This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Bitcoin exchanges now have 1,387 BTC on Lightning Network

Bitcoin still beats all pretenders for long-term saving

Brazil introduced a bill for Bitcoin to be recognized as means of payment

EU Finance Commissioner asks lawmakers to speed up Bitcoin law

Spanish airline Vueling accepts Bitcoin as payment

The IRS has launched an operation targeting taxpayers who attempt to hide their crypto income

Bitcoin: Cryptopayments Energy Efficiency (study)

Russian Oil company Gazpromneft partners with BitRiver to mine Bitcoin

Russia’s central bank recently said that using Bitcoin for international settlement is a “possibility”

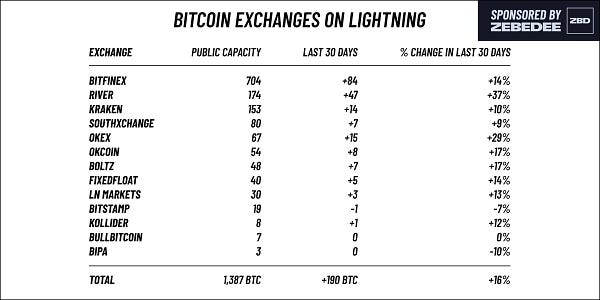

Bitcoin exchanges now have 1,387 BTC on Lightning Network

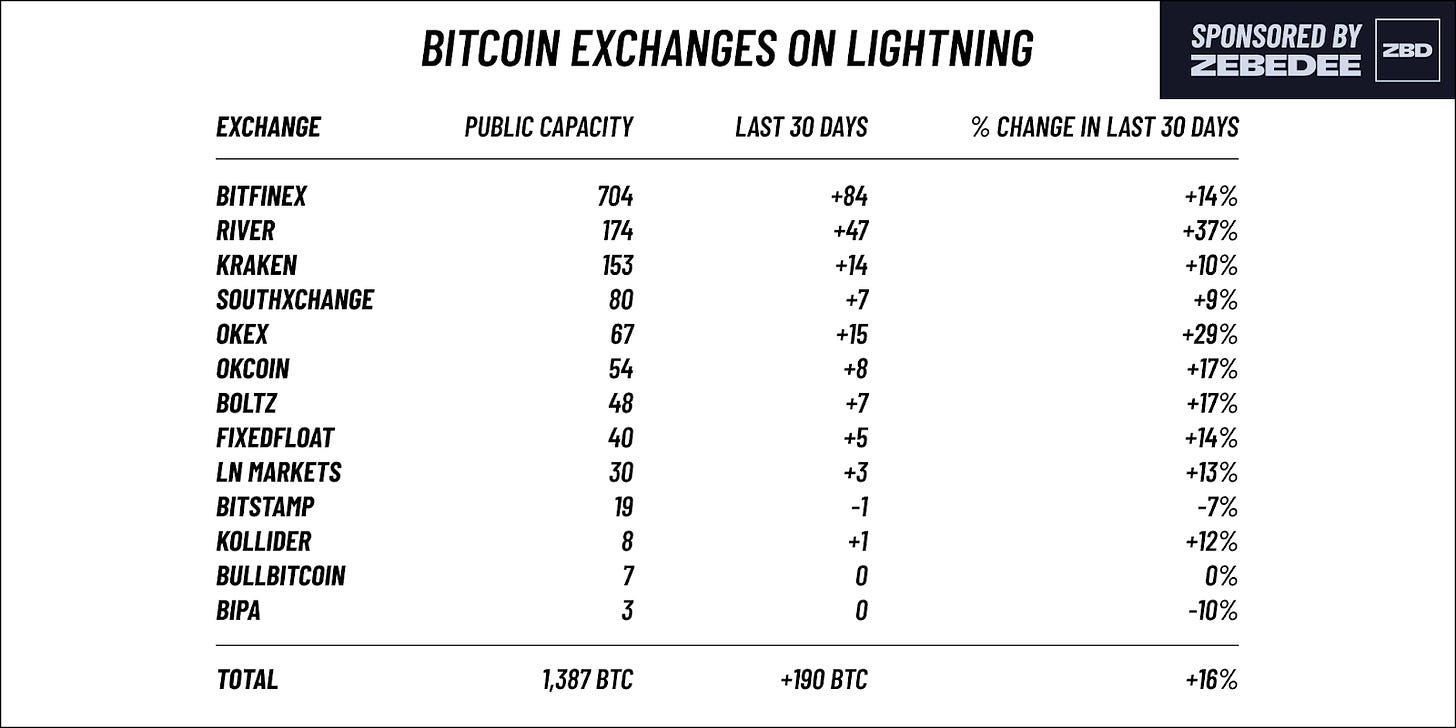

“Kraken's Lightning node has earned 5,365,400 sats from routing 19,483 forwards over the past 3 months.” by @pierre_rochard

“Bitcoin exchanges now have 1,387 BTC of public capacity on Lightning, up 16% in the last 30 days. Combined, these exchanges now represent 35% of the public capacity on Lightning.” by @kerooke

This is a huge step in Bitcoin's life cycle because (1) these companies already prepare for a high-fee environment where the average person will only transact on the Lightning Network (2nd layer); (2) with the possibility of private channels they can instantly move huge funds between each other (less price difference between exchanges); (3) it's a great real time presentation that Bitcoin can be lightning fast and even more scalable with the help of 2nd layer; (4) Lightning Network economic incentives works even when on-chain fees are low, which means huge network growth possibilities ahead.

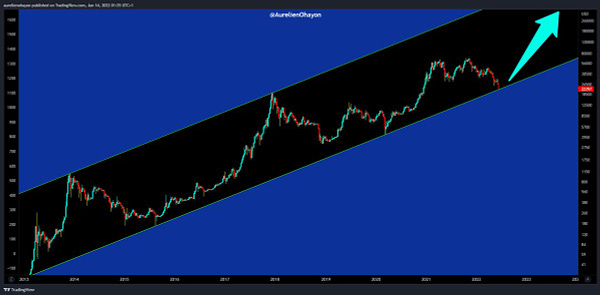

Bitcoin still beats all pretenders for long-term saving

“Even after this huge crash, bitcoin still beats all pretenders for long-term saving. If you spent the last 5 years saving $100 a month, here's what you would have today if you put it in:

Bitcoin: $29,212

S&P500: $7,743

Dow Jones: $7,654

Gold: $7,089

PIMCO Active Bond ETF: $5,387” thread by Saifedean Ammous

Brazil introduced a bill for Bitcoin to be recognized as means of payment

The proposed law won’t necessarily make Bitcoin legal tender in the country, but it’ll at least be a legally recognized financial asset for investments and other uses.

A proposed addition to an existing Brazilian law would grant Brazilians the right to use cryptocurrency as a means of payment while protecting their private keys from being taken by the courts.

The proposed additions are still in the initial phase of discussion in the Chamber of Deputies within the country’s legislature. This means that it could take several years before the additions are passed by the Senate and signed into law by the president. By that time, they may have changed drastically.

EU Finance Commissioner asks lawmakers to speed up Bitcoin law

European Commissioner for Financial Services Mairead McGuinness encouraged the European Union's lawmakers to find a political compromise and speed up passage of its crypto-asset regulatory framework, currently in the last leg of the bloc's legislative process.

