This newsletter contains charts and other interesting pictures too. Some Email clients auto-block pictures, so don’t forget to enable them!

Bitcoin News

TL;DR

Russia has added a proposal to allow Bitcoin payments in foreign trade

Kazakhstan made $1.5 Million from Bitcoin mining fees

Towerbank in Panama just became Bitcoin friendly

Oman's OIA backs U.S. based flared gas Bitcoin miner

Kenya’s largest electricity producer has offered its energy surplus to Bitcoin miners

The U.S. government is working on policies to reduce energy consumption and emissions from bitcoin mining

New York Senate has passed a bill to ban Bitcoin mining

Bitzero announced they're building a $500 million Bitcoin mining facility

Block has partnered with Apple to integrate Square payments

Bitcoin HODLers are more than ever

Russia has added a proposal to allow Bitcoin payments in foreign trade

A proposal to permit companies to use Bitcoin and other shitcoins in cross-border settlements has made its way to a draft law designed to regulate Russia’s crypto space this year.There is a wider consensus among Russian authorities that cryptocurrency should not be accepted as legal tender in the country. The law “On Digital Currencies” bans the use of crypto assets as a means of payment but suggests recognizing them as an investment tool.

Let’s wait for the final implemented version of this law because maybe there will be a not welcomed trick in it. Making it for investments and trades would allow the country to gain a lot because it will make Bitcoin a legal tender in an indirect form in P2P trades.

Kazakhstan made $1.5 Million from Bitcoin mining fees

According to the report, 652 million Kazakhstani tenge ($1.5 million) in energy fees from Bitcoin mining was added to Kazakhstan’s budget in Q1 2022 after the government introduced a digital mining fee on Jan. 1, 2022.In late 2021, the Data Center Industry and Blockchain Association of Kazakhstan estimated that cryptocurrency mining could bring as much as $1.5 billion in revenue for the country in five years. As previously reported, Kazakhstan is one of the world’s largest countries by BTC mining hash rate. According to the latest update of the Cambridge Bitcoin Electricity Consumption Index, Kazakhstan was the third-largest BTC mining location in the world as of January 2022, with a hash rate share amounting to 13%.

Meanwhile a recent ESG (shit) study found that bitcoin mining can eliminate 5.32% of global methane gas emissions. I think you won’t hear anything about this study in the mainstream media.

Towerbank in Panama just became Bitcoin friendly

Towerbank, a top 30 banking institution in Panama, just declared itself bitcoin-friendly in an announcement on Twitter from Cristobal Pereira, the executive director of the Latam Blockchain Summit, the meetup where Towerbank made the announcement.

A video released by the Blockchain Space Instagram account shows Towerbank's vice president of product, Gabriel Campa, explaining the institution is studying bitcoin and other cryptocurrencies.

Campa further explained "And we hope to have something soon to offer our customers," referring to product offerings for bitcoin-based products.

To open a bitcoin friendly account, he said you will need the following:

“They must only present the following requirements: name, ID card or passport, telephone number, email, activity in which they are engaged, place of work, monthly income and place of residence.”

Now if you open a Bitcoin friendly account everyone at the Bank and in the government will know you are interested in Bitcoin. In case of a similar like with the EO 6102 (Gold confiscation) was they know where they will find all their citizens with a Bitcoin stash and of course they will instantly confiscate all the Bitcoin from the Bank account too. Don’t forget that if you hold any amount in any custodial wallet, those bitcoins are not yours! Not your key, not your coins!

Oman's OIA backs U.S. based flared gas Bitcoin miner

Oman Investment Authority (OIA) took part in a $350mn equity round that Crusoe Energy Systems held in April. The Denver-based start-up will open an office in Muscat, Oman, and deploy generators and mining equipment for capturing gas at well sites."We've always felt it was important for us to have a presence in the MENA region," Crusoe CEO Chase Lochmiller said, according to Bloomberg. "Having the buy-in from nations that are actively trying to solve the flaring issues is what we are looking for."

Crusoe held a workshop in Oman on May 31 with the country's largest producers including OQ SAOC and Petroleum Development Oman. Its first Middle East pilot project will be launched by the end of this year or in early 2023.

Kenya’s largest electricity producer has offered its energy surplus to Bitcoin miners

Kenya’s giant energy production company KenGen has offered to supply Bitcoin mining companies with surplus geothermal power following increased demand from different operators.“We’ll have them here because we have the space and the power is near, which helps with stability. Their power requests vary, some of them had asked to start with 20MW to be later graduated. Crypto mining is very energy-intensive,” said Peketsa Mwangi, KenGen’s geothermal development director.

If the plan is realized, Kenya will join El Salvador in exploiting new forms of energy to mine Bitcoin. After declaring Bitcoin as a legal tender, the central American country began the historic mining through volcanic power.

The U.S. government is working on policies to reduce energy consumption and emissions from bitcoin mining

Some of you know what happened in the 70s after leaving The Gold Standard. The government, to stop the ever rising prices of Eggs, made some bullshit scientific stories to make people believe that “Eating eggs is raising cholesterol”. Their plan was to make people eat less eggs, so the prices of eggs won’t rise so fast. Yeah it needed around 40+ years to wipe this nonsense and to delete eggs from the Smartplate.Now as with other things too history began to repeat itself. Some of you (like myself) have a Deja Vu feeling when you first heard about this news: The Biden administration is crafting policy recommendations aimed at lessening the energy consumption and emissions footprint of Bitcoin and other proof-of-work (PoW) shitcoins, according to a report from Bloomberg Law.

“It’s important, if this is going to be part of our financial system in any meaningful way, that it’s developed responsibly and minimizes total emissions,” Samaras reportedly said. “When we think about digital assets, it has to be a climate and energy conversation.”

New York Senate has passed a bill to ban Bitcoin mining

To address some of the environmental issues surrounding cryptocurrencies, the New York State Senate passed a bill targeting proof-of-work (PoW) mining early Friday morning. The PoW method of consensus is used by Bitcoin (BTC) and some other crypto projects to validate transactions.Because of the low cost of hydroelectric electricity, New York has long been viewed as a desirable location for Bitcoin and shitcoin mining companies to set up shop. In recent years, mining companies have reused decommissioned coal power plants for their use.

Yeah, New York state is going back into a barbaric era even if you still think that “ESG is good”. Their citizens' and miners' last hope is that the governor will veto it.

Bitzero announced they're building a $500 million Bitcoin mining facility

Bitzero Blockchain Inc., a 100% renewable bitcoin mining company, is making North Dakota the central headquarters for its North American operations.In a press release the company officials stated plans to invest $400-$500 million in the upcoming data center and also announced plans to partner with MHA Nation’s greenhouse project which will allow heat from Bitzero operations to be used for food production throughout the year.

“It helps Main Street, it helps every citizen, it takes our state off the dependence of being, as we have been for over 100 years, dependent on revenues at the state level,” said North Dakota’s Governor Doug Burgum.

Block has partnered with Apple to integrate Square payments

Block will work with Apple to integrate Square payments with the "Tap to Pay" feature on iPhones and launch it later this year, the fintech company said on Thursday.The company said sellers would be able to accept in-person contactless payments with only their iPhone and a Square Point-of-Sales (POS) app, without the need for additional hardware.

This literally means that potentially Bitcoin could be used for payments on every Iphone with the “Tap to Pay” feature.

