Bitcoin News

TL;DR

Uruguay installs its first Bitcoin ATM

You can now buy a house using Bitcoin as collateral and ZERO fiat deposit with mortgage lender Milo.

Computing giant Intel to debut new ultra-low-voltage Bitcoin mining ASIC at ISSCC conference (UPDATED!)

BitMEX to acquire 268-year-old German bank to expand Bitcoin services to Europe

American Bankers Association: "We firmly stand" with banks offering Bitcoin

Over 4 million people have been onboarded to Bitcoin in El Salvador

LinkedIn says Bitcoin and crypto job postings grew 395% in 2021: 3x the tech industry

Gemini acquires trading tech platform Omniex

300 US community banks to go live with Bitcoin buying by Q2 this year

Bitcoin app Strike #1 in Argentina's app store just one week after launch

62% of Canadians want to be paid in bitcoin or crypto

El Salvador's government is looking to provide Bitcoin-backed loans to small and mid-sized businesses.

The Russian Central Bank calls for a total ban on Bitcoin including mining, trading and payments.

On January 21, the difficulty of the Bitcoin network increased by 9.32%.

Wasted and excess energy “can be turned into economic value through bitcoin mining.” — Bitfury CEO educating Congress

Union Bank of the Philippines plans to offer trading and custodial services for bitcoin

Robinhood Starts To Rollout Bitcoin Withdrawal Support

Google Pay: We will offer a broader range of financial services - that includes cryptocurrencies.

El Salvador just bought 410 bitcoin.

Portugal opens first Bitcoin shop to buy/sell in person

Currently 120% of $MSTR marketcap is $BTC exposure.

Uruguay installs its first Bitcoin ATM, which is a major step towards average people jumping on the Bitcoin ship to be able to defend themselves against inflation. In just 8 years, Uruguay Peso lost nearly 50% against USD and around 300% against Gold.

You can now buy a house using Bitcoin as collateral and ZERO fiat deposit with mortgage lender Milo. This is huge, if you think it over. The whole process is done with Bitcoin only and this is another indicator that Bitcoin is already a currency!

Intel is stepping into Bitcoin mining. Why? Because they see what Nvidia and AMD have done with GPU mining and they want to make huge profits too. I think in the not far future, if Intel is making a really low energy usage miner which can be profitably used in an average household then this will make even more profit than the previous two brands made at all. Soon more and more chip manufacturers will jump onto the Bitcoin train for huge profits and it will make the network even more secure. This is a win-win situation. UPDATED: In the meantime they already have their first buyer (GRIID) with 48 MW of power capacity and they will buy alone (!) at least 25% of all qualified Intel-designed ASICs through approximately May 2025. Intel is planning with the mining market to grow by 2.8 Billion USD in just 3 years. I think this will be even more when other manufacturers will see the profits of Bitmain, MicroBT, Intel…

BitMEX is buying a 268-year-old German bank to expand Bitcoin services to Europe. Why? It’s easy, they need more and more platforms to onboard normies from FIAT world. They need to buy banks to issue in the future Bitcoin/FIAT based loans or other financial lending services. It’s way easier to make good connections with EU regulators, if they see you are a big player. What could be bigger by owning a Bank?

Who can see the current financial situation more than Banks? That’s why they “firmly” want to gather as much Bitcoin they can. But don’t get fooled! If you deposit Bitcoin to a Bank it’s no longer under your control: In any case (like with Gold 6102 EO) they can confiscate your Bitcoin belongings and in the best case scenario you will get some worthless FIAT money. Not your keys, not your coins!

Over 4 million people have been onboarded to Bitcoin in El Salvador. This is not a bad number because in the country there are not much more than 6 million people in total and below 18 years old they can’t even use the Chivo wallet offered by the government. Don’t be fooled, most of the people use it because they got some free sats at the beginning which they instantly converted to USD. But this is a huge step forward. Think about it like in the past the first and the last countries who switched to the Gold standard. The first one was England in 1844 and nearly 60 years later followed India. The difference caused by this delay in these two countries' wealth it’s not needed to explain. Many of us think a similar situation will be with Bitcoin too. The first ones will win a lot and the last ones will lose the most from this opportunity.

LinkedIn says Bitcoin and crypto job postings grew 395% in 2021: 3x the tech industry. Nothing news here because as price moves upwards we will see more and more companies develop any service that can make some profit from this huge growth. These new services produce many job places which have other positive side effects. These new people (mostly developers) are arriving from different countries to the Bitcoin scene. They learn through their work about the precise structure of how Bitcoin and some other shitcoins work. These people have families, friends so they will tell them about their findings which will make more and more people think about how to take a slice of the Bitcoin pie for themselves too.

Gemini acquires trading tech platform Omniex and announces launch of crypto prime brokerage to enhance offering for institutional investors. Like Bitmex is buying a Bank, Gemini is buying other platforms too. Why? Simply just to be able to gather from FIAT World as many funds as possible into Bitcoin. These are such beautiful incentives driven purely by greed. This can only happen in Bitcoin where Miners, Hodlers, Investors incentives are the same.