"Of course, sanctions implementation could be facilitated if our framework on crypto was in place, and if all crypto-asset service providers were regulated entities and subject to effective supervision in the European Union," McGuinness said.

“What I want and what I can tell you that MiCA rules will be the right tool to address the concerns on consumer protection, market integrity and financial stability. This is something that is so urgent given recent developments,” McGuinness said.

I think none of these sounds good from an EU politician's mouth. Of course I think shitcoins should be wiped from the Earth because they do more harm than (any?) good, but just let Bitcoin thrive and it will make the whole EU flourish!

Spanish airline Vueling accepts Bitcoin as payment

Vueling, a Spanish airline belonging to the International Consolidated Airlines Group (IAG), has partnered with one of the largest bitcoin payment infrastructure providers, BitPay, to accept bitcoin as payment in early 2023, per a press release.

"With this agreement, Vueling once again reaffirms its position as a digital airline,” said Jesús Monzó, manager of distribution strategy and alliances at Vueling, per the release. “We are very pleased to have found in BitPay the best partner to offer our customers the possibility of making transactions with cryptocurrencies with the greatest security and reliability".

I will explain this news to you: As soon as we get your Bitcoin we instantly convert it via BitPay to a FIAT shitcoin.

The IRS has launched an operation targeting taxpayers who attempt to hide their crypto income

The details of the report by the Internal Revenue Service (IRS) were reported in a press release by the Tax Law Offices of David W. Klasing on June 16.

The press release states that one of the common ways that investors adopt to evade tax is by doing recurring transactions of less than $10,000. Some other investors utilize shell corporations that assist in hiding the identity of the owner of the company. This enables the investor to carry out multiple activities by undisclosing the identity and party.

“Whether the unreported income was intentional, or a mistake is difficult to prove and the larger the amount of unreported income the less likely the IRS will be to believe your noncompliance was non willful or unintentional.”

As soon as the economy gets worse these kinds of news will just be even more harsher. Because history repeats itself, like with the EO 6102 (Gold confiscation), it is a possibility that it will happen with Bitcoin too. That’s why it is important to educate yourself on how to buy and store Bitcoin in a safe manner.

Bitcoin: Cryptopayments Energy Efficiency (study)

In the recent Bitcoin efficiency study, the result was:

"... We demonstrate Bitcoin consumes 56X less energy than the classical system. When Lightning is compared to Instant Payments, Bitcoin gains exponentially in scalability & efficiency, proving to be up to a million times more energy efficient per transaction."

Russian Oil company Gazpromneft partners with BitRiver to mine Bitcoin

The third largest oil producer in Russia, Gazpromneft, is partnering with Swiss-based bitcoin mining firm BitRiver to build out mining operations located at oil fields according to a memorandum from the St. Petersburg International Economic Forum.

BitRiver will assist Gazpromneft in developing datacenters where the oil producer will receive energy from the remote mining company at either new oil fields where infrastructure is not currently established, or remote sites with expensive transportation costs.

"Over the next two years, BitRiver intends to implement projects to create its own data centers for power-intensive computing with power scaling up to 2 [gigawatts], including [petroleum gas], which will additionally provide high and stable power consumption," Igor Runets, founder and CEO of BitRiver, reportedly stated in the memorandum.

Russia’s central bank recently said that using Bitcoin for international settlement is a “possibility”

Elvira Nabiullina, head of the Central Bank of the Russian Federation, recently attended the St. Petersburg Economic Forum (SPIEF) where she commented on Russia’s use of bitcoin and other shitcoins for international trade, per a report from state-media outlet Kommersant.

"Our position is that cryptocurrency should not be used as a means of calculation within the country... As for use in international settlements, if it does not penetrate the Russian financial system, it is possible," Nabiullina told reporters during the event.

Let’s translate her words: while Russia is not allowing Bitcoin to be used in domestic trades, they are open to its usage in International trades. Which means the government doesn’t want their citizens to save in the long term best medium of exchange, but of course the government can buy, mine and trade with Bitcoin. The government (Gazpromneft has strong ties to the country leaders) is now interested in Bitcoin mining, but it needs way more time to make Bitcoin a legal tender in Russia. Because Rubel is now the strongest FIAT shitcoin.