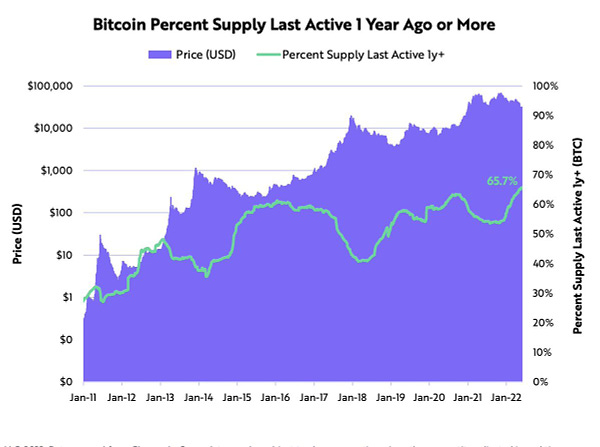

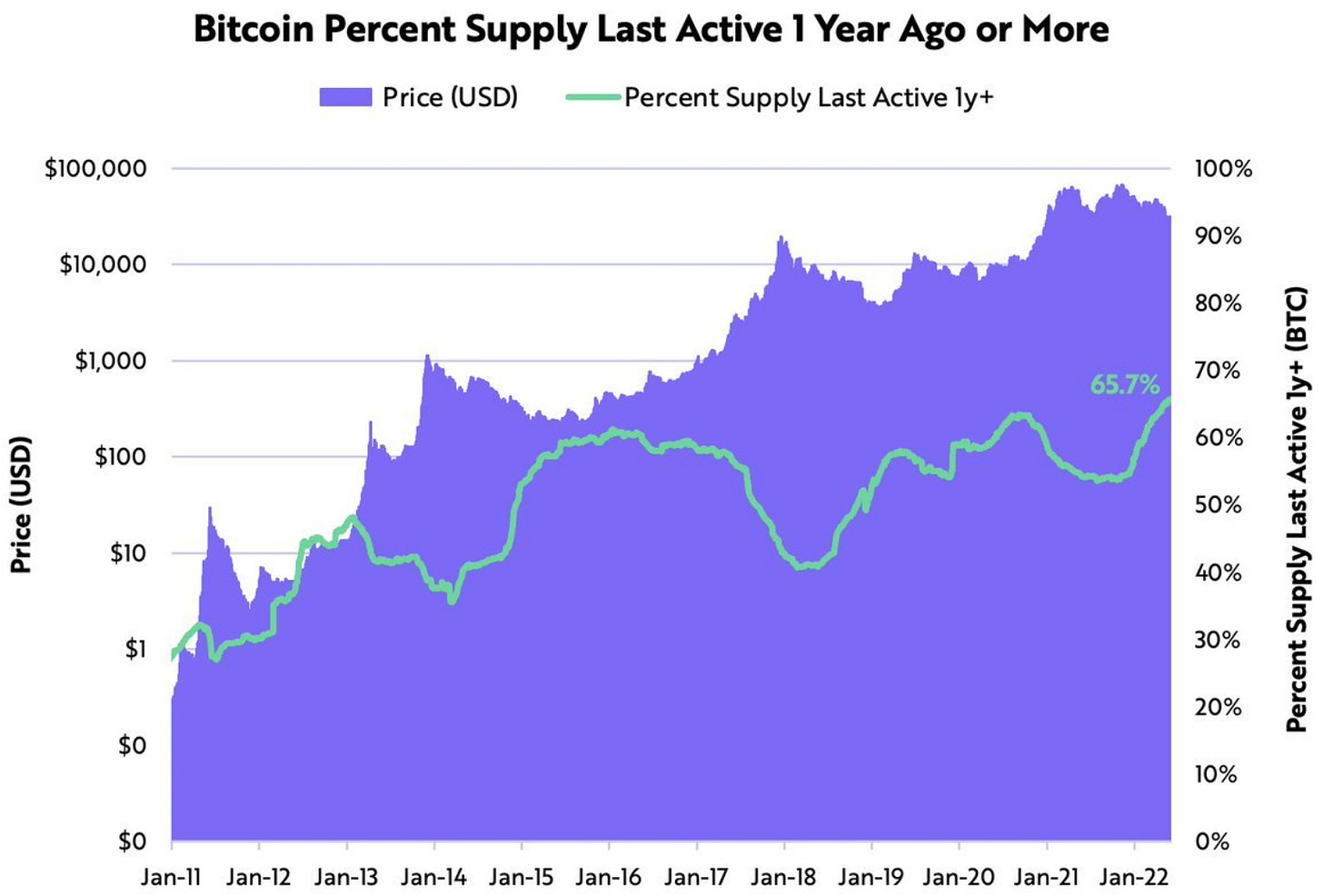

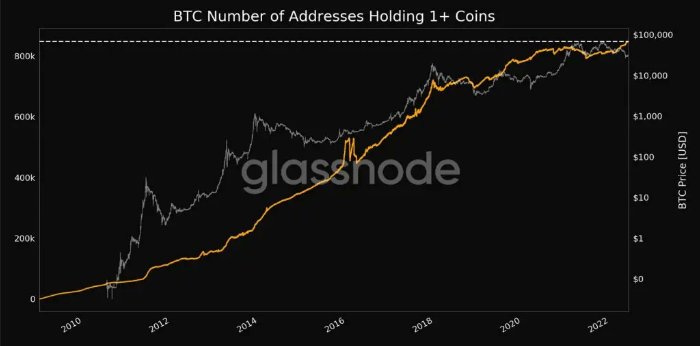

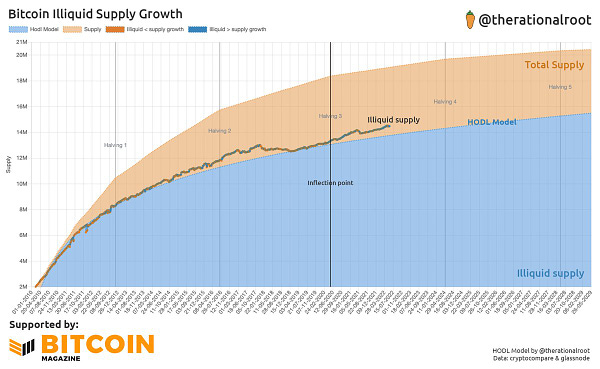

Bitcoin HODLers are more than ever

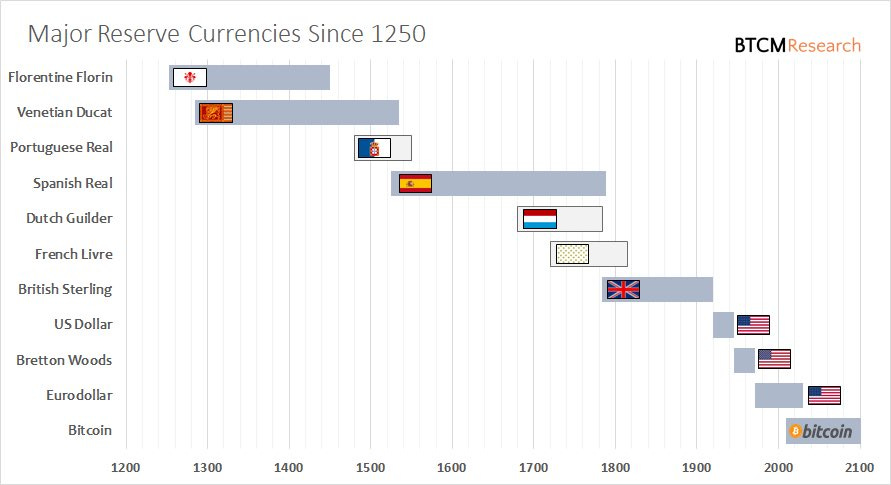

“Nearly 66% of bitcoin has not moved in over a year, marking an all-time high. HODLers have never had more conviction. This is bullish.” by Dan HeldThe chart above tells more things than you maybe can imagine. People think that the price of Bitcoin is mostly driven by a group of wealthy speculators. No model can accurately predict its price because it’s way more complicated than that. Never in history existed a medium of exchange like Bitcoin because of its strict issuance rules, but yet history began to repeat itself like it was with all the previous hardest mediums of exchange like Gold. More and more people start to hold it for a longer time period just purely for its monetary properties and don’t care for its actual price. Don’t forget this chart doesn’t mean that the remaining 34.3% sold its coins, just maybe those were moved from one wallet to another or just regrouped them into fewer addresses (UTXO consolidation).

