2022/15

25 April 2022 - 01 May 2022 week Bitcoin & Economic News

Bitcoin News

TL;DR

In the Central African Republic Bitcoin is a legal tender

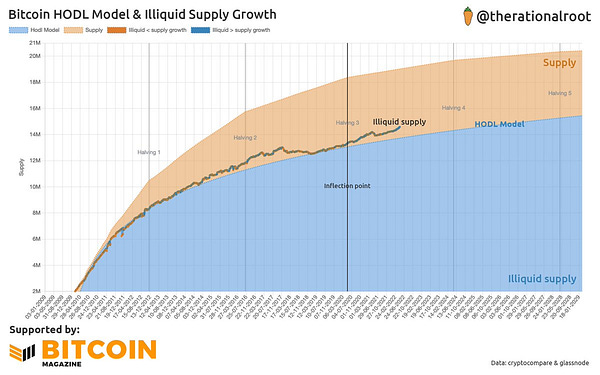

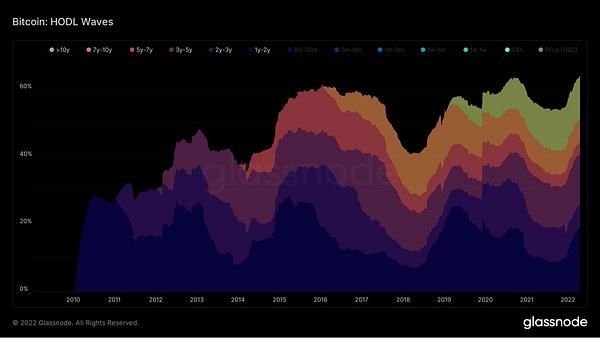

64% of all Bitcoin has not moved in over a year

Bitcoin mining efficiency surged 63% (UPDATED!)

Fidelity Investments plans to allow investors to put Bitcoin in their 401(k)s (UPDATED!)

Fort Worth has become the first city government in the U.S. to mine Bitcoin

New York passes bill in the assembly to ban Bitcoin mining

Bitcoin ATM in the Mexican Senate

Cuban central bank legalizes Bitcoin

Goldman Sachs lent out its first Bitcoin-backed loan

RIOT Blockchain announced a development of a new 1 gigawatt mining farm

First-ever "Hybrid" ETP bets on Gold and Bitcoin

Panama has approved a bill regulating the use of bitcoin as payment

Major Dubai luxury property developer now accepts Bitcoin

In the Central African Republic Bitcoin is a legal tender

Great to start the week with news like this! The Central African Republic is the first country in Africa to take the initiative to make bitcoin a legal tender with a unanimously passed bill. In what is considered to be the first initiative, the country put forward the decision in the country’s plan for development and economic recovery.Following El Salvador, recently an autonomous region in Portugal, Madeira and a special economic zone in Honduras have approved bitcoin as a legal tender, all made easier to choose the wisest option for storing wealth in a sound money solution.

“There’s a common narrative that sub-Saharan African countries are often one step behind when it comes to adapting to new technology,” Finance Minister Herve Ndoba said. “This time, we can actually say that our country is one step ahead.”

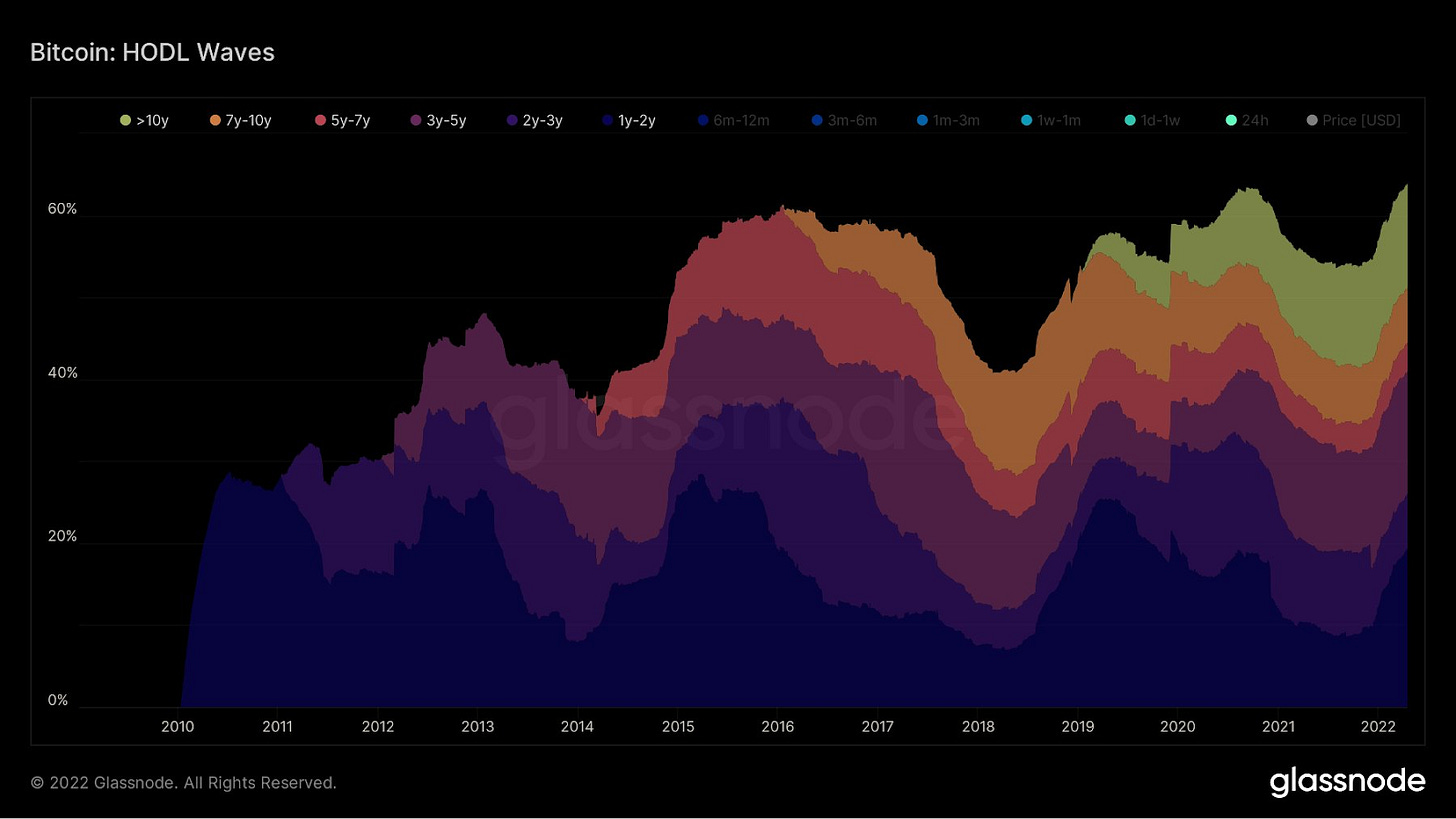

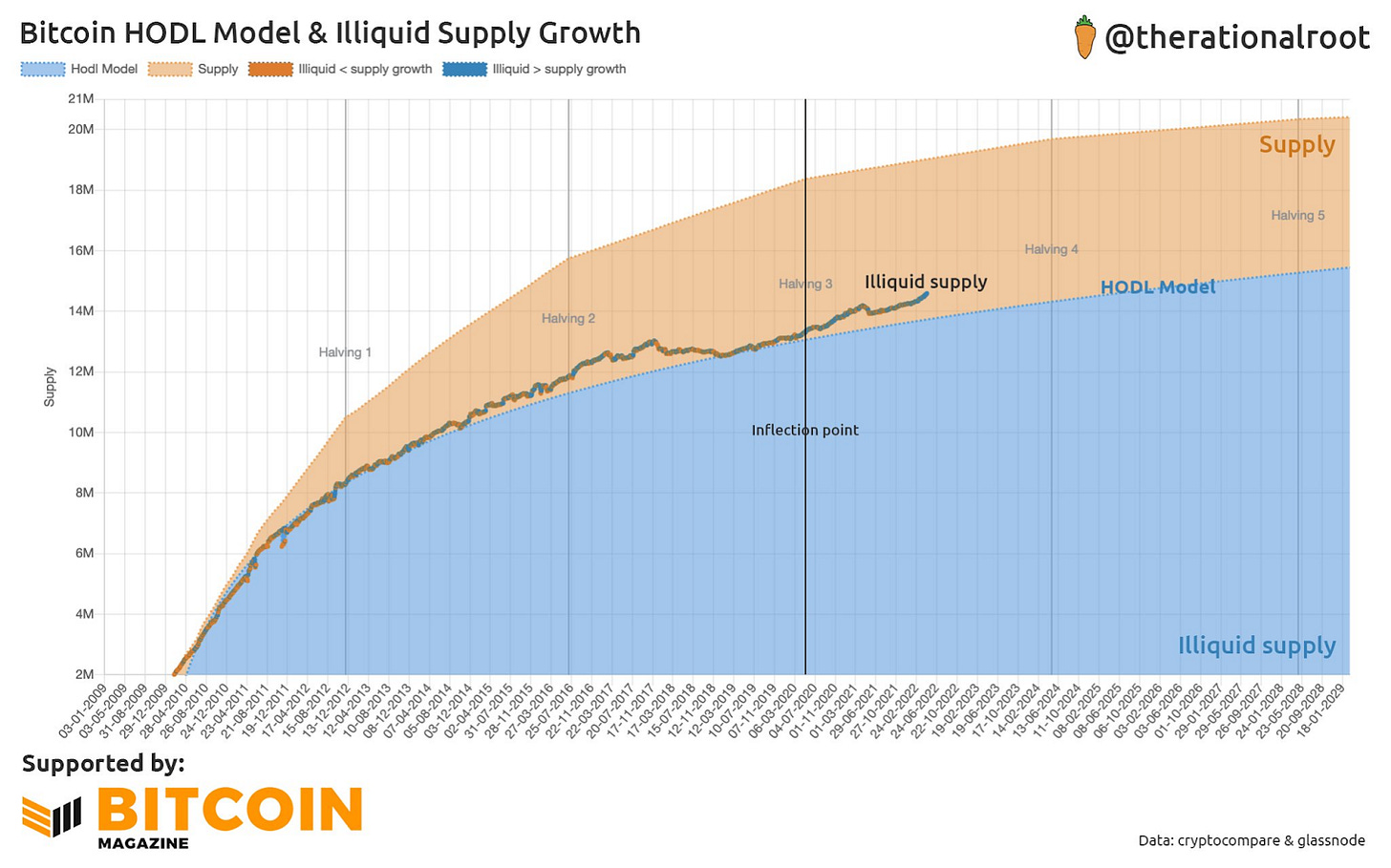

64% of all Bitcoin has not moved in over a year

While some of the holders are afraid of the Bitcoin recent price levels, the onchain metrics are suggesting some really good times to come. Never before has it happened that 64% of all Bitcoin hasn’t moved in over a year. They all sit in their own wallets and wait for the market to value them at a higher price. Just HODL!

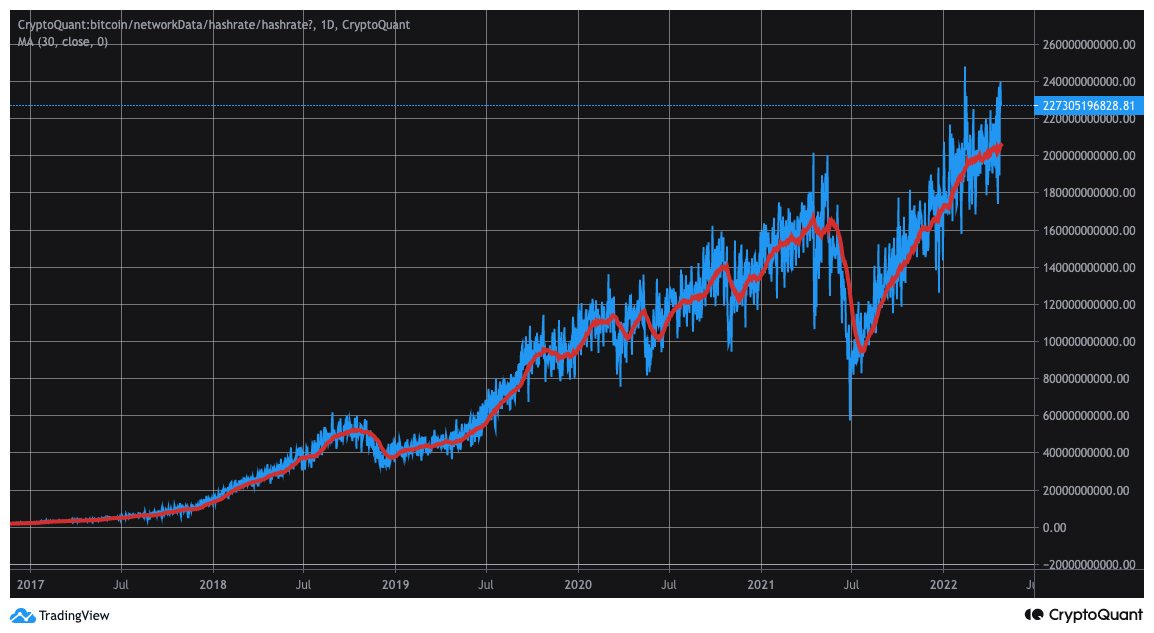

Bitcoin mining efficiency surged 63% (UPDATED!)

“In Q1 2022, Bitcoin mining efficiency surged 63% YoY, while sustainable energy mix was 58%, remaining above 50% for the 4th quarter in a row.” by Michael Saylor

“In the first quarter of 2022, the hashrate and related security of the Bitcoin Network improved by 23% year-on-year while energy usage decreased 25%. We observed a 63% year-on-year increase in efficiency due to advances in semiconductor technology, the rapid expansion of North American mining, the China Exodus, and the worldwide adoption of sustainable energy and modern bitcoin mining techniques.” said Mr. Saylor

(UPDATE 1.: Bitcoin hash rate hits NEW ATH as the Bitcoin network now performs an average of 223.20 exahashes per second (EH/s).

Fidelity Investments plans to allow investors to put Bitcoin in their 401(k)s (UPDATED!)

According to WSJ, Fidelity Investments plans to allow investors to put a bitcoin account in their 401(k)s, the first major retirement-plan provider to do so. In 2015, Fidelity's retirement fund reached $1.4 trillion, serving employees at 23,000 companies.

(UPDATE 1.: “As Micro Strategy continues to be a pioneer in bitcoin for corporations, we are planning to offer our employees the option to invest in bitcoin as part of their 401K portfolio.” by Michael Saylor)

(UPDATE 2.: U.S. Labor Department has "grave concerns" about Fidelity offering Bitcoin to retirement savings accounts.)

Fort Worth has become the first city government in the U.S. to mine Bitcoin

The city of Texas has accepted a donation of three S9 miners from the Texas Blockchain Council, in partnership with Luxor Technologies and Rhodium Enterprises. The three S9 bitcoin mining rigs will be deployed to run 24/7 in a closed environment on a private network operated by the Information Technology Solutions Department Data Center located at Fort Worth City Hall.

“With blockchain technology and cryptocurrency revolutionizing the financial landscape, we want to transform Fort Worth into a tech-friendly city,” said Mayor of Fort Worth, Mattie Parker.

“Texas is increasingly being recognized as the global leader in Bitcoin and blockchain, and Fort Worth will have a seat at that table. The pioneering spirit is alive and well in Fort Worth, and with this program we will attract dynamic companies that share in this vision for the future,” said Robert Sturns, Fort Worth’s director of economic development.

Here you can see the announcement.

New York passes bill in the assembly to ban Bitcoin mining

You always knew that something was wrong with this state. Since the recent Pandemia, things in New York have gone wild. Now they ban any Bitcoin mining which uses fossil fuels for 2 year. Just a question: If I pay the electricity bill like anyone else, how can someone say that I can’t mine Bitcoin, but can charge my Tesla? That’s why “democracies” tend to fail.

Small miners will either stay and mine “underground” or move to more friendlier states like Texas. Anyway New York will lose with these taxes and an important load balancing factor.

Bitcoin ATM in the Mexican Senate

Mexican senator Indira Kempis has put the first Bitcoin ATM in the Mexican Senate

I really like this move because with a little ATM play you can orange pill the whole Senate! More moves like this are needed around the World!

Cuban central bank legalizes Bitcoin

In the EU they are working on banning PoW, but in other parts of the World, governments legalize it. This is how big the difference is between a government who hates their people or tries to help them. Governments see the falling of the FIAT currencies and start to work towards a brighter outcome. I’m really happy to see that one of my favorite countries legalized Bitcoin."If the central bank is creating a cryptocurrency-friendly legal framework, it is because they have already decided that it can bring benefits to the country," said Pavel Vidal, a former Cuban central bank economist who teaches at Colombia's Pontificia Universidad Javeriana Cali.

I couldn’t agree more!

Goldman Sachs lent out its first Bitcoin-backed loan

According to Bitcoin Magazine, “With a bitcoin-backed loan, a bitcoin holder can pay for goods or services with cash – for example, to buy a house or pay medical bills – without needing to sell their bitcoin. Not only does the user keep their bitcoin stash (provided they pay out the loan when it matures) but they also don’t have to worry about tax implications from a BTC sale.”

Sounds good right? Now think about it. If you get a great mortgage loan from Goldman Sachs to buy a house with your Bitcoin collateralized loan, who is risking what? Goldman is risking nothing because if you can’t pay your loan he has your Bitcoin. If Bitcoin dips like it did many times before and your loan gets liquidated you lose your Bitcoin. If there is a governmental seizure of all the deposited Bitcoin at banks and exchanges (like it was with Gold 6102 EO) you lose your Bitcoin. If the Bank goes bankrupt, you lose your Bitcoin. Think twice before you deposit and hold Bitcoin anywhere else other than your own cold storage wallet!

RIOT Blockchain announced a development of a new 1 gigawatt mining farm

Riot Blockchain launches development of 1 GW facility in Navarro County, Texas for bitcoin mining and hosting.

The expansion will strengthen Riot’s bitcoin mining and hosting capacity beginning with an additional 400 megawatts (MW) of capacity on a 265-acre site that will be immersion cooled. Mining and hosting services are expected to be operational come July 2023.

“Upon completion of the expansion, Riot’s developed capacity will total 1.7 GW, establishing the Company among the largest Bitcoin mining operations globally,” said Jason Les, CEO of Riot. “This Expansion is a testament to the Company’s demonstrated ability to build and deliver high-quality large-scale digital asset infrastructure for its Bitcoin mining operations and future hosted clients.”

First-ever "Hybrid" ETP bets on Gold and Bitcoin

According to the ZeroHedge, a novel exchange-traded product, combining Bitcoin and gold, has been launched on the SIX Swiss Exchange and comes when threats of stagflation have battered traditional 60/40 or risk-parity portfolios.

"Gold has historically delivered portfolio protection in inflationary environments, while Bitcoin is the digital equivalent of gold with growing adoption by investors as a distinct asset class and a core store of wealth," said Charlie Erith, CEO of ByteTree Asset Management, in a statement

BOLD ETP includes 81.5% Gold and 18.5% Bitcoin.

Panama has approved a bill regulating the use of bitcoin as payment

Panama has unanimously approved overhaul legislation to regulate the Bitcoin and shitcoin markets in the country in a move that takes the burgeoning industry out of a current gray zone.“This bill seeks to convert Panama into a technology innovation hub in Latin America,” said Congressman Gabriel Silva in a Thursday interview after the approval of the bill. “This is a step forward that seeks to mobilize the economy and create jobs.”

The country's territorial tax system will also apply to Bitcoin, meaning there will be no capital gains tax on investments in the peer-to-peer currency.

“Over 50% of Panama’s population doesn’t have a bank account,” Silva said. “This helps people participate in the digital economy and receive payments from tourists that come to Panama. It helps in the financial inclusion of Panamanians.”

Major Dubai luxury property developer now accepts Bitcoin

Dubai, United Arab Emirates-based luxury real estate developer DAMAC Properties will soon begin accepting Bitcoin payments for the sale of property in the region, the company said in a Wednesday statement.

“DAMAC Properties has always been at the forefront of innovations from developing luxury homes to creating unique experiences,” said ALi Sajwani, general manager of operations at the company and lead of its digital transformations initiatives. “This move towards customers holding cryptocurrency is one of our initiatives at DAMAC to accelerate the new economy for newer generations, and for the future of our industry.”

Global Economic News

TL;DR

Global stocks lost $3.3 trillion in market cap last week

Will the Japanese Yen be the first hyperinflating major currency? (UPDATED!)

FANGMAN has lost $2.4tn in market cap from 2021 ATH

End of negative yields?

U.S. Dollar Currency Index breakout

U.S. Real Estate falling against commodities

Germany's inflation rate hits 7.8%, highest since 1981

U.S. economy shrinks, China's economy grows (UPDATED!)

Germany’s food prices jumped (again)

Germany’s Import Price jumps to 31.2%, highest since 1974

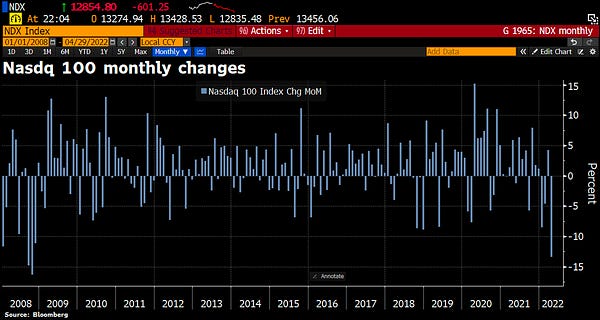

Nasdaq 100 fell 13% in April

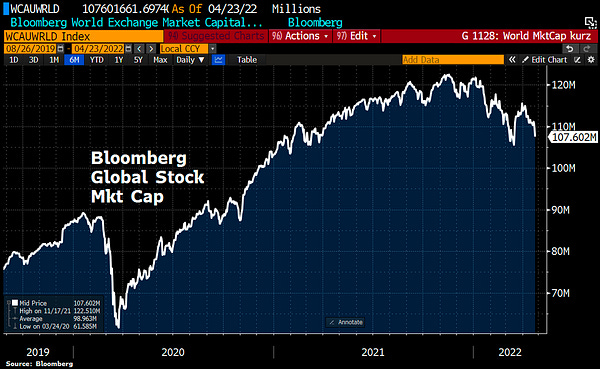

Global stocks lost $3.3 trillion in market cap last week

“Global stocks lost $3.3tn in mkt cap this wk as US equities – after peaking Thur morning – experienced steady fall lower as investors seem to reconsider why they have been buying risk assets in world filled w/so much uncertainty. Global stocks worth $107.6tn, equal to 127% of GDP” by Holger Zschaepitz

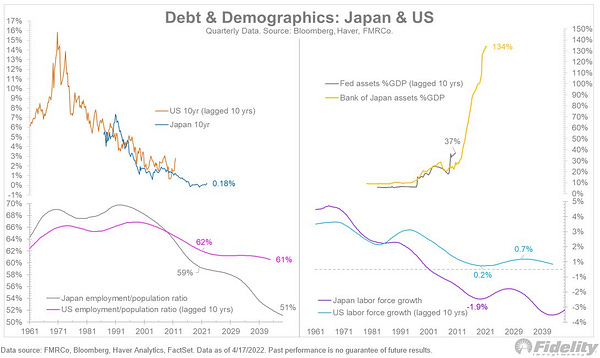

Will the Japanese Yen be the first hyperinflating major currency? (UPDATED!)

After more and more Japanese Yen is going to be printed and their debt is worsening, if we compare Yen value against Gold we see how big is their currency problem. While Gold is near $1900 the Yen against Gold is at a record high!(UPDATE 1.: Japan To Spend Billions To "Ease Inflationary Pain" Caused By Spending Billions )

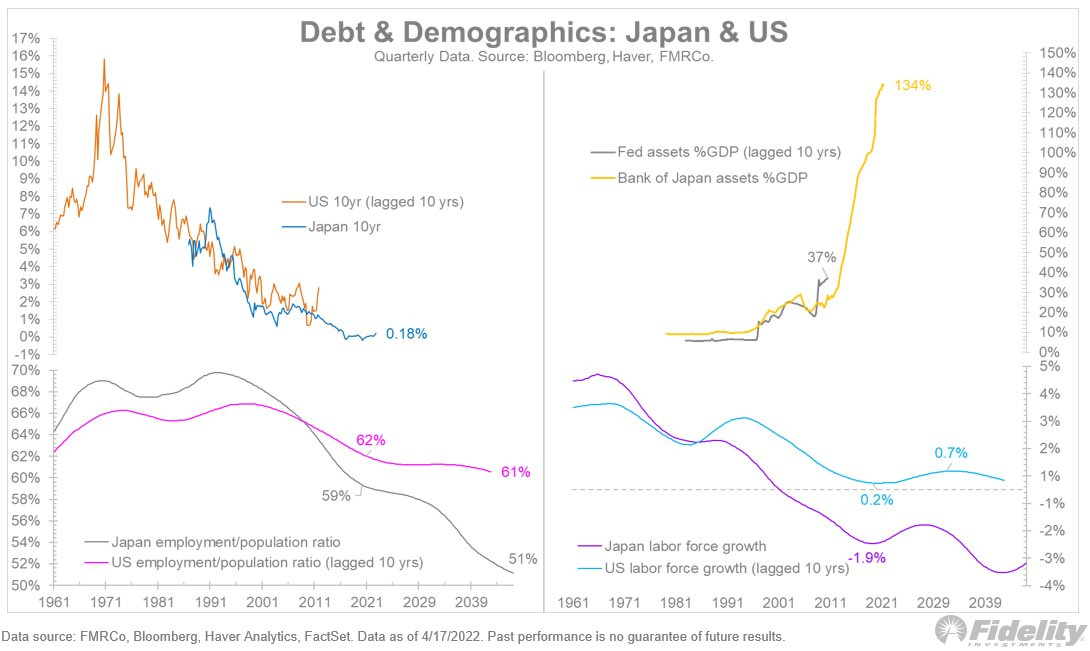

(UPDATE 2.: “If bond yields rise to pinch the government's ability to fund its massive debt, the Fed could use its 1940s financial repression playbook. The Bank of Japan has been doing this for yrs. US demographic trends are more robust, but they are directionally similar, with a 10-15-yr lag” by Jurrien Timmer)

(UPDATE 3.: “Looks like investors are losing faith in the biggest experiment in modern monetary history. #Japan's Yen drops beyond 130 per Dollar for 1st time in 20yrs as Bank of Japan doubled down on bond buying.” by Holger Zschaepitz

FANGMAN has lost $2.4tn in market cap from 2021 ATH

“To put things into perspective: FANGMAN has lost $2.4tn in market cap from 2021 ATH as Netflix and Facebook, now called Meta, have lost most of their gains from past 5yrs. Remember when Facebook hit the $1tn market cap club in 2021? Now it’s worth $499.9bn.” by Holger Zschaepitz

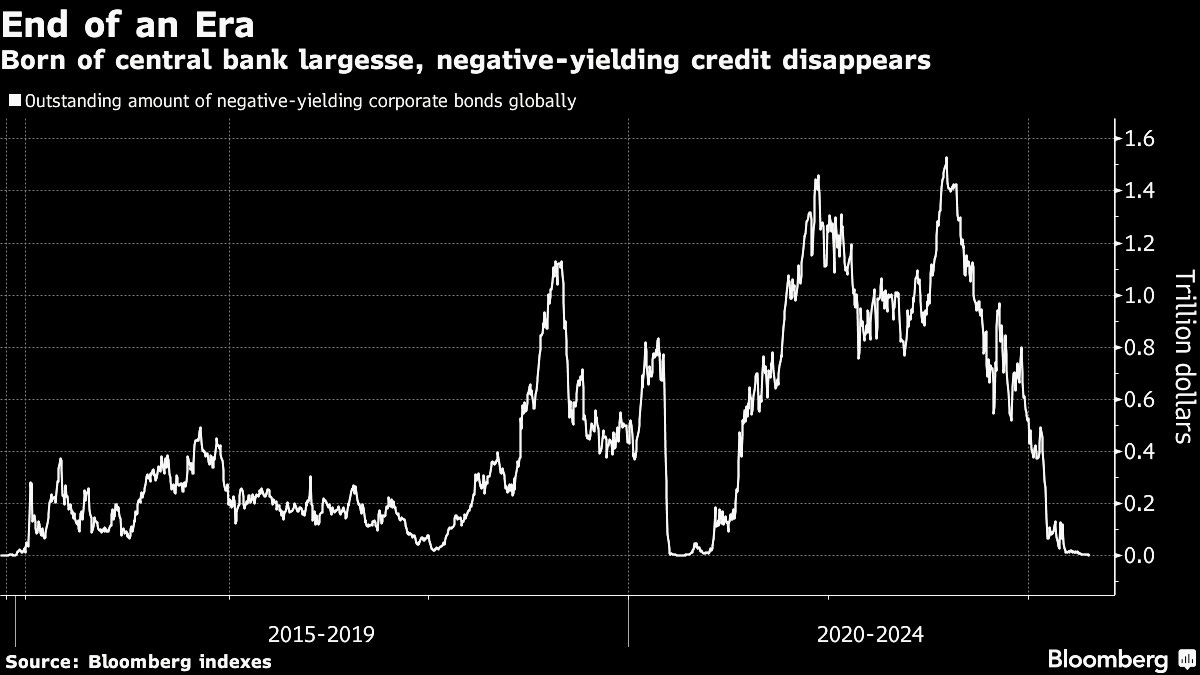

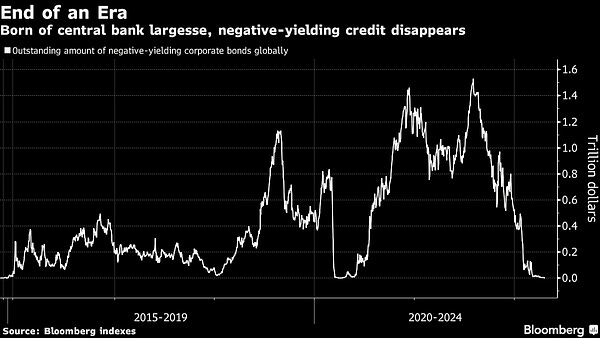

End of negative yields?

“End of an era: Negative yields vanish from world’s corporate bond market as investors brace for monetary tightening. All bonds in global high-grade index now yield 0% or more. It’s a dramatic turnaround from Aug, when >$1.5tn of debt came w/sub-zero yield.“ by Holger Zschaepitz

U.S. Dollar Currency Index breakout

On the weekly chart the DXY broke out upwards of a 5 year long trend. The major economic news is now in favor of a dollar strengthening situation because the people are afraid and they are selling their belongings. Just don’t forget that the printing press just slowed a little bit, but it will never stop!

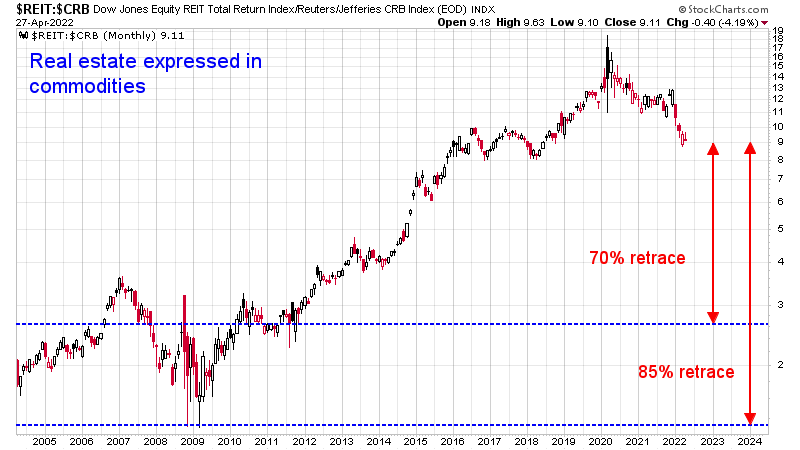

U.S. Real Estate falling against commodities

“How far could real estate fall? It seems like a lot. A further crash of 70% from here would only bring us back to the summers of 2006 or 2011.” by @TuurDemeester

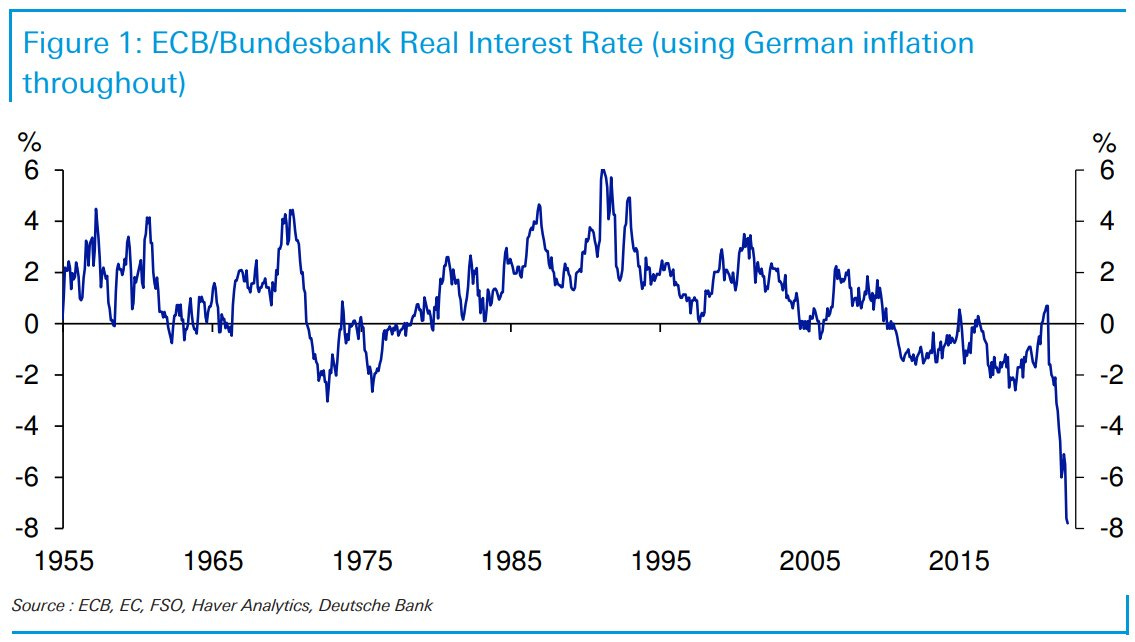

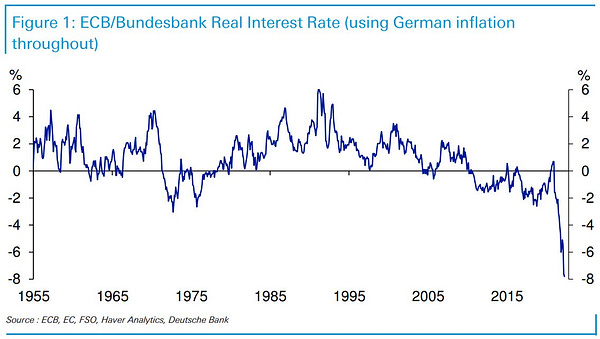

Germany's inflation rate hits 7.8%, highest since 1981

“Highest German CPI since 1981 & ECB rates still negative: This DB chart highlights the extent to which ECB is behind curve by looking at real pol rate through history (using Buba before Euro): "Real pol rate extraordinary extreme rel to anything seen in modern history," DB says.” by Holger Zschaepitz

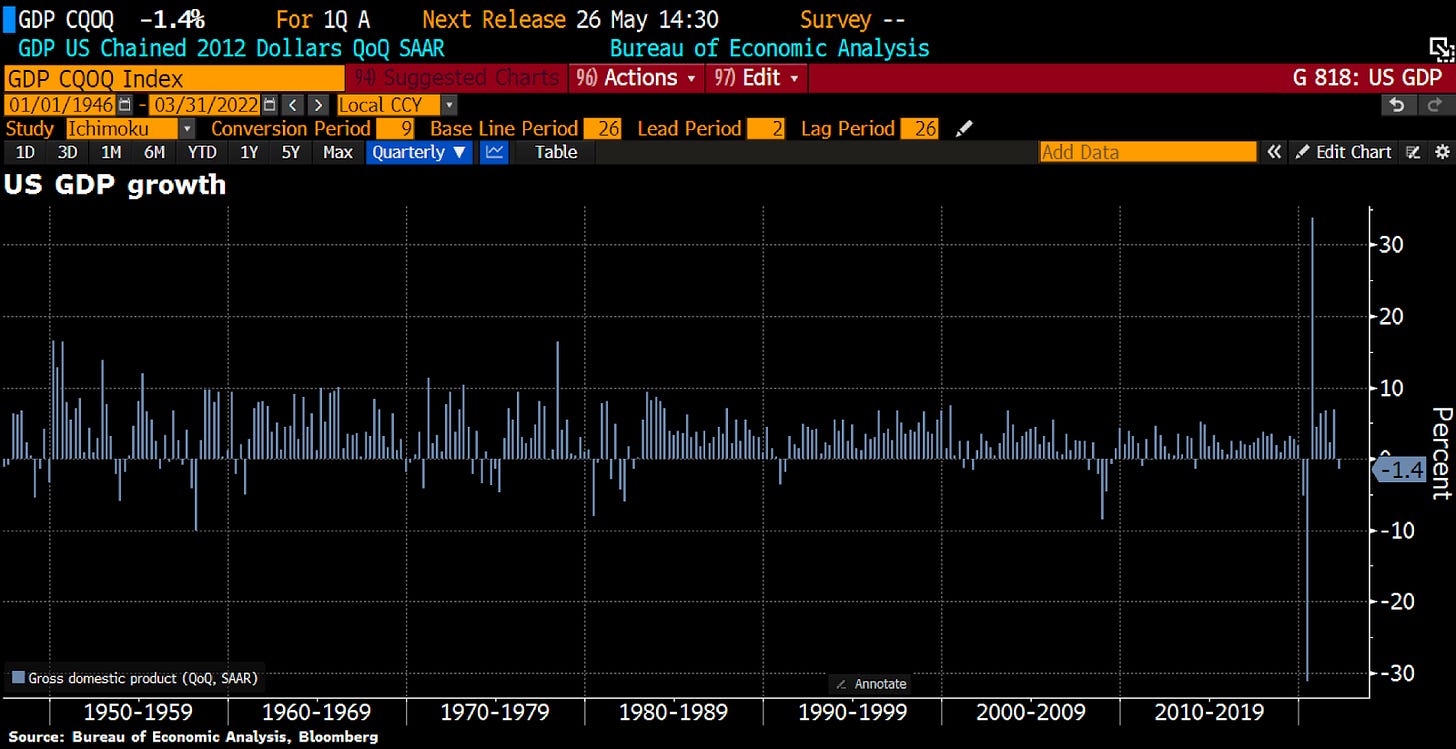

U.S. economy shrinks, China's economy grows (UPDATED!)

Meanwhile China's economic growth rose by 4.8% in the first quarter of 2022, topping expectations, the U.S. economy “unexpectedly” shrinks by 1.4% annual pace.

“Unexpectedly” because according to Zerohedge, “Only 5 of 69 analysts predicted a negative GDP print”, which means Keynesian analysts will always fail. I bet those 5 analysts are Austrian economists.

It’s hard to say it will be a recession because we definitely need to wait for at least the next quarter numbers, but these two countries' numbers show a massive divergence which indicates there is a major drift in Global Economics.

Just based on this week's U.S. economic news we can predict that maybe we are at the top of a dollar based world economy era. Of course this is just a tip, but I can say surely interesting times will come.

(UPDATE 1.: BBG: Biden Blames U.S. Economic Contraction on ‘Technical Factors’ )

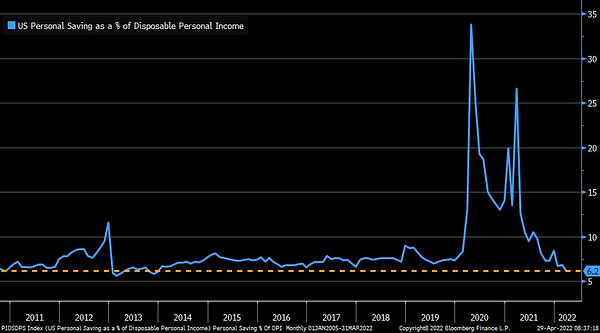

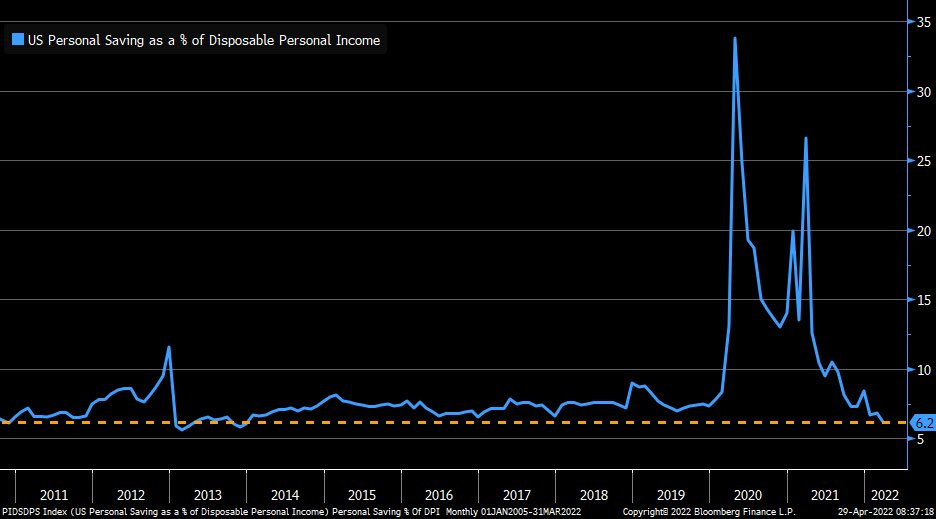

Meanwhile the U.S. Personal savings rate fell to 6.2% in March, lowest since 2013. If the recession starts this year, the average American faces it with empty pockets. The politicians' spending program for boosting the economy worked well (for themselves)!

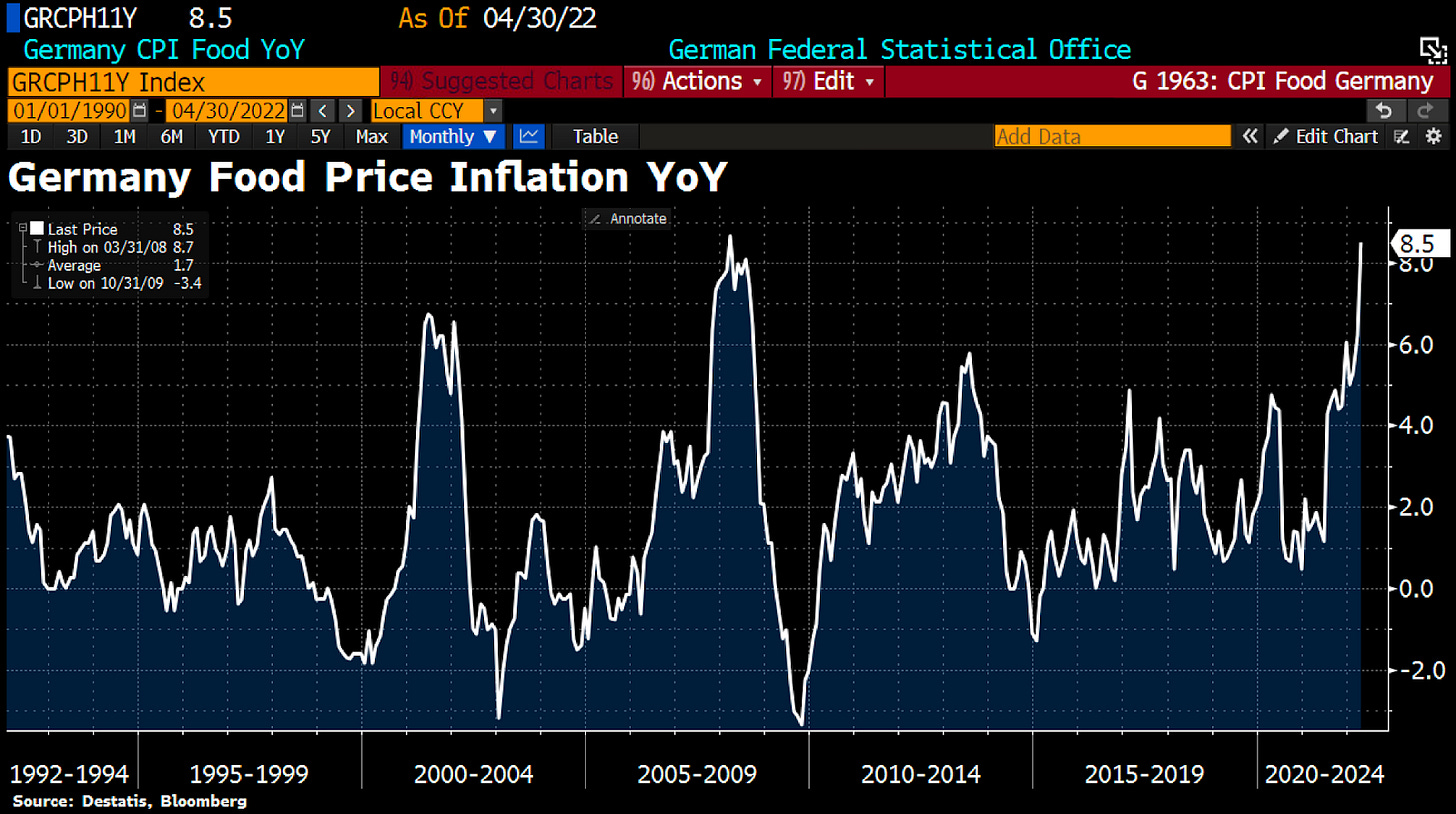

Germany’s food prices jumped (again)

“The recent price increase in Germany was not only driven by energy. Food prices are also rising sharply. In April, food inflation accelerated to 8.5% YoY from 6.2% in March.” by Holger Zschaepitz

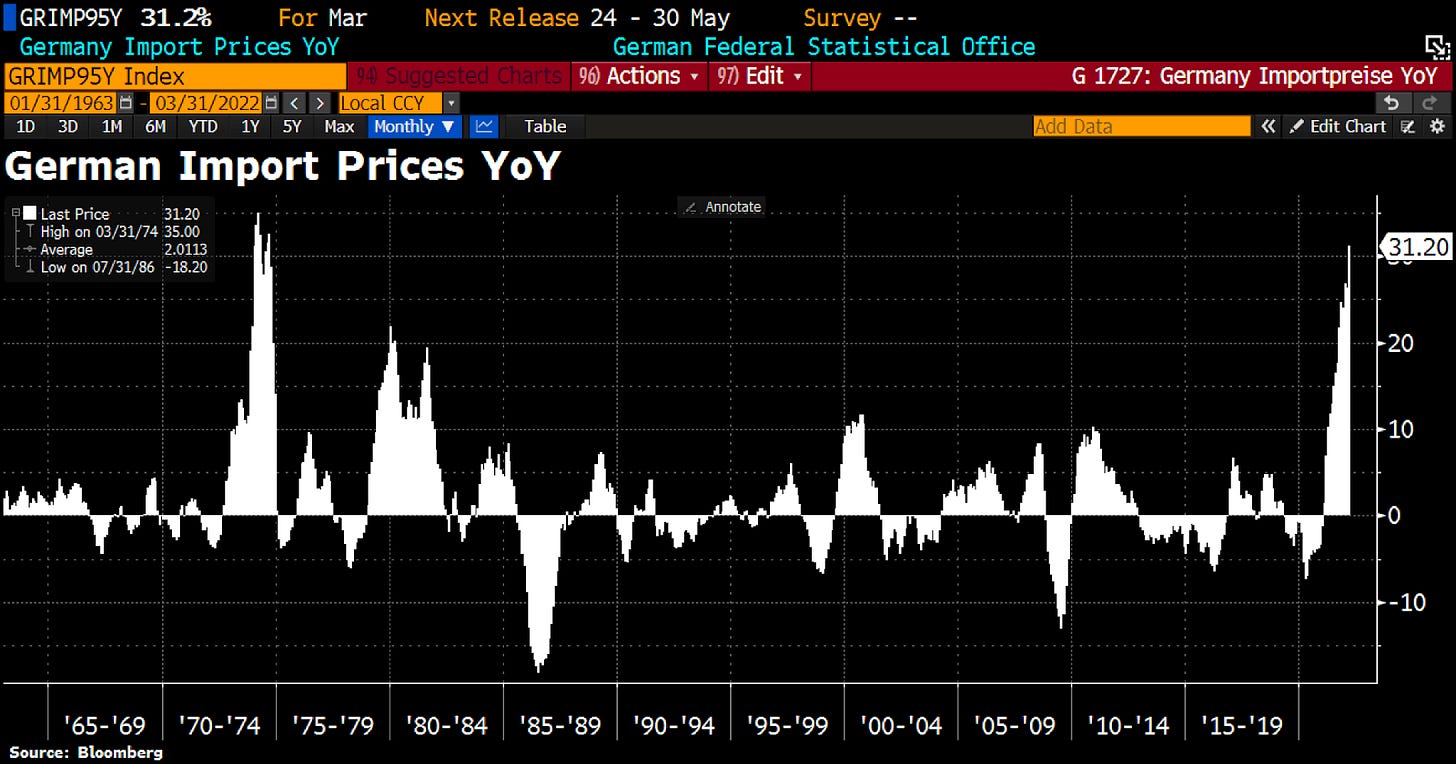

Germany’s Import Price jumps to 31.2%, highest since 1974

“Inflation pressure intensifies in Germany. Import Price jumps to 31.2% in March, highest since Sep1974 during the first oil crisis. The current data are beginning to reflect the impact of the war in Ukraine.” by Holger Zschaepitz

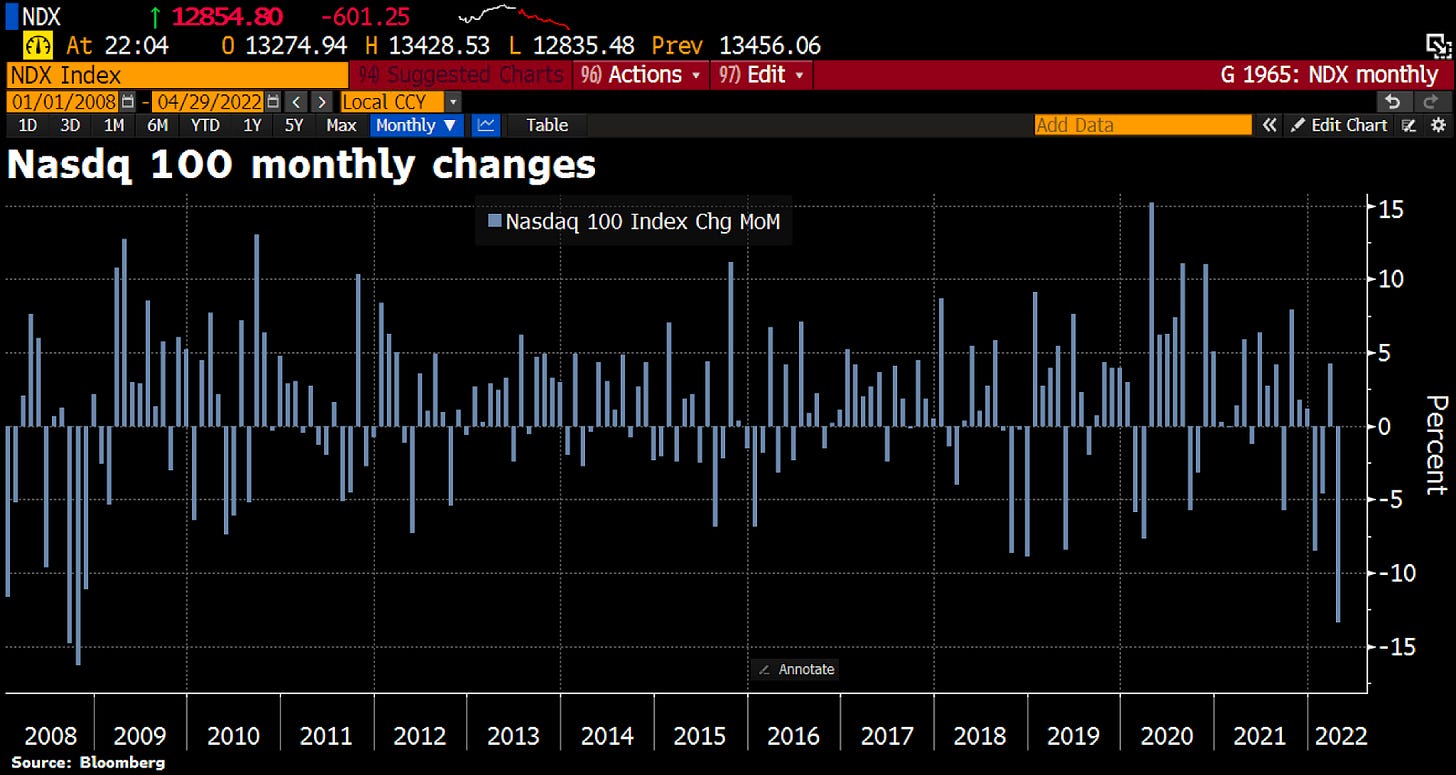

Nasdaq 100 fell 13% in April

“To put things into perspective: Nasdaq 100 falls 13% in Apr, biggest monthly drop since 2008. Now down 22.5% from Nov 2021 high.” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

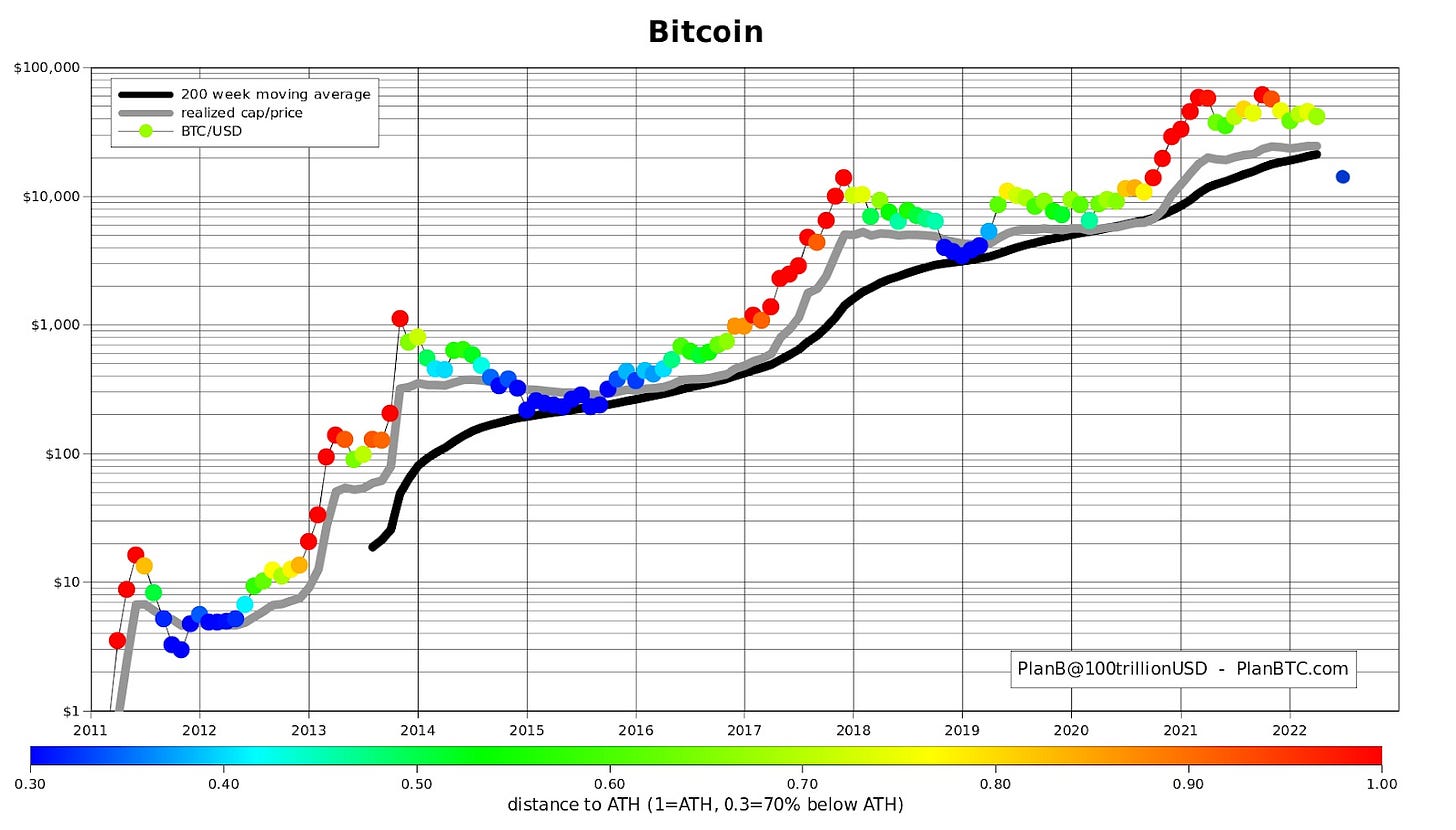

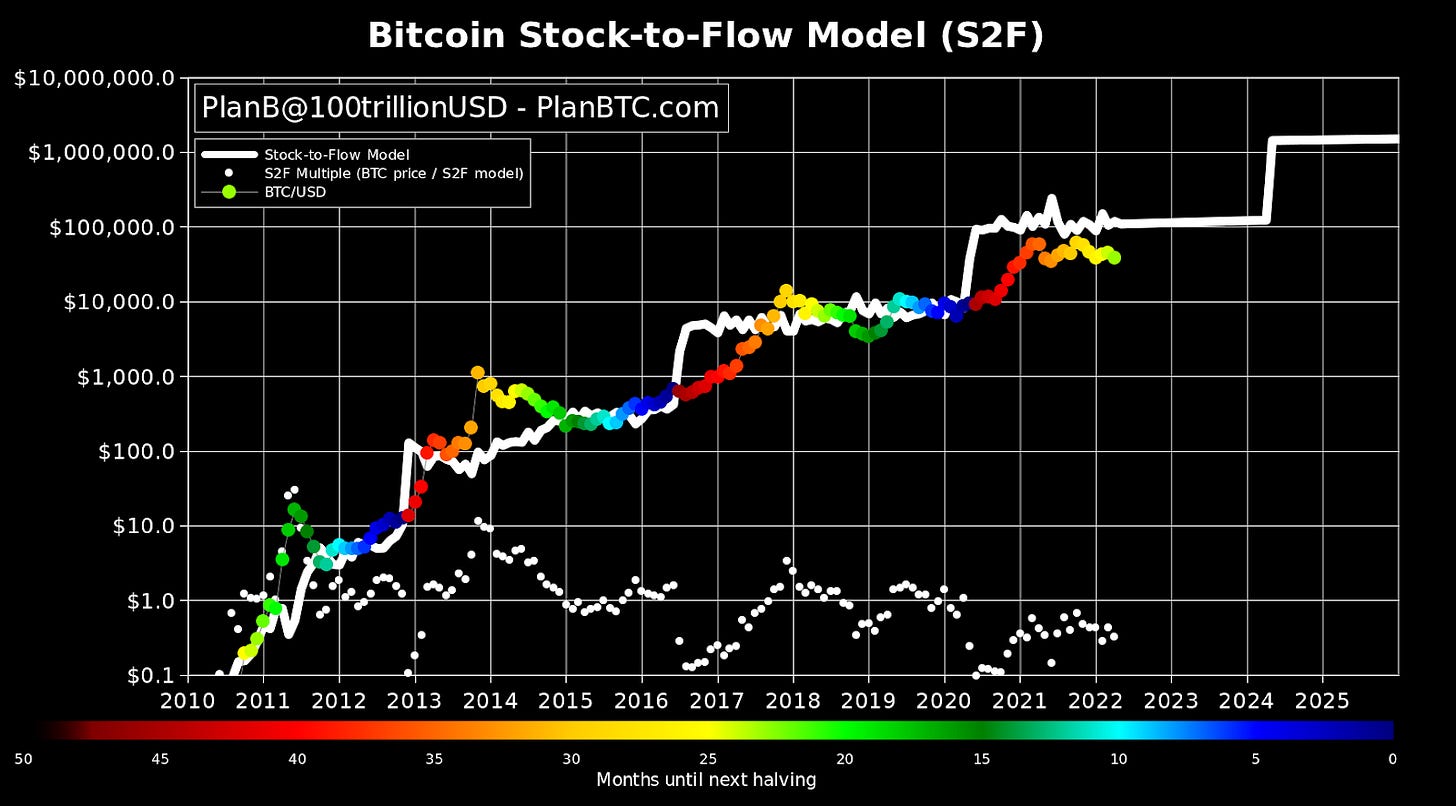

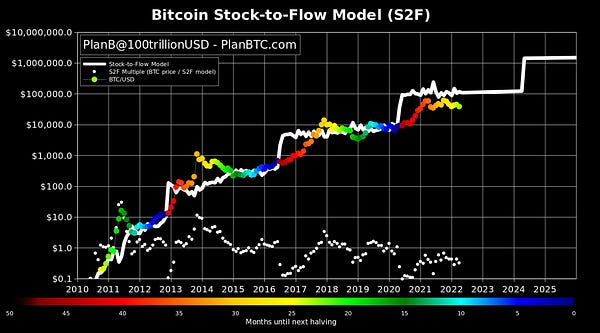

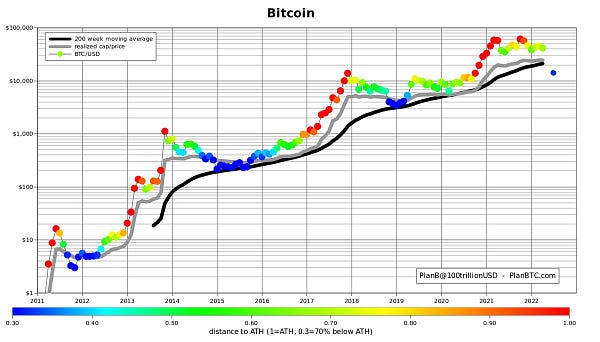

“Some people think that it is time for blue dots and that bitcoin will drop to $15K. This is what a blue dot at $15K would look like ... below 200wma and below realized price. Not gonna happen IMO.” by PlanB

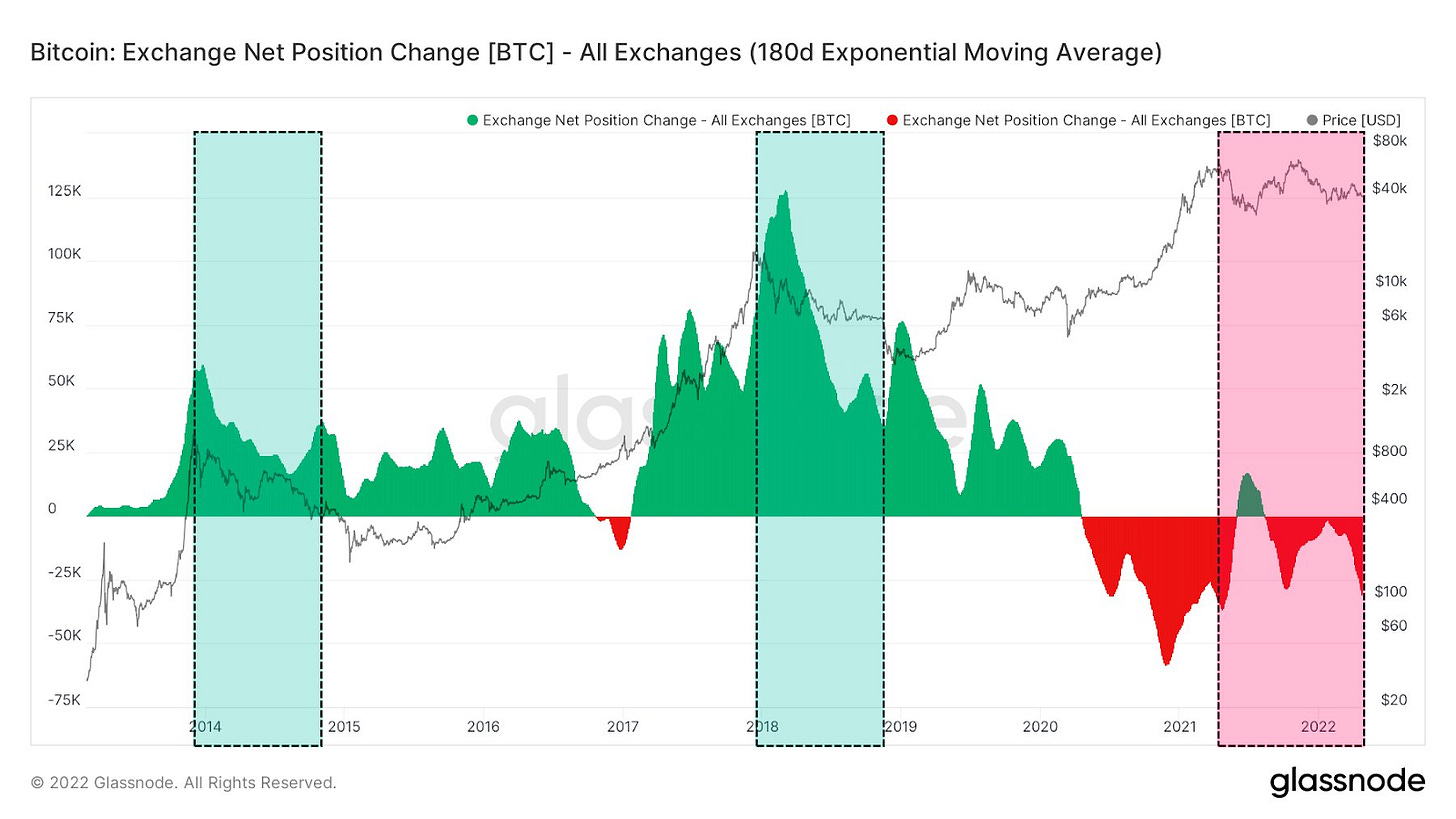

“In the 6+ months leading up to the last two major bear market capitulation events we saw large amounts of BTC moving to the exchanges. The last 6+ months we have seen the exact opposite, we have seen large amounts of Bitcoin being taken off of the exchanges.” by @TheRealPlanC

“Bitcoin 3-Day RSI bounced precisely where it needed to. Remaining above the 40 SMA on the 3-Day RSI is crucial.” by @MatthewHyland_

“Bitcoin 160K” by @888Velvet

“Bitcoin production cost floor holding” by @caprioleio

“Meanwhile, illiquid entities keep on stacking and outpacing supply issuance. “ by Root

“Whales are accumulating as much Bitcoin today as they were at the $3K lows. These are holders with approx. $40M - $400M in their wallets today. In 2018, that was $4M - 40M (but there were no "institutions" then either).” by @caprioleio

“Bitcoin - We had a bull trap at the top, why not have a bear trap at the bottom. Markets never make it easy for everyone, a little too obvious to drop from here without taking out some shorts first.” by @IncomeSharks

“Bitcoin April close: $37,639” by PlanB

Bitcoin Shorts

Funny Bitcoin short stories

“So how many people are holding #Bitcoin worth $10.000 round about 0.25 BTC or more? Fewer than you think… less than 2.5 million people! We are so early…” by @LiveInnovation5

“Satoshi Nakamoto disappeared eleven years ago today.” (Apr 26, 2022) by Documenting Bitcoin

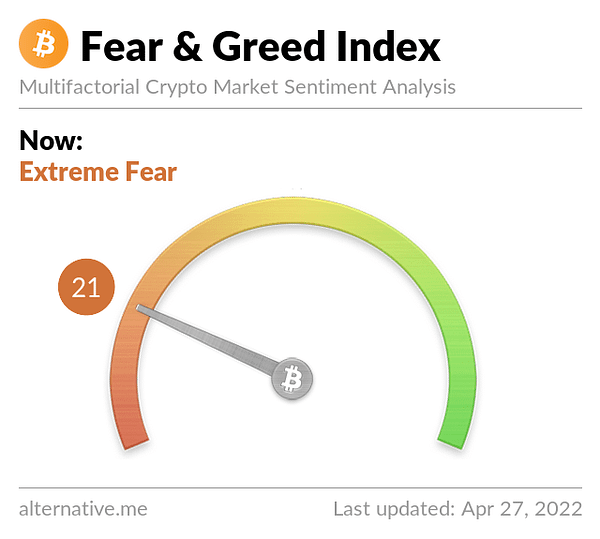

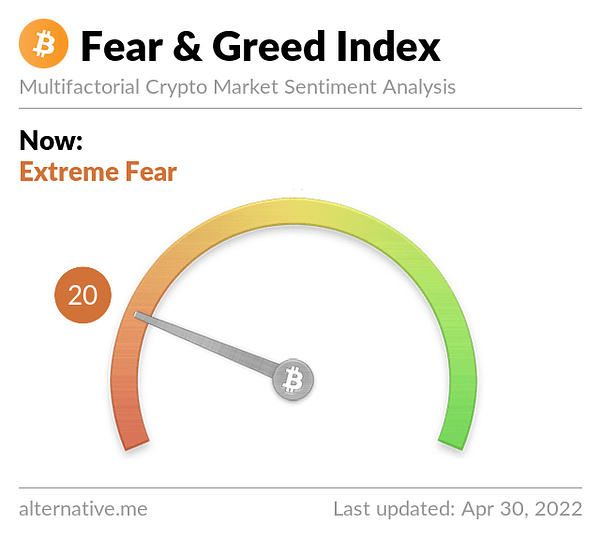

An article about his disappearance.Bitcoin Fear and Greed Index is 20. Extreme Fear Current price: $38,315

“Bitcoin is painting the world orange, slowly then…

- Panama- El Salvador- Central African Republic” by Bitcoin ArchiveSwiss National Bank Chairman: "Buying Bitcoin is not a problem for us"

Suggestions

Interesting articles to read

Hedge Fund CIO: There's A Growing Consensus The Fed Will Keep Going Until The Market Breaks

The Real Victim Of Shanghai's COVID Lockdown? Intra-Asia Trade Pipeline

Global Military Spending Tops $2 Trillion For First Time In History

"Meltdown": Bank Of America Sounding The Alarm On Collapsing Freight Demand

A Mostly Wind- & Solar-Powered US Economy Is A Dangerous Fantasy

Europe faces critical shortage of metals needed for clean energy

Whistleblowers: CDC, FDA "Altered" Covid Guidance And Suppressed Findings Amid Political Pressure

Escobar: Clash Of Christianities - Why Europe Cannot Understand Russia

Sources:

https://bitcoinmagazine.com/business/panama-assembly-passes-bill-regulating-bitcoin-crypto

https://bitcoinmagazine.com/business/dubai-real-estate-giant-to-accept-bitcoin-as-payment