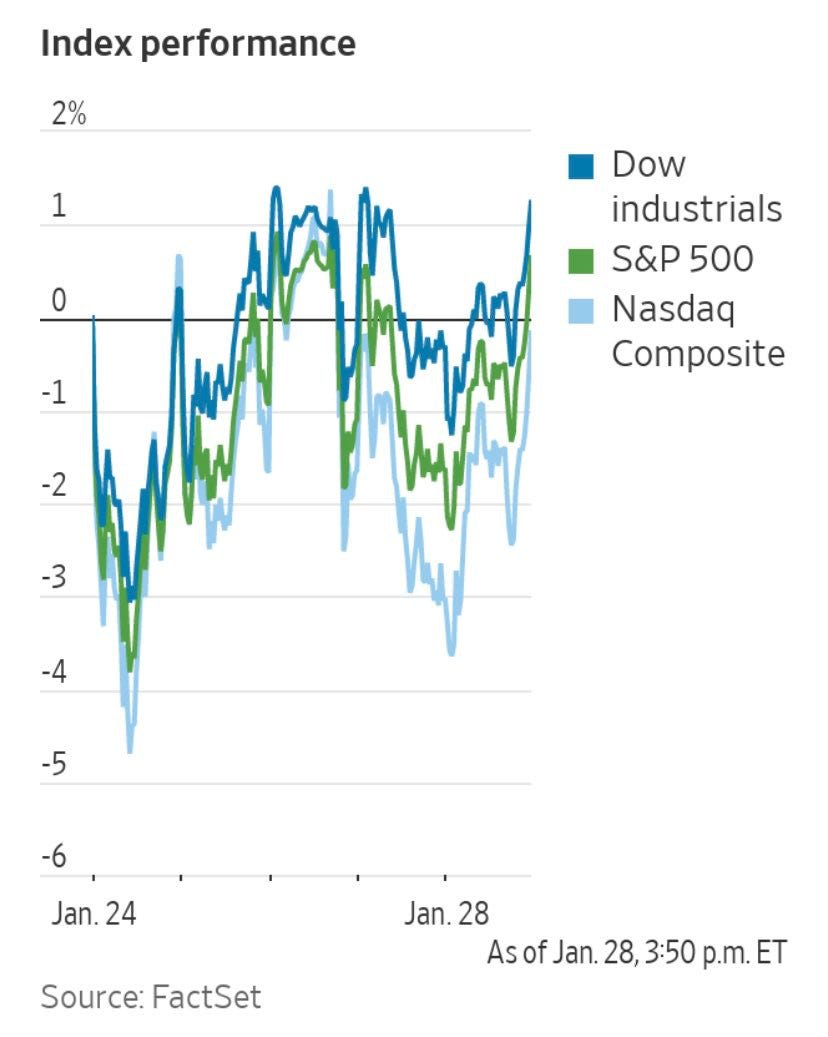

“The S&P 500 saw three of the biggest intraday reversals of the decade, Microsoft swung 15% in 15 hours, & stock volatility doubled. In the end, for one last twist, index rallied Friday, erasing losses for the week.” (via BBG) Just based on technical analysis Bitcoin also reached a major bottom. Maybe it will turn with the Indices which BTW won’t mean any long term correlation.

“Germany where retail deposits have hit fresh ATH at >€2.64tn even though >550 banks & savings banks now charge penalty interest & inflation likely to have exceeded 4% at beginning of the year. Fun fact: Deutsche Bank earned €400mln w/penalty interest in 2021.” by Holger Zschaepitz

For people who don't understand the post above, I will try to explain. Investments like buying a House are too expensive in Germany (because of inflation), so until they find a good investment solution they park their money in Banks. They do this despite the fact that the interest is at negative rates, so they all are paying for banks holding (and using) their money. These kinds of situations are abnormal and hopefully soon German people will learn about Bitcoin and won’t hold their money in banks with negative interest rates.

Bitcoin price speculations

These are just speculations, no investment advice!

“Bitcoin has been going down for 73 days. Are we there yet? Just a little further…” by Bitcoin Archive

