This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Gold Coast Australia Mayor wants taxes to be paid in Bitcoin

Ethiopia's central bank has stated that the use of Bitcoin is illegal

Octagon Networks company converts their entire balance sheet to Bitcoin

Senator Lummis and Senator Gillibrand introduce landmark Bitcoin bill

PayPal supports the transfer of Bitcoin to external wallets

New York state governor will “not commit” to signing the Bitcoin mining ban

Edge unveils Bitcoin’s first confidential Mastercard

Russian parliament plans to ban to use Bitcoin as a form of payment

Bitmain going big in Texas

Jack Dorsey and Jay-Z have announced plans to fund a Bitcoin academy

Up to 75% of merchants may accept Bitcoin

Luxury Retailer Farfetch Will Accept Bitcoin Payments

American Express is launching a Bitcoin rewards credit card

Gold Coast Australia Mayor wants taxes to be paid in Bitcoin

The mayor of Australia’s Gold Coast, Tom Tate, has suggested that city residents could be paying council rates, or local property tax, in Bitcoin.“It sends a signal that we’re innovative and bring in the younger generation,” said Tate, acknowledging the plan is still in the research phase.

The Gold Coast is the second-largest city in the eastern Australian state of Queensland and is a popular holiday destination due to its long beaches and excellent surfing conditions.

Ethiopia's central bank has stated that the use of Bitcoin is illegal

A few weeks ago India, now Ethiopia is stepping back in the evolution of finance.The National Bank of Ethiopia (NBE), has reiterated that it is illegal to conduct business with cryptocurrencies such as bitcoin, according to a translated report from Ethiopian state media outlet Fana Broadcasting Corporate (FBC).

In April, it was reported that Ethiopia was suffering 36% year-over-year (YoY) inflation rate. High inflation rates have largely contributed to some countries adopting newer forms of currency, such as bitcoin, that offer higher levels of stability amid the devaluation of their currencies.

Octagon Networks company converts their entire balance sheet to Bitcoin

Octagon Networks has become the first cybersecurity company to convert its entire balance sheet into bitcoin, per a statement on Octagon’s website.

The company said its next goal is to enable Bitcoin payments for all services while offering a 50% discount when paid in bitcoin.

The company explained that its inspirations for choosing this specific business model “are many,” but MicroStrategy, a software analytics company and the world’s largest corporate holder of bitcoin, inspired the specific implementation Octagon chose to use.

Senator Lummis and Senator Gillibrand introduce landmark Bitcoin bill

The bill tasks the U.S. Securities and Exchange Commission (SEC) and Commodities Futures Trading Commission (CFTC) with the bulk of the work as lawmakers strive to bring the broad cryptocurrency space under the umbrella of specific regulators once and for all.The SEC will regulate digital assets classified as securities whereas the CFTC will be in charge of overseeing those that receive the commodity stamp.

The legislation uses the Howey test to determine that an ancillary asset provided to a purchaser under an investment contract is not inherently a security.

As previously hinted at by Senator Lummis, the legislation will provision a tax exemption for capital gains that don't surpass $200 on a Bitcoin payment for goods and services.

The bill goes one step further to declare that miners are not to be seen as brokers, and that digital assets obtained from mining activities are not to be treated as income until they are converted into fiat currency.

I think if the SEC will do their job as intended all of the shitcoins will be sentenced to be securities just purely based on the Howey test!

More details of the bill can be read here.

PayPal supports the transfer of Bitcoin to external wallets

In response to customer demand, PayPal announced that its users will now be able to transfer cryptocurrency from their accounts to other wallets and exchanges.“This feature was the most demanded from our users since we began offering the purchase of crypto on our platform,” said Jose Fernandez da Ponte, SVP and general manager of blockchain, crypto and digital currencies at PayPal.

“If users have crypto somewhere else and want to consolidate, they can bring it to PayPal from external addresses,” Fernandez da Ponte. “They can also send crypto to anyone who is in the PayPal system.”

This is great to be able to withdraw your coins from PayPal. Never ever store there because PayPal is not even needed as 3rd intermediary in the Bitcoin world. You can resolve anything with Bitcoin, you don’t need them for any kind of transaction.

New York state governor will “not commit” to signing the Bitcoin mining ban

“We’ll be looking at all the bills very, very closely. We have a lot of work to do over the next six months,” said Governor Hochul.

New York governor Kathy Hochul is yet to publicly commit to signing the controversial Proof-of-Work (PoW) crypto mining ban bill, instead noting that her team will be looking “very closely” at the proposal over the next few months.

A wise woman! I hope she will get enough independent information to make the best choice to NOT ban Bitcoin mining. ESG policies are just a cancer in the Economy.

Edge unveils Bitcoin’s first confidential Mastercard

San Diego-based startup Edge released the first “Confidential” bitcoin Mastercard which does not require know-your-customer (KYC) data used for collecting information related to identity, via an announcement from the company.“There is no name or address associated with your Edge Mastercard, making for completely private transactions when your card is used,” stated the companys’ website. “We protect your privacy while complying with all requirements for issuers, card associations, regulations, local, federal and international laws.”

This is too good to be true because many companies tried to run a KYC-Free debit card before, but all failed. Why? Because the regulators won’t allow you to use debit or credit cards without KYC. I think in 1-2 years the banking lobby will strike down or even sooner if it gets too famous.

Russian parliament plans to ban to use Bitcoin as a form of payment

Just last week the first news was about a plan making in Russia Bitcoin as a payment solution for foreign trades and I warned everyone to not drink too much hopium because there will be maybe a catch. The catch here it comes:According to a new piece of legislation put forward by Anatoly Aksakov, the head of Russia’s lower chamber of parliament, any form of “digital financial activities” will be banned as a means of payment within the country.

“The ruble is the official monetary unit (currency) of the Russian Federation. The aforementioned article sets a prohibition against the introduction of other monetary units or monetary surrogates on the territory of the Russian Federation,” wrote Aksakov.

That’s it. None of the big countries will abandon the control above their monetary system. It’s that simple. Small countries will do it only when they see the major drawback from insane “printing” of USD, EUR, GBP, JPY etc.

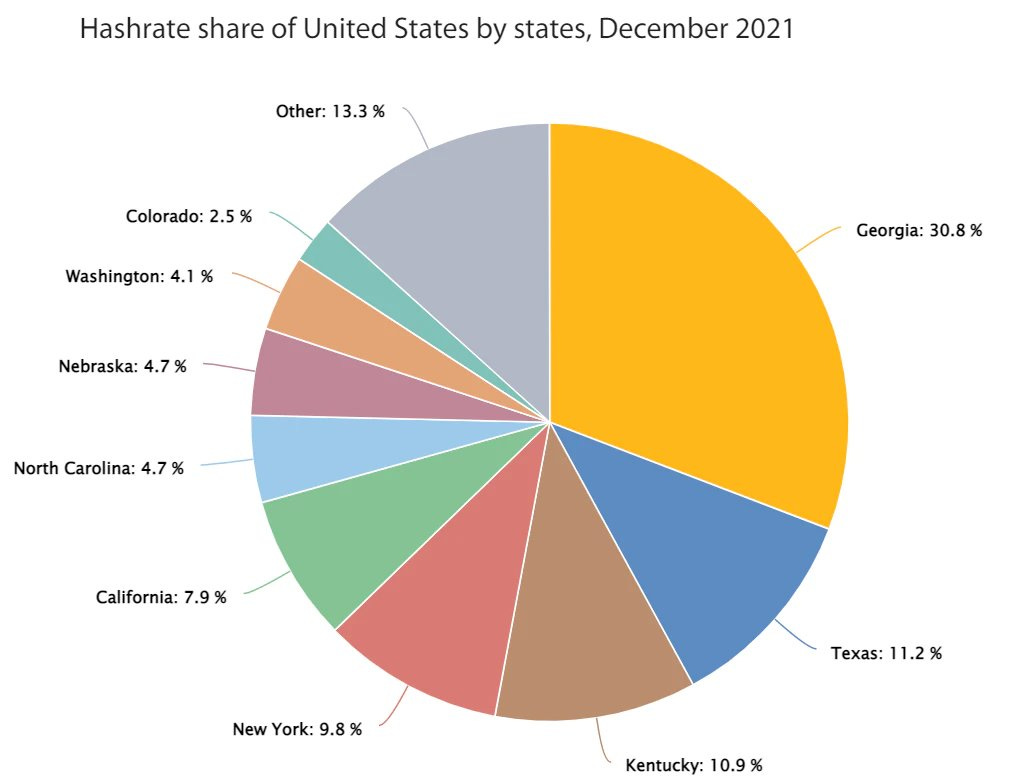

Bitmain going big in Texas

According to Wu Blockchain, Bitmain introduced two data centers under construction by Poolin, located in Texas, with 600 megawatts. The equipment is mainly the S19 PRO+ water-cooled miner, which is the first fully operational water-cooled data center in North America.Jack Dorsey and Jay-Z have announced plans to fund a Bitcoin academy

Jack Dorsey, founder of bitcoin financial services company Block Inc., and Shawn “Jay-Z” Carter have partnered to fund The Bitcoin Academy to provide financial education and empowerment to the community in which Jay-Z grew up, Dorsey announced.“Education is where we start. This isn’t just about bitcoin…it’s about long-term thinking, local economies, and self-confidence,” Dorsey said in a reply to his announcement. “Courses are free to all Marcy residents, including kids. And to make it even easier we’re providing devices and data plans for all who need it.”

