Bitcoin News

TL;DR

Nayib Bukele: 44 countries met in El Salvador to discuss Bitcoin (UPDATED!)

Portugal will lose crypto tax haven status

Texas Pacific Land Corporation announces a new 60 MW Bitcoin mining venture

Indian regulators have proposed banning public figures from promoting Bitcoin

China re-emerges as the 2nd largest Bitcoin mining hub

The Bolt Card is the first offline Lightning contactless card (UPDATED!)

The Block plans to sell open-source Bitcoin mining ASICs

Russia legalizing Bitcoin it's just a matter of time

Bitcoin Education is launching for 40 High Schools in Argentina

Tag Heuer now accepts Bitcoin for online purchases

Swiss bank Julius Baer offers Bitcoin services

Nayib Bukele: 44 countries met in El Salvador to discuss Bitcoin (UPDATED!)

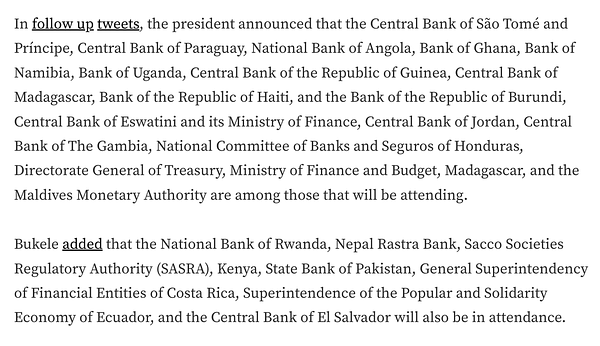

You will think I’m making this up, but in line this is the 3rd week that I’m starting writing this newsletter with positive vibe news. Can’t wait what will be on next week!President Nayib Bukele announced on Twitter that 32 central banks and 12 financial authorities from 44 countries are to meet on Monday, May 16, to discuss financial inclusion, digital economy, banking the unbanked, El Salvador’s Bitcoin rollout and its benefits in the country.

In follow up tweets, the president announced that the Central Bank of São Tomé and Príncipe, Central Bank of Paraguay, National Bank of Angola, Bank of Ghana, Bank of Namibia, Bank of Uganda, Central Bank of the Republic of Guinea, Central Bank of Madagascar, Bank of the Republic of Haiti, and the Bank of the Republic of Burundi, Central Bank of Eswatini and its Ministry of Finance, Central Bank of Jordan, Central Bank of The Gambia, National Committee of Banks and Seguros of Honduras, Directorate General of Treasury, Ministry of Finance and Budget, Madagascar, and the Maldives Monetary Authority are among those that will be attending.

Bukele added that the National Bank of Rwanda, Nepal Rastra Bank, Sacco Societies Regulatory Authority (SASRA), Kenya, State Bank of Pakistan, General Superintendency of Financial Entities of Costa Rica, Superintendence of the Popular and Solidarity Economy of Ecuador, and the Central Bank of El Salvador will also be in attendance.

These countries need the most Bitcoin. I think it’s a clever step that Mr. President is not wasting its energy on some bigot Western country, but on the most in need. First we should turn to the most vulnerable ones, to let them gain the maximum potential out of it, if a wealthy country joins. Don’t forget what happened with the late awakened countries when most of the World was already on the Gold Standard. India was the last one. Don’t be India!

(UPDATE: A great article about these few days.)

Portugal will lose crypto tax haven status

The new Minister of Finance Fernando Medina confirmed in parliament on Friday that cryptocurrencies will be subject to taxation in the near future. Medina said that “many countries already have systems, many countries are building their models in relation to this subject and we will build our own”.

You will not be charged VAT or Personal Income Tax (IRS) as an individual. However, businesses that provide services related to cryptocurrency are taxed on gains between 28% and 35%. Guess who will pay this additional tax on cryptocurrency payments? Or who will advertise this payment option in their business? Yes, this is a major step back and if you are a portuguese, don’t forget your politician name to thank for this idea!

I think those people who moved to Portugal because of tax exemption, are already thinking of moving to another country. Portugal will simply lose these people's capital.

Texas Pacific Land Corporation announces a new 60 MW Bitcoin mining venture

Texas Pacific Land Corporation – one of the largest landowners in Texas – Mawson Infrastructure Group Inc., and JAI Energy have partnered to build up to 60 megawatts (MW) of bitcoin mining capacity on TPL’s surface in West Texas, according to a joint press release.“This project marks the beginning of TPL’s journey into bitcoin, and we are fortunate to collaborate with Mawson and JAI as two highly regarded companies in the bitcoin mining industry,” said Tyler Glover, CEO of TPL, a digital infrastructure provider. “We believe TPL’s extensive surface footprint in West Texas can serve as a premier destination for the bitcoin mining industry, providing site locations proximate to existing grid infrastructure and excellent solar and wind resource for future renewable power procurement.”

“Texas is rapidly emerging as an attractive new Bitcoin mining destination in the United States, and we are eager to establish a foothold in the state,” said founder and CEO of Mawson, James Manning.

Indian regulators have proposed banning public figures from promoting Bitcoin

Just two news stories above I used India as an example and here it comes this news. I thought people in masses won’t make the same mistake twice, but enough time passed by to not remember when and what was the economic effect when they as the last country switched to The Gold Standard. Yeah, India was the last one and with this major delay they lost a lot of wealth!With slowing Bitcoin adoption or maybe later banning it they will make the same mistake again. Not to mention that at the very best they can be just the 3rd country who made Bitcoin legal tender.

Meanwhile in just these days the President of El Salvador is converting another 44 countries to implement Bitcoin in their countries. Soon India can be again the last country to switch to The Bitcoin Standard.

China re-emerges as the 2nd largest Bitcoin mining hub

According to Cambridge Center for Alternative Finance, Global Bitcoin Mining hashrate stats:- US: 37.84%

- China: 21.11%

- Kazakhstan: 13.22%

- Canada: 6.48%

- Russia: 4.66%

Ok, so the news above is just a misrepresentation of the truth. The truth is that these miners in China never left.

Based on last week’s Shanghai High-court decision, we can now really speculate that the year before when China imposed the Bitcoin mining “ban”, it was cleverly implemented.

I was personally thinking after that ban only some really ballsy guys remained in China and were still mining Bitcoin “underground” without the fear of being caught.

But now I think differently. What if the remaining ~21% mining hashrate was always in control of the government and they made the mining ban just to wipe out the westerner’s thinking that “Bitcoin is under total control of China”. Thinking that China steps out of Bitcoin helps to spread Bitcoin everywhere which makes the Chinese government bitcoin stash to be worth a lot. In the end they only “lost” (most of these miners just went abroad to mine further) around 20% of hashrate with the mining ban. On the flip side they helped the Bitcoin legalization in the World.

Anyway even if my speculation is not true or just part of it is true, any step the Chinese government has made so far is just good for Bitcoin and for its holders. That’s the beauty of this new medium of exchange: everyone can gain from its flourish!

The Bolt Card is the first offline Lightning contactless card (UPDATED!)

Danny Scott, the CEO of CoinCorner announced the World’s first offline Lightning contactless card which works exactly the same as your VISA or MasterCard, but without the legacy Banking system. How?“An offline NFC (contactless) card “tapped” the Lightning enabled POS device, which requested the required payment, my CoinCorner account grabbed my GBP, turned it into BTC and instantly sent BTC over Lightning to the merchant instantly settled.” written by Danny Scott

From their blog post: “Over the coming months we will help introduce options to allow people to operate their own Bolt Card in a non-custodial manner. Very Soon™”

Don’t forget that storing Bitcoin at CoinCorner is a custodial wallet. Based on their promises, soon other non-custodial wallets will implement this technology and from your own wallet you can upload your sats to an NFC card.

(UPDATE: I’m really astonished how fast the Bitcoin ecosystem evolves. @BitcoinQ+A already done and tested how the Bolt Card works in a non-custodial form. Great!

(UPDATE 2.: After examining in detail how this system works in the end it’s kinda frightening. Currently this is a “pull” system, which means you are trusting that the merchant is only withdrawing the amount you two agrees upon and not more. Not only this, but you’re trusting the other party to not charge you multiple times (as long as you have funds on it). You can set limits (ex. Daily X amount of sats), but the system is not built on authorisation. Of course any time you can revoke the LNURL on that card, but if from malicious use your funds are gone, they are gone for good.

I think this card should remain as a gift card and not be used for normal payments because with these kinds of flaws the funds on it are at major risk.)

The Block plans to sell open-source Bitcoin mining ASICs

Jack Dorsey's (former Twitter CEO) Block company plans to sell open-source Bitcoin mining ASICs.The company said it is focused on creating an open system that would cut back on the concentration around Chinese manufacturers of bitcoin mining ASIC chips. The approach – an open-source setup – has the potential to reduce risks and increase competition, Dorogusker said.

“We want to build our own bitcoin ASIC,” Dorogusker, who also leads the mining initiative, explained. “Our ASICs will be available for sale and will all be open source.”

This is huge because now individual countries can build their own ASIC miners and the diversity of Bitcoin mining equipment will be even more distributed!

Russia legalizing Bitcoin it's just a matter of time

Denis Manturov, Minister of Industry and Trade of the Russian Federation, recently expressed his opinion that bitcoin and other shitcoins being legalized in Russia is just a matter of time, according to a report from Russian state news agency TASS.“The question is when it will happen, how it will happen and how it will be regulated. Now both the Central Bank and the government are actively engaged in this.”

We are not surprised because a few months ago Putin himself promoted Bitcoin mining in Russia. I was sure that soon they would implement it in their economy. Don’t forget that friendly countries can pay for Russian commodities in Bitcoin too! Maybe they just don’t want to boost prices up before they can buy enough.

Bitcoin Education is launching for 40 High Schools in Argentina

A non-governmental organization by the name of Bitcoin Argentina has partnered with Paxful and the Built With Bitcoin Foundation to educate students about Bitcoin. The program named Schools and Bitcoin will include students from 40 different schools.“Education at every level is crucial to the next wave of global Bitcoin adoption,” said Ray Youssef, Founder and CEO of Paxful. “We’re thrilled to work with NGO Bitcoin Argentina and the Built With Bitcoin Foundation to support a movement that focuses on youth and shares the power of Bitcoin as a peer-to-peer financial tool for masses.”

Jimena Valone institutional development coordinator for Bitcoin Argentina and lead of the Schools and Bitcoin Project explained “All this was the starting point to start thinking about the project, which begins with 40 schools, but we hope to have a great number. It is designed to serve more and more educational institutions, of various characteristics and regions.”

“Decentralized financing has benefits and advantages that go beyond the macroeconomic situation of a region, such as Argentina and inflation. Financial independence, for example, is one of those advantages. Finance is inherent in life.”

Meanwhile in the Financial Times: ARGENTINA: Bitcoin &

crypto(shitcoin) adoption spreads even as central bank tightens rulesTag Heuer now accepts Bitcoin for online purchases

TAG Heuer, a Swiss luxury watchmaker, is now accepting bitcoin and other cryptocurrencies as payment online through a partnership with BitPay, according to a press release.“We have been following cryptocurrency developments very closely ever since Bitcoin first started trading,” said Frédéric Arnault, CEO of TAG. “As an avant-garde watchmaker with an innovative spirit, we knew TAG Heuer would adopt what promises to be a globally integrated technology in the near future despite the fluctuations — one that will deeply transform our industry and beyond.”

Don’t forget that BitPay is a simple “exchange service”. Tag Heuer is not receiving Bitcoin, they just receive the FIAT money equivalent because BitPay instantly converts them upon receiving. Soon Tag Heuer will regret this decision as anyone else who's using BitPay and not BTCPay Server which is a self-hosted, open-source cryptocurrency payment processor.

Swiss bank Julius Baer offers Bitcoin services

The $500 billion asset management Julius Baer Group, a private bank based in Zurich, Switzerland, announced that it is creating a proprietary digital wealth management system focused on bitcoin and other shitcoins exclusively tailored to high-net-worth clients.“It could well be that at this very instant we are witnessing a bubble-burst moment of the crypto industry, and we all know what happened after the dot-com bubble burst 30 years ago,” said CEO of Julius Baer Philipp Rickenbacher during a presentation to investors, according to a report from Bloomberg.

“It paved the way for the emergence of a new sector that indeed transformed our lives; I believe digital assets and decentralized finance hold that same potential,” Rickenbacher reportedly continued.

Global Economic News

TL;DR

There's virtually zero demand for non-USD stablecoins

Germany where not just housing boom keeps going but inflation too

UK inflation just hit 9%

Russia says Q1 economic growth seen at 3.5% (UPDATED!)

Exports from El Salvador broke a record and grew 15.3% in April

S&P 500 is in bear market

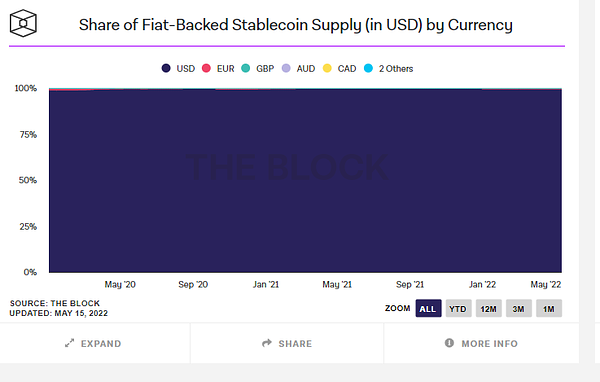

There's virtually zero demand for non-USD stablecoins

You may wonder why I put this shitcoin news here in the Global Economic News part, but soon you will understand.As I learned from Saifedean Ammous at the end of the current FIAT monetary system, the last one which will fail will be the USD. Because it has the biggest market and the major commodities prices are denominated in USD (till recently when Russia and China drifted away, but that will be another article).

In the era of rising shitcoins (a new one emerges daily), clearly we can say here too that the “most stable” and “most valuable” will win in their market. If you check the chart below the USD clearly dominates even in the stablecoin market, like between the FIAT currencies. There is no magic, maybe this will change (see Russia and China decisions), but the fall of FIAT currencies are running by the plan written in the past. The only question is how long will you stick to that already sinking ship?

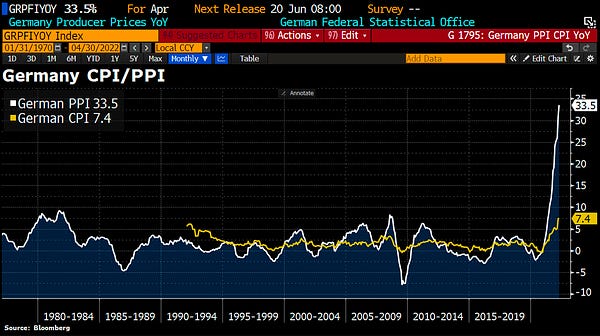

Germany where not just housing boom keeps going but inflation too

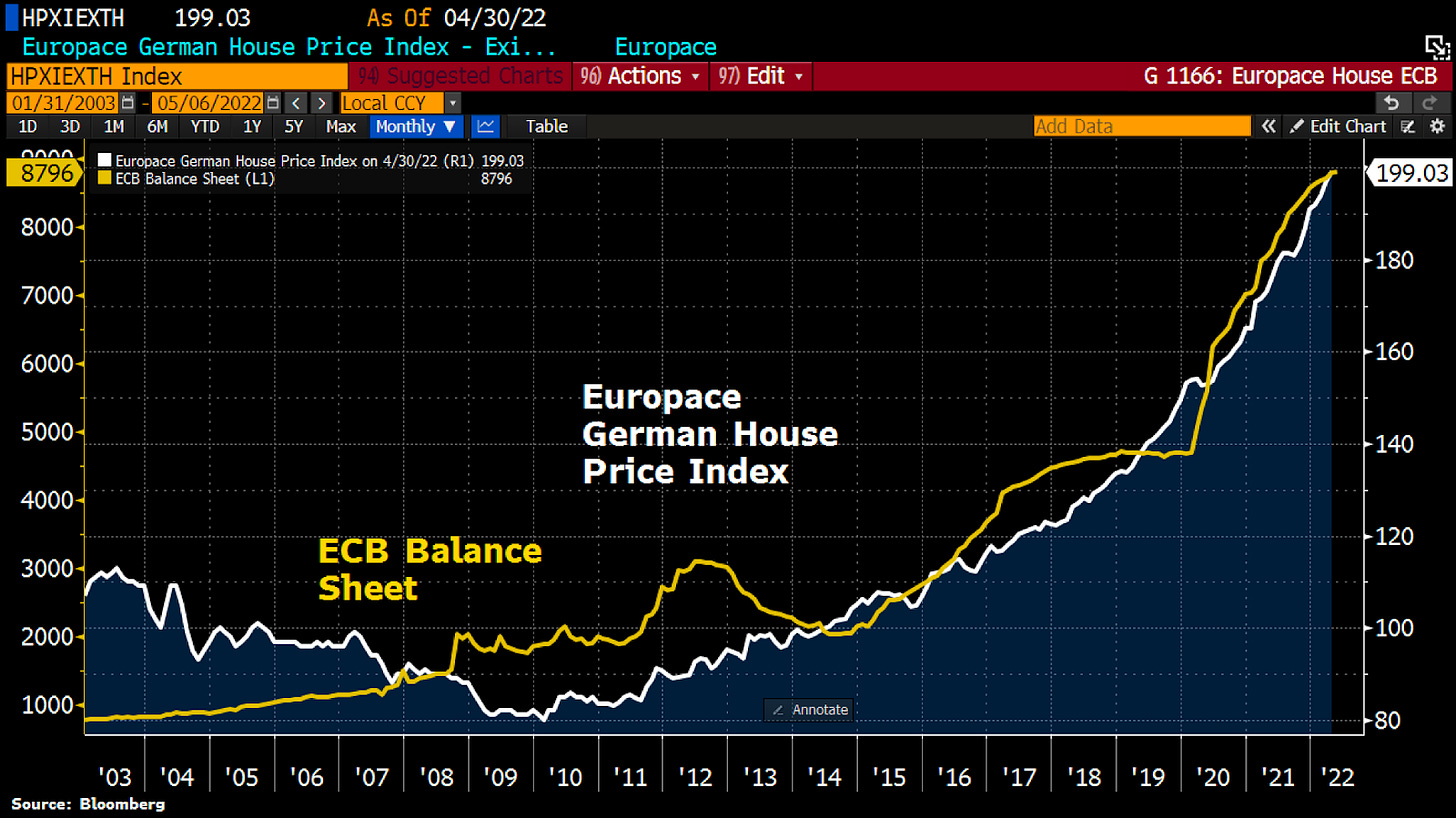

“Germany where housing boom keeps going as Germans buying real estate fearing rising inflation, rents & rates. Europace House Price Index jumped 1.1% in Apr. Gained 4.3% ytd, 11.1% pa in past 5yrs. Index has risen in tandem w/ECB balance sheet to ever new ATHs.” by Holger Zschaepitz

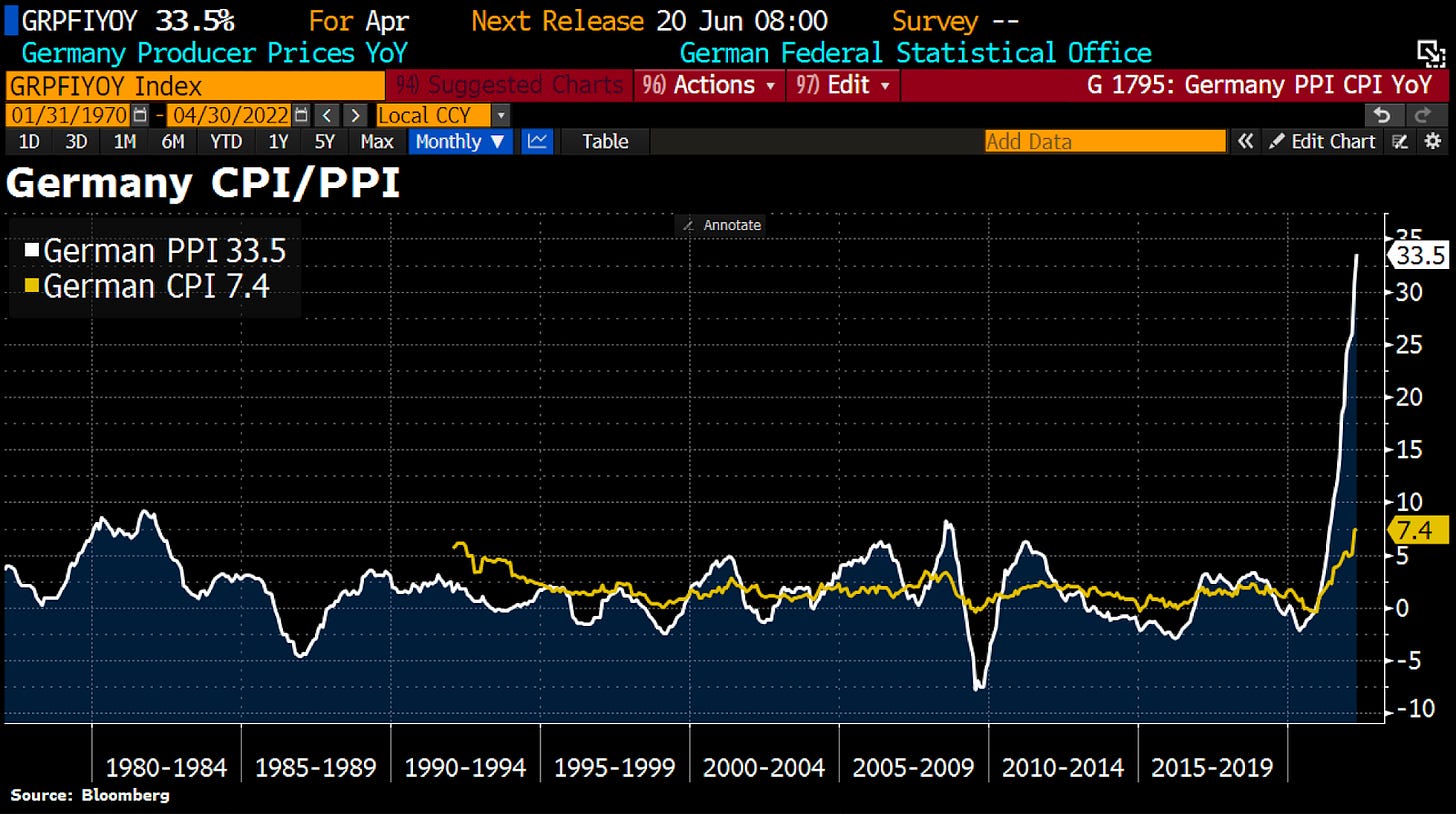

“PPI jumped by 33.5% in Apr YoY, the highest increase ever since the start of the statistic in 1949 b/c price increases following the Ukraine war now taking full effect. Energy prices as a whole were up 87.3% YoY.” by Holger Zschaepitz

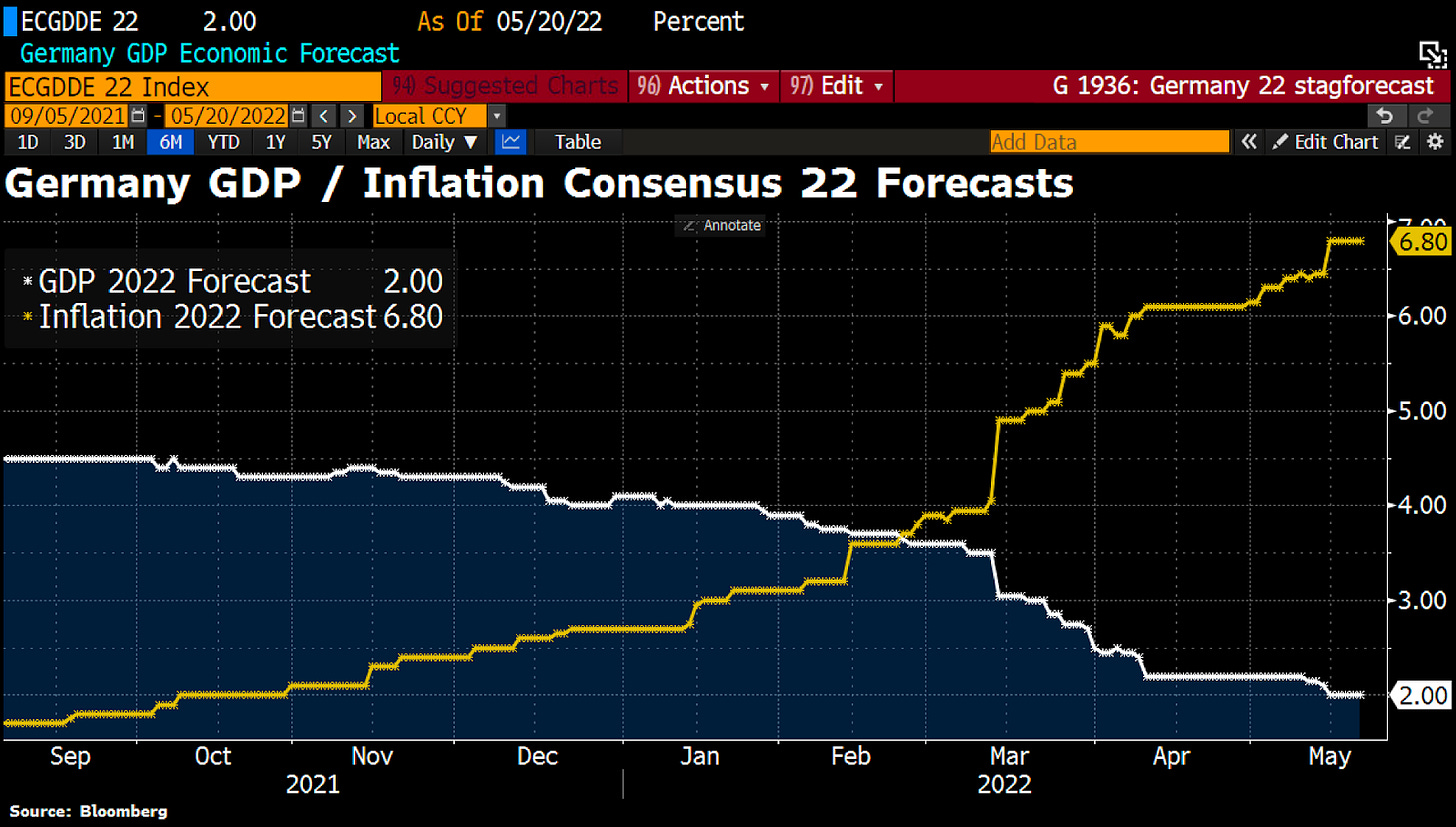

“Germany where stagflation fears keep rising. Analysts have cut their 2022 German GDP forecast to 2% while upped their 2022 inflation forecast to 6.8%.” by Holger Zschaepitz

UK inflation just hit 9%

You know as always I tell you these are just the official numbers, real ones are way into double digits. The main upward price shifts in the 12 months to April were:• Natural gas - 95.5%

• Electricity - 53.5%

• Motor fuels - 31.4%

• Furniture and maintenance - 10.7%

• Restaurants and hotels - 8%

• Food and non-alcoholic drinks - 6.7%

Russia says Q1 economic growth seen at 3.5% (UPDATED!)

I see that people say this number must be fake, so I start with explaining my view on why it could be possibly true and why as time goes by this number will be even higher. Let’s put away the “war sides” and try to answer logically.In the World today there is massive inflation which was caused by people influenced by stupid keynesian economists whose are pro-printing money.

This money then flows into hard assets which all need dedicated scarce human time to produce or to mine. While everyone wants to spend this freshly printed money the raw materials are going to be temporarily sold out (as we as end users see this in the shops) because raw materials compared to the printed money are much-much scarcer. This is why we experience 5-6-7-8-90% price increase in these markets, which will be way higher as time goes by.

Now just imagine if a country which is massively exporting raw materials, what happens to their income? It gets massively boosted by 5-6-7-8-90% with freshly printed money. At the end the number will show that their economy is growing by X percent.

Let’s go back to Russia. Is it really impossible that the Russian economic growth is 3.5% based on the above shown rational thinking?

Let’s not forget that all the sanctions in the past were bypassed and except for 40 westerner countries 140 countries have not sanctioned Russia! Try to watch the world with an Austrian economist's view and it will be much easier to understand.

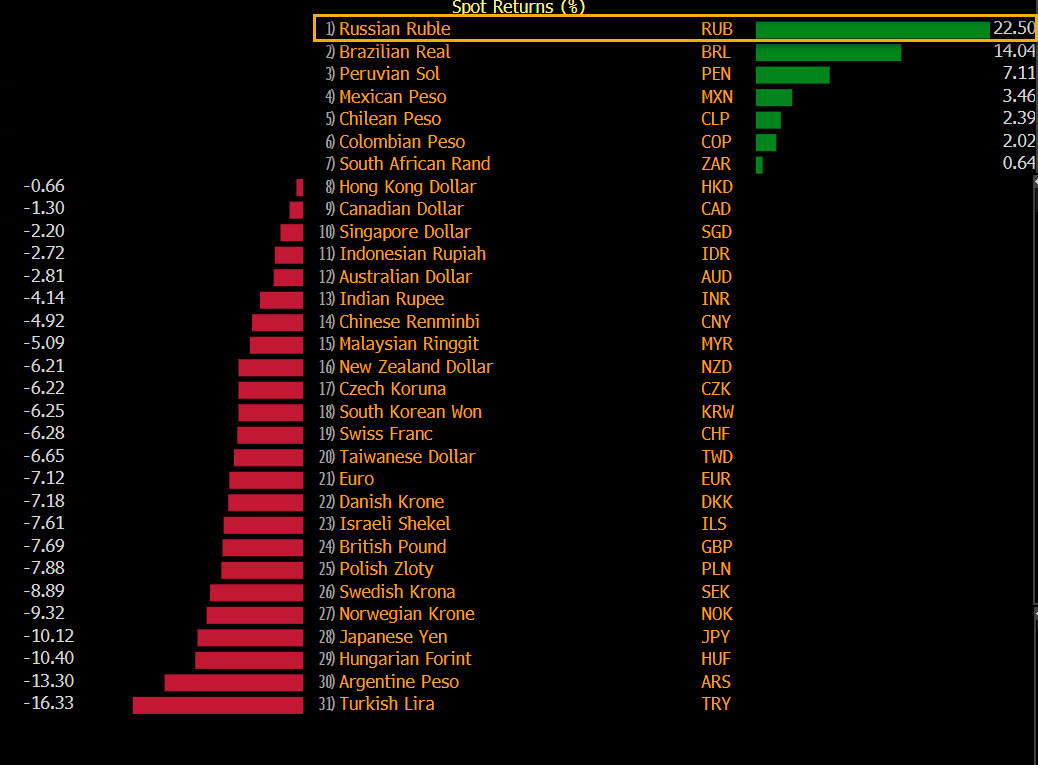

(UPDATE: “Ruble jumped as much as 9% against the euro, hitting its strongest level since June 2015. The ruble is by far the best performing currency of 2022” by Zerohedge)

(UPDATE 2.: Bloomberg: The Russian ruble surges to a seven-year high after natural gas buyers bend to Putin's will and pay in the local currency)

Exports from El Salvador broke a record and grew 15.3% in April

I know I know it’s a small country, but I’m following it closely because I want to find out that Bitcoin is really changing a country's previous course? Till today the reports show yes.According to El Salvador in English, El Salvador accumulated $2,476.1 million in exports in April of this year, surpassing the same period in 2021 by $328.1 million, which represented a growth rate of 15.3%, reported the Central Reserve Bank (BCR).

According to its economic classification, up to April 2022, $2,111.1 million in consumer goods were imported, with a growth of 19.9%, highlighting non-durable goods with an increase of $300.5 million. On the other hand, $2,550 million of intermediate goods were imported (growth of 43.4%), while capital goods accumulated $837.5 million (3.7% growth).

Of course, this is not yet a causal relationship to the positive effects of Bitcoin, but rather shows only the proper functioning of the government. Beside the record of the export, the growth of the import in consumer goods shows that the El Salvadoran people are getting wealthier and can afford to buy more goods. Hopefully this trend continues and will be a positive example for other countries.

S&P 500 is in bear market

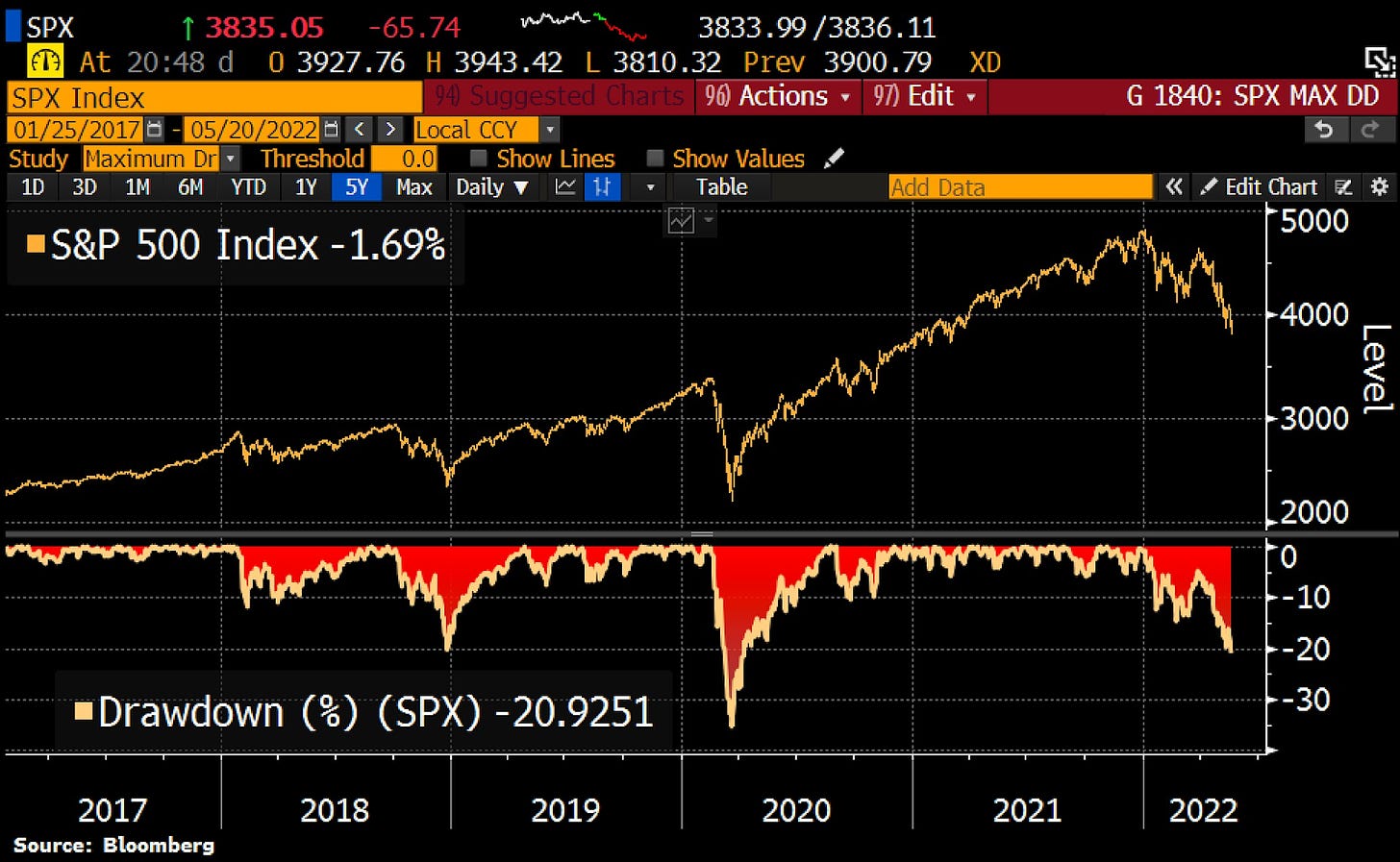

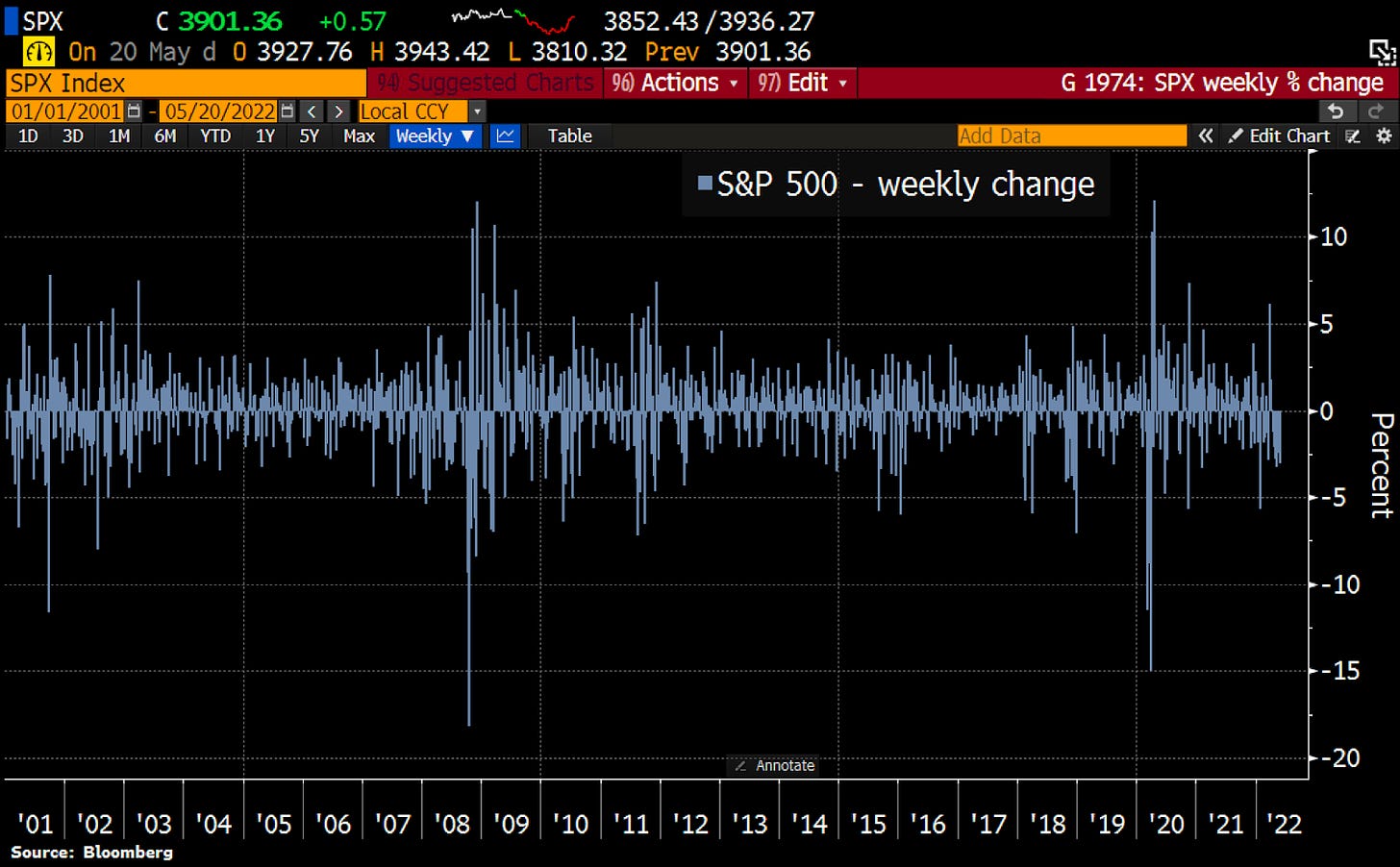

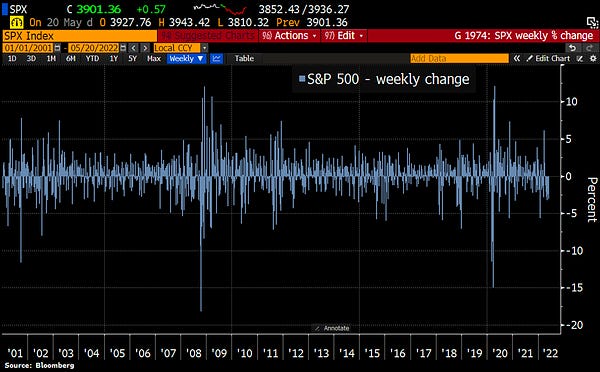

“S&P 500 falls >20% from Jan high and so in a bear market now.” by Holger Zschaepitz

Now even Keynesian economists see that the US is already in a bear market. Never forget, this is just the beginning. The US housing market already topped last week. What will be the next domino?

“The end of the Fed put? Looks as if the Fed will sacrifice investors to beat inflation and lower S&P 500 is not a buck but a feature. S&P 500 fared first 7-week losing streak in 21 years.” by Holger Zschaepits

But if you ask a Keynesian, he will definitely say:”The Economy is Strong!” by @NorthmanTrader

Bitcoin price speculations

These are just speculations, no investment advice!

“Bitcoin with clear chart similarities and fractals” by @StockmoneyL

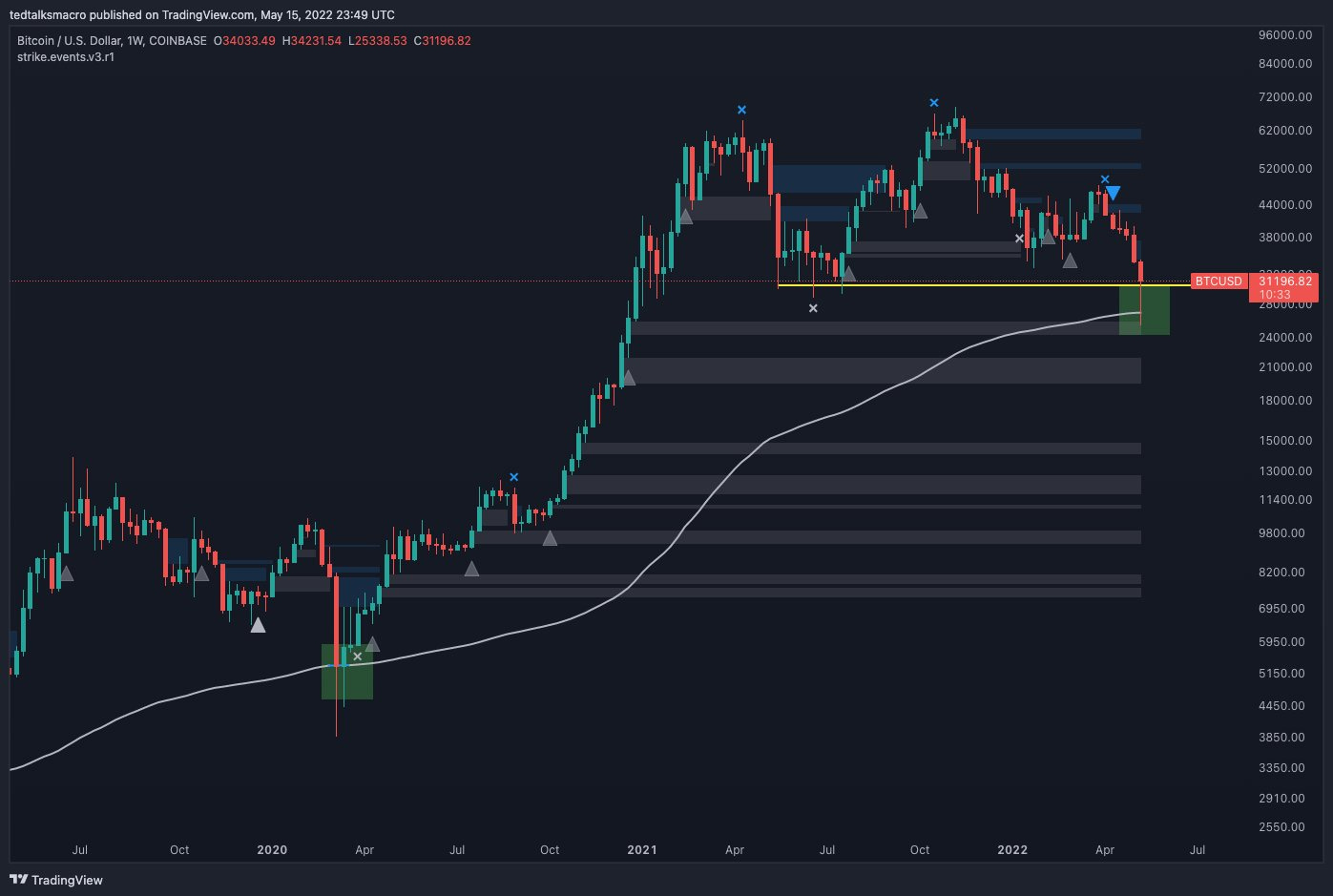

“BTC bottom could be in.” by @tedtalksmacro

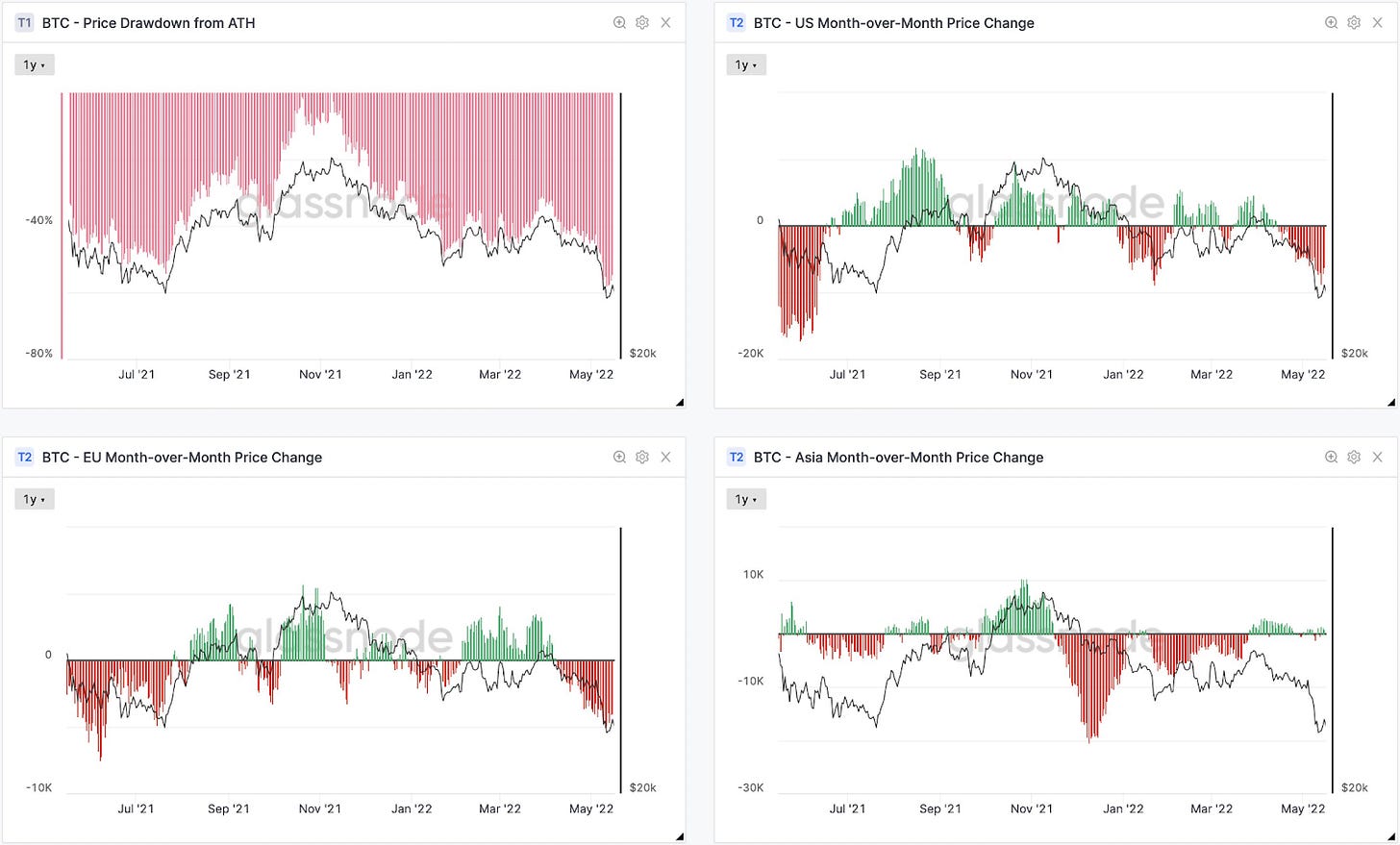

“Interesting divergence between market sessions for BTC. Q4/Q1 were highlighted by rampant selling from Asian markets. Now most losses have migrated to the western hemisphere.” by @TXMCtrades