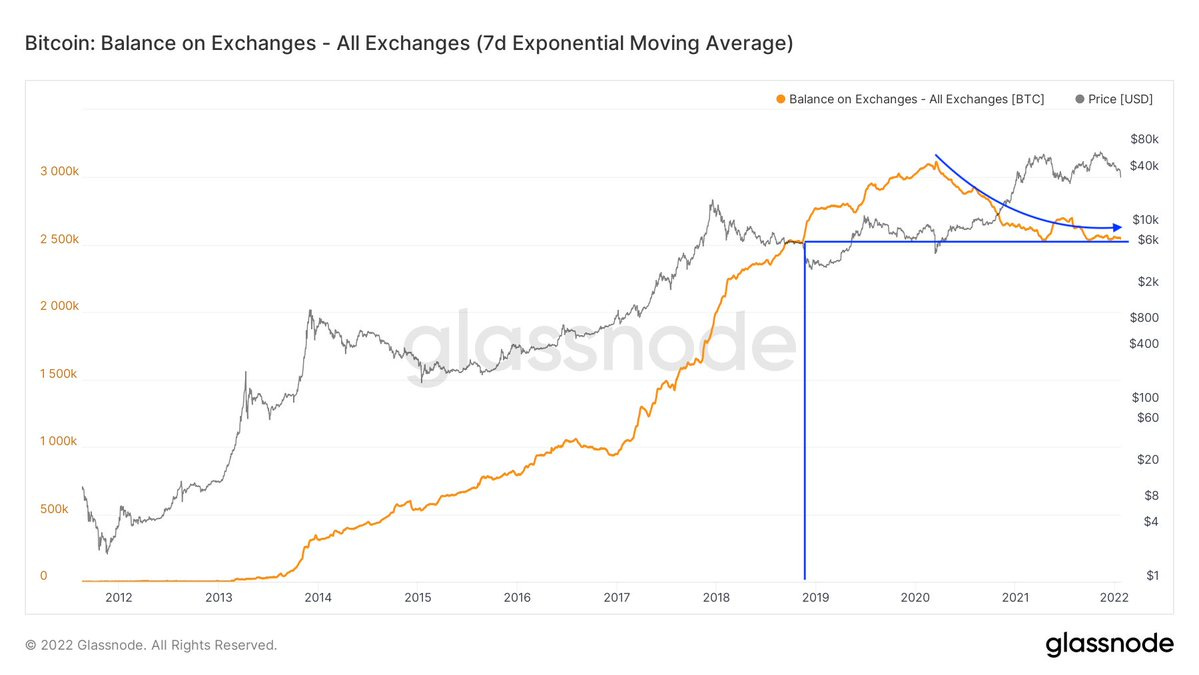

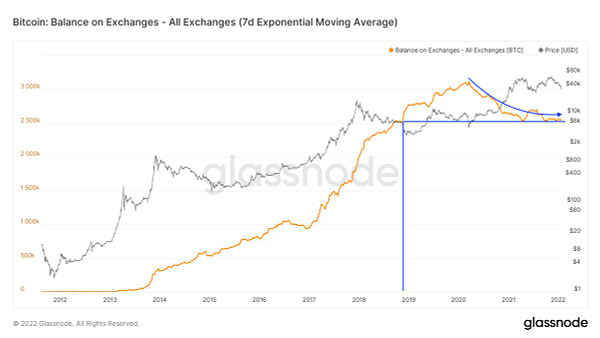

“Bitcoin on exchanges has plateaued after declining for almost 2 years.” by Bitcoin Archive