Global Economic News

TL;DR

The U.S. FED has raised interest rates by 0.75% and markets are hit

ECB would limit Digital Euro to maximum 1.5T

Russian bank Sber to complete its first digital currency deal

Japan Yen is tumbling

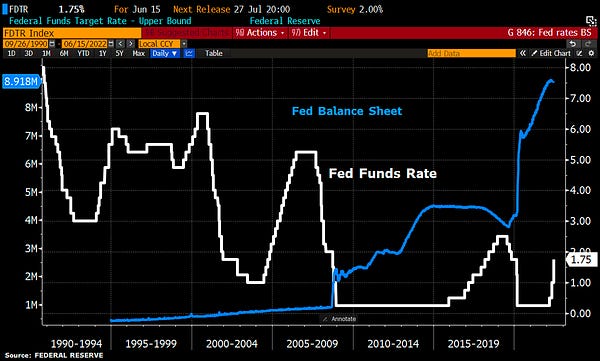

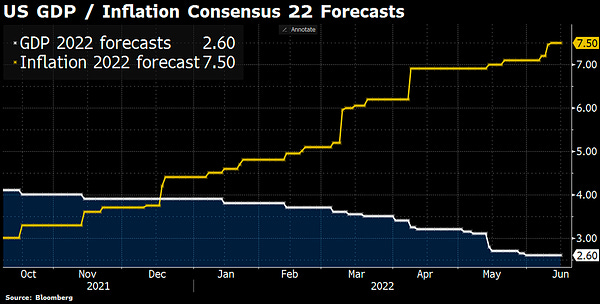

The U.S. FED has raised interest rates by 0.75% and markets are hit

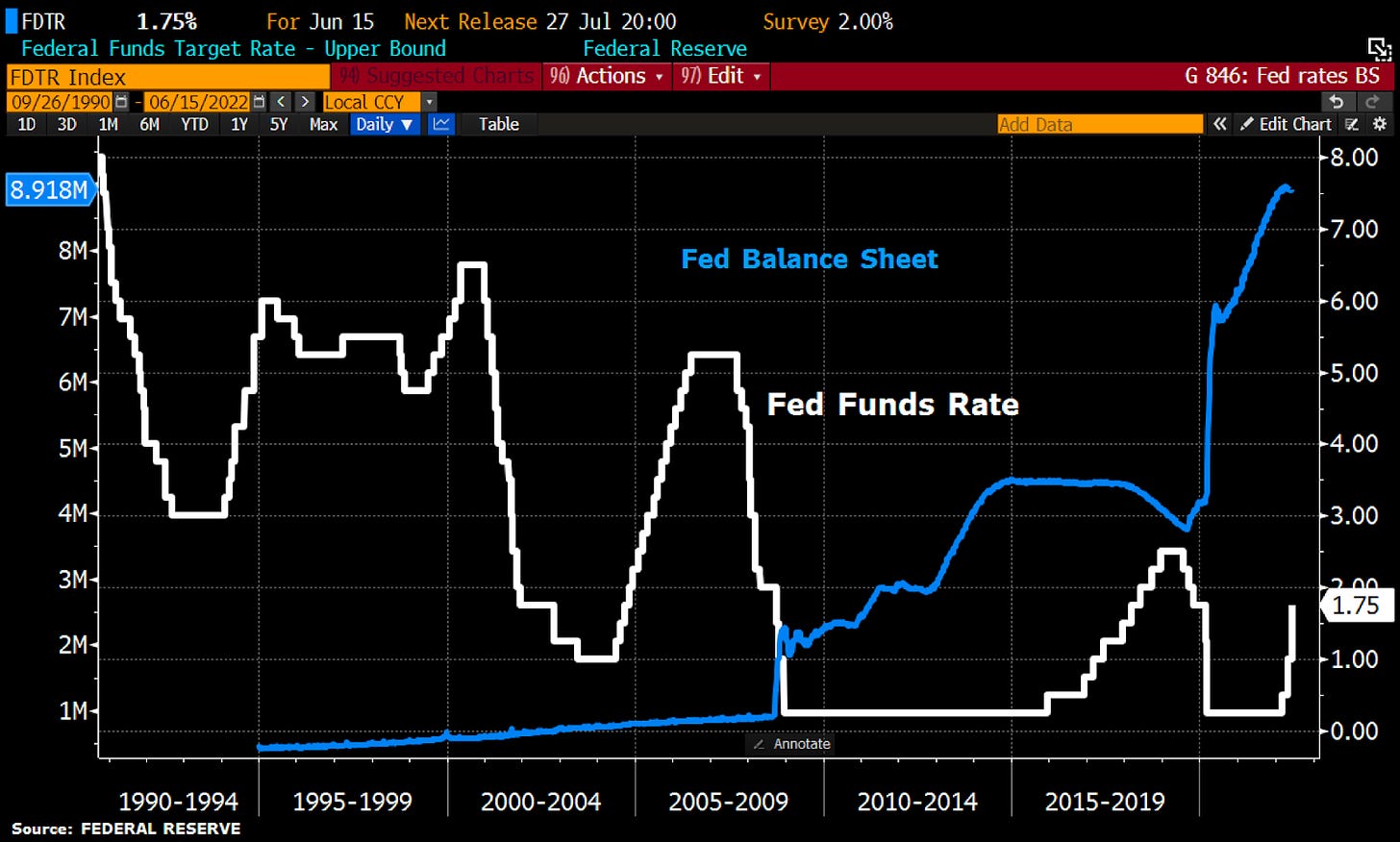

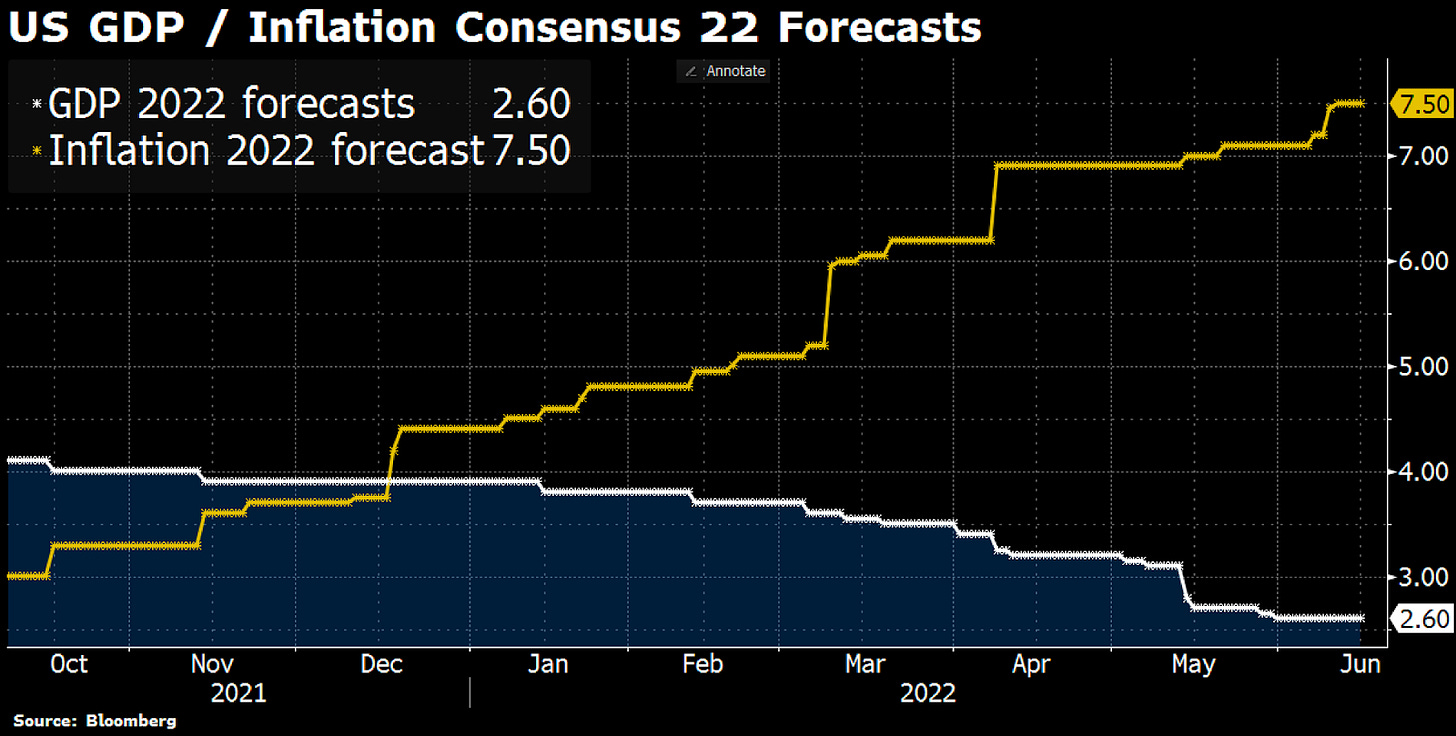

“Fed lifts key rate by 75bps, single biggest increase since 1994, as CenBank accelerates its effort to rein in inflation. Fed"anticipates that ongoing increases in the target range will be appropriate." "Committee is strongly committed to returning inflation to its 2% objective" ” by Holger Zschaepitz

“Fed's Powell sees 'no sign' of broader slowdown in US economy. Says Fed 'not trying to induce a recession' ” by Holger Zschaepitz

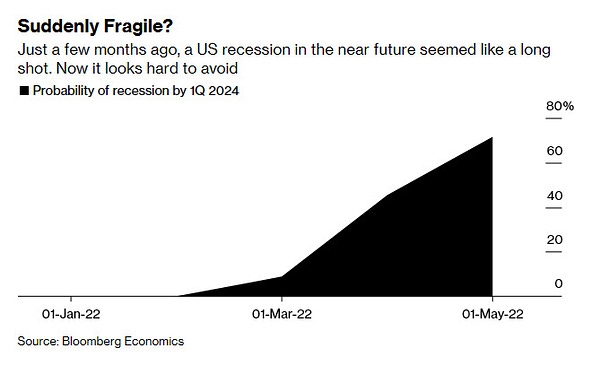

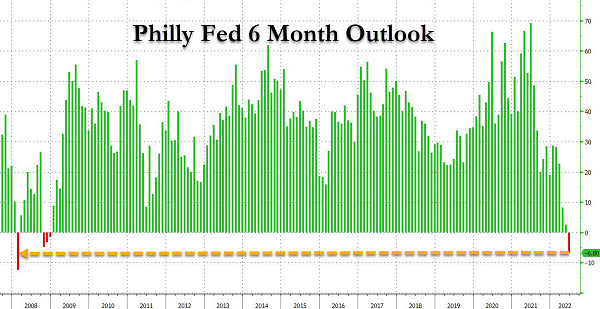

The Bloomberg economists and JPMorgan strategists think about this totally different:

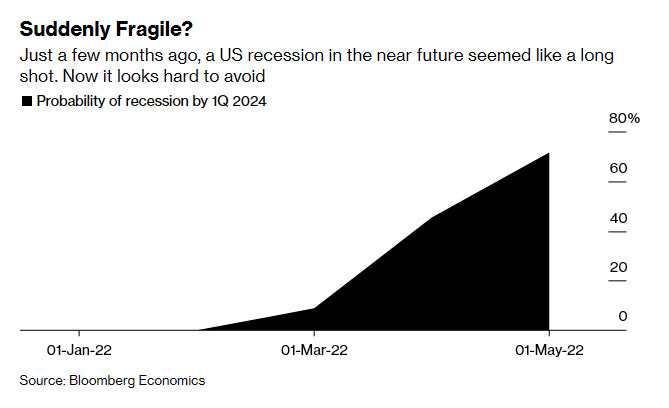

“Recession probability rises to 75% by Q1 2024: Bloomberg Economics”

“JPMorgan Strategists Say Stocks Pricing 85% Chance of Recession” by Zerohedge

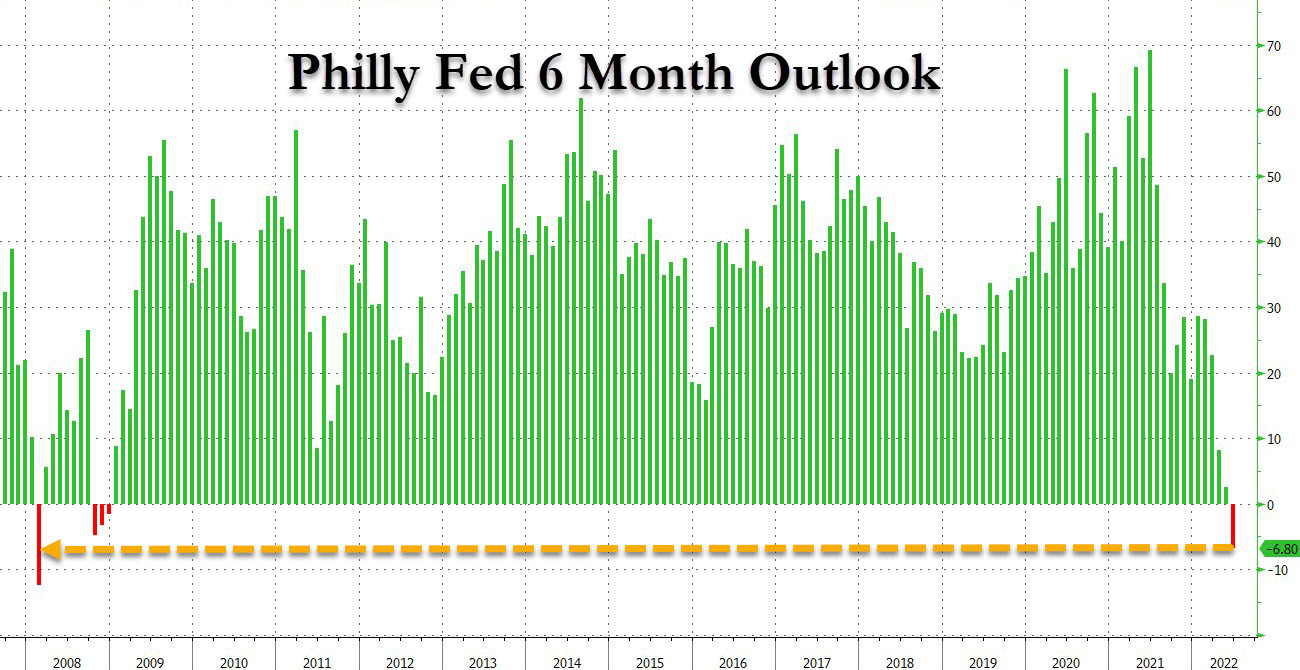

“Oh nothing, just business outlooks crashing to depression levels” by Zerohedge

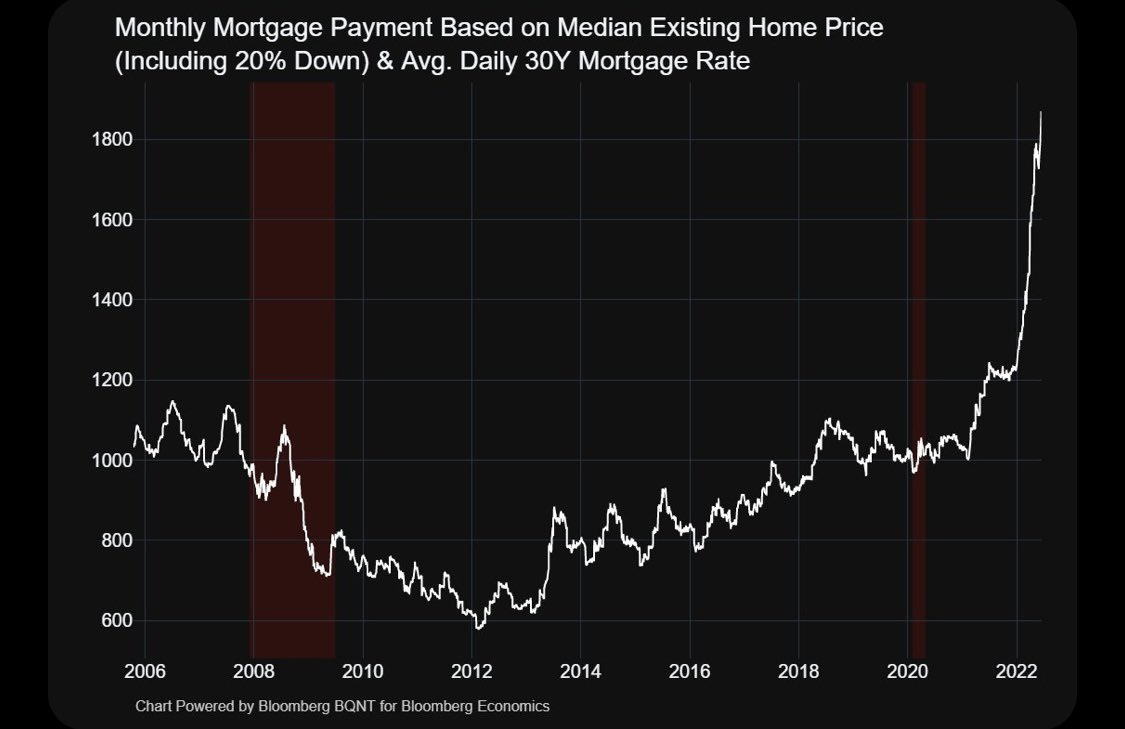

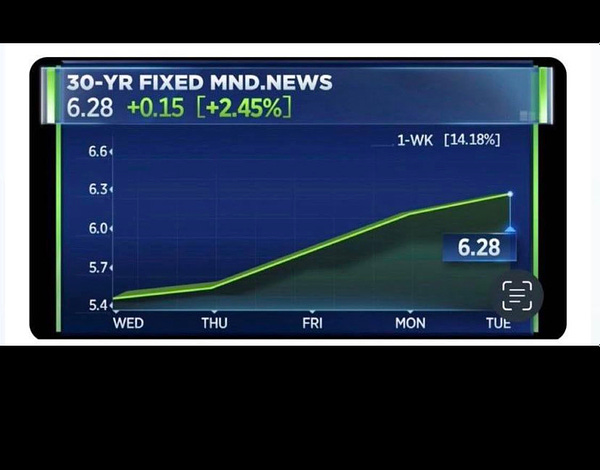

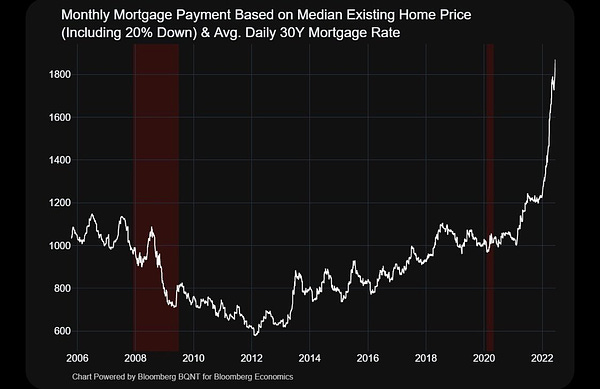

“In Jan 2021, the 30-yr mortgage rate was 2.65% and average new home price in the US was $401,700. Today the 30-yr mortgage rate is 5.78% and average new home price is $570,300. Assuming a 20% down payment, that's a 106% increase in the monthly payment (from $1,294 to $2,671).” by @charliebilello

“Mortgage Rate Hit 6.28% Today. Real Estate Market About to Get Interesting.” by @WallStreetSilv

“This is not oil, a meme stock or even a shitcoin. It’s the average monthly mortgage payment in America up 50%:” by @GRDecter

The U.S. National debt is $30 trillion and over $10 trillion has been wiped out from the US stock market this year.

Meanwhile China continues to dump U.S. Treasuries.

Based on these news I think the FED’s Powell is either delusional or simply lying in their citizens face. If you want to read more about what is happening now in the U.S., this article explains a lot.

ECB would limit Digital Euro to maximum 1.5T

Those of you who have seen enough centralized shitcoins even from this title you know this will be just another one.

The eurozone's central bank initiated a two-year investigation into a possible digital currency last July. While it has not said when it will decide on proceeding, Panetta, an ECB executive board member, has said he's optimistic a central bank digital currency (CBDC) will be ready for launch within four years.

"Keeping total digital euro holdings between one trillion and one and a half trillion euro would avoid negative effects for the financial system and monetary policy," Panetta said in a statement. "As the population of the euro area is currently around 340 million, this would allow for holdings of around 3,000 to 4,000 digital euro per capita."

The CBDC’s will be only good to make the switch from the future hyperinflated EURO to another form of centralized shitcoin. There will be a fixed conversion rate (from old to the new one) and they will start the process from the beginning. Don’t be fooled that this one will have a max cap. I will bet with any amount on it that this max cap will be changed! BTW don’t forget the unique possibility that with a CBDC’s the government can control anyone's wallet and its contents! Maybe today you post something wrong and tomorrow you will be faced with an empty wallet…

Russian bank Sber to complete its first digital currency deal

Russian banking giant Sber — formerly known as Sberbank — is preparing to complete its first digital currency deal involving the bank’s proprietary digital asset platform soon.

Popov claimed that Sber finally received registration from the country's central bank — the Bank of Russia — in spring 2022, following a series of registration delays. Sber has been struggling to register its digital asset issuance platform, initially expected to launch alongside its Sbercoin stablecoin by spring 2021.

“We are looking closely at the development of new technologies like distributed ledger technology. We are studying how blockchain technologies are developing. Our platform has already passed acceptance tests, and the first transaction will take place within a month.” said Anatoly Popov, deputy chairman of Sber’s executive board.

The news came in conjunction with VTB — Russia’s second-largest bank — also preparing to test the purchase of DFAs in exchange for Russia’s central bank digital currency, the digital ruble, in September 2022. VTB’s board member Svyatoslav Ostrovsky reportedly announced plans to launch a new platform to buy digital rubles at the Saint Petersburg International Economic Forum on June 15.

The race with the CBDC’s begun and now as we see Russia will maybe finish 2nd after China. Never ever was so important to HODL and educate yourself about Bitcoin. The only form of Freedom's money!

Japan Yen is tumbling

As I speculated before, maybe Japan will be the first one from the G7 countries which will default and with the recent news this seems to be a real possibility now.

According to ZeroHedge, The yen weakened on Friday after the Bank of Japan maintained its ultra-easy monetary stance, increasing policy divergence with its global peers.

“While the decision was within expectations, those who want to challenge the BOJ will continue to do so, putting focus on Japan’s upper house election,” said Mari Iwashita, chief market economist at Daiwa Securities.

“I doubt if the challenge will pick up immediately after today’s decision, but the battle will resume in July.”

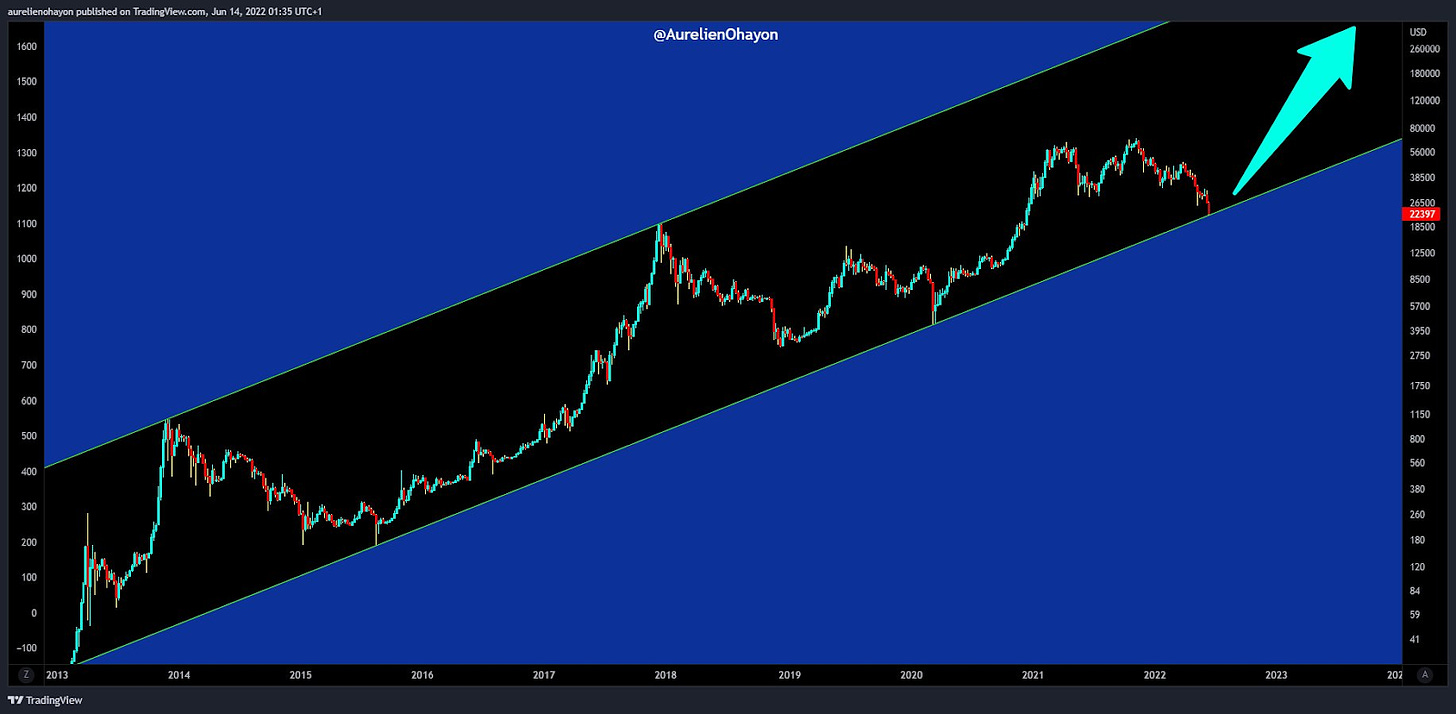

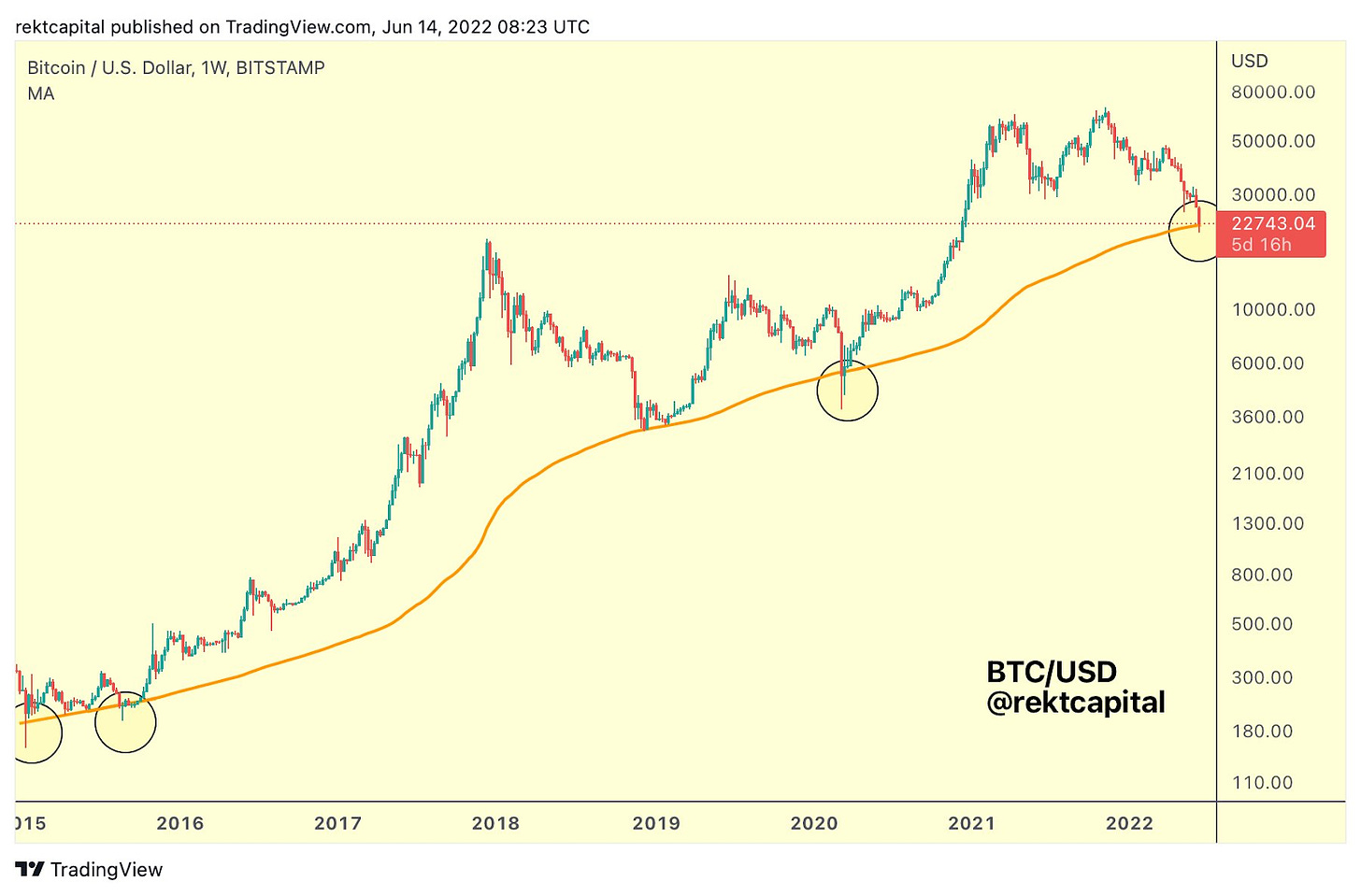

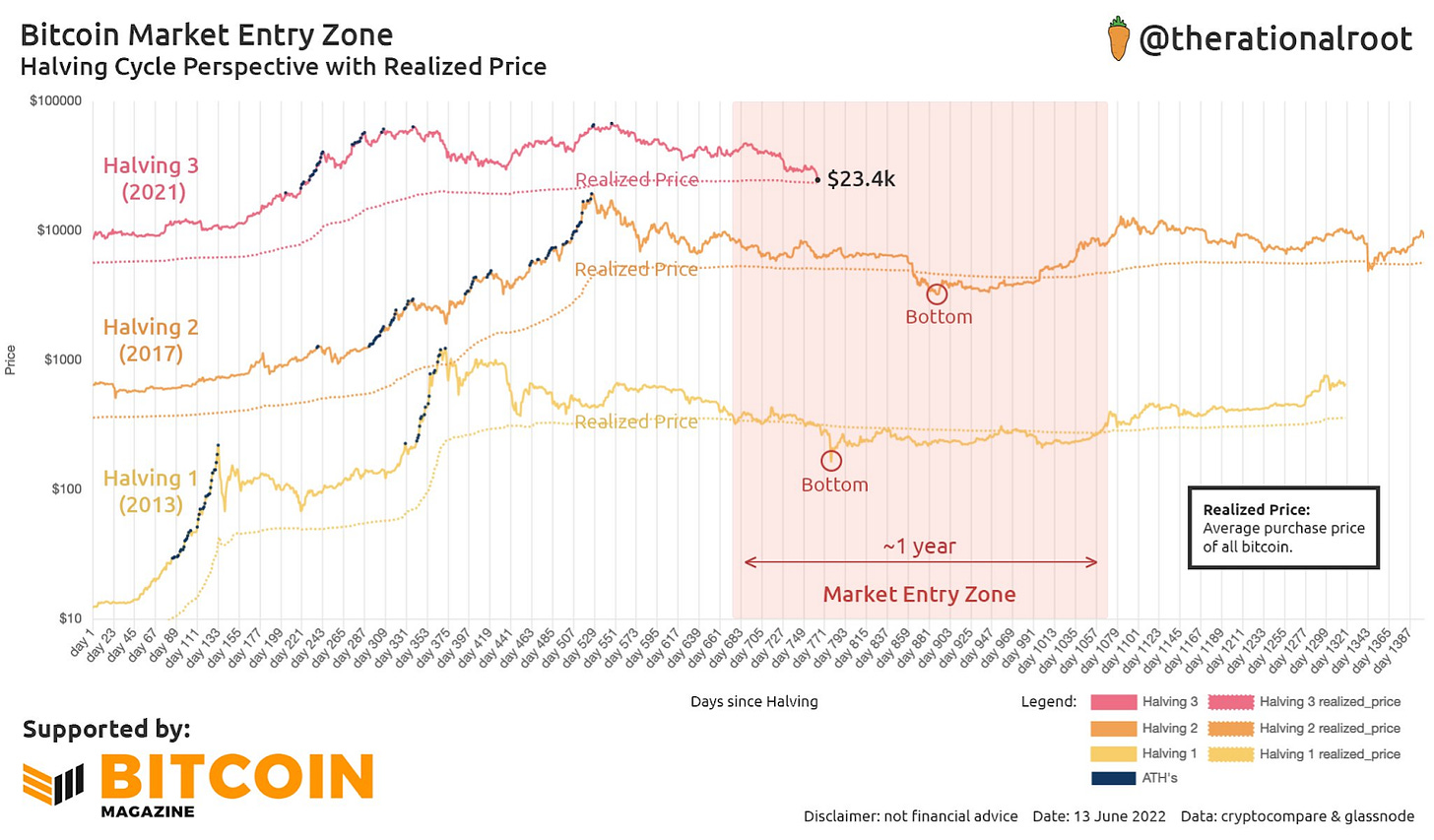

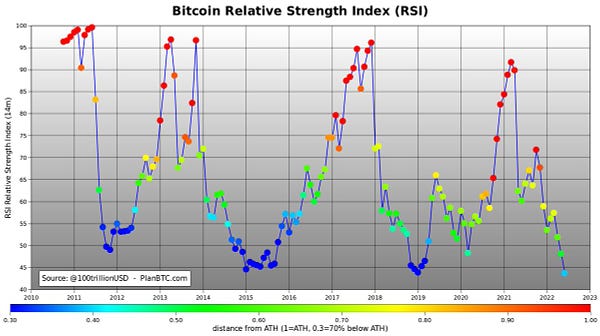

Bitcoin price speculations

These are just speculations, no investment advice!

Bitcoin Shorts

Funny Bitcoin short stories

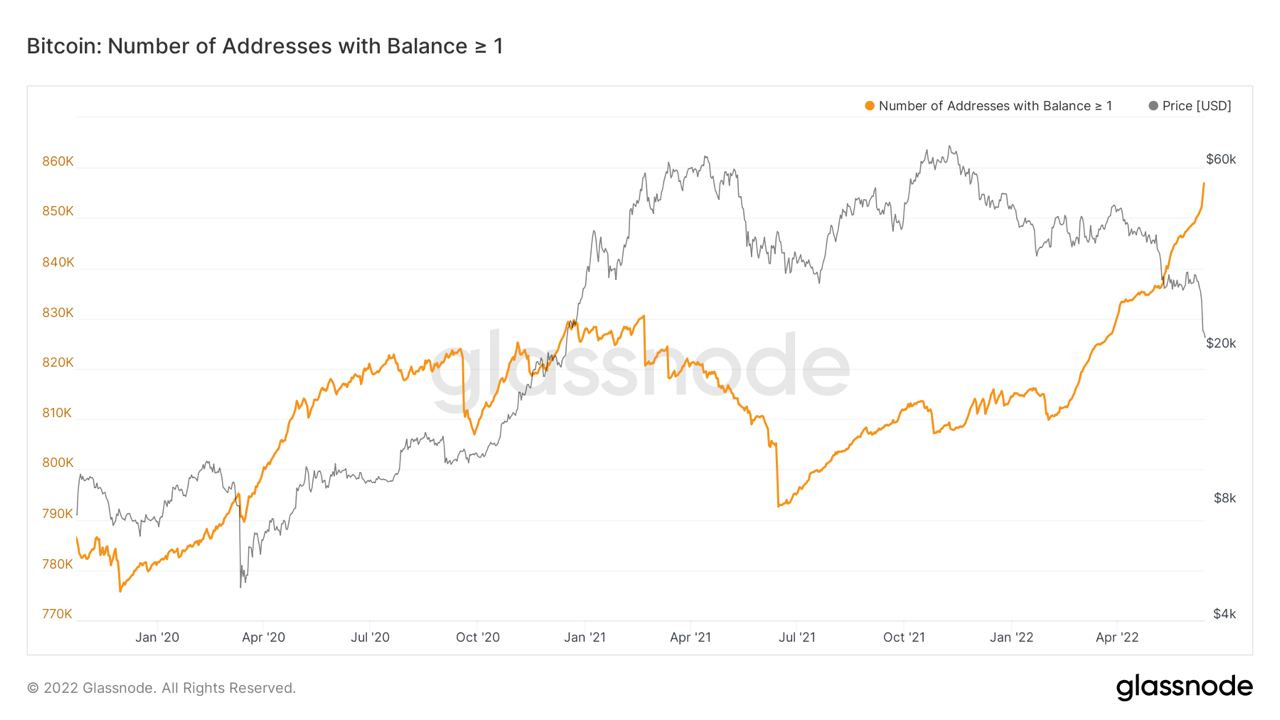

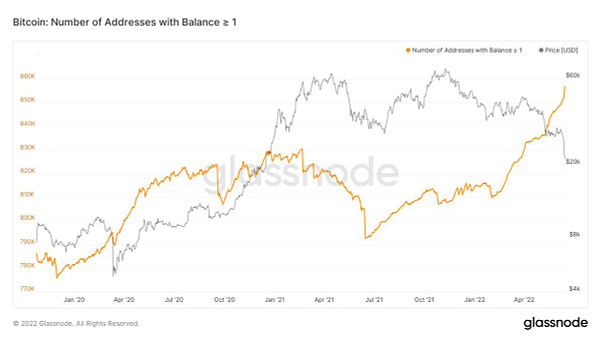

The number of addresses holding at least one Bitcoin has reached a new all-time high of 851,921.

42% of hedge funds expect Bitcoin to be $75,000 to $100,000 by the end of this year.

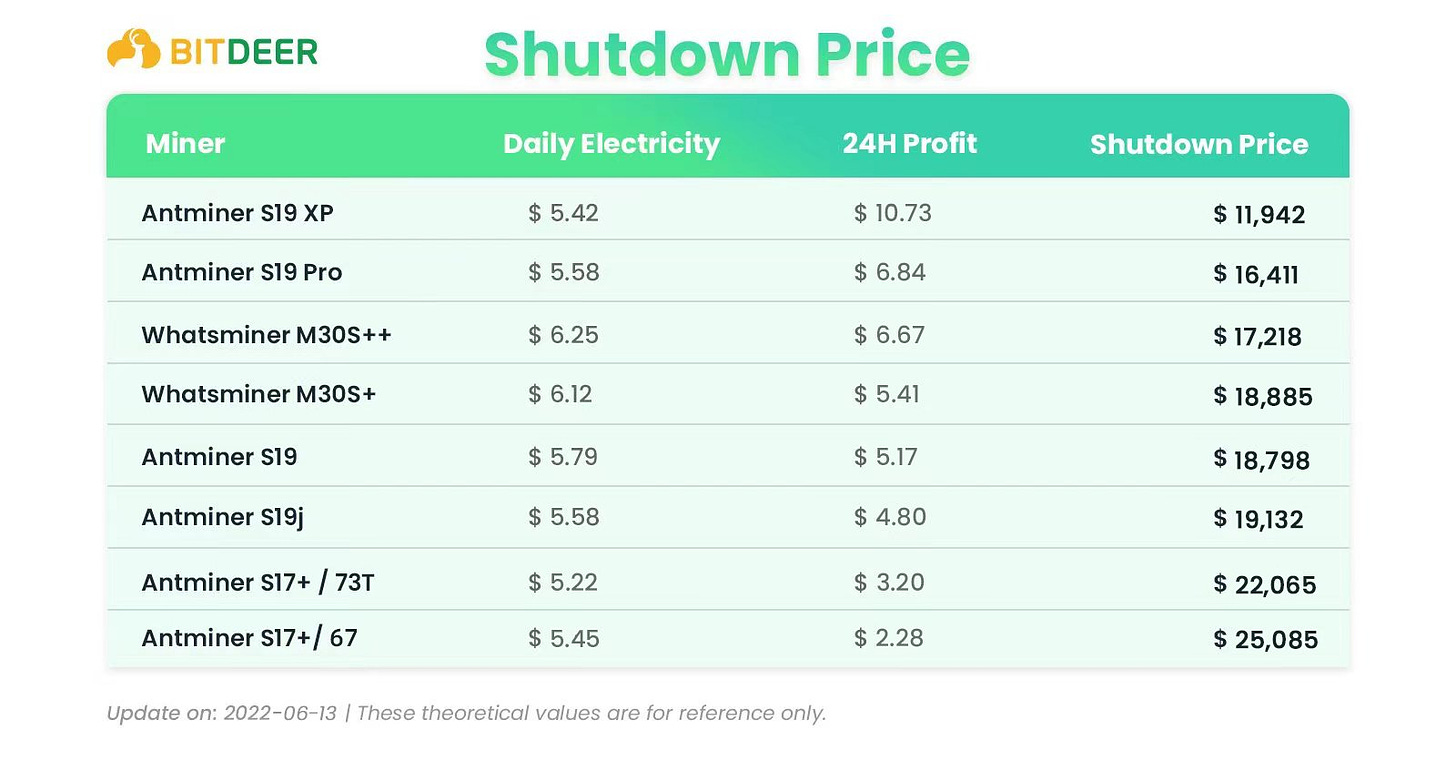

“For your information, we publish the latest list of the Shutdown Price below which crypto mining machines in this chart will have to be shut down for lack of profitability.” by @BitdeerOfficial

A must-read story about Roya Mahboob and her freedom fight with the help of Bitcoin since 2013.

Bank of Canada says the number of Canadians holding Bitcoin doubled in 2021.

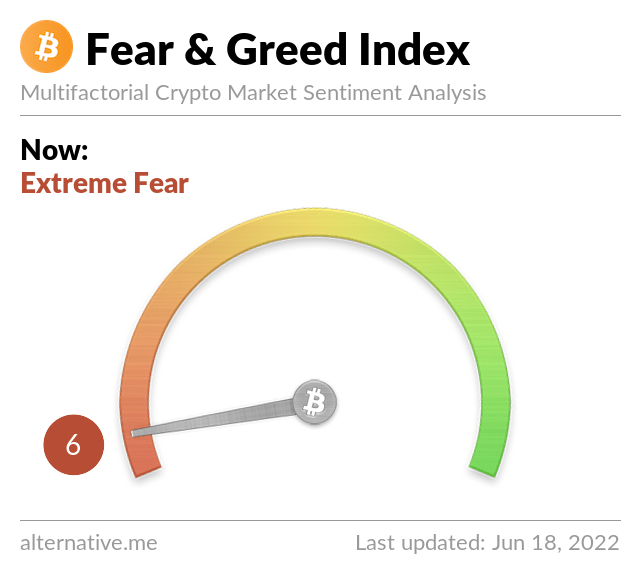

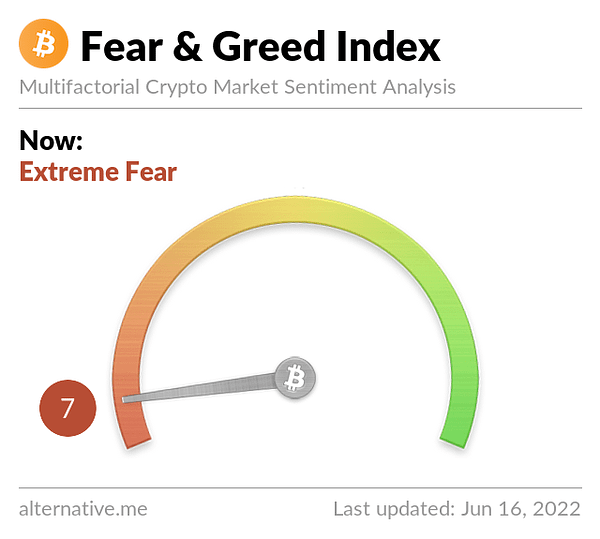

Bitcoin Fear and Greed Index is 6 — Extreme Fear

Current price: $20,468

Microstrategy CEO Michael Saylor says now is a great buying opportunity for Bitcoin, calling it an "ideal entry point."

“BTC largest whale has purchased an additional 927 ($20,100,000) Bitcoin this month alone.” by @WatcherGuru

75% of U.S retailers will accept Bitcoin in two years - Deloitte

Elon Musk: it makes sense to integrate Bitcoin payments into Twitter.

Majority of hedge funds predict Bitcoin at $100K by the end of the year - PricewaterhouseCoopers

7.6 Million South Africans invested in Bitcoin.

Suggestions

Interesting articles to read

US Official Admits Russian Energy Sales Outpacing Pre-War Levels

Giant Hedge Fund Goes "Soros" On Bank Of Japan: Bets Billions That Japan, And MMT, Will Break

Uganda says exploration results show it has 31 million tonnes of gold ore

Hester Peirce: “Everyone asks me when a spot bitcoin ETP will be approved. Here's my answer.”

American Business Elites Have Become Lobbyists For China, Expert Says

Australia's Energy Crisis Worsens As Gov't Ask People To Keep Lights Off To Avert Blackouts

Sources:

https://finbold.com/bank-of-canada-number-of-canadians-holding-bitcoin-doubled-in-2021/

https://cointelegraph.com/news/russian-bank-sber-to-complete-its-first-digital-currency-deal

https://bitcoinmagazine.com/business/spanish-airline-vueling-to-accept-bitcoin-payments

https://watcher.guru/news/operation-hidden-treasure-launched-by-the-irs-to-target-crypto-tax-evaders

https://bitcoinmagazine.com/business/gazpromneft-partners-with-bitriver-to-mine-bitcoin