That’s what huge wealth causes to good people, they begin to make good things with it for the much poorer ones. Like Michael Saylor did with the Saylor Academy. Now Jay-Z and Jack Dorsey are following his steps with a Bitcoin academy, great idea!

Up to 75% of merchants may accept Bitcoin

Up to 75% of retailers in the U.S. plan to accept Bitcoin and cryptocurrency payments within the next two years according to a new survey published by Deloitte and PayPal on Wednesday titled, “Merchants Getting Ready for Crypto.”The survey sampled 2,000 senior executives at U.S. retail organizations between December 3rd and December 16th, 2021. The organizations were distributed equally between cosmetics, digital goods, electronics, fashion, food and beverages, home and garden, hospitality and leisure, personal and household goods, services, and transportation sectors.

Inflation is the keyword. After many people in key positions now face the cruel consequences of what Inflation is causing they now see that the only solution is to begin protecting themselves with an “insurance” against it which is Bitcoin, nothing else.

Luxury Retailer Farfetch Will Accept Bitcoin Payments

Farfetch Ltd., a digital platform for luxury fashion featuring brands like Balenciaga, Burberry, Gucci, and more, will begin accepting Bitcoin and other shitcoins for payment.The company will have a pilot program that will begin with luxury European stores in Paris, London, and Milan. All U.S., U.K., and European customers will be able to use Bitcoin and shitcoin payments with Farfetch later this year.

“As a platform company, we are continually innovating to serve as the bridge for the luxury industry to new technologies and environments where the luxury customer is today, and where they’ll be tomorrow,” Neves said. “With this move, we look forward to empowering our incredible boutique and brand partners to embrace cryptocurrency.”

American Express is launching a Bitcoin rewards credit card

Announced Friday at Consensus 2022, the Abra Crypto Card will allow users to earn back Bitcoin and other shitcoins on any purchase, no matter the amount or category. Cardholders can choose from Bitcoin and other shitcoins supported on the Abra platform, with no annual or foreign transaction fees. The card will also come with Amex Offers for shopping, travel, dining and services as well as presale ticket access and purchase protections.

“This has been a long time coming and is the first American Express crypto product,” said Abra CEO Bill Barhydt in an interview with CoinDesk. “Amex retail offers from hundreds of merchants are integrated into the app with the whole fraud and purchase protection all integrated with the Abra wallet.”

Global Economic News

TL;DR

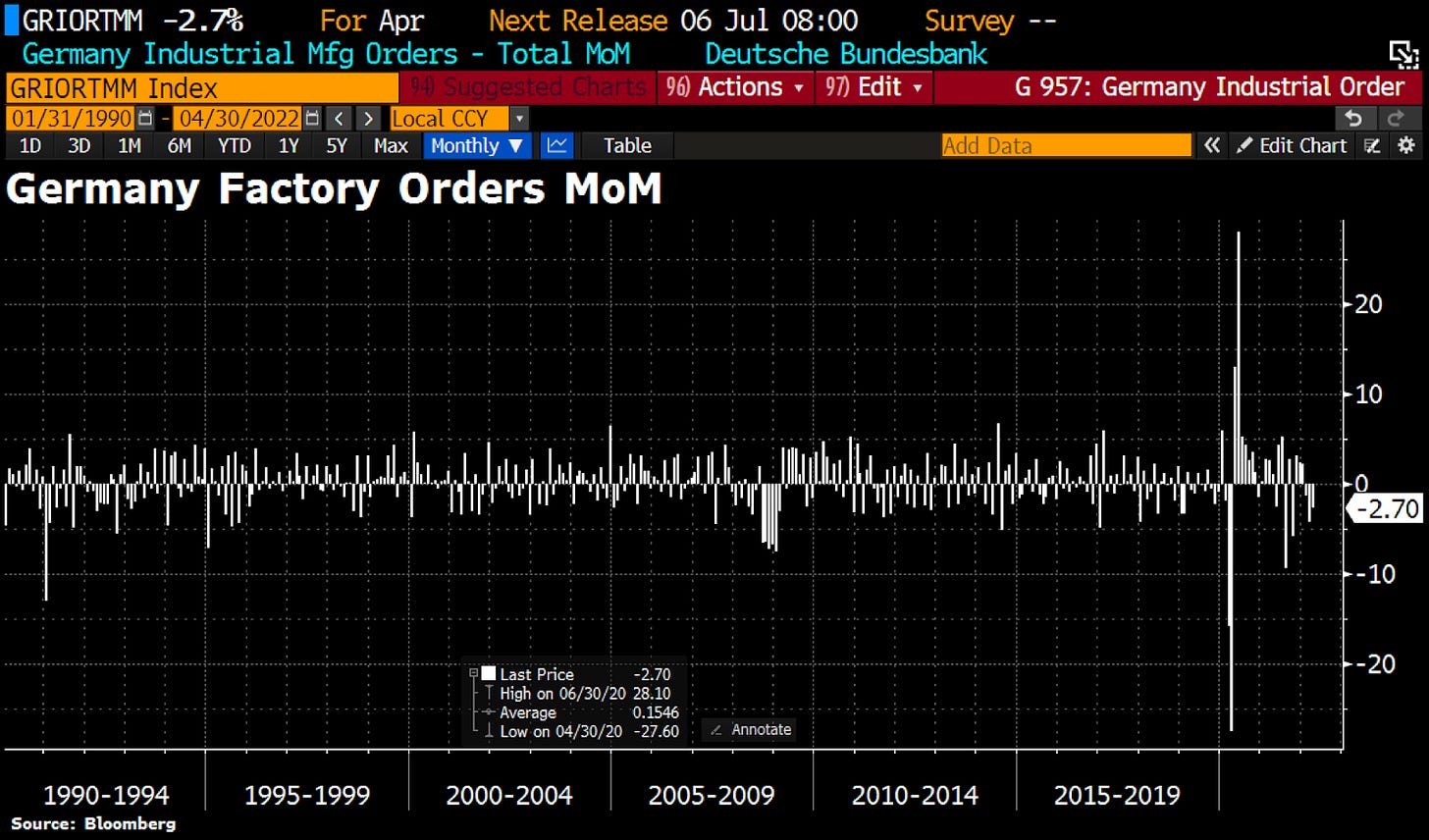

Germany’s factory orders are falling again while others are soaring

Will the Japanese Yen be the first which will lose in the monetary race?

The World Bank is warning us

Americans use credit card like no tomorrow

EURO turns lower

China vs. USA CPI war

Germany’s factory orders are falling again while others are soaring

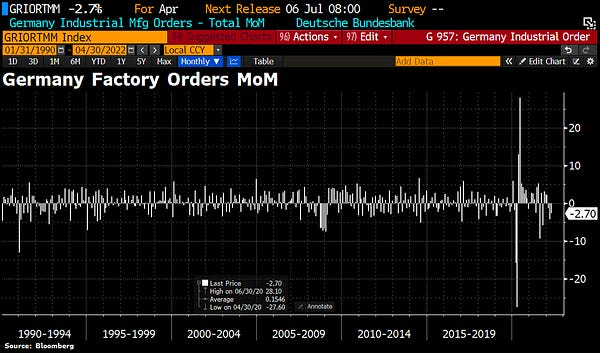

“Germany April factory orders crater -2.7% in Apr MoM – a 3rd straight drop - mainly driven by a decline in foreign orders. That brought the annual number down 6.2%. Economists had predicted a 0.3% monthly gain. Economy faces uncertainty soaring energy costs, supply limits.” by Holger Zschaepitz

“The risk of a wage-price spiral is rising. Now the union Verdi has demanded S&W hike of up to 14% for dock workers in container shipping, amongst others hourly compensation plus €1.20, extra payment of €1,200 as well as compensation for inflation.” by Holger Zschaepitz

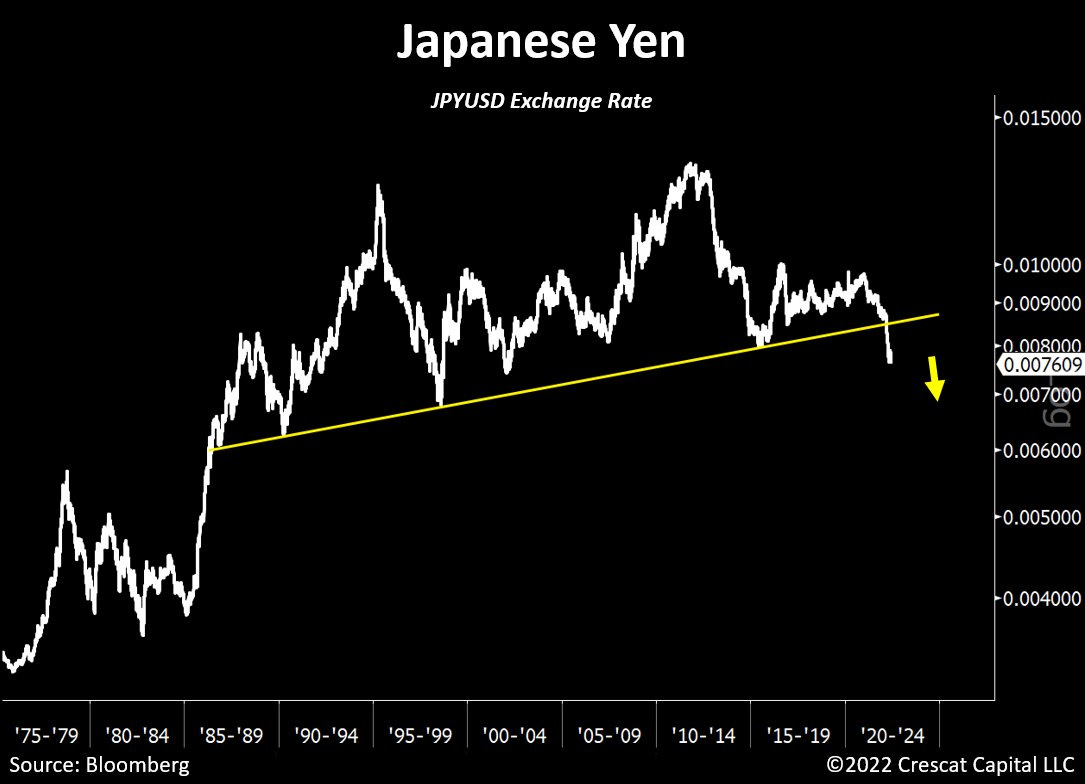

Will the Japanese Yen be the first which will lose in the monetary race?