Global Economic News

TL;DR

Goldman says bull market in battery metals is finished for now

Global stocks have gained $3.6tn in market cap

Spanish inflation soared

Germans consumers 2022 food bills gone up heavily because of rising inflation

El Salvador had a 165% increase in tourist numbers

The oil price is still cheaper than it was in 2008

Why this recession will be the harshest one in the U.S. history

Turkey's annual inflation reaches 73.5%

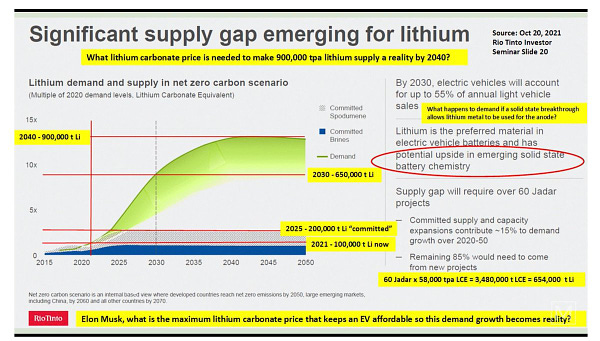

Goldman says the bull market in battery metals is finished for now

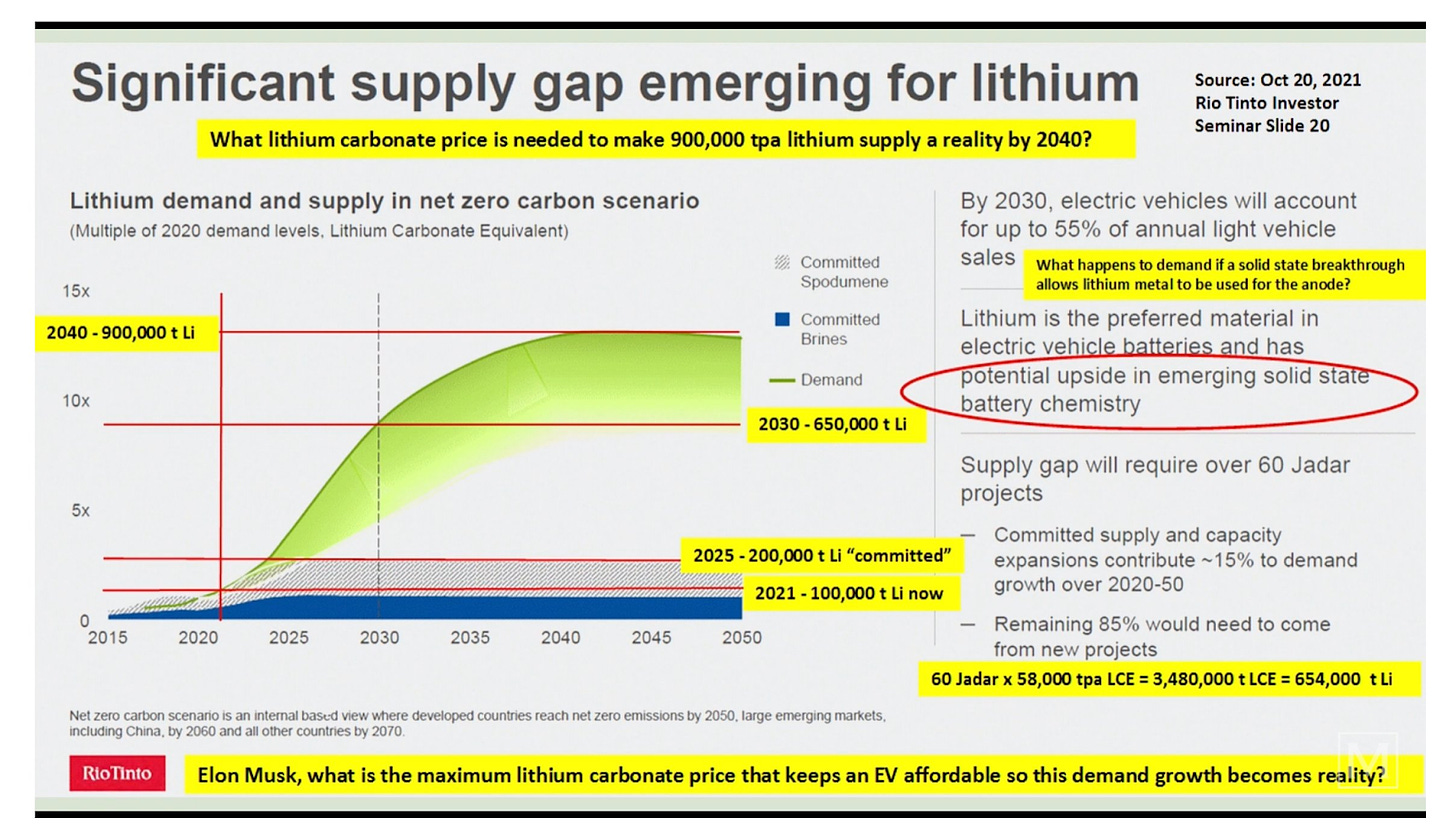

Cobalt, Lithium, Nickel to fall in the next two years. A new bull market may start in the second half of this decade.“Investors are fully aware that battery metals will play a crucial role in the 21st century global economy,” Goldman analysts including Nicholas Snowdon and Aditi Rai said in a note on Sunday. “Yet despite this exponential demand profile, we see the battery metals bull market as over for now.”

Still they predict, prices could soar again after 2024.

“This phase of oversupply will ultimately sow the seeds of the battery materials super cycle over the second half of this decade,” the bank said. Then, “the demand surge will more sustainably overcome current supply growth.”

Global stocks have gained $3.6tn in market cap

“Global stocks have gained $3.6tn in mkt cap w/a positive feedback loop may be forming, as @knowledge_vital puts it, whereby stocks rally, inflation cools, Fed tightening expectations abate, yields drop, Shanghai reopen, recession fears diminish, all of which drives more buying.” by Holger Zschaepitz

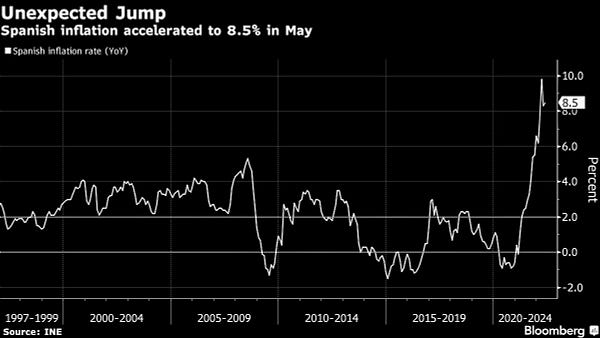

Spanish inflation soared

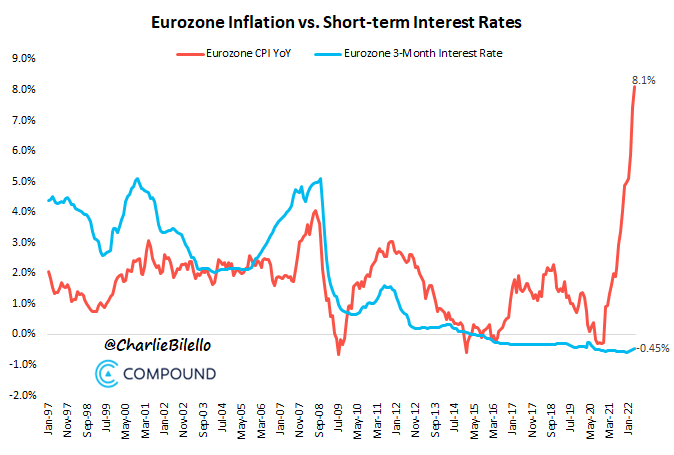

“Spanish inflation unexpectedly quickened, denting hopes that Eurozone’s record price surge is peaking and piling more pressure on the ECB to act. Consumer prices jumped 8.5% in May vs 8.3% expected. Spain’s core inflation quickened to 4.9%.” by Holger Zschaepitz

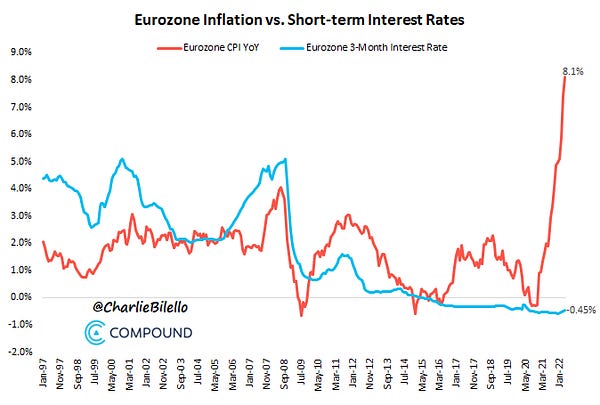

Meanwhile the Eurozone inflation hits 8.1%, but Switzerland is having only 2.4% inflation. Why? Because they were less greedy and printed less Swiss Franc. But everyone should take Michael Saylor long term solution:

“Inflation in Europe has reached a 50 year high, emblematic of the collapse of the currency and contraction of the economy. There is no simple cure for the disease of stagflation, but Bitcoin remains the best therapeutic.”

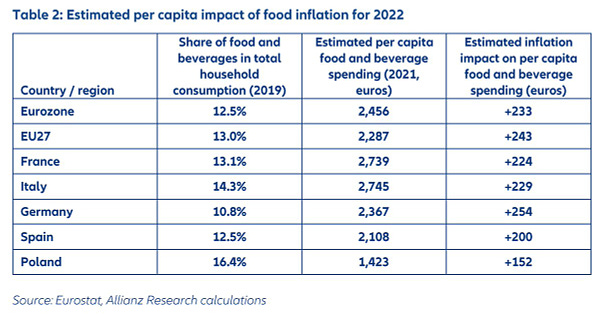

Germans consumers 2022 food bills gone up heavily because of rising inflation

“Germany where consumers should brace for €254 surge in their 2022 food bills. This means that Germans face significantly higher additional costs than other consumers in Europe, even though they spend just 10.8% of their budget on food, Allianz has calculated.” by Holger Zschaepitz