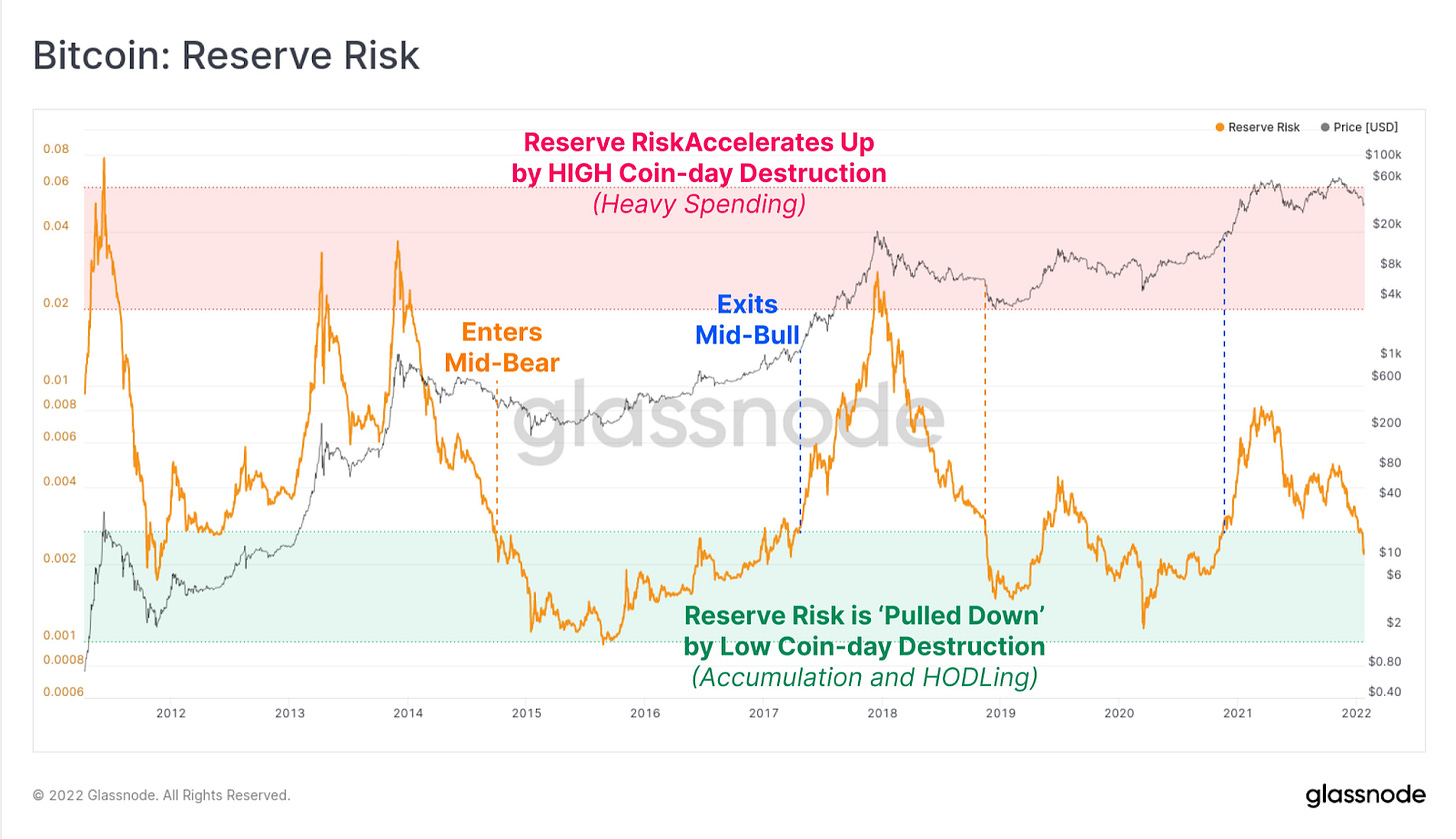

“Bitcoin Reserve Risk is a macro scale oscillator capturing aggregate investor behavior, and has hit a 1yr low. Low values of R-Risk are characteristic of mid-bear to mid-bull cycles, where prices are depressed, but HODLing dominates onchain.” by Glassnode

“Bitcoin Monthly with RSI. Be prepared.” by Bit Harington

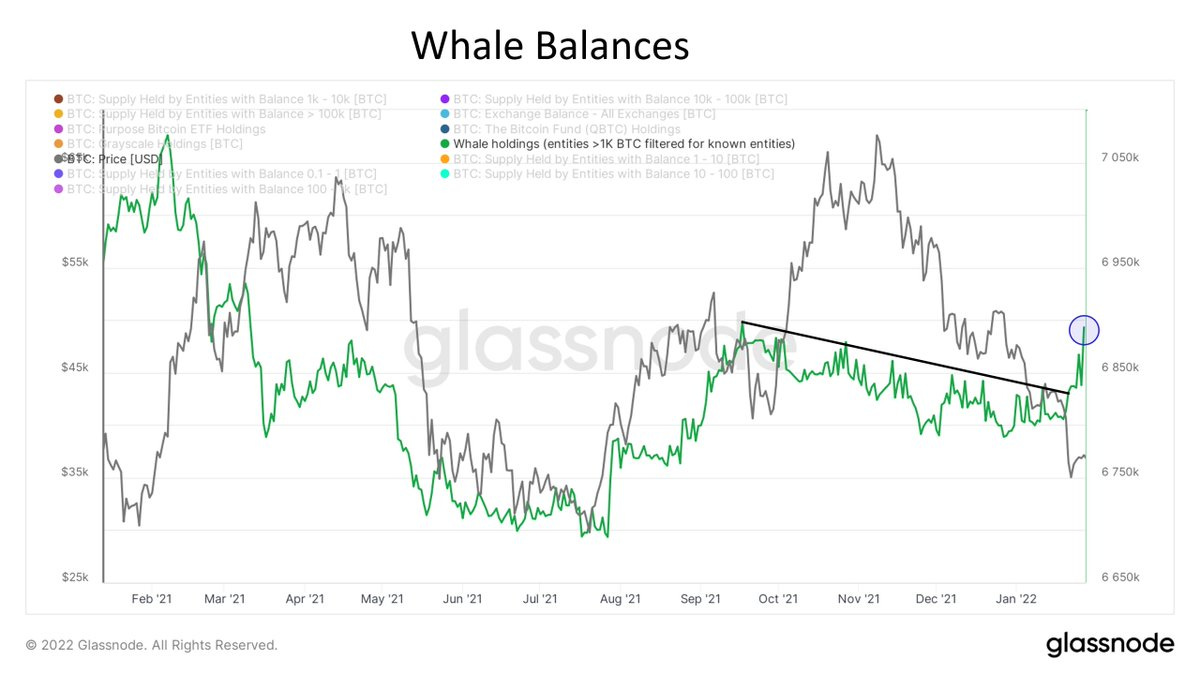

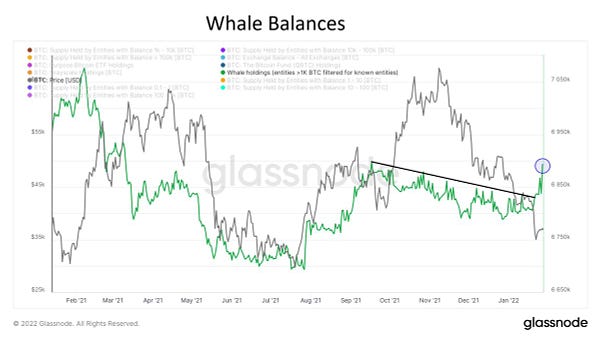

“Whales are finally adding to their Bitcoin holdings after distributing since September.