“Japan is now facing a true monetary crisis. It’s what happens when one is forced to loosen monetary conditions in an already inflationary environment. Ultimately, other central banks will follow the BOJ’s lead. Global monetary debasement is inevitable.” by @TaviCosta

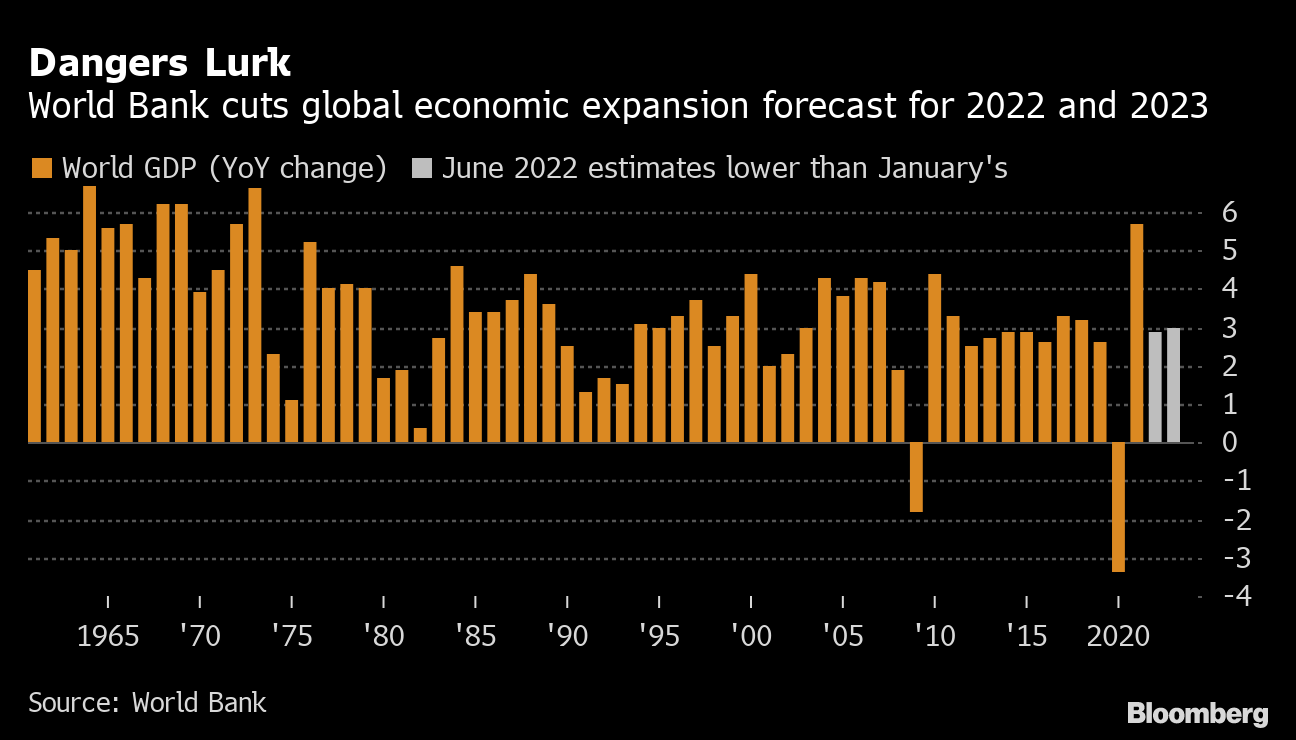

The World Bank is warning us

According to The WP, the global economy may be headed for years of weak growth & rising prices, a toxic 1970s stagflation combination that will test the stability of dozens of countries still struggling to rebound from the pandemic, World Bank warned.“The risk from stagflation is considerable with potentially destabilizing consequences for low- and middle-income economies,” said David Malpass, president of the multilateral development institution in Washington. “ … There’s a severe risk of malnutrition and of deepening hunger and even of famine in some areas.”

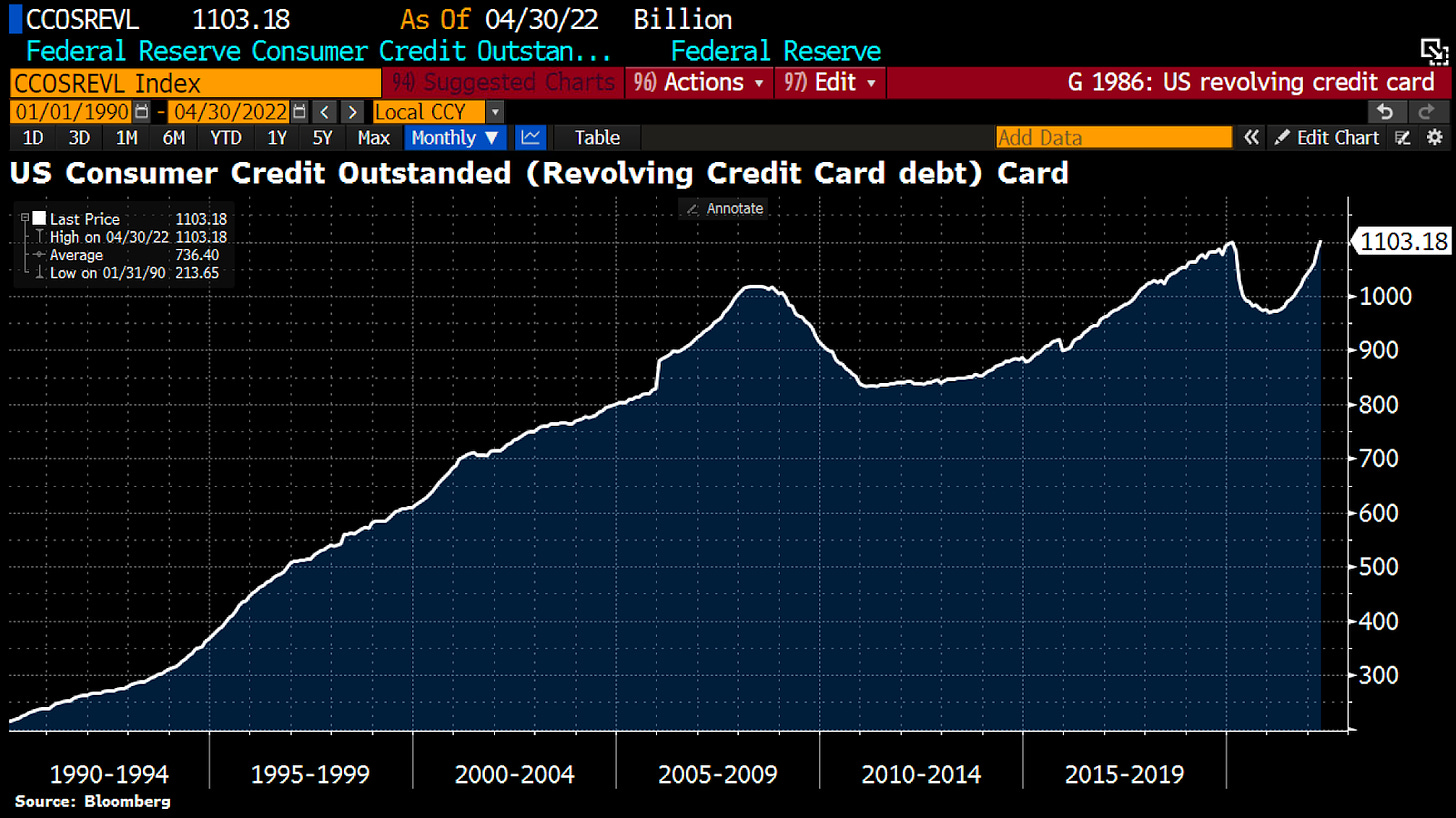

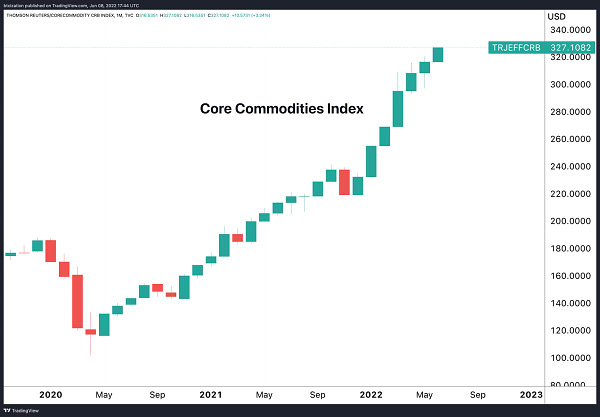

Americans use credit card like no tomorrow

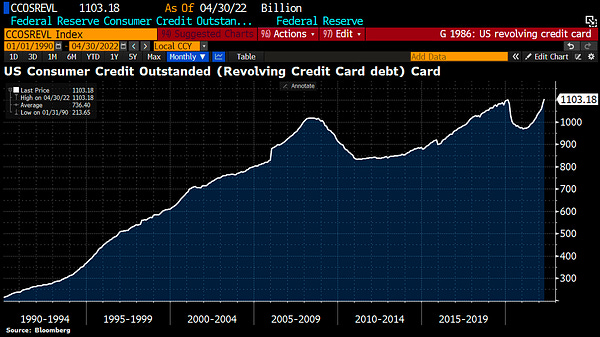

“Americans ramp up credit card usage as high prices continue to bite. Revolving credit, which mostly includes credit card balances, grew at an annualized rate of 19.6% and totaled $1.103tn in April, just breaking a pre-pandemic record of $1.1tn.” by Holger Zschaepitz

Not just the money printing, but credit card spending will induce the commodity prices to go up only and it’s just the beginning. Still the strongest inflation driver is the cantillon effect caused by money printing which hikes the prices with a ~18 month delay period. The huge amount of money made in just the last 2 years barely begins to be shown in prices. I wrote more details about the printed amount further down in the 6th news.

EURO turns lower

“Euro turns lower as ECB's Lagarde has no concrete anti-fragmentation tool at hand.” by Holger Zschaepitz

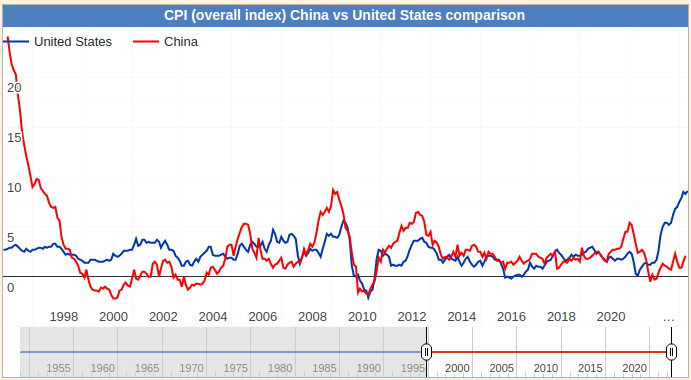

China vs. USA CPI war

It depends on what we value: who is winning, the highest or the lowest one? You decide, but these numbers even if are the official ones (not real) are speaking for themselves: The Chinese government announced that the CPI rose 2.1% in May, down 0.2% month-on-month. Meanwhile the U.S. Inflation reaches 8.6% YoY vs 8.3% expected, the highest the U.S has seen in 40 years. The Core CPI up 6% vs. 5.8% expected. If you check the chart below you will find out that for the last 20 years China moved along with the U.S. CPI metrics, but since 2021 the abnormal U.S. printing starts to be priced in.

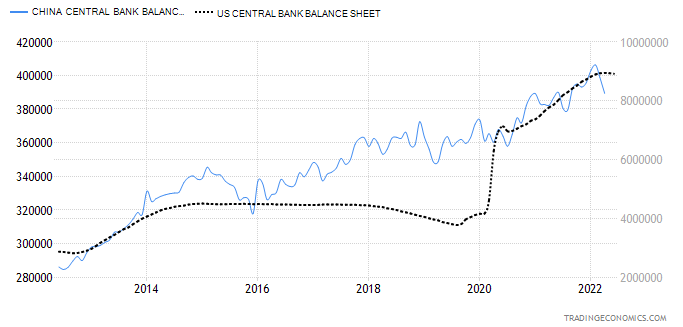

Why could there be this divergence since 2021? If we compare the “printing vectors” for these two countries, they are fundamentally different. The U.S. from 2020 till 2021 inflated its central balance sheet two fold (+100%), while the Chinese central bank balance only rose around 10%. This means the U.S. counterparty printed ten (!) times more money compared to their own balance sheet than the Chinese did. This is the cause of the major divergence in the official CPI metrics.

Just to feel how wrong the CPI numbers are, here are some examples of the real U.S. inflation (which most of you already experience):

“Gas: +48.7% Fuel Oil: +106.7% Meat, Poultry, & Fish: +13.1% Milk: +15.9% Eggs: +32.2% Coffee: +15.3% Used Cars: +16.1% Airline Fares: +37.8% Real Average Hourly Earnings: -3%” by @jackikotkiewicz

Bitcoin price speculations

These are just speculations, no investment advice!

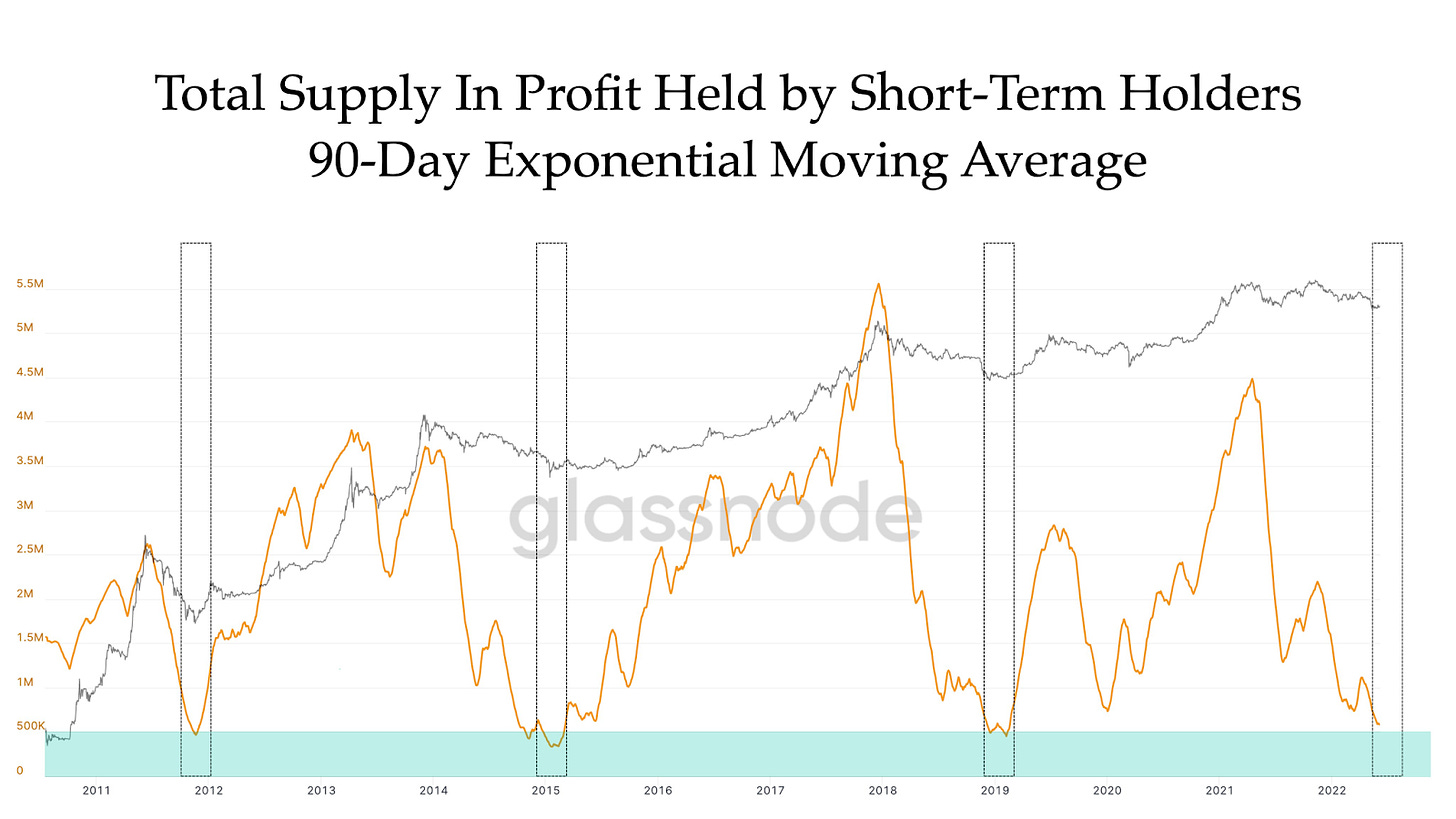

“But... macro bro!” by @TheRealPlanC

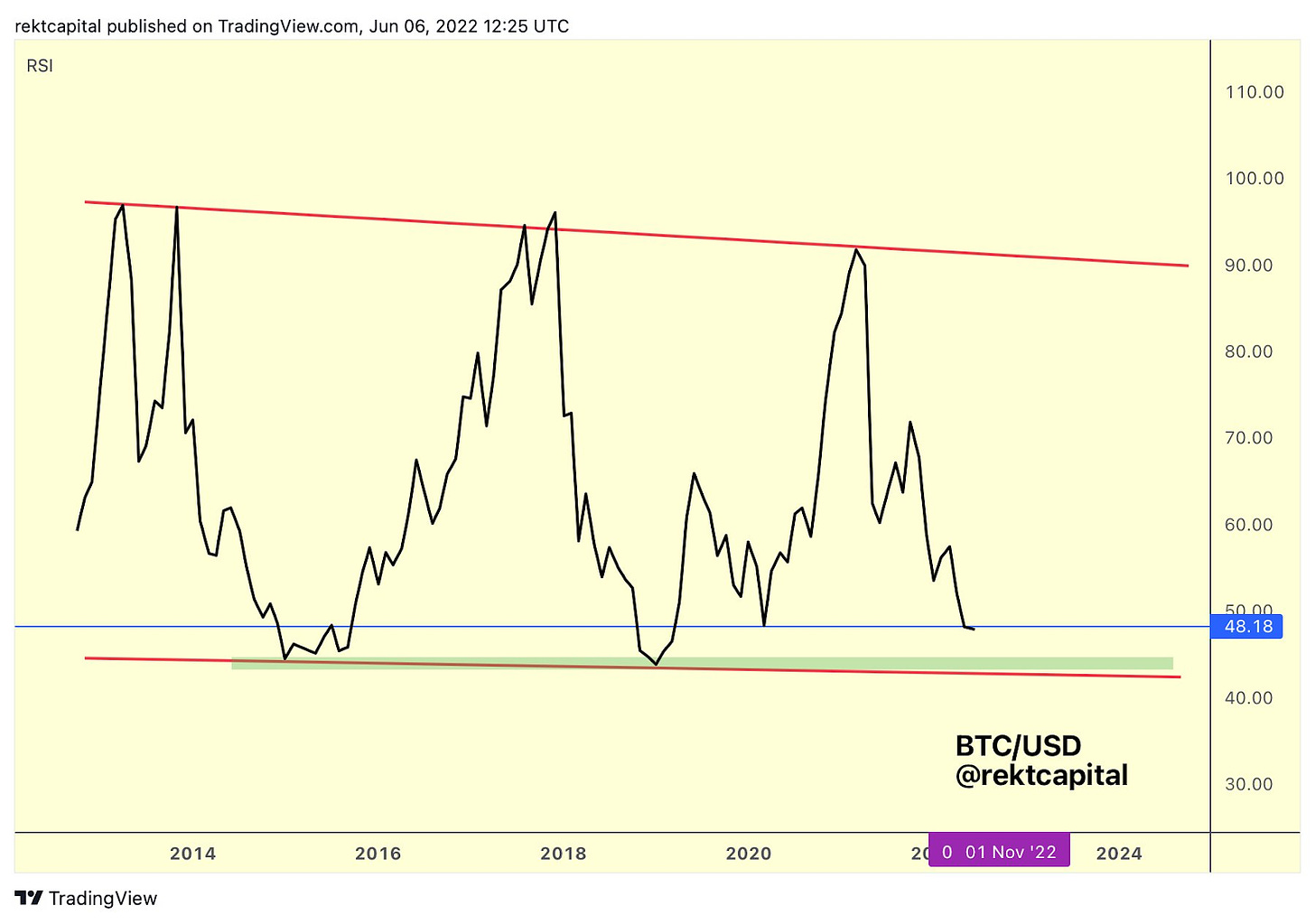

“BTC RSI levels have not yet reached Bear Market bottom values (green)” by @rektcapital

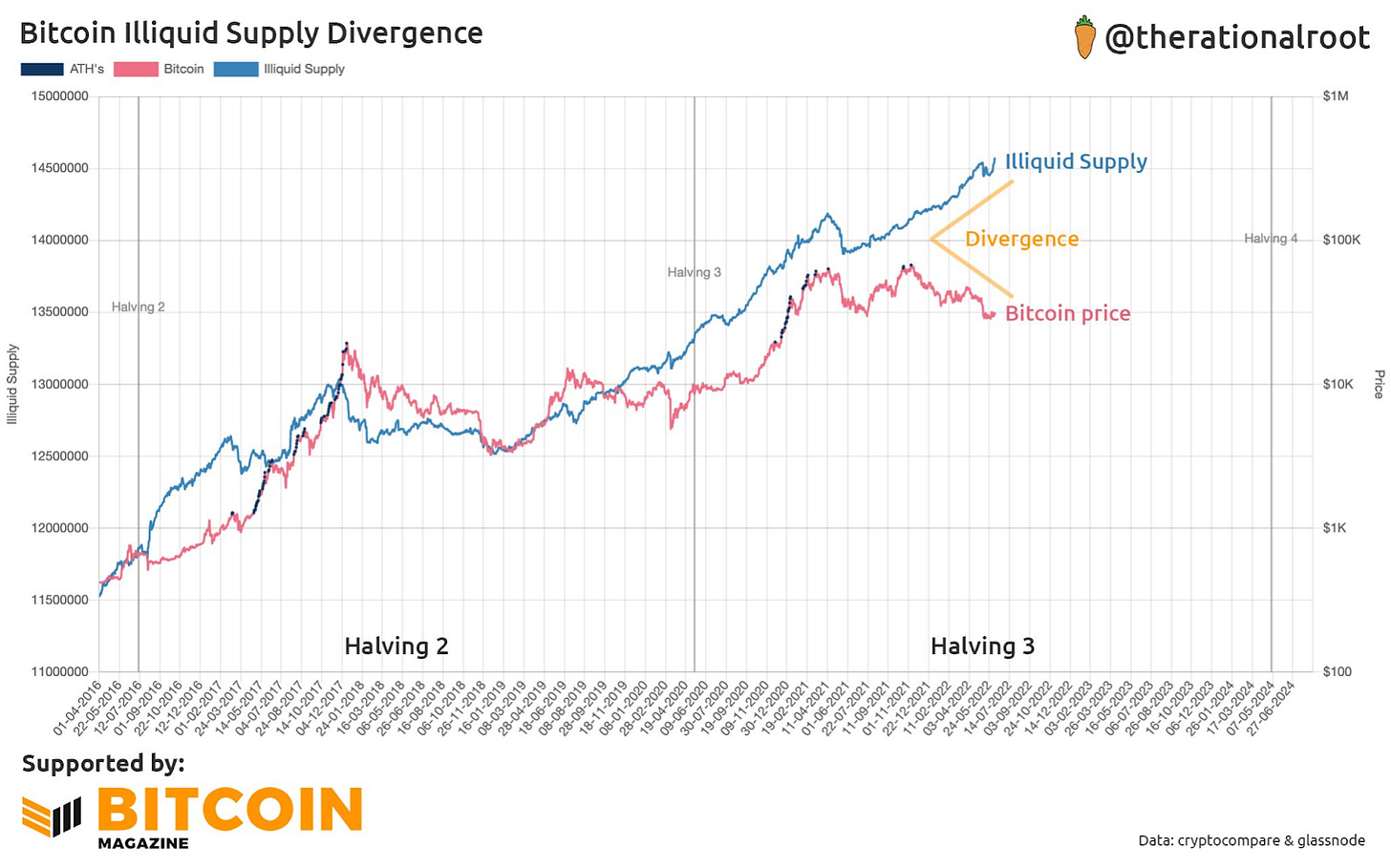

“Something is fundamentally different about current halving's "bear market".“ by Root

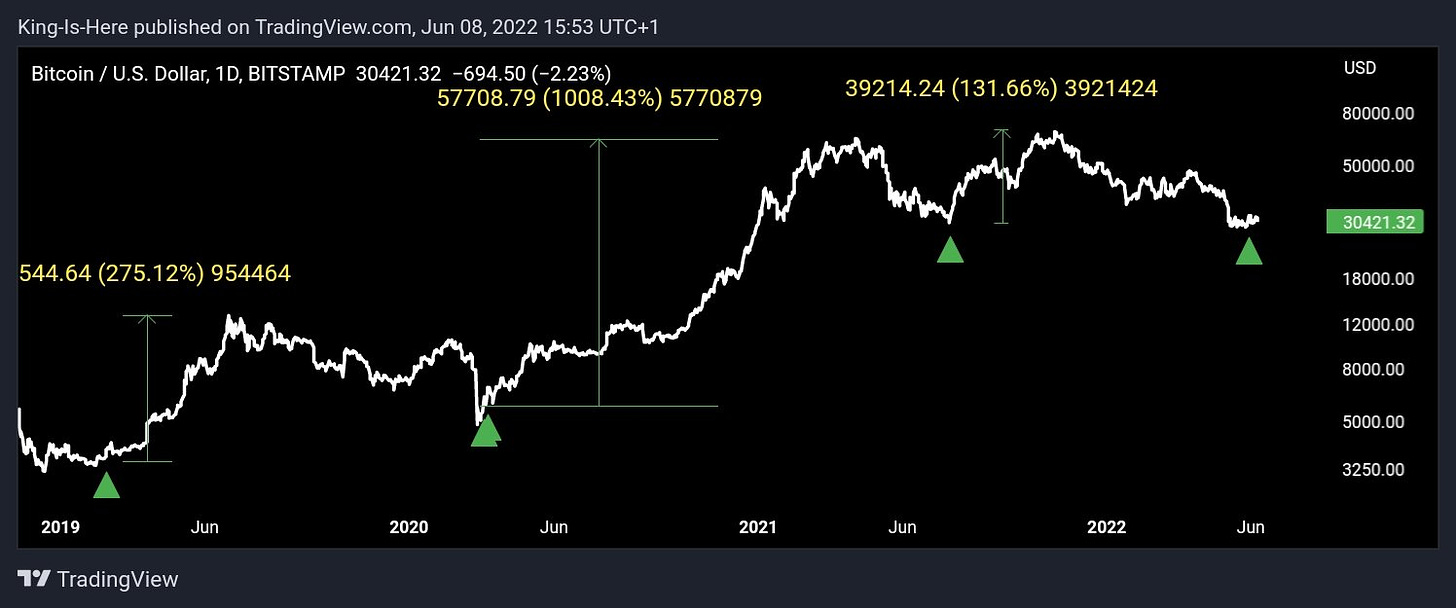

“Bitcoin 420K” by @nihkalowz

“I'm not saying the indicator works 100%. But this indicator has Successfully Identified the Bottom last 3 times. Then Hughes pumped. Hopefully this time it will be the same.” by @Trader_Jibon

“Weekly RSI reversed at the exact low of the March 2020 crash.” by @JohalMiles

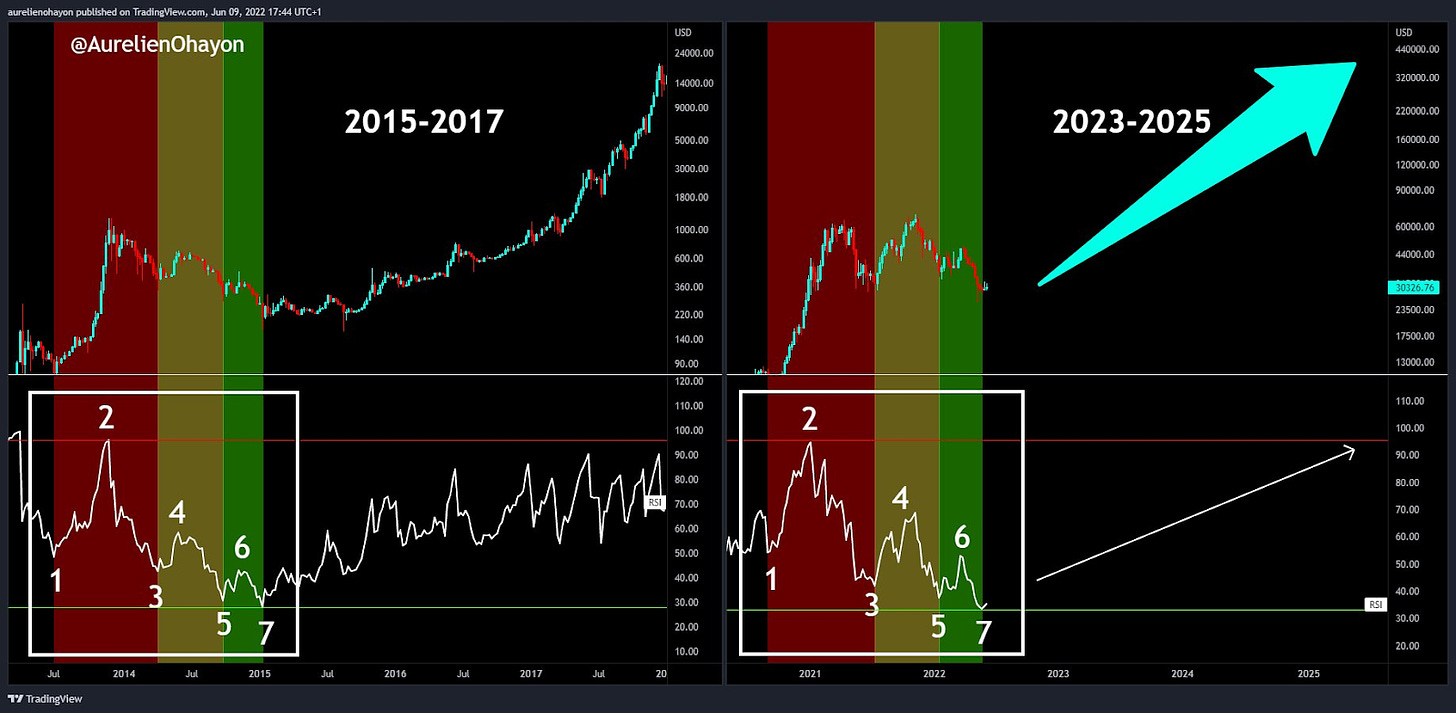

“Are you ready for a 2-year Bull Run on Bitcoin ?” by @AurelienOhayon

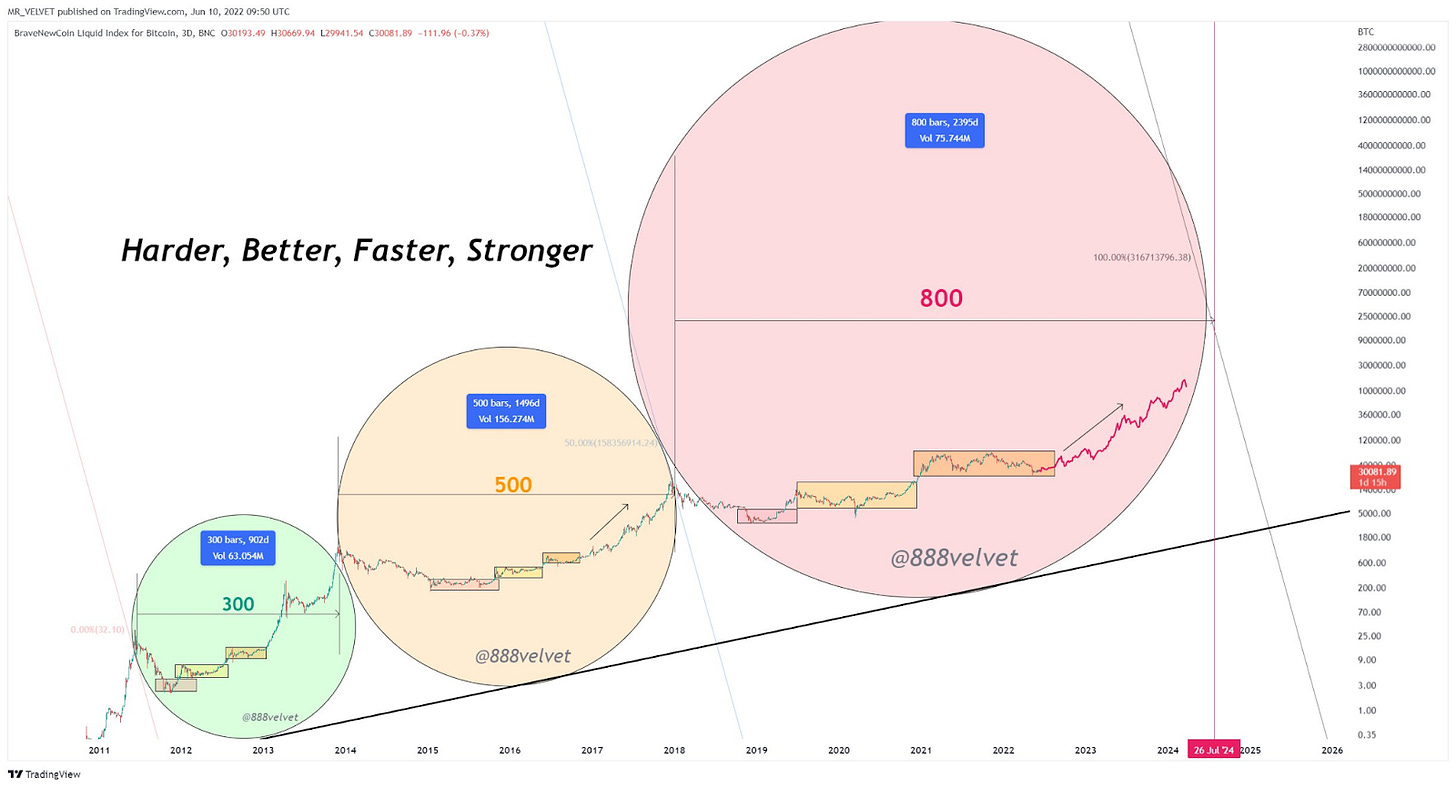

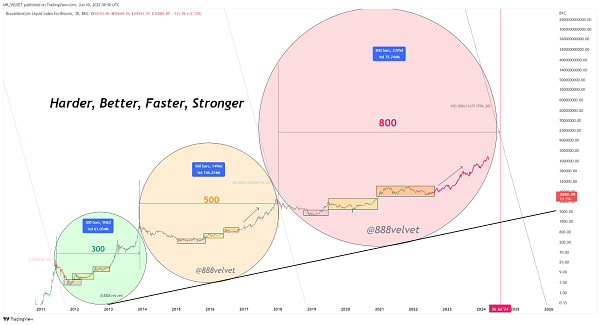

“🟢300 🟠500 🔴800” by @888Velvet

Bitcoin Shorts

Funny Bitcoin short stories

Over 11k comments have been submitted to the SEC in support of Grayscale's Bitcoin ETF.

Bloomberg Senior ETF Analyst: Grayscale hiring top former U.S. gov lawyer means they might sue the SEC if its Bitcoin ETF is denied.

