This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

$100,000 Bitcoin Grants to Salvadorian Entrepreneurs

Russia has passed a bill to remove VAT taxes on Bitcoin sales

Bitcoin generated from mining will be tax free in Uzbekistan (UPDATED!)

Central Bank of Morocco to introduce Bitcoin regulation bill

MicroStrategy has purchased an additional 480 Bitcoin

US SEC denies Grayscale's Spot Bitcoin ETF application

Luxury watchmaker Breitling accepts Bitcoin for Purchases

MicroBT will get the first access to Samsung's new 3nm Bitcoin mining chips

The first Spot Bitcoin ETF will be launched in Europe

El Salvador is building a $200 million solar-powered Bitcoin mining facility

El Salvador has purchased an additional 80 BTC

Bank of International Settlements proposes letting banks hold 1% of reserves in Bitcoin

OpenNode + Lemon Cash = 1 million Argentines to the Lightning Network

$100,000 Bitcoin Grants to Salvadorian Entrepreneurs

290,000 people reside in the state of Soyapango. This makes it the third most densely populated region in El Salvador.

A Salvadorian entrepreneur operating in the Soyapango region can claim a $100,000 Bitcoin grant.

Once, Soyapango was believed to be a very violent neighborhood. But now with catching the bad guys, the whole area is completely changed.The Salvadorians hope that this law will help boost the economy of the region and make it a developed region in the upcoming months.

Russia has passed a bill to remove VAT taxes on Bitcoin sales

The State Duma, the lower house of the Russian legislature, has passed a bill on the taxation of digital assets that exempts their sale from value-added tax (VAT) in the Russian Federation.

In addition, the bill established income tax rates of 13% for Russian exchanges on the first 5 million rubles (currently about U$93,000) of the taxable base annually, 15% on amounts above that limit and 15% across the board for foreign exchange operators. The current tax rate for companies is 20%.

Bitcoin generated from mining will be tax free in Uzbekistan (UPDATED!)

Miners are required to register and apply for certificates before they start mining as stated by the new order. Each certificate must be issued by the national registry in charge of Bitcoin mining.

However, the regulators of Uzbekistan would deduct special tariffs on energy the mining farms consumed. Additionally, Bitcoin mining assets are only allowed on exchange platforms that are legalized by the country’s regulators.

(UPDATE: It also obliges crypto miners to utilize electricity produced by photovoltaic stations and bans them from providing power from their supply source to any third party. Bitcoin mining farms will also be allowed to connect to the national power grid, to ensure the stable operation of their hardware, through a separate electricity meter. That applies to the peak times of consumption, between 5 p.m. and 10 p.m., and also at night, from 10 p.m. until 6 a.m., when they will pay a surcharge.)

Central Bank of Morocco to introduce Bitcoin regulation bill

Morocco is joining the list of countries aiming to formally control Bitcoin and the shitcoin sector by reportedly working on a final regulatory framework to guide the market.

The country’s central bank, Bank Al-Maghrib (BAM), is designing a crypto regulation outlook in consultation with a global financial institution, Bitcoin News reported on June 27.

According to BAM’s governor Abdellatif Jouahri the institution has engaged with the International Monetary Fund (IMF) and the World Bank on specific benchmarks.

Because it’s a close work with the IMF and the World Bank it won’t be in favor of their citizens, but for the IMF and the World Bank. These institutions are against Freedom of currency choice, because they attacked El Salvador who made Bitcoin a legal tender.

MicroStrategy has purchased an additional 480 Bitcoin

In a Form 8-K filing with the United States Securities and Exchange Commission (SEC), Microstrategy disclosed that it had acquired an additional 480 BTC at an average price of roughly $20,817. The total purchase amount was $10 million in cash.

With the purchase, MicroStrategy now holds 129,699 BTC, making it the largest corporate holder of Bitcoin. The total value of its holdings is roughly $3.98 billion.

That’s what I call a clear vision about the Bitcoin future. MicroStrategy aka. Michael Saylor buys regularity (a form of DCA) Bitcoin. In the long run he knows the actual price doesn’t matter. If you don’t see it like him, it’s better to educate yourself!

US SEC denies Grayscale's Spot Bitcoin ETF application

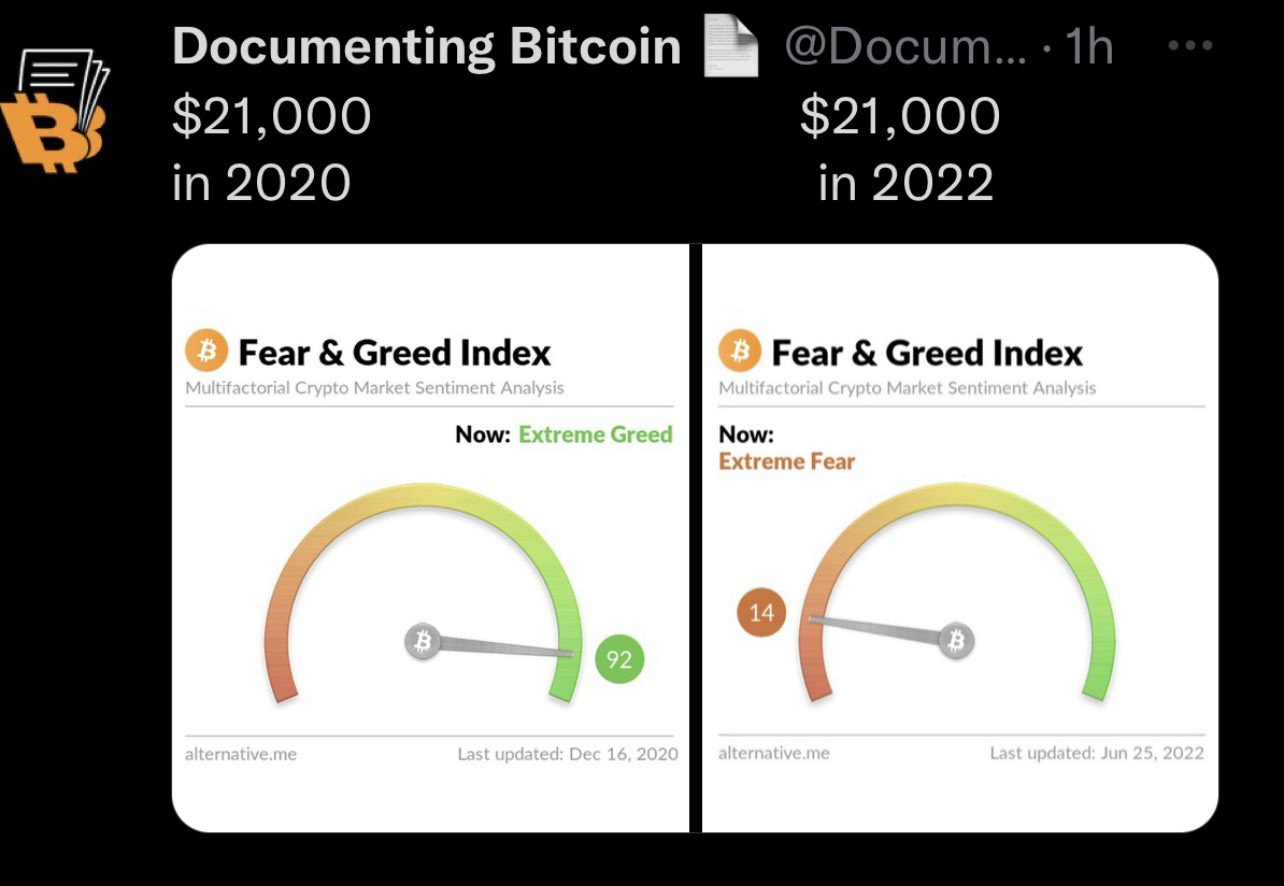

I hope no one is surprised about this news because the SEC will evade the creation of a Spot Bitcoin ETF as long as it can. Why? Because they learned from what happened with Gold. It went from 2 digits to 4 digits price. They can’t risk that this will happen again. They don’t even care about the +11,400 investors' written request in which they asked the SEC to allow Grayscale’s Spot Bitcoin ETF proposal.

The answer from Grayscale was fast. They initiated a lawsuit against the US SEC. The end of this lawsuit is questionable because it depends only on the “bosses” of the SEC. If they bought enough Bitcoin they will allow a Spot Bitcoin ETF.

Luxury watchmaker Breitling accepts Bitcoin for Purchases

I guess that after so many Luxury brands got involved in the Bitcoin hype, Breitling goes FOMO.

Yes, they are all the same “non believers” because Breitling has partnered with BitPay too as their Bitcoin payment service provider. Which means they will instantly convert all the Bitcoin payments to FIAT.

MicroBT will get the first access to Samsung's new 3nm Bitcoin mining chips

Samsung will start trial production of its 3-nanometer(nm) foundry process for customers this week at the earliest, TheElec has learned. Their first customer will be PanSemi.

Samsung’s gate-all-around (GAA) 3nm processes, as its name implies, have the current gates on all four surfaces. The most advanced process that has been commercialized to date is FinFET, which uses three surfaces, and is sometimes called 3D for this reason. GAA is more advanced and allows for more precise control of currents while the gate width is even narrower.

Samsung’s advanced 3nm process for ASIC miners reduces the power consumption of those who own the latter by 30% and improves its performance by about 15%. It’s said that preliminary tests have already begun for new 3nm ASIC miners.

PanSemi is a subsidiary of MicroBT and MicroBT's line of Bitcoin ASICs are called Whatsminers.

The first Spot Bitcoin ETF will be launched in Europe

While the U.S. SEC denied Grayscale's Spot Bitcoin ETF application, the Jacobi Asset Management is launching the first spot bitcoin exchange-traded fund (ETF) in Europe through Euronext Amsterdam, the largest exchange to host a spot bitcoin ETF, according to a report from Reuters.

“The Jacobi Bitcoin ETF will enable investors to access the underlying performance of this exciting asset class via a well-established and trusted investment structure,” said Jamie Khurshid, CEO of Jacobi Asset Management. “Our goal at Jacobi is to make digital asset investments simpler and more familiar for institutional and professional investors.”

Being a spot bitcoin ETF, the fund will hold bitcoin on balance and has partnered with Fidelity Digital AssetsSM to serve as the fund’s custodian, while Flow Traders and DRW will facilitate the fund as market makers.

“We are excited to be acting as lead market maker for Europe’s first Bitcoin ETF, which is another milestone in the development of the institutional digital assets space,” said Edd Carlton, institutional digital asset trader at Flow Traders. “This is also aligned with the growing demand from institutional investors who are looking to diversify their portfolios by adding Bitcoin and other digital assets.”

El Salvador is building a $200 million solar-powered Bitcoin mining facility

According to El Salvador in English, the Ambassador of El Salvador to the United States, Milena Mayorga, said that with an investment of $200 million, a Swiss consortium, led by a Salvadoran, made a commitment to build a photovoltaic plant in the country that will inject energy into the national grid but will also be used to mine bitcoin.

“Josué López is a young Salvadoran who lives in Switzerland and has a fund that he manages from several consortiums, and this is the one that is coming to invest in El Salvador. Precisely they are going to aim to be able to supply more of the energy needs of El Salvador with a photovoltaic plant that is going to help us generate more renewable energy, but, in addition, on one side they will have a bitcoin mining plant,” said the official.

Both Ambassador Mayorga and López valued the accompaniment of entrepreneurs and bitcoiners Max Keizer and Stacy Herbert for the support provided in terms of bitcoin mining and the exploration of new businesses based on the cryptoactive.

El Salvador has purchased an additional 80 BTC

El Salvador's President Nayib Bukele tweeted that El Salvador bought the dip with another 80 bitcoins at a price of $19,000 each, for a total of about $1.5 million. This is the eleventh time El Salvador has bought bitcoin and currently holds 2,381 bitcoins at an average price of $43,000.

Bank of International Settlements proposes letting banks hold 1% of reserves in Bitcoin

Despite its skeptical approach to digital currencies, exacerbated by the recent market crash, it looks like the Bank for International Settlements (BIS) intends to extend its hand to the new asset class by allowing banks to hold up to 1% of reserves in Bitcoin (BTC).

Of course they are open to shitcoins too, but I don’t think that they will hold anything other than Bitcoin, like no other Institutions are holding anything else. For more details click here.

OpenNode + Lemon Cash = 1 million Argentines to the Lightning Network

More than one million Argentines will soon have access to Bitcoin’s Lightning Network on the Lemon Cash digital wallet through a partnership with bitcoin payments infrastructure company OpenNode, per a joint press release.

Lemon Cash is a fintech company based in Argentina and is mostly known for being a cryptocurrency exchange and also for operating the aforementioned digital wallet. The company serves well over one million customers in the Latin American (LATAM) region. This integration will allow all of these customers to facilitate transfers of value on Bitcoin with low-fees and fast settlement times through Lightning.

"Introducing the Lightning Network to more than one million users in partnership with OpenNode will be a huge step towards our main goal: to make crypto more usable and accessible in LATAM," Lemon Cash co-founder Borja Martel Seward said.

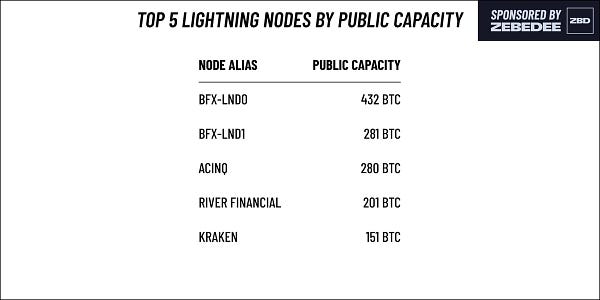

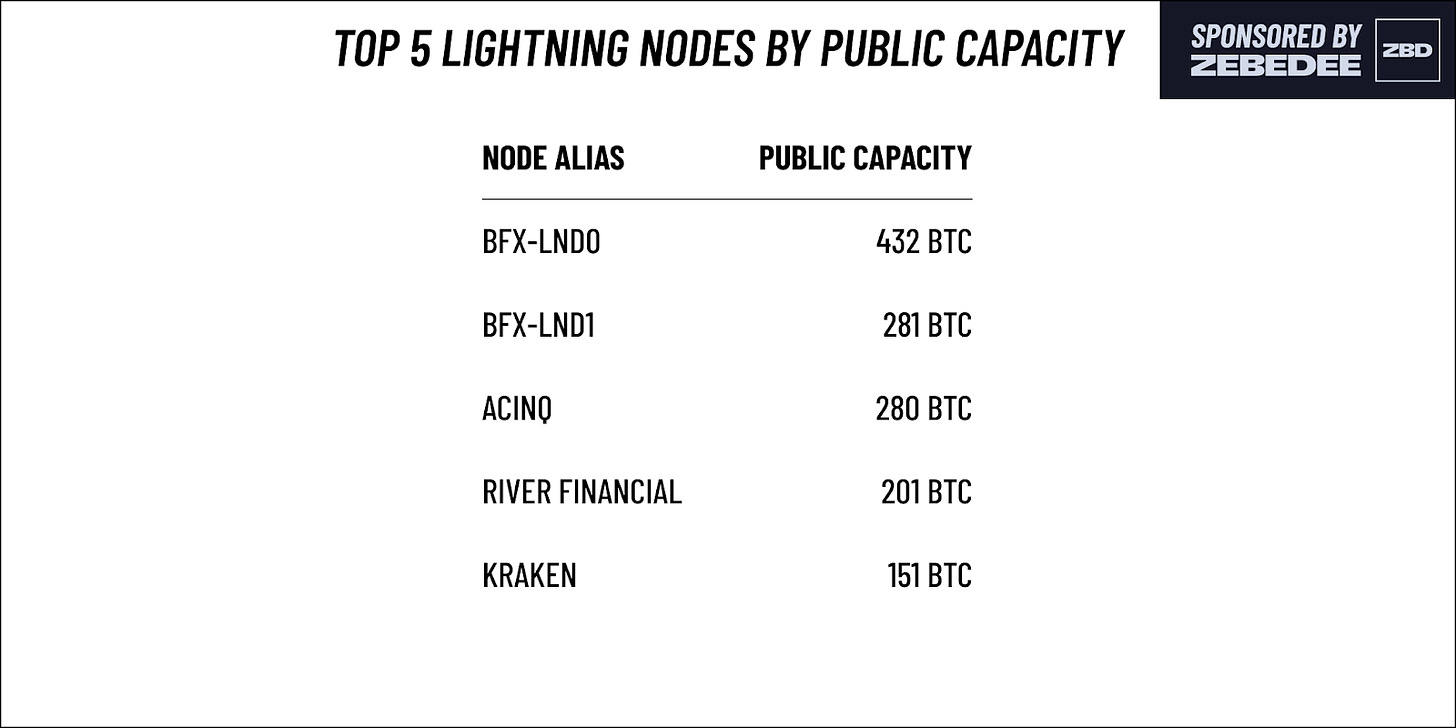

This is quite frankly unbelievable! Just checked the Lightning Node leaderboard and the River Financial just topped 200 BTC of public capacity, and the top 5 nodes now have more public capacity than the entire Lightning Network just 13 months ago. This is fantastic despite the fact that the on-chain fees are really low these days, but the main reason is that the big institutions are already heavily building on Layer 2. With this current news we see that now companies are teaming up to onboard millions of citizens around the World. Life was never better! Let’s Free up everybody from the iron fist of the central banks!

Global Economic News

TL;DR

While Global stocks are falling economies are shifting

The U.S. economy valuation has fallen below average

The German Housing Market has already topped and the economy is already shrinking?

Bank of Japan heavily buys government bonds

The ECB balance sheet hit another ATH with a ship that goes without a sane captain?

While Global stocks are falling economies are shifting

“Global stocks have lost $2.3tn in mkt cap this wk on recession angst following weaker Chicago PMI & ISM Manufacturing Survey in US & weaker PMI surveys in Europe as well. US 10y ylds plunge 25bps due to recessionary concerns. All stocks now worth $98tn equal to 102% of global GDP” by Holger Zschaepitz

“1) Iranian Oil is now welcome back on the market.

2) Venezuelan Oil being encouraged.

3) Coal stocks are ripping higher.

4) Germany likes nuclear power all of a sudden.” by @WallStreetSilv

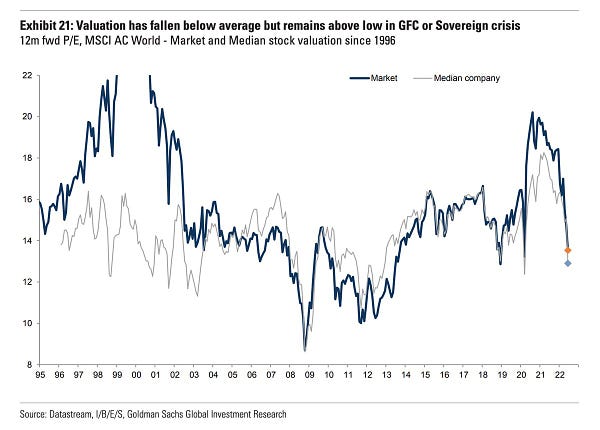

The U.S. economy valuation has fallen below average

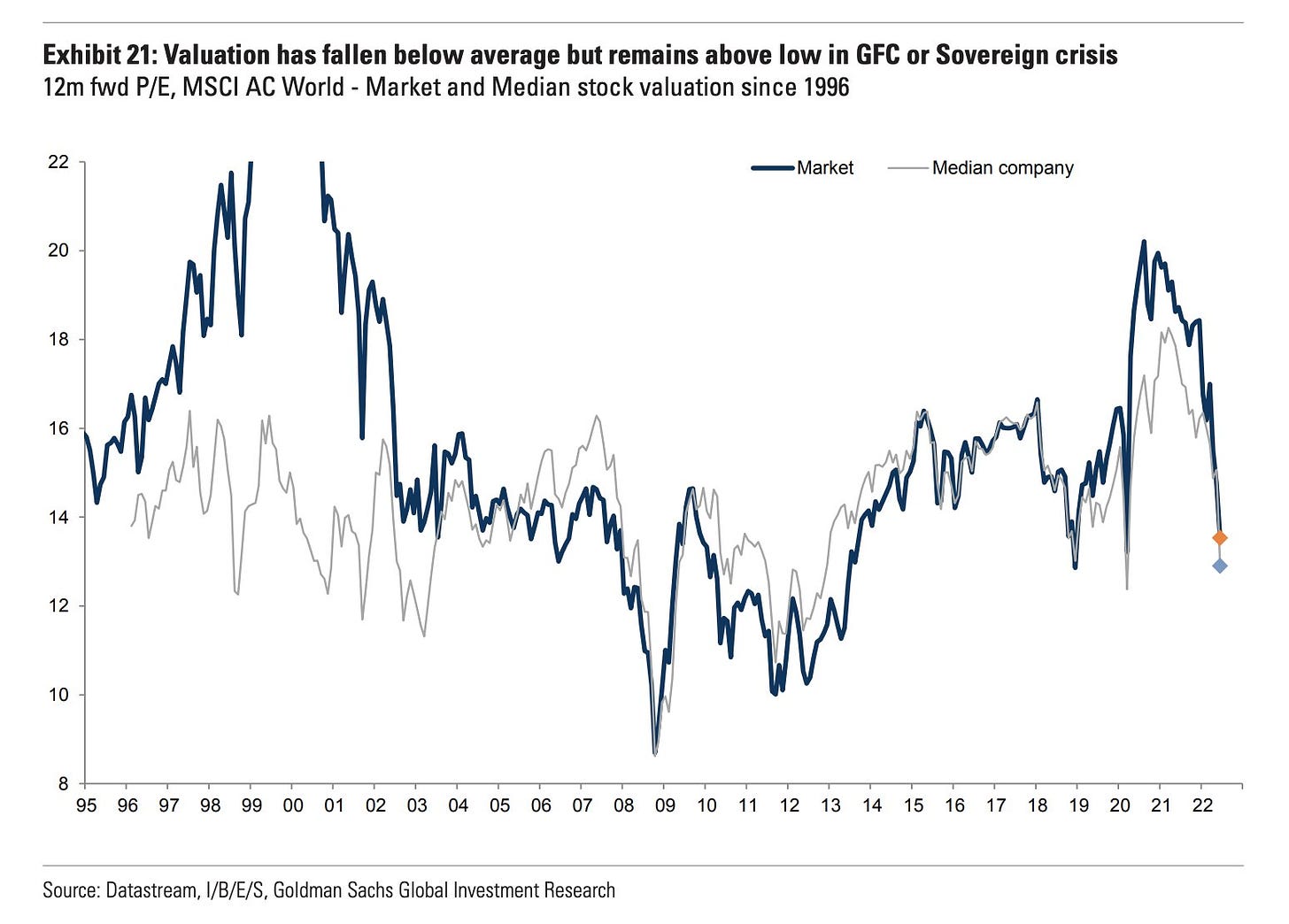

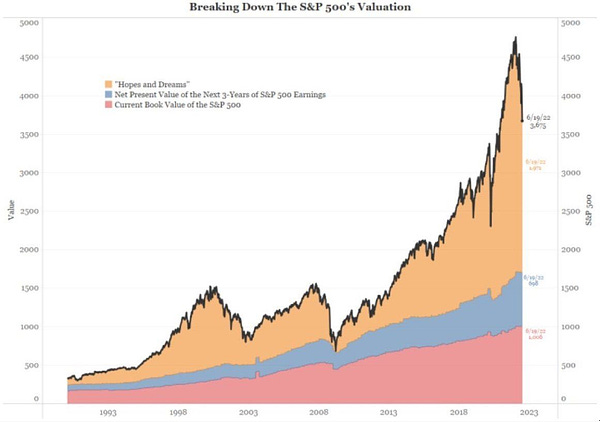

“S&P 500 valuation has fallen below average but remains above the lows of the GFC or Sovereign crisis, Goldman says. This is at least true if a recession does not ruin profit expectations. In a normal recession, earnings usually fall by around 40%.” by Holger Zschaepitz

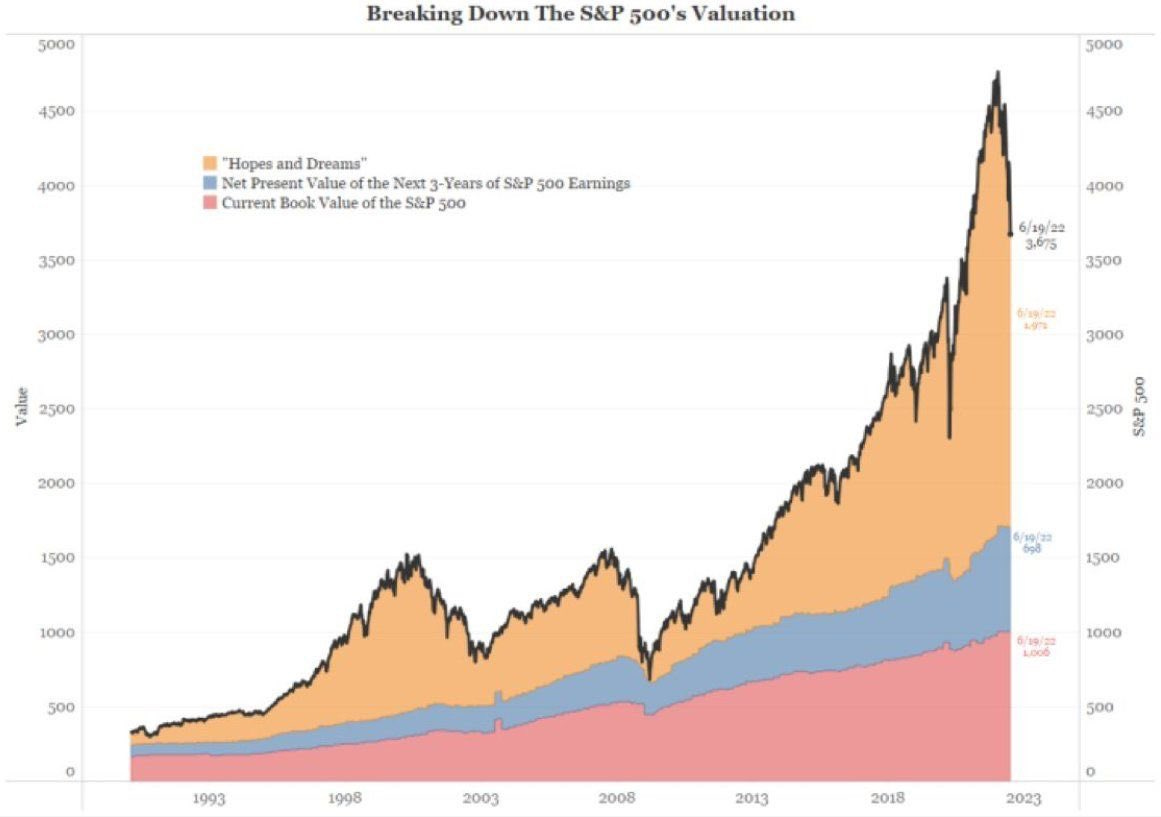

“Best ‘Hopium’ chart I have seen in a while. by Arbor Research” by @jsblokland

The more interesting article on Zerohedge explains why Even One Of The Biggest Bears Expects The S&P To Dead-Cat Bounce To 4,100.

The FED tries to destroy demand to lower the inflation which will hurt everyone, but money printing will never stop for good! The perfect example for that is what California is doing: Millions are going to receive $1,050 “inflation relief” cheques. The politicians are simply gone full communist thinkers. They give, share or take what should not be touched!

Just to summarize:

“Worst first half for stocks in 52 years” according to Zerohedge. Why? Because over $8.5 trillion has been wiped out of the US stock market this year.

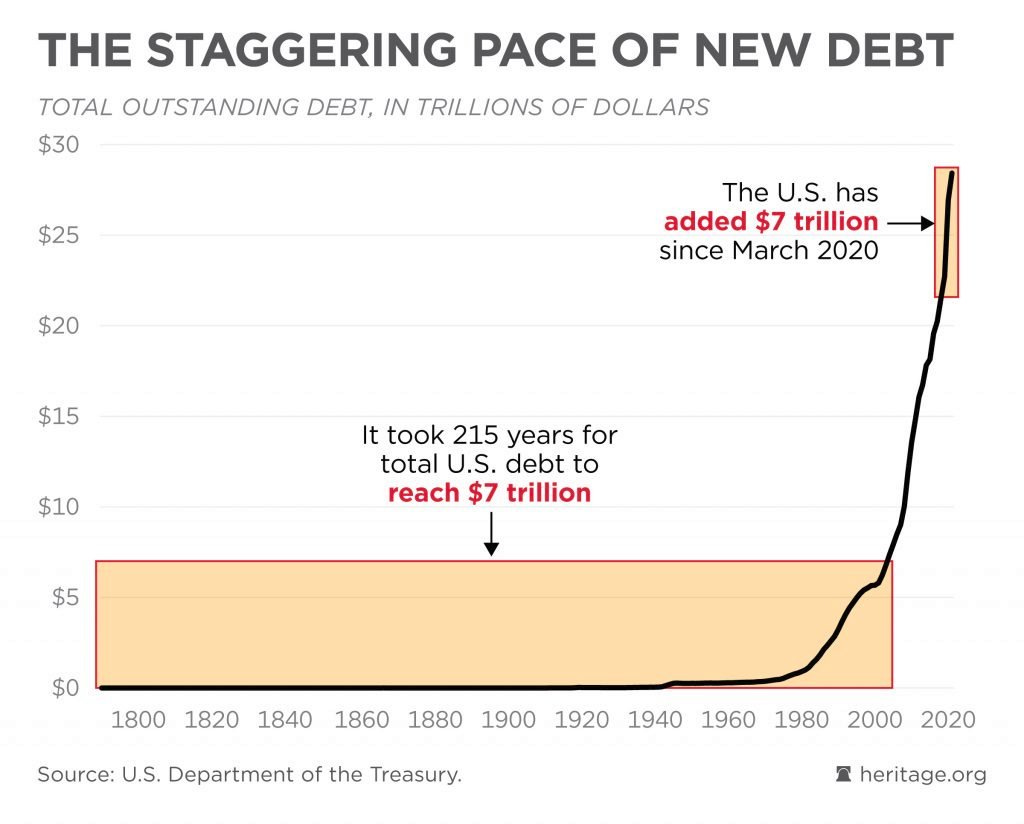

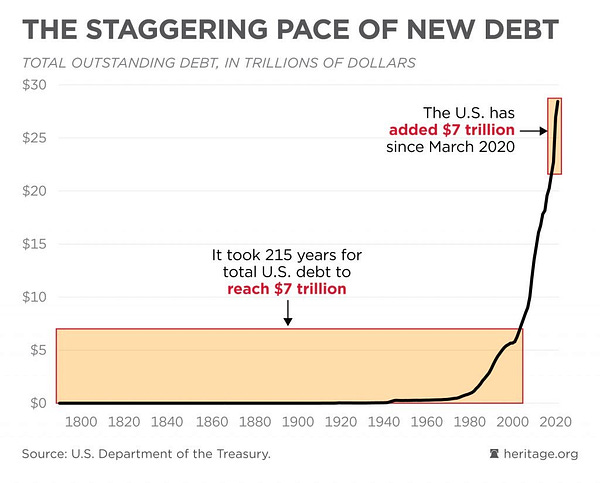

The US debt took 215 years to reach $7 trillion, but just two (!) to add another $7 trillion!

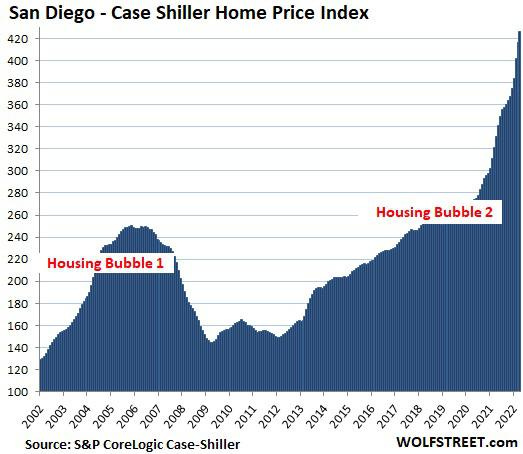

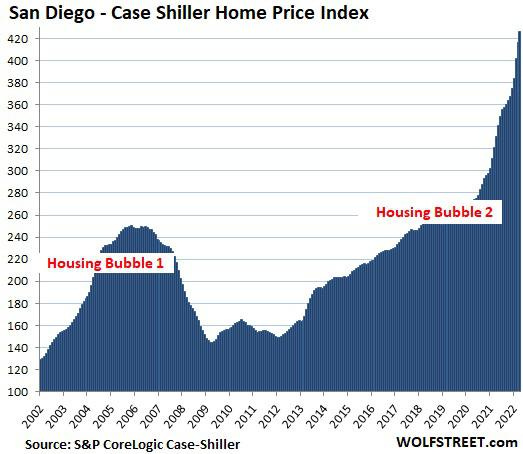

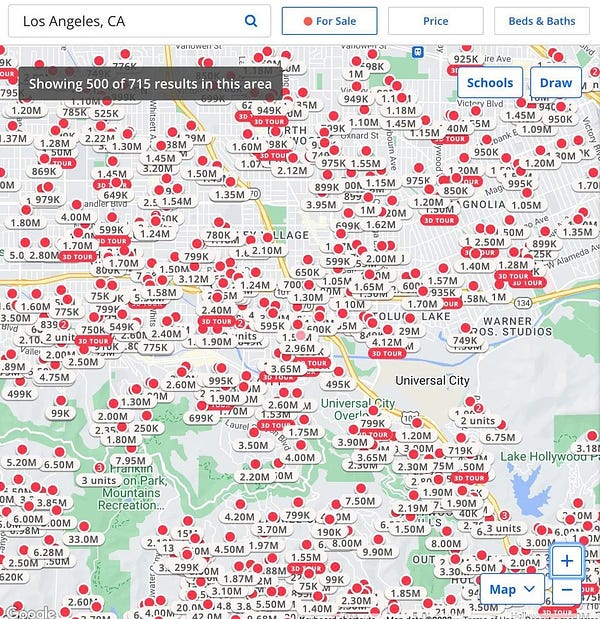

“This price growth of 326% since 2000 is 4.5 times the rate of CPI inflation (+73.2%), which crowns San Diego the most splendid housing bubble on this list, followed by Los Angeles and Seattle” by @WallStreetSilv

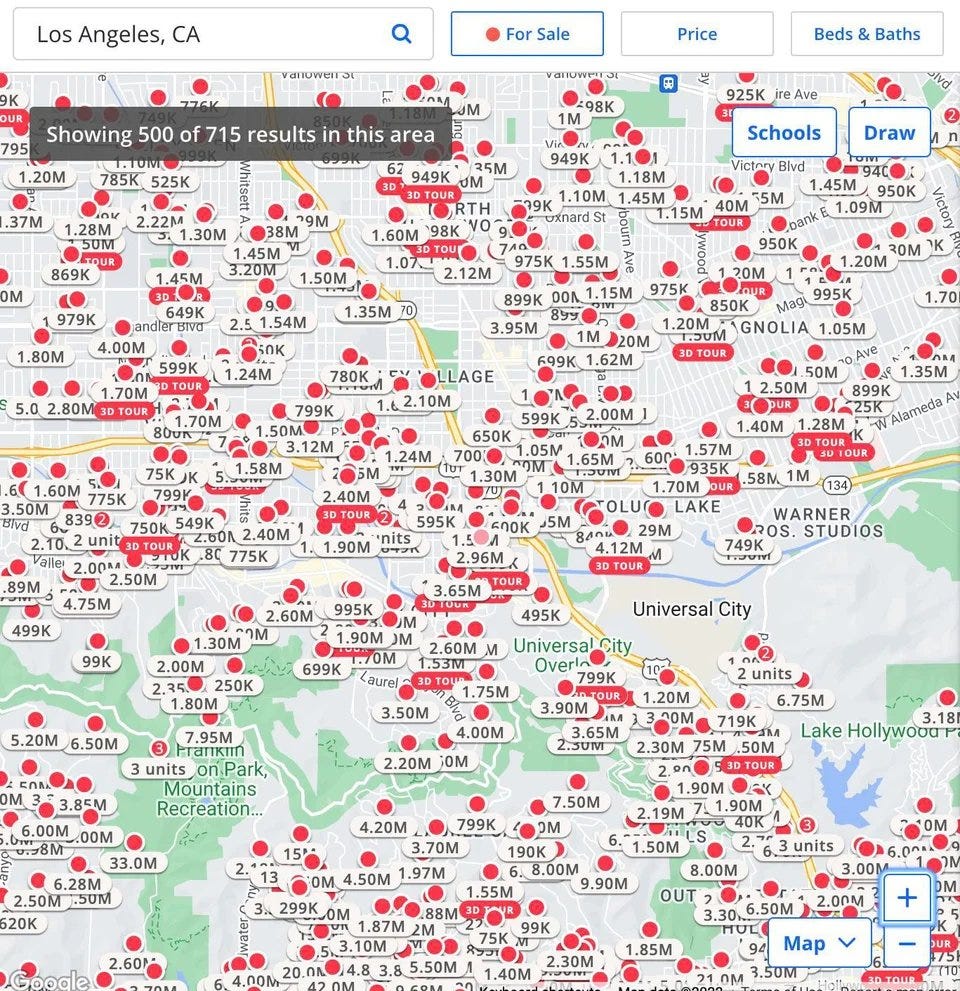

“Zillow Gone Panicked (Small slice of LA - everyone now wants to sell asap, huge increase in inventory)” by @WallStreetSilv

Why is the U.S. Dollar still getting stronger and stronger? Because of the recession where everyone is selling: Stocks, Bonds, Housing, etc. and all the wealth goes into USD. This is the short term cause of recession because in the long term USD price will plummet when the U.S. Treasuries market will be dead (cause no forreign entity will invest in it) and/or people will face with the hyperinflation of the USD (and other currencies too) which can’t be stopped.

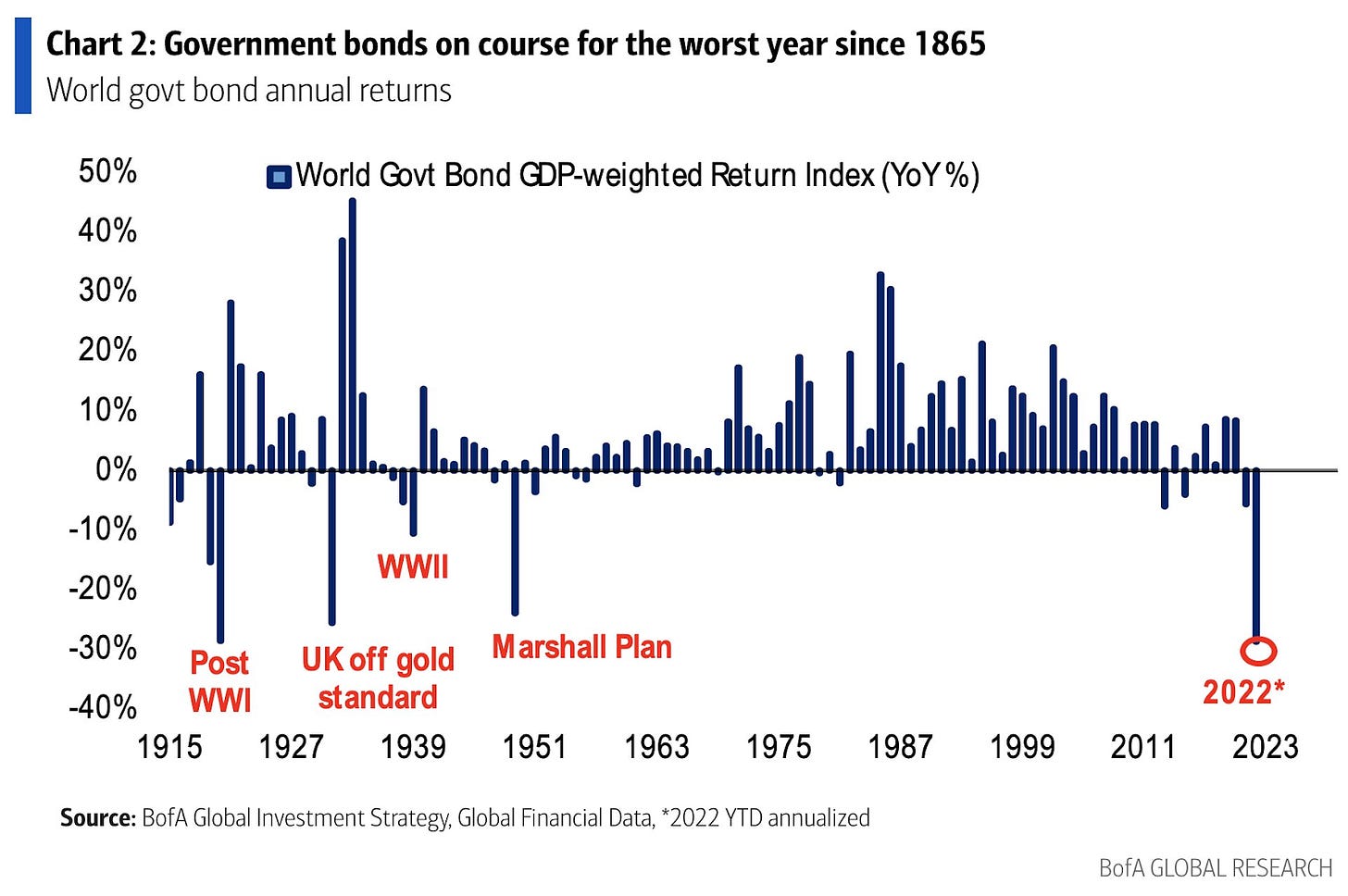

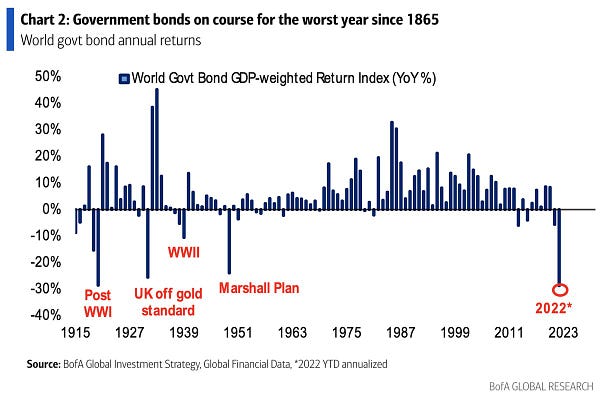

Why am I so sure? Because according to the BofA, the World government's bonds are on course for the worst year since 1865. Eventually when people will feel the harsh result of this big recession caused by the upcoming bigger inflation, they all will blame the governments for it.

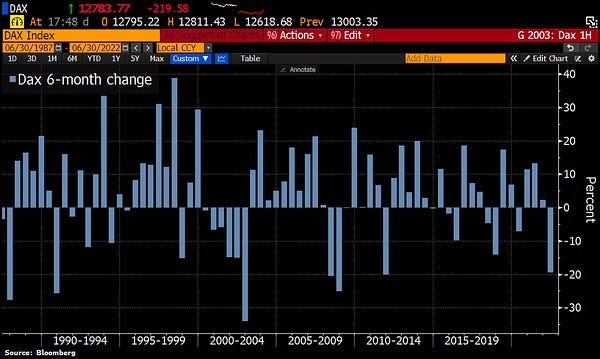

The German Housing Market has already topped and the economy is already shrinking?

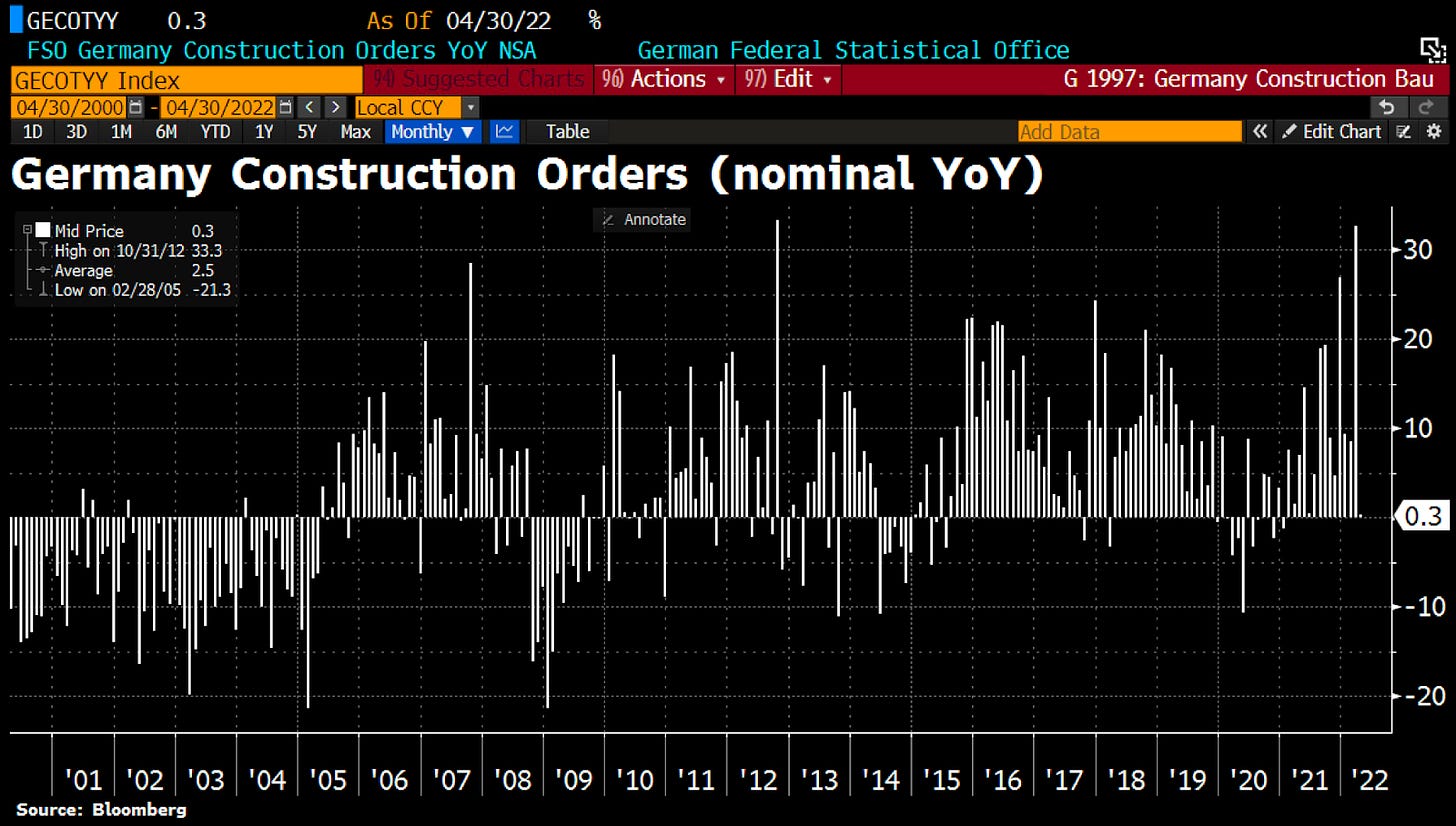

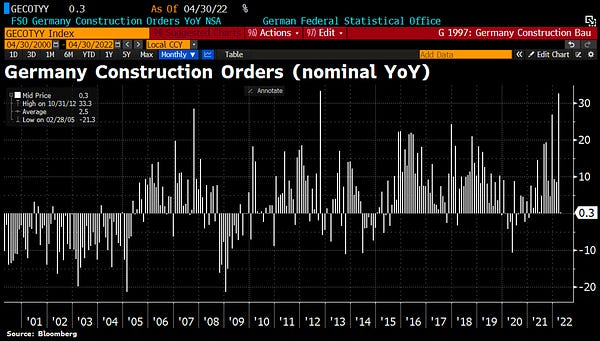

“Germany, where construction activity is threatening to topple due to higher construction prices & more expensive mortgage rates. New orders in main construction industry growth dropped to 0.3% YoY in nominal terms but plunged -9.7% YoY in real terms.” by Holger Zschaepitz

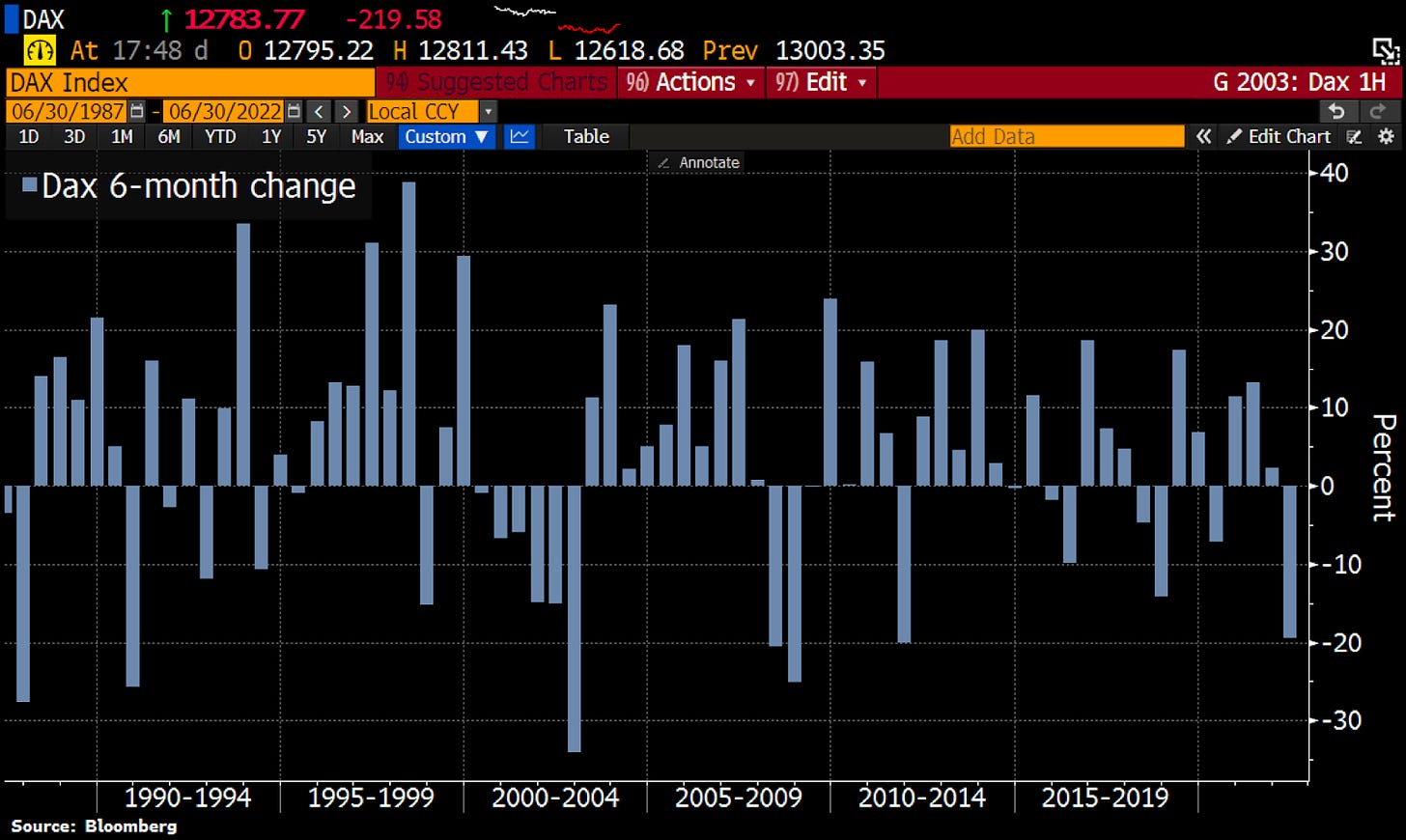

Meanwhile, since 2008 the worst half year was in DAX’s history because it fell 19:52%.

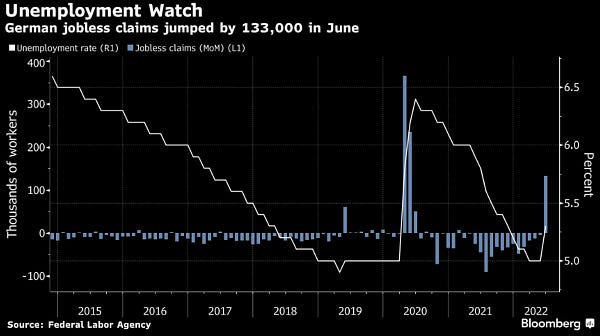

According to Bloomberg, German unemployment unexpectedly rises, snapping 15 straight months of decline as refugees from the war in Ukraine were included in those searching for work. In June it rose by 133k versus expected rise of 5k, so the Unemployment rate 5.3% versus estimate of 5%.

The German economy will most probably face their most hurting financial meltdown in their entire history because not only they put their economy in an inflation spiral without any exit possibilities, but they're right now bleeding out their producing market too (think here on companies which are physically producing stuff). Till now this happened only in the poorest African countries where there exists no sophisticated production market and besides that they face hyperinflation too. The times of Weimar Republic hyperinflation was completely different. The production market was then not killed with ESG and other suicidal political decisions. Today they are not just inflating the money supply, but they are now killing the backbone of their economy too.

Last but not least, the following absurdity shows how serious the problem is:

“Fear of freezing: Wood stoves and firewood are in short supply nationwide in Germany.

"The market is empty," Gerd Müller, head of the office of the German Firewood Association, tells dpa.” by @disclosetv

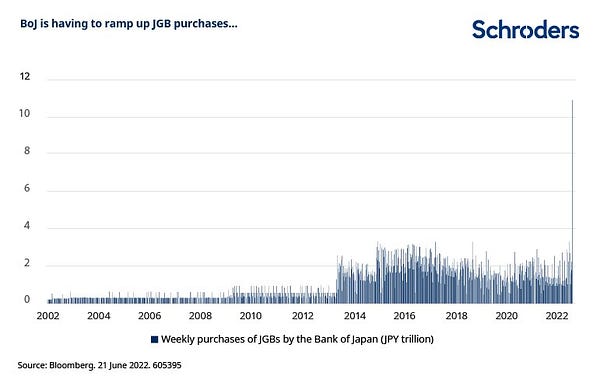

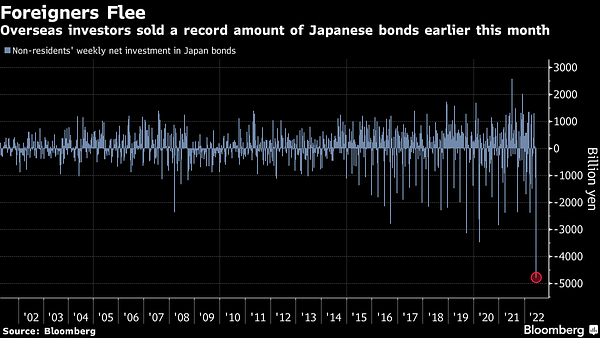

Bank of Japan heavily buys government bonds

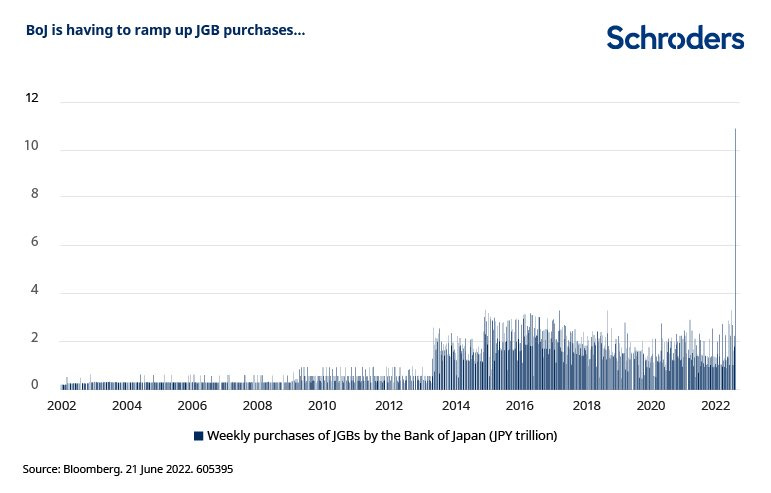

“BoJ weekly purchases of government bonds. Holy moly” by @DuncanLamont2

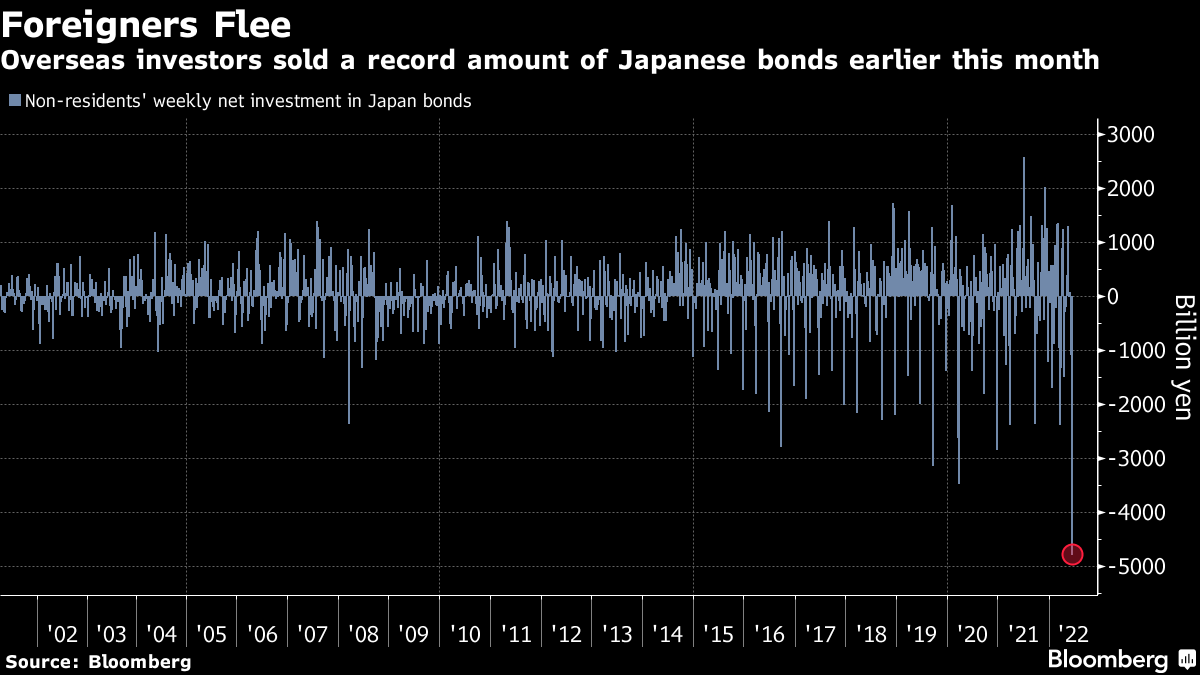

Meanwhile, according to Bloomberg,

“the big short is back for hedge funds betting against the Bank of Japan (BoJ). BoJ says it’s committed to keeping yields low despite a global push to hike rates. As the Yen gets pummeled, investors once again doubt its resolve.” by Holger Zschaepitz

The Japanese economy continues to crater:

Industrial Production May m/m -7.2% (Estimate -0.3% | Previous -1.5%)

Industrial Production May y/y -2.8% (Estimate 4.2% | Previous -4.9%)

As I wrote in previous newsletters too, I definitely think that the first economically fallen country of the G7 will be Japan. They are in serious trouble caused by blatant money printing and other suicidal economic decisions too.

The ECB balance sheet hit another ATH with a ship that goes without a sane captain?

First I wrote “The ECB balance shit hit another ATH”, but then I corrected it.

“ECB balance sheet hit another ATH amidst record-high inflation. Total assets rose by €8bn to €8,836bn shortly before the end of the bond purchase program. ECB balance sheet now equal to 82.5% of Eurozone's GDP vs Fed's 36.6%, BoE's 39.6%, BoJ's 137%.” by Holger Zschaepitz

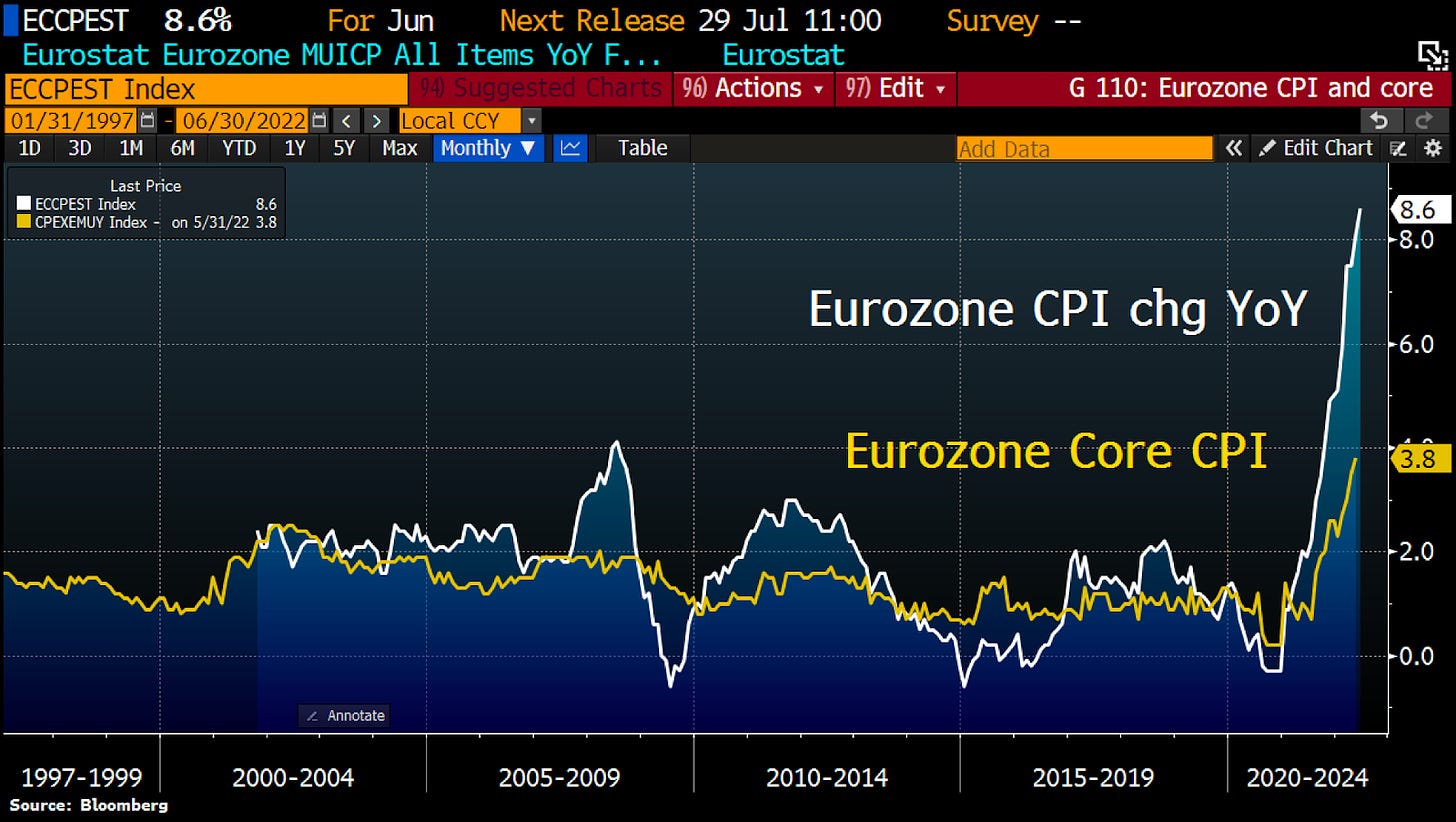

After money printing comes the tide which is the huge inflation (cantillon effect) because:

“Eurozone inflation surged to 8.6% in June from 8.1% in May, a fresh record, surpassing expectations of 8.5% & bolstering calls for an aggressive ECB hike. Data reflect an escalating squeeze on households across Eurozone, where France, Italy & Spain reported new ATH this wk” by Holger Zschaepitz

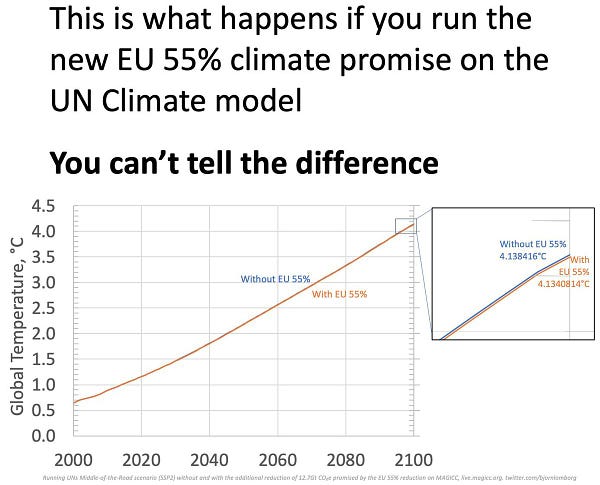

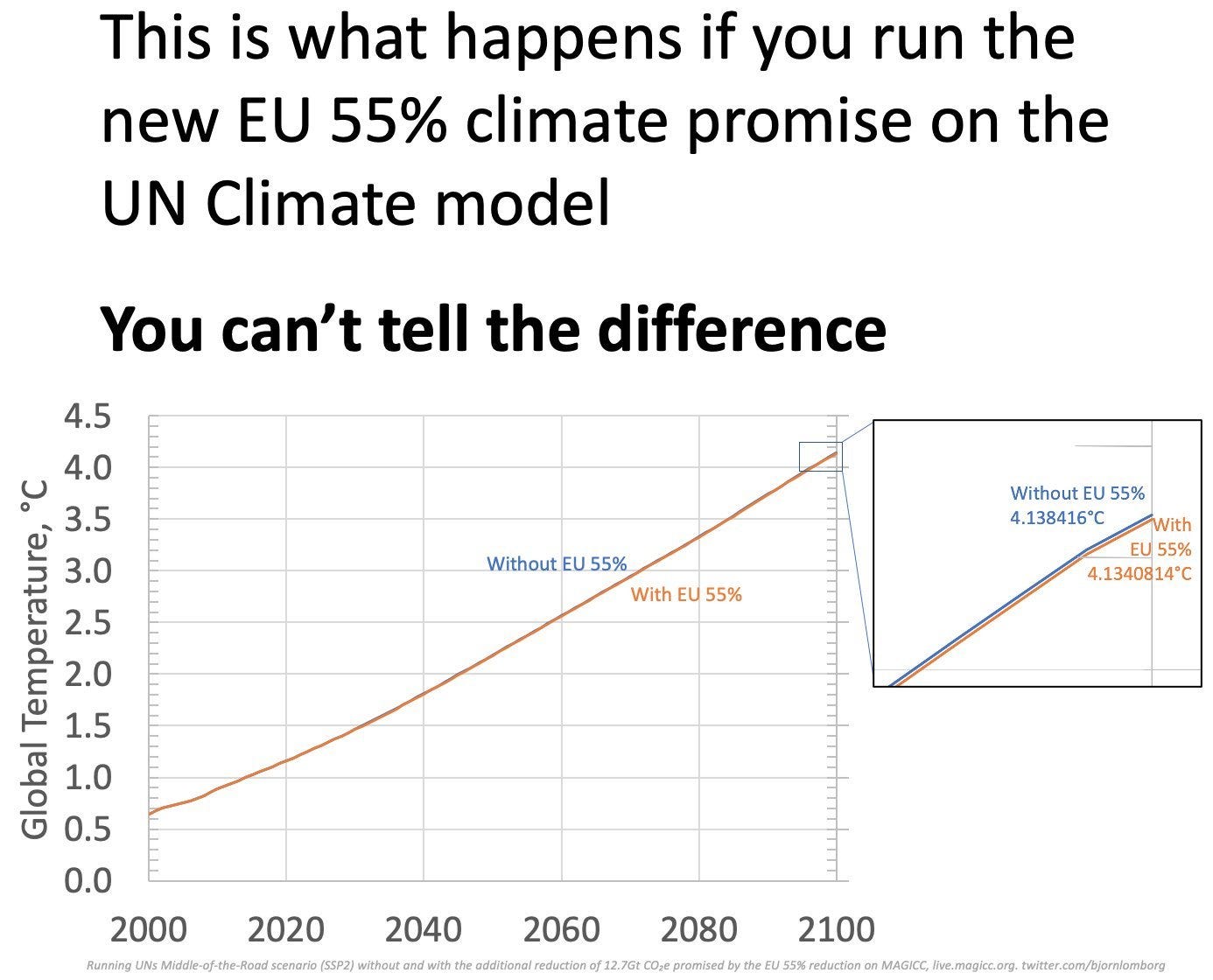

While they are still printing like no tomorrow, then according to Euractiv, if the EU wants to radically change itself to reduce emissions 55% by 2030, it will be an Extra cost upwards of €10,000 per EU citizen (€5tr) and it will reduce global temps by 0.004°C (0.007°F). Let's not be surprised when the rest of the world doesn't follow.

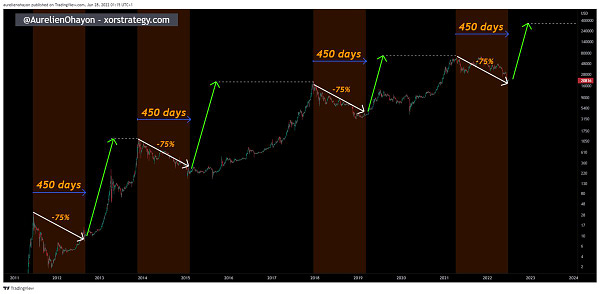

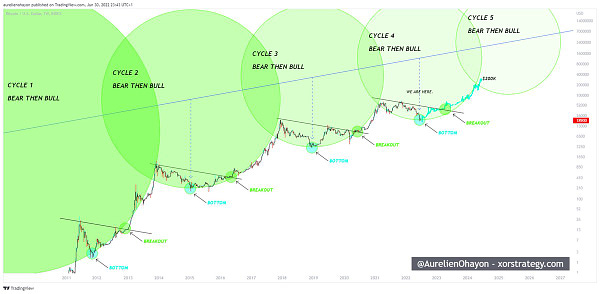

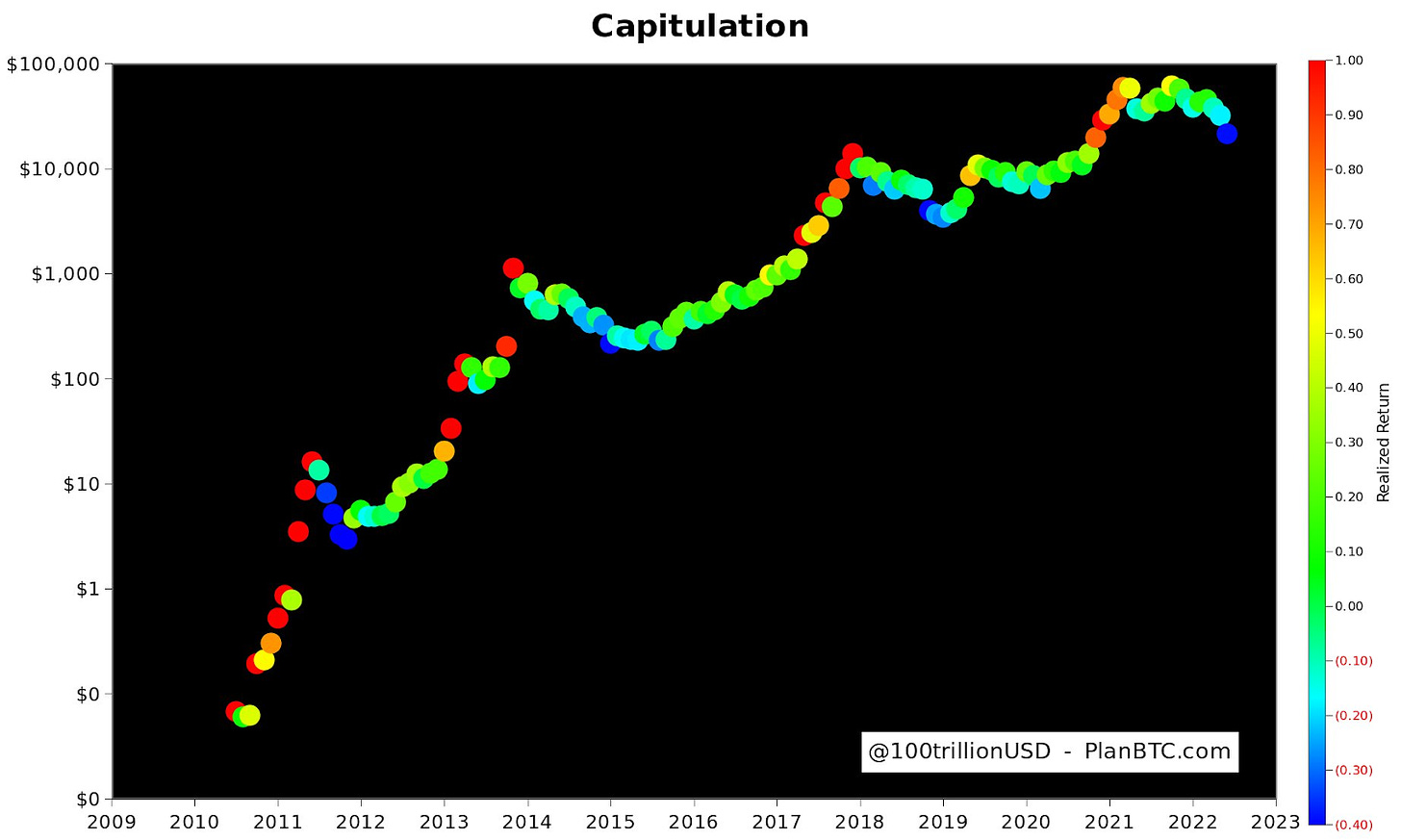

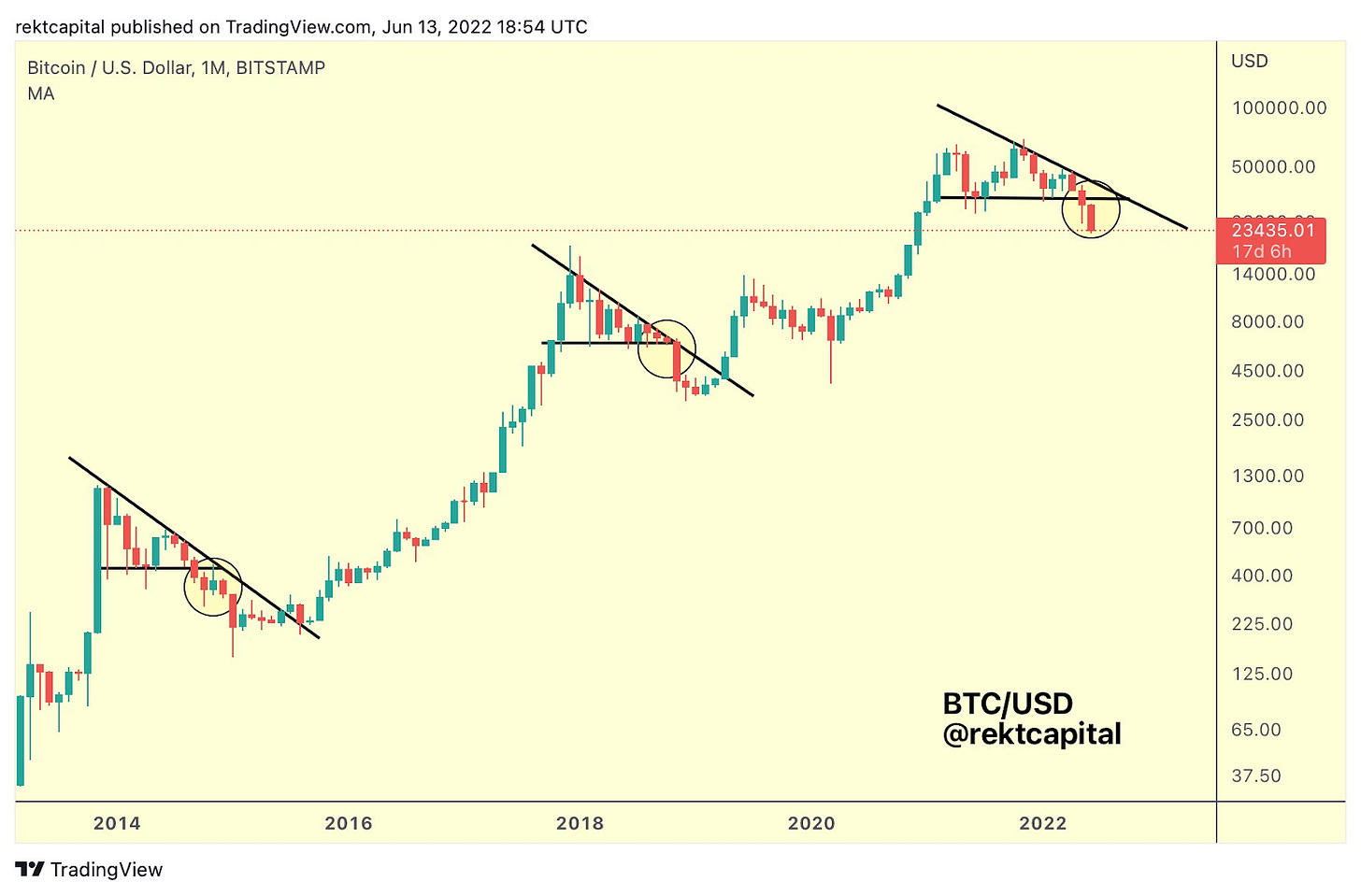

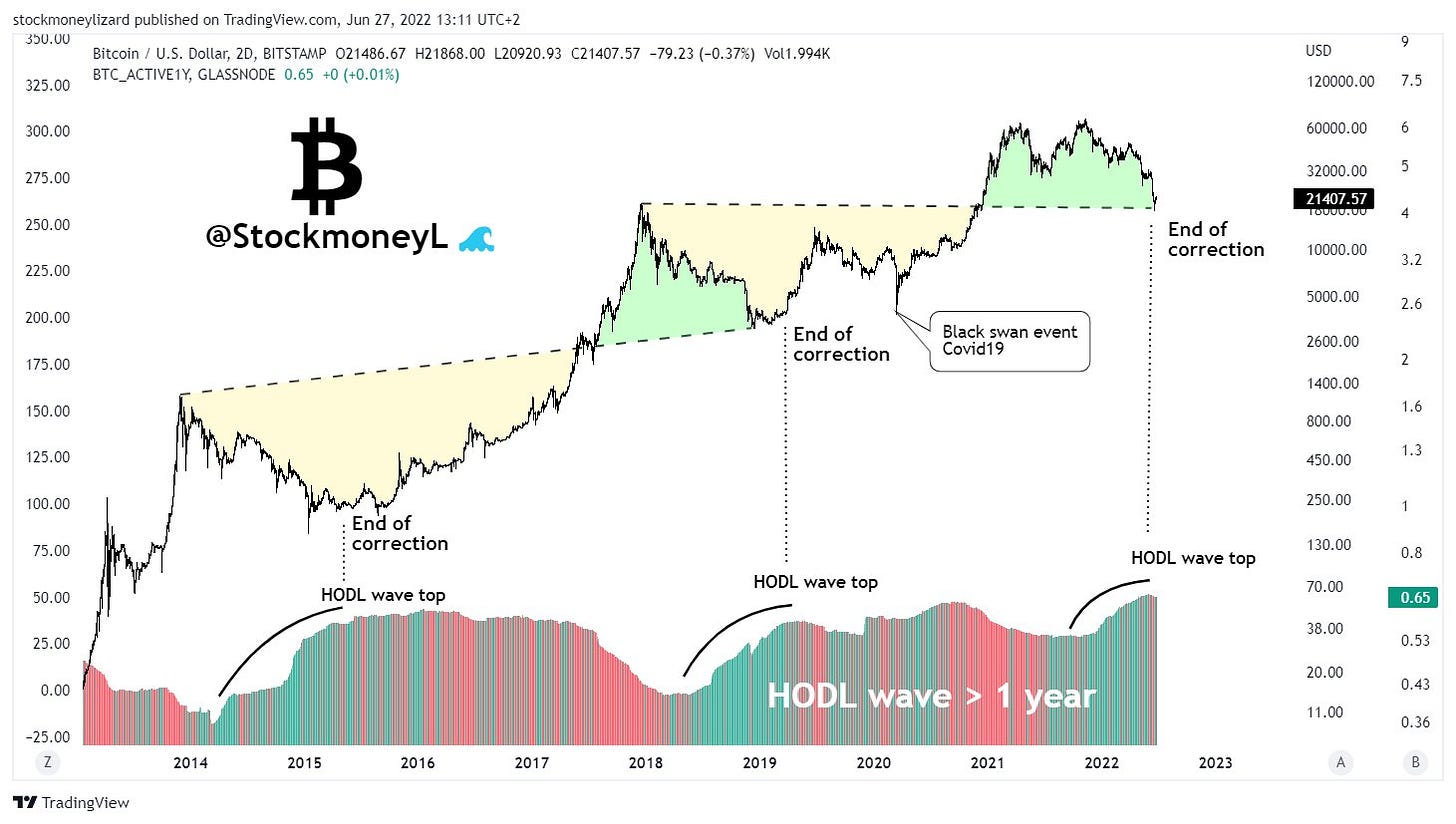

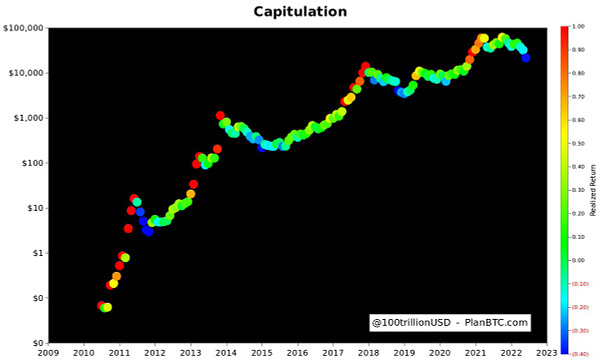

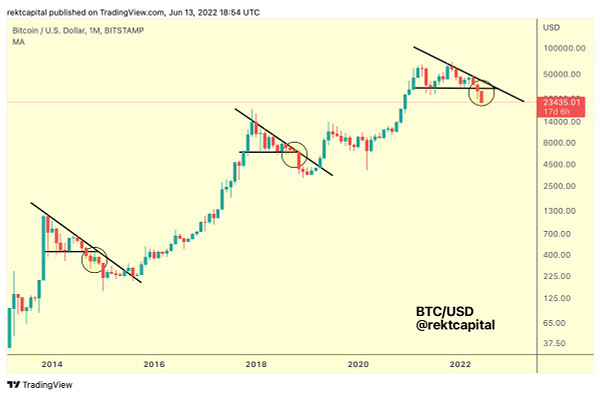

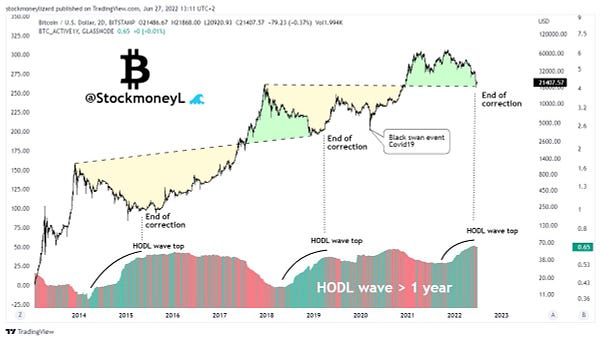

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

Adopting Bitcoin will benefit the generations to come - President of Central African Republic

US SEC Chair Gary Gensler says Bitcoin is the only cryptocurrency he is prepared to call a commodity. (@WatcherGuru)

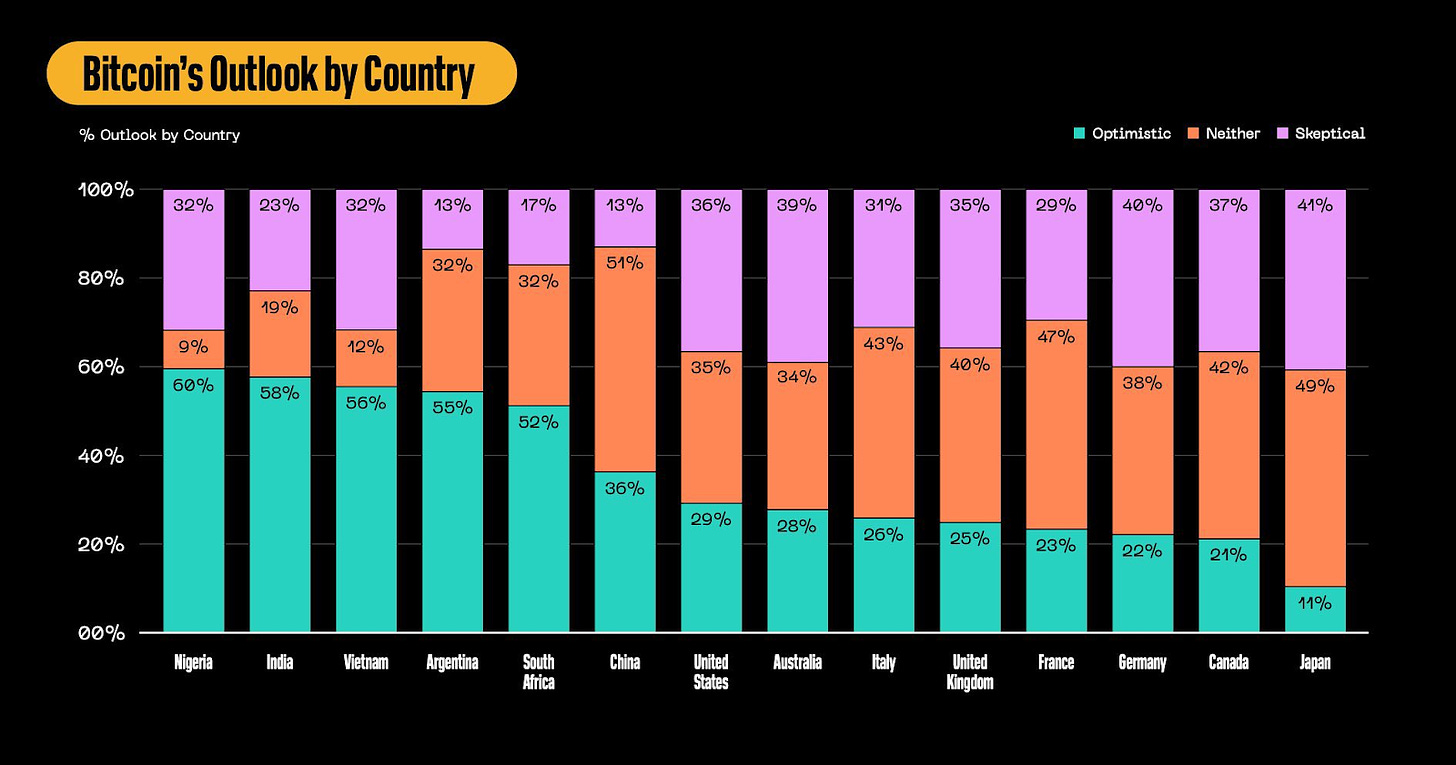

According to the following report, Nigeria, India, Vietnam, and Argentina have the highest rates of optimism about bitcoin’s future

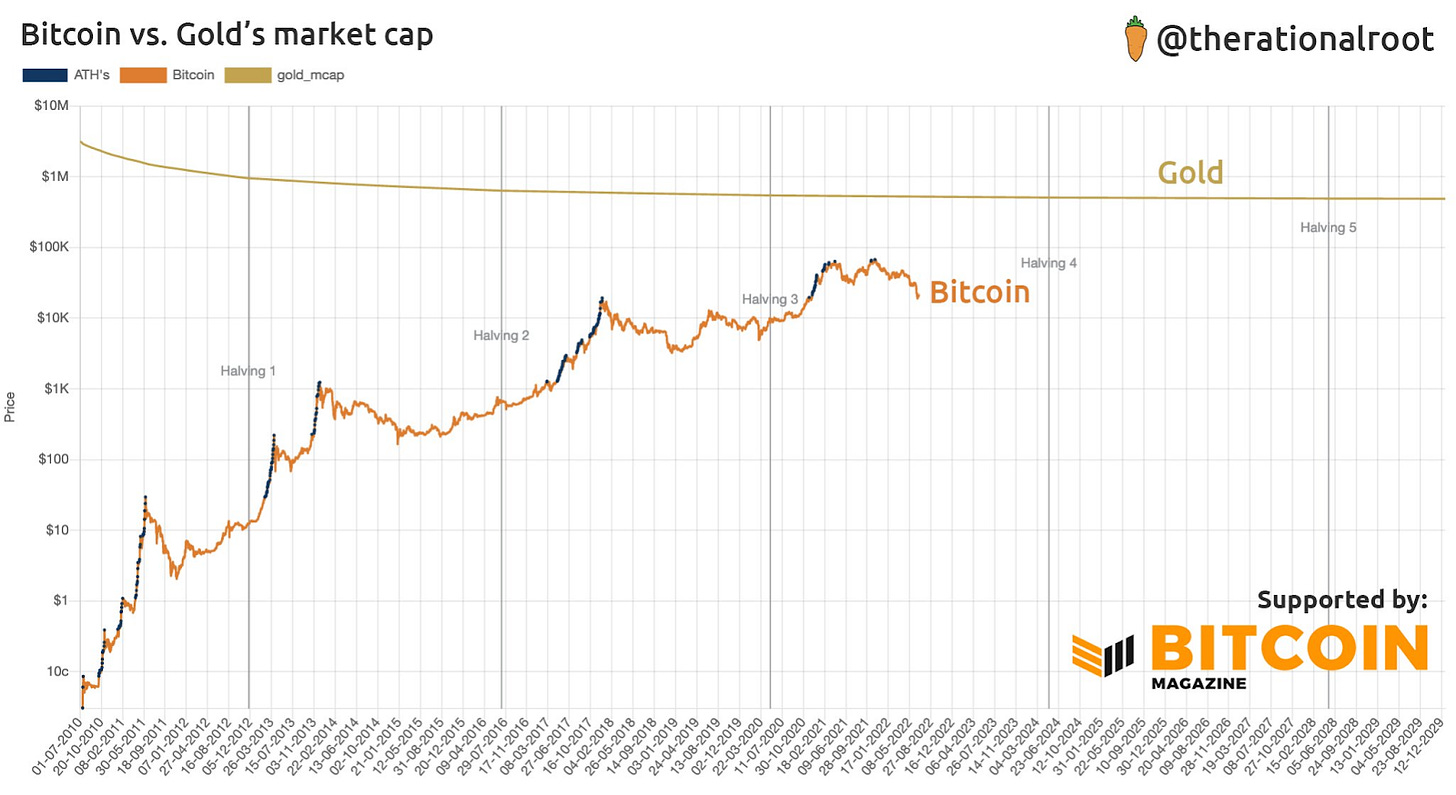

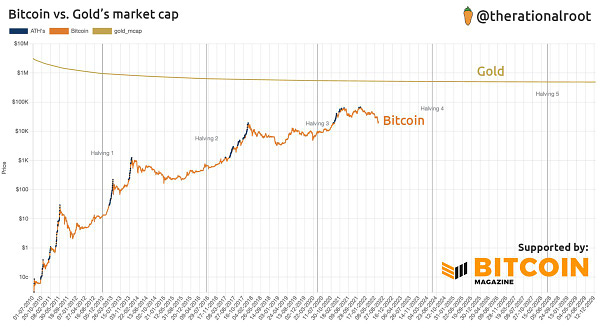

Bitcoin vs. Gold

A young Salvadoran entrepreneur about to get a Bitcoin boost from @stacyherbert - thanks to bitfinex (video)

What has changed? Nothing, Bitcoin is still the same!

Bitcoin fixes the government.

Addresses holding $1 million+ Bitcoin have fallen to 26,300, from an all-time high of 108,886 in November, 2021. Which means Bitcoin is getting more decentralized!

Whales are buying 140k Bitcoin each month directly from exchanges - Glassnode

Web5 vs. Web3

TL;DR: Bitcoin vs. Webshit (in way longer details)

Suggestions

Interesting articles to read

Newspeak In The 21st Century: How To Become A Model Citizen In The New Era Of Domestic Warfare

Sri Lanka Suspends Fuel Sales Amid Economic Collapse; Asks Russians For Help

Gas Prices Squeezing Americans As More Rate Biden's Economy "Poor"

EU Moves Closer to Strict Anti-Money Laundering Rules on Crypto

The Great Reset In Action: Ending Freedom Of The Press, Speech, & Expression

Iran, Argentina apply to join BRICS bloc after recent summit: Report

Sources:

https://www.thecoinrepublic.com/2022/06/28/100000-bitcoin-grants-to-salvadorian-entrepreneurs/

https://www.oregonblockchaingroup.com/uzbekistan-set-to-allow-bitcoin-mining-but-with-exceptions/

https://finbold.com/central-bank-of-morocco-to-introduce-bitcoin-and-crypto-regulation-bill/

https://cointelegraph.com/news/microstrategy-scoops-up-480-bitcoin-amid-market-slump

https://www.btctimes.com/news/luxury-watchmaker-breitling-accepts-bitcoin-for-purchases

https://bitcoinmagazine.com/markets/jacobi-asset-management-to-launch-spot-bitcoin-etf-europe