Bitcoin News

TL;DR

Argentina's largest private bank has launched Bitcoin trading (UPDATED!)

Uzbekistan legalized Bitcoin as an asset with property rights

Coinbase was the recipient of Goldman Sachs' first Bitcoin backed loan

California Governor signed an executive order to foster Bitcoin innovation

Halfway to the next halving

Gucci has announced they will start accepting Bitcoin

The biggest inflow in the Bitcoin Purpose spot ETF ever recorded

Argentina's largest private bank has launched Bitcoin trading (UPDATED!)

Banco Galicia is the largest private bank in Argentina by market share and recently announced it will allow its customers to invest in bitcoin and other shitcoins.Banco Galicia will be working with Lirium, a cryptocurrency infrastructure company, to accomplish the rollout of these new investment vehicles. Lirium enables banks and digital wallets to buy, sell, send, and receive cryptocurrencies.

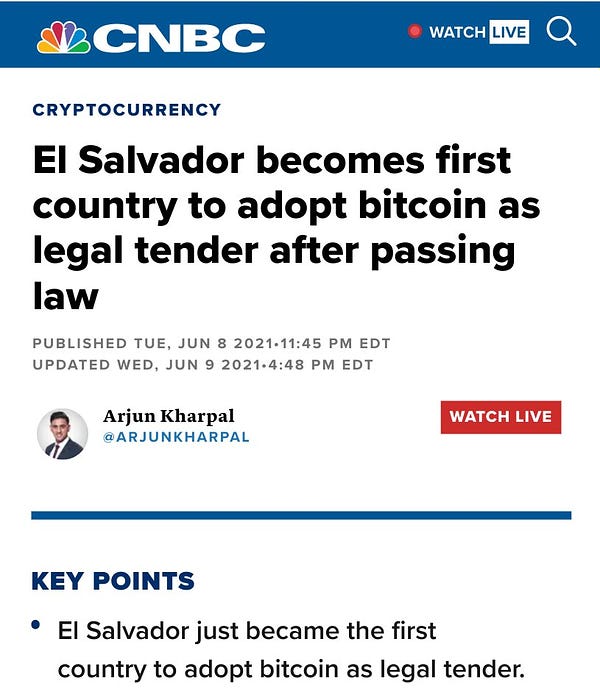

In August, 2021 Alberto Fernandez, President of Argentina, was asked if he would follow the likes of El Salvador in making bitcoin legal tender stating: "I don't want to go too far out on a limb [...] but there is no reason to say no."

(UPDATE: The IMF forces Argentina to take an Anti-Bitcoin stance as they put it as a condition for a $45 Billion Bailout. The above read news was totally vanished by the central bank of Argentina with the following bullshit sentence: “to further safeguard financial stability” they banned trading with cryptocurrencies all Argentinian banks to allow.The IMF won one battle against Bitcoin, but they will lose the war. )

Uzbekistan legalized Bitcoin as an asset with property rights

The government of Uzbekistan has moved to expand its crypto regulations through a decree signed by President Shavkat Mirziyoyev.The decree defines crypto assets as property rights representing a collection of digital records in a distributed ledger that have value and owner. Starting from Jan. 1, 2023, Uzbekistan’s citizens and companies will be allowed to buy, sell and exchange cryptocurrencies through crypto service providers.

The President’s order lists a number of entities that fall under this category, including digital asset exchanges, mining pools, crypto depositories, and crypto stores. They will be required to register as local businesses and obtain licenses or mining certificates from the government agency.

The broad, digital asset legislation will exempt Bitcoin and shitcoin-related transactions from taxation.

Coinbase was the recipient of Goldman Sachs' first Bitcoin backed loan

Are you surprised? Yes? I’m not because Coinbase is sitting on a huge amount of Bitcoin. Yeah, I know people have already begun to withdraw Bitcoin from the exchange, but still plenty remains. If we want to speculate on “why”, than there are a few options:(1) Coinbase has USD liquidity problems and doesn’t want to sell their own BTC at this price.

(2) Coinbase lost on some shitty trades too much and they need to gain those losses back (hope not).

(3) Coinbase listened to Michael Saylor when he spoke about the “never sell Bitcoin”.

Anyway there is still a huge risk in trusting Banks with your Bitcoin. I hope Coinbase is not risking their own clients Bitcoin, but just their own ones.

California Governor signed an executive order to foster Bitcoin innovation

Based on the recent press release, Gavin Newsom, Governor of California, signed an executive order today crafting a regulatory framework for companies operating in Bitcoin and other shitcoins.“California is a global hub of innovation, and we’re setting up the state for success with this emerging technology – spurring responsible innovation, protecting consumers, and leveraging this technology for the public good,” said Governor Newsom.

Let’s see how they actually will do their work.

Halfway to the next halving

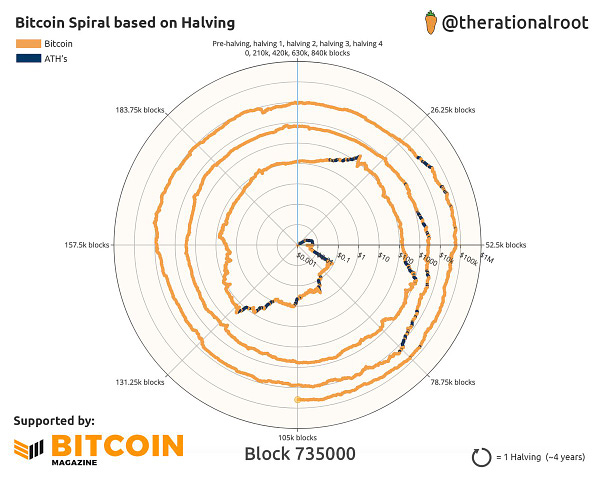

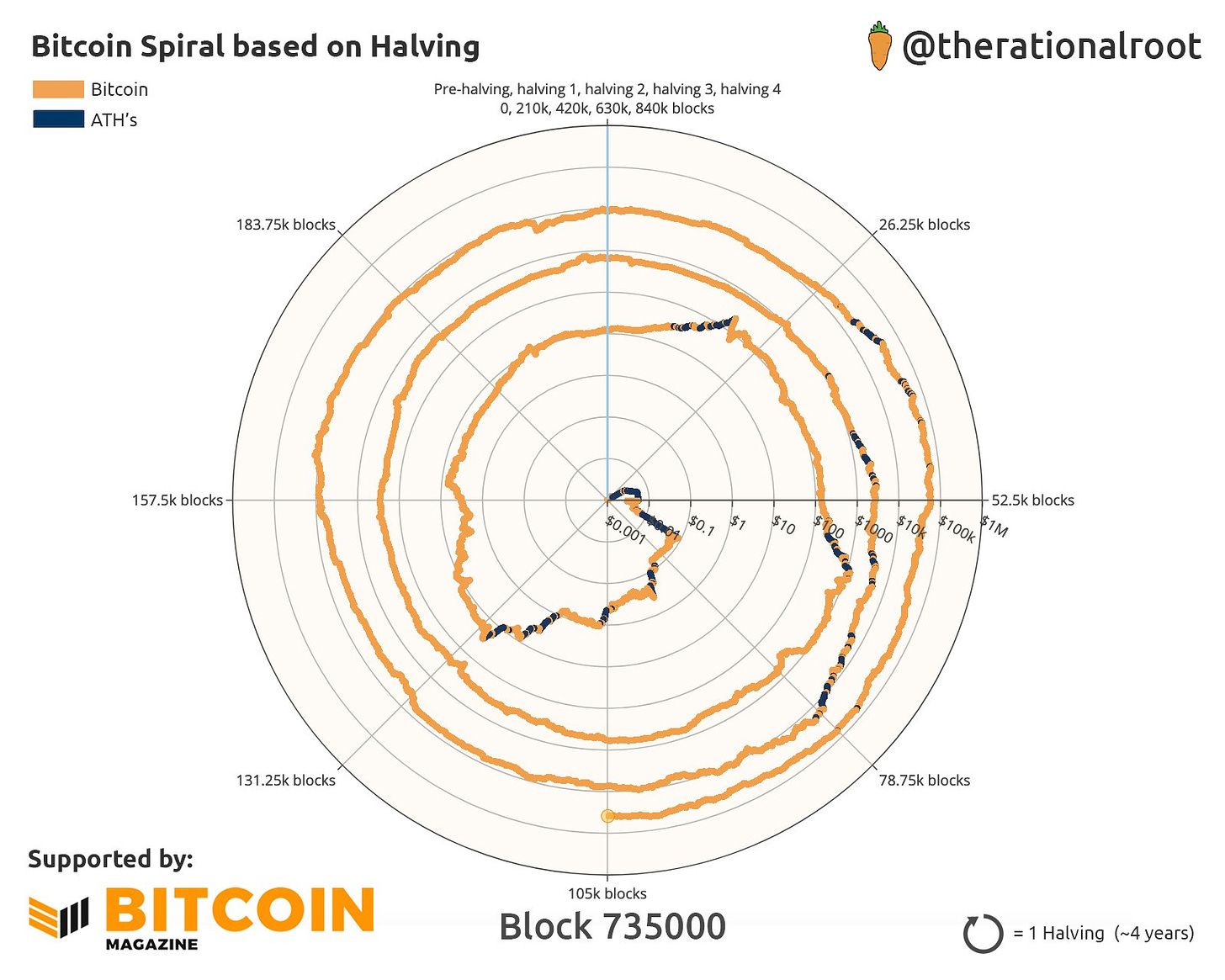

On May 5th we arrived at the 735,000th block number which is exactly in the middle of this halving period. Many people don’t know that Bitcoin knows nothing about the current time, it works with Blocktime which is calibrated with precise difficulty adjustments.

We know that after every 210,000 blocks (every ~4 years) the Bitcoin reward for the miners will be cut to half. This current period started at the 630,000th block and it will be finished with the 839,999th block.

With the 735,000th block number we were exactly in the middle which was nearly 2 years after the last halving. Time flies when people are focusing on innovations, not just on the price itself.Gucci has announced they will start accepting Bitcoin

We don’t know exactly which stores, but Gucci announced that in the near future they will start accepting Bitcoin in some “selected” stores. It’s not hard to find out that behind all of this are financial motives. Gucci is an old brand which is owned by a big conglomerate, no longer connected with the name of the family (if you haven’t seen the movie, it's worth a watch).

First when I heard this news I thought these Bitcoin “compatible” stores will be in those countries where Gucci are gaining their income in some even worse currency than USD or EUR. But these will be in the U.S. This means the USD is bad enough in the Gucci brand owner's eyes to play with Bitcoin and even with some other shitcoins. I’m sure that soon they will accept only Bitcoin in all of their stores."Gucci is always looking to embrace new technologies when they can provide an enhanced experience for our customers," Marco Bizzarri, Gucci's president and CEO, tells Vogue Business. "Now that we are able to integrate cryptocurrencies within our payment system, it is a natural evolution for those customers who would like to have this option available to them."

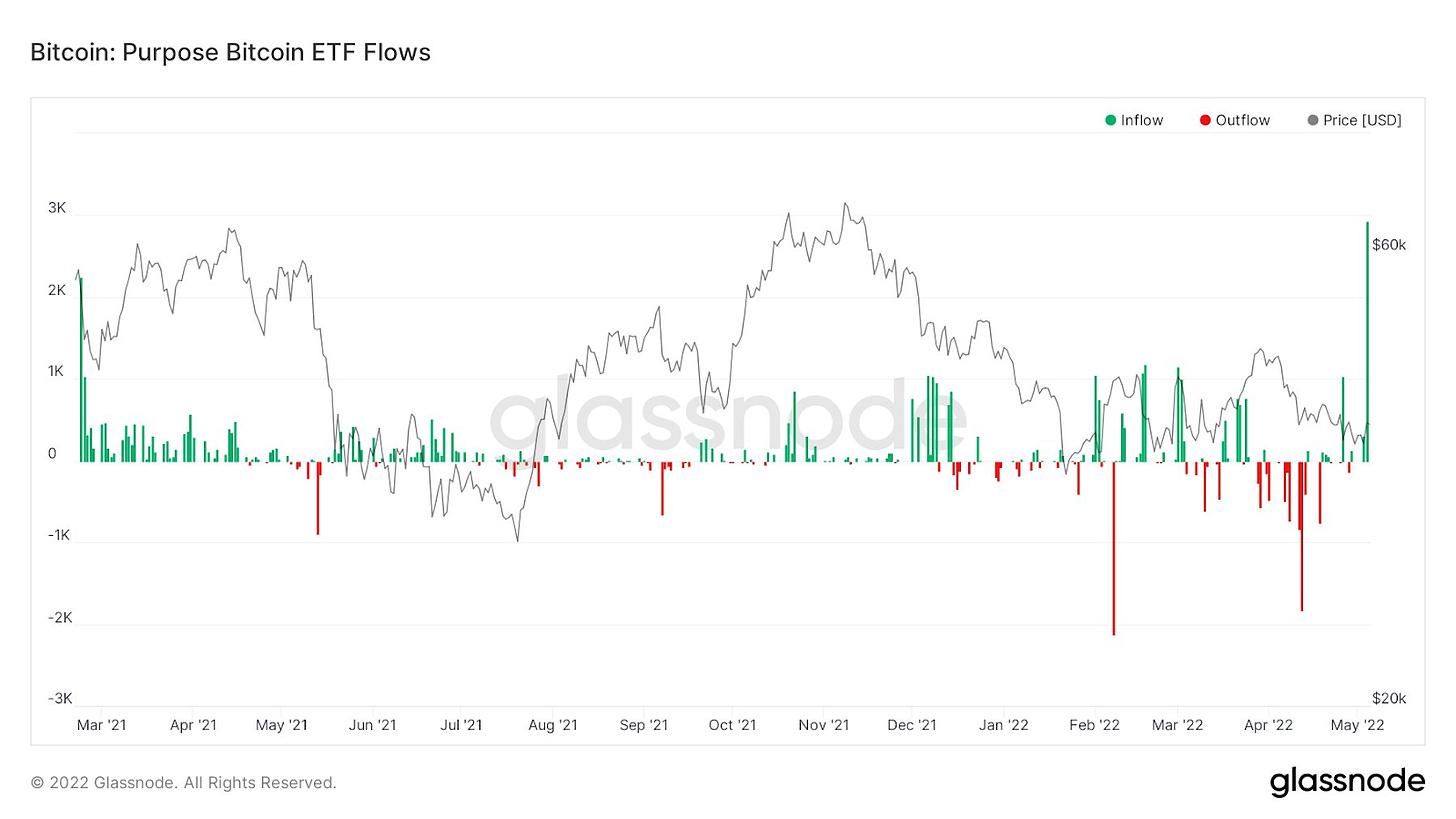

The biggest inflow in the Bitcoin Purpose spot ETF ever recorded

“The biggest inflow ever was recorded yesterday for the Bitcoin Purpose spot ETF. More than 2.9k $BTC added within one day.

AUM with that is currently at 34.4k BTC and roughly 2k BTC away from the all-time high.” by @JanWues

Global Economic News

TL;DR

Global stocks lost another $2.7tn in market cap

German people already buying less and Russian trade deficit hits ATH

Russian natural gas exports to China jump 60%

ECB balance sheet has shrunk for 1st time since Oct 2021

The Eurozone economies faces massive inflation

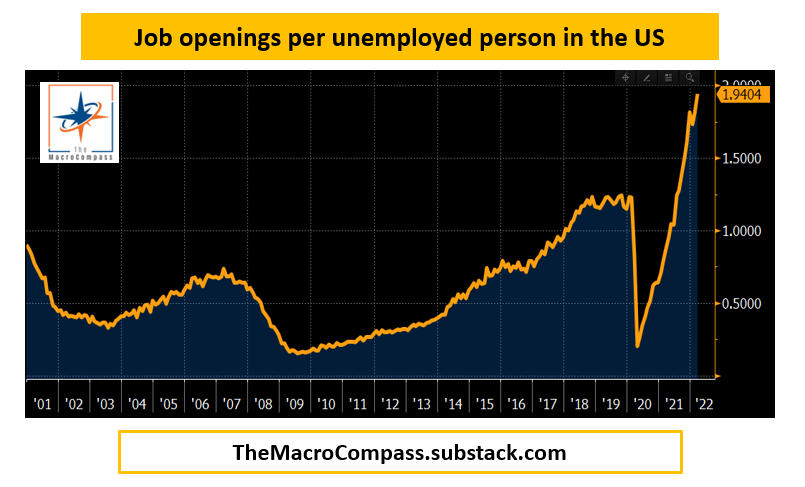

Nearly twice as many job offerings than workers in the U.S.

Really bad U.S. economic stats (grouped)

Carbon price keeps rising

Global stocks lost another $2.7tn in market cap

“Global stocks lost $2.7tn in mkt cap this (last) week as US GDP surprisingly declined, on a decidedly mixed set of results from FAAMG complex, recession fears & persistent concerns that Fed will still aggressively raise rates. Global stocks now worth $105tn, equal to 124% of global GDP.” by Holger Zschaepitz

German people already buying less and Russian trade deficit hits ATH

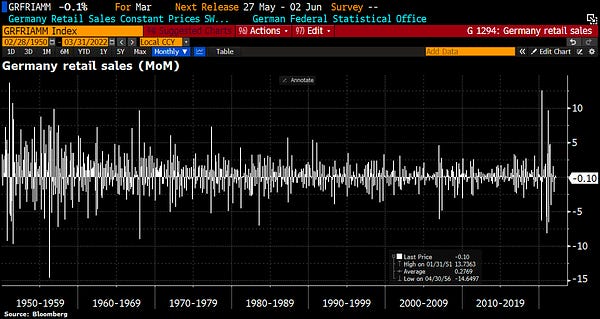

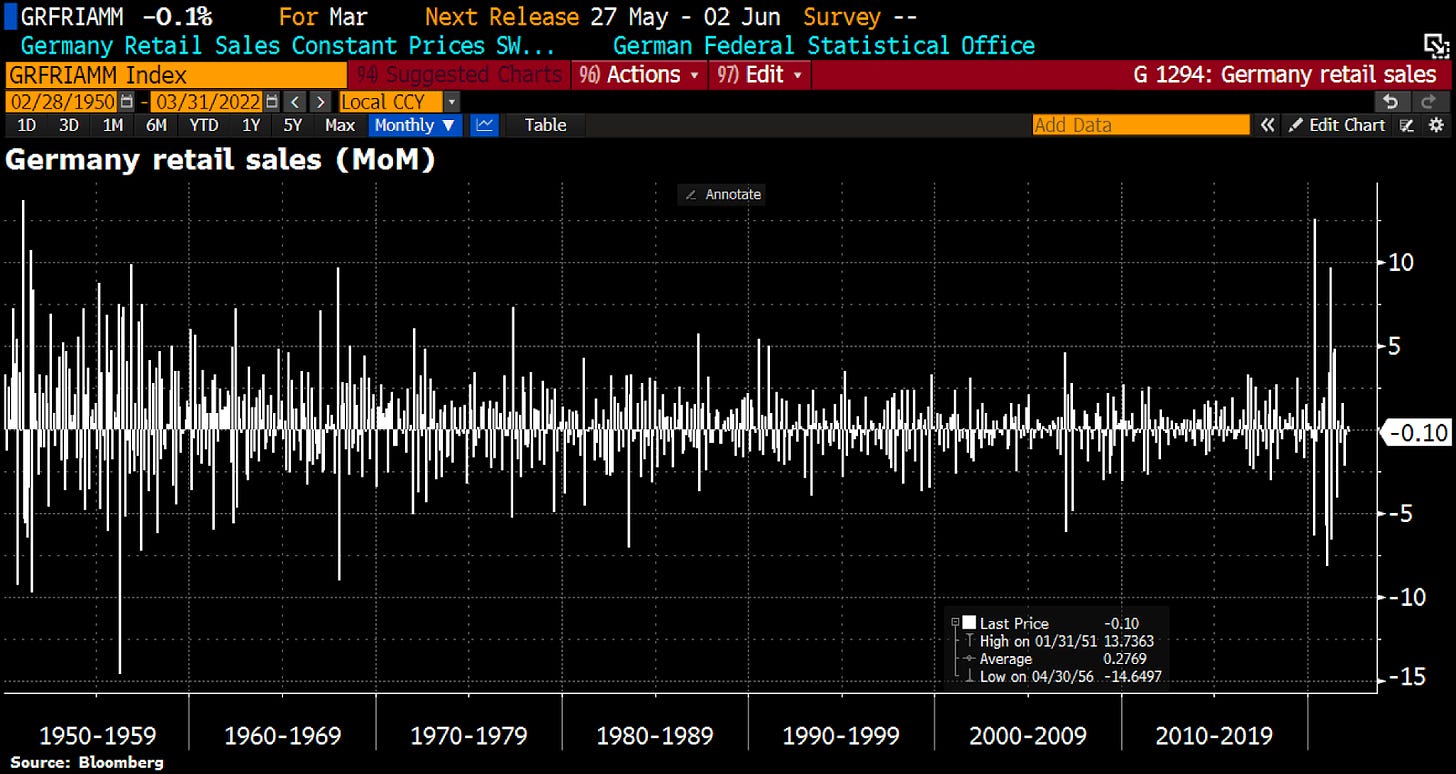

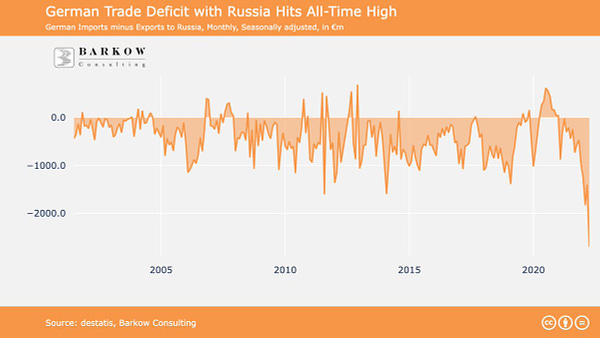

“Germany where consumers are buying less because of inflation. Retail sales unexpectedly fell in March as the war in Ukraine leads to price increases. Retail sales were down 0.1% MoM in real terms vs +0.2% MoM expected. Internet retail sales plunged 7.7% MoM.” by Holger Zschaepitz

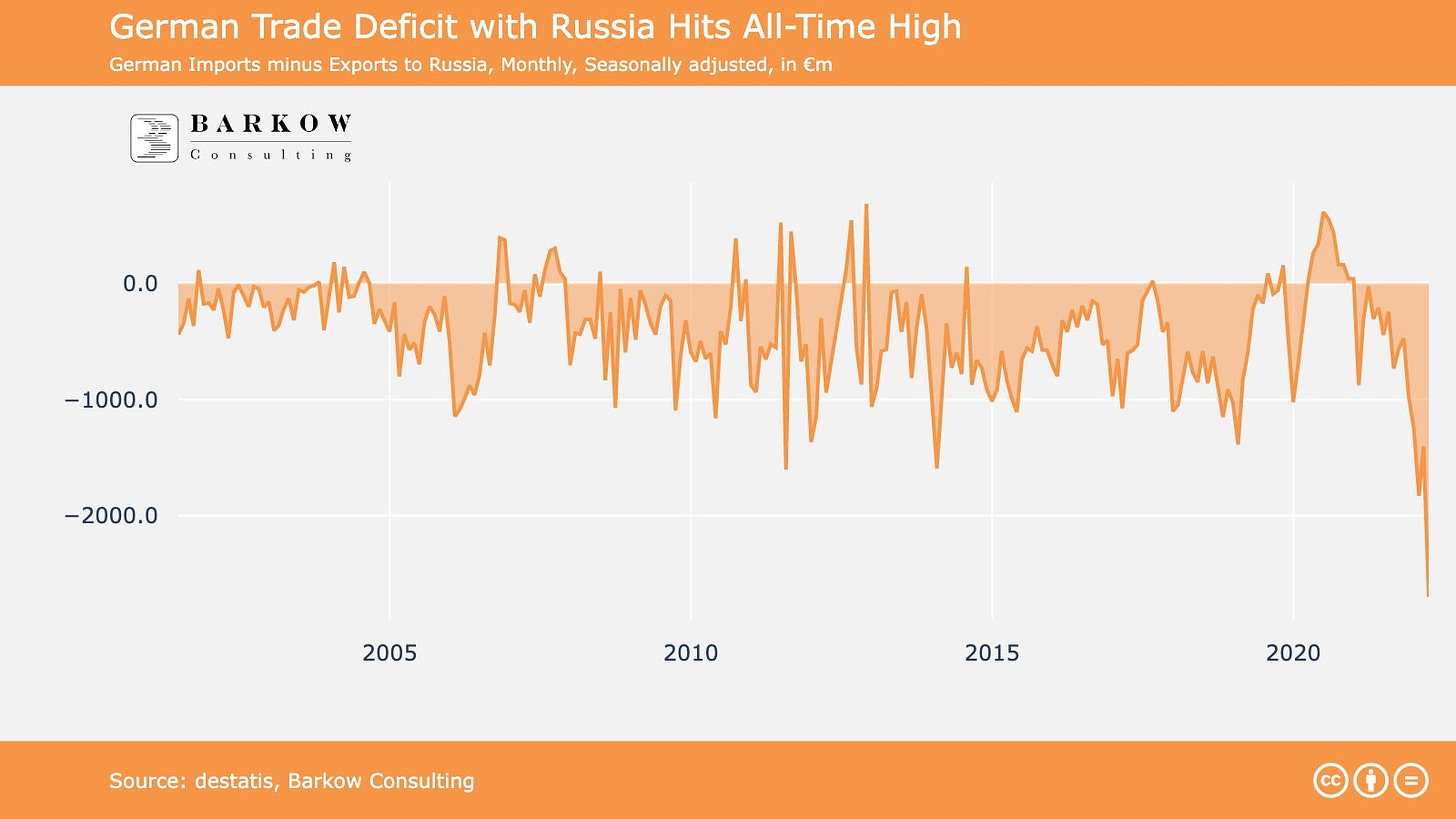

“Germany where trade deficit w/Russia hits ATH as German exports to Russia have collapsed & fallen to their lowest value in 19yrs, also down 65% MoM while imports remained high in Mar, down only 2%, after more than tripling since May2020.” by Holger Zschaepitz

Russian natural gas exports to China jump 60%

Russian gas producer Gazprom said natural gas exports to China went up 60 per cent in the first four months of the year from the same period of 2021.Russian President Vladimir Putin in February signed an estimated US$117.5 billion of oil and gas deals with Chinese leader Xi Jinping. They included a contract for Gazprom to supply China with 10 billion cubic metres of gas a year via a new pipeline – the Power of Siberia 2 – that will run from the island of Sakhalin, in the Russian Far East, to Heilongjiang province in China’s northeast.

The new pipeline is expected to be up and running by 2026 and will mean that – together with the existing pipeline – the annual supply of natural gas could increase to 48 billion cubic metres from around 10 billion cubic metres in 2021.

ECB balance sheet has shrunk for 1st time since Oct 2021

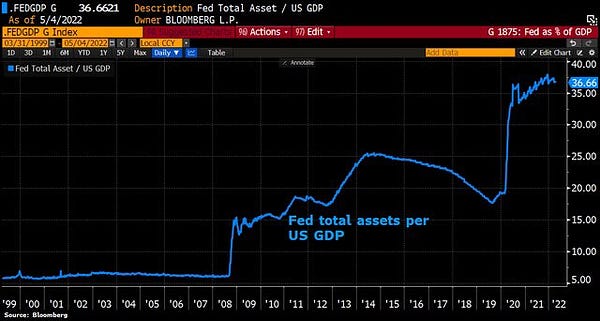

“ECB balance sheet has shrunk for 1st time since Oct 2021. Total assets have fallen €7.3bn in past week. But unlike in US, this is not end of balance sheet expansion. QE will continue until at least Jul. ECB balance sheet now equal to 82% of Eurozone GDP vs Fed's 37%, BoJ's 137%” by Holger Zschaepitz

The Eurozone economies faces massive inflation

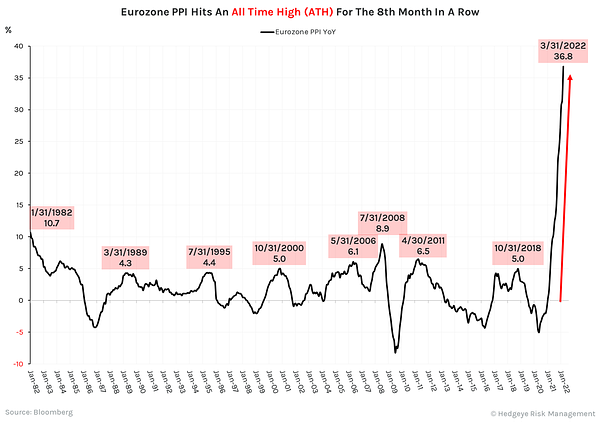

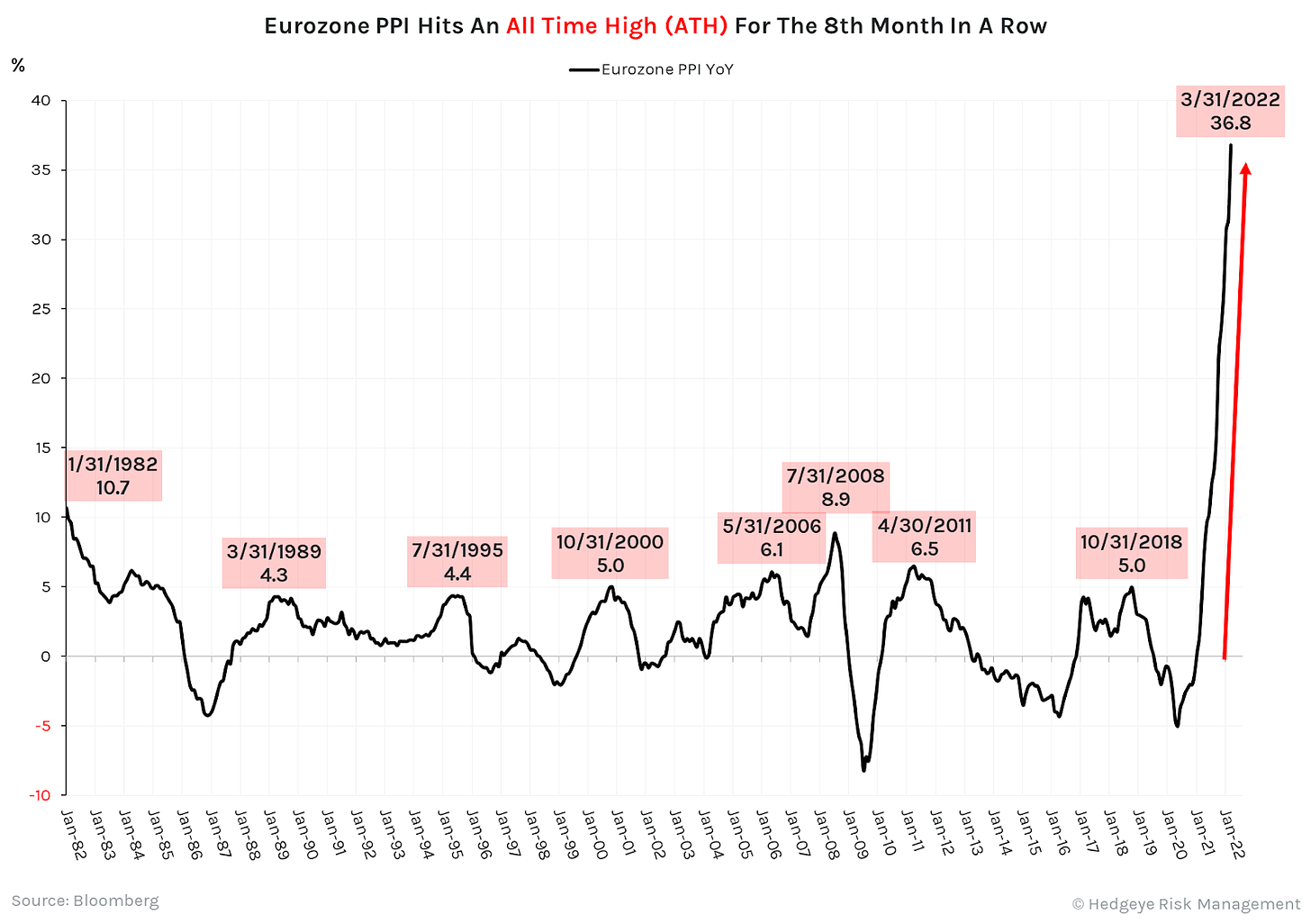

“Eurozone PPI just hit an all-time high at 36.8% YoY. 8th consecutive all-time high, previous print was 31.5%.” by Hedgeye

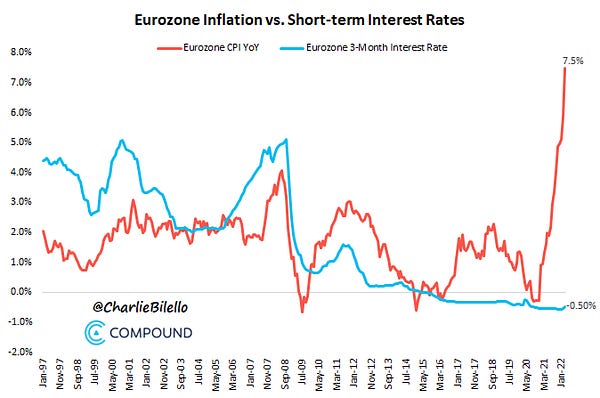

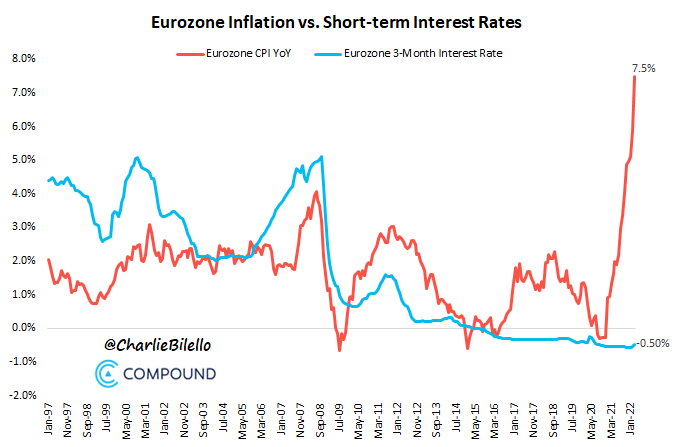

“Eurozone inflation has moved up to 7.5%, its highest level ever. Meanwhile, the ECB is still holding interest rates at negative levels with no plans to normalize. This is perhaps the greatest disconnect between monetary policy and rising prices that the world has ever seen.” by Charlie Bilello

Meanwhile the aluminium premium in the Eurozone has jumped by +15%

Nearly twice as many job offerings than workers in the U.S.

I don’t think that you will be surprised about this because after the government is giving free money to their citizens, who will want to work? Yeah, I know the brilliant unemployment stats, but guess what: Who won’t be in those statistics? Those who got enough free money, so they don’t even need to search for a job.Really bad U.S. economic stats (grouped)

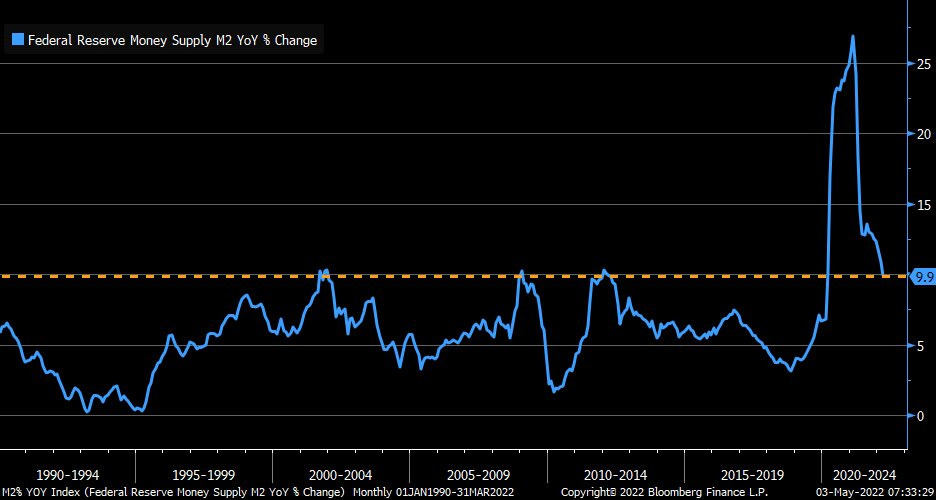

The Federal Reserve on Wednesday announced the largest (50 bp) interest rate hike since May 2000 and unveiled additional details about how it will further ease monetary stimulus, escalating its fight against the highest inflation rate in 40 years as the stock market reels over the potential implications for economic growth.The Fed announced it would begin reducing the size of its balance sheet by as much as $47.5 billion per month beginning on June 1, and as much as $95 billion per month starting in September.

Don't be fooled because if they really stop for a long term the USD printing machine the economy will face a never seen long recession. No politician will choose this path.

Remember Saylor’s words:”Inflation is a vector, inflation is not a scalar”, meaning it will never stop printing.

If you want to imagine how this vector looks like:

“We are 7 times more leveraged than we were in 2008. Crisis to Crisis. Bad news is we're at war, more lockdowns, cultural wars, food shortage, energy crisis, recession, trade deficit. Hey, but stonks soared on this 7 times to the downside move” by @WallStreetSilv

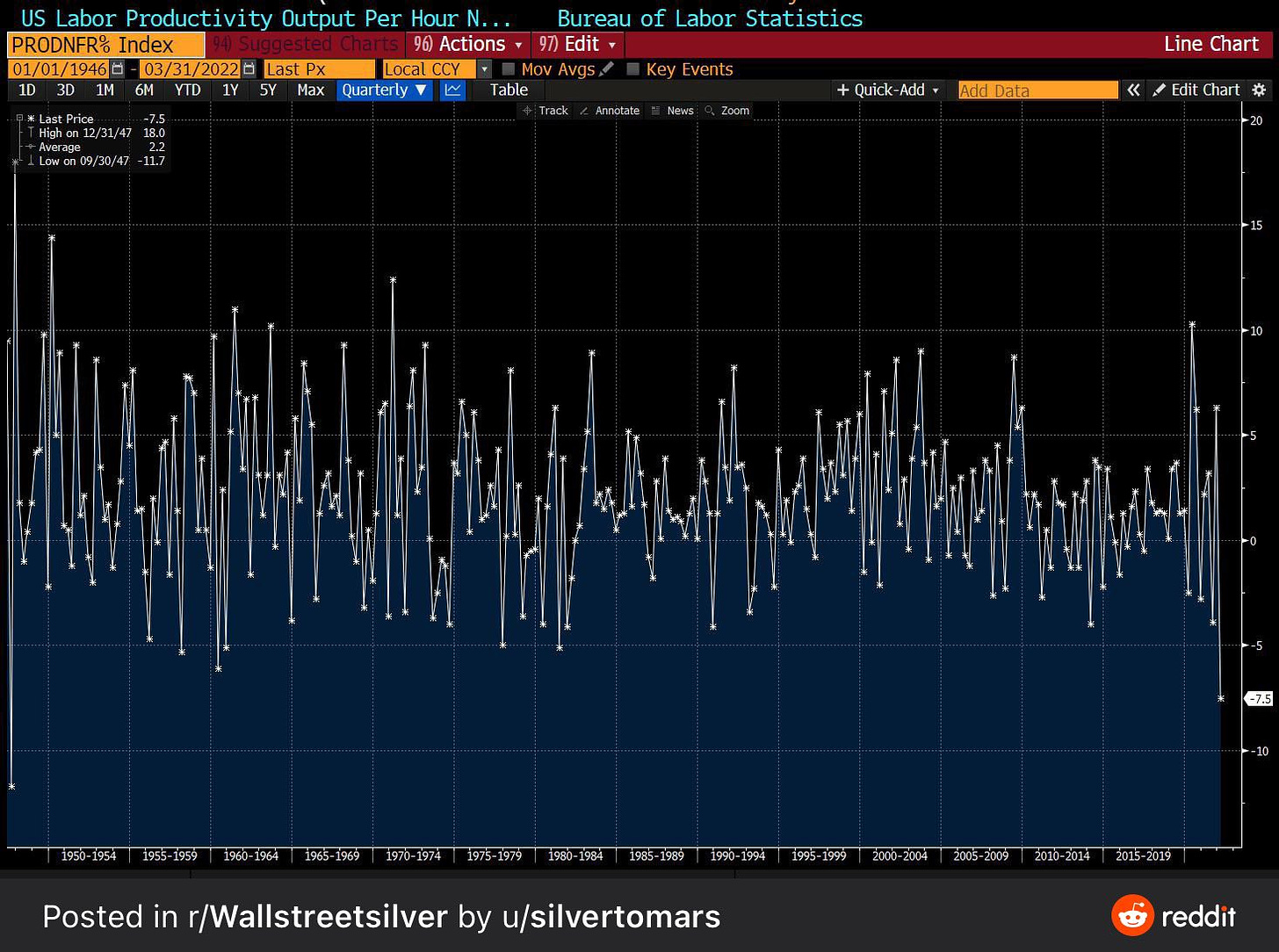

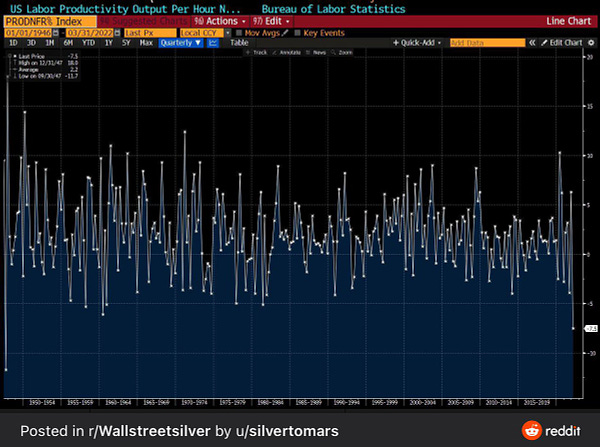

Meanwhile the U.S. productivity registered the biggest drop since 1947!

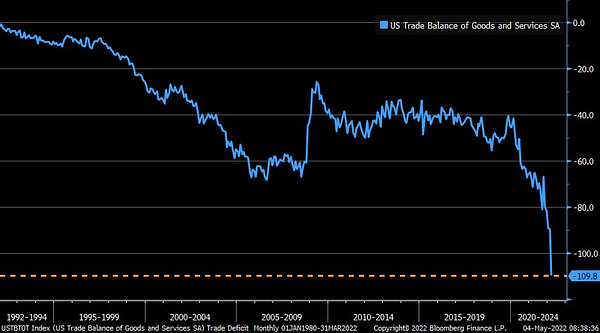

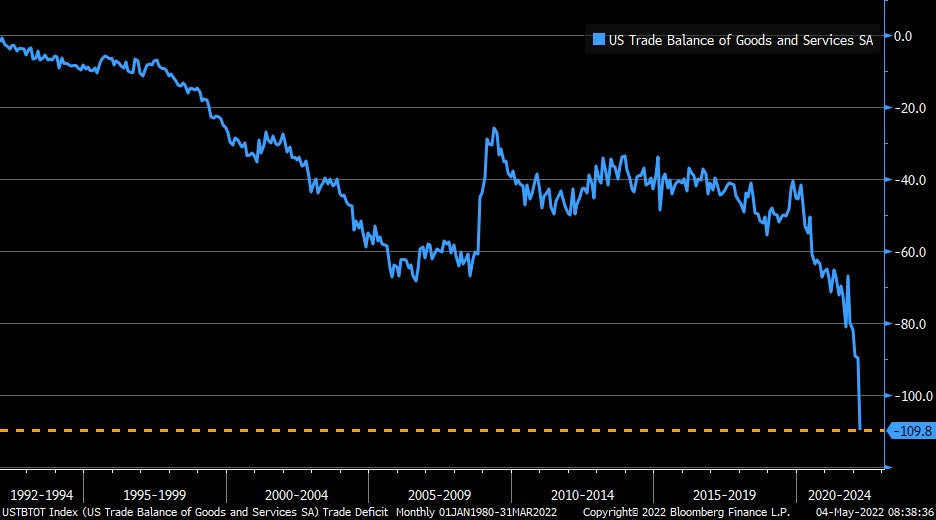

“Trade deficit surged to record in March, $109.8 billion vs. $107.1 billion est. & $89.8 billion in prior month (rev from $89.2 billion) … imports +10.3%; exports +5.6%” by Liz Ann Sonders

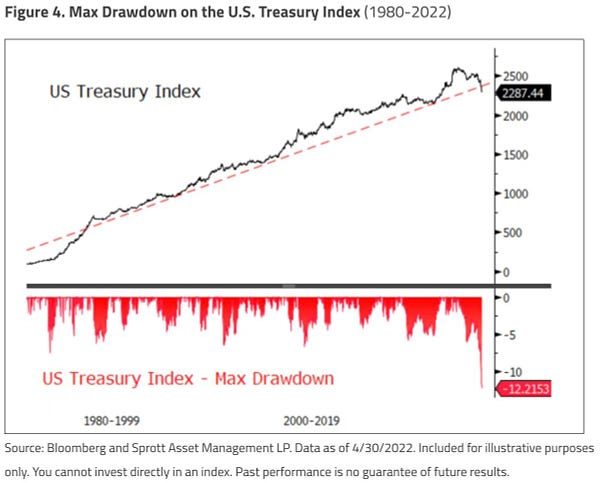

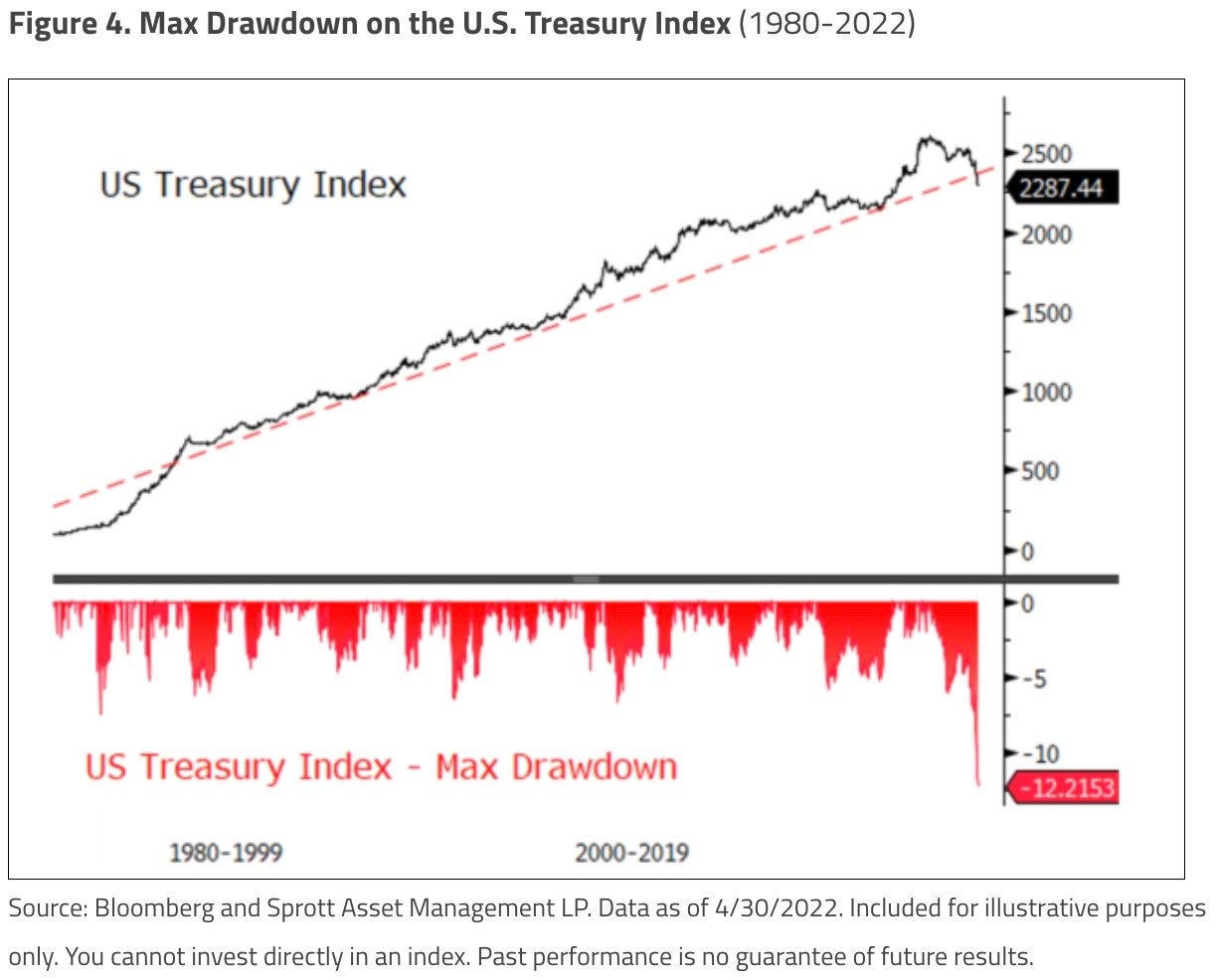

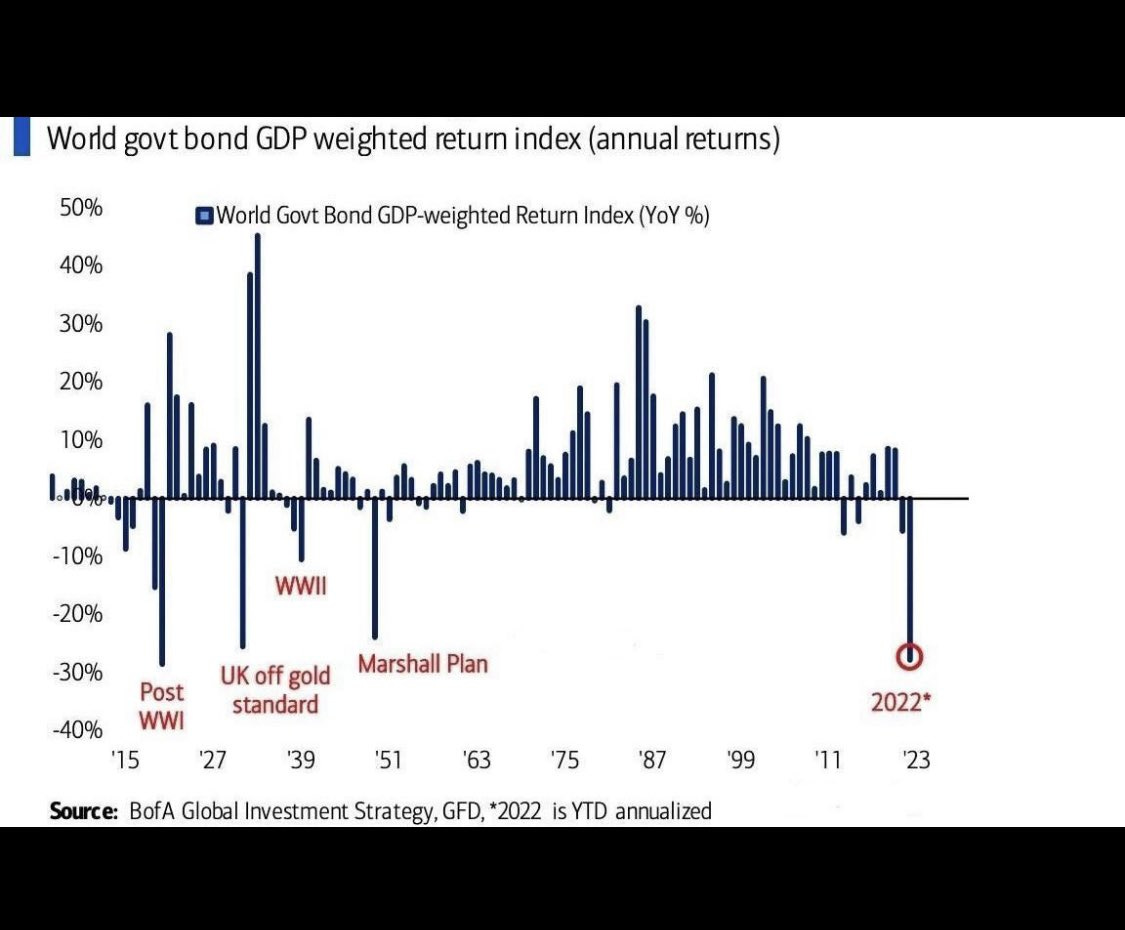

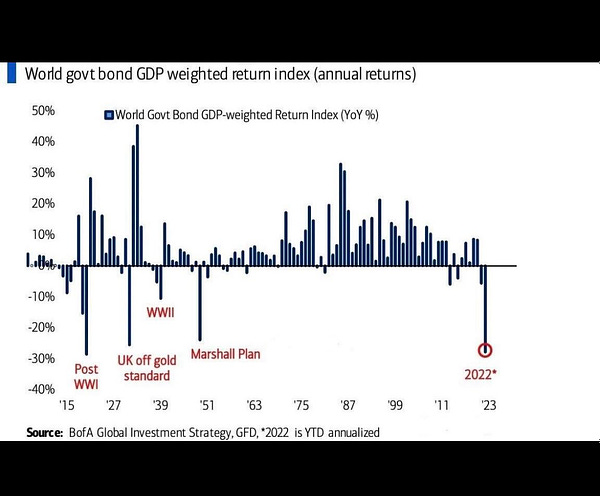

“The U.S. Treasury Index’s YTD 2022 return is now -8.5%, representing a significant loss in the value of U.S. government bonds. But it is the drawdown that highlights the pressure facing most multi-asset funds. The drawdown is the worst in nearly 50 years.” by @Ben_Rickert

“Bonds on course for biggest loss since 1920” by @WallStreetSilv

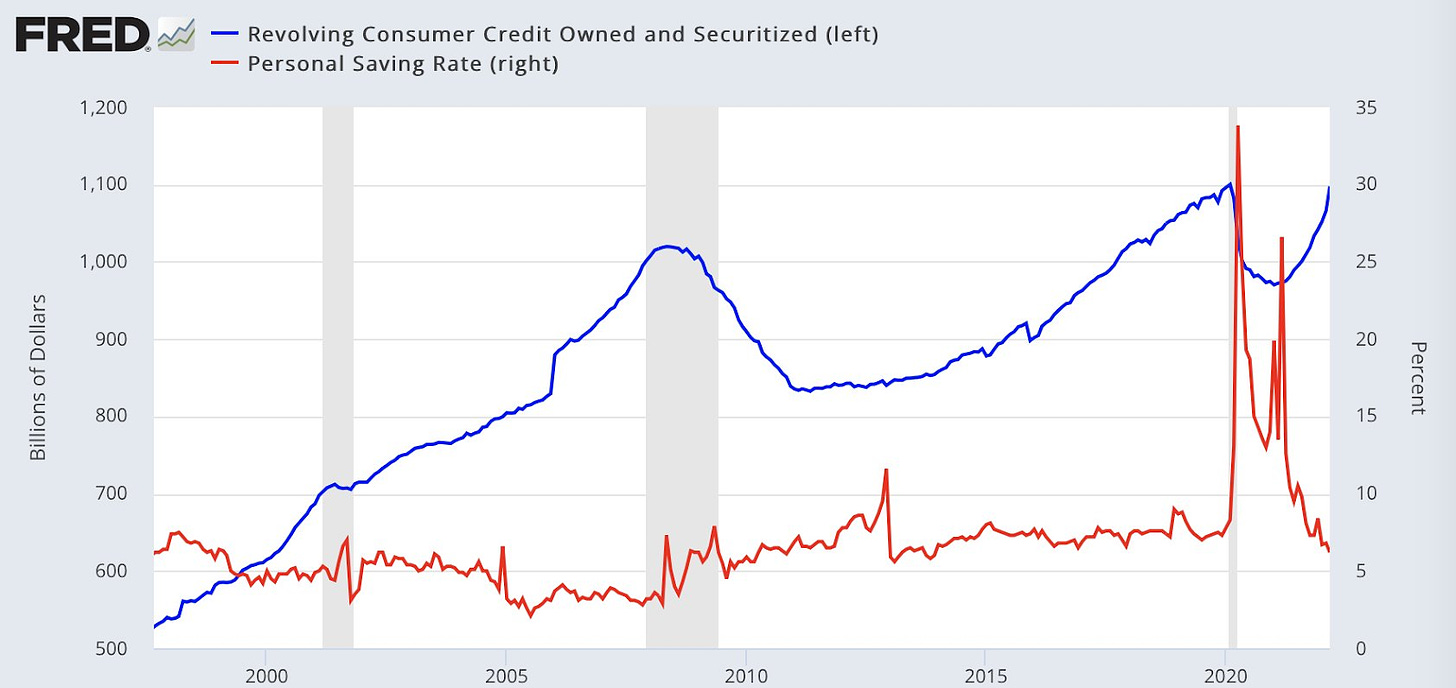

“Personal savings rate collapsing while piling back into record credit card debt with 40 year highs in inflation..Yea, this can't miss.” by Sven Henrich

Carbon price keeps rising

“Carbon price keeps rising as more and more money is flowing into the carbon market via ETPs. The total funds flowing into exchange-traded carbon products have soared to almost $2.4bn currently, BBG reports.” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

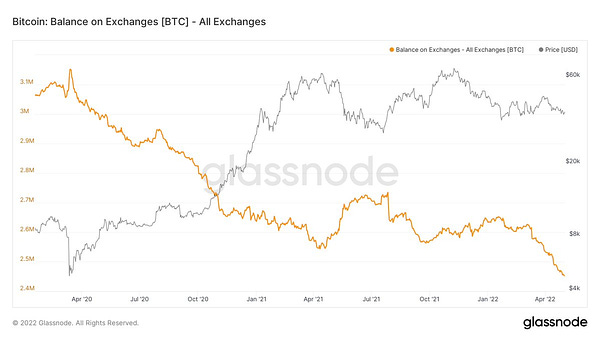

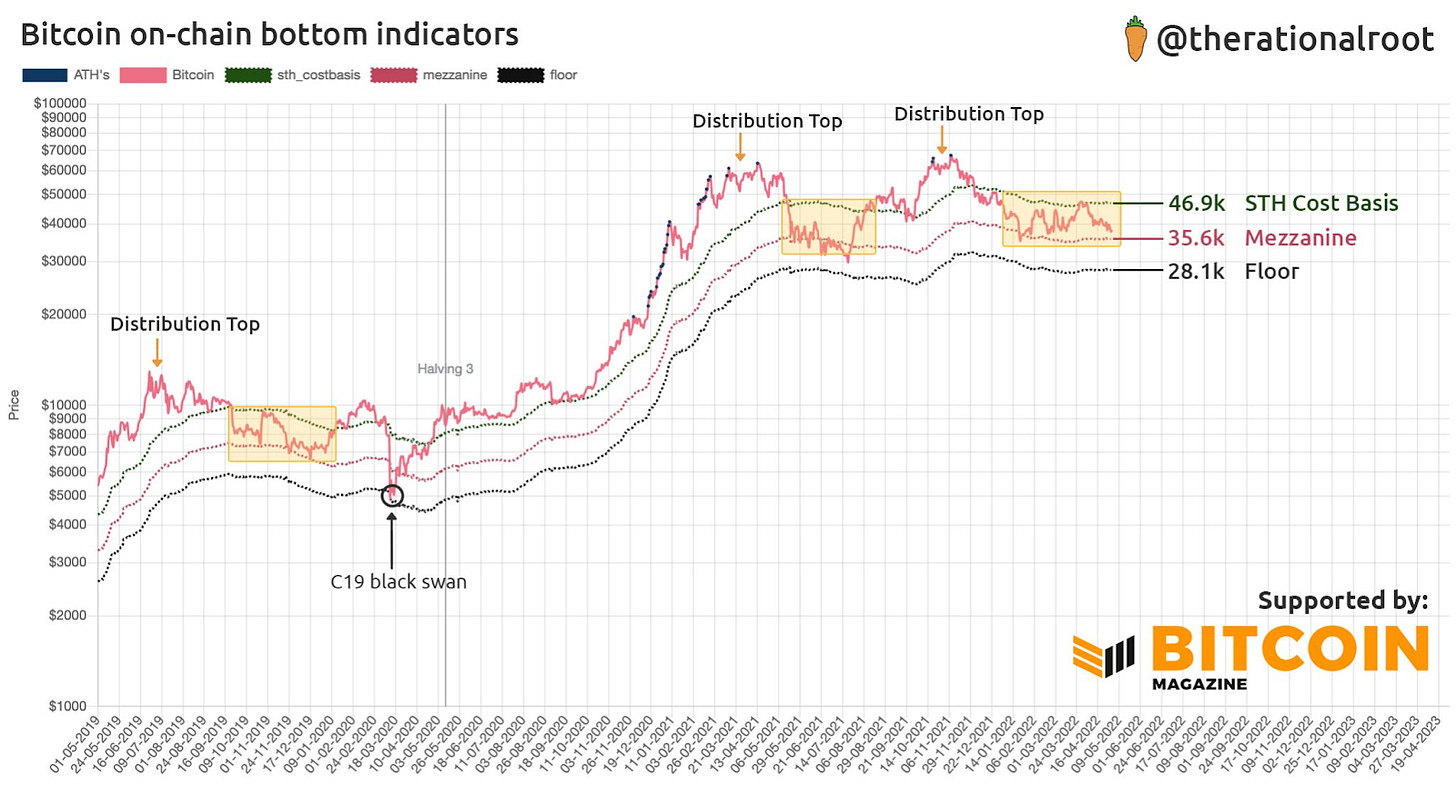

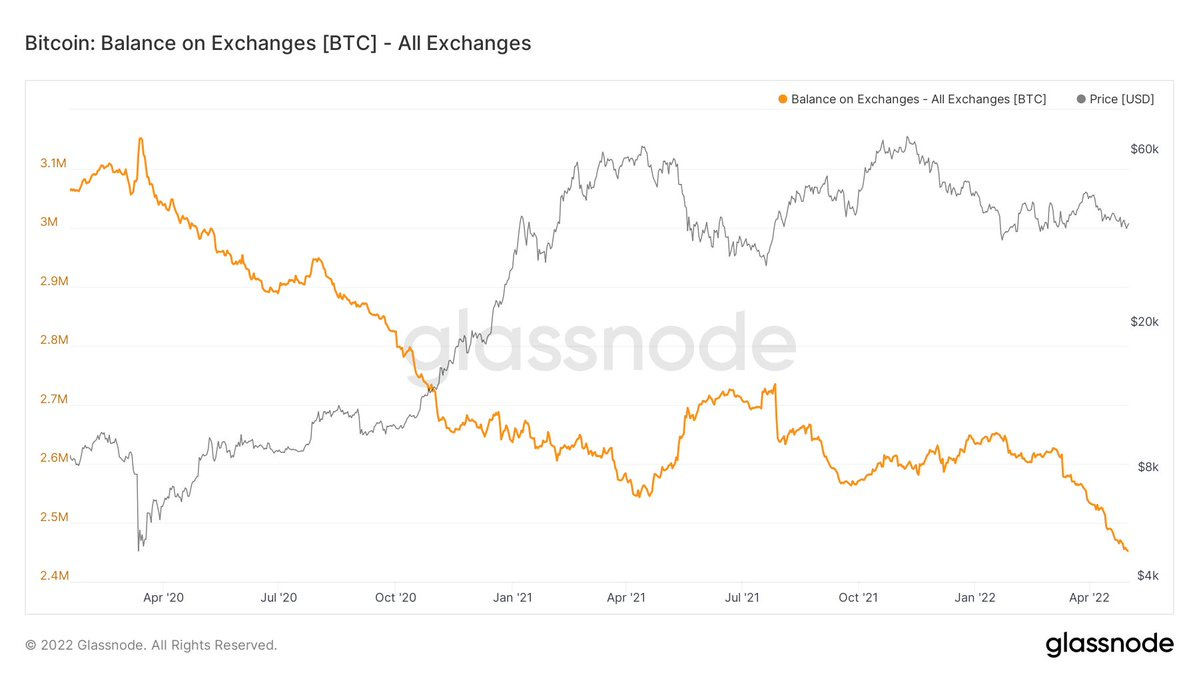

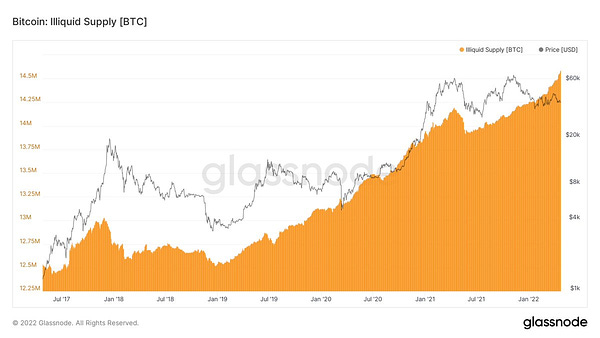

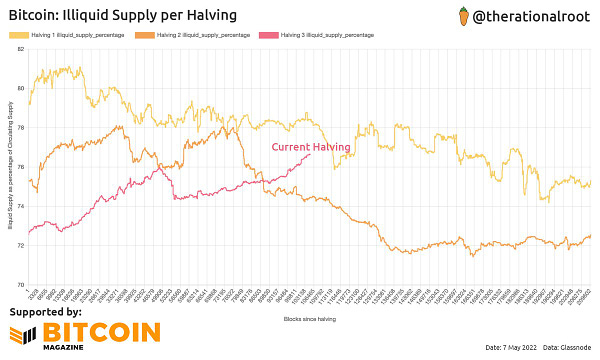

“Still in the same choppy area, Bitcoin changing from weak to strong hands.” by Root

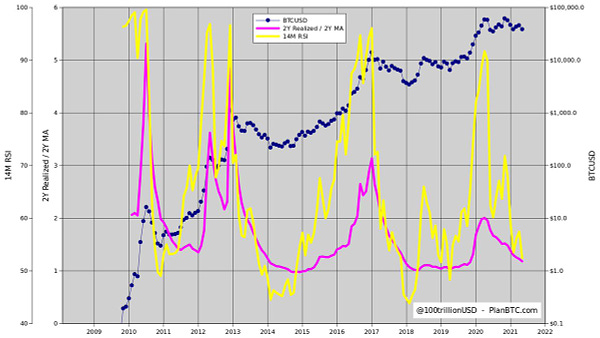

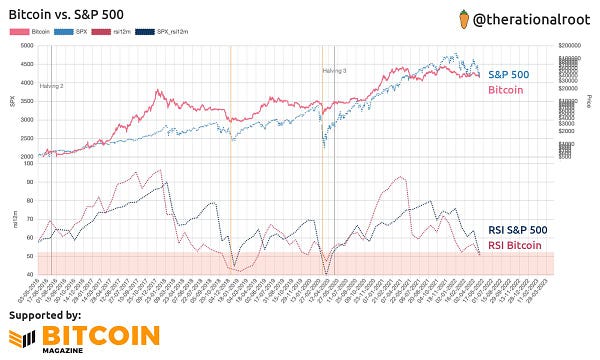

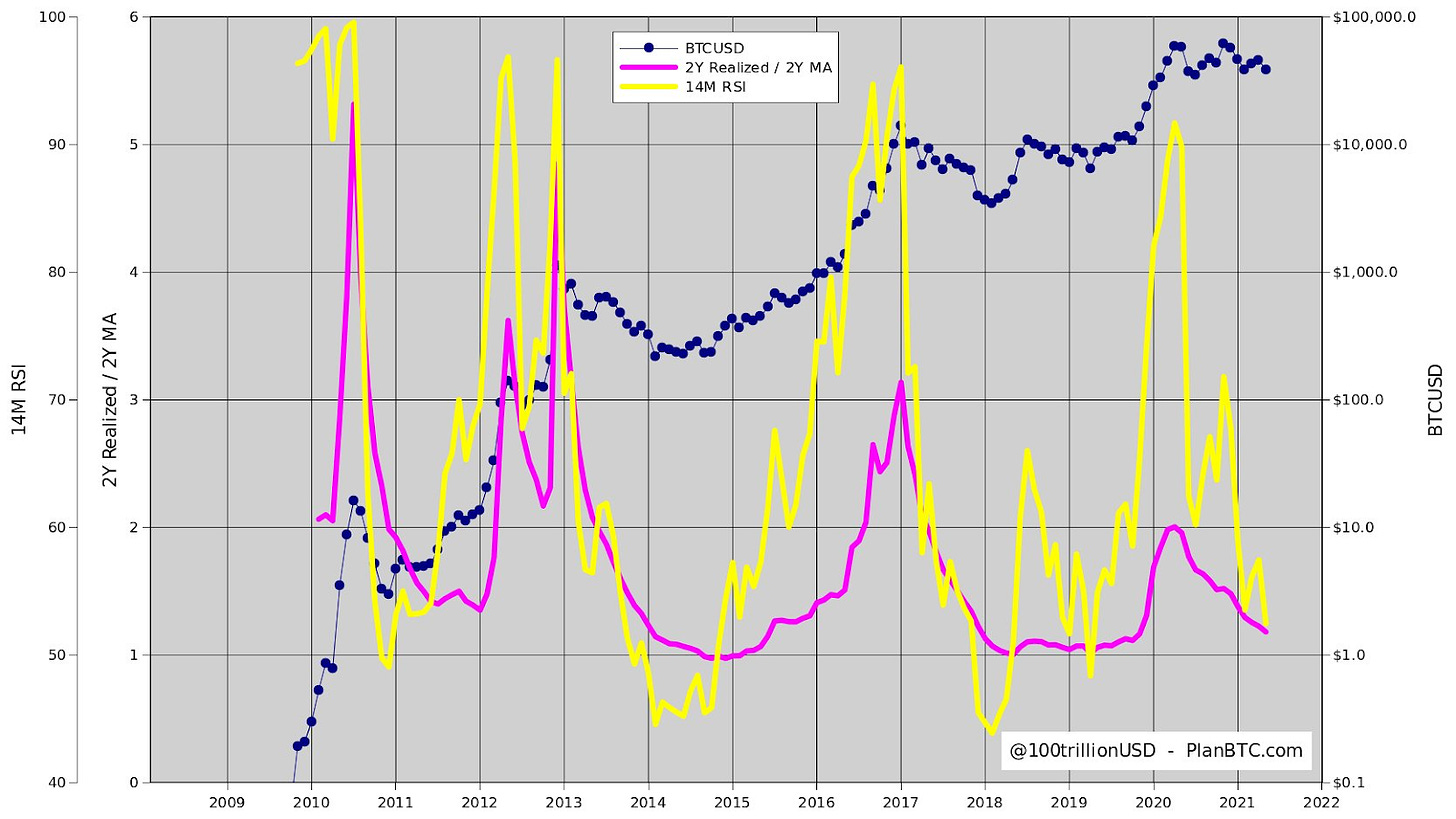

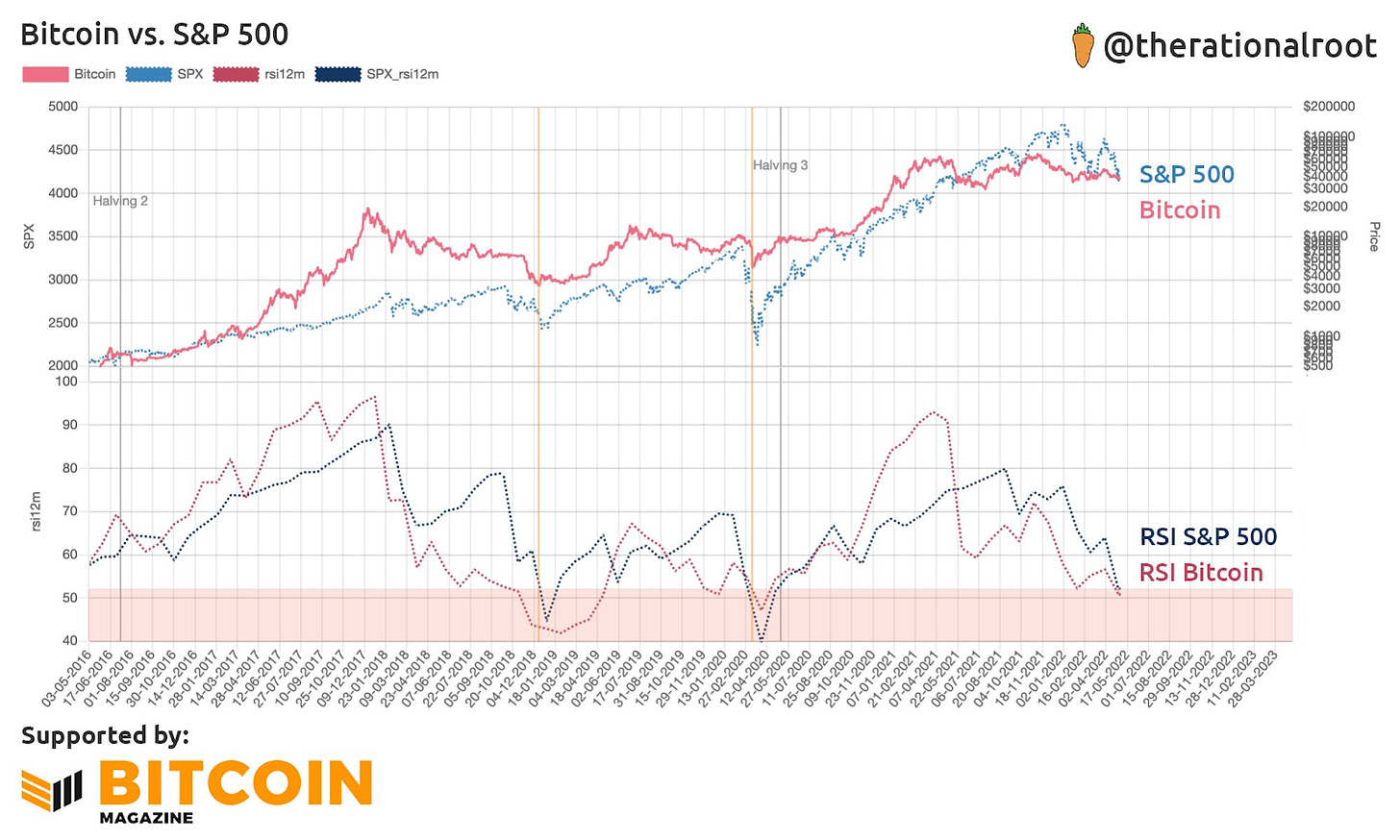

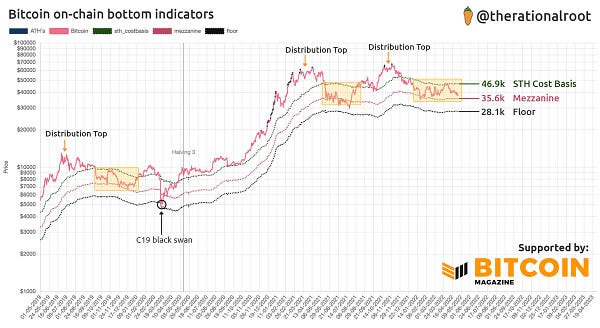

“Technical (RSI) & on-chain (realized) indicators show that bitcoin went full cycle. We had a bull market (top Mar/Apr 2021) and a bear market. In fact we are still in a bear market. Question is: is the bottom behind us (similar to realized in 2012) or yet to come (e.g. RSI<50)?” by PlanB

“Bitcoin bullish divergence... “ by Bitcoin Archive

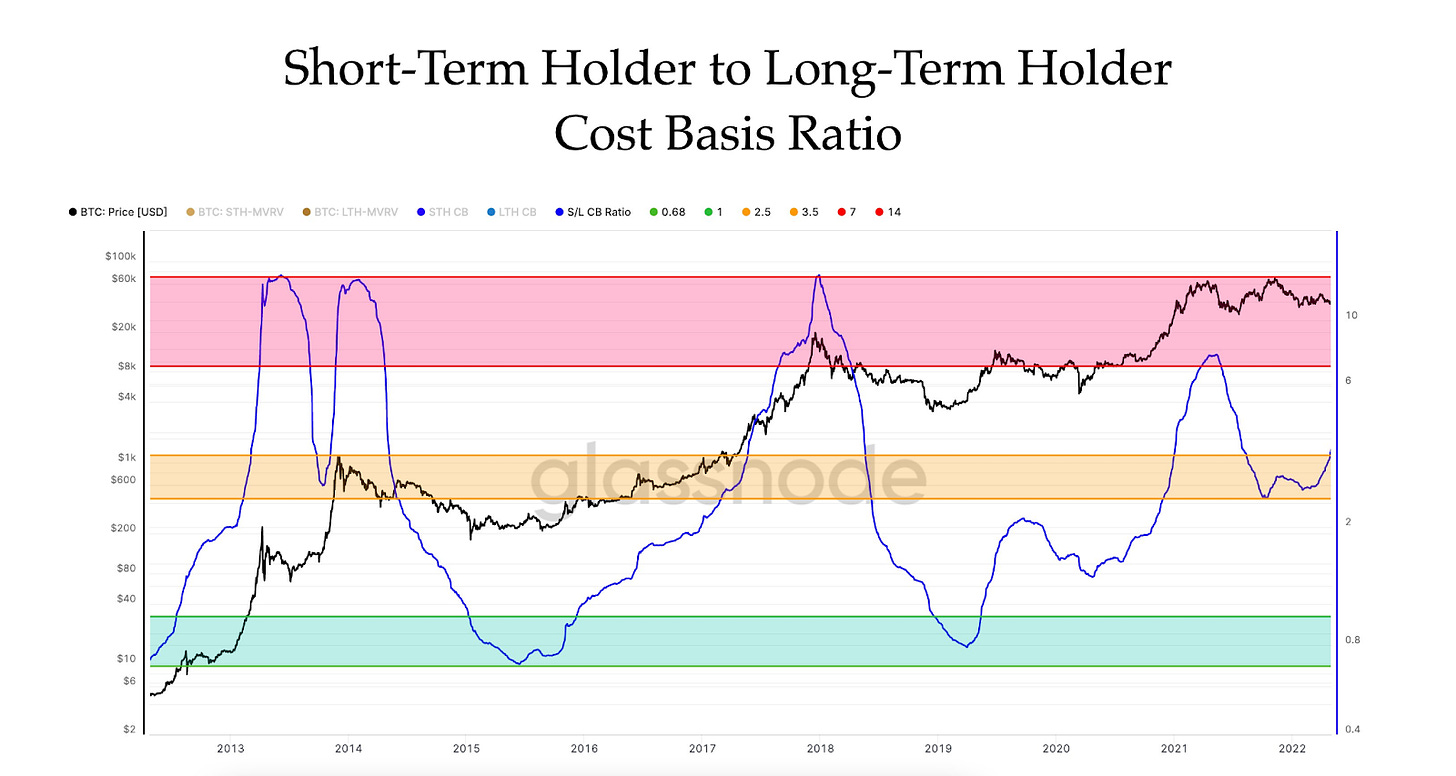

“This metric just left the middle orange zone to the upside. This has never happened in a bear market or leading into a bear market.” by @TheRealPlanC

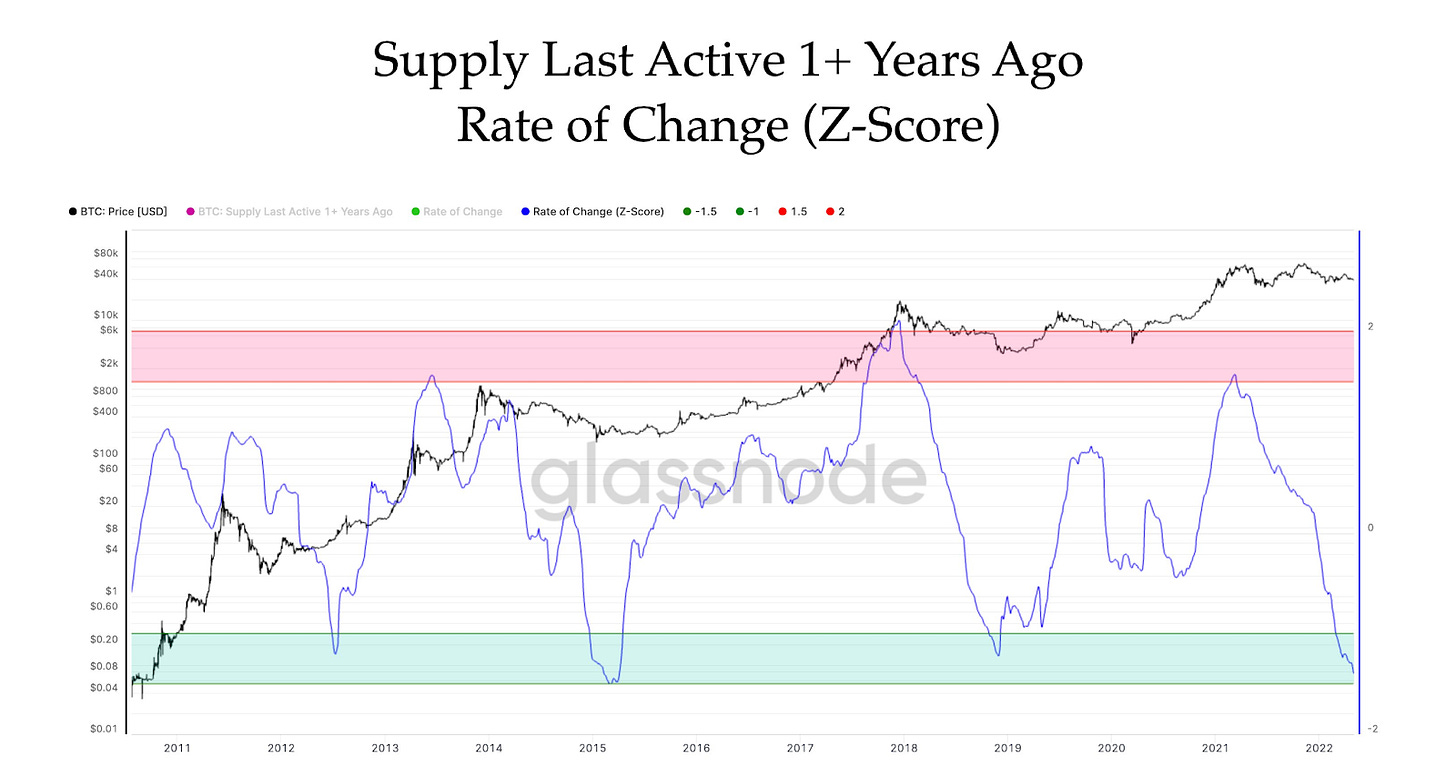

“April 8th | -1.24 ; May 4th | -1.38

We are now the second lowest we have ever been. The last time we were this low once we left the green zone the 2017 crypto bull market followed.” by @TheRealPlanC

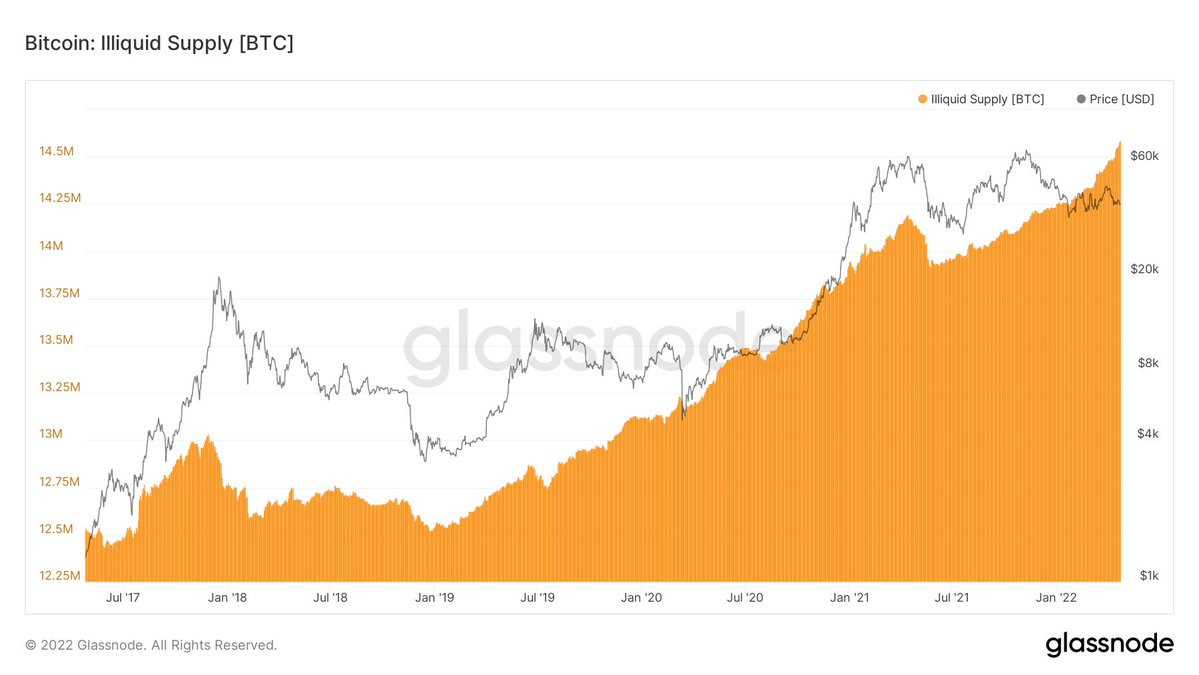

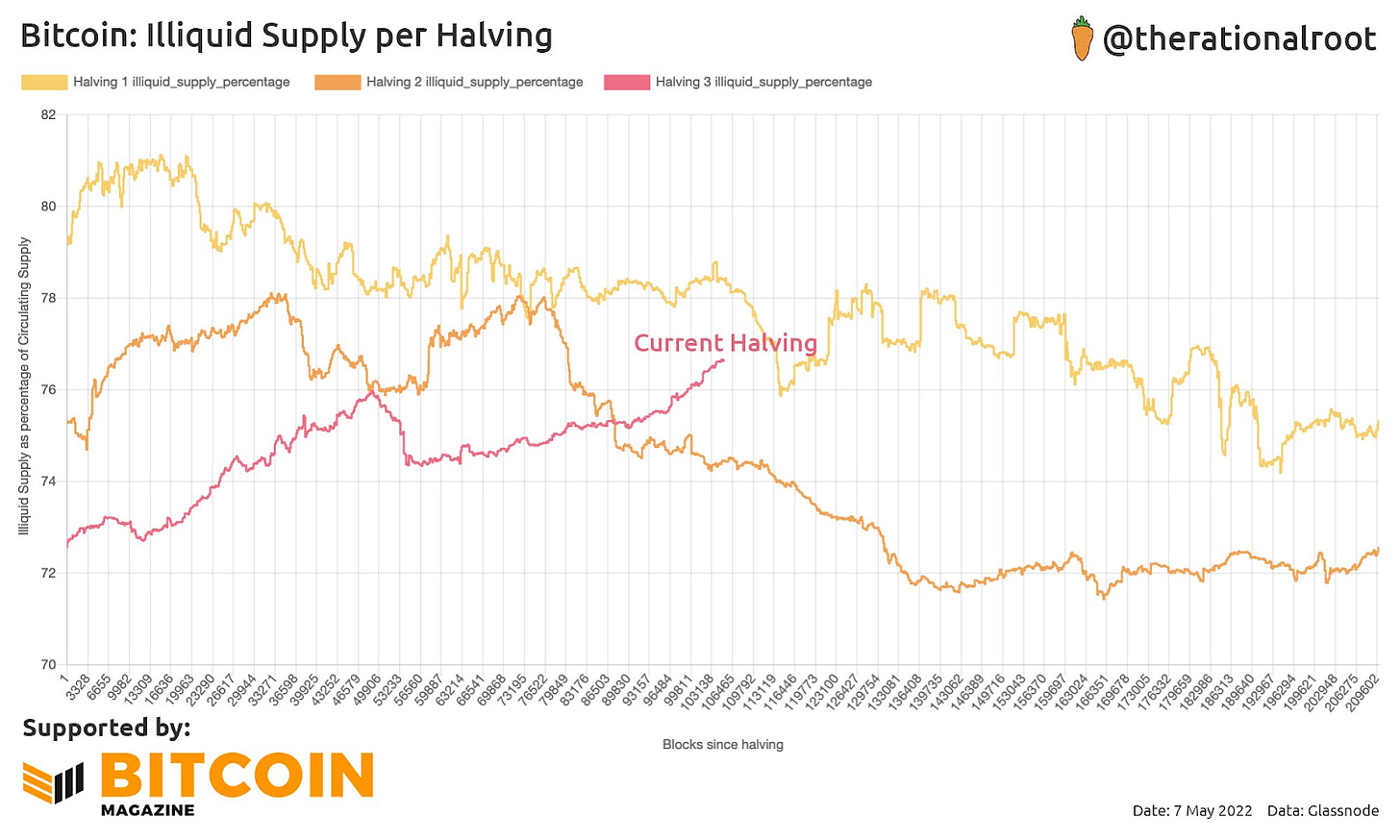

“Bitcoin illiquid supply is reaching new heights!” by @HardBlockBTC

“RSI SP500 and RSI Bitcoin now together in the oversold zone where historically fairly rapidly a bottom formed.” by Root

“While price is down because hype is gone and fear is ruling the market — a supply shock is brewing. Remember, fear will fade and hype will pick up again. “ by Root

Bitcoin Shorts

Funny Bitcoin short stories

“It took 12 years for the first nation to adopt Bitcoin. It took 9 months for the second” by Documenting Bitcoin

Streaming platform Angel Studios has bought $10.6m Bitcoin. Angel Studios is backed by gigafund, a VC company investing in Elon Musk’s companies.

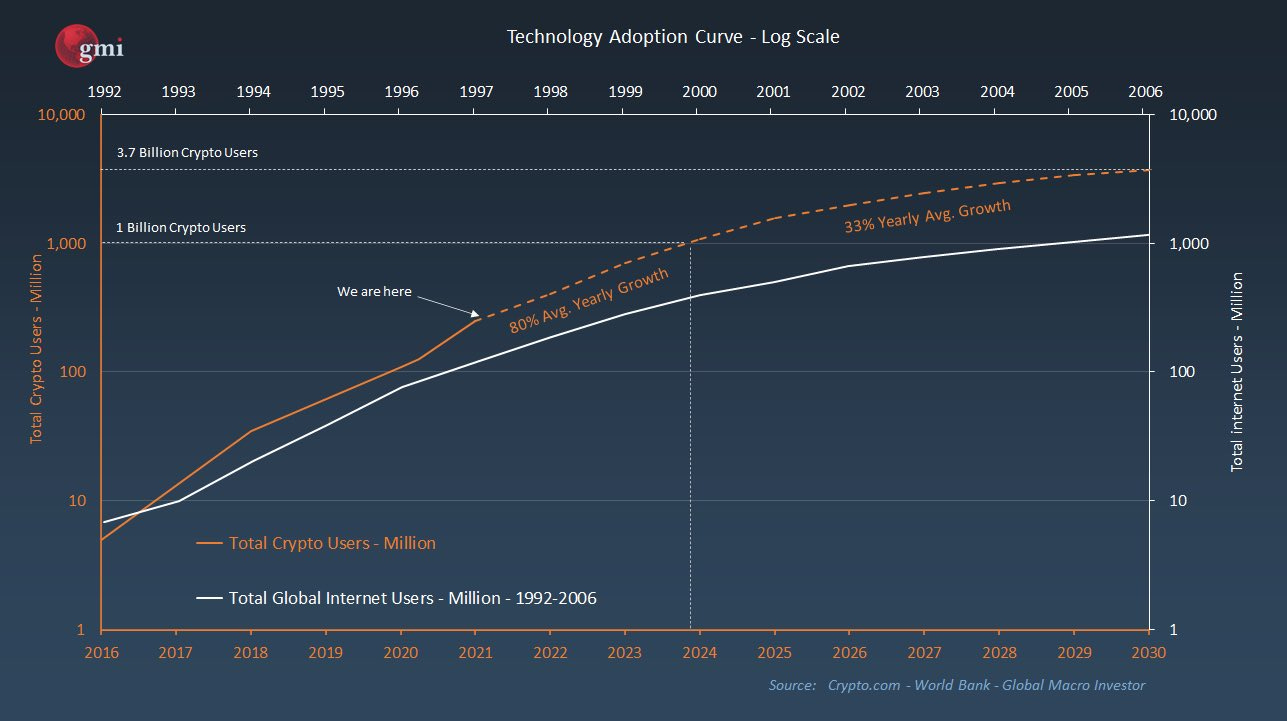

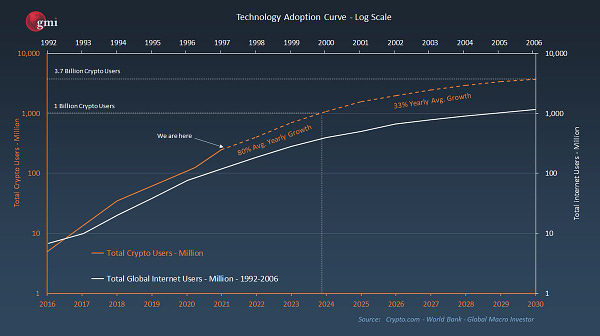

“Bitcoin is growing faster than the Internet.” by Documenting Bitcoin

JOE ROGAN: Bitcoin is a viable form of currency. (video)

"If you look at the smartest and brightest minds that are coming out of colleges today, so many of them are going into crypto", says Paul Tudor Jones. (video)

“The amount of Bitcoin on exchanges just keeps falling! Retail keeps buying. Whales keep buying. Institutions keep buying. I keep buying.” by Lark Davis

“Future S.Korea Finance Minister wants to delay Bitcoin capital gains tax until 2025” by Blockworks

Happy Birthday, Hal Finney!

“The average home in America is worth 14 Bitcoin. Collectively, all the homes in America are worth 1.3B Bitcoin. ($507k avg sales price * 95M homes / $37k BTC) There will only ever be 21M Bitcoin. Only 0.22 Bitcoin per existing home in America.” by @Croesus_BTC

“100 Bitcoin gold bar bought for cash 9 years ago.

A $12,000 risk, a $3.8 million reward” by @pete_rizzo_

“PORTUGAL: A house was just sold for 3 Bitcoin in the first 100% Bitcoin transaction for real estate (in Portugal)” by Bitcoin Archive

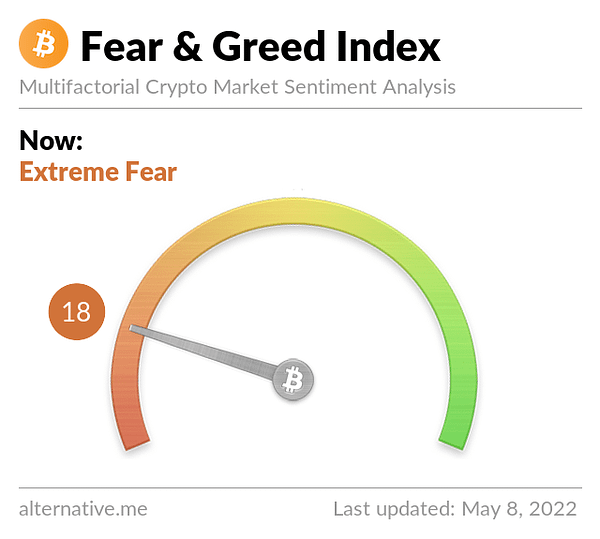

“Bitcoin Fear and Greed Index is 18 — Extreme Fear Current price: $35,339” by @BitcoinFear

Bitcoin was first referenced on TV when it was $3. “It’s the future.” (video)

Suggestions

Interesting articles to read

Half Of France's Nuclear Reactors Are Shutdown Amid Energy Crisis

China Holds Secret Bank Meetings To Plan For Protecting Assets From US Sanctions

Tamny: The Dollar Is 'Mighty' In the Way That Kim Jong Un Is 'Tall'

China Has 'Financial Nuclear Bombs' If West Levies Russia-Style Sanctions, Beijing Warns

Sources: