This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Iran cut’s off Bitcoin miners citing increased demand for electricity

Bitcoin proves again that has no correlation with anything else

Deloitte and NYDIG ramp up Institutional Bitcoin adoption

Newly elected Colombian President supports Bitcoin

Luxury watchmaker Hublot now accepts Bitcoin

Earn Bitcoin by listening to podcasts

University of Cincinnati to launch new curriculum about Bitcoin

A true Bitcoiner is building a Bitcoin mining museum

Iran cut’s off Bitcoin miners citing increased demand for electricity

A report by Bloomberg said that a spokesperson from the Iran power industry, Mostafa Rajabi, had confirmed that the country would shut down all licensed crypto miners on June 22, 2022. The country currently has so far licensed 118 mining operations.

This is not the first time that Iran is shutting down miners, citing increased demand for electricity. Last year’s ban was lifted in September. However, the country’s recent ban has not been categorized as temporary or permanent.

Mashhadi noted that power outages had been reported over the past few weeks. The demand for electricity in the country had surpassed 60,000 megawatts, and if the grid continued to supply energy to miners, the strain would affect the power supply at a crucial season.

At first this could be really bad news, but if you think over it this proves that as in other parts of the world (like Texas) the Bitcoin’s energy-grid balancing feature works well. It’s like a “battery” because if the need rises the mining can be temporarily fully or partially turned off. This is a great feature which will never be possible with the use of ever unreliable working renewable energy. Reaching this stability with real batteries is not an option due to their massive limitation of storing capacity and with the huge waste of creating them and preserving energy in them.

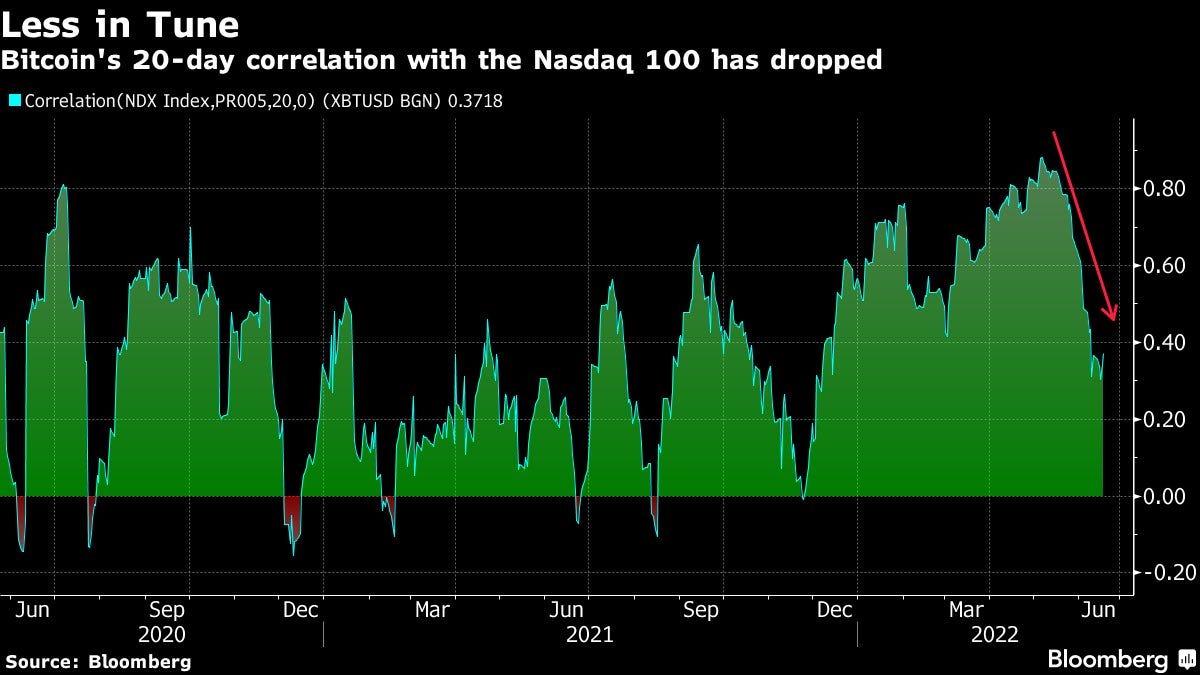

Bitcoin proves again that has no correlation with anything else

“Bitcoin’s tight relationship w/Tech stocks, fueled by declines in both amid Fed hikes & high inflation, drops amid crypto rout. Bitcoin“s 20d correlation w/Nasdaq 100 has fallen from ~0.88 in early May to the low-0.30’s now, BBG has calculated.” by Holger Zschaepitz

I hope with this the ever returning correlation nonsense will be stopped for good. Bitcoin is totally unique; it can't be measured to anything on Earth.

Deloitte and NYDIG ramp up Institutional Bitcoin adoption

Deloitte, a Big Four global professional services firm, and NYDIG, an institutional Bitcoin services provider, have announced that they will partner together to integrate Bitcoin into various sized companies.

“We envision a world where traditional financial infrastructure works alongside digital asset infrastructure to deliver clients a best-in-class experience with the highest standards of regulatory compliance.” by President of NYDIG Yan Zhao

Deloitte works with various clients and companies like Dell, Yamaha, Adobe, and other Fortune 500 companies. NYDIG recently partnered with payment processor Jack Henry in May and has many more partnerships planned for 2022.

Newly elected Colombian President supports Bitcoin

Gustavo Petro recently won the presidential elections in Columbia, and he is set to be sworn in as the country’s president in August. Petro could change the crypto atmosphere in Columbia, as he has previously supported Bitcoin.

Petro’s running mate, Francia Marquez, who will now be the vice president of Columbia, has not openly spoken about cryptocurrencies in the past. He has previously reacted to El Salvador’s plans to mine Bitcoin using volcano energy, saying that Columbia should also use the natural resources on its western coastline to mine cryptocurrencies.

Hopefully the new direction won’t be towards shitcoins, but only to Bitcoin adoption. They won’t have another such great possibility to raise Columbia out of poverty.

Luxury watchmaker Hublot now accepts Bitcoin

Swiss-based luxury watchmaker Hublot is now accepting bitcoin as payment, beginning with a limited-edition release of the Big Bang Unico collection of 200 pieces, per an announcement from the company.

While the release begins with this limited-edition collection, the addition of bitcoin to the platform will not be going away for the United States eBoutique. The company partnered with BitPay to bring the functionality to this limited release, but its partnership will continue.

As you see it’s another “Bitcoin to FIAT” partnership. I mean they will not hodl Bitcoin just instantly convert them to FIAT. As all the others, they will regret this move too.

Earn Bitcoin by listening to podcasts

Podcast streaming app Fountain on June 23 announced a new feature that allows listeners to earn bitcoin while they listen to their favorite podcasts.

“The time and attention we give to tech platforms is incredibly valuable. Every minute that you spend consuming content, creating content, or viewing ads, increases the value of the platform you’re using,” Fountain said in a blog post.

“Most free apps we use every day don’t recognise or reward this - but Fountain is different. It’s the only podcast app that rewards both listeners and podcasters for the value that they bring to the platform,” it said.

Great idea to receive some sats while you’re listening to your favorite podcasts.

University of Cincinnati to launch new curriculum about Bitcoin

UC is working on two new programs that will educate students about Bitcoin (BTC) and emerging financial technologies, according to a Wednesday UC News story.

"Our students will learn how to manage cryptocurrencies and how such digital assets impact our economy, positioning UC as the regional leader and among the top universities nationally with this kind of program.” by Dean Marianne Lewis, Ph.D.

The only problem is that it’s not a “Bitcoin only” curriculum, but with shitcoins too.

P.s. Just this week alone in El Salvador 38 high school students received their Bitcoin diplomas. No shitcoins, just Bitcoin! Congratulations!

A true Bitcoiner is building a Bitcoin mining museum

TheCoinDad (@TheCoinDad) already has the largest collection of Bitcoin Miners in the World with over 75 diff models dating back from 2013 to now that vary from common to rare to very rare.

“To make this Worlds 1st ASIC Miner Museum a success I need a sponsor. I already have thousands $ invested and @MiningDisrupt leaders are also investing a lot by building me an awesome 1,500sqft display area for this high profile project. I will have 24hr security and cameras and will also have a very seasoned OG Miner on my team from 2011 that will be on site answering questions. This will surely spark conversations for OG miners as they reminisce and more importantly schooling newbie miners as they learn the evolution of SHA256 hash.”

I really love the idea of making a Bitcoin mining museum. It is really interesting to see how these machines (CPU, GPU, ASIC miners) evolved and it’s fascinating to understand the idea and the mechanics behind all of them.

If you want to check the pictures and the details here you can. Maybe some of my readers can help him to contribute to the World 1st ASIC Miner Museum.

Global Economic News

TL;DR

The German inflation is getting unstoppable

This global selloff just the beginning?

The U.S. consumers are losing wealth rapidly

The visible cracks in the banking sector

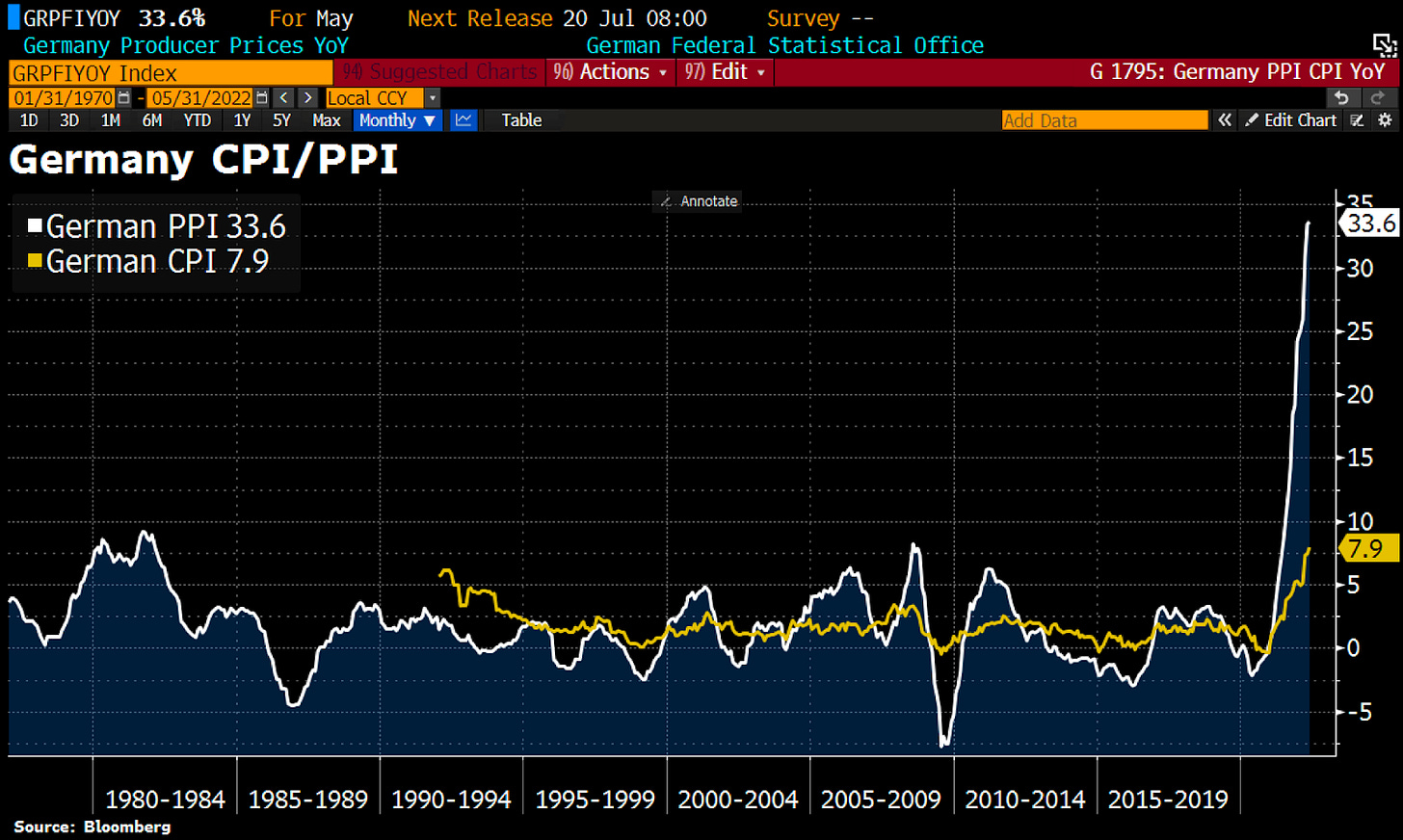

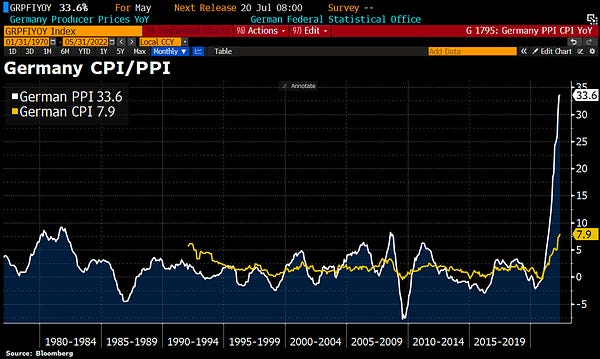

The German inflation is getting unstoppable

“German PPI jumped by 33.6% in May YoY, the highest increase ever since the start of the statistic in 1949. Electricity prices rose by 90.4% YoY. Especially high were the price increases of fertilizers & nitrogen compounds (+110.9 %).

German Producer Price Inflation (PPI) rose by 33.6% in May, more than ever before.” by Holger Zschaepitz

Meanwhile the wages are getting into a price spiral:

“Biggest union IG Metall pushes for 7%-8% raise in wage talks, highest demand in 13yrs for metal & electronics sector. Historically IG Metall achieved 60% of their claims, means would result in outcome of 4.5 %” by Holger Zschaepitz

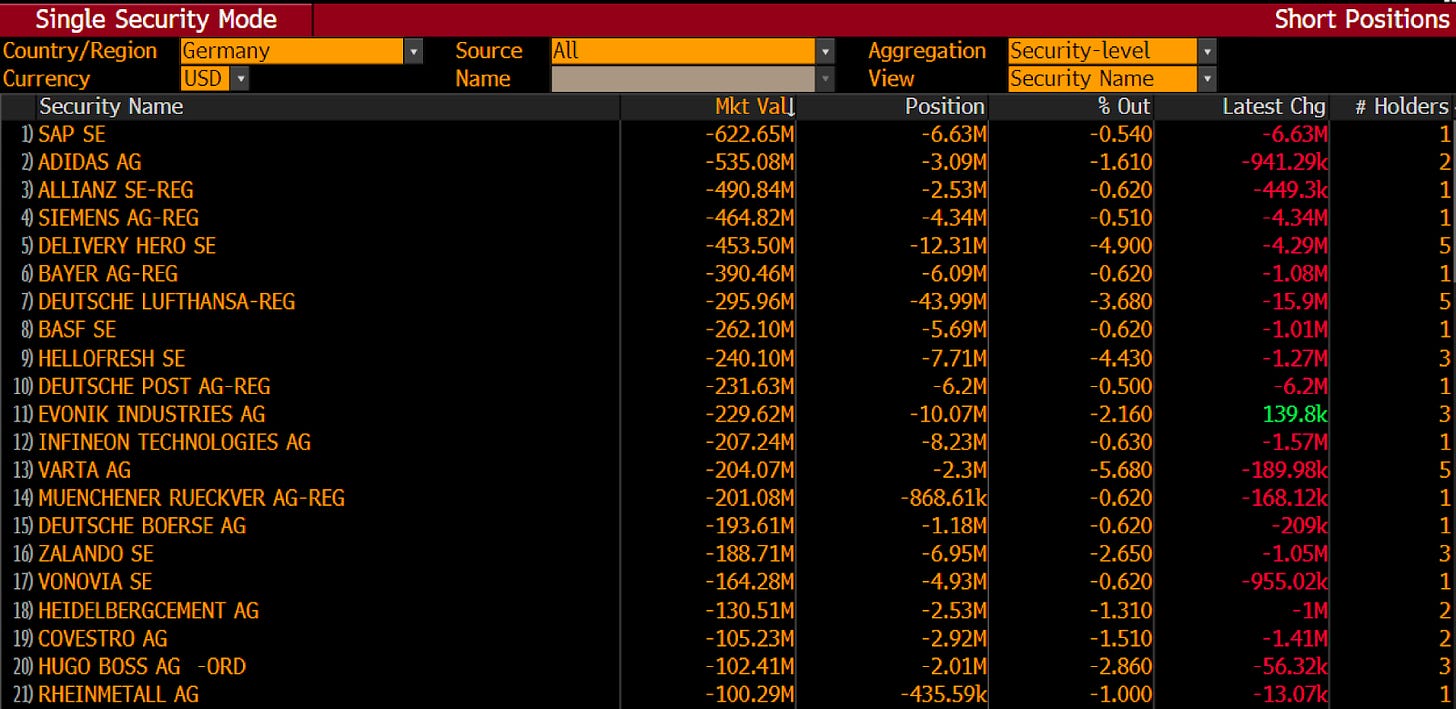

The big hedge funds already begun to short the market:

“Bridgewater doubles bet against European Stocks to $10.5bn. Short of Bayer has grown to 0.62% of Bayer stock, up from 0.51%. A rough estimate based on current mkt cap would value short position at €380mln. Similar increases were seen in its shorts of Allianz, Santander and BASF.” by Holger Zschaepitz

The ever rising wages, causes ever rising prices which leads to ever rising inflation. That’s why the cantillon effect hits so hard because at the beginning money printing is not perceptible, just after a certain amount of time (~18 mths), but then the tide can’t be stopped. Another proof why German inflation is getting unstoppable. Sharks already smell the blood, so they are shorting the key areas of the German economy.

There is hope that while Germany is falling into a deep recession, the unbelievable stupid idea to ban in the EU the making of new fossil-fuel cars from 2035 won’t happen.

Germany’s biggest problem is that they’re right now stepping back in the stone age. Without reliable energy, their economy will stand still and they will freeze in the winter. To see how big the problem is, read this great article.

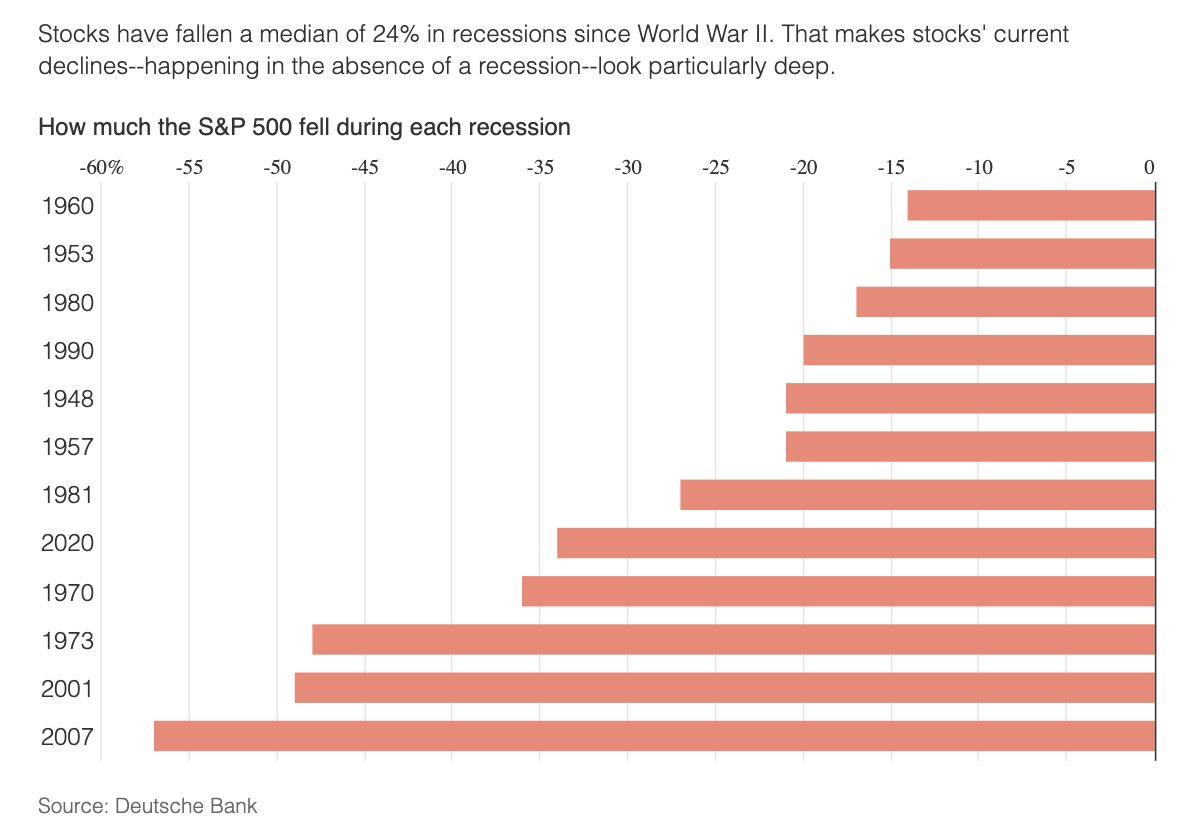

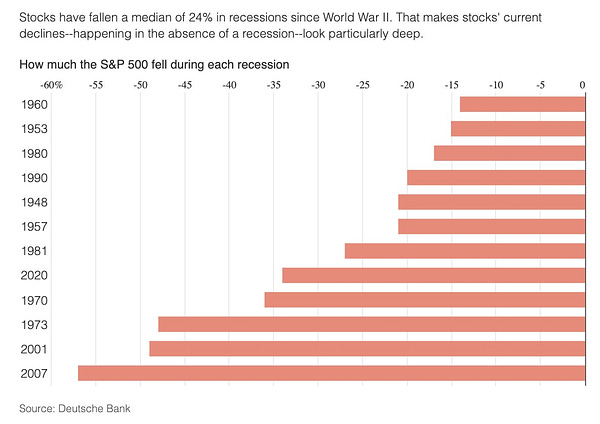

This global selloff just the beginning?

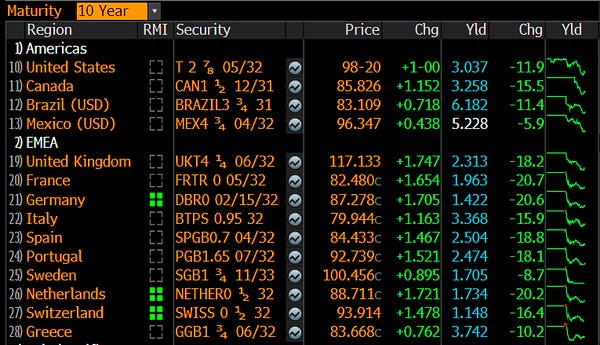

Based on WSJ, “If history is any guide, the selloff might still be in its early stages. Stocks historically don’t bottom out until the Fed eases. The S&P 500 has dropped a median of 24% during recessions going back to 1946.“ by Holger Zschaepitz

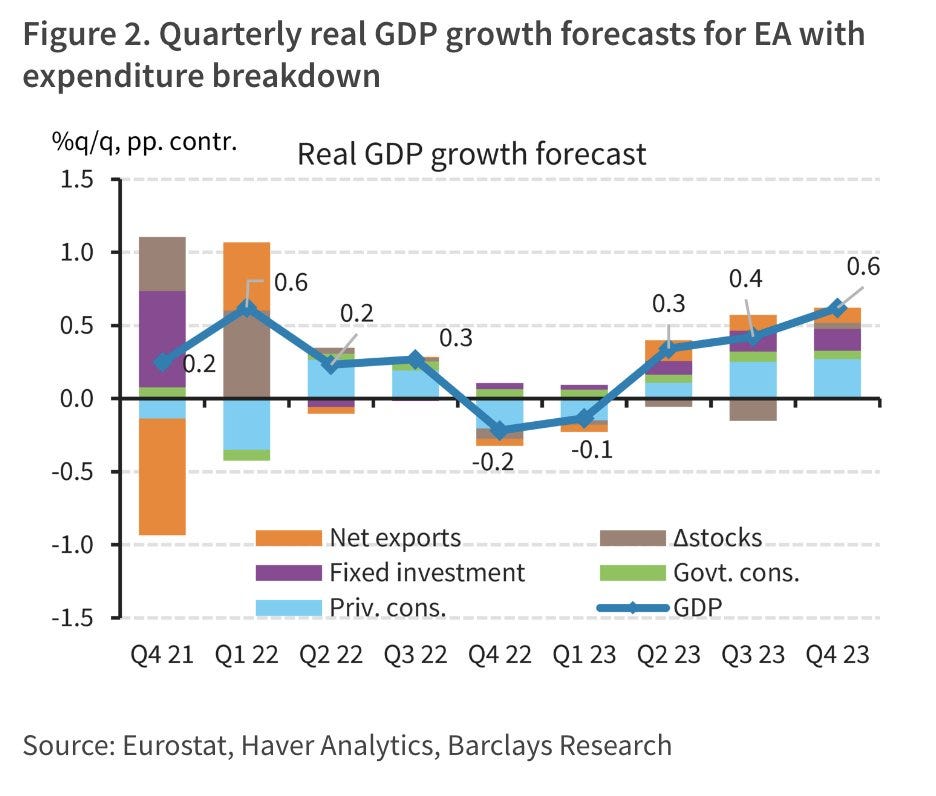

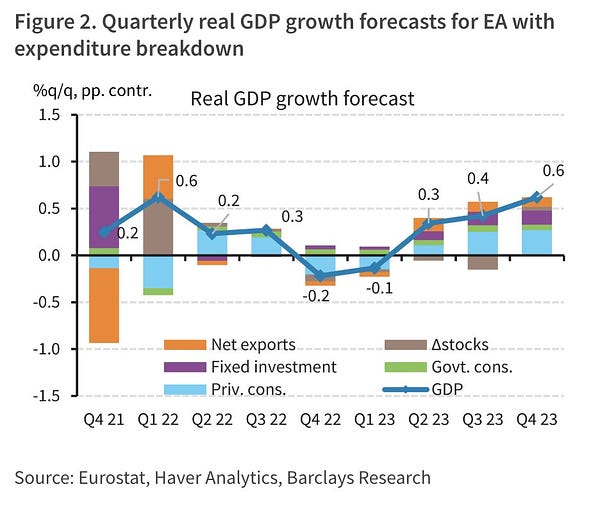

“Barclays expects recession in Eurozone as straighter monetary policy & reduced fiscal space in high-debt countries increase risk of 'doom loop' as in summer of 2011: house prices could fall in countries w/overheated mkts, acc to Barclays. Fin stability risks are also a concern.” by Holger Zschaepitz

Meanwhile the UK Inflation reaches 9.1%, the highest it’s seen in 40 years.

Global inflation rates:

🇨🇦 - 7.7%; 🇺🇸 - 8.6%; 🇧🇷 - 11.7%; 🇦🇷 - 60.7%; 🇻🇪 - 167.2%

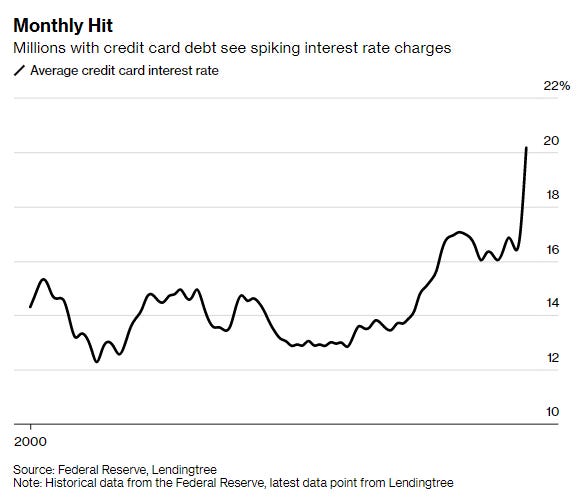

The U.S. consumers are losing wealth rapidly

“Consumer getting hit from all angles:

- Inflation highest since 1980s.

- Mortgage payment to income ratios above 2006 high of 34.1%.

- Stock bond portfolio carnage = 52% of GDP.

- Now blow out in credit card rates as balances grow.” by @TeddyVallee

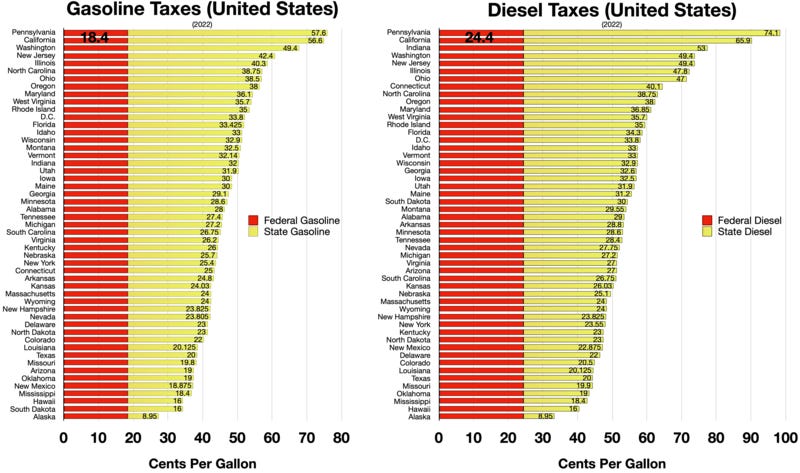

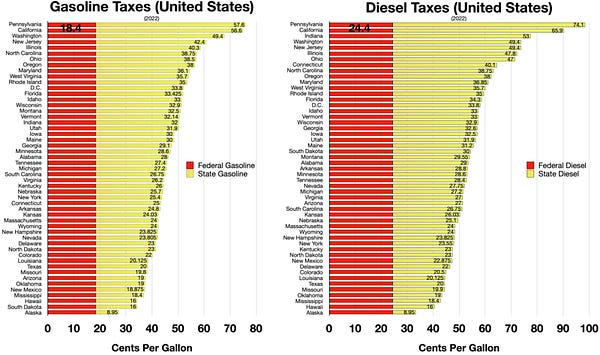

Gas taxes:

“2 years ago, the 30-yr mortgage rate was 3.13% & the median existing home price in the US was $283k.

Today the 30-yr mortgage rate is 5.78% & the median existing home price is $408k.

With a 20% down payment, that's a 96% increase in the monthly payment (from $972 to $1,909).” by @charliebilello

Sadly the consequences of ever rising prices of everyday life will be really harsh for the lowest income households because “3.5 million households were somewhat likely to leave their rented spaces (homes/apartments) within the next two months because of an eviction.“ as the Zerohedge article says.

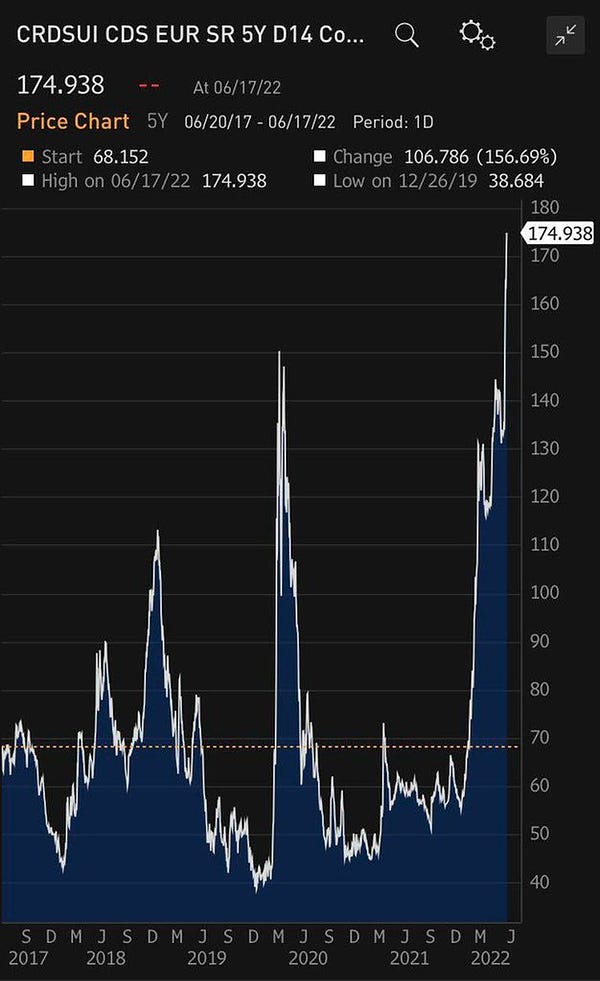

The visible cracks in the banking sector

“Germany, where banks get hammered due to rampant recession fears & lower yields. German 10y yields have dropped to 1.42% from 1.9% within 5d. Deutsche Bank shares have now lost 40% from recent high. German Banks Index trading at levels similar to those of 1980s” by Holger Zschaepitz

“Credit default swaps on Credit Suisse to the moon? The number of ppl making bets that Credit Suisse will go under is increasing” by @WallStreetSilv

This is an unbelievably interesting thread and if it’s true Credit Suisse is making really shitty investments and involved in massive international fraud scandals too. The biggest “can’t believe” investment they made is: Silver. The biggest lie among Keynesians is that silver is “undervalued”. They still don’t understand the stock-to-flow ratio and why silver will never gain the same price (adjusted by inflation) as it was in the good-old-years.

That’s why the Credit Default Swaps are so high because literally they are burning investors and depositors capital.

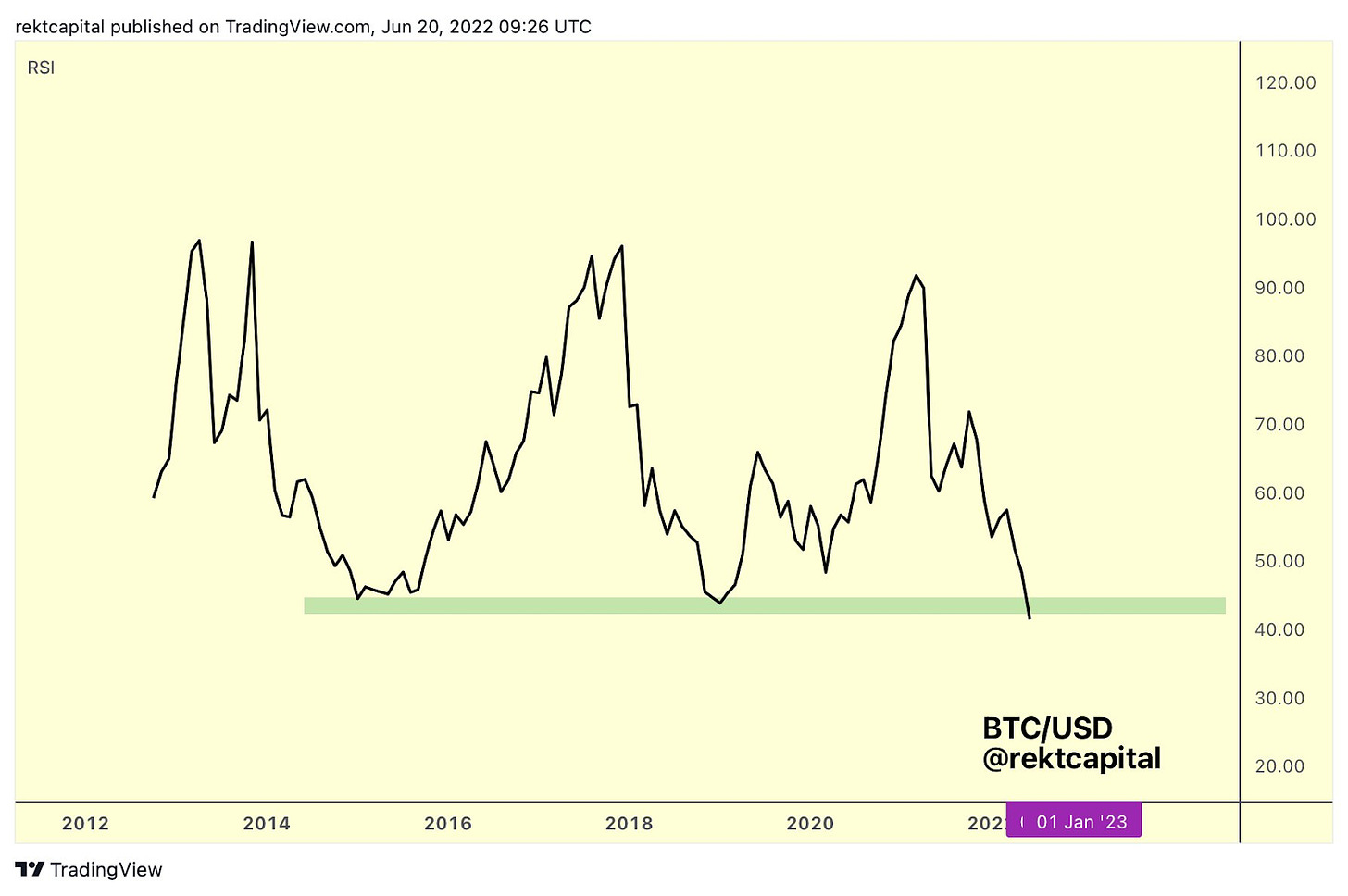

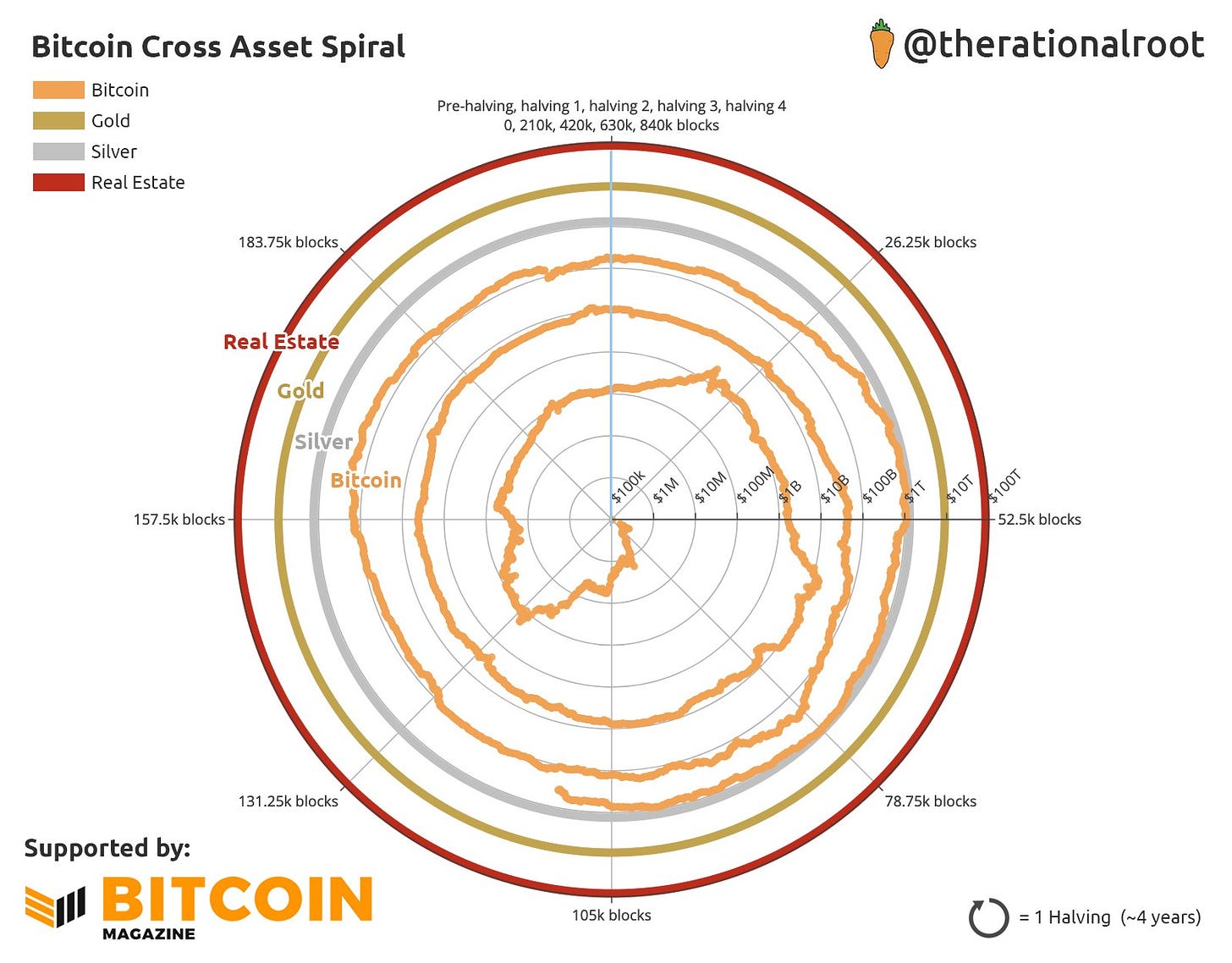

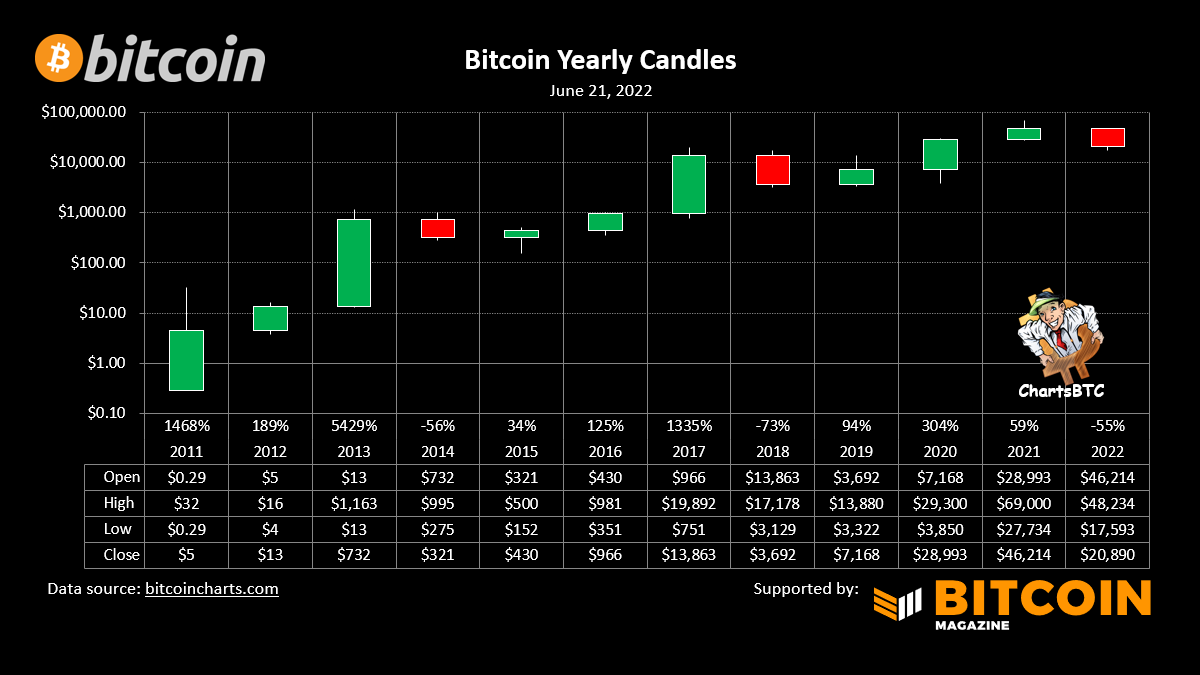

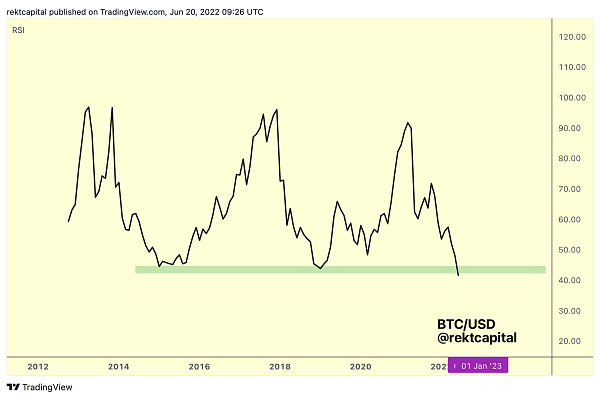

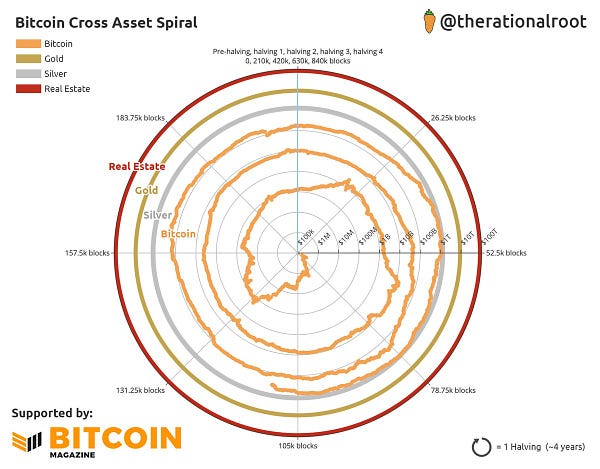

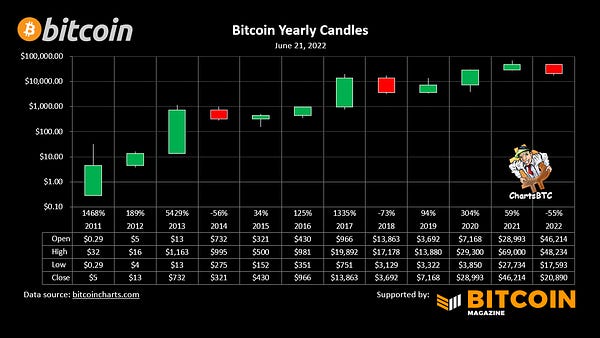

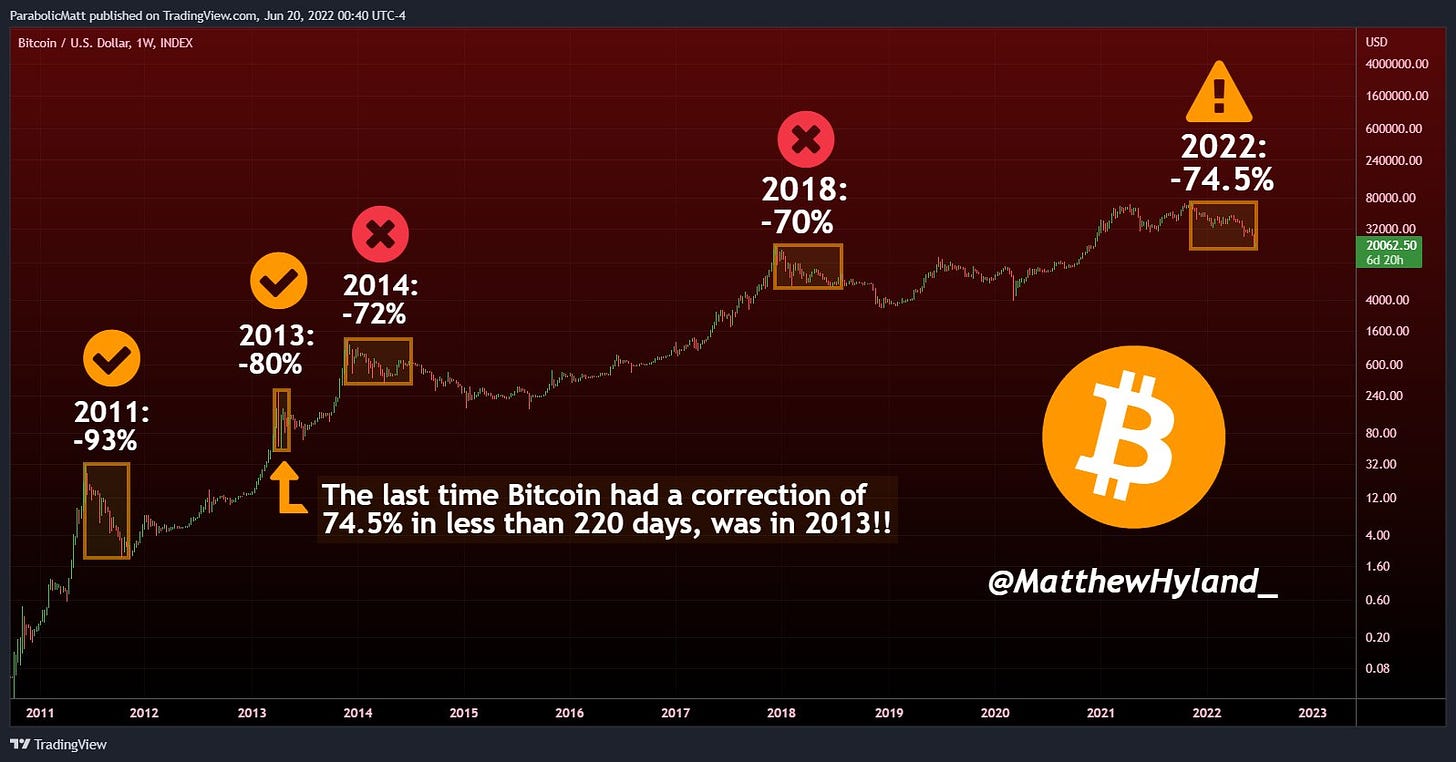

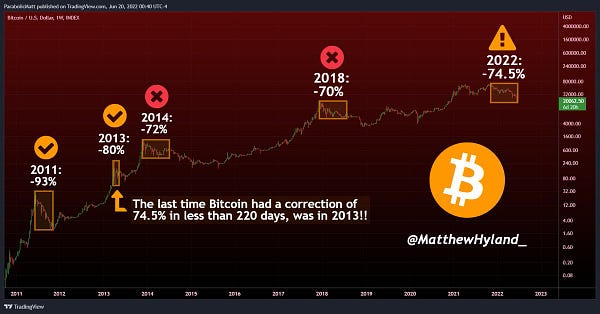

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

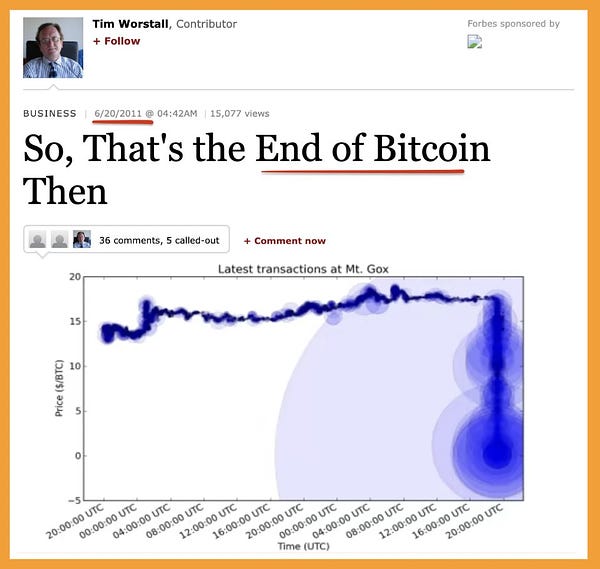

Funny Bitcoin short stories

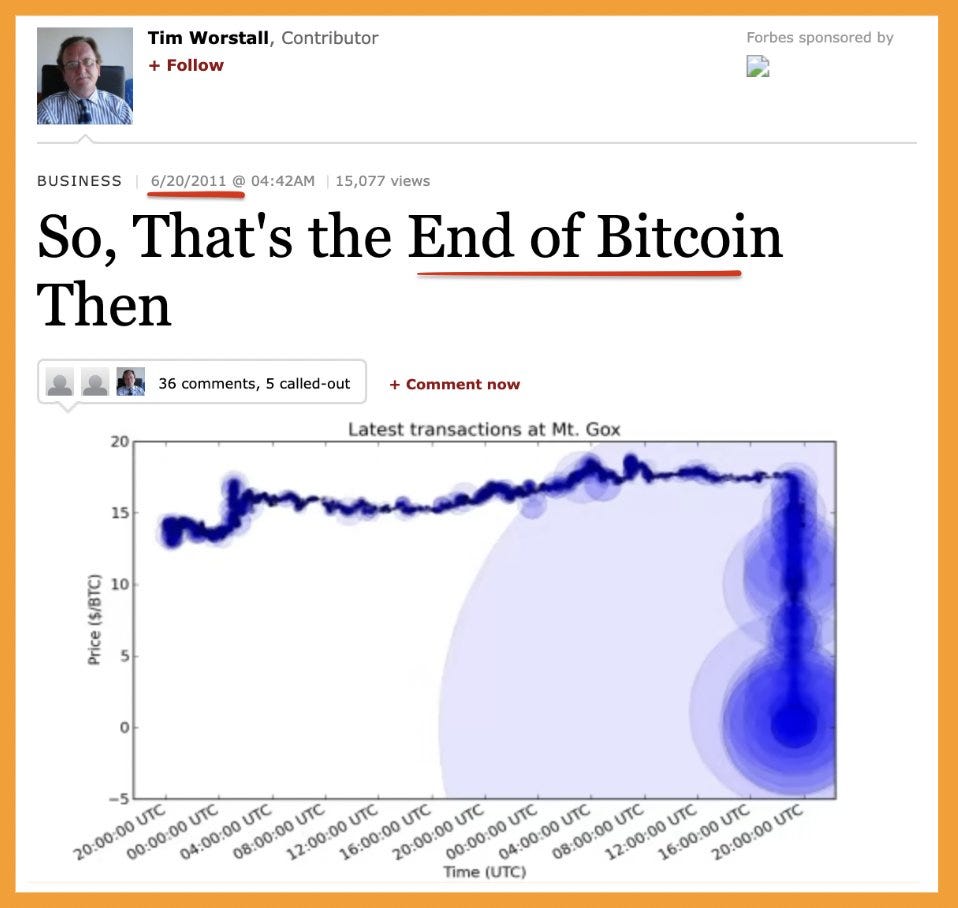

“Wrong at $1, wrong today” by @pete_rizzo_

FUN FACT: 11 years ago on June 21st 2011 Bitcoin was $0.01

South Korea delays its 20% tax on Bitcoin gains until 2025

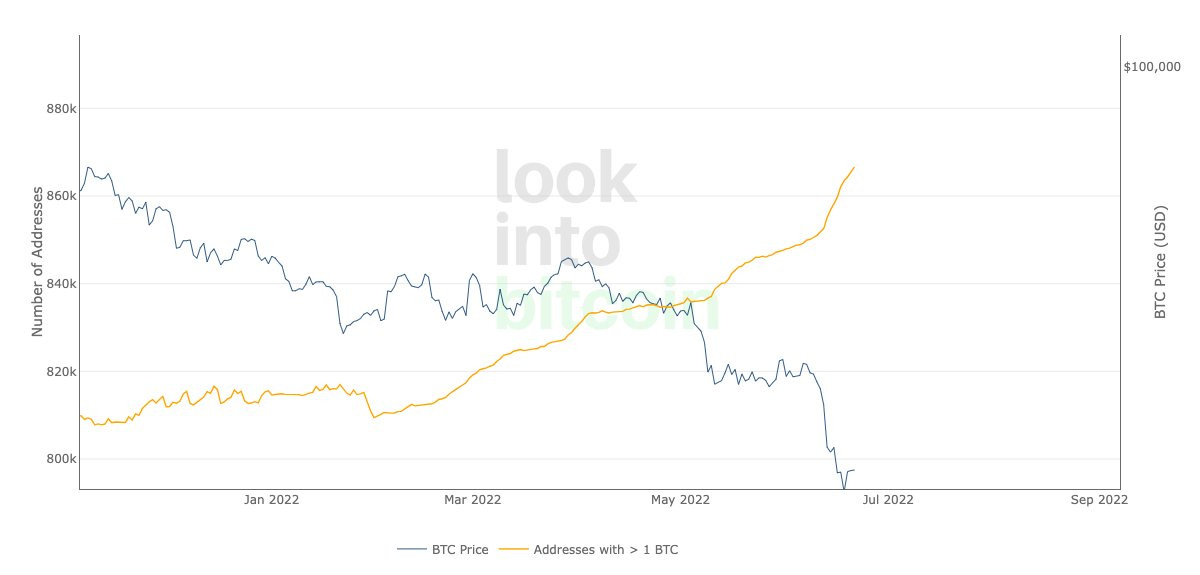

Over 13,000 wallets reached 1 Bitcoin in the past week

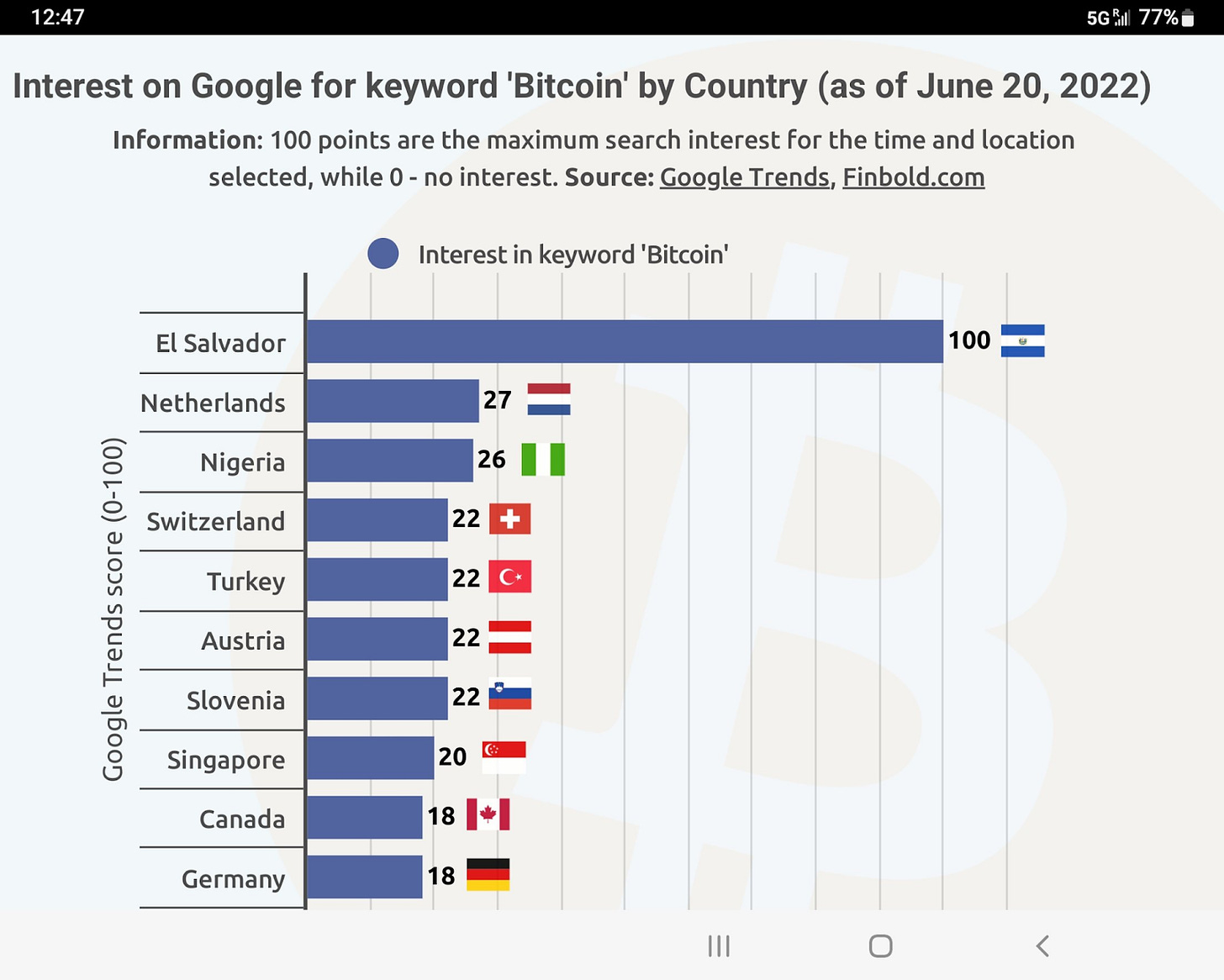

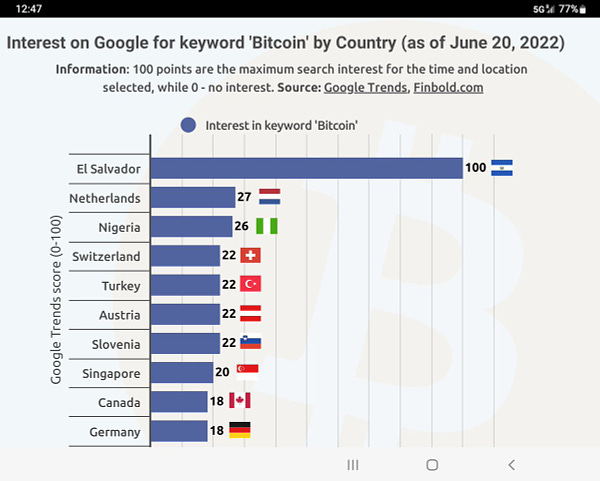

“Bitcoin is not about the US. Bitcoin is not a US investment. Bitcoin is the first truly global global macro investment. It cannot die because it will never die in all places all at once. As long as it always can live somewhere it can always live.” by @DTAPCAP

“82,187 ($1,600,000,000) BTC has been taken off exchanges in the last 30 days.” by @WatcherGuru

“The Governor of Louisiana just signed a bill that allows financial institutions in Louisiana to custody Bitcoin and digital assets for customers.” by @Dennis_Porter_

Don’t forget: Not your keys, not your coins!

Michael Saylor: “Bitcoin is a life boat offering hope to billions during the worst financial crisis of our lifetime.”

Number of addresses holding at least 0.01 bitcoin just reached a new ATH of over 10 MILLION

Former Thai Prime Minister spotted on TV with Bitcoin block clock in the background

UK: New platform for real estate transactions in Bitcoin is in development.

59 Bitcoin ATMs to be installed by Cardena Markets - one of the largest Hispanic grocery chains in the USA.

“Another 18,633 addresses holding a balance of at least 1 bitcoin have been added since the start of the month. Congrats to those who took this opportunity to finally get 1 whole BTC!” by @TheCryptoLark

Pro-Bitcoin U.S. Congressman: “Inflation is a "hidden tax" on the people.”

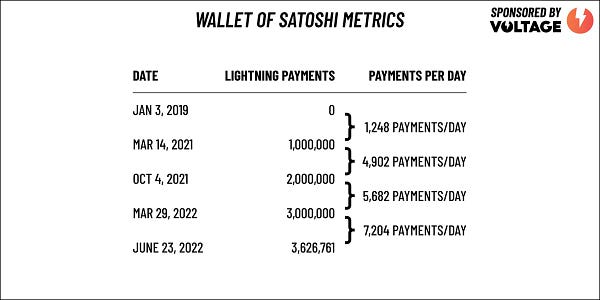

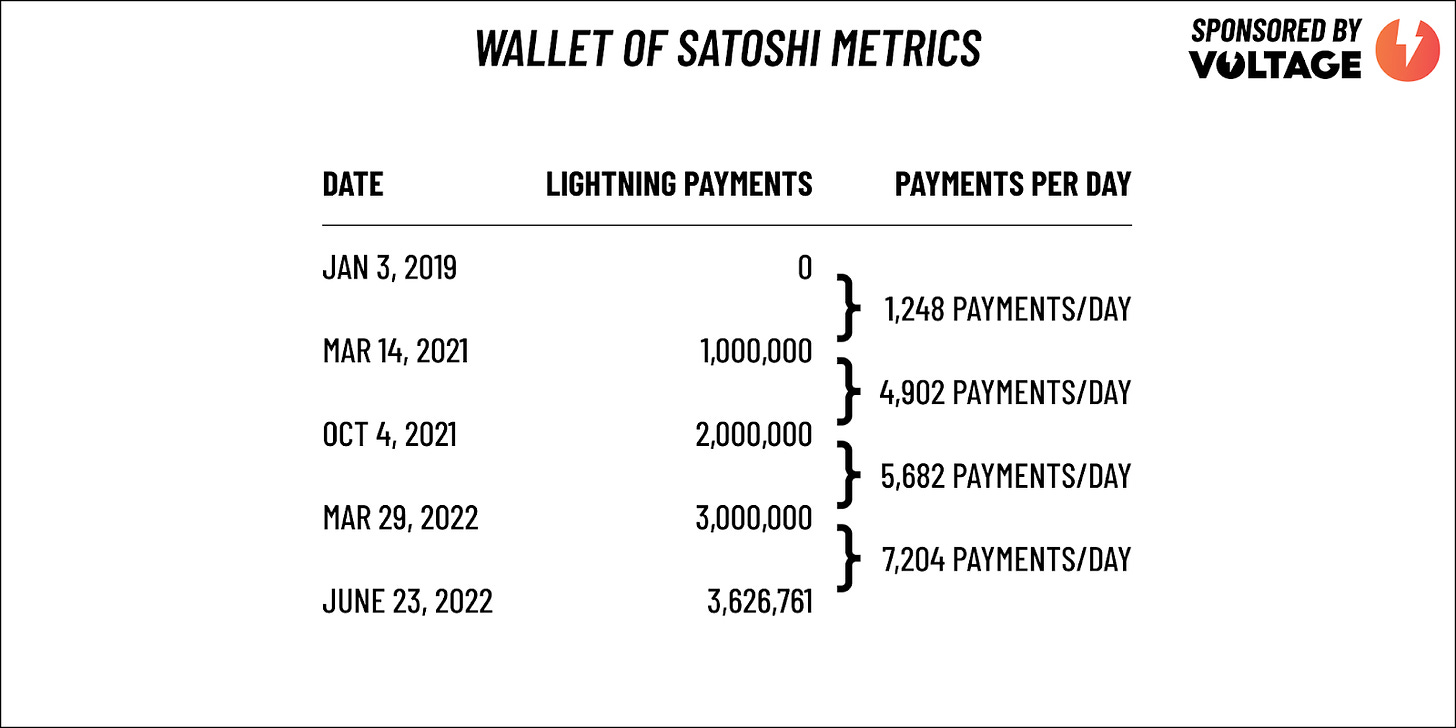

“The first million is always the hardest. It took 26+ months for @walletofsatoshi to do 1 million Lightning payments, but each million after that has happened faster than ever. Don't sleep on Lightning.” by @kerooke

Suggestions

Interesting articles to read

Escobar: St. Petersburg Sets The Stage For The War Of Economic Corridors

PUTIN’S SPEECH. IS THIS A DECLARATION OF INDEPENDENCE AND ARE WE KING GEORGE?

Pozsar Was Right Again: Shipping Costs Soar 82,000% Amid Global Supply Chain Chaos After Ukraine

Escobar: Exile On Main Street - The Sound Of The Unipolar World Fading Away

Sources:

https://insidebitcoins.com/news/iran-to-shut-down-bitcoin-miners-as-electricity-demand-spikes

https://www.btctimes.com/news/deloitte-and-nydig-ramp-up-institutional-bitcoin-adoption

https://bitcoinmagazine.com/business/hublot-now-accepts-bitcoin