“Bitcoin We are here.” by @AurelienOhayon

“Bitcoin is ready for a HUGE BOUNCE. Weekly timeframe.” by @AurelienOhayon

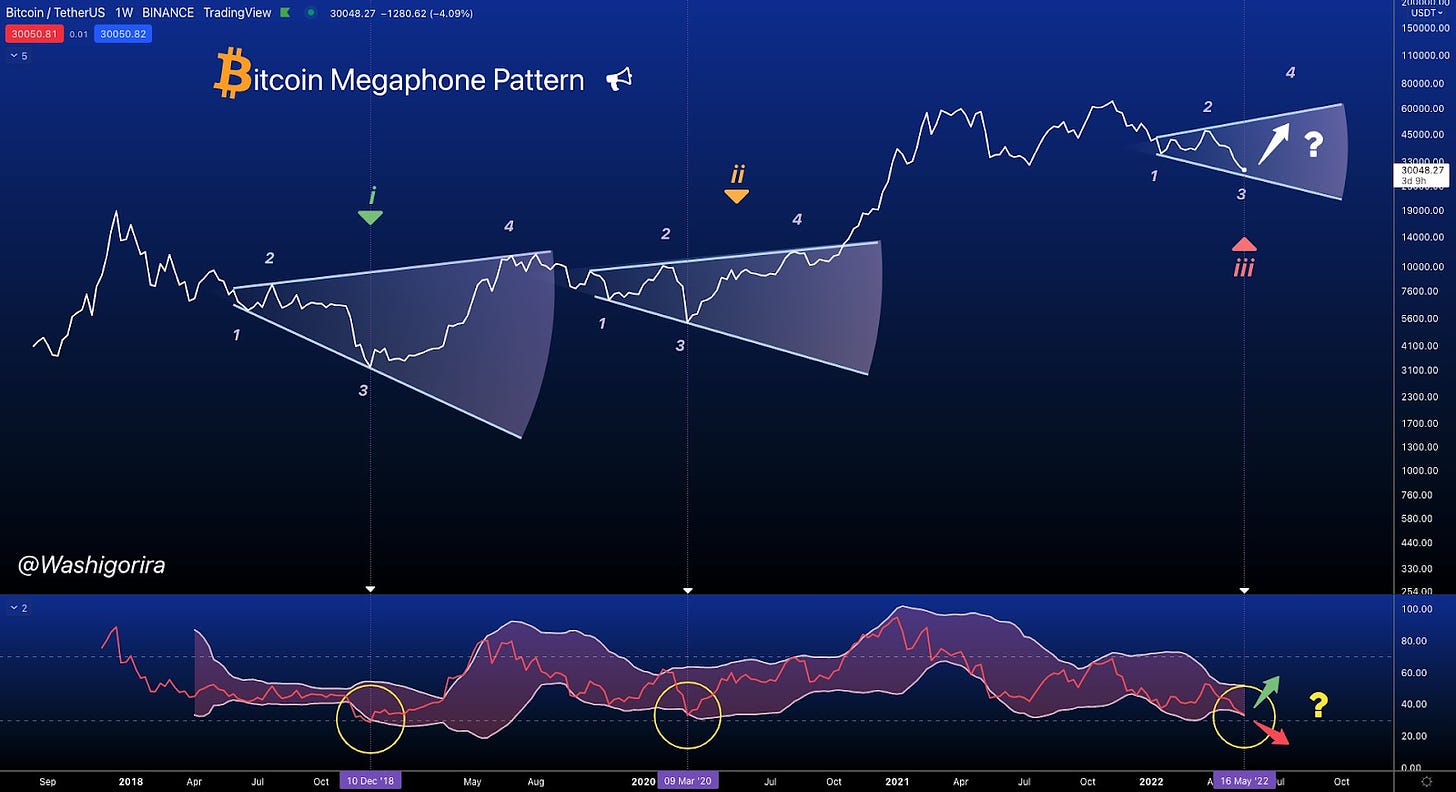

“Megaphone Pattern. Here’s why I think #BTC price could bounce from this level & might found its bottom. ⅙ At the top of the chart you can see I’ve spotted a pattern that occurred 2 times in the past cycle (i & ii). The price followed a Megaphone chart pattern.” by @Washigorira (thread)

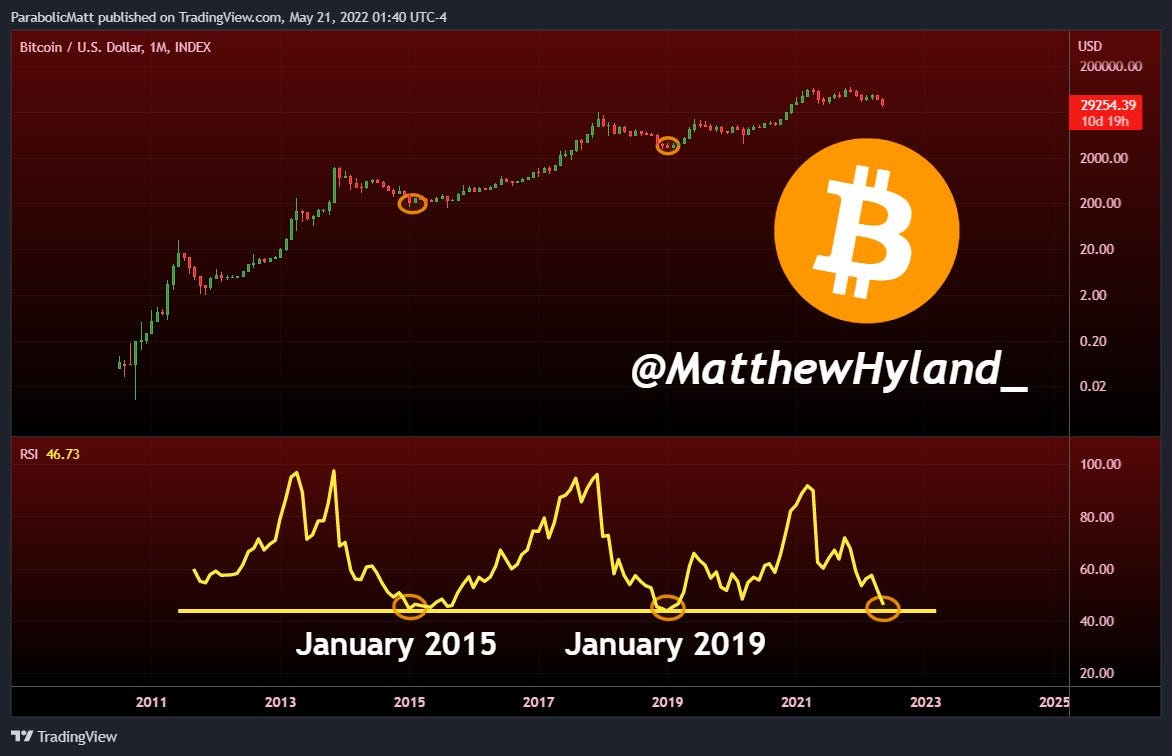

“Bitcoin Monthly RSI approaching historical lows” by @MatthewHyland_

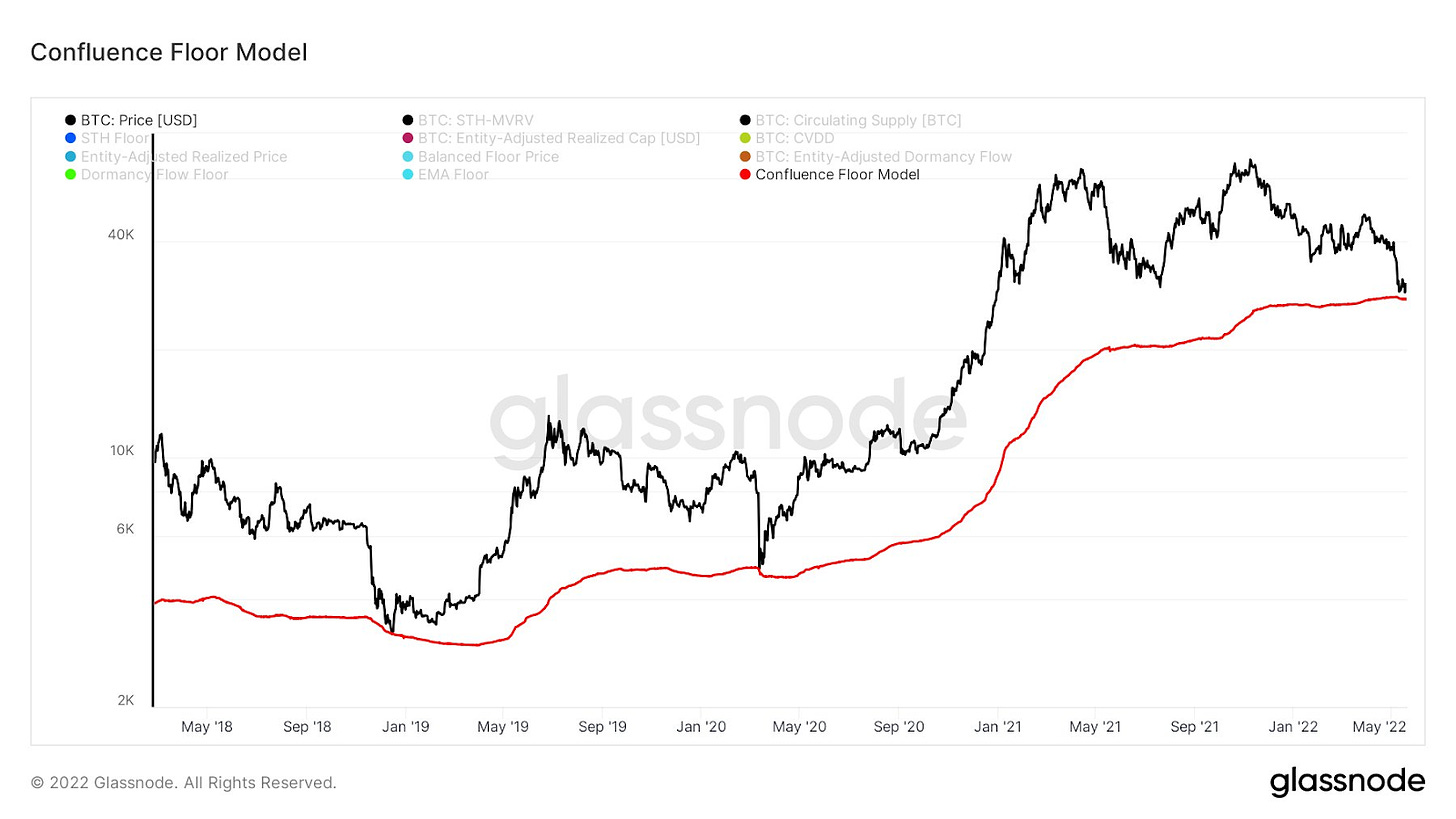

“Confluence Floor Model - Bitcoin continues to levitate just above my floor model.

May 21 | 0:00 UTC (Glassnode Daily Close)

Price | $29,215

Floor Model | $27,523” by @TheRealPlanC

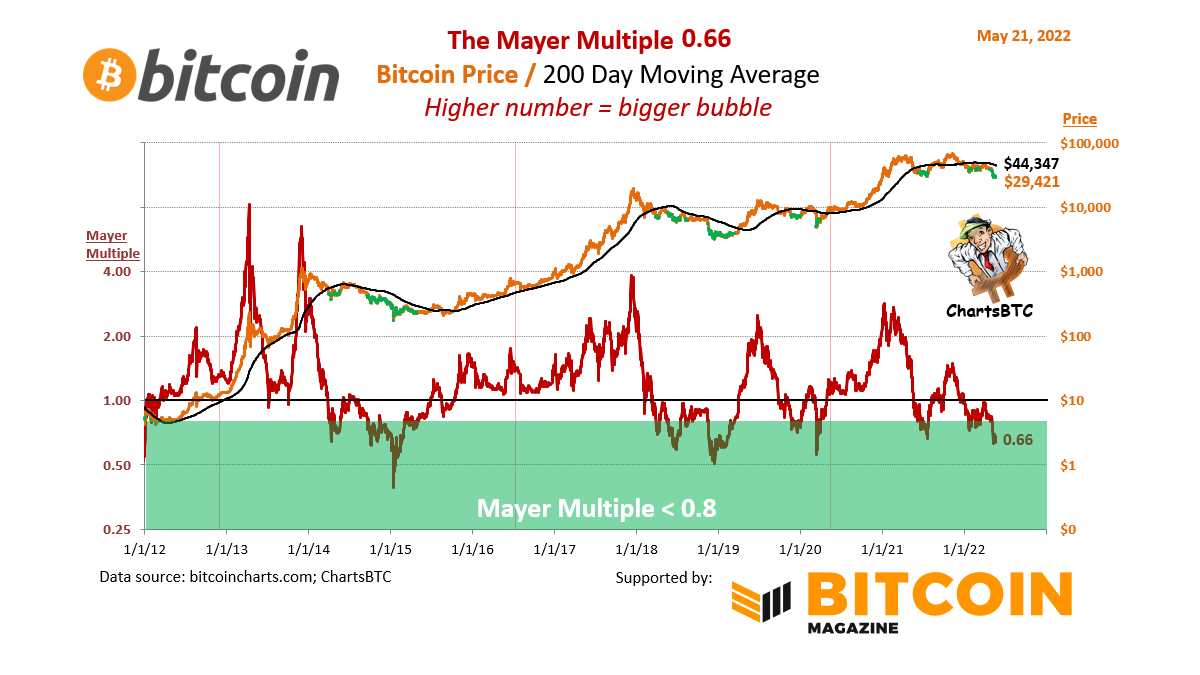

“Bitcoin markets are for stacking sats” by @ChartsBtc

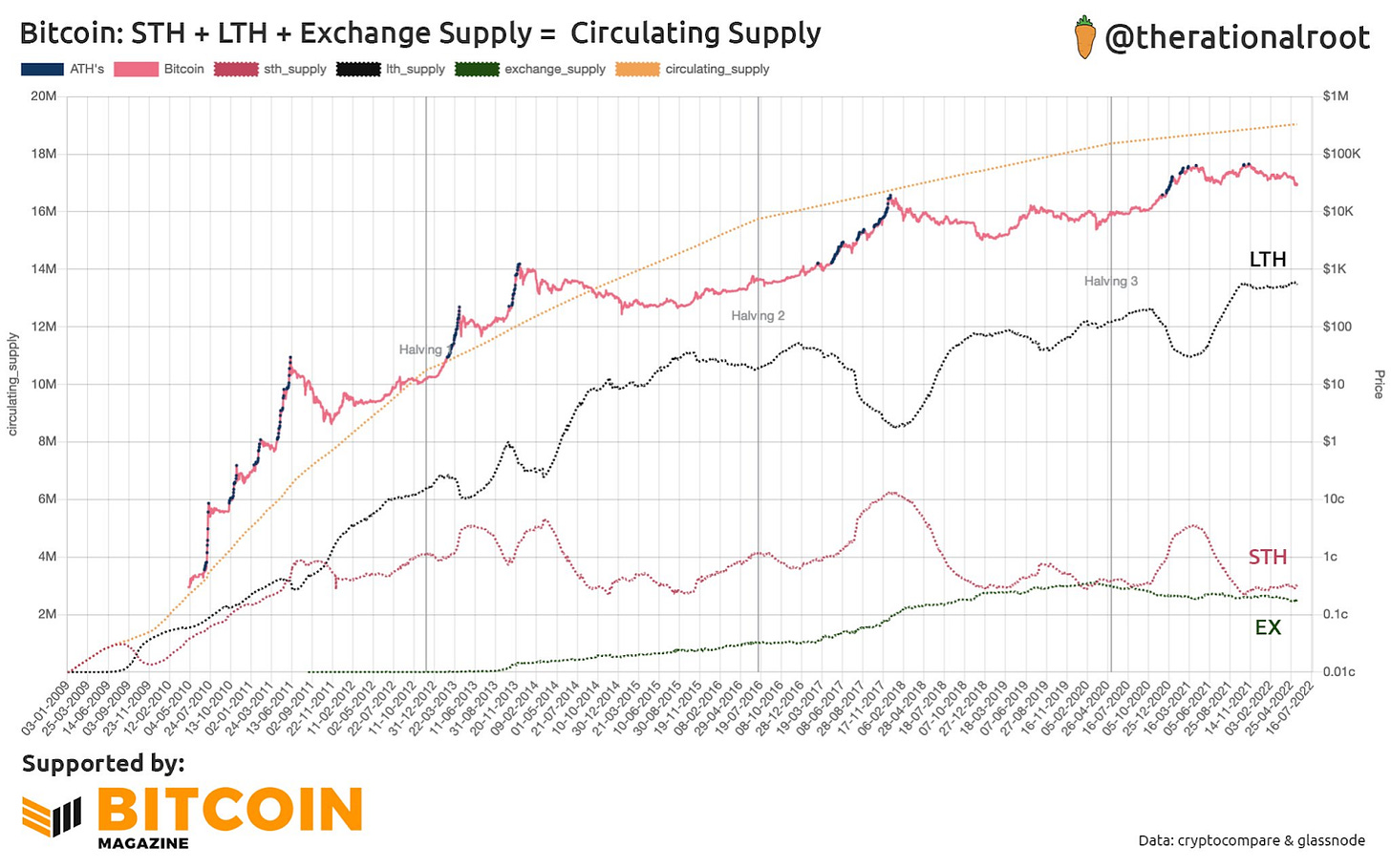

“The dynamics between Short-Term Holder, Long-Term Holder and supply on Exchanges.” by Root

Bitcoin Shorts

Funny Bitcoin short stories

“Japanese bank SBI Holdings is reportedly set to buy a 51% stake of Bitcoin and crypto trading platform BITPoint Japan.” by @WatcherGuru

Bitcoin being explained to an empty room at a conference in 2013. (Video)

Follow The Money #1 - Bitcoin in El Salvador (Documentary video)

Bloomberg analyst dismissing Bitcoin exactly 10 years ago:

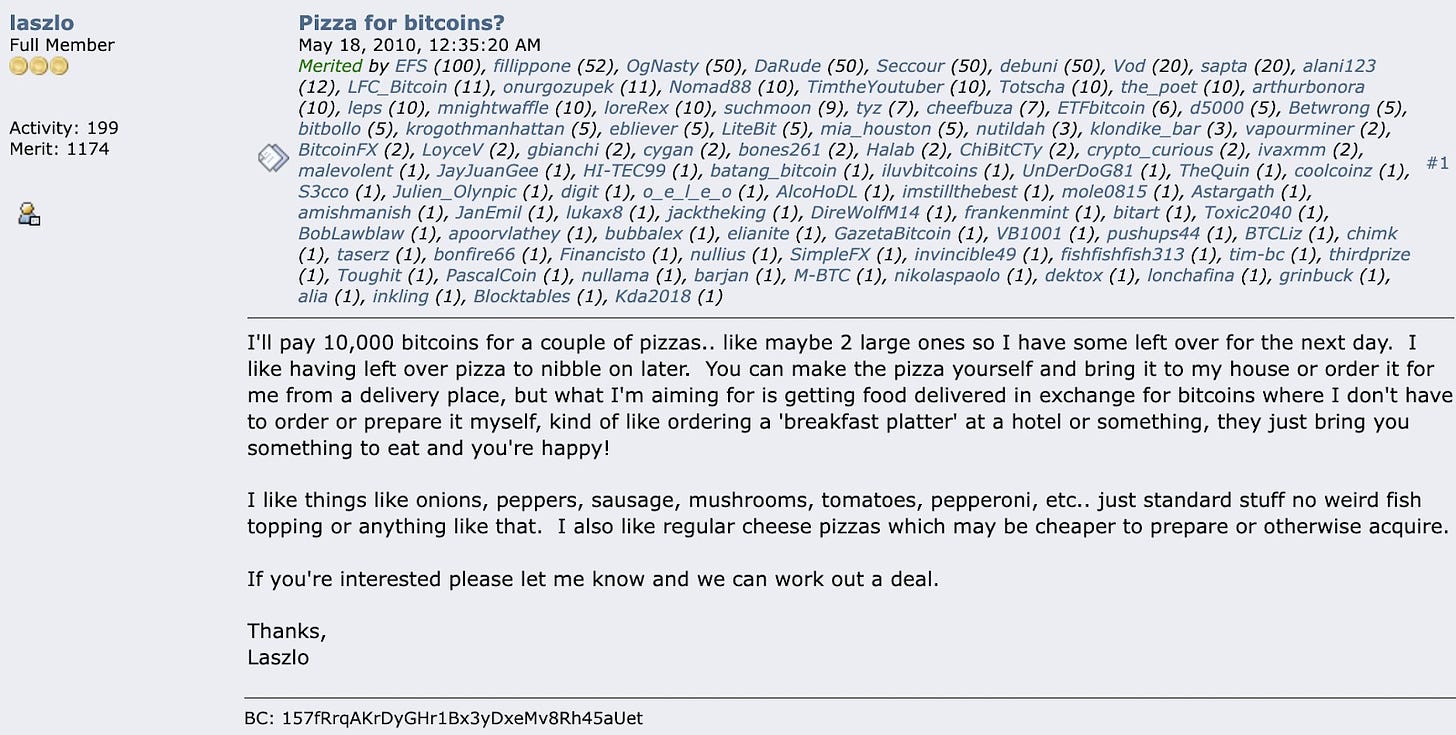

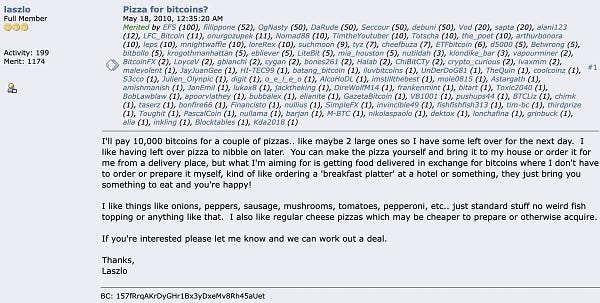

"The problem is it works too well." by @pete_rizzo_“Laszlo offering to buy 2 pizzas for 10,000 Bitcoin exactly 12 years ago. A $300 million milestone for financial freedom” by @pete_rizzo_

“Which way, Western man?” by @JoeConsorti

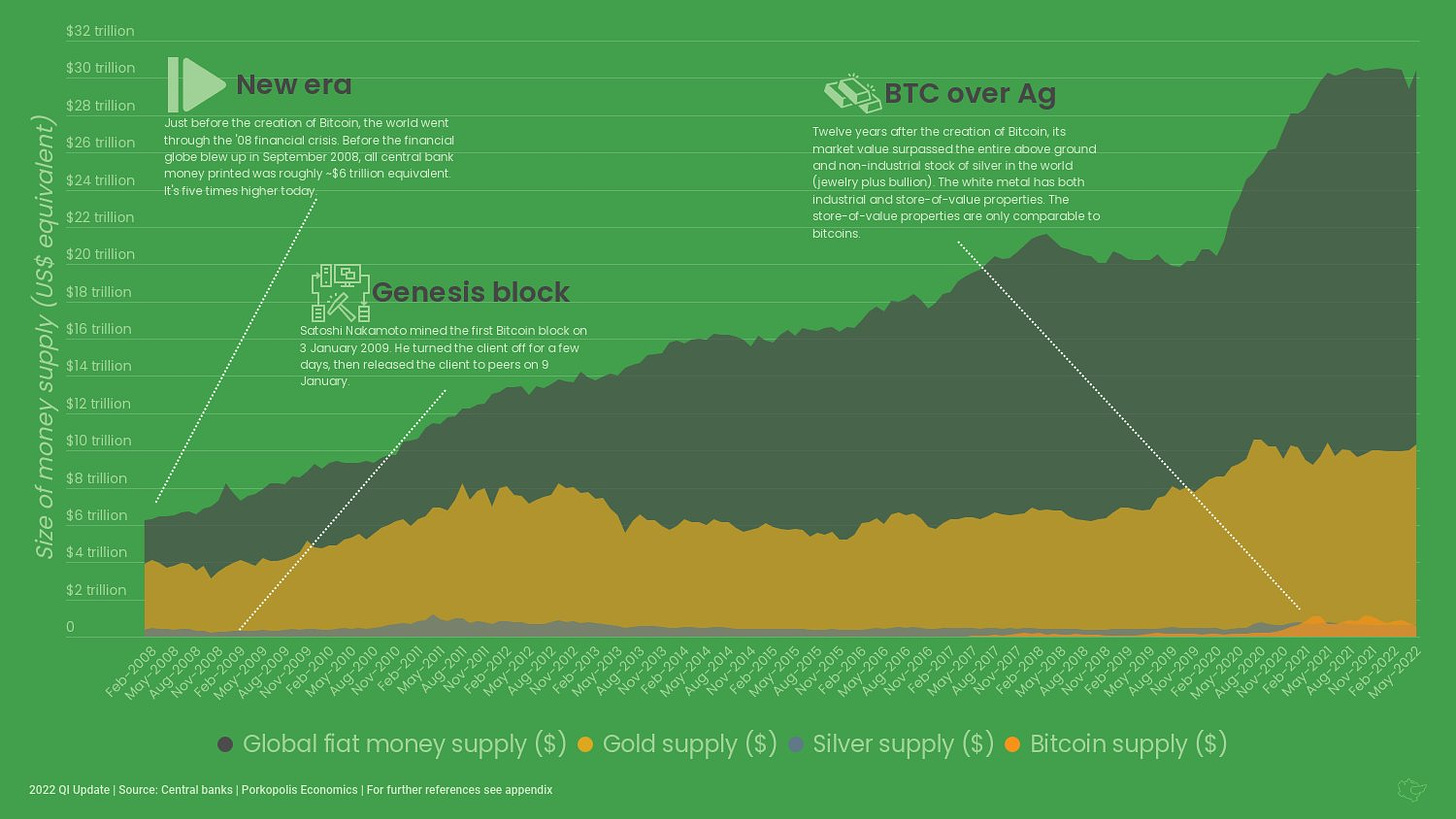

This research covers the globe's top 50 fiat currencies, sourced directly from their central banks, gold, silver, and bitcoin. We are so early!

Silvergate Bank Announces Quarterly Recurring Donation to Brink - funds will go toward supporting bitcoin open source development

“Bitcoin hit its lowest reading in over 2 years on the BTC Fear and Greed Index this week!” by @TheCryptoLark

Suggestions

Interesting articles to read

If You Thought The Coinbase Bankruptcy Disclosures Were Bad…

China Economy Crashes Worse Than Expected Amid Covid Lockdowns

Escobar: Death By A Thousand Cuts - Where Is The West's Ukraine Strategy?

MicroStrategy Won’t Change Bitcoin Plans Despite Recent Declines, New CFO Says

Putin: Oil Sanctions Will Be Europe's "Economic Suicide" On Orders From "American Overlords"

The EU Commission is planning automatic CSAM scanning of your private communication

China In Talks To Buy Cheap Russian Oil For Strategic Reserves

Sources:

https://www.portugal.com/news/medina-confirms-crypto-will-be-taxed-in-portugal/

https://bitcoinmagazine.com/business/bitcoin-education-launches-in-argentina-for-high-schools

https://bitcoinmagazine.com/business/tag-heuer-now-accepts-online-bitcoin-as-payment

https://bitcoinmagazine.com/business/julius-baer-to-offer-bitcoin-crypto-services