A trend to keep an eye on that bulls want to see continue.” by Will Clemente

“Some fairly heavy whale buying over the last week. Very interesting.” by Will Clemente

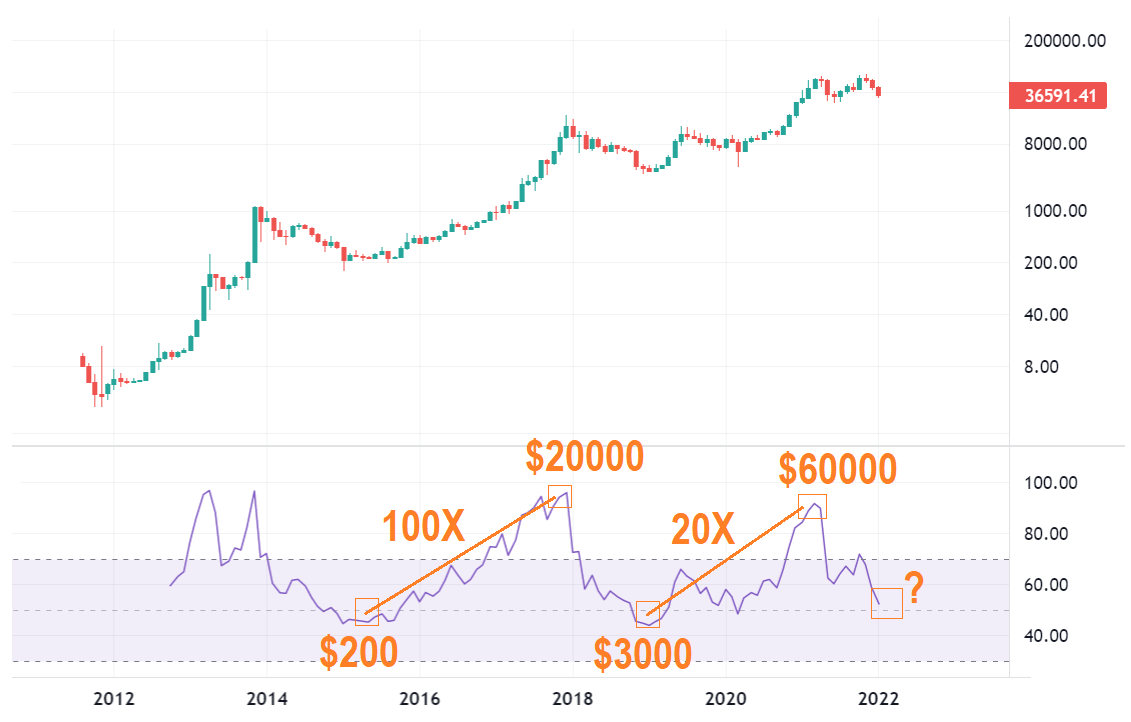

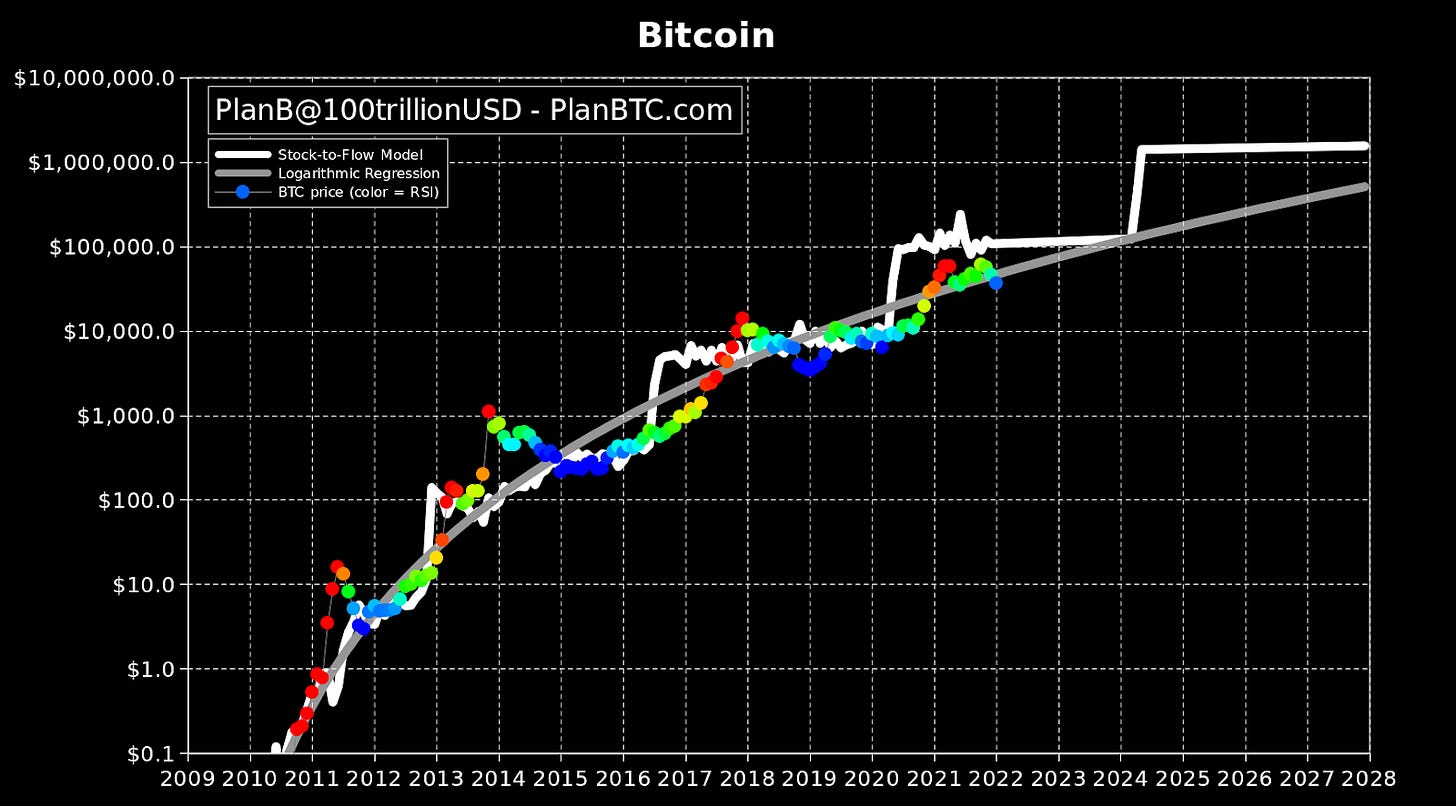

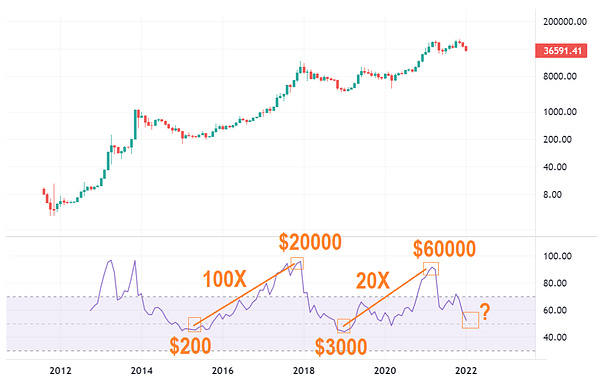

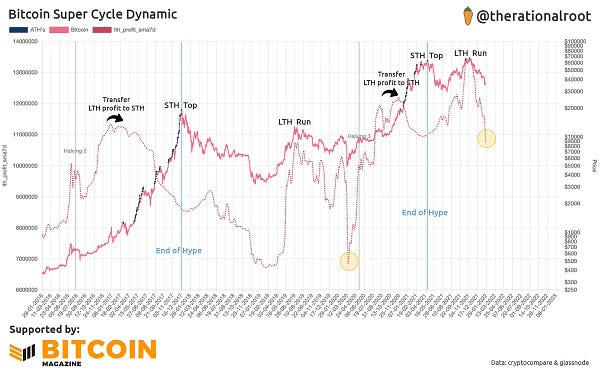

“As you know I track many indicators & models besides S2F: RSI, 200WMA, Realized Cap, Logarithmic Regression etc. Chart below (above) combines S2F, log regression & RSI. #Bitcoin price currently tracks log regression better than S2F. My money is still on S2F. 2022 will be very exciting!” by PlanB