“Grayscale has hired former US solicitor general Donald B. Verrilli Jr., who served from 2011 to 2016 under the Obama administration. Verrilli is the senior strategist in the Bitcoin ETF application. And will serve as lead counsel if SEC rejects Grayscale application. Anticipate” @TajoCrypto

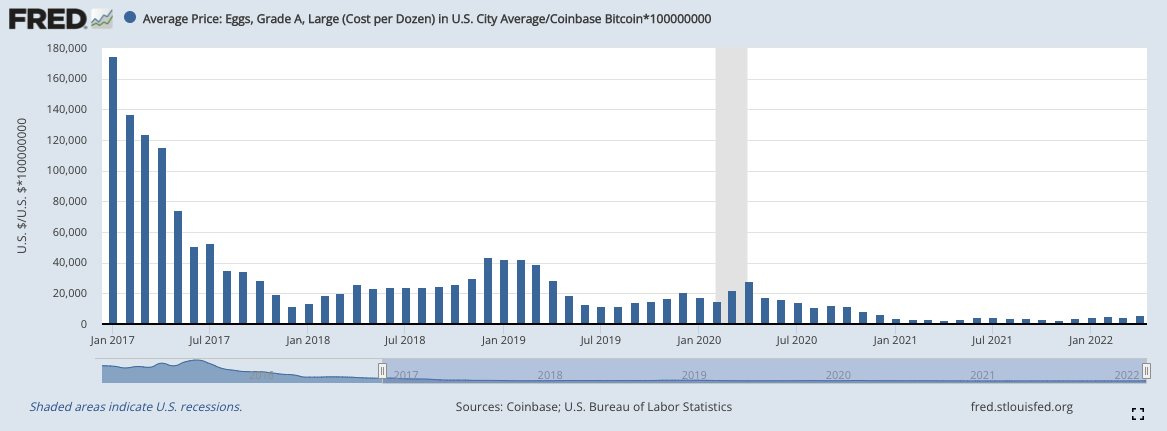

“If you save in BTC, your cost of living drops. BTC is an inflation hedge over the long term. Even the FED is tracking it.” by @asianhodl1

"It's not going to zero, and if it's not going to zero, it's going to a million. " - Michael Saylor on bitcoin

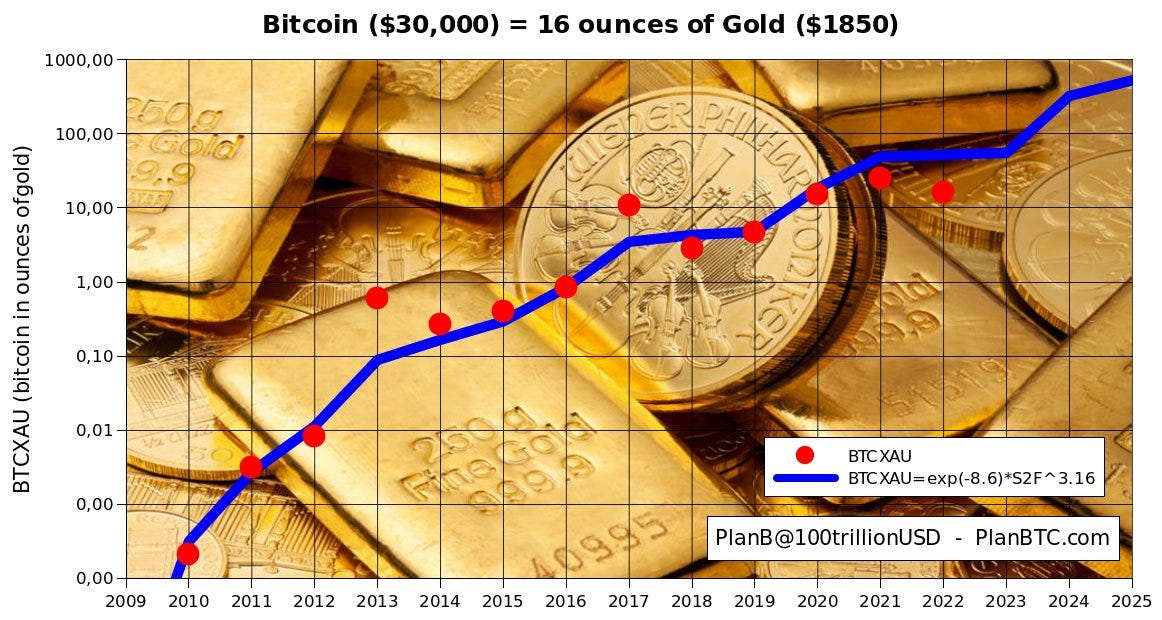

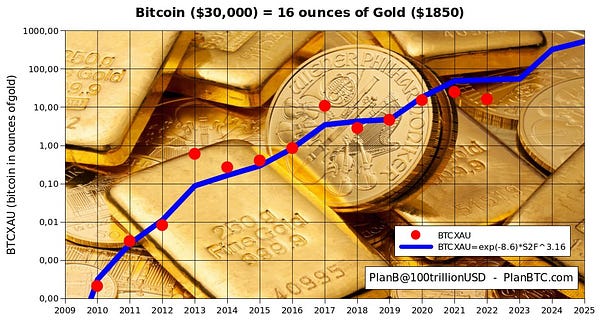

“Bitcoin seems a bit undervalued IMO” by PlanB

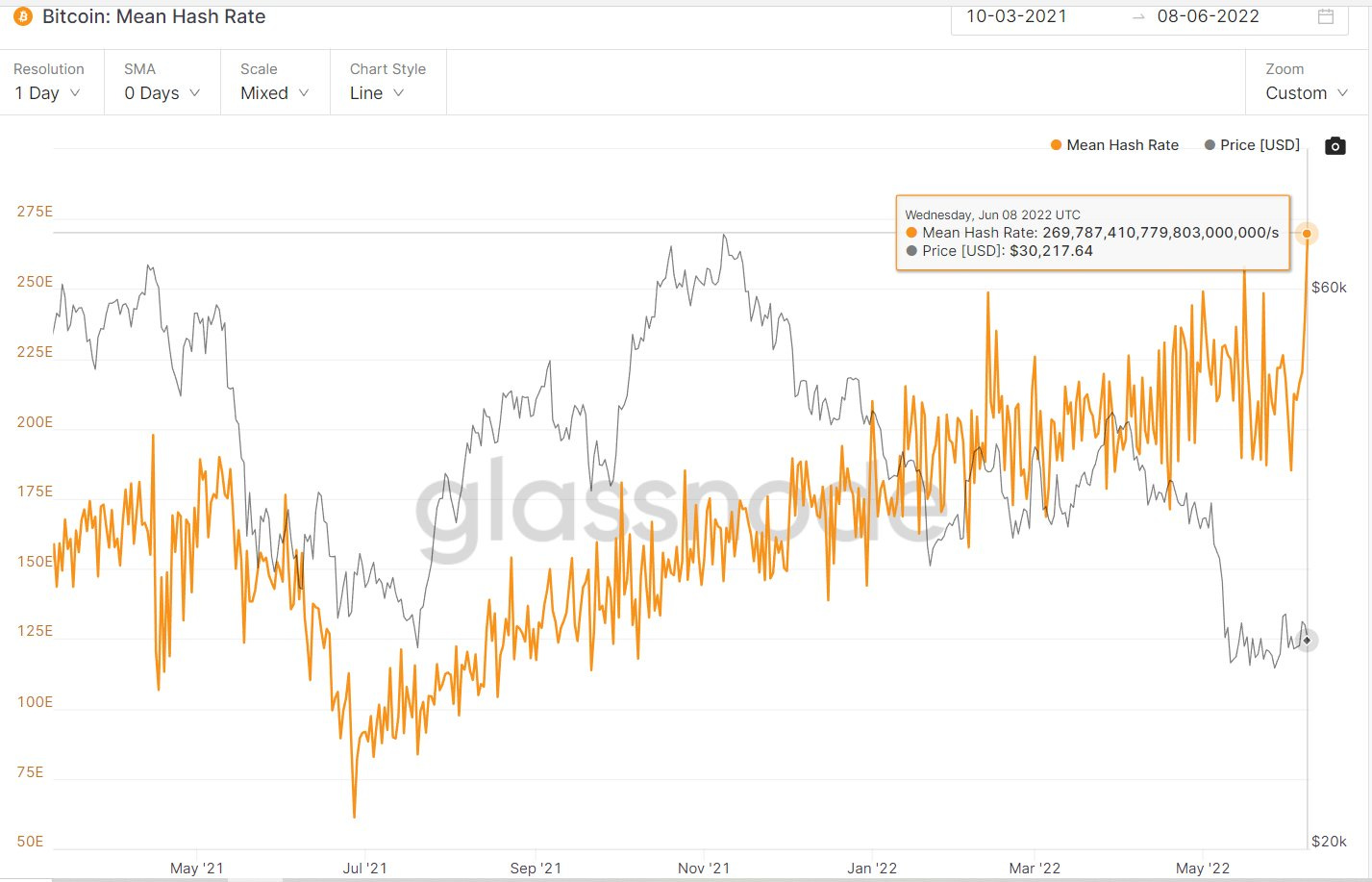

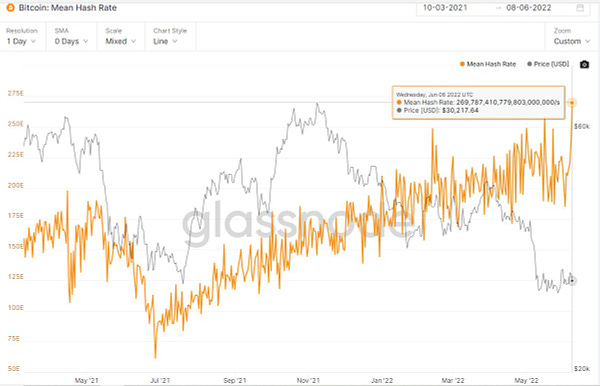

The Bitcoin Hashrate just made a new all-time high!

“Western Academic: bitcoin is useless. Libyan money exchanger:” by @sobradob

“Only 9.9% of Bitcoin circulating supply is held on centralized exchanges. The lowest level since December, 2018.” by @WatcherGuru

Finally people started to listen!

