Bitcoin News

TL;DR

The Lightning Network is on a new ATH

A new unsuccessful attack on Bitcoin

Canada candidate for Prime Minister is pro Bitcoin

MacroStrategy got $205 million bitcoin-collateralized loan to purchase Bitcoin

Senator Ted Cruz fights against CBDCs

The EU bans Anonymous Crypto transactions

Australia jumps into Flare Bitcoin mining

Only less than 2M Bitcoin left

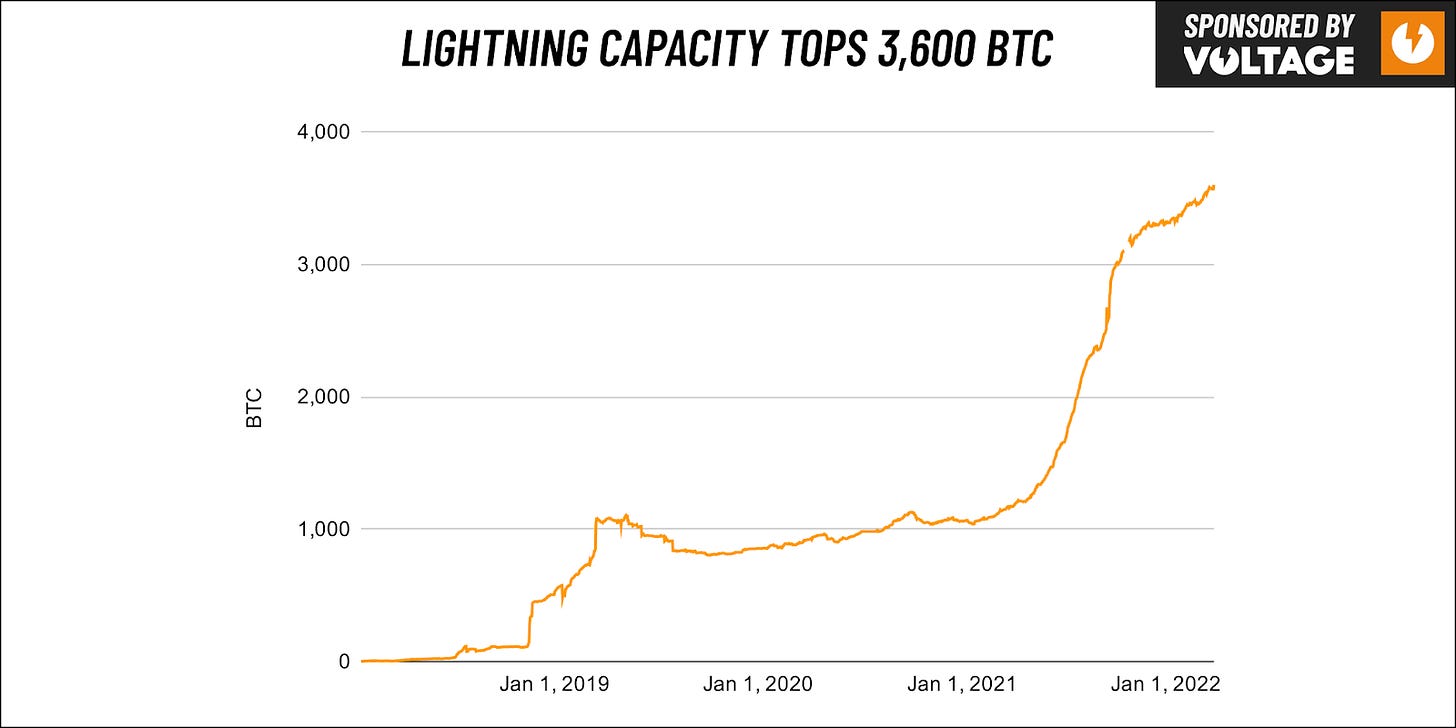

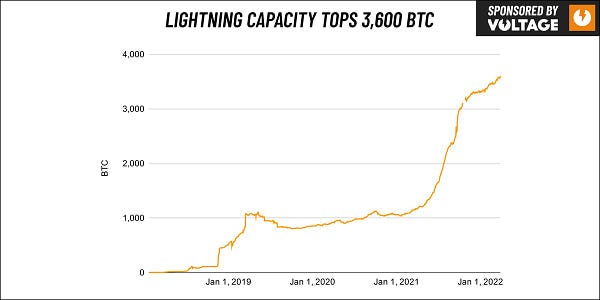

The Lightning Network is on a new ATH

The Lightning Network just broke 3,600 BTC of public capacity. It’s interesting to see in a short period of time how fast the Lightning Network evolved as more and more small businesses began to use it all around the World.

A new unsuccessful attack on Bitcoin

One of the biggest FIAT World scam organization Greenpeace with the leading shitcoin billionaire Chris Larsen thought that they will change the Bitcoin mining structure. They are thinking of changing from PoW (Proof of Work) to PoS (Proof of Stake) because it consumes too much electricity. This is a well known FUD, but it comes up from time to time. Bitcoin incentivizes using the cleanest energy since miners (PoW) look for the cheapest or even free energy source available on earth. Why? Because the miners need to race against other miners and as more and more miners connect to the network, it will be harder to “mine” a block. It is a must in this business to always buy the electricity from the cheapest source. Who is the cheapest? Who has more than it can sell or for economic reasons it can’t sell/transport it to a buyer for a higher price. Dirty energy sources like coal will never be cheap. I don’t think that we should talk about this bullshit anymore because PoS is a dead end with unsolvable problems. Luckily they already wasted $5M on it, but I’m 100% sure that if any BIP regarding this will happen, it won't get a majority vote.

Canada candidate for Prime Minister is pro Bitcoin

Pierre Poilievre, a Conservative Party candidate for Prime Minister of Canada recently spoke about supporting bitcoin on the campaign trail.

"Government is ruining the Canadian dollar, so Canadians should have the freedom to use other money, such as bitcoin," Poilievre reportedly said on Monday.

“Choice and competition can give Canadians better money and financial products. Not only that, but it can also let Canadians opt-out of inflation with the ability to opt-in to crypto currencies,” says Poilievre . “It's time for Canadians to take back control of their money and their lives by making Canada the freest country on earth."

MacroStrategy got $205 million bitcoin-collateralized loan to purchase Bitcoin

“MacroStrategy, a subsidiary of MicroStrategy, has closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase Bitcoin.” by Michael Saylor CEO of MicroStrategy

I think this is out of words. Literally Saylor bought Bitcoin with free money (nearly free). I mean they got a super cheap loan to buy Bitcoin from it and the loan itself will be collateralized with $820 million Bitcoin. They have 3 years to pay back the loan and maybe at the end they can even refinance it. For me it is a bit risky because of the 1:4 ratio, but I hope they used at least a 3 way multi-sig wallet for safe storing of the $820 million worth of Bitcoin.

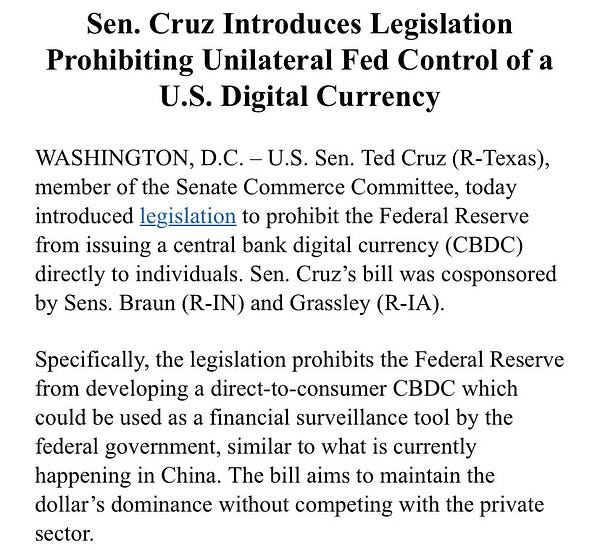

Senator Ted Cruz fights against CBDCs

Senator Ted Cruz introduced legislation to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC) directly to individuals. He made himself a true freedom fighter after getting the Orange pill. I hope he will succeed!

The EU bans Anonymous Crypto transactions

The European Parliament voted in favor of an anti-money laundering legislation which requires every crypto transfer be reported to authorities. The legislation cites the use of “unhosted wallets” as potential avenues for money laundering.

More and more companies will comply with these rules and will send your valuable private trading data to these agencies.

With the non-compliant crypto-asset service providers are defined to be “(not) established in any jurisdiction” and don't have “central contact point(s) or substantive management presence in any jurisdiction… that is unaffiliated with a regulated entity or that operates in the Union” under the Markets in Crypto Assets (MiCA) regulatory framework. This framework would require each wallet to set up a license and force regulations in order to operate in countries in the EU.I think it’s time to use only decentralized services providers which are not working like these Orwellian agencies dictate.

Australia jumps into Flare Bitcoin mining

Canadian oil and gas company, Bengal Energy, will mine Bitcoin with “stranded” gas in Australia. I think this year we will see more and more energy related companies mining Bitcoin directly.

Only less than 2M Bitcoin left

With the 730,000 block number the 19th million of Bitcoin was mined. It left for the rest of ~118 years only 2M Bitcoin to be mined. This is still not priced in!

Global Economic News

TL;DR

In Germany the consumer confidence is in free fall

The battle of bonds vs. stocks

German house prices are again at ATH

China Tech drops after U.S. SEC “attack”

Oil price continues to fall

The Ruble trading above invasion-day level

French stocks outperformed EU peers

The biggest monetary experiment

In Germany the consumer confidence is in free fall

“Good Morning from Germany where consumer confidence in free fall as inflation & Ukraine war darken households' expectations about econ & personal finances. GfK consumer index dropped to -15.5 in Apr, 14mth low, from -8.5 in Mar. Income expectations fell to -22.1, lowest since GFC” by Holger Zschaepitz

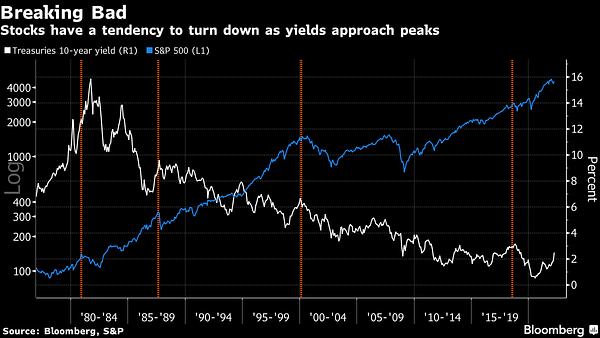

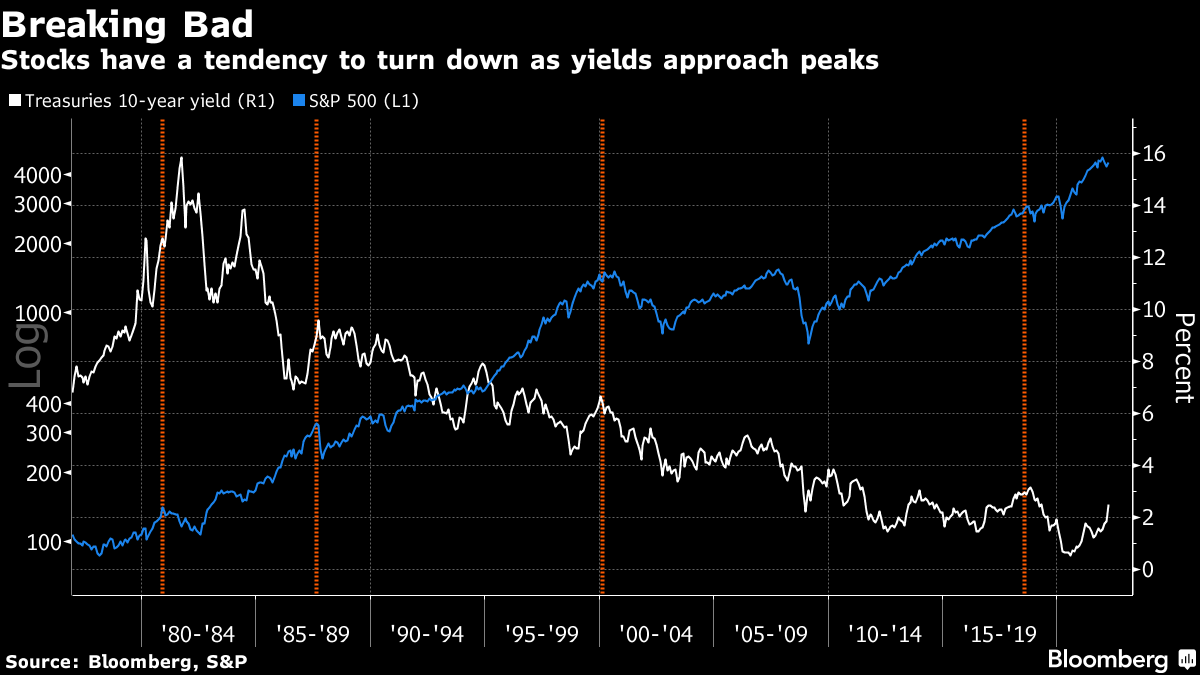

The battle of bonds vs. stocks

“In the battle of bonds vs. stocks, equities are, it seems, the new haven as Treasuries crash ever lower and investors shrug off soaring inflation worries, BBG reports.” by Holger Zschaepitz