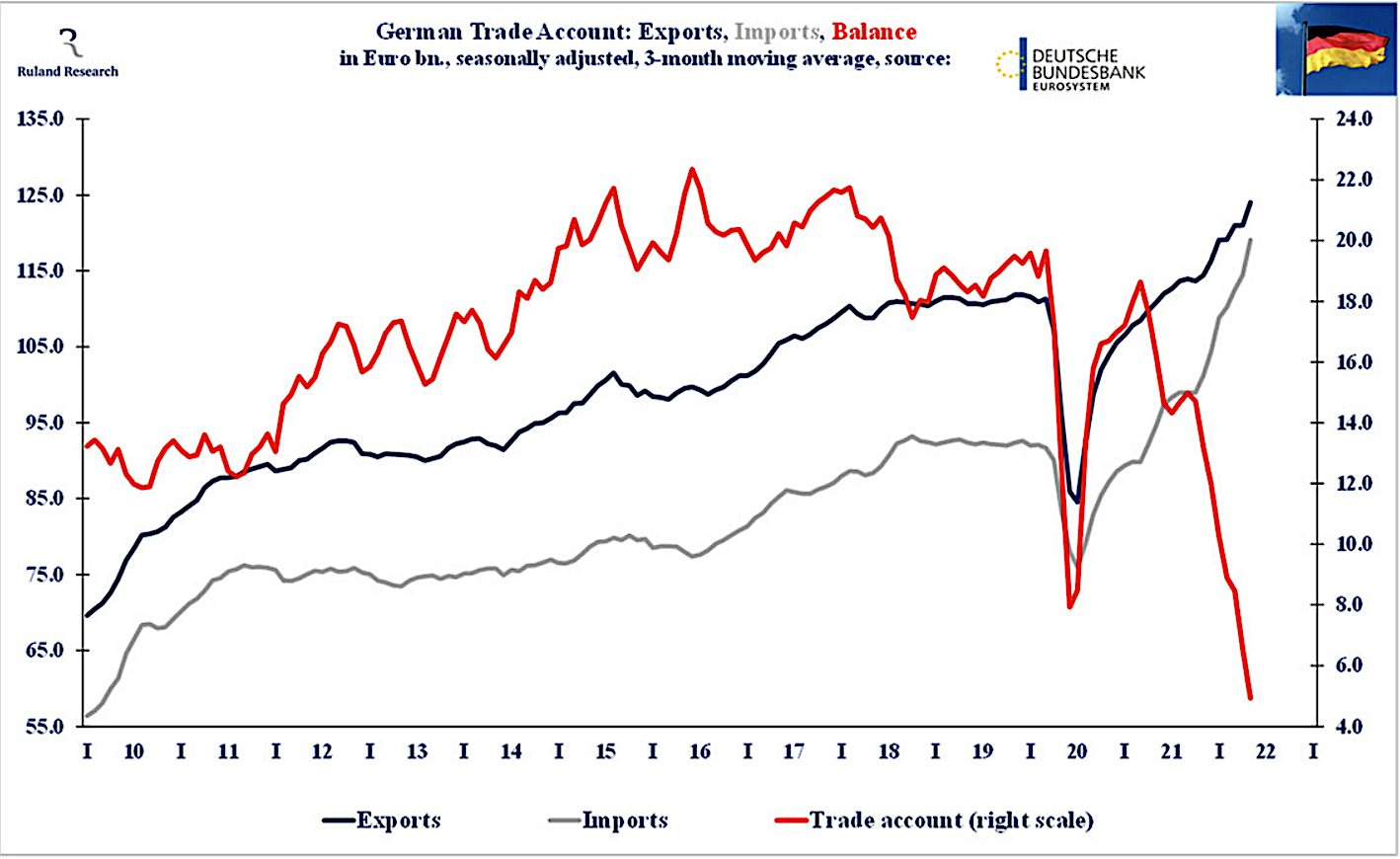

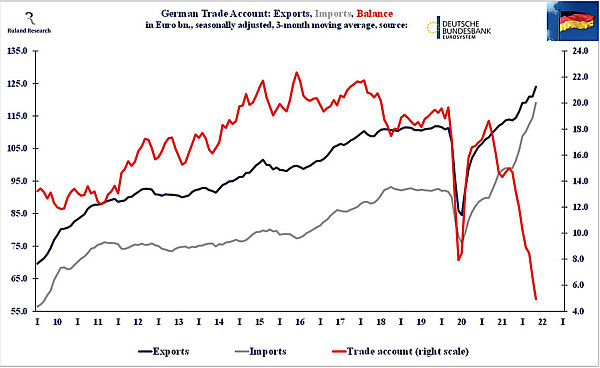

“Germany has reported a trade surplus of only €1.3bn in the month of April, the lowest figure since 1992.” by @thesiriusreport

“Terms of trade continues to deteriorate, which weighing heavily on trade account surplus. In last 3mths over prev 3mths trade account surplus fell 45%. Terms of trade set to fall further which is neg for growth & corp's profit margins. (via Ruland)” by Holger Zschaepitz

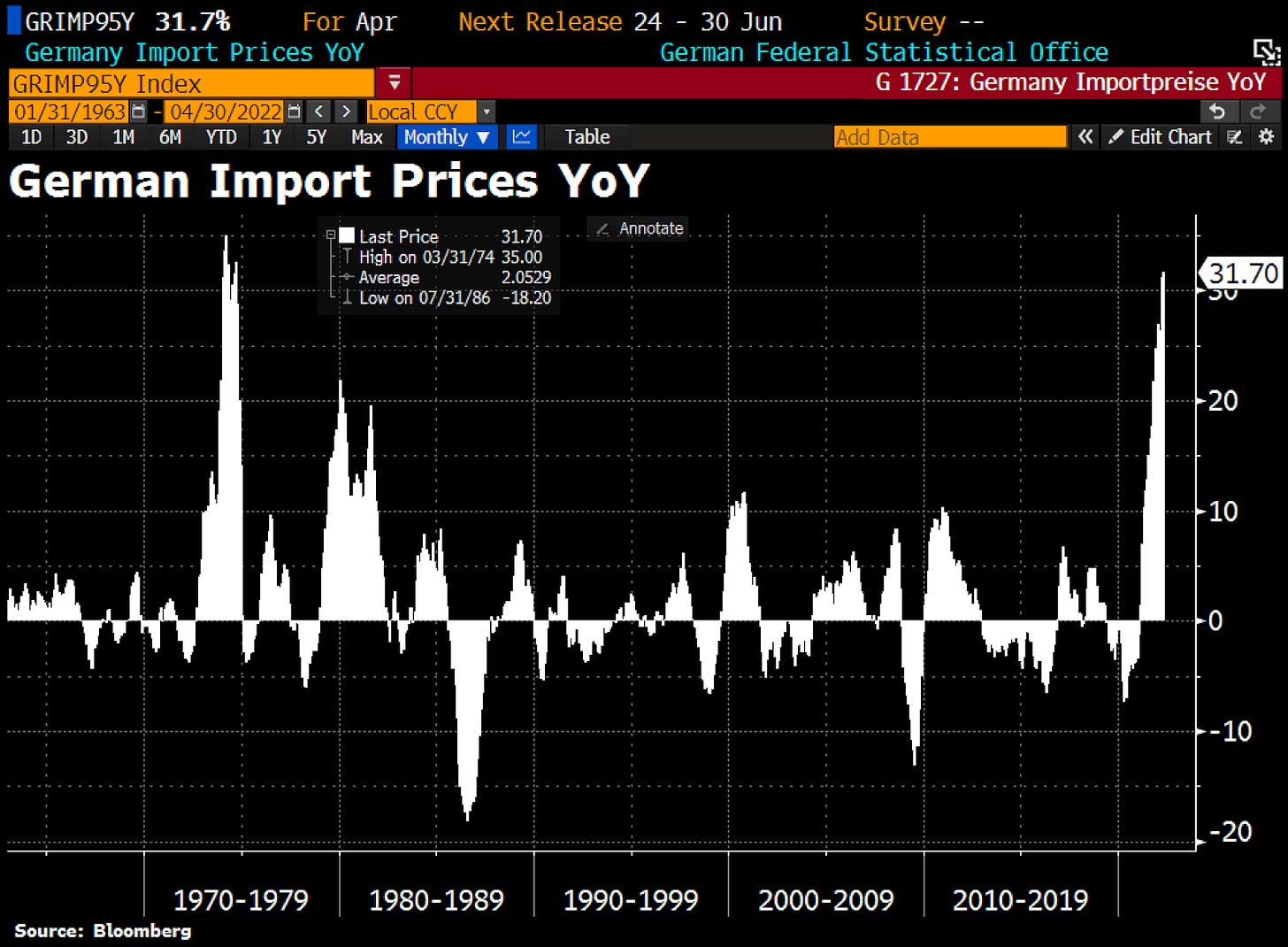

“Germany's inflation pressures keep rising: German import prices quickened to 31.7% in April YoY from 31.2% in March and most since Sep1974 during the first oil crisis (+32.6% YoY).” by Holger Zschaepitz

Germany's annual inflation rate accelerated to 7.9% in May, its highest level in nearly half a century, according to an official estimate Monday.

The Federal Statistical Office said year-on-year inflation jumped from 7.4% in April, with energy prices 38.3% higher than in May last year and food prices up 11.1%. Germany has Europe's biggest economy.

In comments shortly before the latest inflation figure was released, Finance Minister Christian Lindner said that “the top priority must be fighting inflation.”

“Inflation is an enormous economic risk and we must fight this inflation so that no economic crisis grows out of it, so that no spiral develops through which inflation feeds itself,” Lindner said.

Did Mr.Lindner ever talk to an Austrian economist? I think never because their plan is to pour gasoline into a wildfire. But of course this train is already gone, the vast amount of money already printed can’t be undone.

El Salvador had a 165% increase in tourist numbers

During the first quarter of this year, El Salvador received 521,000 tourists who left an income of more than $352.7 million, said the president of the Central Reserve Bank, Douglas Rodríguez, in a television interview.

That figure represents 165% more than the country received in the same period of 2021, when 197,000 tourists entered and spent $235.6 million.

You all know that I like to follow El Salvador because it’s the first Bitcoin “pilot program” run in a country. I think this rise of tourism is definitely caused by making Bitcoin a legal tender in the country which made a world wide advertisement for them. The country is already economically in a net positive even if we don’t count in the future gains of already purchased bitcoins.