We can’t go next to this news. This is HUGE! Three HUNDRED US community banks will offer a Bitcoin onboarding solution in this year's Q2! Average US Joe will have so much advantage against other world citizens. Just think of a Russian or Chinese citizen who is by the default forbidden by the government to invest into Bitcoin and if he or she is lucky can only buy underground with big premiums. People tend to underestimate this type of news, but without multiple concurrent onboarding solutions by companies competing against each other there won’t be easy, cheap (low fees) offers.

Inflation in Argentina is crazy. People are craving for solutions to conserve their wealth against time, but the government is not even allowing them to trade in USD. This is a speculation, but I think that Strike is #1 in the app store just because most Argentinian people thought that they could instantly buy Bitcoin, like the El Salvadoreans. But sadly not this is the case. Till today Argentinian Strike users are not allowed to buy Bitcoin. Hopefully soon will change, but I think the shitty government needs to change their policy first which takes too much time.

People are not blind. They see what the Trudeau cabinet is doing with the CAD: Printing like no tomorrow! Ok, ok. Maybe they are not knowing this, but they feel the huge amount of real (!) inflation is caused by the printing press. Like in every other “printmaster” country, money wants to find the safest place for preserving value. That’s why 62% (soon all of them) Canadians want to store their wealth in Bitcoin. Of course in shitcoins too to gamble a little bit.

I think this is the brightest future we all can imagine. A World without shitcoins or FIAT, just pure Bitcoin. El Salvador will offer Bitcoin-backed loans. What will this mean? Businesses will need to pay back these loans in Bitcoin which means they need to sell their products/services in Bitcoin. In any other way, like with FIAT (ex. USD), they take a huge risk because if the BTC price jumps then maybe they can't pay back the loans. I get the feeling like in the “good old days” with Aureus and Rome…

This is the perfect example of fear against Bitcoin dominance. Countries with Kings interested in tyranny ruling they will ban Bitcoin because they see the true power which is liberating the people! This is the first and only solution to be able to reach absolute freedom. So after China, Russia is the first country you can think of which will ban it. Yeah, the average Russian citizen will need to pay a premium if he or she wants to buy, but they will find a way. There are already a lot of P2P solutions in the country. I heard that the same routes people buy drugs can buy Bitcoin too. In China after banning mining, 20% of the mining remained underground, so the same will happen in Russia too. Incentives are already too strong to be able to suppress the infiltration of Bitcoin in the World.

After the China ban, Bitcoin lost around 40% of their all-time high hashrate. People thought this is bad and it will never recover from it, but it did! Not only arriving back to the same level, but now it’s made another ATH with reaching on January 21 197EH/s hashrate. Bitcoin can’t be controlled and the China ban was the best thing that could happen with the mining industry. The hashrate is now even more distributed. Don’t forget around 20% of the Chinese hashrate still remained in the country, so this is another example that Bitcoin can’t be banned, stopped or blocked.

When financial incentives are met then people like the Bitfury CEO are educating the US Congress about Bitcoin. Flare gas is the perfect example. Not only harmful, but it’s wasted and could be used to mine cheaply (nearly free) Bitcoin and reduce (by a lot) harmful gasses reaching the atmosphere. The even better use of mining would be balancing with it the energy grid load. Yeah, and not with renewables because they just add even more burden.

Union Bank of the Philippines plans to offer trading and custodial services for Bitcoin. Do we need to explain? Not? Yeah, another bank wants to board onto the Bitcoin ship.

The famous Robinhood exchange is rolling out in phases Bitcoin Withdrawal to those on the waitlist. The market has been demanding this feature for a long time, so they needed to act. Hopefully soon other companies like Revolut will follow.

Google denied for years to be offering payment solutions in Bitcoin. But if you can imagine an over 100K USD Bitcoin price then definitely Google like big companies must be onboarding. It’s inevitable that sooner or later all of them will be involved.

If you have ever bought Bitcoin you can’t stop buying if you see a Bitcoin dip. That’s what happened with President Nayib Bukele, who bought the dip! For 15M USD stashed another 410 Bitcoin for his country. This is not needed to explain further. That’s what a responsible President does for his country!

Portugal is one of the few European countries who already had some financial problems before the Pandemic. This step proves that the market wants to serve the people with Bitcoin onboarding solutions, hopefully soon others will follow and the government will buy some too.

With the recent Bitcoin dip Microstrategy’s Bitcoin exposure jumped to 120% which means Michael Saylor building it’s company foundations on stronger financial bricks than USD. Soon other companies will see that in “free helicopter money” you can’t store value against time. How will they explain this to the stockholders? Of course, now most of the keynesian analysts think that Michael overexposed his company in Bitcoin, but just because they still don’t understand the real value of Microstrategy’s stash.

Global Economic News

TL;DR

El Salvador’s President Nayib Bukele is meeting with Turkey's President Erdoğan.

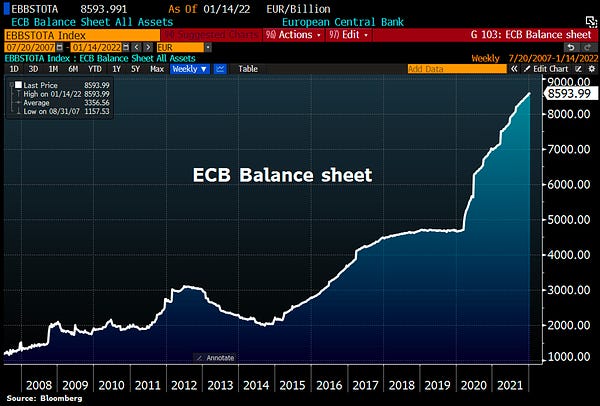

ECB Balance Sheet hit a fresh ATH at €8,594bn.

China PBOC cuts benchmark lending rates from 3.85% to 3.7%.

U.S. Federal Reserve opens debate over possible "digital dollar"

The “winner” DAX Index has lost just 1.8% this week & is 5.1% off the top.

El Salvador’s President Nayib Bukele is meeting with Turkey's President Erdoğan. This makes some speculations because El Salvador is a very small (21000 Km2) country with huge distances from Turkey. Turkey has some major financial problems, their currency the Turkish Líra lost 1000% against the USD and 2000% against Gold. Speculators say they will soon have hyperinflation in their currency. Why have they met? What could Bukele offer to Erdoğan? Some of us can only think about the precious experiences with Bitcoin as legal tender. If this is true, maybe Erdoğan will first move his own funds into Bitcoin then make it a legal tender in Turkey? These are just speculations, but sooner or later we will find out.

“ECB Balance Sheet hit a fresh ATH at €8,594bn. Total assets rose by another €20.7bn as Lagarde keeps printing press rumbling despite strong inflation. ECB Balance Sheet now equal to 82% of Eurozone GDP vs Fed's 38% or BoJ's 135%”

China PBOC cuts 1y loan prime rate from 3.85 per cent to 3.7% for the 2nd consecutive month in response to the economic slowdown. This means besides the World is rushing to buy every kind of silicon chip that China could produce, the overpumped economy is shrinking means the problem is bigger than we can imagine. Just think about the Evergrande payment problem with the crazy amount of unfinished buildings which are built simply for loans. You know loans right? The magic way how FIAT money is made out of nothing. If this bubble explodes… consequences are unimaginable!

The U.S. Federal Reserve opens debate over possible "digital dollar". Are you confused? Don’t be! The dollar is already digital. More than 92% is already digital USD so it’s not printed. What’s the difference? With CBDC’s they want to skip the banks. The central bank wants to create, distribute and control the whole USD market, which is the ultimate level of money control. Knowing this you are not surprised anymore that they are thinking of issuing CBDS in the future.

The Dax index was producing the best numbers this week. It only lost 1.8% and is only 5.1% off the top, while Nasdaq has fallen 7.6% and 15% below ATH. Does this mean the German economy is so much better working? I don’t think so. The already worsening Pandemic numbers and the mandatory vaccination will soon show even worse numbers. Without freedom the market will plummet, but of course it will be just a correction on the chart. Germany is too important a country to totally collapse.

Bitcoin price speculations

These are just speculations, no investment advice!

In case the trendline will be broken either way (up or down) the price will maybe follow that direction.

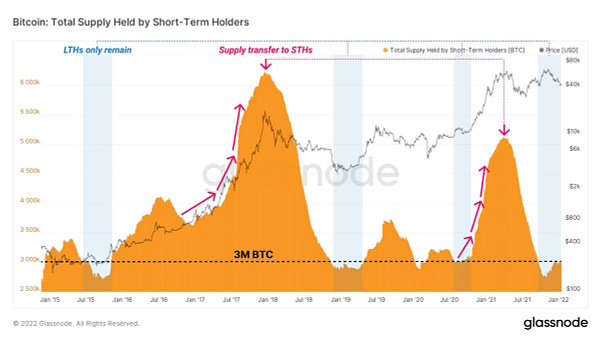

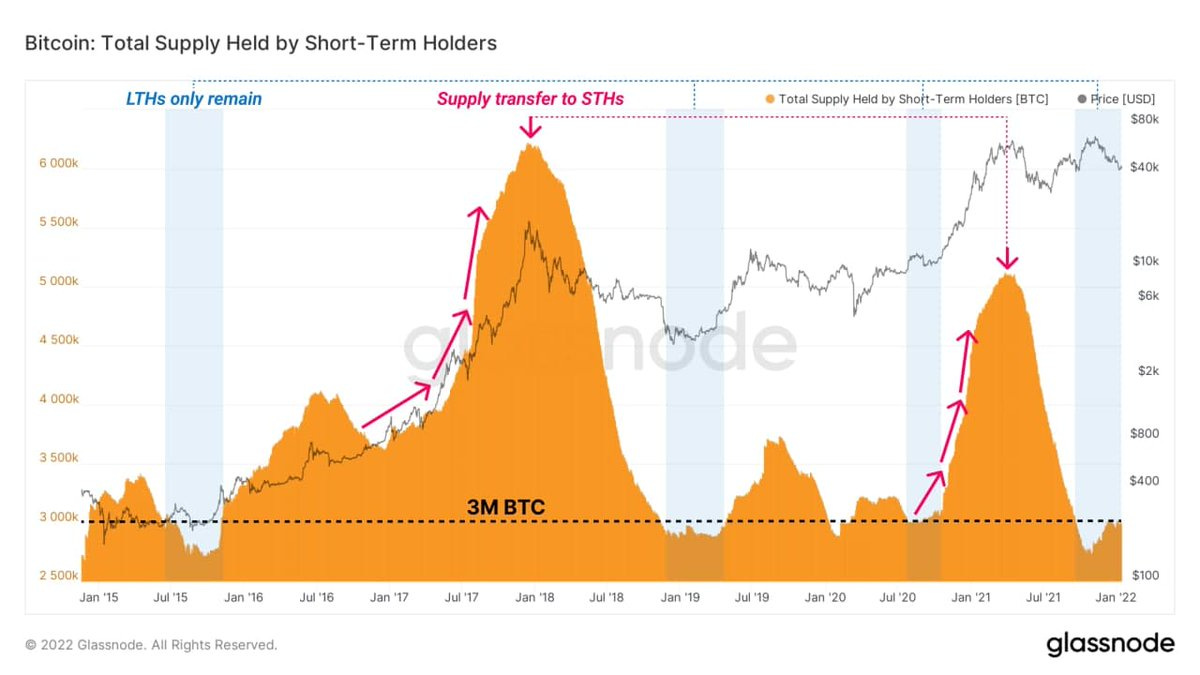

“Short-Term Holders, investors who bought their coins within the past few months, currently hold 3 million #BTC. This is a historically low level, and one that hasn’t been seen since August 2020. “

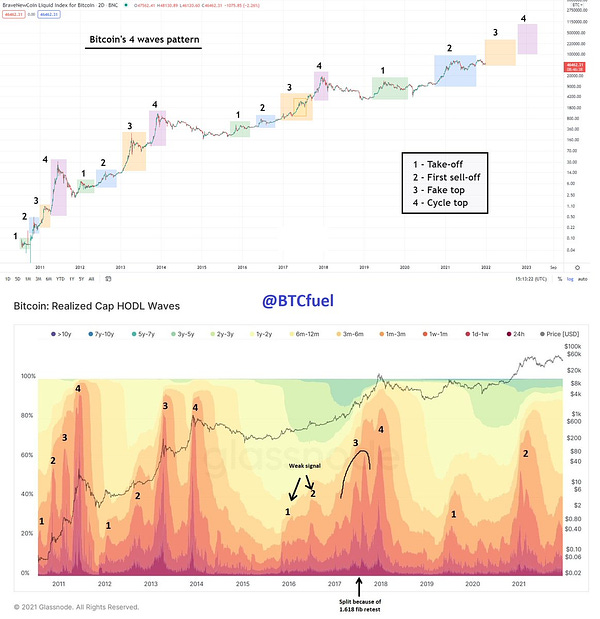

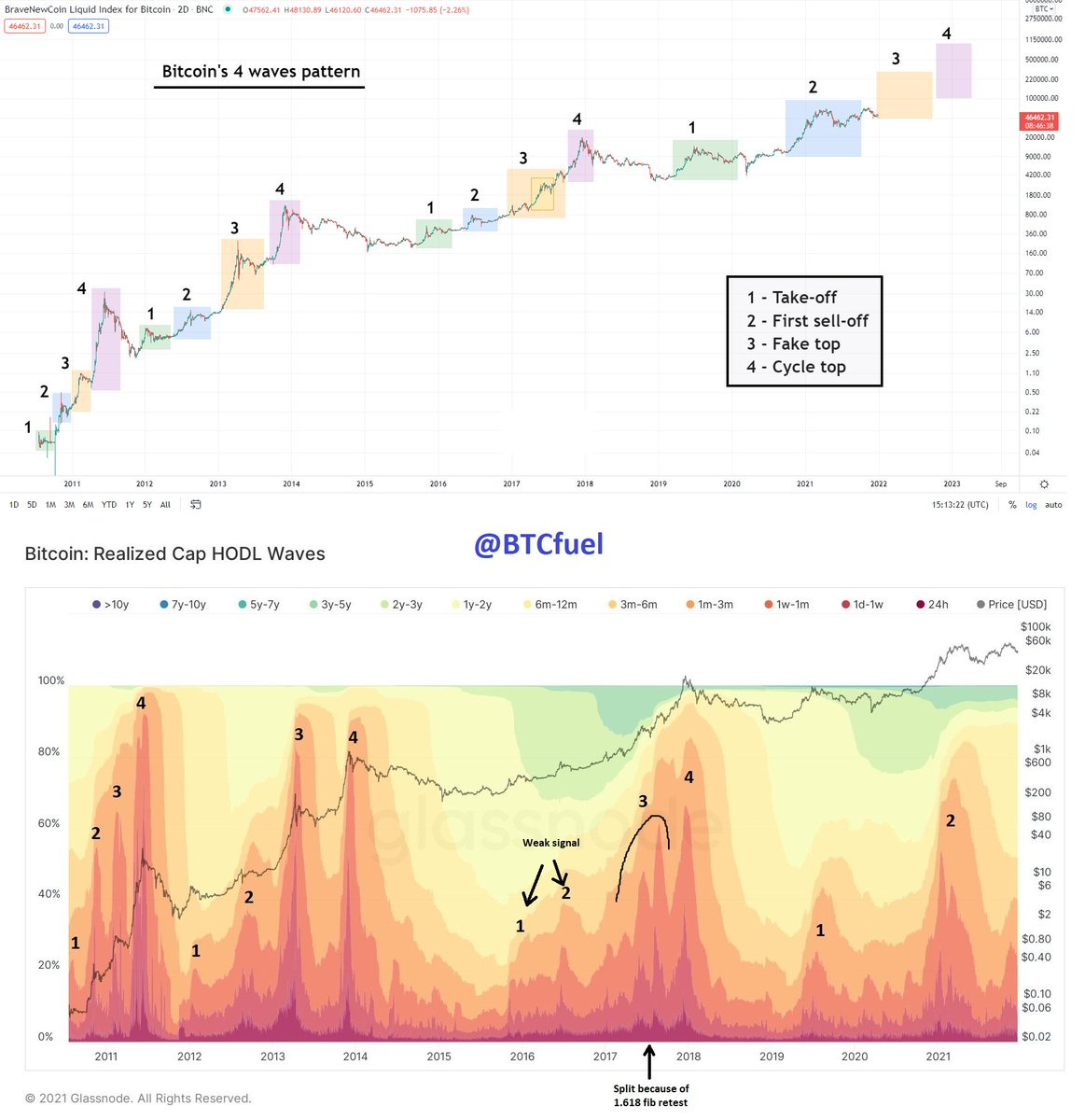

“Bitcoin has a 4 waves pattern that happens every cycle. These 4 waves are demand waves and happen when a lot of money flows into Bitcoin in a short timeframe. The 4 waves are clearly visible in the Realize Cap HODL Waves indicator”

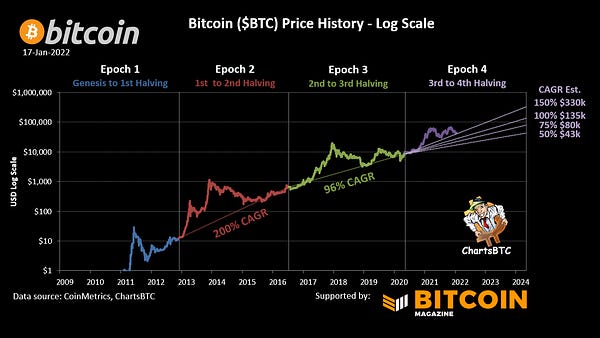

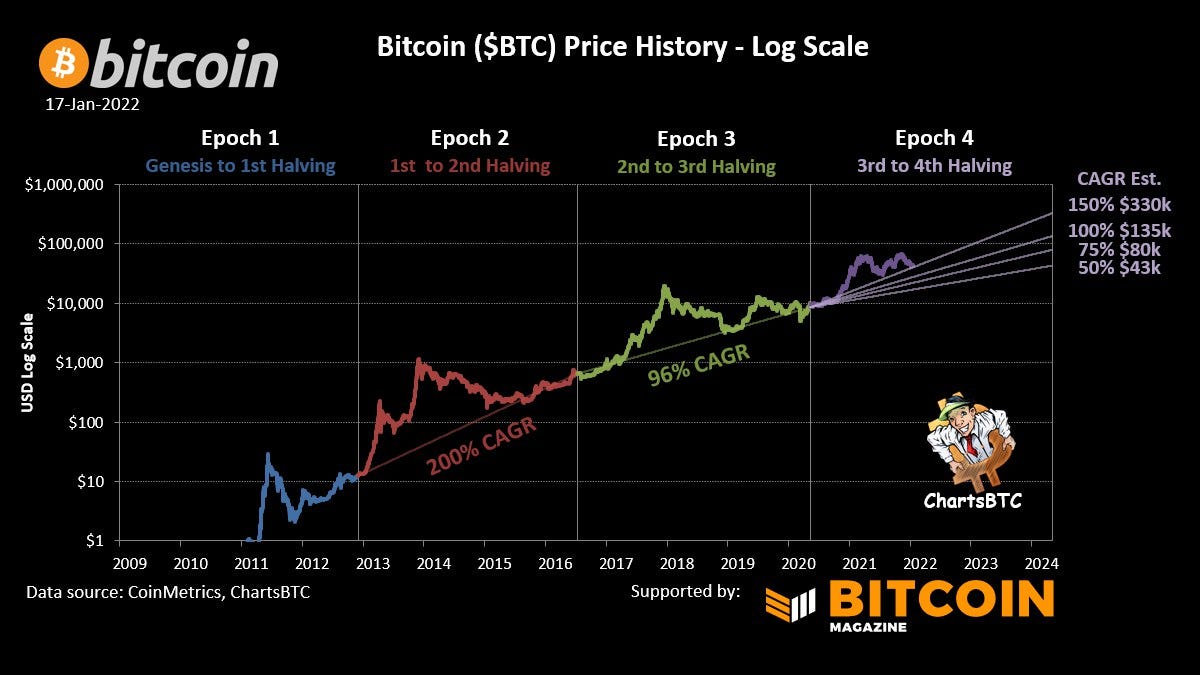

“#bitcoin Compound Annual Growth Rate by epoch

Epoch 2 = 200% CAGR

Epoch 3 = 96% CAGR

Epoch 4 projections...

150% = $330k at 4th halving

100% = $135k

75% = $80k

50% = $43k”

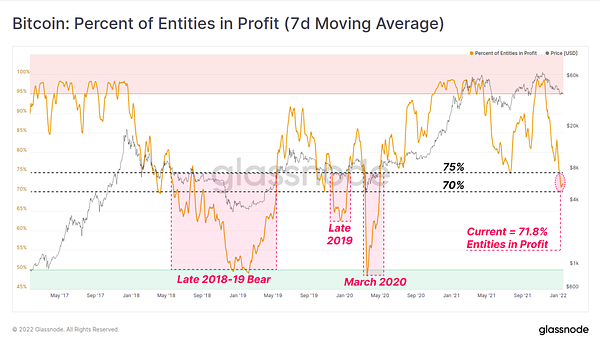

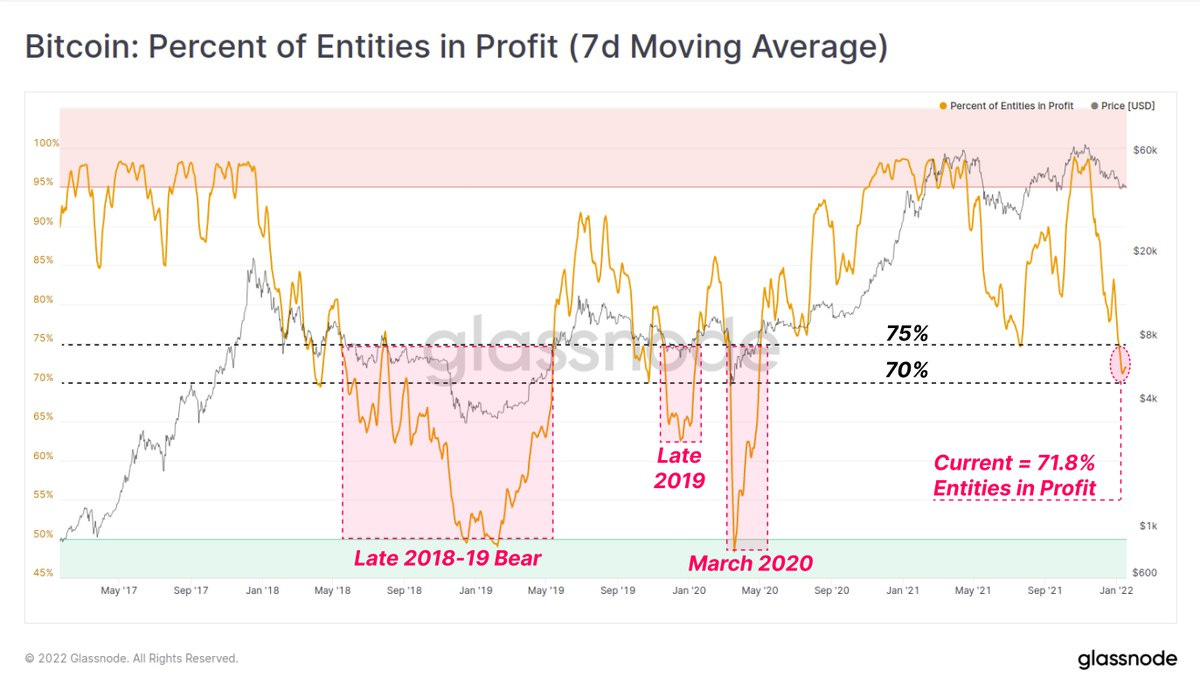

“Bitcoin onchain entities are clusters of wallets which have the same owner. The proportion of entities with an average coin balance in profit, has now fallen to 71.8%. Historically, this level of poor profitability has occurred in the later stages of bearish trends.”

“Bitcoin supply being absorbed by strong hands since October - unlike previous corrections. Sooner or later the balance of Supply/Demand will flip and the price will rip. Don't get shaken out. The patient will be rewarded IMO.”

In the chart above we can see a trendline break downwards. It depends on how the latest candlestick will close (above or below that trendline) at the end of this month then we can make further speculations about the future price movements.

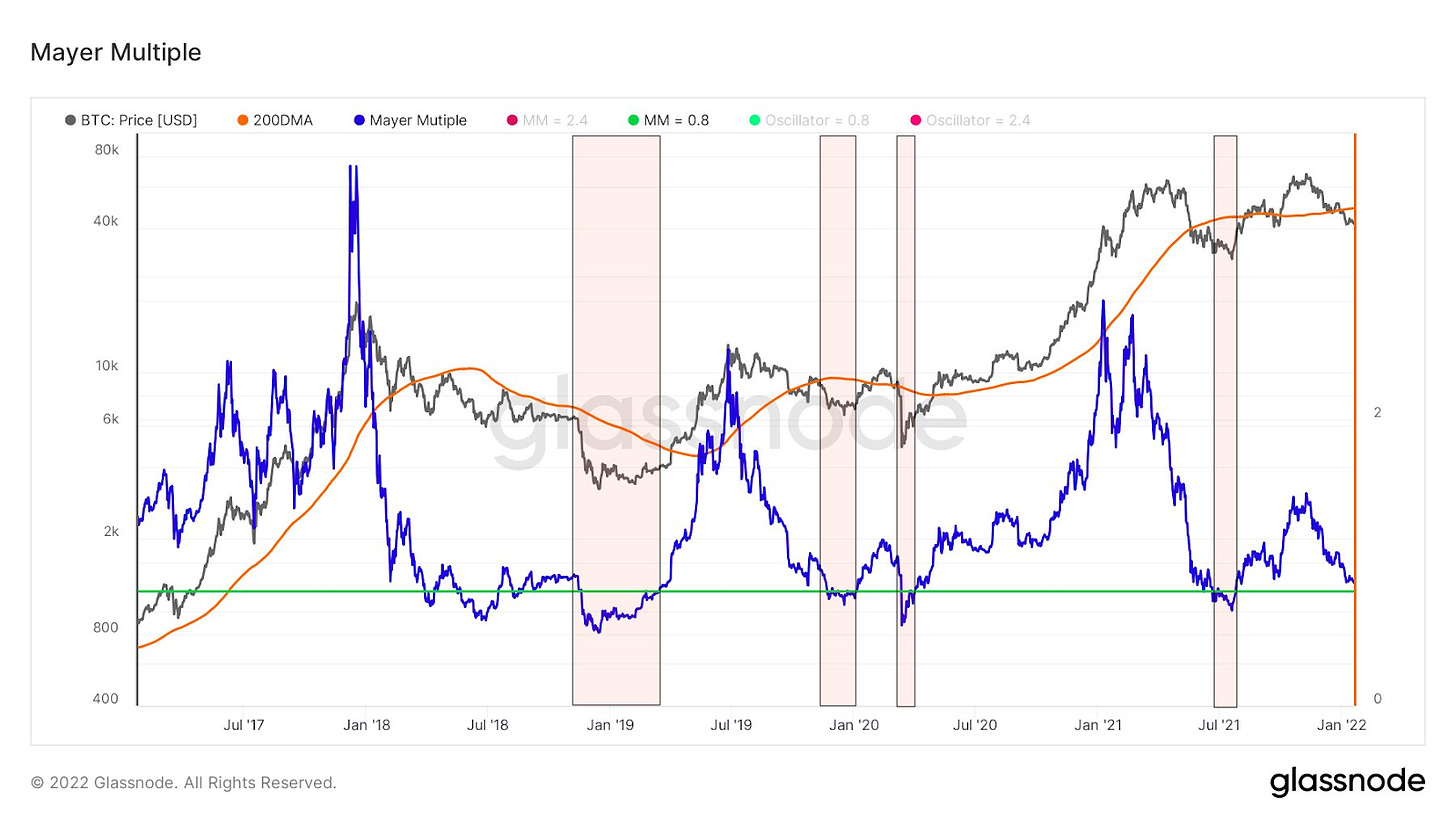

“Bitcoin has bounced strongly the last 4 times when the Mayer Multiple has dipped this low. See green line below. Might dip a bit below the green line before the rip but getting closer each day.”

“In 2016 I bought my first #bitcoin at $400

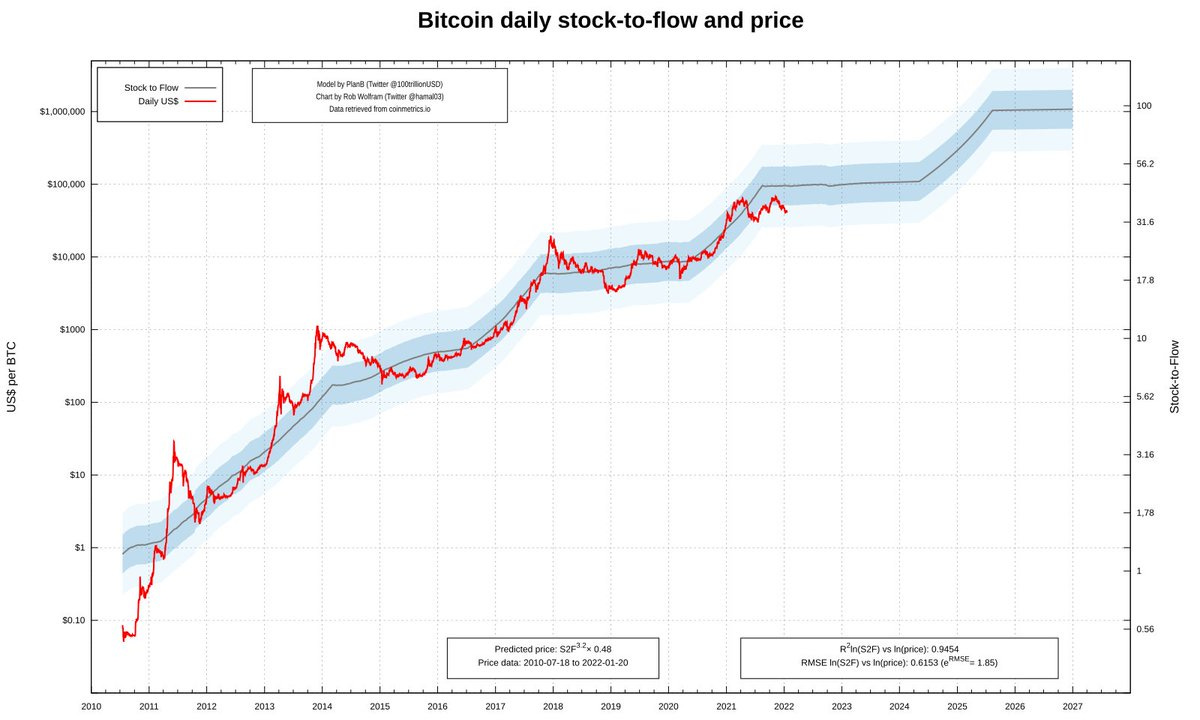

March 2019 I published S2F model, at $4000 btc

Now, Jan 2022 btc dropped below $40,000 (within 2sd band)

Some are worried about current dip, but I am quite sure that btc will add another zero next couple of years. Embrace volatility!”

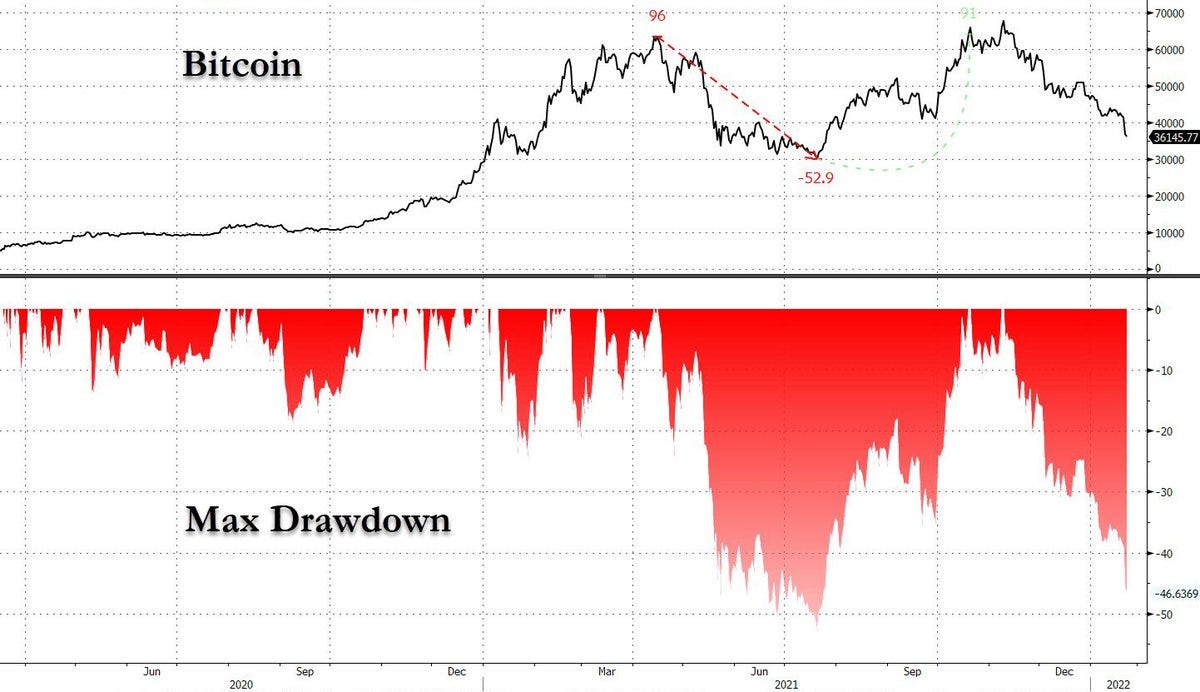

Bitcoin recent drawdowns

Bitcoin Shorts

Funny Bitcoin short stories

In 2013, billionaire Charlie Munger called Bitcoin rat poison. #Bitcoin has increased 36,900% since then.

Ohio Senate candidate: Bitcoiners are going to multiple like gremlins in congress

Just think about the following:

Don’t forget, that not everyone can buy 1 whole Bitcoin, only:

When BTC price is down and you want to get as much as you can (El Zonte, El Salvador):

$8.1 trillion Charles Schwab CEO: We would "welcome the chance" to offer direct trading of bitcoin and crypto

Back in 2011 when Bitcoin crashed to 11 USD…

This family went all in on #Bitcoin at $900. They now store their $BTC in 6 locations across 4 continents.

Sources: