Bitcoin News

TL;DR

Malaysia Minister of Communications wants Bitcoin legal tender

El Salvador has $1.5B demand for its $1B Bitcoin Bond

Energy firms are becoming a major force in Bitcoin mining

Braiins: The future of bitcoin mining in Paraguay is incredibly bullish.

New Indian crypto Tax policy hurts shitcoin traders

Goldman Sachs becomes the first U.S. bank to offer bitcoin OTC trades

The world should fear El Salvador’s bizarre Bitcoin experiment (UPDATED!)

El Salvador is now running their own Bitcoin Full Node

Exxonmobil is mining bitcoin

New Hampshire city lets residents pay with BTC

Russia is open to selling Natural gas for Bitcoin (UPDATED!)

Mexico's third richest man and Binance CEO are in El Salvador

U.S. Senate Candidate: “It's time to remove capital gains tax on all Bitcoin transactions”

Coinbase for Canadian users requests additional frightening KYC details

A shitcoin is transacted using the Lightning Network

Northern Italy turns to Hydro powered Bitcoin mining

Rio de Janeiro will be the first city in Brazil to accept Bitcoin

Malaysia Minister of Communications wants Bitcoin legal tender

The ministry hopes that legalizing Bitcoin would support and engage the country's youth.

"We hope the government can allow this," Communication deputy minister Zahidi Zainul Abidin said on Monday. "We are trying to see how we can legalize this so that we can develop youth participation in crypto and assist them."

Sadly he is in favor of shitcoins and not just Bitcoin. He and his country will learn the hard way.

El Salvador has $1.5B demand for its $1B Bitcoin Bond

According to the Financial Times El Salvador has $1.5B demand for its $1B Bitcoin Bond. My sources say that it’s way over $2B+, but let’s not play with the numbers. Why is this huge interest in the Bitcoin Bonds? Because they pay a wooping 6.5% on the $1B invested funds. All are backed by Bitcoin. The IMF said no to the requested loan in the past, but Bitcoin jumped in to help and it will help everyone on Earth too. Never too late to learn.

Energy firms are becoming a major force in Bitcoin mining

Energy companies’ capital intensity risk models by necessity look to opportunity for growth and to evolve. Energy prices have risen for the past year and are accelerating higher after the Russian invasion of Ukraine. Together with the price of Bitcoin still down 40% from its November higher, bitcoin margins have contracted to about 70% from 90%, according to analysts. Energy companies are in the position to deliver power directly to Bitcoin miners. Beowulf Mining Plc is an example of the opportunity for both energy firms and miners cutting out the middleman.

“Energy companies tend to be very conservative by nature and they are often regulated,” said Paul Prager, chief executive officer of TeraWulf. “We are early adopters because we had a front-row seat in our partnership with Marathon.”

“It is not only the efficiency from the commercial perspective but it is from a risk perspective where we are better built to handle the downside,” Prager said. “When a transformer goes out on site, you are not calling a third party service firm to come in to repair it, putting in a change order, paying them overtime and hoping that in two to three weeks that transformer is repaired.”

More and more energy companies will see a big possibility in direct Bitcoin mining because it not just directly makes a huge profit, but it can be used to balance the energy grid load.

Braiins: The future of bitcoin mining in Paraguay is incredibly bullish.

Braiins the Bitcoin mining software company visited miners in Paraguay to understand the future of mining in this energy-rich region.

“...The country’s Itaipu Dam has been the focal point of attention for miners who have been eyeing Paraguay as a place to set up operations. Considered the second largest dam in the world after China's Three Gorges Dam, the Itaipu Dam has an overproduction of 5500 MW of hydroelectric power, most of which is currently being sold to Brazil at a relatively low price.

Paraguay will finish paying off the debt for the construction of the dam in 2023, but Brazil’s government is still planning for most of the dam’s excess energy to be sold to them. Itaipu’s technical advisors say the biggest challenge facing Paraguayan leadership is "to be able to utilize more of this energy in Paraguay and for all Paraguayans to benefit."

After our visit, the Braiins team is convinced that bitcoin mining can be a huge component in solving that challenge…” more details here.

I want to see more and more of these kinds of education around the World. Poor countries sell vast amounts of energy subsidized to wealthy countries. This must be changed with Bitcoin! Bitcoin brings fair trade!

New Indian crypto Tax policy hurts shitcoin traders

We can argue about whether the 15% profit tax on Bitcoin trading is too much or not, but we can say that it’s good that it punishes gambling with shitcoins over Bitcoin.

The new policy will likely incentivize traders to pick one virtual asset like Bitcoin to trade with, rather than using trading pairs. For example, if a trader were to invest $200 into a BTC/SHC trading pair, and profited 15% in BTC but lost 15% in SHC, they would be required to pay 30% gains on their Bitcoin profits while not being able to account for any of their shitcoin losses. Most shitcoins don’t have a FIAT money pair, just Bitcoin trading pairs.

Goldman Sachs becomes the first U.S. bank to offer bitcoin OTC trades

Goldman Sachs becomes the first U.S. bank to offer bitcoin over-the-counter trades.

“This trade represents the first step that banks have taken to offer direct, customizable exposures to the crypto market on behalf of their clients,” said Galaxy co-President Damien Vanderwilt.

Goldman traded a bitcoin-linked instrument called a non-deliverable option with crypto merchant bank Galaxy Digital.

“This trade represents the first step that banks have taken to offer direct, customizable exposures to the crypto market on behalf of their clients,” Galaxy co-President Damien Vanderwilt said in an interview.

This is a milestone for bitcoin and will be offered to institutional investors.

The world should fear El Salvador’s bizarre Bitcoin experiment (UPDATED!)

With the headline above an article was written by Telegraph. Nayib Bukele President of El Salvador highlighted the following paragraph:

“Each new initiative like El Salvador’s bitcoin bond could chip away at the greenback’s supremacy a little, potentially making the world that bit harder to police and a touch more dangerous.”

“Making the world that bit harder to police”? WTF?!

The money elite like Frederick Barclay (owner of Telegraph) are afraid of El Salvador stepping towards funding the country through Bitcoin Bonds because any future financial sanctions against the country would be worthless. That’s why more and more articles like the one mentioned above will be written. Like in the fall of 2017, just now maybe it will be even more of them.

Finally this sentence: “There is very little chance of the dollar losing its crown as the global currency of choice any time soon.” Ok, we will see…

(UPDATE: ‘National Strategic Military Implications’—MIT Researcher Issues Surprise U.S. Bitcoin Warning.

"If this truly does become the new property defense protocol that everyone subscribes to, then you are posturing yourself to become a superpower for the next 1,000 years."

This MIT Researcher maybe sees now how powerful Bitcoin is?)

(UPDATE 2: El Salvador has postponed the issuance of the world's first Bitcoin backed bond because the government decided to wait for favorable conditions in the market, as originally clarified by Finance Minister Alejandro Zelaya on Tuesday. The denial of the FUDs can be read here.)

El Salvador is now running their own Bitcoin Full Node

According to Samson Mow tweet, former Blockstream CEO, the government of El Salvador is now running their own Bitcoin Core full node. I hope from now on they will hold their own BTC too and not in a custodial solution as was before.

Exxonmobil is mining bitcoin

Exxonmobil is mining bitcoin using excess flared gas to power Bitcoin miners. The pilot project, which launched in January 2021 and expanded in July, uses up 18 million cubic feet of gas per month that would have otherwise been burned off -- or flared -- into the atmosphere because there aren’t enough pipelines. Instead it is now used to mint new bitcoin.

New Hampshire city lets residents pay with BTC

Residents of Portsmouth, New Hampshire are seeing this in no uncertain terms, now that the city has started accepting bill payments in Bitcoin and other shitcoins.

“There’s waves of new things that are going to affect us in terms of our future that use the type of technology used in cryptocurrency,” said McEachern. “I want to make sure Portsmouth is not waiting around to see how this is going to affect us in the future, because it’s already affecting us.” by the city's Mayor Deaglan McEachern.

Russia is open to selling Natural gas for Bitcoin (UPDATED!)

Russia is open to accepting bitcoin for its natural resources exports, the chairman of the country’s Congressional energy committee, Pavel Zavalny, said in a press conference on Thursday.

“When it comes to our ‘friendly’ countries, like China or Turkey, which don’t pressure us, then we have been offering them for a while to switch payments to national currencies, like rubles and yuan,” Zavalny said during the press conference.

“With Turkey, it can be lira and rubles. So there can be a variety of currencies, and that’s a standard practice. If they want bitcoin, we will trade in bitcoin.”

(UPDATE: Russia Prime Minister: The time is now to integrate Bitcoin and shitcoins into our economy)

Mexico's third richest man and Binance CEO are in El Salvador

Mexico's third richest man Ricardo Salinas Pliego has arrived in El Salvador to learn about Bitcoin's possibilities as legal tender. He is a toxic maximalist, hope soon he will push through the corrupt Mexican bureaucracy and make Bitcoin a legal tender in Mexico. Not much later Changpeng Zhao, CEO of Binance exchange arrived in El Salvador too. The details why Mr. Zhao is in El Salvador is not yet known because Nayib Bukele, President of El Salvador said the Bitcoin Bonds were issued through Bitfinex and not Binance. Soon we will find out the visit details.

U.S. Senate Candidate: “It's time to remove capital gains tax on all Bitcoin transactions”

According to Vice, last week U.S. Senate Candidate Bryan Solstin said:”It's time to remove capital gains tax on all Bitcoin transactions.”

“El Salvador was aggressive with Bitcoin legal tender. They will be rewarded. Early Bitcoin adopters will be rewarded,” Solstin said in an interview over email. “The US, however, is a bigger country. The US will have to [take] baby steps, then legal tender will be an obvious next step.”

“Zero-tax on Bitcoin transactions is the first step. In comparison to legal tender, zero-tax means the merchants do not have to accept Bitcoin. Regardless, with zero-tax Bitcoin, many cafes, bars and grocery stores will accept BTC/LN,” LN=Lightning Network

“Zero tax transactions. Zero tax capital gains,” said Solstin. “No upper limit. What is good for the goose is good for the gander. Imagine the frictionless velocity.”

He is a true Bitcoin Maximalist, who knows the real use case of Bitcoin and is not involved in the shitcoinery. I think he is a must in the Senate!

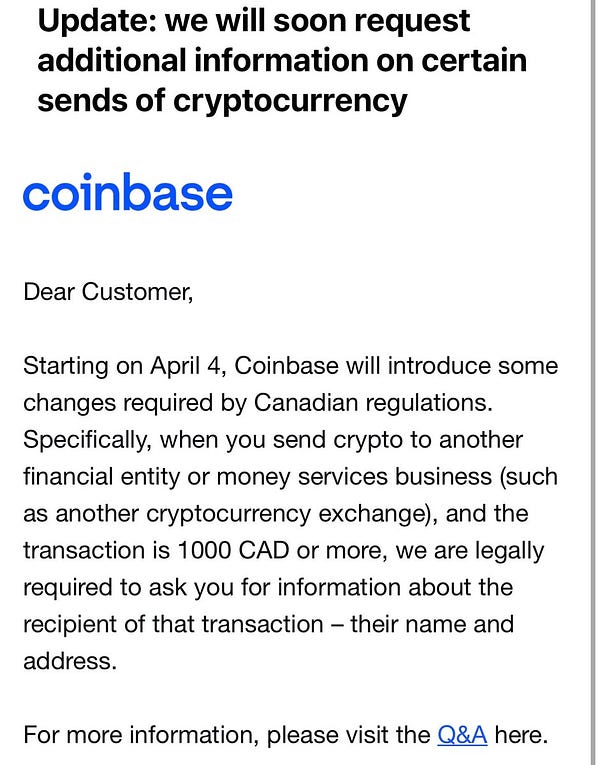

Coinbase for Canadian users requests additional frightening KYC details

Coinbase exchange starting from April 4 from their Canadian users, they will request additional frightening KYC details when they will send/withdraw funds >1000 CAD. These requested information will be about the recipient of that transaction - their name and address.

I think now, if you are a Canadian, is a good time to close your Coinbase account, but I think no-one else should use a centralized exchange filled with private KYC information because sooner or later other governments will go after it too.

A shitcoin is transacted using the Lightning Network

I will never ever advertise a shitcoin, but I need to write about it because I don’t want you to think that it is “legalized” on the Bitcoin Lightning Network because someone just implemented it. The USDT (Tether) is a dollar pegged stablecoin, literally a copycat of its FIAT shitcoin. Why is it a shitcoin? The answer: it's the same as any other FIAT currency, just this is worse. Worse because it’s not regulated by any means, it’s just an IOU connected to a bank account. Imagine that someone opens a bank account and deposits ~$81B USD in it. Next step he issues the equivalent amount of digital USD tokens and starts to distribute them between its buyers.

Questions: Who knows that the amount of USD is still there on that Bank account, all the time (besides the audit)? Who guarantees that it will always be there? What if a government bans the use of it? What if the government confiscates it? What if the Bank that holds it goes bankrupt? We can ask many more questions, but if any of these fail, your tokens are worthless! Think always twice when you see something that's shining, it doesn't automatically mean it’s a good bargain. The use of a shitcoin against your Bitcoin is never a good bargain even if it’s offered on Bitcoin 2nd layer!

Northern Italy turns to Hydro powered Bitcoin mining

Borgo d’Anaunia is located near the Swiss Alps and experiences dry seasons during the winter. Mayor Daniele Graziadei says it is hard to justify the costs for maintaining these plants when there is a lack of snow and rain to raise water levels. In previous years they would shut down the facilities but with Bitcoin mining they are now able to keep the dams running year round.

Graziadei’s main motivation for setting up a data center at the municipal hydropower plant was economic. The municipality doesn’t actually mine or trade bitcoin. Alps Blockchain, the Italian tech company that set up the mining farm at Alta Novella and carries out maintenance, simply purchases the computing power produced by the facility’s mining farm for at least 35% more than what the government pays for its energy. Alps Blockchain sells the computing power purchased from the facility to bitcoin mining pools around the world.

Rio de Janeiro will be the first city in Brazil to accept Bitcoin

According to Portal do Bitcoin, Rio de Janeiro will be the first city in Brazil to accept Bitcoin and shitcoins to pay for taxes starting in 2023. Take this with a grain of salt because no other official sources have confirmed!

Global Economic News

TL;DR

Steel prices in Europe are at fresh ATH (UPDATED!)

North American and European fertilizer prices exploding (UPDATED!)

McDonald’s gone, “Uncle Vanya” arrived in Russia

Powell: the FED will do whatever it takes to beat back inflation

German PPI jumps 25.9% YoY

The German 2022 GDP consensus forecasts dropped, while inflation forecast jumped

ECB Balance Sheet on a fresh ATH

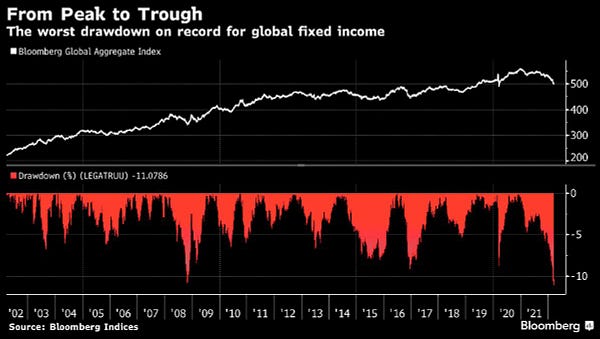

The Bloomberg Global Aggregate Index fell 11%

Russia demands ruble payments for natural gas purchases

Sri Lanka is seizing foreign currency reserves

Germany slashes fuel tax in €15B energy package

Reopened Russia stocks plunged

The bond market continues to deflate

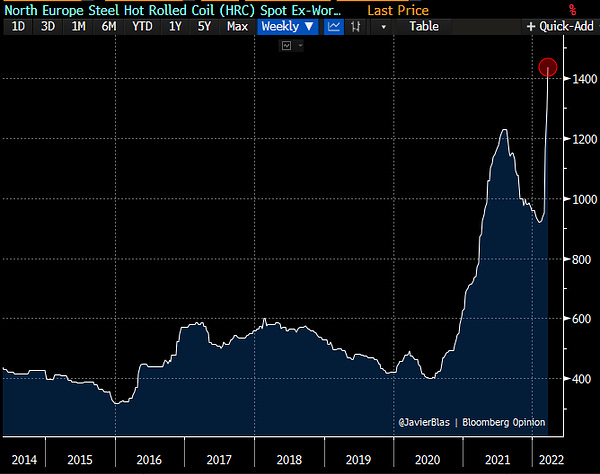

Steel prices in Europe are at fresh ATH (UPDATED!)

Steel prices in Europe have surged to a fresh all-time high, with benchmark hot rolled coil trading above €1,400 per tonne. Alongside the surge in fertilizer prices, this is another corner of the commodity market few are paying enough attention, but will bite.

(UPDATE: Rebar steel prices in Europe jumped on Friday to a fresh record high, up ~55% since the beginning of the year. Rebar is indispensable in construction. More details in Javier Blas BBG article.)

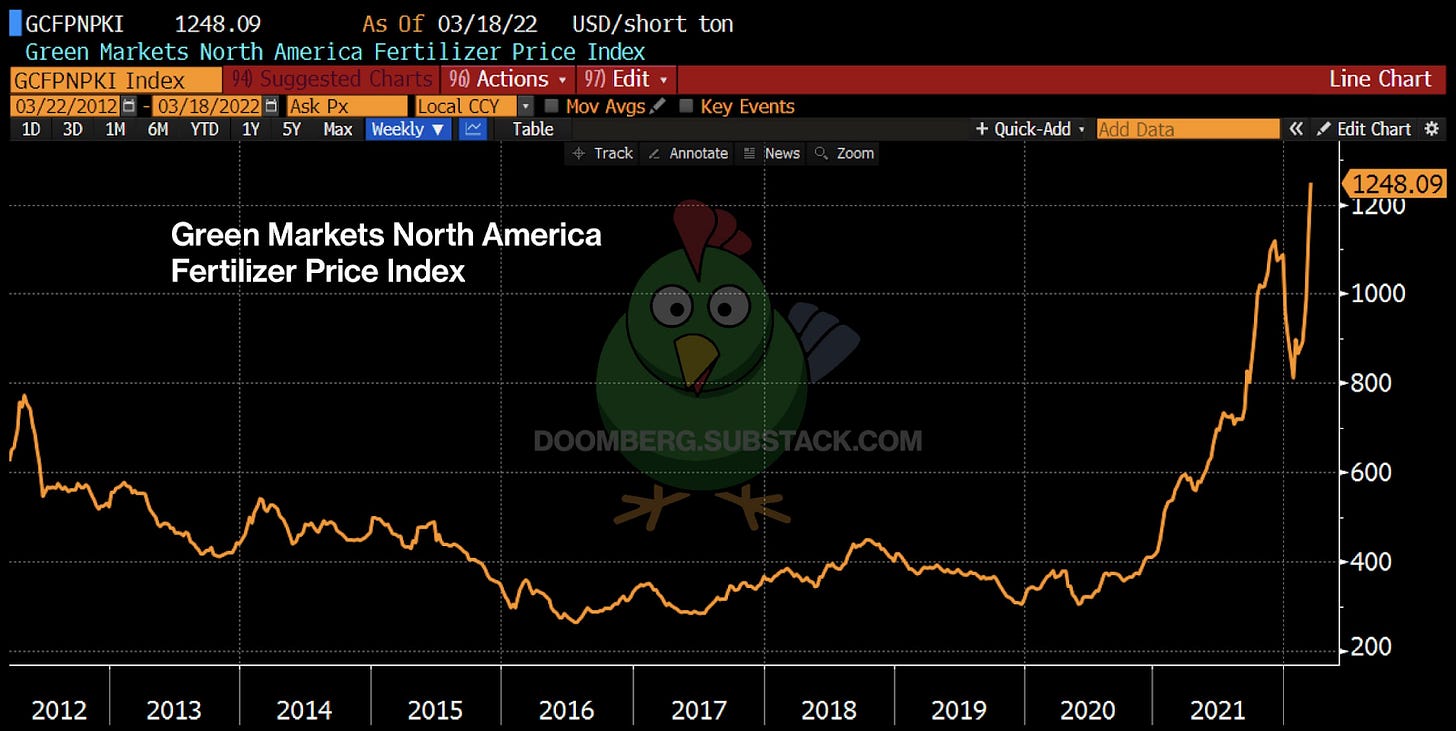

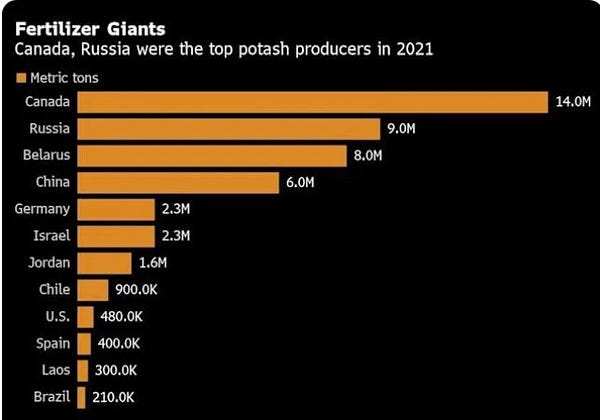

North American and European fertilizer prices exploding (UPDATED!)

The following two charts will speak for themselves. This is the price that everyone on earth will pay. Fertilizer will be priced in not just the vegetables, but in meat prices too.

Most people know Russia controls a significant percentage of global energy. They forget Russia also controls a significant percentage of global food. There are already supply shortages around the World because of the Suez traffic incident, the pandemia and now because of the war too. In this year people will face food shortages and with unimaginable prices too.

(UPDATE: Michael Shellenberger, the great author of Apocalypse Never book, made a thread on this issue. I think both the book and the thread are a must read.)

McDonald’s gone “Uncle Vanya” arrived in Russia

In Russia after McDonald decided to close their 847 restaurants and leave the country, Russians turned the logo 90 degrees, and named the new stores "Uncle Vanya".

The assortment will remain the same in all stores, and the prices will be lower because only Russian ingredients will be used.

Powell: the FED will do whatever it takes to beat back inflation

Meanwhile Powell thinks that the FED can resolve with more and more printing the inflation, the markets now price 7.74 Fed hike moves this year - a fresh record - as after Powell talk a wave of hawkish statements by Fed officials continued. In a public appearance, Fed of Chicago President Charles Evans said the recent rate hike "was the first of what appears to be many this year." This is insane and will go on and on.

Meanwhile, the US Yield Curve is flattest since March 2020. U.S. 2-10s spread drops <20bps as traders ramped up bets about the pace of Fed tightening.

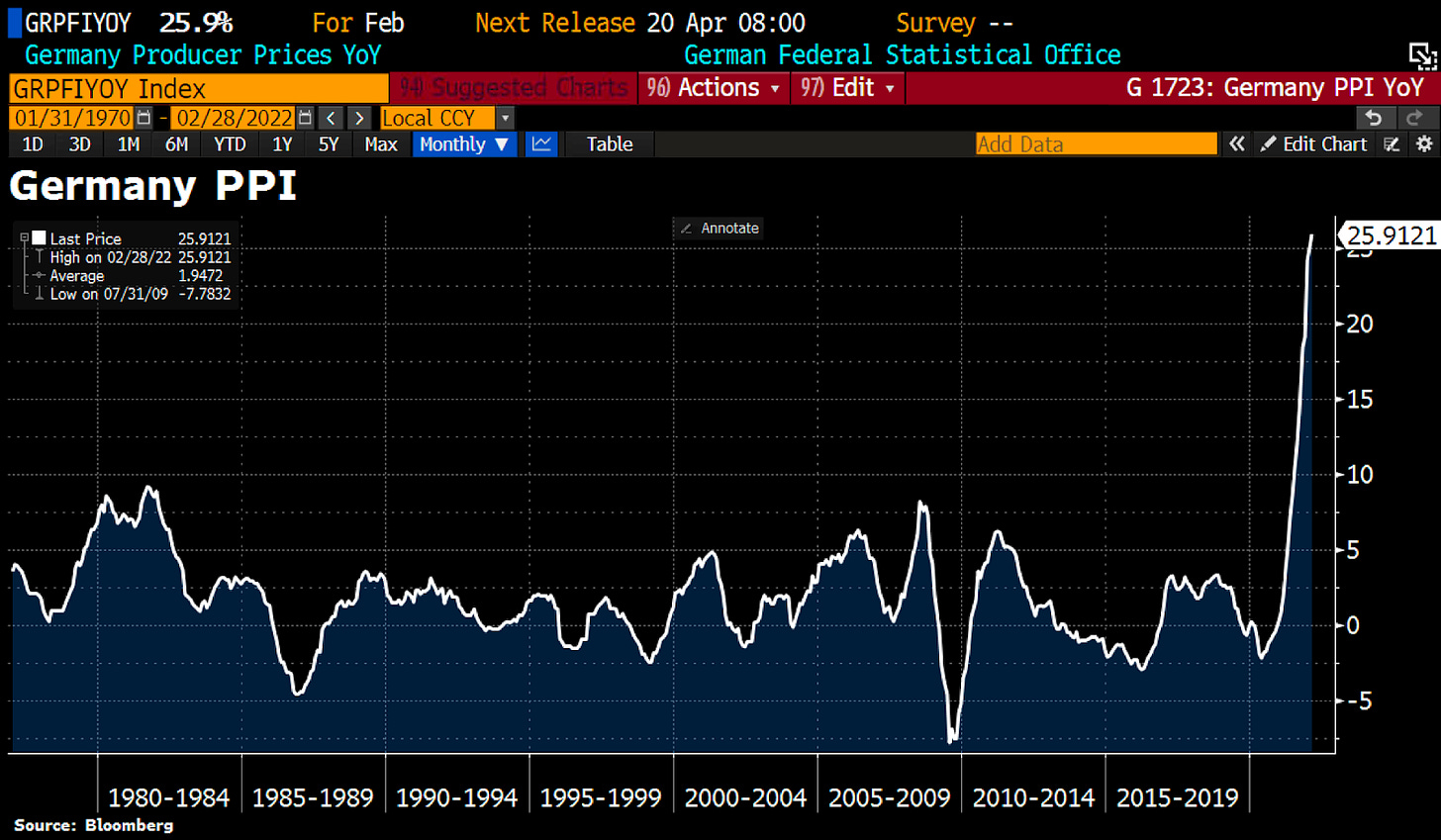

German PPI jumps 25.9% YoY

The German Producer Prices are crazy high 25.9% YoY in Feb. It wasn’t so high since the Weimar republic. The PPI ex-energy rose 12.4% YoY. All these numbers are 0 correlation with the Ukraine war because it contains only previous periods. Can you imagine how high the new ones will be?

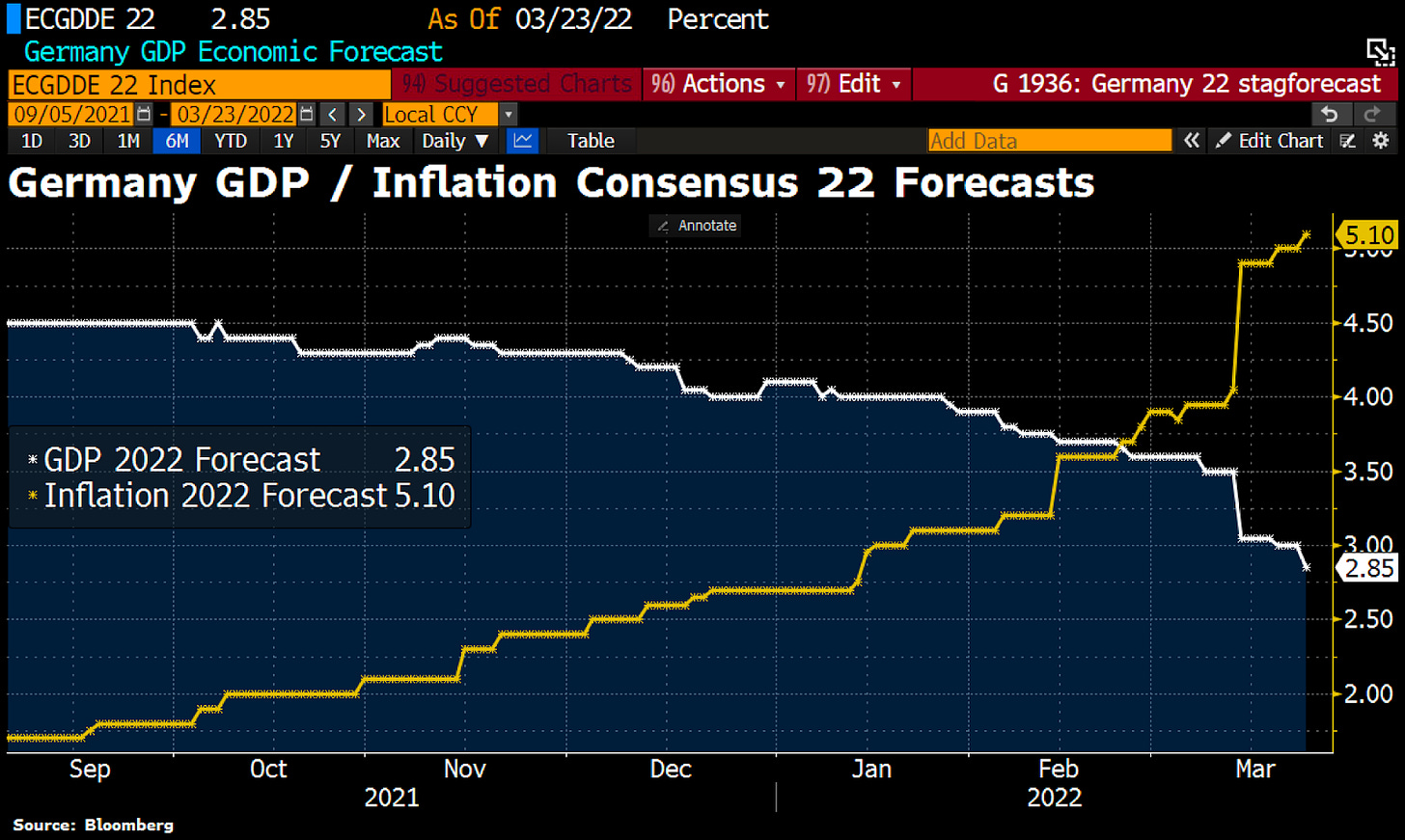

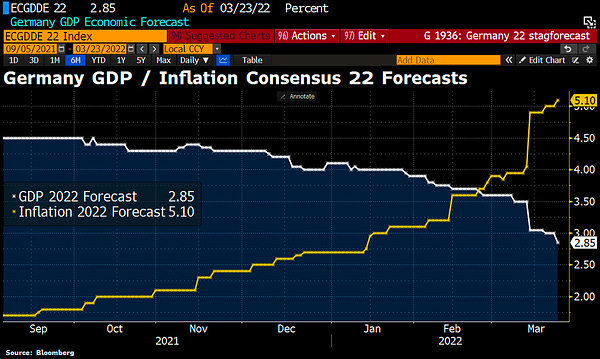

The German 2022 GDP consensus forecasts dropped, while inflation forecast jumped

In Germany the 2022 GDP consensus forecasts have dropped <3% while inflation forecasts for 2022 have jumped >5%. What could possibly go wrong from here?

ECB Balance Sheet on a fresh ATH

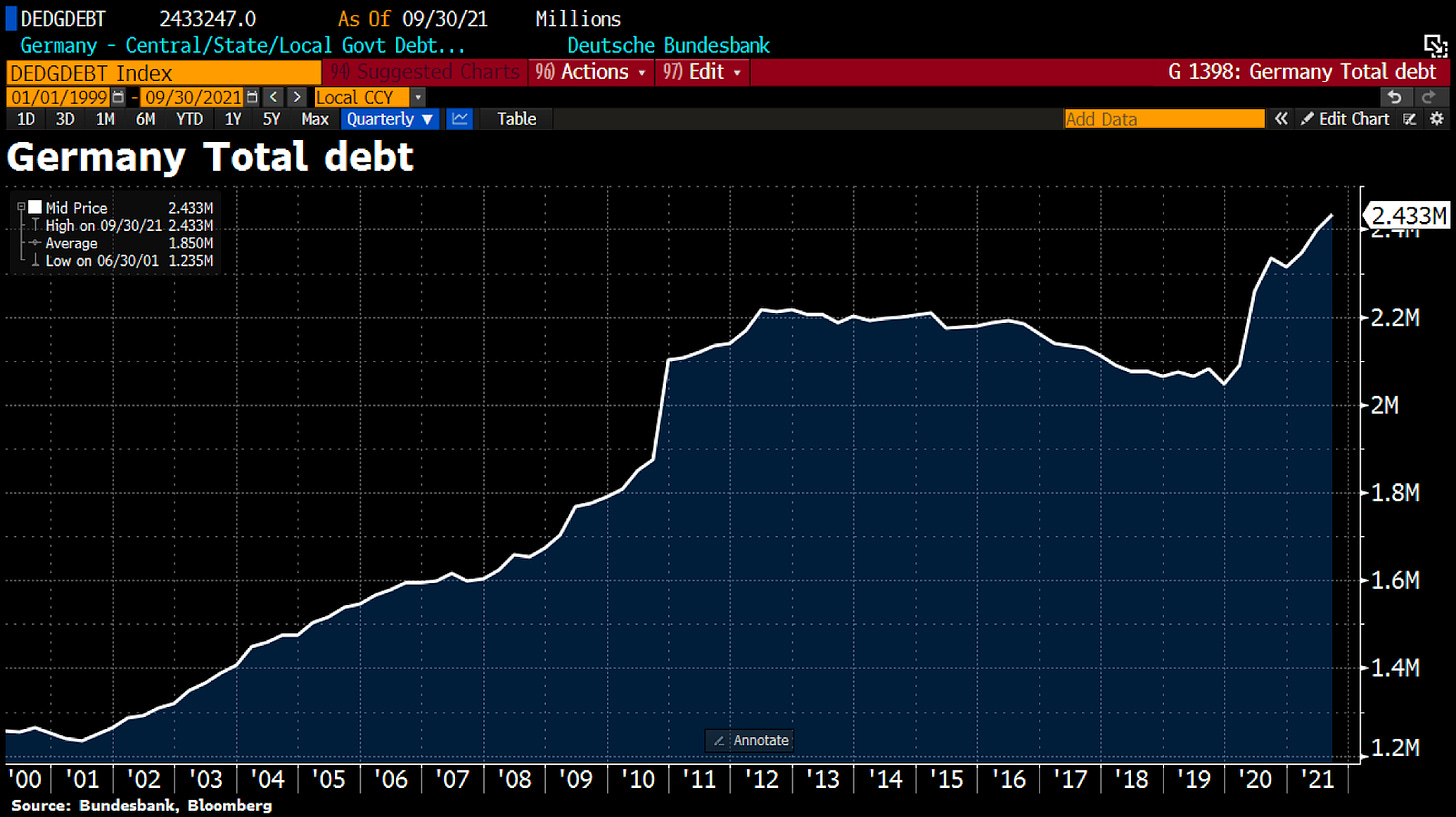

Virtual money printing is UNSTOPPABLE! The ECB Balance Sheet has hit fresh ATH >€8.7T. Total assets rose by another €13B as ECB keeps buying bonds despite record-high Eurozone inflation. The Balance Sheet now equals 82% of Eurozone GDP vs. Fed's 37%, and BoJ's 136%.

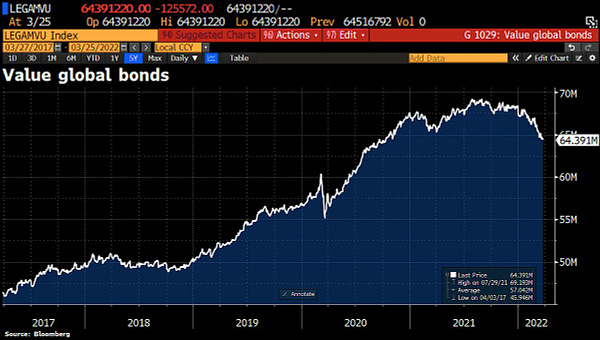

The Bloomberg Global Aggregate Index fell 11%

The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt, has fallen 11% from a high in early 2021, the most in data stretching back to 1990 and surpassing a 10.8% drawdown during the global financial crisis. (BBG)

Russia demands ruble payments for natural gas purchases

From now on, Russia demands ruble payments for natural gas purchases, from “unfriendly” nations, and doesn't want euros or dollars. European gas prices surged more than 30% after the news. The interesting part is that with this simple move, the western countries need to buy Ruble from the Russian Central Bank, so the country receives USD or EUR for it. This makes the USD/RUB price lower.

Sri Lanka is seizing foreign currency reserves

As Sri Lanka's economic meltdown is occurring, they are seizing their own citizens and businesses foreign currency reserves from banks. I know Sri Lanka is a small country, but Canada, Russia are not and in one way or another their citizens too are faced with the same result: domestic or forreign money confiscated either by their own or by forreign countries. Learn from it. Never ever hold in banks either your money or later your Bitcoin because one day maybe it will be confiscated.

Germany slashes fuel tax in €15B energy package

Germany slashes fuel tax in €15bn energy package. Chancellor Olaf Scholz’s government will cut the tax on fuel for three months by 30 euro cents ($0.33) for gasoline and 14 cents for diesel, Finance Minister Christian Lindner told reporters in Berlin. This will particularly ease the burden on drivers with SUVs. Ruling coalition also agrees to a bonus for taxpayers of €300. Not just in the US, but in the EU populism is getting stronger and stronger. They forgot to tell, that it was all paid by freshly printed money! More details here.

Reopened Russia stocks plunged

“Russia stocks plunged on Friday, reversing most of the gains made in the previous session when the market reopened following a record-long shutdown, while govt measures to prevent a selloff helped limit the losses. MOEX Index closed 3.7% lower after climbing 4.4% on Thursday.” by Holger Zschaepitz

The bond market continues to deflate

“The biggest bond bubble in 800yrs continues to deflate after the start of the Fed's rate-hike cycle & as rising inflation shakes up the bond markets. The value of global bonds has dropped by another $754bn this week, bringing total loss from ATH to $4.8tn.” by Holger Zschaepitz

Bitcoin price speculations

These are just speculations, no investment advice!

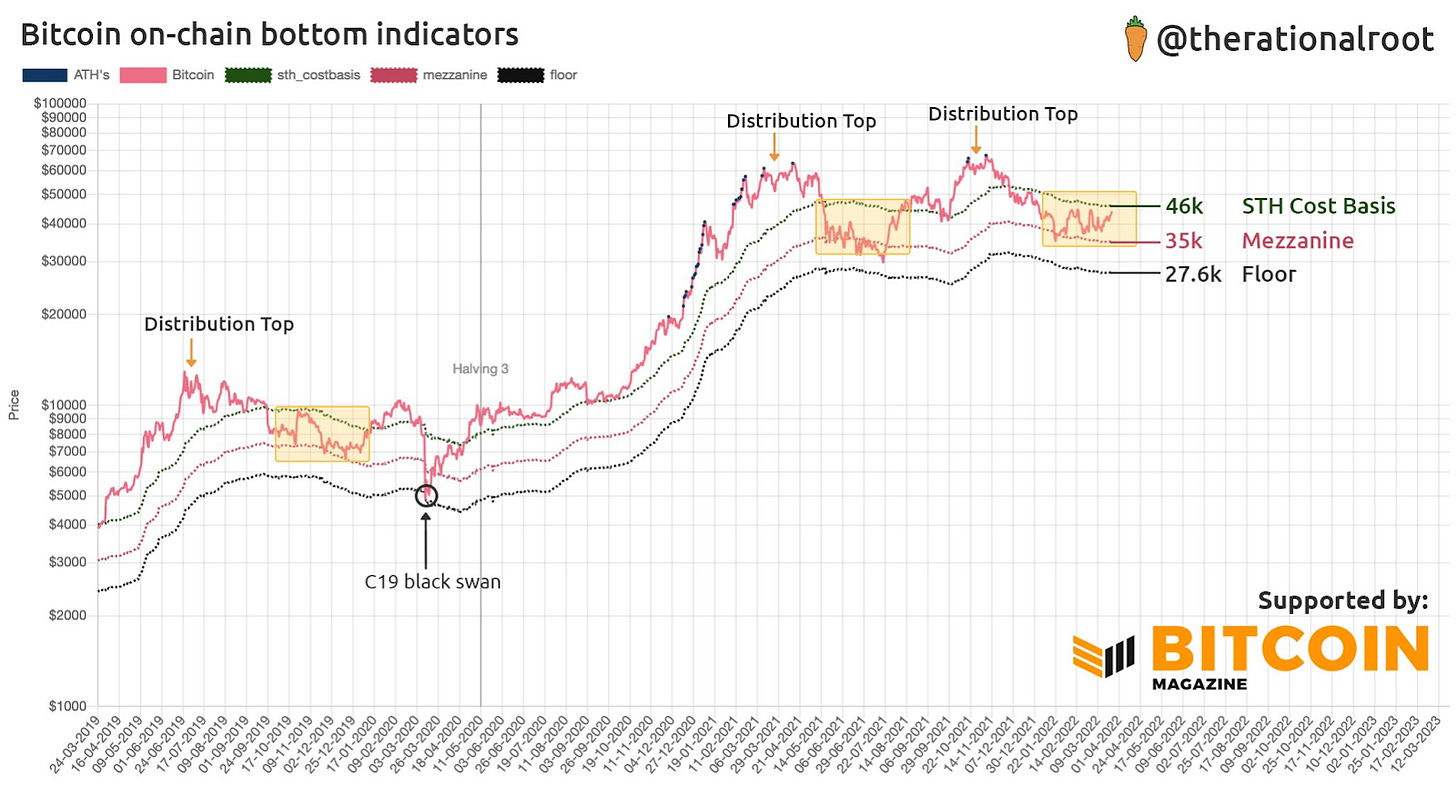

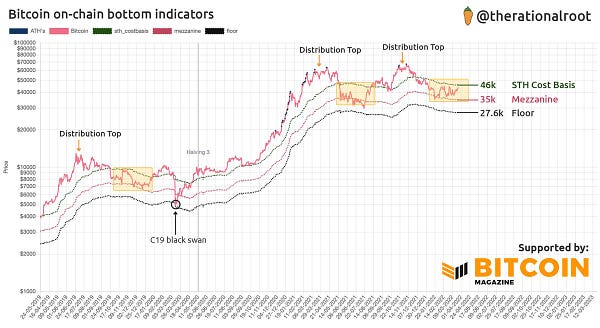

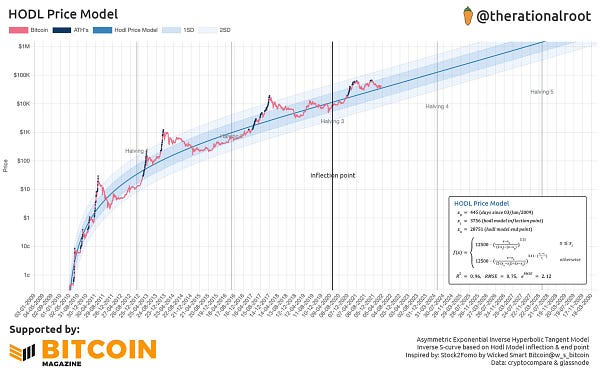

“The HODL Price Model scenarios: 1. Mid-cycle dip (2013 style) 2. Visit below model value (capitulation), note how every cycle drop below model value was less severe.” by Root

“Getting back above STH Cost Basis => Bull market. Are we gonna give it another shot?” by Root

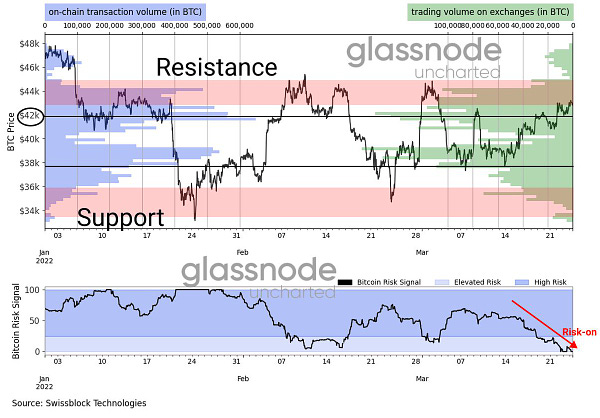

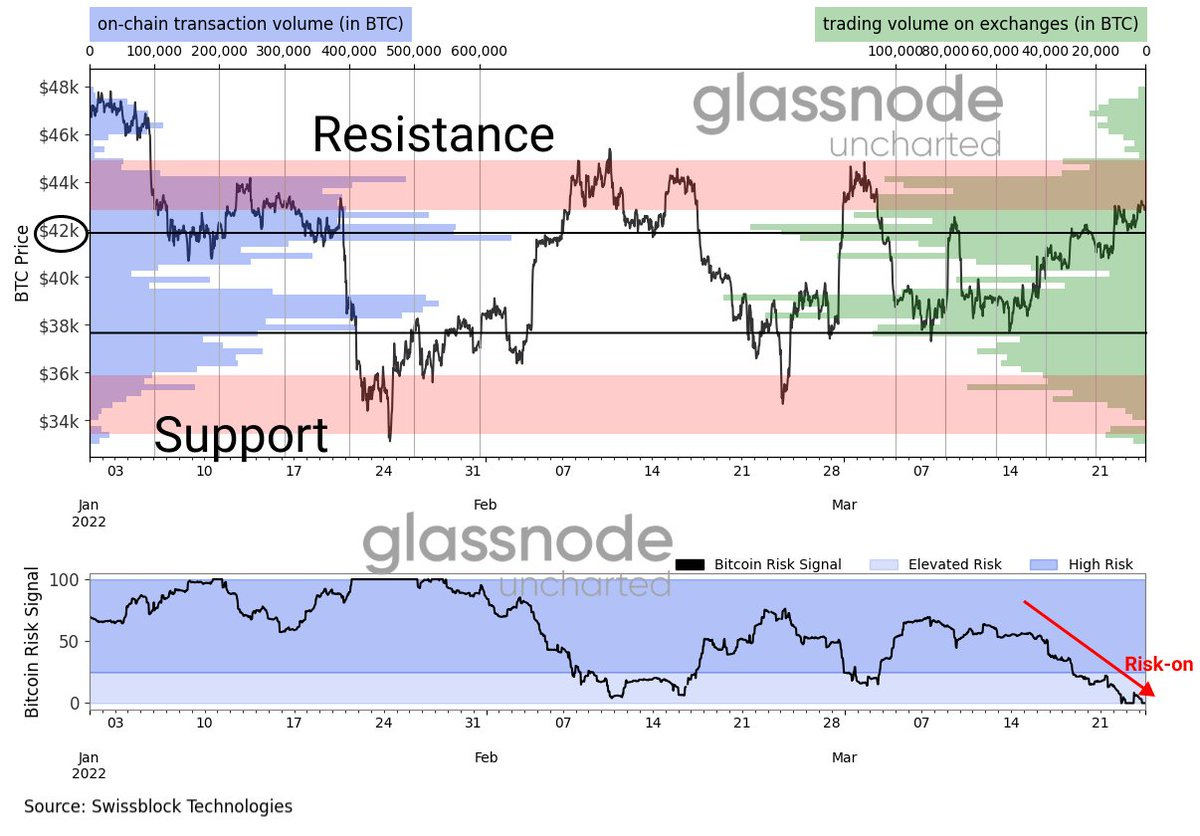

“Quick update on Bitcoin 's trading channel. BTC back at $44k levels and the risk of a deep retrace eases. Keep an eye on $42-$45k.” by @Negentropic_

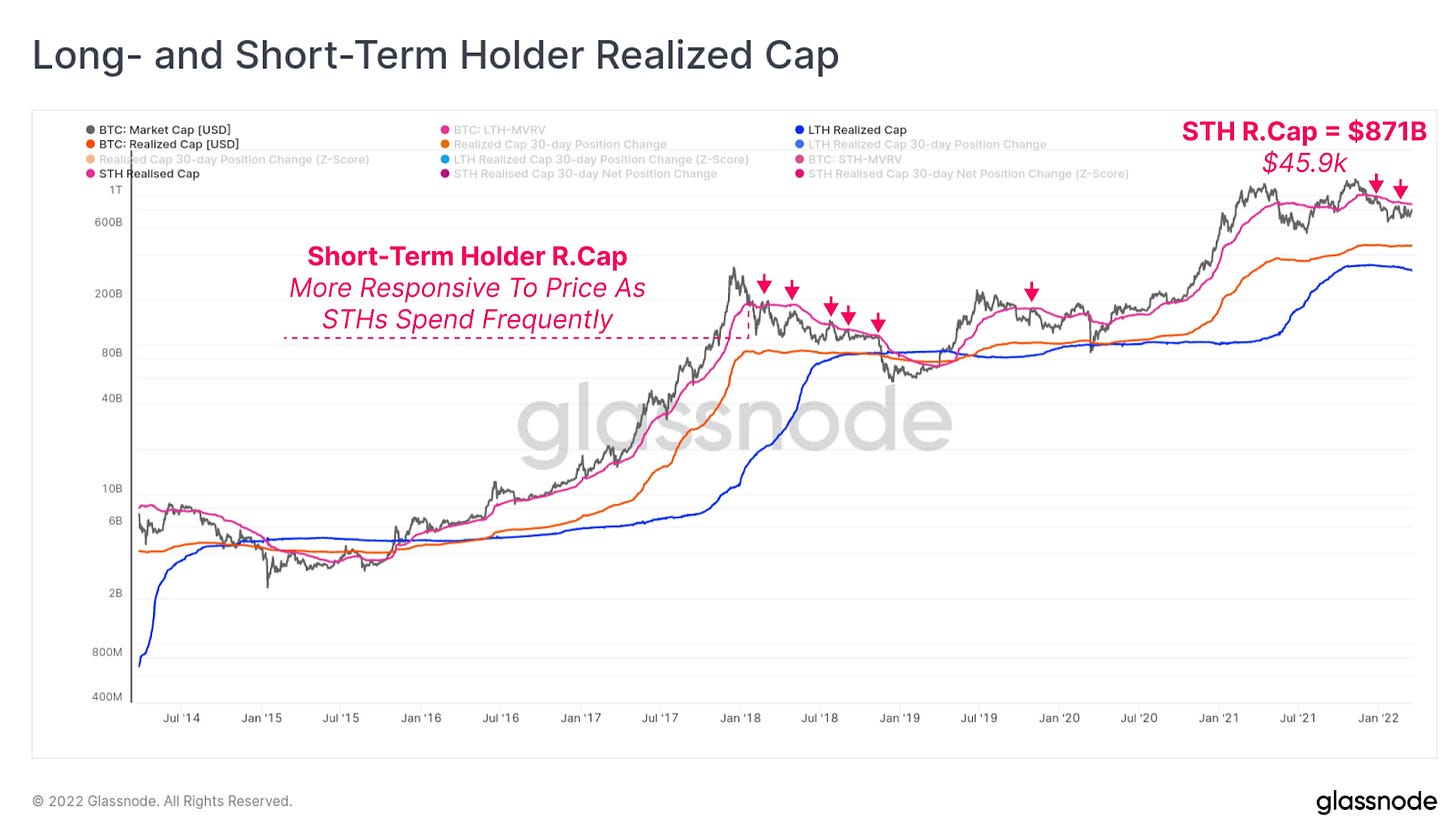

“The next major on-chain resistance for #Bitcoin is the Short-Term Holder Realized Price, trading at $45.9k. This metric is the average price paid for $BTC by investors who purchased after the October ATH. Bearish resistance comes from STHs seeking to 'get their money back'.” by @glassnode

“Bitcoin Daily RSI has broken out of the Multi-Month downtrend in which its first touch-point started last October” by @MatthewHyland_

“The only real move will be when #Bitcoin breaks $46k or falls below $33k. Everything else is just noise!!!” by @MatthewHyland_

Bitcoin Shorts

Funny Bitcoin short stories

“There aren’t enough Bitcoin for every millionaire in the world.

56M millionaires. 21M Bitcoin.” by @danheld

Converting Grayscale Bitcoin Trust into an ETF is our No.1 priority as a firm - Grayscale CEO

Bloomberg: Because of inflation, you should skip your pet's medical needs.

El Salvador: Because of Bitcoin, we opened a new national veterinary hospital.

“A single Bitcoin transaction now requires more than 2,000 kilowatt-hours of electricity, or enough energy to power the average American household for 73 days, researchers estimate.” by NYTimes Tech

This is a simple lie, because I can make a single Bitcoin transaction through my lightning node (consumption 4W, yearly $3.5) for 1 satoshi which costs $0.0004.

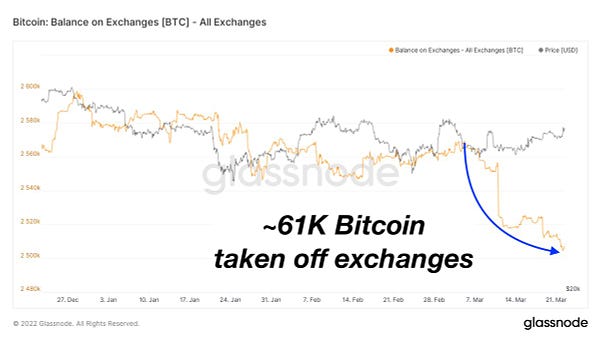

“~61K Bitcoin taken off exchanges in just 15 days.” by @BTC_Archive

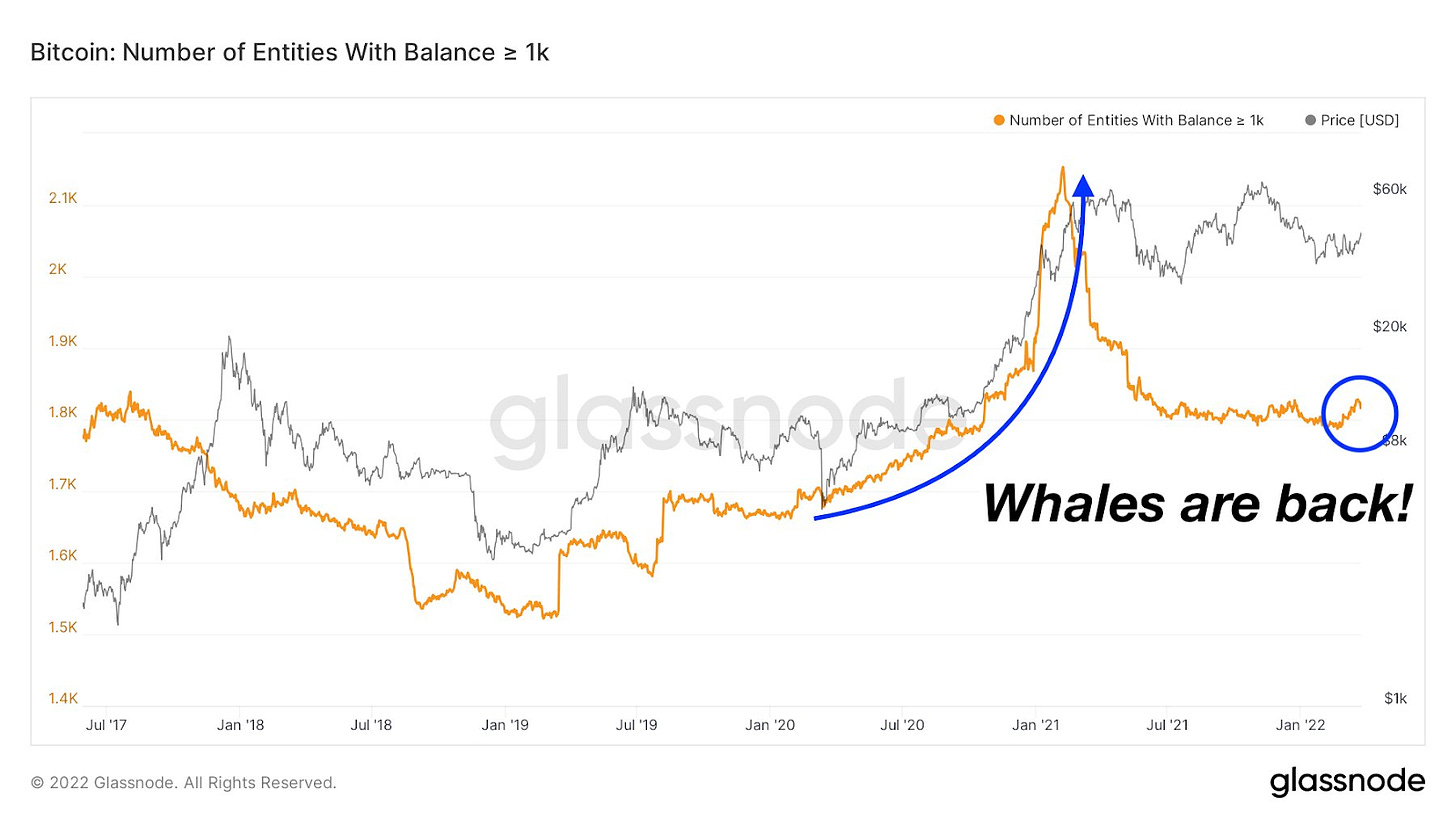

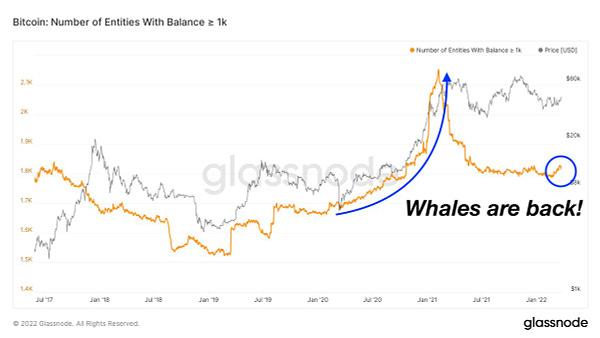

“Whales are returning...The biggest trend reversal in +1 year.” by @BTC_Archive

“20 year old Ukrainian crossed border to escape war with $2,000 Bitcoin on a thumb drive - CNBC” by @BTC_Archive

LightningNetwork Bitcoin transactions in South Africa (video)

“Send it fam” by Dylan LeClair

“I can guarantee you nearly 3x your money. It is simple. Get 0.5 Turkish Lira coins. Metal in the coin alone costs 1.47 Liras. Best example of free market and why fiat will fail and Bitcoin will prevail.“ by @1971Bubble

Myth: Bitcoin mining destroys the planet.

Reality: (video)

“A view above El Salvador’s volcano Bitcoin mining operation” (video)

“If Bitcoin becomes the ultimate currency adopted by the human society, we all gonna die. It’s not a joke.” - Qu Quiang, Assistent Director of the Intl. Monetary Institut, Renmin University of China. (video)

Suggestions

Interesting articles, books to read

WEF Issues Ominous Warning Over Coming Food Crisis, Recommends 'More Sustainable Diets'

Ukraine Crisis Accelerating Rise Of Central Bank Digital Currencies

What 'Vibrancy': NYC Hit By Surprisingly High Jobless Rate As Workers Fail To Return

Thread: What happened next brought on the BIGGEST obesity epidemic the world has ever seen

DO Black - the world’s first credit card with a carbon limit - a more interesting view here.

Goldman: How China's COVID Lockdowns Could Disrupt Global Supply Chains

Ukrainian Refugees Welcomed In Latin America, Though Few Are Staying

Sources:

https://www.btctimes.com/news/new-indian-crypto-tax-policy-hurts-traders

https://www.btctimes.com/news/new-hampshire-city-lets-residents-pay-with-btc

https://www.zerohedge.com/markets/russia-open-selling-natural-gas-bitcoin-gold