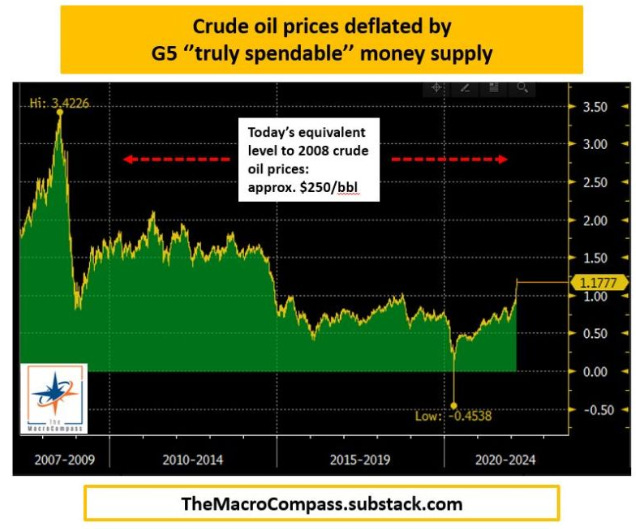

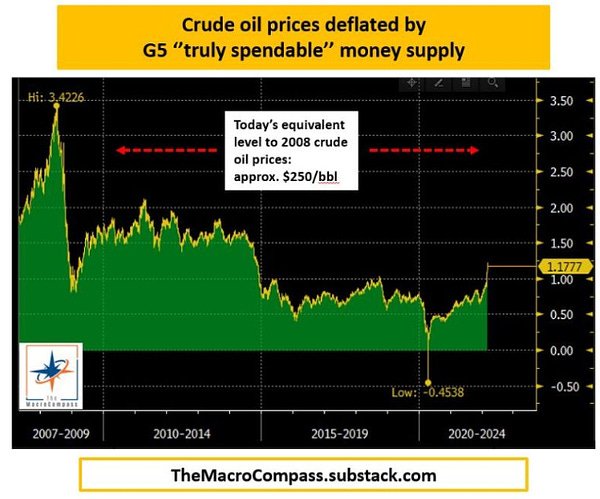

The oil price is still cheaper than it was in 2008

“The highest oil price ever was $147/bbl in 2008. BUT. Oil is denominated in fiat currency, and there has been A LOT of spendable money printing over the last 15y.

If you think the market gets as extreme as 2008, the equivalent oil price in today's USD would be above $250/bbl.

Wages haven't grown nearly as quick as spendable bank deposits for the private sector though, and the distribution has been pretty uneven too. This means that consumers would start to feel the heat way below $250/bbl, but still worth to look at Crude Oil prices in ''real'' terms.” by @MacroAlf

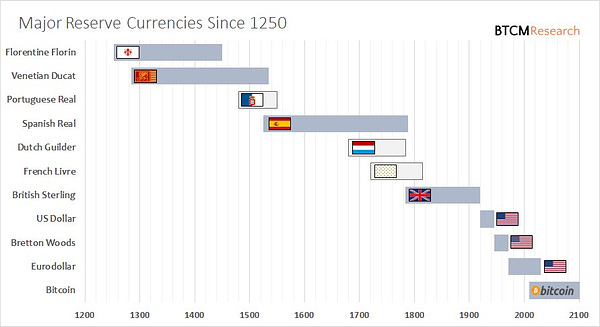

Why this recession will be the harshest one in the U.S. history

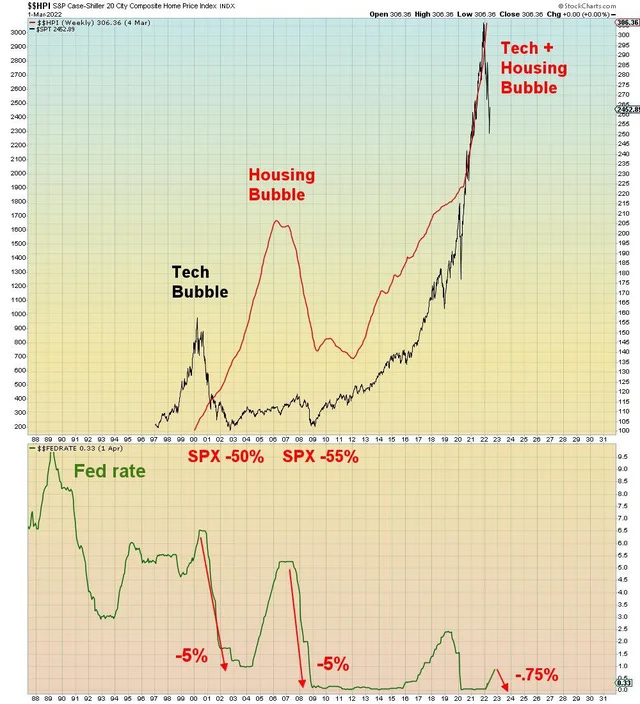

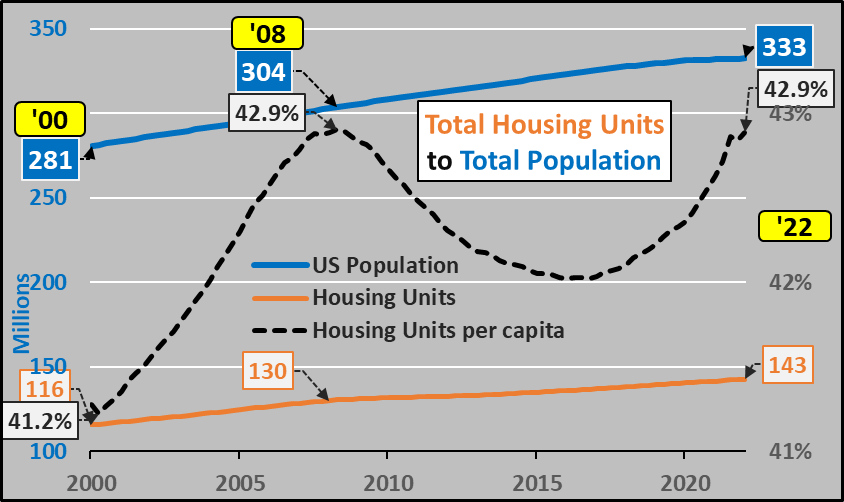

“We have a parabolic housing bubble AND a collapsing Tech bubble, this time with no safety net beneath the economy. Yet both gamblers AND economists are convinced this bear market and this recession will be the easiest of the three.” by @WallStreetSilv

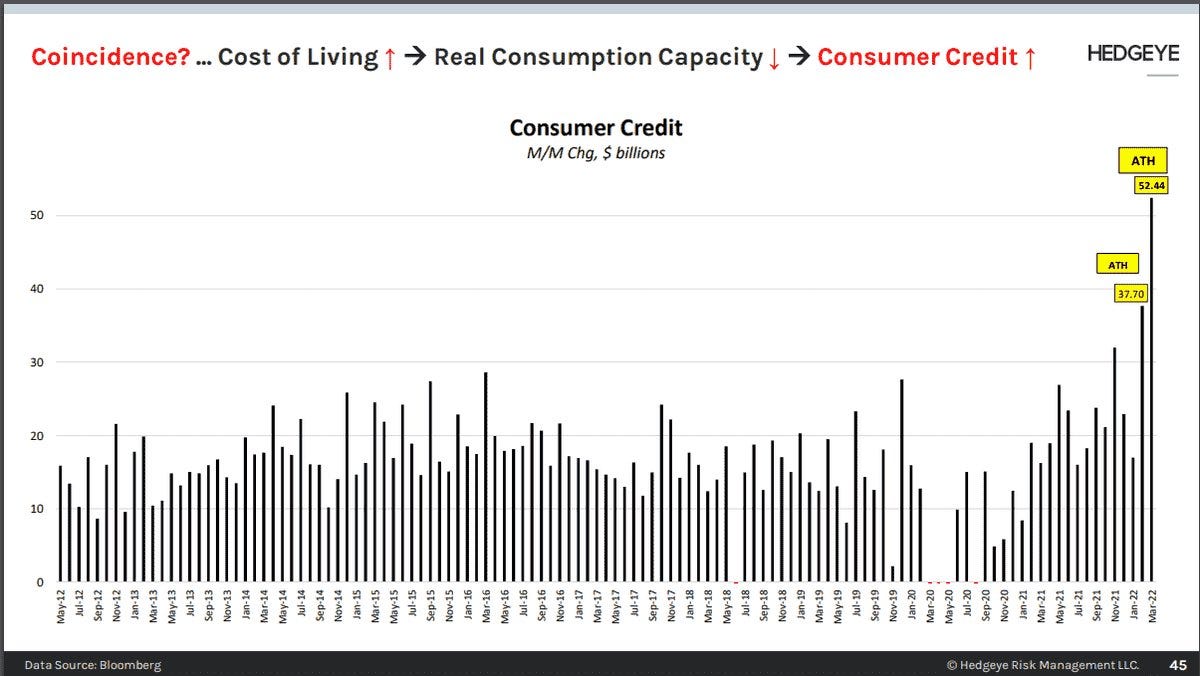

“Consumer weakening quickly, using more credit, saving less than in 2019. What could go wrong?“ by @AdamKiesel

Meanwhile 36% Of Americans Making $250,000 Are Living Paycheck To Paycheck and small businesses crushed.

If you still think Real Estate investment is still a good idea, you’re lost. It’s time to learn that a house or apartment is just a consumer good, not a good investment. Soon the market will price in these real estates, but this time because of Bitcoin it will be priced in for good!

Turkey's annual inflation reaches 73.5%

“Turkey’s official inflation rate hit a 23y high as President Recep Tayyip Erdoğan’s unorthodox strategy for managing the country’s $790bn econ continued to backfire.” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

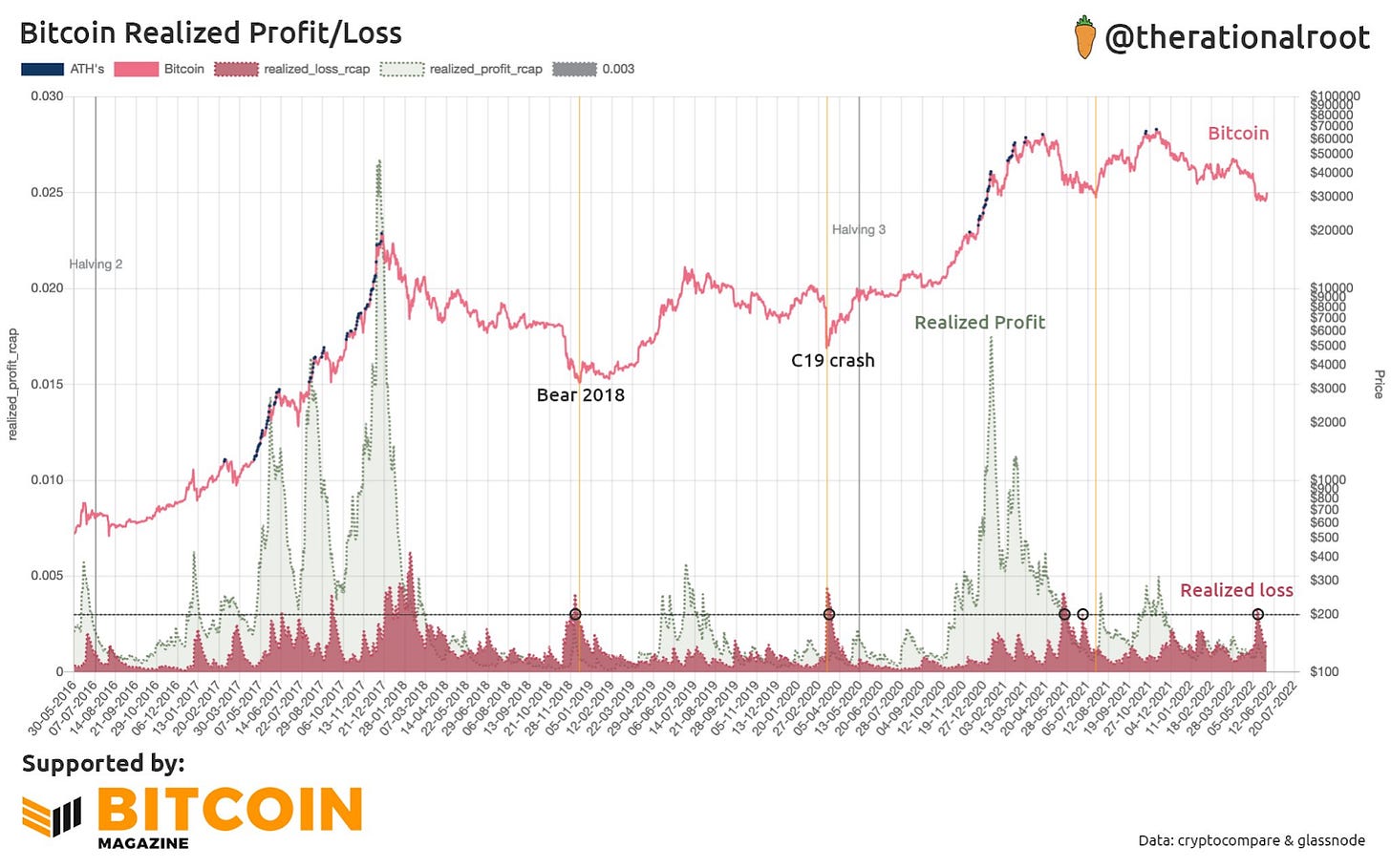

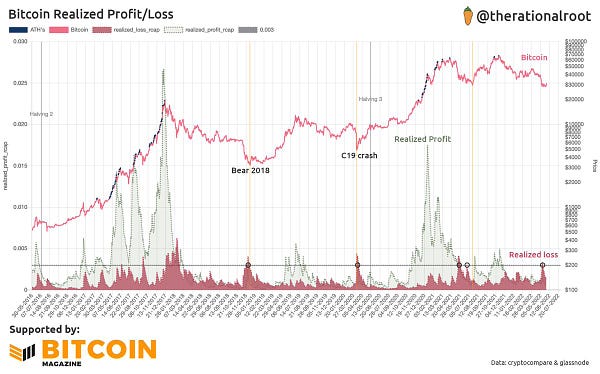

“During bear markets it's rare to have these large spikes of realized losses.” by Root

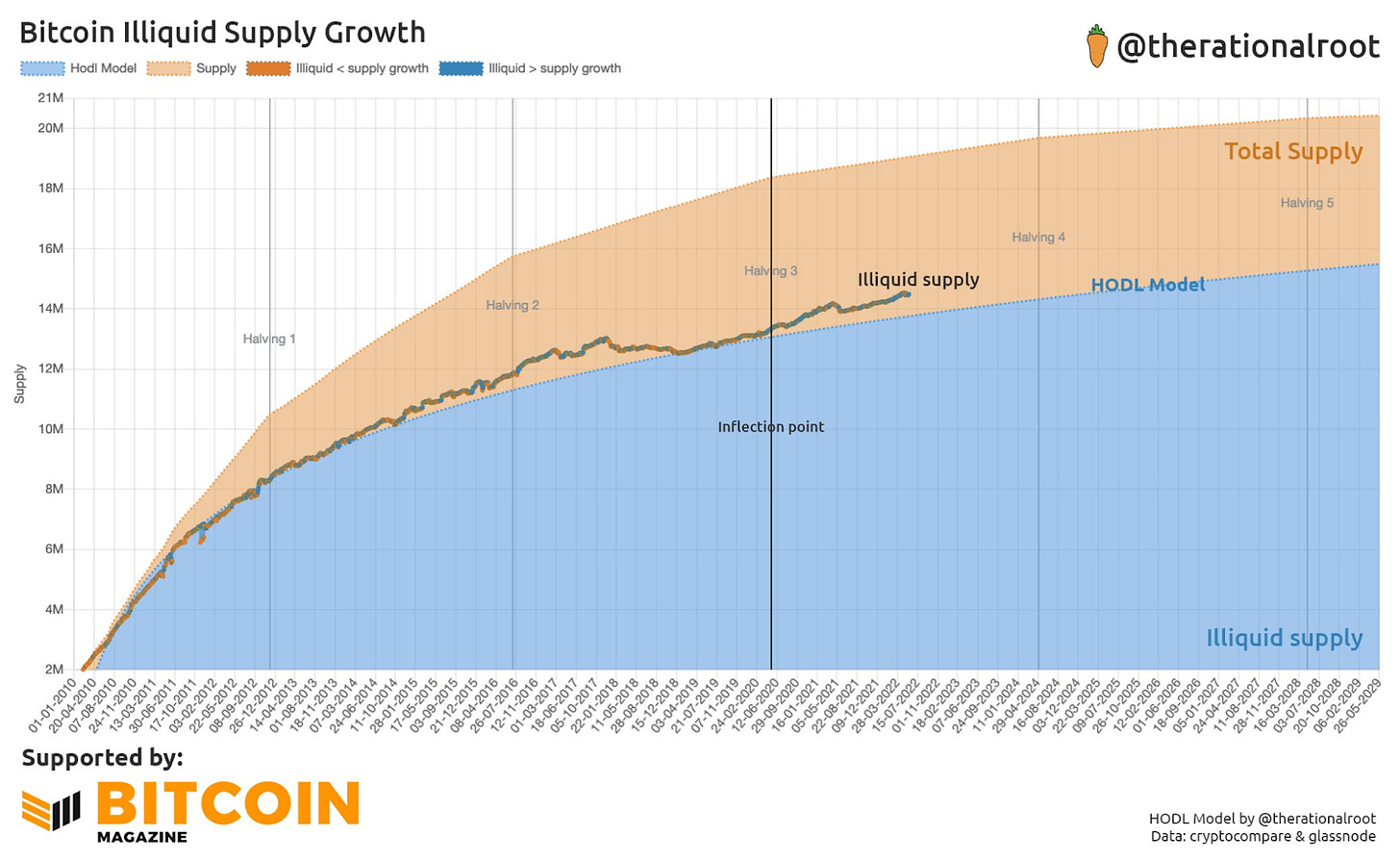

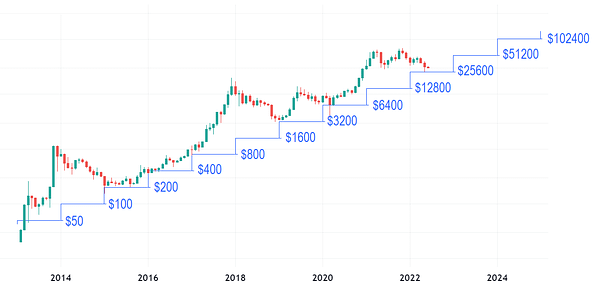

“Biggest macro trend in Bitcoin — since the 3rd Halving illiquid supply is outpacing new supply issuance — digital scarcity.” by Root

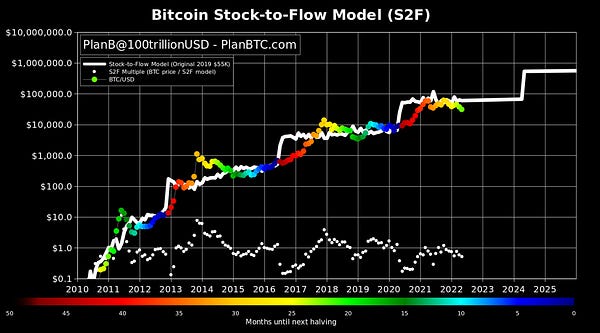

“Bitcoin May close $31,762 .. lowest monthly close since Dec 2020” by PlanB

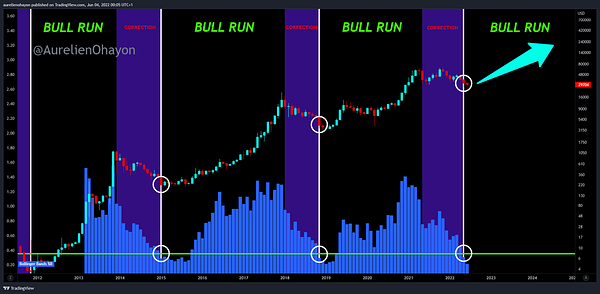

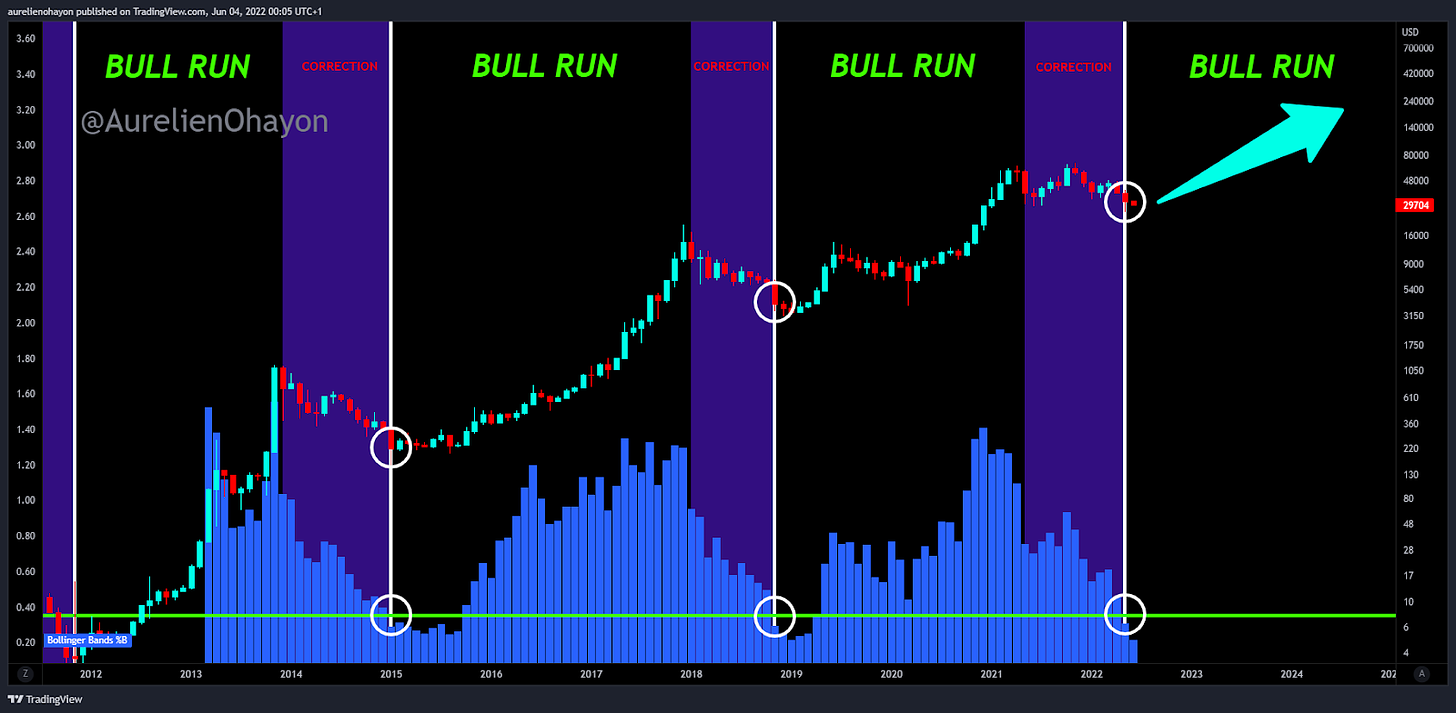

“Bitcoin The future.” by @AurelienOhayon

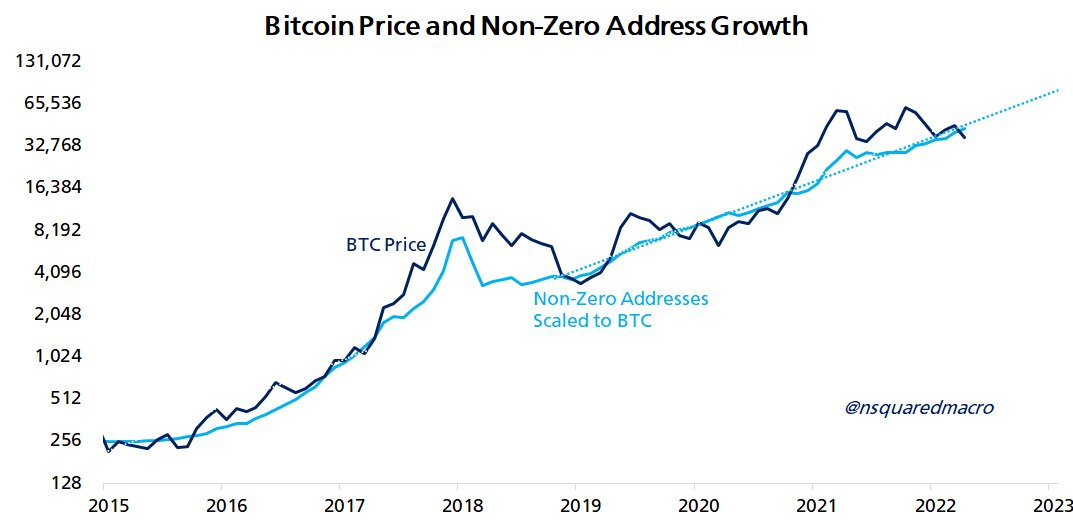

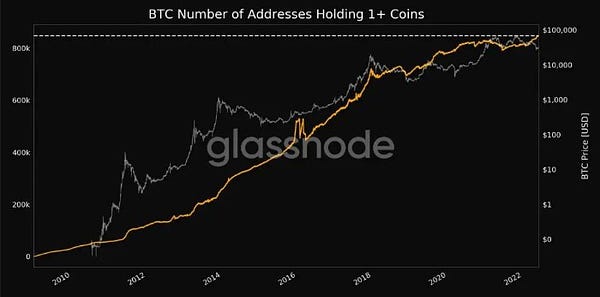

“Based solely on non-zero addresses, #bitcoin could hit a new all-time high this year.” by @nsquaredmacro

“Bitcoin 2X every year. Ignore the price bubbles. $100000 before 2025” by @bitharington

“What if..? If you look closely, it's always the same pattern, except that the cycles happen faster in time (from bottom to top).” by @el_crypto_prof

“THE 4TH GREAT BULL RUN BEGINS. Indicator : The Monthly Percent Bandwidth (%B). The Halving Cycle Theory is dead.” by @AurelienOhayon

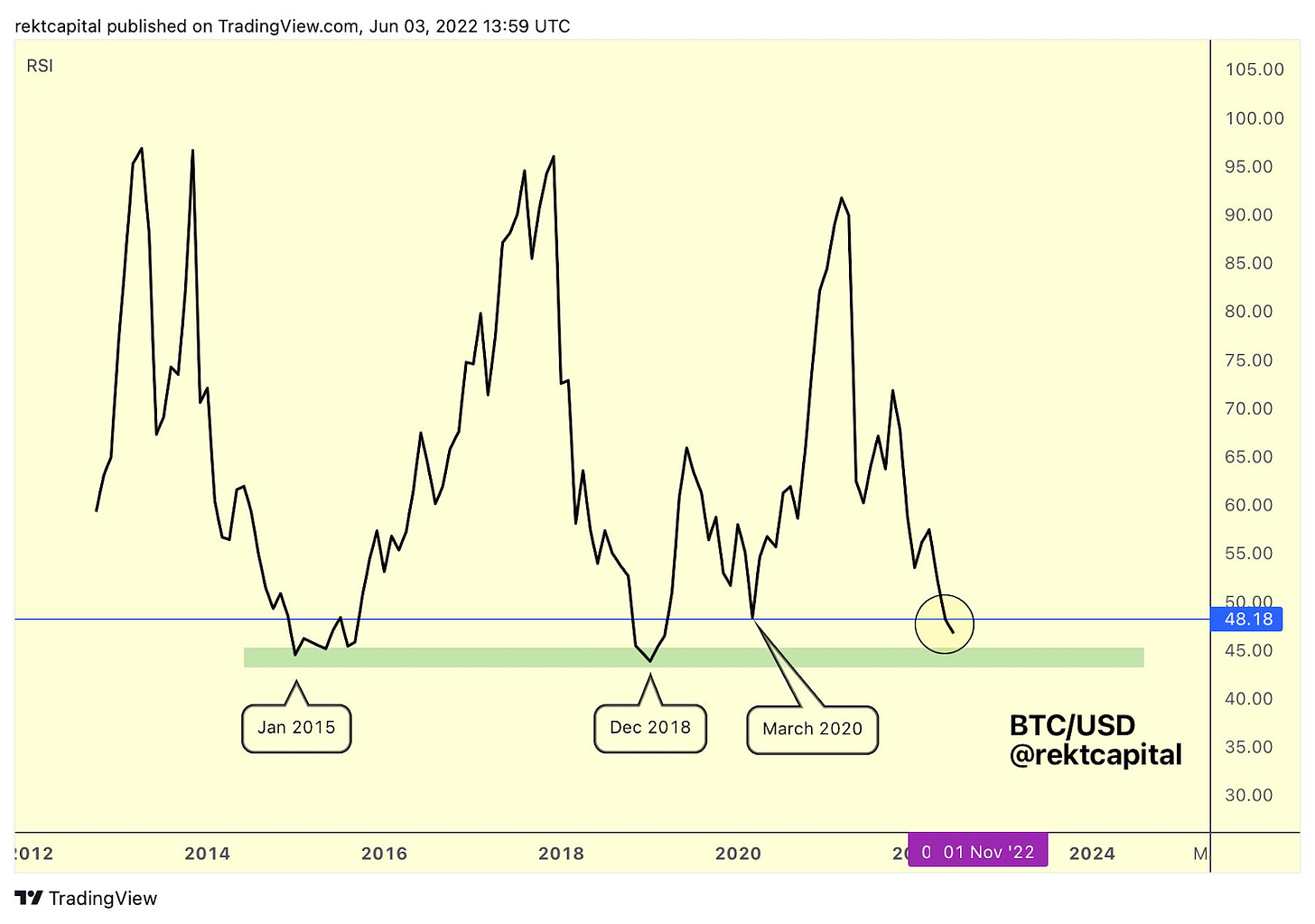

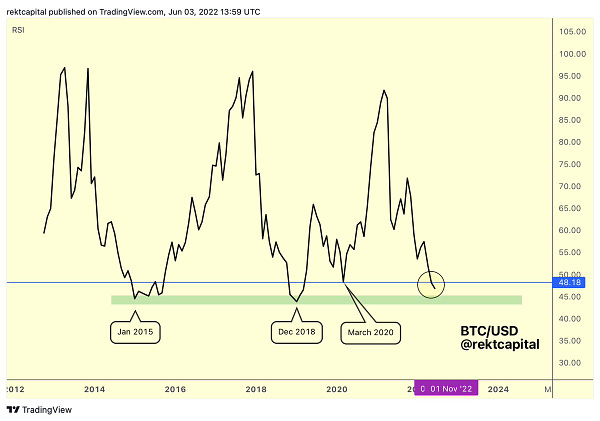

“BTC RSI has broken down from March 2020 levels” by @rektcapital

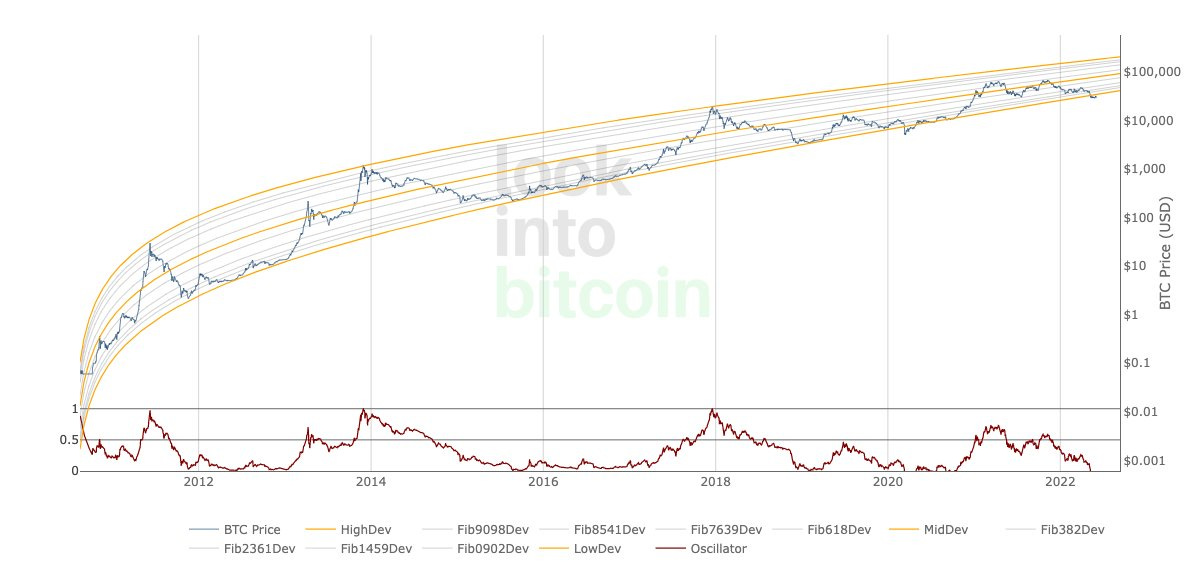

“For ONLY the second time in Bitcoin's history we are below the bottom of the Logarithmic Growth Curve Current Bottom = $34,190“ by @TheRealPlanC

Bitcoin Shorts

Funny Bitcoin short stories

Central African Republic President: “Bitcoin is the currency of the universe.” Why the Central African Republic intends to press ahead with Bitcoin

“bitcoin produces freedom” by @Superalkaline11

While some centralized shitcoin halts, Bitcoin uptime:

It’s inevitable

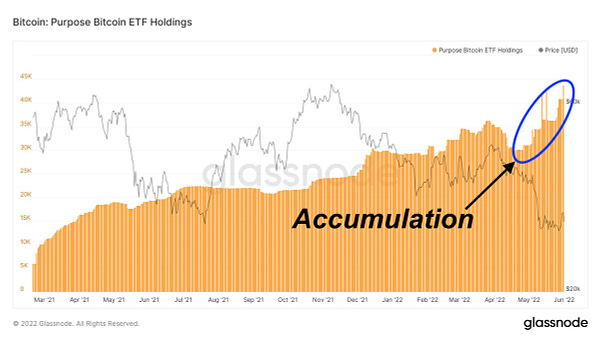

The Whales are buying Bitcoin. +13,000 bitcoin in 6 weeks!

Addresses Holding at Least 1 bitcoin Hits All-time High of 848,082.

German Finance Ministry: The German government opposes an EU ban on self-hosted wallets (more details here).

International shipping companies want to pay for oil with Bitcoin and shitcoins, says President of CI International Fuels

BLOOMBERG: Bitcoin will be one of 'best assets on Earth’ when the Fed pauses rate hikes.

Suggestions

Interesting articles to read

Davos Reveals Building-Blocks For "Green" Social-Credit System

Brent Tops $122 After EU Agrees On "Partial" Ban Of Russian Oil

Czech Republic To join Poland And Hungary In Central European Gold Rush

EU Slowly Weaning Off Russian Crude Gives Moscow Time To Divert Flows To Asia

Sources:

https://news.yahoo.com/german-inflation-rate-hits-highest-122909075.html

https://cointelegraph.com/news/here-s-how-much-kazakh-gov-t-made-off-crypto-mining-in-q1-2022

https://gaspathways.com/oman-backs-us-crypto-miner-to-cut-flaring-897

https://cryptonews.net/news/mining/7560329/

https://bitcoinmagazine.com/business/white-house-to-reduce-bitcoin-energy-use-report

https://watcher.guru/news/new-york-senate-passes-bill-targeting-bitcoin-proof-of-work-mining

https://bitcoinmagazine.com/business/bitcoin-miner-bitzero-to-build-headquarters-in-north-dakota