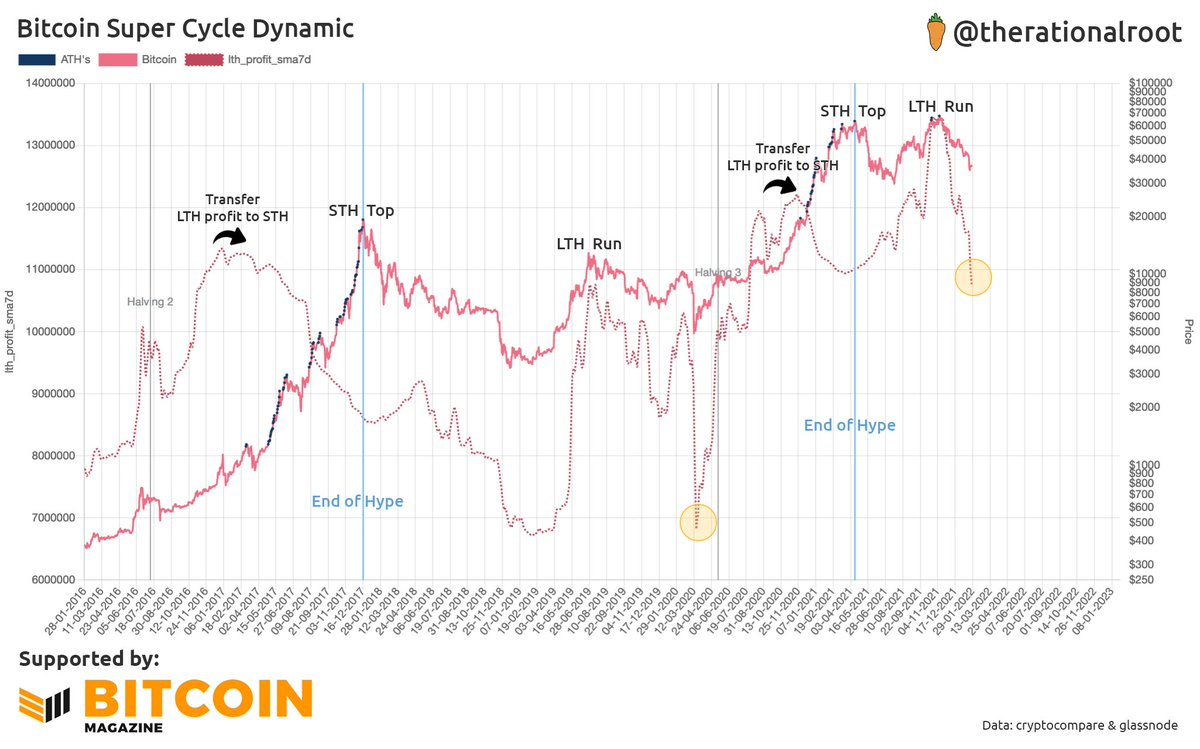

“This is big, first on-chain signs for a #Bitcoin Super Cycle. cc: @danheld, @btcdirect“ by Root

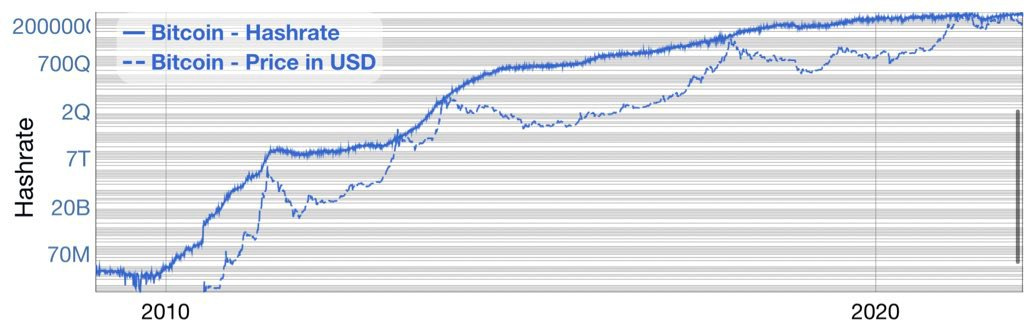

“Price won’t break $100k until total hashrate 5k-block average is above 250Eh/s. Soooo...get hashing.” by Adam O

Bitcoin Shorts

Funny Bitcoin short stories

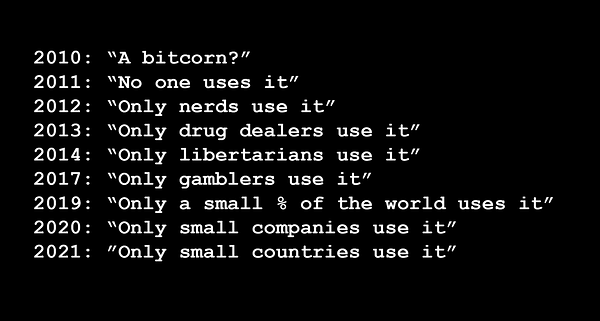

2050: "Only small planets use it" by Documenting Bitcoin

“Bitcoin's annual settlement volume has officially surpassed Visa's.” by Documenting Bitcoin

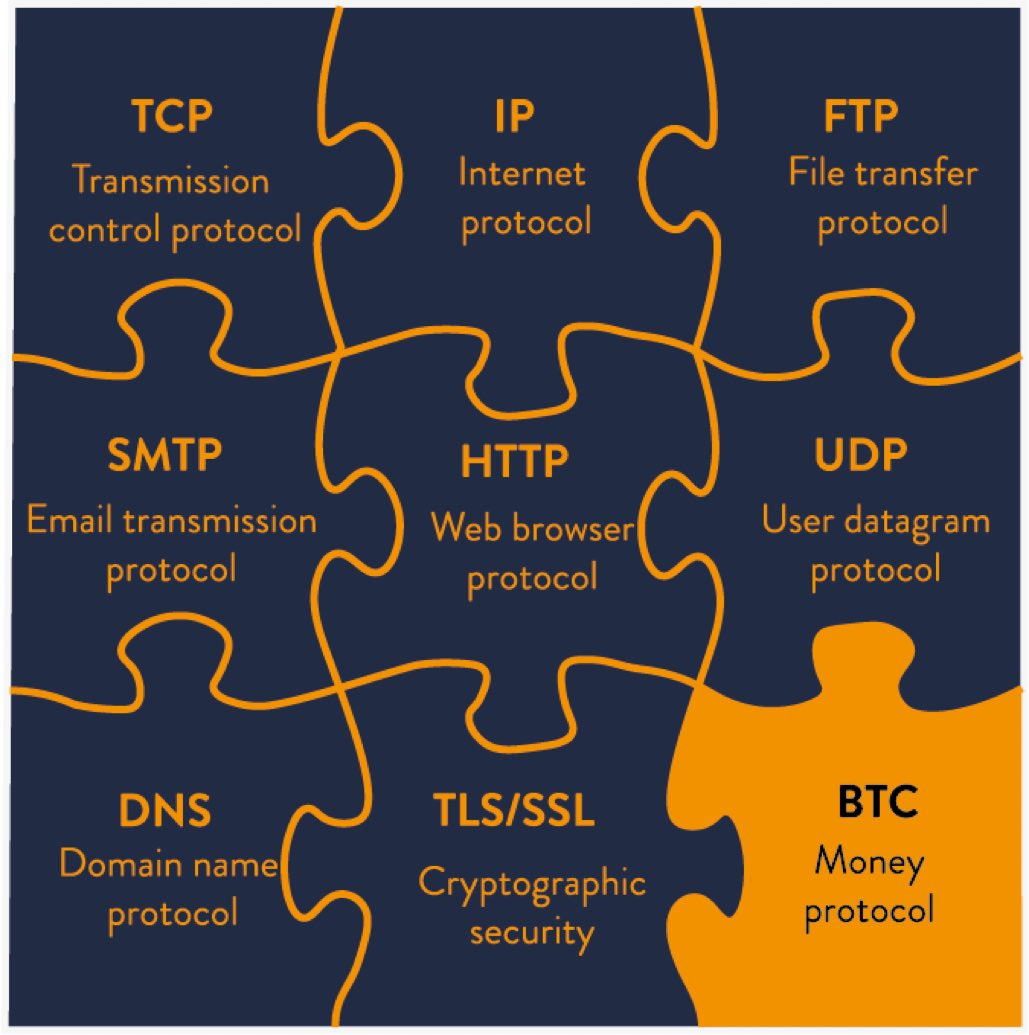

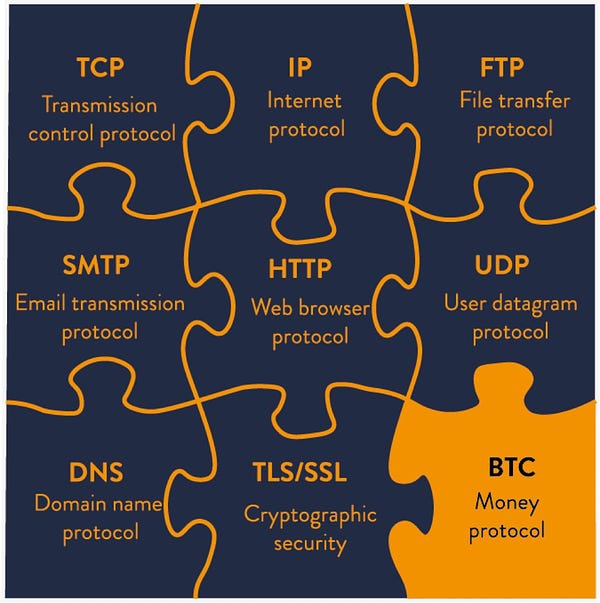

“Bitcoin is the missing piece of the Internet.” by Documenting Bitcoin

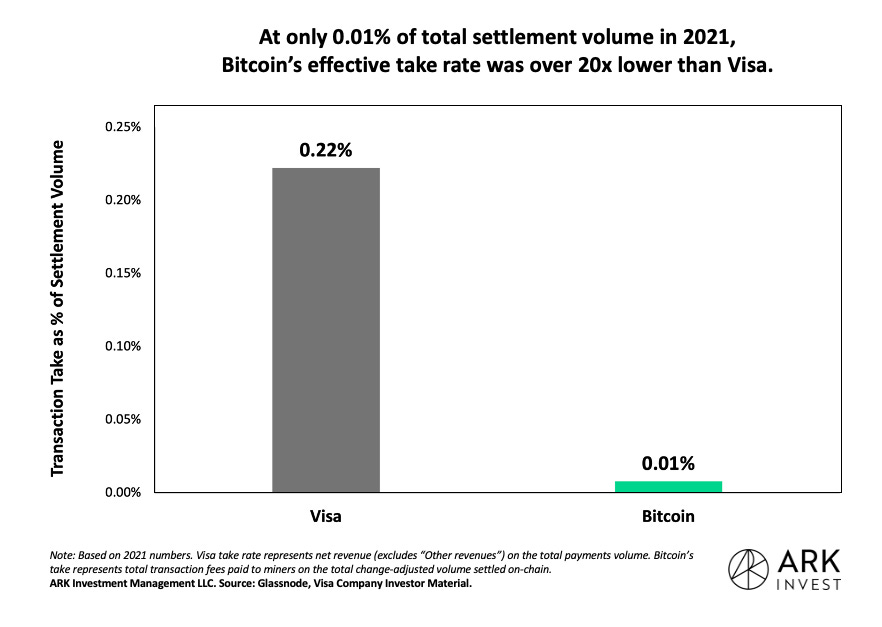

“Bitcoin miners collect 1 cent for every $100 the Bitcoin network settles. Visa collects 22 cents for every $100 it settles. Visa is inefficient.” by Yassine Elmandjra

“Visa’s Bitcoin and crypto cards carried out $2.5 billion worth of transactions in Q1* 2022. On track