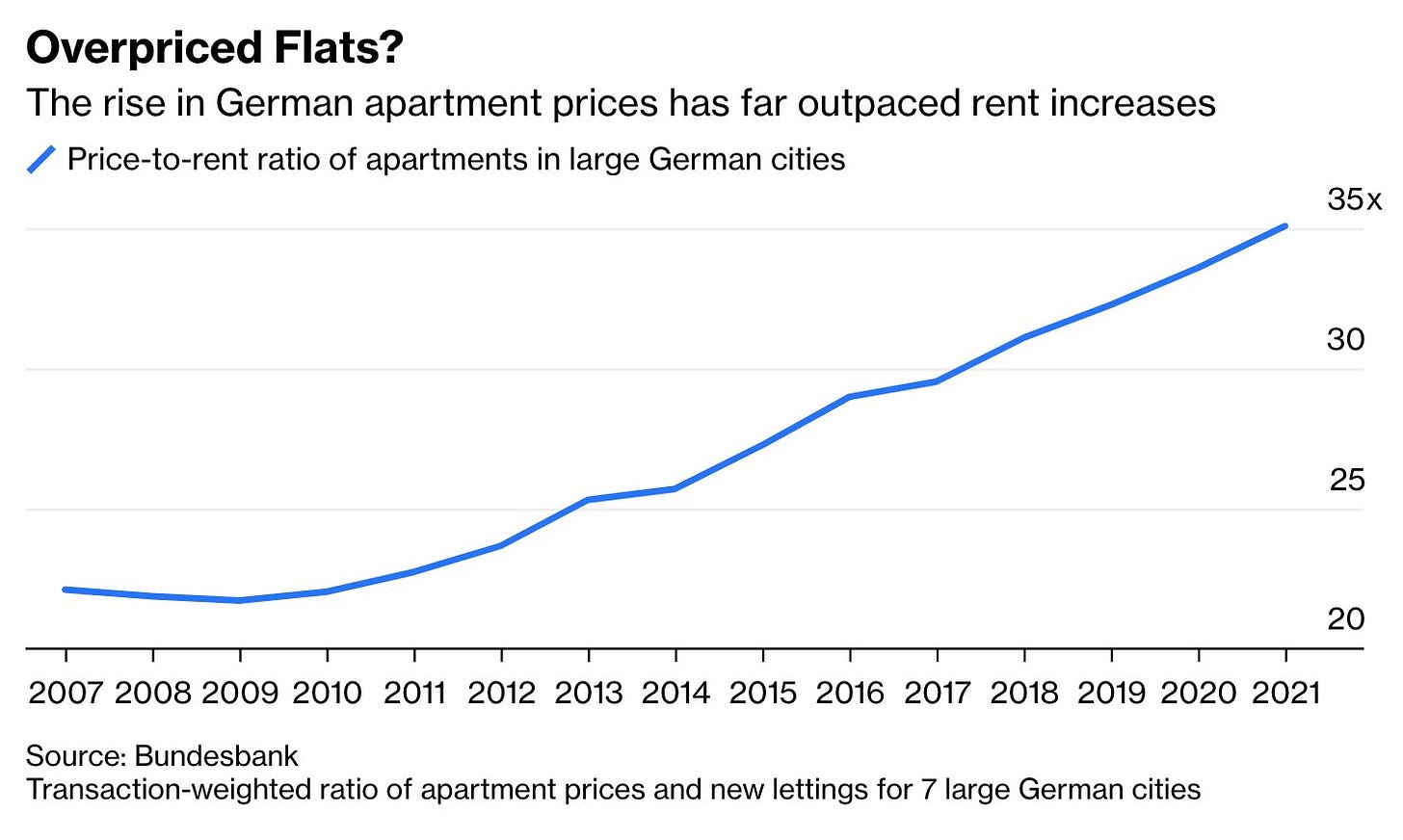

German house prices are again at ATH

According to Bloomberg, German house prices are even higher, inflating the bubble. Rise in German apartment prices has far outpaced rent increases. With a Price-to-rent ratio of 35, real estate is more than twice as expensive as stocks. That’s what printing money like no tomorrow causes. This is still just the tip of the iceberg way worse inflation numbers will come!

China Tech drops after U.S. SEC “attack”

“China Tech drops as the US signals a tough stance on Delisting. US securities regulator SEC adds Baidu to delisting watch list. Chinese regulator says talks with U.S. counterpart ongoing.” by Holger Zchaepitz

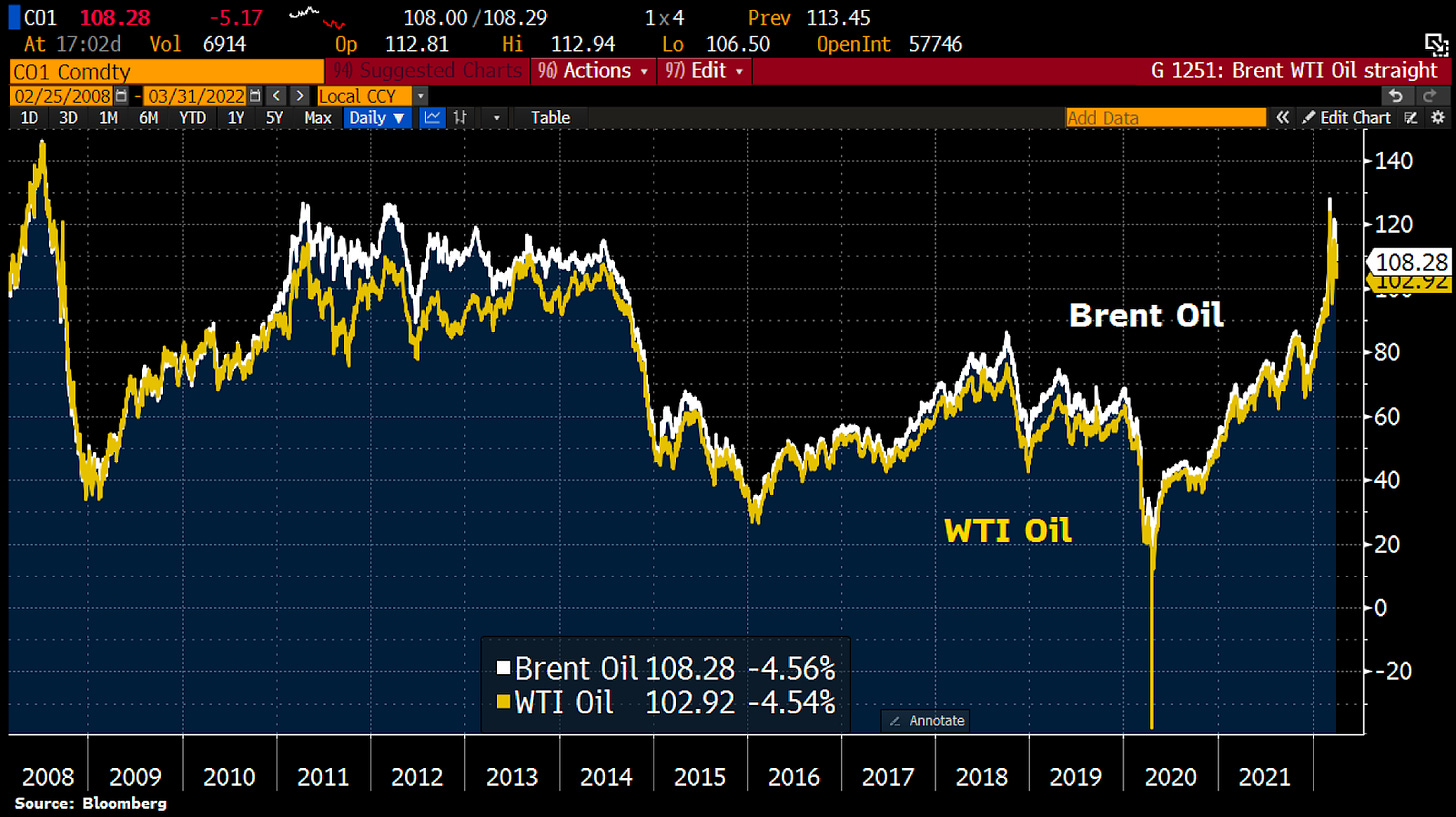

Oil price continues to fall

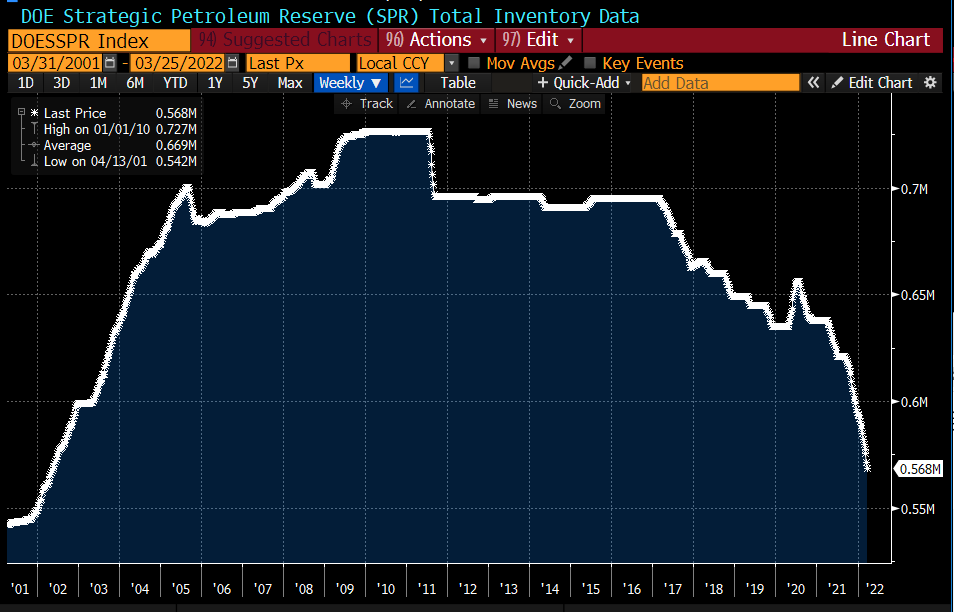

Oil price continues to fall as the US makes the biggest ever release from the Strategic Petroleum Reserve. The reserve was already at a record low level (around ~33 days enough), but with the recent Biden order, I can’t imagine how desperate they could be to lower the oil price. The President ordered 1mln barrels per day into the market over the next 6 months.

“The Strategic Petroleum Reserve exists specifically for EMERGENCIES. Like, if the U.S. was in Germany’s shoes. It is NOT designed to be wasted in the hopes of angering fewer voters fed up by prices at the pump. Not-so-strategic after all eh?” by Emma Muhleman

The Ruble trading above invasion-day level

The Ruble trading above invasion-day level, but don’t forget that there are some limitations in the Ruble trading, so you can’t short it as you could normally do. The selling of commodities for Rubel only made it possible to regain traction and rise to “normal” levels. As with any FIAT it’s time to rethink and opt out from this tyrannical game.

French stocks outperformed EU peers

According to Bloomberg, French stocks outperformed EU peers during Macron’s presidency, & investors betting on further gains if he wins again. Luxury emerged as the biggest winner under Macron as he cut taxes for the wealthy. LVMH, Kering, Hermes accounted for 60% of CAC performance.

The biggest monetary experiment

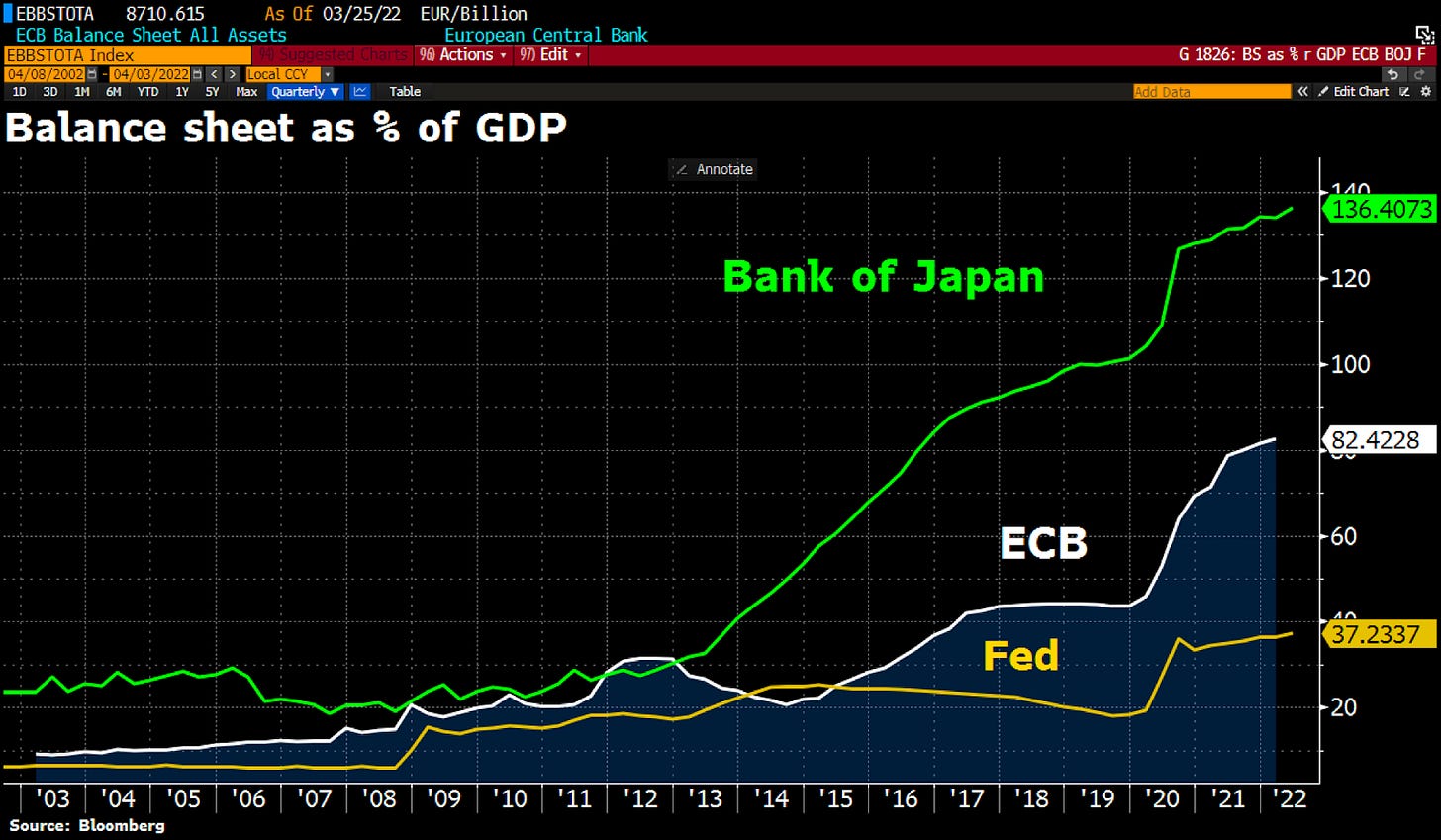

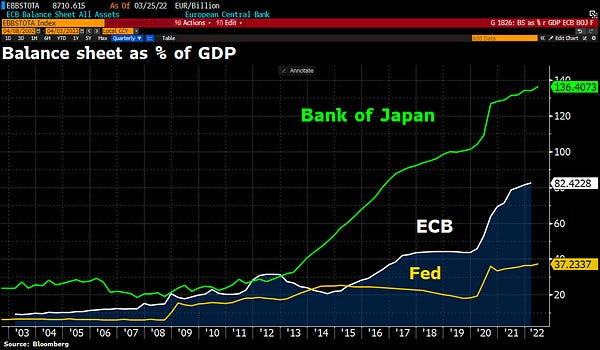

“The biggest monetary experiment in history? Most recently, the Bank of Japan fired up the printing press again to keep long-term interest rates low. Meanwhile, BoJ's balance sheet now equals 136% of Japan's GDP. In comparison, the ECB and the Fed look like amateurs.” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

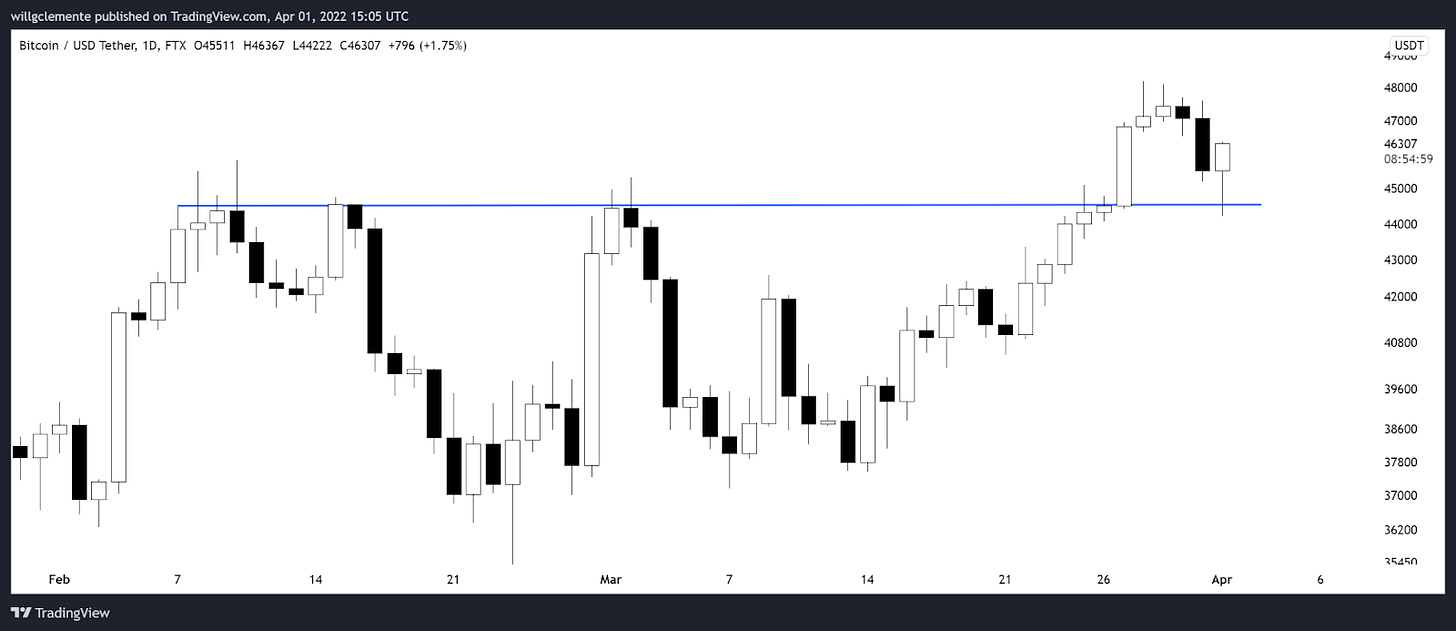

“Bitcoin has broken above the $46k resistance zone. The next major resistance zone is around $52k.” by @MatthewHyland_

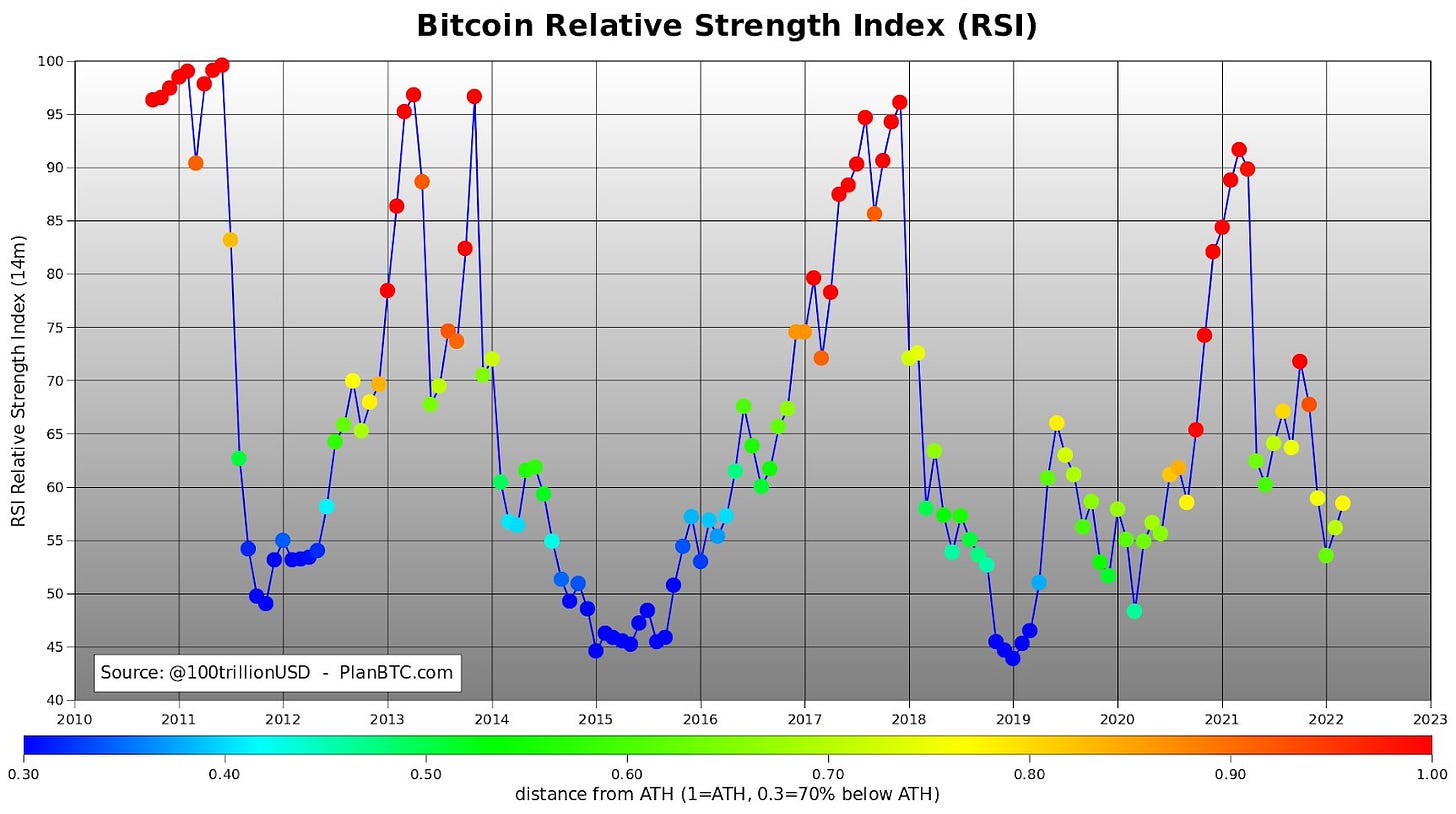

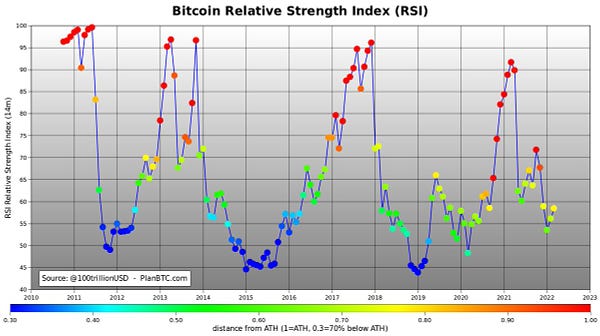

“Bitcoin has broken out of the Ascending Triangle!!! The RSI breakout I highlighted a few days ago lead to this price breakout.” by MatthewHyland_

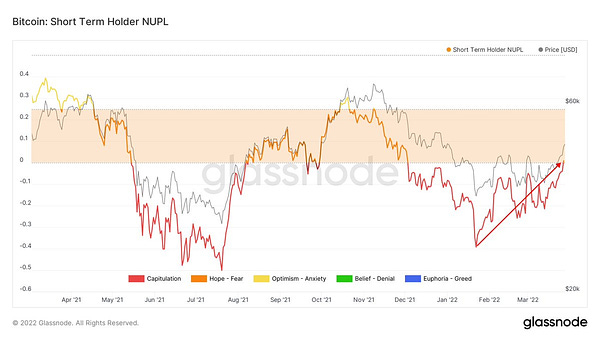

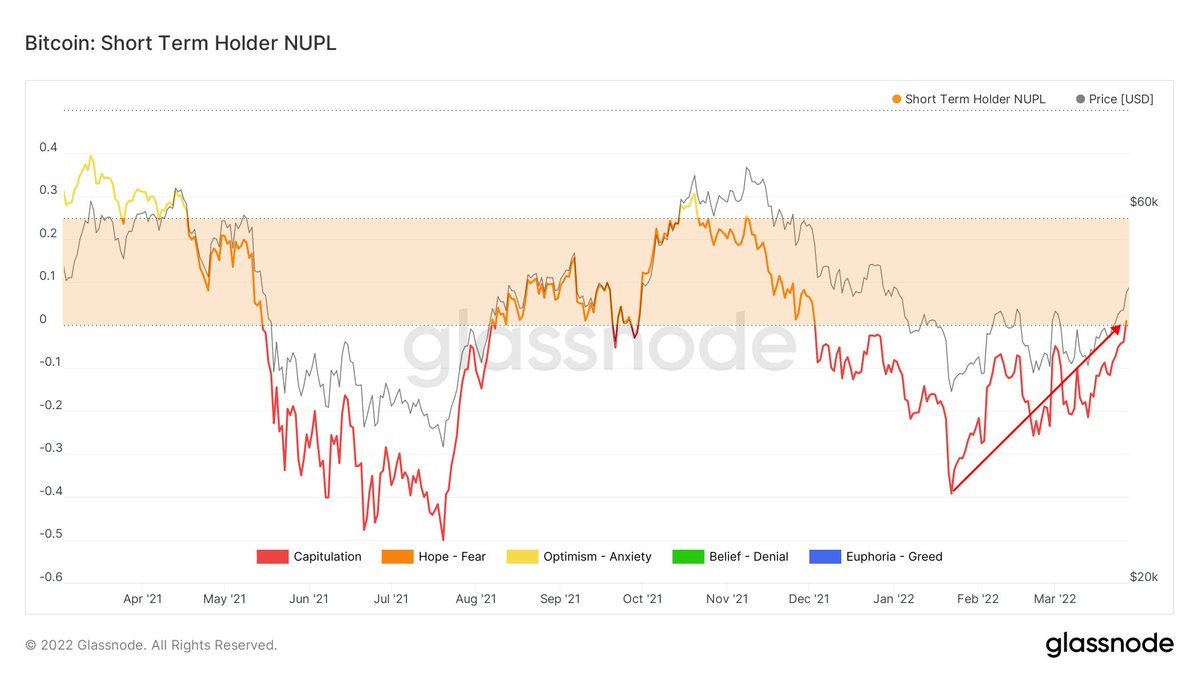

“Bitcoin short-term holder capitulation is over. Unrealized profits show hope as BTC closes the week above $46k.” by @Negentropic_

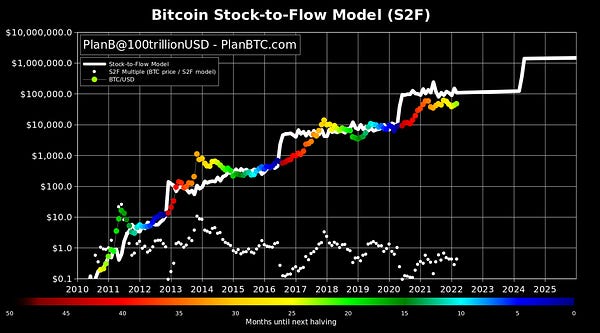

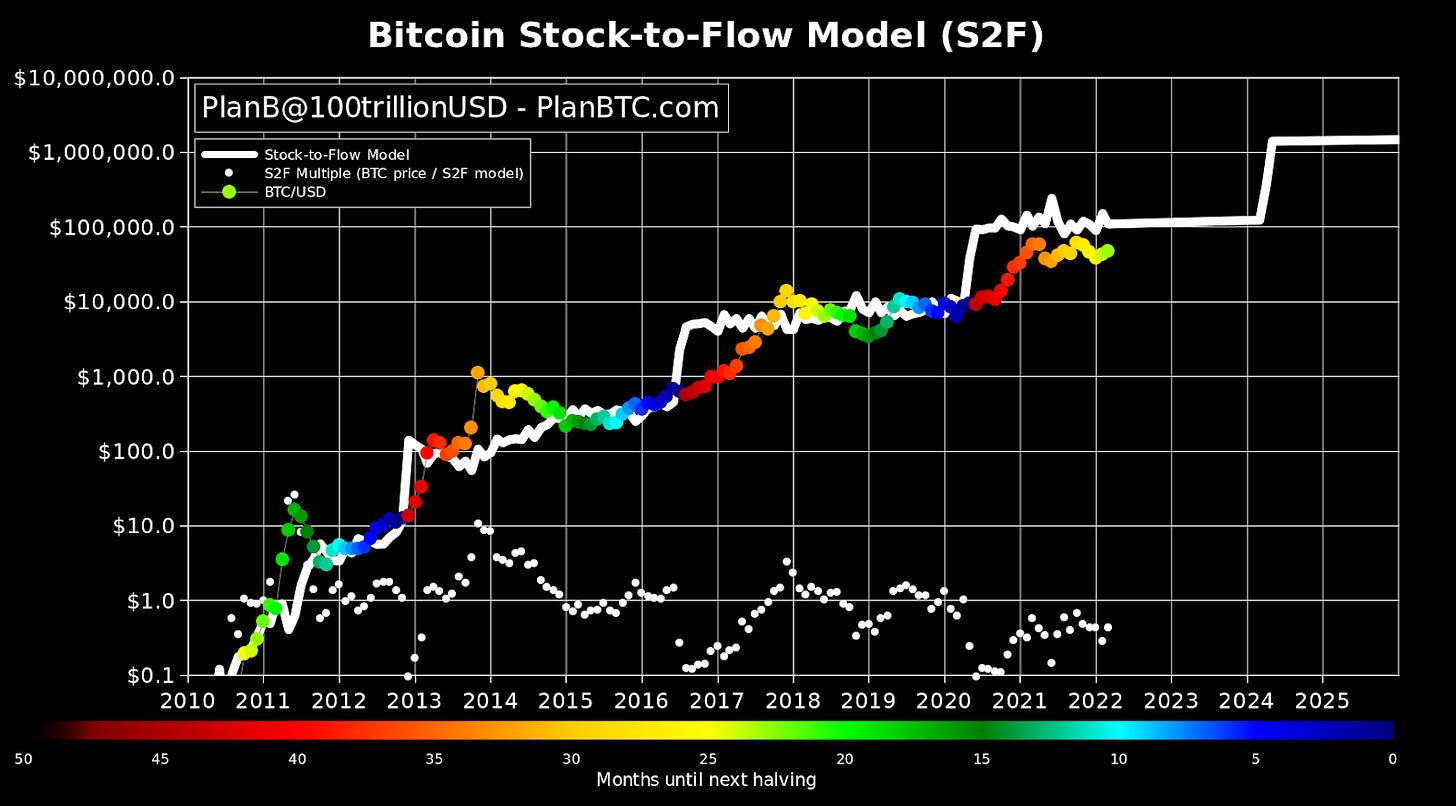

“Some people think that because bitcoin crashed on green in 2014 & 2018, btc will crash again on green in 2022. But this could be coincidence. Btc can also pump on green (like 2011). Color just indicates months until next halving. S2F says nothing about WHEN btc pumps or crashes.” by PlanB

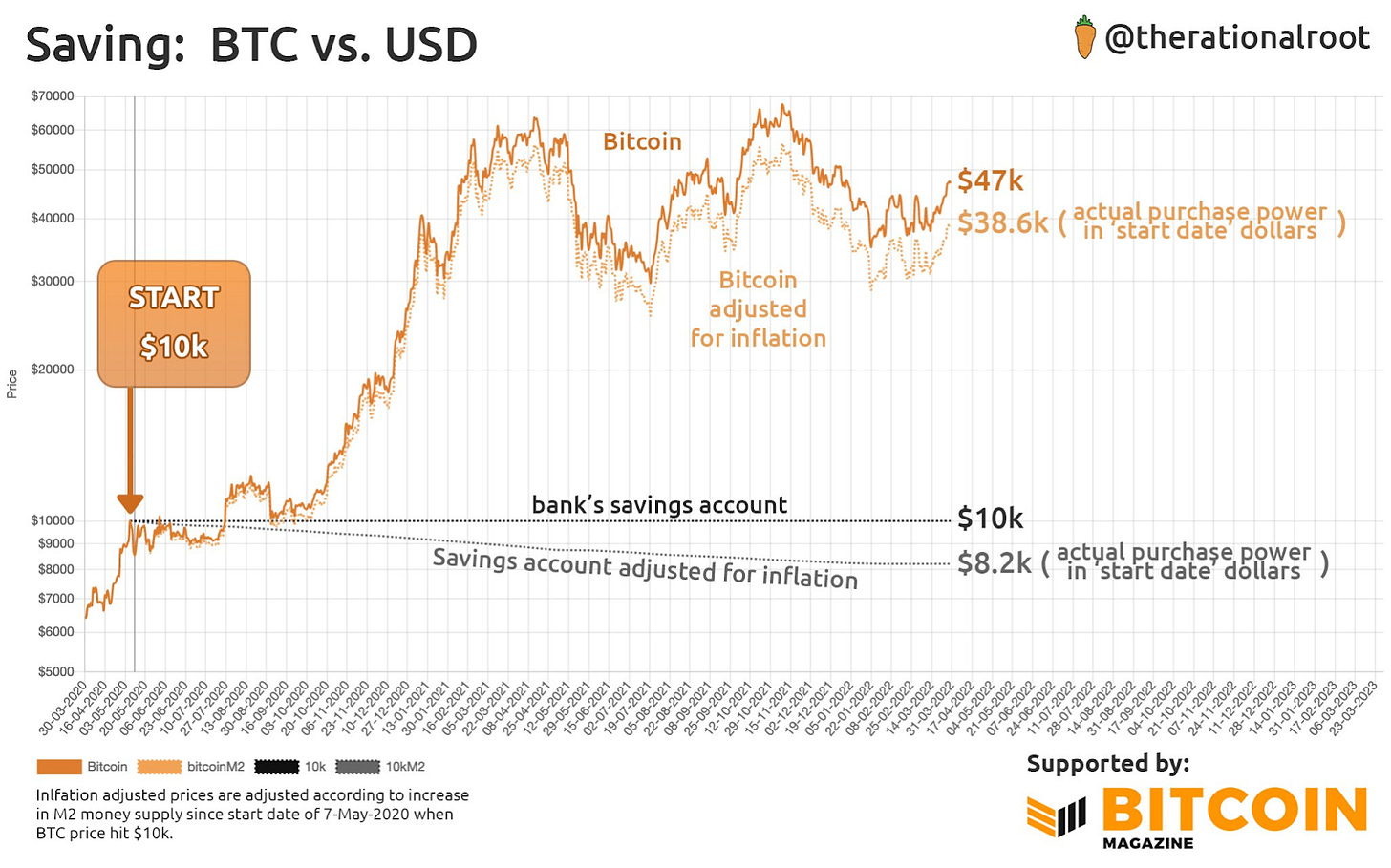

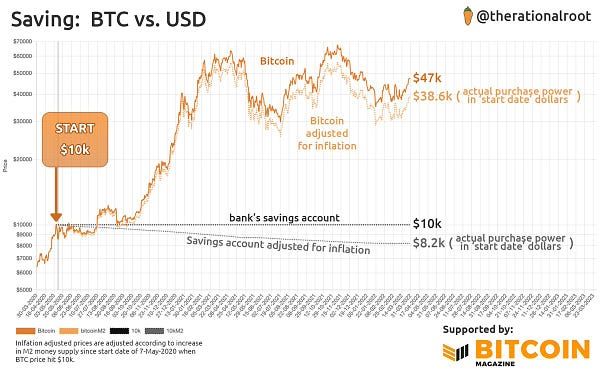

“$10k in the bank or Bitcoin?” by Root

“Pretty clean reaction from BTC so far on this pullback” by Will Clemente

“bitcoin RSI bouncing back up. BTC 25% below ATH levels.” by PlanB

Bitcoin Shorts

Funny Bitcoin short stories

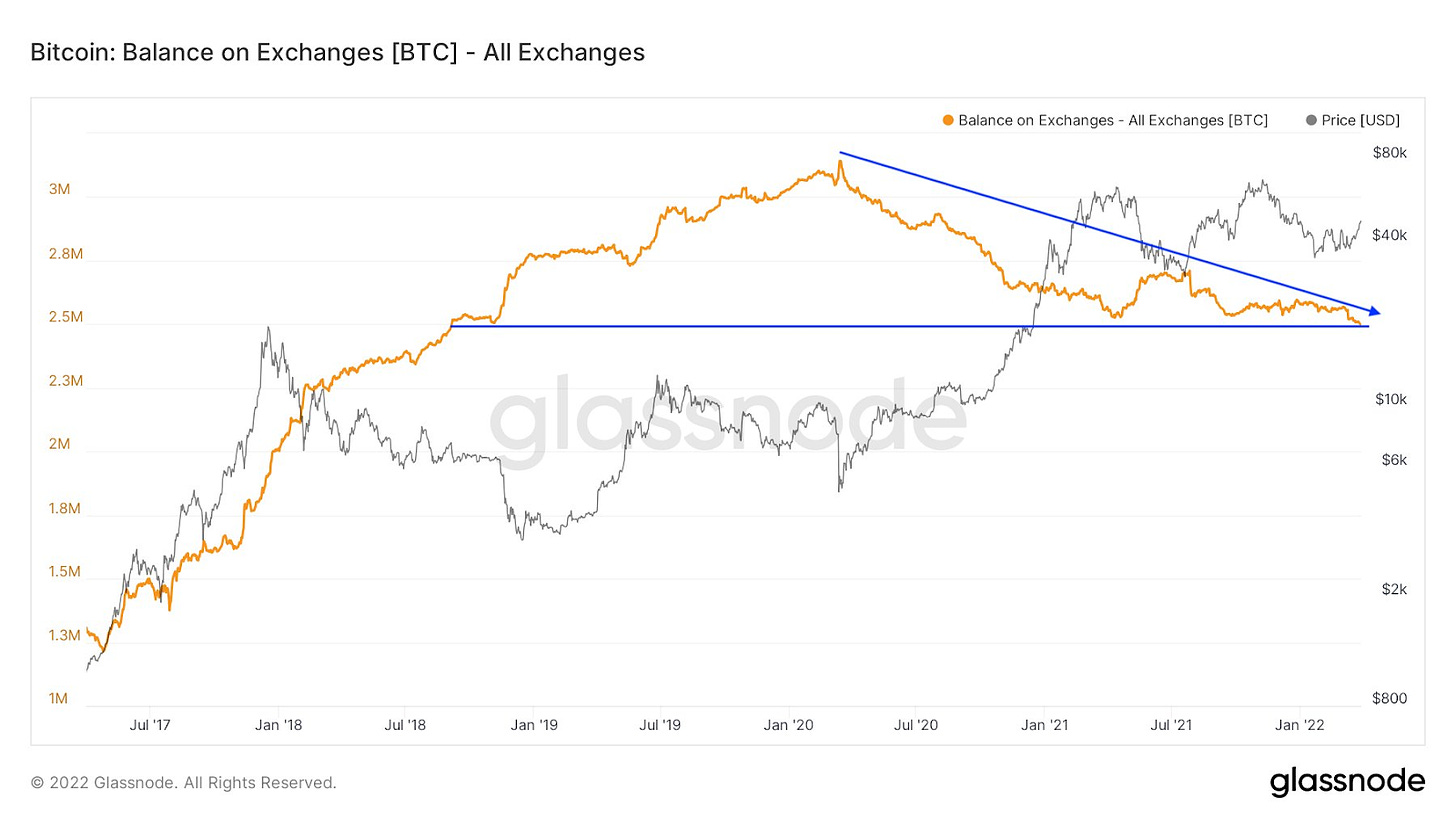

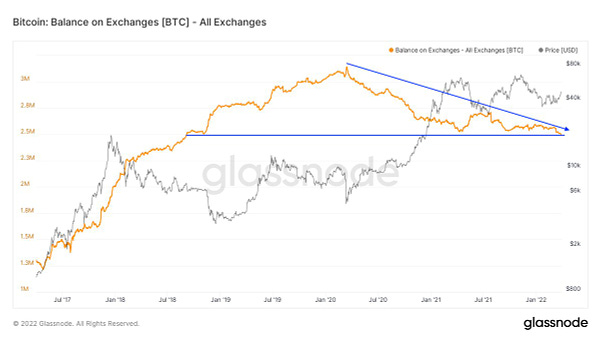

“Bitcoin supply on exchanges is falling and is the lowest in 3.5 years.” by Bitcoin Archive

The Legend Hal Finney

Suggestions

Interesting articles, books to read

#GotGoldorRubles? Did Russia Just Break The Back Of The West?

Rand Report Prescribed US Provocations Against Russia & Predicted Kremlin Retaliation In Ukraine

Europe's Plan To Boost LNG Imports From US, Elsewhere Faces Major Obstacles

Sources: