This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

The United States second-largest electric power company is reportedly studying Bitcoin mining

VISA launched “no-limit” Bitcoin card in UAE

Bitcoin Miner Core Scientific Sold Majority of the Bitcoin They Held (UPDATED!)

In June 151,000 bitcoins were withdrawn from centralized exchanges

Bank of Russia proposes Crypto Trading Platform on the Moscow Stock Exchange

The United States second-largest electric power company is reportedly studying Bitcoin mining

The United States’ second largest electric power firm, Duke Energy, is reportedly exploring bitcoin mining. The firm is reportedly planning to integrate mining activities as a part of its demand response strategy.

Justin Orkney, Duke Energy’s Lead Rates and Regulatory Strategy Analyst said on the Bitcoin, Energy, and the Environment podcast that the firm will integrate several energy sources into its micro-grid and test it with different levels of miners before they deploy the final report about the mining.

Importantly, a number of states in the United States are utilizing the concept of demand response to increase power supply and reduce outages. To improve and strengthen the electricity grid, the Texas Governor recently opened up the state to crypto miners via a demand response program.

This is huge in Bitcoin’s life cycle because it means that the large electrical companies are calculating with Bitcoin not just as a potential money income, but as a safe solution for stabilizing the electricity grid too.

VISA launched “no-limit” Bitcoin card in UAE

Visa Inc, one of the world’s largest payment networks, announced that they have officially launched a premium crypto-powered credit card called ‘bitcoinblack’ in the UAE, and it will be accepted globally with no maximum spending limit.

The card will allow its holders to convert their bitcoin and other major cryptocurrencies to fiat currency, and its members will receive rewards of up to 10% in their own shitcoins.

Those shitcoins work like any other currently existing “useless” reward program points. You can spend them only in points where they accept it. With this trick Visa is just trying to farm Bitcoin users by making them not just identifiable and they earn from their spendings too. To be a 21st century FIAT company, they reward the Bitcoiners with some shitcoins. The only question:”Why not a Bitcoin only reward program?”

Bitcoin Miner Core Scientific Sold Majority of the Bitcoin They Held (UPDATED!)

This period of time is sad for everyone in the Bitcoin economy because it makes you sell bitcoin at an even lower price than when you bought or mined it.

The Core Scientific company is quite big with its 180,000 ASIC miners, but because of maybe wrong business plans they needed to sell 7,202 bitcoins at an average price of $23,000 per bitcoin.

Let’s hope they come out of this in a positive way because they still hold 1959 bitcoin and mine 36.9 bitcoin per day on average.

(UPDATE: Meanwhile Bitcoin miner HUT8 just added 5,800 mining rigs to it's operations in Ontario, Canada)

(UPDATE 2.: Hive Blockchain Reports 278.5 BTC Mined in June and currently holds 3,239 bitcoins)

In June 151,000 bitcoins were withdrawn from centralized exchanges

As per the latest weekly report from Glassnode, Data shows Bitcoin saw the largest monthly outflow from exchanges in history this June as 151k BTC flew off centralized wallets.

I’m really happy to see this because it means that more and more people want to hold their own assets even in these bearish times.

Bank of Russia proposes Crypto Trading Platform on the Moscow Stock Exchange

The Russian Banking Association’s head proposed the creation of a crypto trading platform on the Moscow Stock Exchange.

The Russian Banking Association’s head speaks about deploying a crypto trading platform on the largest stock exchange in the country, the Moscow Stock Exchange (MOEX).

“Of course, there should be a crypto exchange, which, again, is created according to the strict requirements of the Central Bank. I admit that this is a division of the Moscow Exchange.” said Anatoly Aksakov, the head of the Russian Banking Association.

In the meantime, according to the Bitcoin Magazine, Bitcoin hardware wallet demand is up 700% in Russia.

Global Economic News

TL;DR

Russia’s oil exports are soaring

The fall of Germany

The Argentinian inflation is over 60%

The big question: Are we already in a recession?

Russia’s oil exports are soaring

Russia’s oil exports between 22nd February and 22nd June rose by around 10%. The EU 27 oil importer countries lost ⅓ of their imports, but India as a new importer not just bought this amount, but it bought the small USA’s amount too. China and Turkey raised their import amount so in general the export of Russian oil rose by 10% with an average of 20% oil price increase. But let’s not forget that China and India are probably buying at -30% price of the oil.

The fall of Germany

“The fall of Germany in one chart: German total mkt cap as % of global mkt cap has hit another All-Time low at 1.97%. Only 1 German comp, Linde, is among global Top100 when measured by mkt cap. 2nd largest comp SAP #110, 3rd largest Deutsche Telekom #123, 4th largest Siemens #127.” by Holger Zschaepitz

Germany’s trade surplus is gone. Germany reported its first monthly trade deficit in over 30 years after exports "unexpectedly" fell in May. The deficit was €1bn, the first since 1991.

“Germany where recession fears are on the rise. 2022 growth forecasts have already plummeted to 1.7% from 4.5% at one point. The danger of recession is also becoming visible in bond mkts. 10y German bund yields have virtually collapsed from 1.9 to 1.2%.” by Holger Zschaepitz

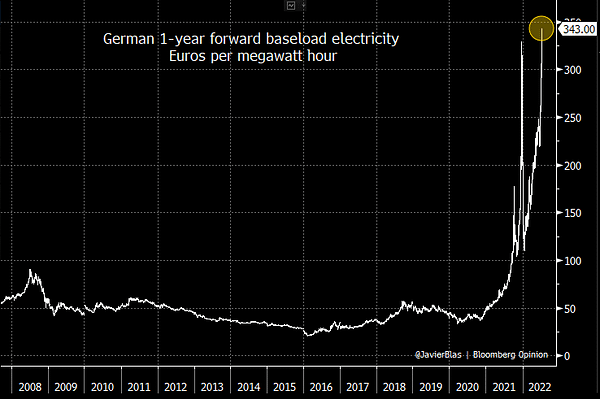

There is a very big risk that if something major shift in the energy policy is not happening soon the major factories and businesses won't survive with the following prices:

The recent raise of electricity price happened because the German Federal Network Agency reported that the current gas reserves in Germany may be enough only for one or two months in event of a cessation of supplies from Russia.

Meanwhile Nordstream 2 could double gas supplies to Germany but Berlin still agrees to it being sanctioned at the behest of Washington.

When you read news like these you think that Germany’s politicians are either out of their minds or simply they want to economically slaughter their own nation. Either way I feel really sorry for the German citizens because cruel life will come to them.

The Argentinian inflation is over 60%

Meanwhile the Argentinian Economic Minister resigned and they formally requested to join the BRICS, the YoY inflation is 60.7% since December 2017. What comes next? Maybe a wiser politician will command the resourceful country with the help of the BRICS to a financially more stable future or they go bust like other hyperinflating countries today.

In the following Steve Hanke’s inflation board Argentina is in the middle and not far from their own official record inflation rate. Hopefully they will evade it, but seeing what’s in the rest of the World there is little chance.

The big question: Are we already in a recession?

It’s not so easy to answer because even the Keynesian economists fail to answer it right now. They still wait for another quarter of the year, but I think the already released news and charts talk for themselves:

“A 60/40 portfolio is now worth less than before the pandemic” by @patrick_saner

Meanwhile the huge amount of printed money still arrives in the commodity sector:

According to the WSJ, The average monthly payment for a new-car loan hits an all-time high of $686 in June; for a used car, it’s $554, near a record. The number is $1K+ for 12.7% of new-car buyers.

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

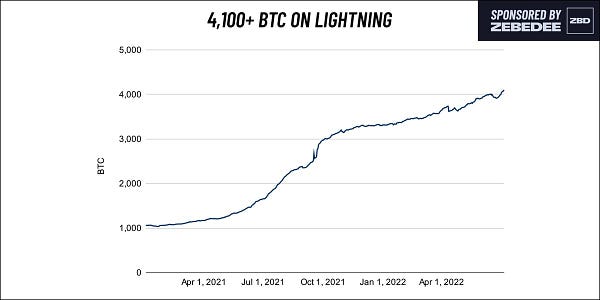

Lightning public capacity continues to quietly trend upwards, as Lightning apps continue to see record user signups and payment activity. The new top is 4,100 BTC.

12 years ago Satoshi was explaining Bitcoin

“Since when the @nytimes has devoted so much time and space to El Salvador’s economic initiatives? It’s clear they’re afraid Bitcoin is inevitable. By the way, they say we’re heading to default. Will they publish an apology once we pay everything on time?” by Nayib Bukele, President of El Salvador

Cost to mine 1 bitcoin in every U.S. state

“The world’s largest non-exchange Bitcoin whale has purchased 901 $BTC ($19 million) so far in July and is now holding a total of 132,323 BTC worth $2.86 billion.” by @WatcherGuru

“59,170 $BTC ($1.26 billion) has been taken off exchanges in the last 30 days.” by @WatcherGuru

Suggestions

Interesting articles to read

Polish PM: The green transition cannot come at the cost of European security

Is The Chinese Yuan Beginning To Chip Away At Dollar Dominance?

Sources:

https://coinquora.com/premium-crypto-no-limit-visa-bitcoinblack-launches-in-uae/

https://bitcoinist.com/bitcoin-largest-monthly-withdrawal-exchanges-june/

https://www.theblock.co/post/156367/hive-blockchain-reports-278-5-btc-mined-in-june