for +$10B for the whole year.” (*first fiscal quarter) by Bitcoin Archive

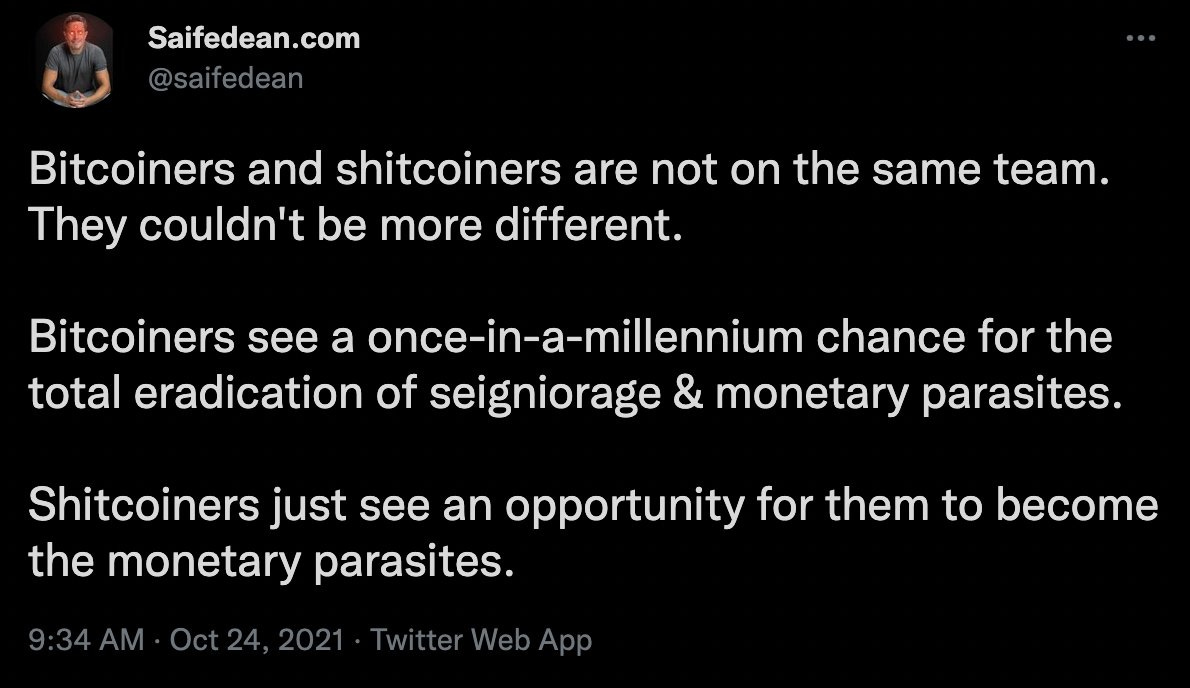

“Always important to remember the words of @saifedean Bitcoin” by Hugo Ramos

Sources:

https://bitcoinmagazine.com/markets/third-solo-bitcoin-miner-finds-valid-block

https://bitcoinmagazine.com/markets/bill-introduced-to-make-bitcoin-a-legal-tender-in-arizona

https://bitcoinmagazine.com/culture/bitcoin-making-africa-financial-liberation-leader