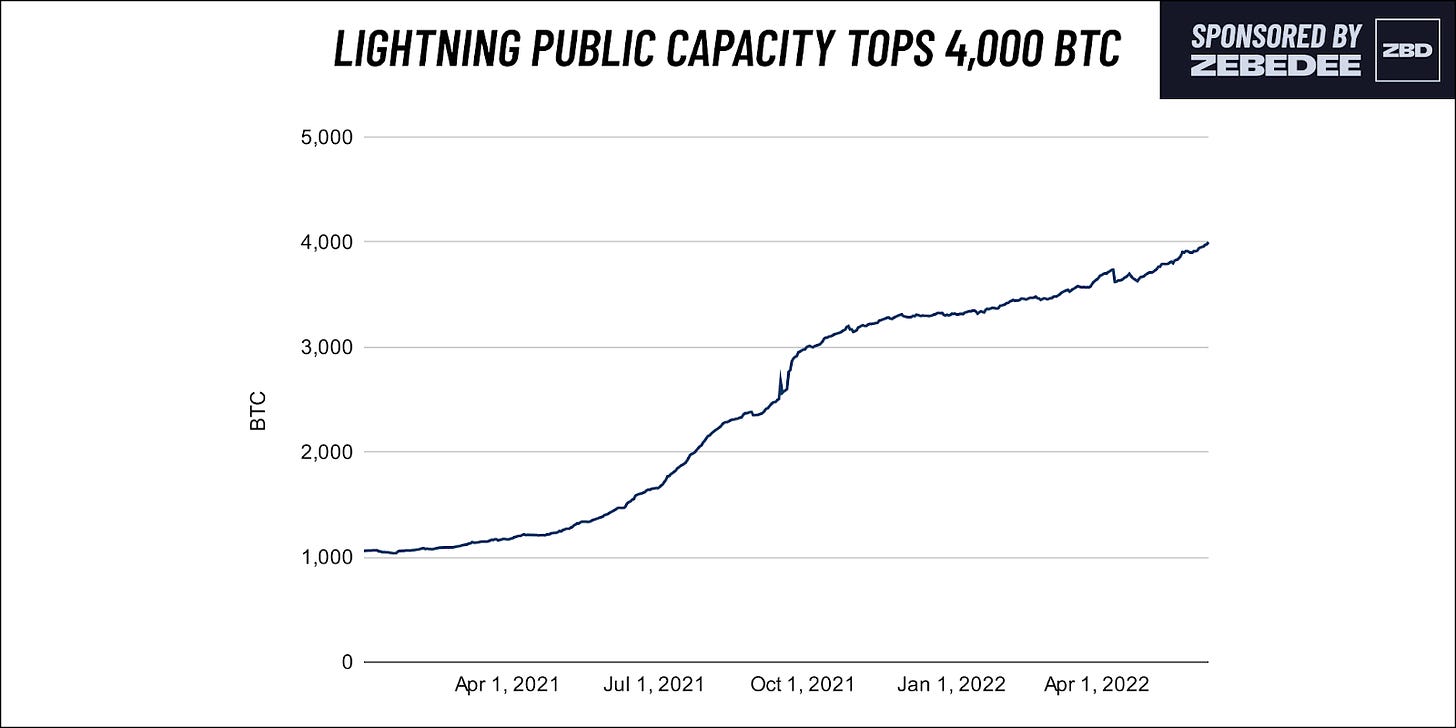

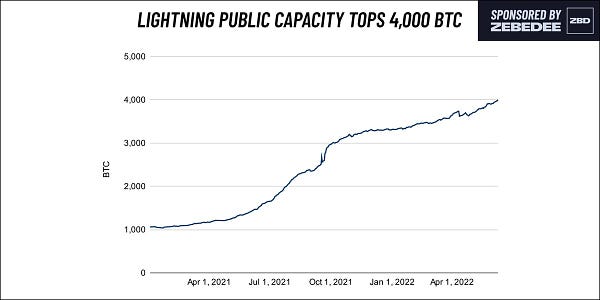

The Bitcoin Lightning Network capacity has surpassed 4,000 $BTC ($120 million).

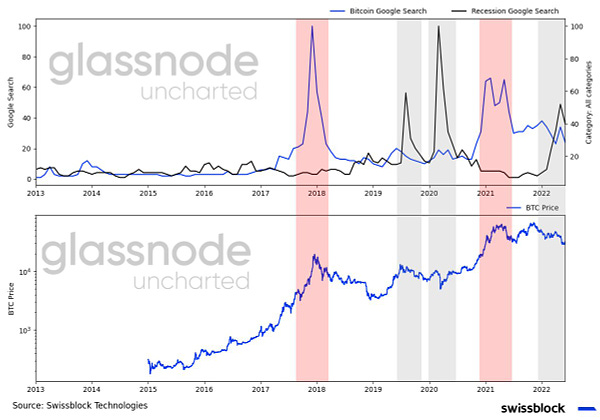

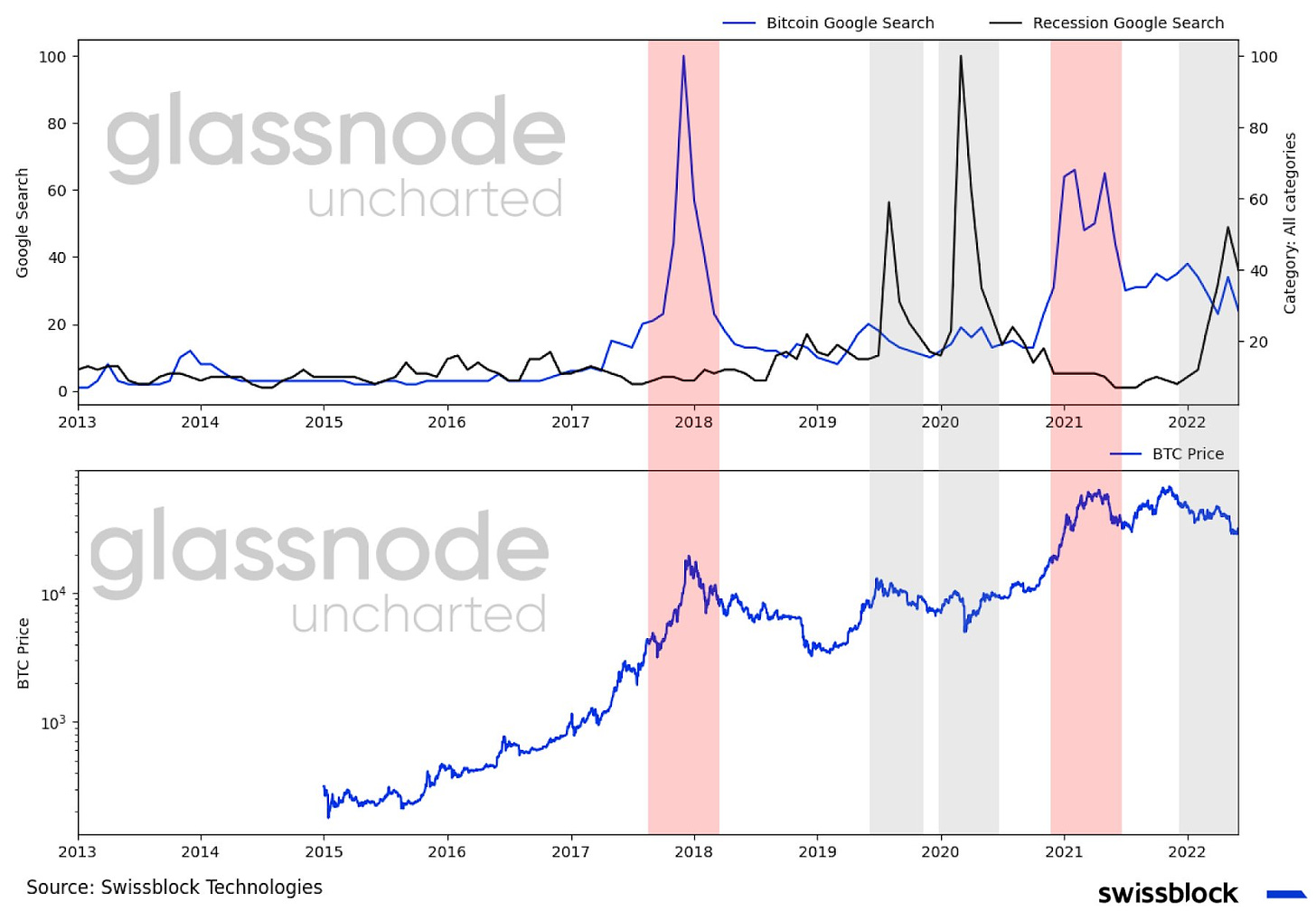

“The number of Bitcoin google queries is above 2019-2020 bear market levels despite the ongoing fear of a recession. The latest Uncharted expands on BTC's structural changes during a weak market and its potential as an alternative investment.” by @Negentropic_

“There is no single point of failure for the Bitcoin network” by @BlockwareTeam

Suggestions

Interesting articles to read

Russia Sees Extra $6.4 Billion Oil Revenue In June As Prices Rally

"Ticking Timebomb": 500,000 UK Small Businesses Could Imminently Go Bust

Bitcoin Bank Custodia Sues Federal Reserve, Demanding Decision On Master Account

Sources:

https://finance.yahoo.com/news/bitcoin-payments-local-taxes-works-012902177.html

https://bitcoinmagazine.com/business/bitcoin-transactions-are-illegal-ethiopian-central-bank

https://bitcoinmagazine.com/business/octagon-networks-converts-full-balance-sheet-into-bitcoin

https://finance.yahoo.com/news/paypal-finally-allowing-users-move-153603017.html?guccounter=1

https://bitcoinmagazine.com/business/fintech-company-edge-releases-bitcoin-mastercard

https://bitcoinmagazine.com/business/jack-dorsey-and-jay-z-announce-the-bitcoin-academy

https://www.btctimes.com/news/up-to-75-of-merchants-may-accept-bitcoin

https://www.btctimes.com/news/luxury-retailer-farfetch-will-accept-bitcoin-payments